DIpil Das

What’s the Story?

The Coresight Research Think Tank series delves into the trends and segments that we have identified as presenting growth opportunities in retail in 2021 and beyond. In this report, we explore two key areas of textile innovation that are gaining traction in the global apparel and footwear market: performance and sustainability. Performance textiles are fabrics that are engineered to provide protection from environmental conditions or offer some other benefit such as resistance to odors or wrinkles. We present analysis of the performance textiles market, discussion of heightened consumer focus on health and wellness as a key market driver, and an overview of selected textiles. Sustainable textiles are materials derived from eco-friendly resources such as natural fibers or recycled materials. We present analysis of the sustainable textiles market, discussion of rising consumer consciousness of sustainability as a key market driver, and an overview of selected textiles. This report considers three notable innovators in the field of textile innovation in the apparel and footwear market—namely, Celliant, Evrnu and OROS. We also present three key themes that we are watching in the textile innovation space:- Partnerships for sustainable textiles

- Fashion upcycling

- Expanding range of apparel categories using sustainable textiles

Why It Matters

We have seen interest in outdoor activities, health and fitness rise significantly due to Covid-19—a trend that we believe will persist post pandemic and continue to drive sales in outdoor apparel and footwear and performance apparel. Growth in these two sectors will support demand for performance textiles that help active people stay cool, comfortable and dry while working out, through moisture management and other technical features. Consumers are also becoming more conscious of the importance of sustainability, which is leading many brands and retailers in the global apparel and footwear market to implement strategies to reduce their environmental impacts—such as adopting more sustainable practices throughout their supply chains and using sustainable fibers in garment production.Think Tank: Textile Innovations in Apparel and Footwear

