DIpil Das

Introduction

What’s the Story?The Coresight Research Think Tank series delve into the trends and segments that we have identified as presenting growth opportunities in retail. We provide a definitive overview of each topic and its impact on retail. Coresight Research has identified logistics and last mile as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer centricity, in 2022 and beyond (see the appendix of this report for more details).

Omnichannel fulfillment services BOPIS (buy online, pick up in-store), curbside pickup and parcel lockers—also collectively known as click-and-collect—have gained momentum among US online consumers, while retailers have continued to strengthen these offerings to provide a seamless experience for shoppers.

In this Think Tank, we explore the outlook for click-and-collect services in the US, presenting insights into the competitive landscape, headwinds and tailwinds, as well as themes we are watching in the space. We analyze findings from Coresight Research surveys conducted in February and June 2022 to inform our insights into US consumers’ use of omnichannel fulfillment services.

Why It MattersWhile the growth of collection services such as BOPIS and curbside pickup has been a retail industry trend for several years, the pandemic led many more consumers to embrace these services—and many more retailers to implement them.

These services are less margin-erosive and require fewer resources than delivery for retailers. According to Target, it costs 90% less for the company to fulfill online orders by BOPIS and curbside pickup than traditional fulfillment. Consumers picking up in-store also positively impact retailers’ in-store traffic and offers upselling opportunities. These services act as a strategic weapon for brick-and-mortar retailers to compete with their pure-play, online-heavy rivals. From the consumer perspective, pickup is cheaper than delivery and gives shoppers control over the time of fulfillment.

We expect pickup services to continue to see steady growth post pandemic as retailers are incentivized to invest in this channel to keep their physical stores relevant while shoppers become more accustomed to the convenience, speed and experience offered by these services.

BOPIS, Curbside Pickup and Smart Lockers in the US: A Think Tank

Consumer Preferences for Collection Services: Our Survey DataOur June 2022 survey of US online shoppers examines the fulfillment channels they had used to receive online orders, types of collection service they used and the product categories they collected in the past 12 months.

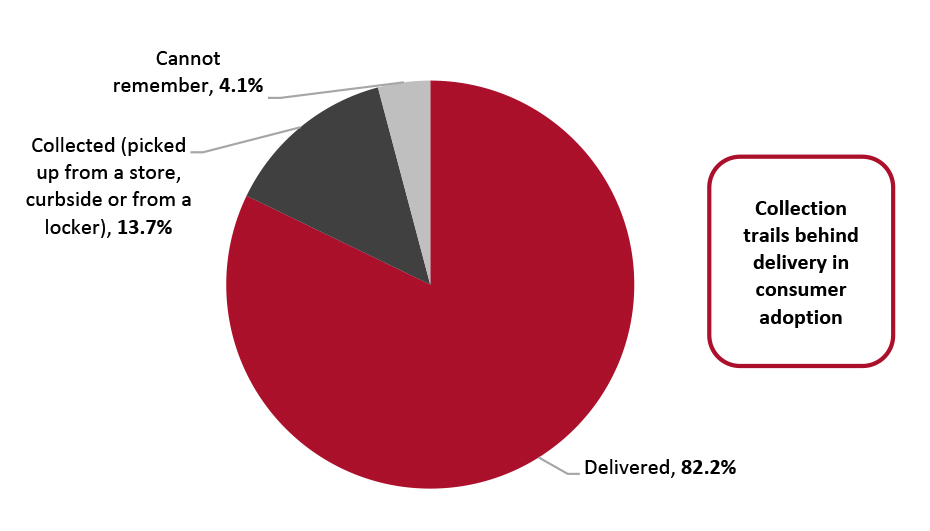

Our findings show that online shoppers prefer delivery more strongly than pickup. Around eight in 10 respondents said they mainly had their online purchases delivered to them in the past 12 months, compared to 13.7% who said they mainly collected their online purchases (see Figure 1). However, with click-and-collect being the newer of two fulfillment channels, we expect it to continue to play a more prominent role in e-commerce last mile because of the significant benefits it offers to both retailers and consumers.

Figure 1. Online Shoppers: Whether They Mainly Used Delivery Services or Collection in the Past 12 Months (% of Respondents) [caption id="attachment_152324" align="aligncenter" width="701"]

Base: 920 US respondents aged 13+ who had purchased a product online in the 12 months ended June 2, 2022, surveyed on June 2, 2022

Base: 920 US respondents aged 13+ who had purchased a product online in the 12 months ended June 2, 2022, surveyed on June 2, 2022 Source: Coresight Research [/caption]

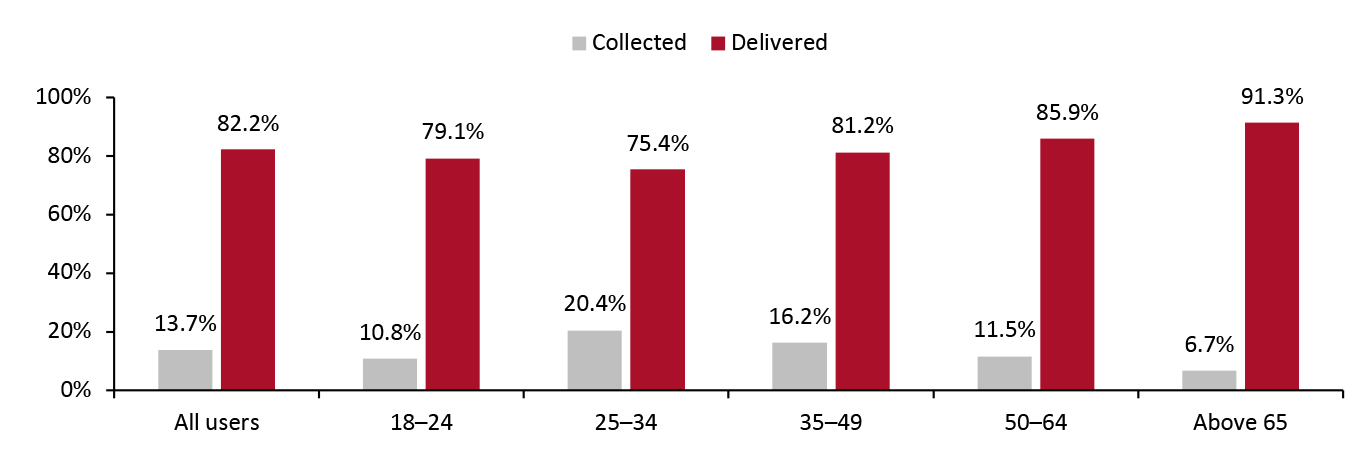

The average usage rate for collection is dragged down by older online shoppers, who are much less likely than the average to pick up online orders from a store or use other collection methods—only 6.7% of online shoppers aged above 65 said they mainly used collection service in the past year. Online shoppers aged 25–34 and 35–49 are more likely than the average shopper to pick up orders from the store or use other forms of click-and-collect.

On the other hand, online shoppers aged 50 and above are more likely than the average to use delivery to receive their online orders. Those aged above 65, especially, have a strong preference for delivery, with 91.2% of the respondents in this age group saying they mainly had their online orders delivered in the past 12 months.

Figure 2. US Online Shoppers: Whether They Mainly Used Delivery Services or Collection in the Past 12 Months, by Age Group (% of Respondents) [caption id="attachment_152325" align="aligncenter" width="700"]

Base: 920 US respondents aged 13+ who had purchased a product online in the 12 months ended June 2022, surveyed in June 2022

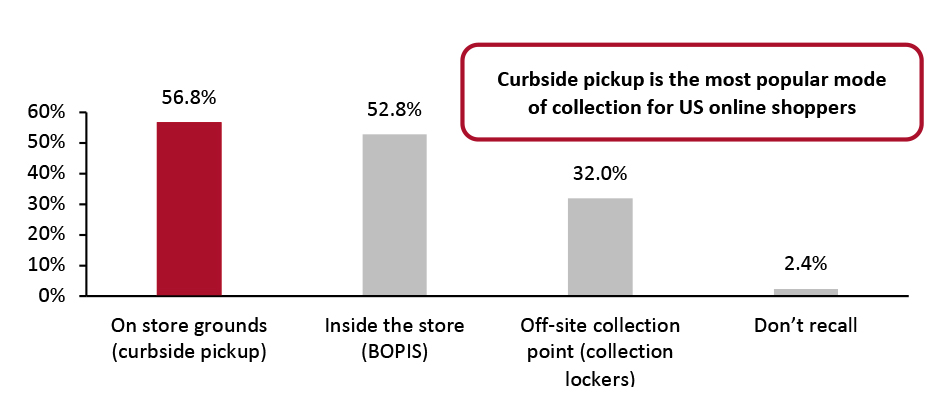

Base: 920 US respondents aged 13+ who had purchased a product online in the 12 months ended June 2022, surveyed in June 2022 Source: Coresight Research [/caption] Unlike international markets, where BOPIS is the dominant mode of click-and-collect service, curbside pickup is the most popular collections service in the US, according to our survey. In international markets, the requirement of owning a vehicle to access the curbside-pickup service often limits its wider adoption, but the US has high automobile ownership rates. Furthermore, US stores typically have larger premises than in other countries, allowing for more space for curbside pickup.