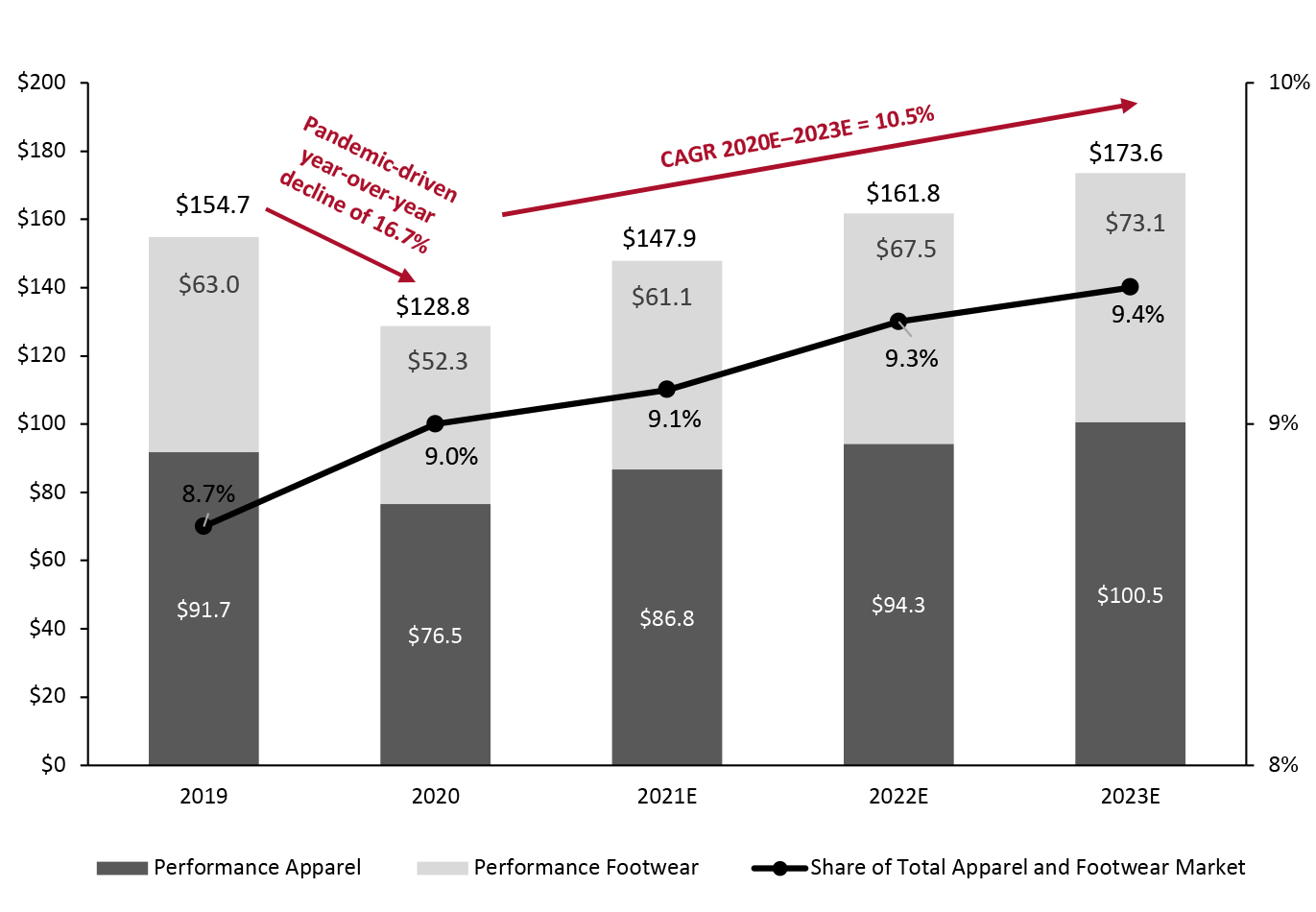

Performance Textiles Market Analysis There are different types of functions that performance textiles offer, but the sports and fitness arena currently has the most applications. Functional considerations of how garments will behave during wear are important, with specific fabric characteristics offering benefits to the wearer. Design innovations in performance textiles include moisture management and energy-restoration functions. Performance footwear includes design features such as athletic outer-sole tread and anti-injury devices, for example. Global performance apparel and footwear sales totaled $128.8 billion in 2020, which represented a pandemic-driven year-over-year decline of 16.7%, according to Euromonitor International. However, Euromonitor International estimates that the sector will recover in 2021 with 14.8% growth, although this means that total sales would remain below pre-pandemic levels. Beyond this year, the global performance-wear sector will continue gaining share of the total apparel and footwear market, reaching 9.4% in 2023, according to Euromonitor International. The global performance apparel and footwear market will grow at a CAGR of 10.5% from 2020 to 2023, according to Euromonitor International—faster than its estimate of an 8.7% CAGR for the total global apparel market. We therefore see opportunities for increased adoption of performance textiles in apparel.Figure 1. Global Performance Apparel and Footwear Sales (Left Axis; USD Bil.) and Share of Total Market (Right Axis; %) [caption id="attachment_125696" align="aligncenter" width="725"]

Performance apparel and footwear is characterized by the use of new fibers and fabrics with functional features, as well as innovative process technologies.

Performance apparel and footwear is characterized by the use of new fibers and fabrics with functional features, as well as innovative process technologies. Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research [/caption] Key Market Driver: Heightened Consumer Focus on Health and Wellness The stay-at-home measures imposed worldwide due to the Covid-19 pandemic have seen more consumers place higher value on outdoor activities. The outdoor apparel and footwear industry is set to benefit from strong demand moving forward. In the US, Coresight Research estimates a 9% increase in outdoor apparel and footwear sales in 2021, driven by increased consumer interest in active lifestyles and a surge in participation in outdoor activities and recreation. In addition, consumers worldwide have become more focused on health and wellness, which is a key driver of demand for fitness activities. The rising number of fitness club members and outdoor activities is likely to influence the market growth of performance textiles in the coming years. Although the pandemic has disrupted the outdoor activity and fitness sectors in 2020 (with gym closures and activity restrictions), we believe the short-term impact will not cease the overall long-term growth trend of performance wear and textiles. Key Performance Textiles Most performance fabrics adopted by apparel brands and retailers are focused on functions such as body-temperature management and waterproofing as opposed to odor resistance, antibacterial properties or more advanced smart textiles that use data collection and offer heart-rate monitoring. The pandemic led to increased attention on antibacterial textiles in personal protective equipment in 2020, but in 2021 and beyond, we expect to see growth opportunities in textiles that help adjust body temperature and have waterproofing functions: Many activewear retailers—including Backcountry, NIKE and Under Armour—are exploring new technologies in performance apparel.

Figure 2. Key Performance Textiles [wpdatatable id=861 table_view=regular]

Source: Company reports/Coresight Research We expect many apparel retailers to continue to work with tech providers, but some may look to create proprietary technologies, which, although more costly, may enable them to gain a strategic advantage in the competitive landscape. We present selected examples of apparel brands and retailers with proprietary performance-textile technologies in Figure 3.