Figure 3. US Online Shoppers Who Used Collection Services: How They Collected the Items They Bought (% of Respondents) [caption id="attachment_152326" align="aligncenter" width="701"]

Base: 125 US online shoppers aged 13+ who mainly had their orders collected in the 12 months ended June 2, 2022, surveyed on June 2, 2022

Base: 125 US online shoppers aged 13+ who mainly had their orders collected in the 12 months ended June 2, 2022, surveyed on June 2, 2022 Source: Coresight Research [/caption]

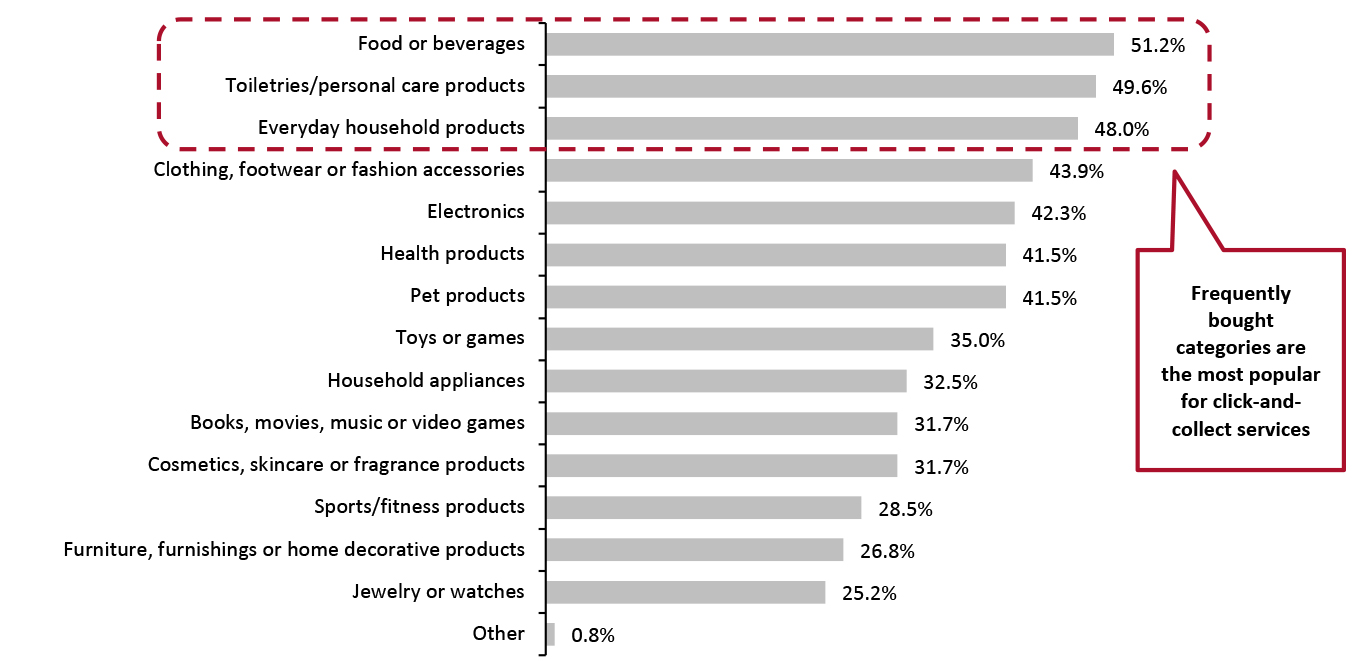

Food and beverages and other everyday grocery items are the most popular product categories for click-and-collect services, with more than half of survey respondents saying they collected those category products in the last 12 months. This is likely due to the commoditized nature of these items as well as consumers preferring to circumvent delivery fees or product markups through third-party grocery-delivery platforms.

Figure 4. US Online Shoppers Who Used Collection Services: Product Categories They Collected in the Past 12 Months (% of Respondents) [caption id="attachment_152328" align="aligncenter" width="700"]

Base: 125 US online grocery shoppers aged 13+ who mainly collected their orders in the 12 months ended June 2, 2022, surveyed on June 2, 2022

Base: 125 US online grocery shoppers aged 13+ who mainly collected their orders in the 12 months ended June 2, 2022, surveyed on June 2, 2022 Source: Coresight Research [/caption]

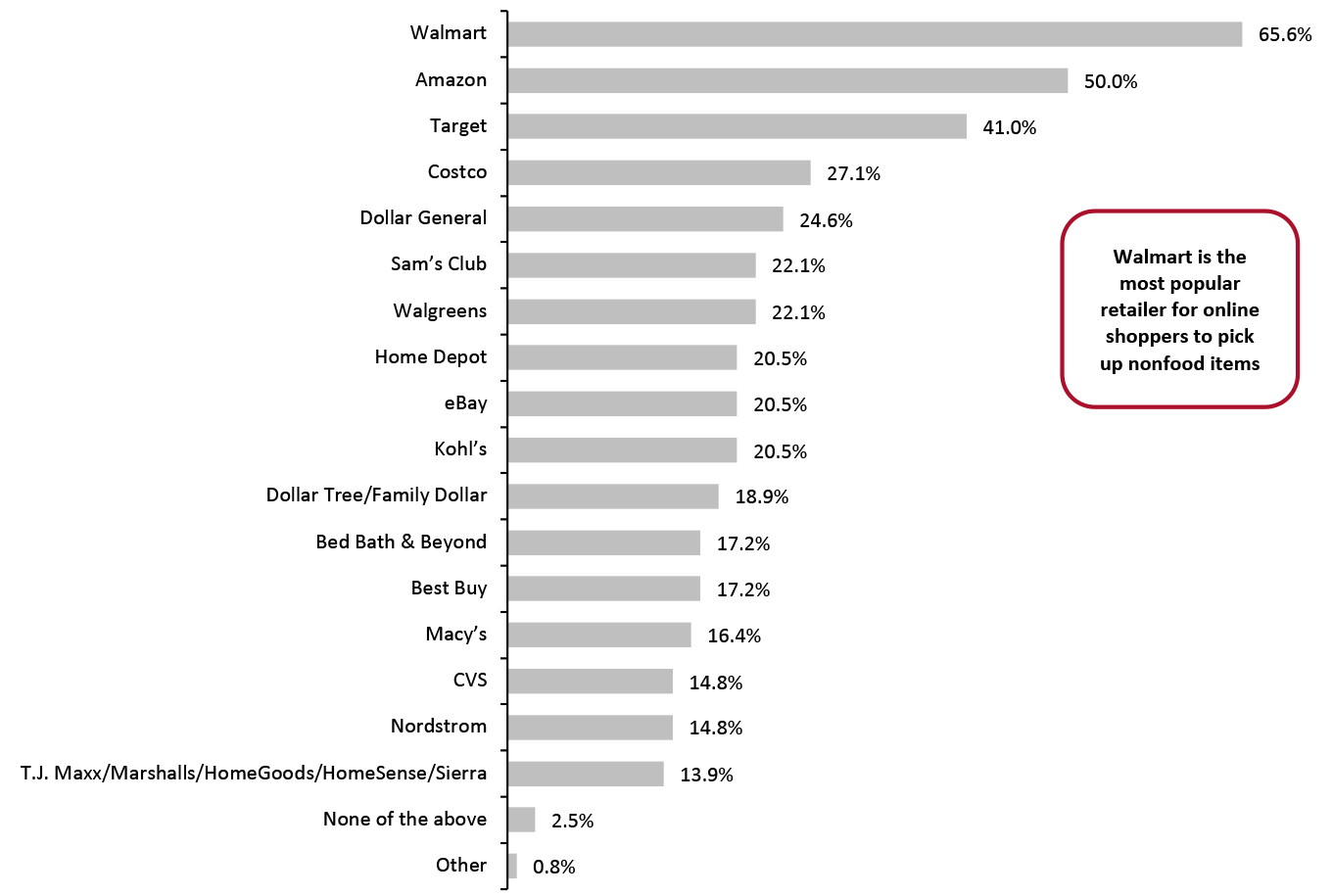

Our survey found that Walmart, which has a dominant presence in the physical store space as well as online, is the most popular retailer for the pickup of nonfood products. Around two-thirds of respondents said they have collected nonfood products from Walmart in the last 12 months.

Amazon is ranked second by number of online shoppers that have collected nonfood products from the retailer. Amazon offers a wide array of collection options for shoppers, including pickup services at Whole Foods and Amazon Fresh stores, parcel lockers installed in shopping malls and retail partners’ stores, as well as through the Local Selling program (which allows customers to purchase items from merchants on Amazon and pick them up at the seller’s store).