Figure 3. Selected Examples of Apparel Retailers and Brands with Proprietary Technologies [wpdatatable id=862 table_view=regular]

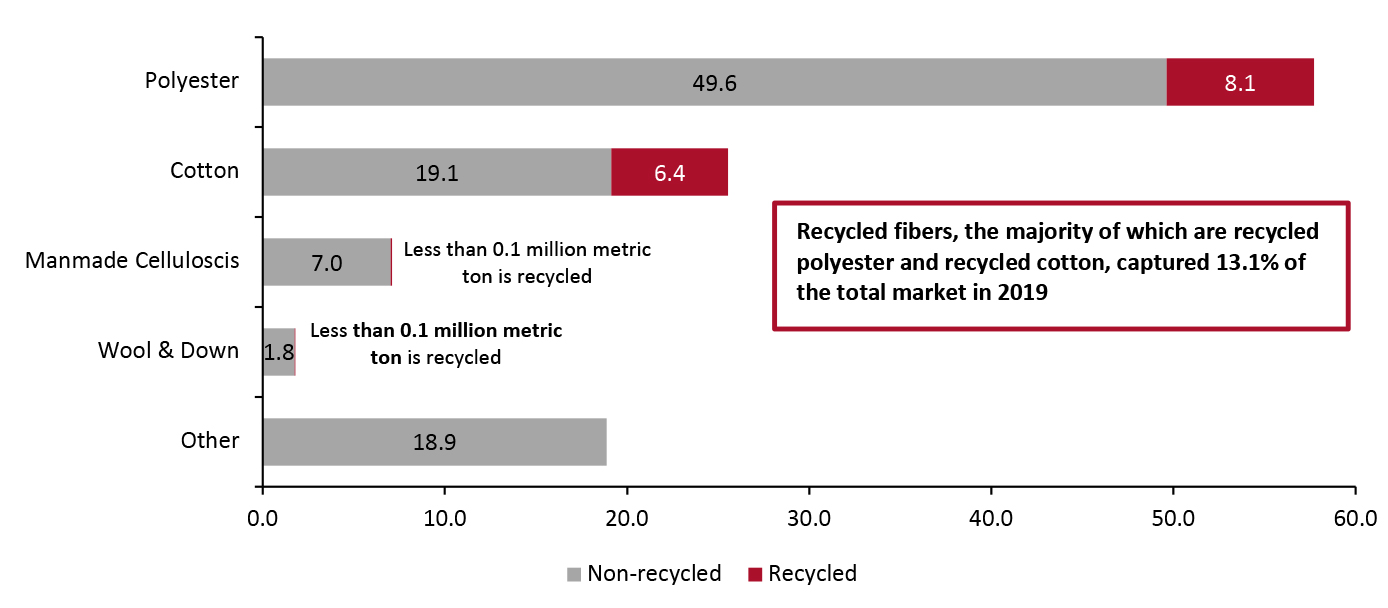

Source: Company websites/Coresight Research Sustainable Textiles Market Analysis The global recycled-fiber market captured 13.1% of the total fiber market in 2019, according Coresight Research analysis of the latest available data from Textile Exchange, a nonprofit organization. This low proportion indicates that there is white space for sustainable fibers in the market. Recycled polyester and recycled cotton are the two fibers that dominated the recycled-fiber sector in 2019. We expect the proportion of recycled fibers to grow in the next three years as consumers become more conscious of sourcing sustainability, a trend that manufacturers and retailers are already taking actions to respond to.

Figure 4. Global Fiber Market (Million Metric Tons), 2019 [caption id="attachment_125676" align="aligncenter" width="725"]

Note: A metric ton equals 1,000kg

Note: A metric ton equals 1,000kg Source: Textile Exchange/Coresight Research [/caption] Key Market Driver: Rising Consumer Consciousness of Sustainability Consumers have become more focused on sustainability. According to a recent survey by Coresight Research and Blue Yonder, 65.6% of US consumers believe that sustainability is an important factor in choosing where to buy apparel and footwear. With shopping choices being influenced by consumers’ growing awareness of environmental sustainability, there are likely to be opportunities in secondhand products, sustainable fabrics and textiles in the near future. We expect more consumers to show preferences for clothing made from sustainable raw materials or recycled materials. Key Sustainable Textiles The majority of apparel brands and retailers that have adopted sustainable fabrics use traditional sustainable fabrics such as organic linen, organic hemp and recycled cotton, nylon and polyester, rather than newer textiles such as Merino wool and Piñatex. Although the use of innovative sustainable fabrics is on the rise, they currently hold a small share of the sustainable fabric market, with only a few manufactures owning proprietary patents.