Figure 5. US Online Shoppers Who Used Collection Services: Retailers from Which They Have Collected Nonfood Products in the Last 12 Months (% of Respondents) [caption id="attachment_152327" align="aligncenter" width="700"]

Base: 125 US respondents aged 13+ who had purchased a product online in the 12 months ended June 2, 2022, surveyed on June 2, 2022

Base: 125 US respondents aged 13+ who had purchased a product online in the 12 months ended June 2, 2022, surveyed on June 2, 2022 Source: Coresight Research [/caption] Competitive Landscape

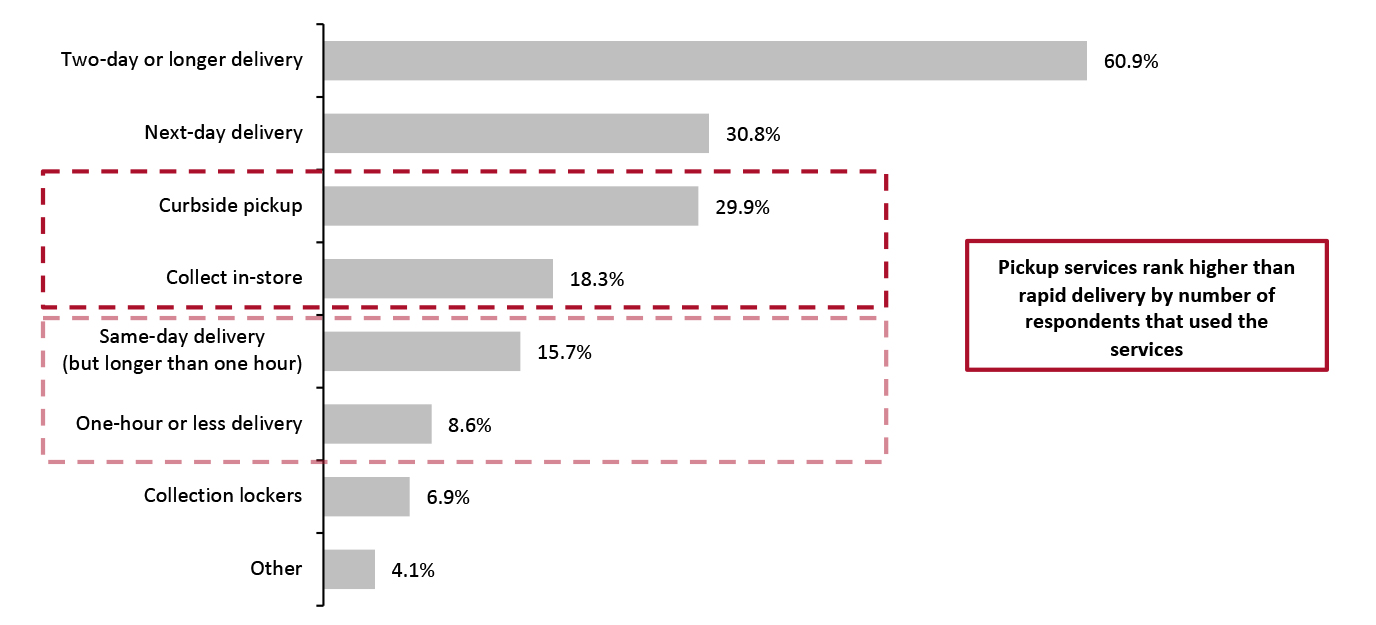

As noted above, consumers have a high preference for delivery over collection. However, according to our separate survey conducted in February 2022 (which gave a wider range of delivery and pickup choices to respondents), curbside and in-store pickup ranked higher than “one-hour or less” delivery and same-day (longer than one-hour) delivery services by number of respondents, implying that consumers choose pickup over rapid delivery for time-sensitive online purchases.

Figure 6. Online Shoppers: Delivery or Pickup Methods They Have Used in the Past Three Months (% of Respondents) [caption id="attachment_152329" align="aligncenter" width="700"]

Base: 465 US respondents aged 18+ who had purchased a product online in the three months ended February 28, 2022, surveyed in February 2022

Base: 465 US respondents aged 18+ who had purchased a product online in the three months ended February 28, 2022, surveyed in February 2022 Source: Coresight Research [/caption] Market Drivers

Mid-Size and Small Retailers Will Push Click-and-Collect

Most US retailers are yet to start successfully developing or scaling their own delivery services and have partnered with third-party delivery platforms to satisfy delivery demands. However, retailers are realizing the drawbacks of these partnerships, including loss of valuable customer data and ceding control of customer relationships. Markups and additional service fees charged by the platforms potentially make their delivery offerings much less price competitive.

The next logical step for retailers would be to either reduce the price of their delivery offerings (i.e., offer delivery for less on platforms or build out an owned platform) or aggressively push collections services to their customers. The latter solution could very well be the one that is implemented most, given it is easier and more immediate. We believe that mid-sized/smaller players, which are behind big retailers in implementing cost-lowering technologies, will be more apt to push customers toward less dilutive click-and-collect rather than delivery in the short- to-medium term.

Growing Scrutiny of Gig Economy

Most delivery platforms rely on the gig economy, with its system of independent contractors offering much-needed flexibility in a competitive environment. However, this model is still in flux and has come under fire on recent occasions regarding the treatment of gig workers, with multiple controversies emerging around conditions and pay, especially during the pandemic. Governments worldwide are putting a spotlight on the gig economy and evaluating work environments where workers should be entitled to employer benefits.

Any drastic change in legislation can shake up the economics of delivery platforms and drive up their labor costs. This development can potentially temper delivery growth but augur well for pickup services, while also denting the sales of retailers that rely heavily on such platforms for their delivery solutions.

Themes We Are WatchingRetailers Digitally Enhance In-Store and Curbside-Pickup Services

BOPIS and curbside pickup have gained immense popularity, but they are not without flaws, including long wait times, vague pickup instructions and poorly timed rendezvous plans to connect customers and staff.

Coby Berman, Co-Founder and COO of location intelligence solutions provider Radar, told Coresight Research that shorter wait times are associated with higher levels of customer satisfaction and an increased probability of repeat visits. He added that incorporating technologies to pickup services has two main benefits: first, this helps product teams build the right customer communications to make pickup experiences less confusing and more seamless; and second, in-store staff receive real-time updates that allow them to ensure items are ready when the customer arrives, thereby reducing wait times.

As such, several retailers are now looking to digitally enhance their pickup services to eliminate customer wait time, optimize staff efficiency and improve profitability as they scale BOPIS and curbside-pickup operations.

- Convenience store operator Quality Mart partnered with off-premises platform Swipeby in April 2022 to roll out the latter’s geofenced “virtual drive thru” solution at five stores. The technology will provide the staff with live estimated times of arrival and arrival information to manage orders more efficiently.

- American Eagle Outfitters partnered with Radar in September 2020, which provided flexible geofencing functionality to support trip tracking for curbside pickup.

- Lululemon launched a virtual waitlist technology in September 2020 that notifies consumers via text when it is their turn to enter the store or perform pickups, returns and exchanges outside the store.

- n September 2020, Giant Eagle partnered with Radius Network to use its FlyBuy Pickup location technology to optimize curbside and in-store pickup. Similarly, Lowe’s Foods, SpartanNash and Albertsons-owned United Supermarkets implemented the FlyBuy system in 2020 to reduce the time it takes to fulfill pickup orders.

Many technology vendors have also been integrating new features in pickup solutions to enhance the customer experience:

- In addition to BOPIS and curbside pickup, Flybuy extended its location technology solution service to include e-commerce returns (BORIS—buy online, return in-store) in March 2022. Retailers using Flybuy can conduct fast returns both curbside and at a drop-station in the store. The solution automatically notifies staff when the customer begins their journey to the store and provides an exact ETA, so they can meet the customer upon arrival for a handoff or exchange.

Smart Lockers Gain Traction

Smart lockers are electronic storage solutions that enable retailers to store parcels at convenient locations, including store premises, shopping centers, public terminals and residential areas. Once the package is delivered into the smart locker system, the recipient is automatically notified that their package is ready for pickup. Consumers can access these lockers through various electronic means such as by scanning a barcode, using a RFID tag or using their fingerprint.

Smart-locker solutions gained momentum after pickup services exploded with the onset of the pandemic. According to a survey conducted by Coresight Research in June 2022, around 43.1% of respondents who shopped online said they had used an unattended collection locker or kiosk to pick up online purchases in the prior 12 months.

The advantages offered by lockers over conventional pickup services—including handling multi-temperature product storage, after-hours pickup, and secure deliveries—have galvanized many retailers to incorporate them into their last mile fulfillment mix. Lockers and kiosks also come with efficiency benefits, such as the ability to drop multiple orders at a single spot, saving on fuel and labor costs. They can also be used to make product returns, thus increasing convenience for customers.