Figure 5. Key Sustainable Textiles [wpdatatable id=867]

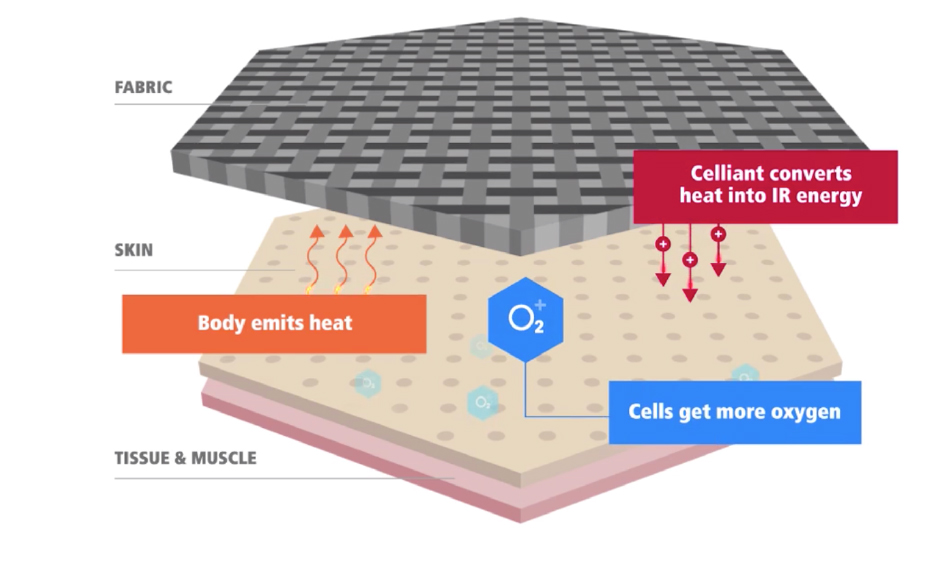

Source: Company websites/Coresight Research Innovators Below, we discuss three notable innovators in the field of textile innovation in the apparel and footwear market. Celliant Founded in 2002, Celliant is a US-based private company with patented technology that helps transform the wearer’s body heat into full-spectrum infrared energy to keep the body dry and provide oxygen to cells. The technology can help athletes develop strength and stay comfortable while doing exercise; it can help people recover from physical fatigue faster; and it can help people get better sleep as the technology can be incorporated into mattresses and sleepwear. The company has collaborated with a number of retailers. For example, Celliant collaborated with Under Armour on UA Rush and UA Recovery, two product lines that support athletes’ training. The company worked with Levi’s to create thermo-reactive fibers. It has also worked with Bed Bath & Beyond, Costco and Kohl’s on apparel and sleepwear products. [caption id="attachment_125677" align="aligncenter" width="725"]

Source: Celliant[/caption]

Evrnu

Founded in 2014, Evrnu is a US-based technology company that recycles cotton waste to create renewable textiles. Its technologies help create a wide range of fibers such as regenerated cellulosics, regenerated polyester, and recoverable stretch and bio-engineered fibers. Products made with these fabrics can be disassembled to the molecular level and reused multiple times.

With Evrnu, the textile or the apparel industry can transform waste into more valuable resources, creating a new and better alternative to simply burning or burying waste. Some early partners of Evrnu include Adidas, Levi’s, Stella McCartney and Target.

OROS

Founded in 2014, OROS is a US-based company that produces outdoor winter jackets featuring its patented SOLARCORE insulation technology, combined with light and thermal textiles with the flexibility of foam. The company’s technology has also been used by NASA for space-suit insulation. OROS tested its outerwear innovation against more than 250 other insulations and found its patent the warmest, according to the company.

Three Themes We Are Watching

1. Partnerships for Sustainable Textiles

Although some apparel brands and retailers will be able to develop their own proprietary textiles, we see partnerships with technology companies as an enabler for retailers to start using sustainable textiles at lower costs. Such partnerships would help retailers to test the market and let stakeholders and consumers see the concrete steps that companies are taking to improve environmental and social standards in textile supply chains, speeding up sustainability initiatives and the formation of a whole sustainable apparel ecosystem.