Smart lockers are not a new concept. Amazon has led the way in placing lockers across the US, including in apartment buildings and third-party retail stores, since 2011. In European countries, retailers have been delivering to remote pickup points for rural and suburban shoppers to collect. In the US, several retailers, including Ahold Delhaize, Albertsons and Lowe’s, have shown interest in adding smart lockers to their last-mile mix. In January 2022, grocery chain Shoprite partnered with automated pickup solutions provider Bell and Howell to deploy the latter’s QuickCollect Go! Pod smart grocery retrieval system in the parking lot of a store in New Rochelle, New York, providing customers with self-serve pickup of online orders.

Many technology vendors have been integrating new features in parcel-pickup solutions to make the fulfillment service more efficient:

- Cleveron offers automated pickup kiosks equipped with three different temperature-controlled modules and can store both groceries and regular parcels at one location.

- Parcel locker suppliers such as Mobikey and Parcel Pending use Bluetooth Low Energy (wireless personal area network technology) to provide the capability for lockers to be opened via consumers’ smartphones.

- Retail Robotics’ pickup grocery robot, known as Arctan, houses 200 bins and 28 frozen bins. The unmanned setup dispenses orders through any four drawers, allowing it to serve multiple orders at a time.

- Bell and Howell’s QuickCollect XL grocery kiosk offers an automated curbside-pickup service. The kiosk has seven drive-up stations with a dedicated parking space for each station, enhancing the ease and efficiency of pickup for consumers.

Although parcel lockers and kiosks can provide significant economic benefits in terms of reduced labor and last-mile shipping costs, they have several operational complexities that challenge a retailer’s ability to deploy and scale the service. Lockers come in different sizes, but they generally cannot fit very large packages, limiting their use. In addition to investment and maintenance costs, effort needs to be put into negotiating with local authorities regarding selecting locations and setting up smart-locker sites where these are located outside of stores. Additionally, imprecise or wrong order fulfillment could be costly for the retailers.

We believe that smart lockers will experience more traction as consumers spend more time out of their homes again while continuing to order online, and as retailers figure out how to provide these remote pickup options more cost-effectively and conveniently.

Launch of Retailer Loyalty Programs May Hinder Pickup Growth

Consumers typically are deterred from choosing delivery as a fulfillment option due to the additional shipping fees included in the order price. Given the pandemic-induced shift in shopping habits online, many retailers have launched premium/subscription loyalty programs to lock in the loyalty of a more digitally engaged consumer base. Free delivery (although, in many cases, with a minimum order requirement) with no product markups is the primary benefit offered under those programs. We believe this can potentially swing the pendulum toward delivery even more and reduce pickup’s market penetration in the future.

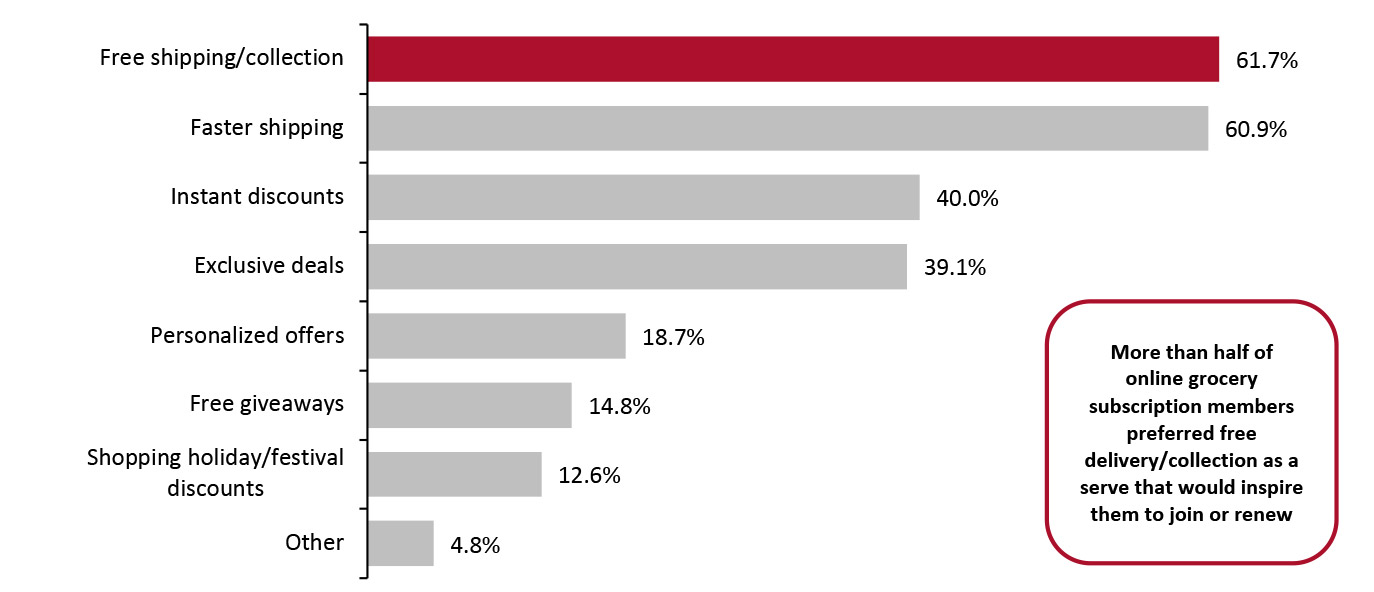

This is supported by findings from a Coresight Research survey conducted in August 2021 and discussed further in our report on grocery subscriptions, which indicated that free shipping/collection is the perk that consumers want most from an online grocery premium/subscription program. While most of these memberships also include free collection, we believe that consumers are likely purchasing them to maximize the free delivery feature and not necessarily free pickup—particularly since collection services can be free at some retailers without a membership.

Figure 7. Respondents with Any Paid-For Online Grocery Subscription from Grocery Retailers or Services such as Amazon Prime or Instacart Express: Top Benefits that Motivate Them To Join or Renew (% of Respondents) [caption id="attachment_152363" align="aligncenter" width="700"]

Base: 230 US respondents aged 18+ who are members of an online grocery subscription program, surveyed in August 2021

Base: 230 US respondents aged 18+ who are members of an online grocery subscription program, surveyed in August 2021 Source: Coresight Research [/caption]

What We Think

The rise of pickup services has given brick and mortar retailers a much stronger value proposition, bringing together the strengths of online and offline shopping to create more choice and flexibility for customers. However, merely offering these services to online shoppers is no longer enough. Retailers should look to boost the efficiency and quality of these services through enhanced training, technology and store designs.

Implications for Retailers

- To better support pickup service, retailers need to optimize their store layouts to offer better access for shoppers. Retailers should put pickup counters near the front door for easy and quick access and allocate dedicated fulfillment areas or parking spots for pickup near the store entrance.

- Retailers should look to promote their collection offerings over delivery in less dense, suburban and rural areas. As these services transfer the cost and responsibility of the last mile to the customers, it can lead to less margin squeeze than the delivery service, which is more suitable for urban locations.

- Retailers can highlight pickup as a more affordable alternative to home delivery, showcasing the savings associated with its lower fees and no additional surcharges or tips, to retain their online customers in the current inflationary environment.

- We believe the jury is still out on pickup lockers as an investment for many US retailers. However, the locker service has the potential to be adopted on a greater scale due to the convenience and labor-cost benefits the format has over other last mile options. As with automation in logistics and fulfillment, retailers must weight those advantages against the investments required.

Implications for Technology Vendors

- Given consumers must engage with retail locations to access BOPIS and curbside pickup, we believe these services provide unique opportunities to generate impulse consumption versus delivery. Technology vendors should offer a functionality that triggers push notifications to inform customers of in-store offers and deals and prompts them to add impulse items to their cart once they enter the geofence. To reduce complexity, retailers can feature a limited impulse assortment, allowing store associates to easily locate these additional items and pack them into the customer’s bags as needed.

- Technology providers can add features that would help retailers identify customers who have experienced longer wait times and kick off proactive marketing campaigns to win them back.

Methodology

Coresight Research surveyed 920 US respondents aged 13+ who have purchased a product online in the past 12 months. Of these, 125 indicated they mainly collected their online purchases in the last 12 months. The survey was conducted on June 2, 2022. The results have a margin of error of +/-3% with a 95% confidence interval.

For the second survey featured in this report, Coresight Research surveyed 465 respondents aged 18+ who have purchased a product online in the past three months. The survey was conducted on February 28, 2022. The results have a margin of error of +/-5%, with a 95% confidence interval.

Appendix: About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes.

RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework.

The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments.

Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.

Appendix Figure 1. RESET Framework [caption id="attachment_143517" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]