Several brands and retailers in the apparel and footwear industry have announced textile sustainability efforts in the past year across three types of partnership:

Source: Celliant[/caption]

Evrnu

Founded in 2014, Evrnu is a US-based technology company that recycles cotton waste to create renewable textiles. Its technologies help create a wide range of fibers such as regenerated cellulosics, regenerated polyester, and recoverable stretch and bio-engineered fibers. Products made with these fabrics can be disassembled to the molecular level and reused multiple times.

With Evrnu, the textile or the apparel industry can transform waste into more valuable resources, creating a new and better alternative to simply burning or burying waste. Some early partners of Evrnu include Adidas, Levi’s, Stella McCartney and Target.

OROS

Founded in 2014, OROS is a US-based company that produces outdoor winter jackets featuring its patented SOLARCORE insulation technology, combined with light and thermal textiles with the flexibility of foam. The company’s technology has also been used by NASA for space-suit insulation. OROS tested its outerwear innovation against more than 250 other insulations and found its patent the warmest, according to the company.

Three Themes We Are Watching

1. Partnerships for Sustainable Textiles

Although some apparel brands and retailers will be able to develop their own proprietary textiles, we see partnerships with technology companies as an enabler for retailers to start using sustainable textiles at lower costs. Such partnerships would help retailers to test the market and let stakeholders and consumers see the concrete steps that companies are taking to improve environmental and social standards in textile supply chains, speeding up sustainability initiatives and the formation of a whole sustainable apparel ecosystem.

Several brands and retailers in the apparel and footwear industry have announced textile sustainability efforts in the past year across three types of partnership:

- Brand-brand partnership: An apparel brand works with another apparel brand to together develop products that use sustainable fibers, which will allow the brands to exchange techniques and improve the brands’ reputations together. For example, H&M collaborated with Lee tolaunch 100% recycled cotton jeans and non-leather backpatches made from cork and jacron paper; Adidas and Allbirds partnered to develop a low-carbon athletic shoe; and Candiani Denim worked with Dim Mak (DJ Steve Aoki's fashion brand) to launch jeans that are crafted with sustainable fabrics.

- Brand-organization partnership: An apparel retailer works with a third-party organization, typically a non-profit agency or a foundation with some proprietary principles, framework or tracking system to improve transparency in the manufacturing process. For example, brands and retailers including Banana Republic, Marks & Spencer, Target Australia, Wrangler and Zalando have worked with organizations to have more established guidelines on sustainability and tracking resource usage.

- Brand-technology partnership: More brands and retailers are using third-party technological innovation to create fibers that can offer enhanced functionality, as well as the partnerships providing benefits in optimizing supply chains.

Figure 6. Sustainable Textiles: Selected Retail Partnerships [wpdatatable id=864 table_view=regular]

Source: Company reports/Coresight Research 2. Fashion Upcycling Upcycling is a method of transforming an item to increase its quality, often using waste materials. In apparel, upcycling has gained traction over the past few years, and brands and retailers are seizing the opportunity to make pledges to sustainability and create special merchandise to attract consumers. Among 24 apparel and footwear companies in the Coresight 100 (our focus list of retailers, brand owners and real estate firms), 17 have launched upcycled collections—on their own or in partnership with other brands—in the past five years. Upcycled apparel will be an important part of the sustainability revolution, helping people make meaningful choices with their clothing. We are seeing more retailers and labels launch upcycled collections, and we believe that this momentum will continue in the next five years. In Figure 7, we present selected brands and retailers and brands that have created upcycled collections. However, there are also some headwinds to the growth of upcycling in apparel, including longer production times, higher labor costs and the need for smarter designs to make use of random material scraps, compared to traditional apparel production. Patagonia addresses these problems by using the same shape and style for merchandise, rather than offering lots of different designs; it is only the fabric that changes between products, depending on the materials available.

Figure 7. Selected Retailers and Brands that Upcycle Their Garments [wpdatatable id=865 table_view=regular]

Source: Company websites/Coresight Research 3. Expanding Range of Apparel Categories Using Sustainable Textiles Having expanded from denim, the range of apparel categories using sustainable textiles now includes intimates, swimwear and loungewear, to name a few. As apparel retailers are extending their offerings across multiple categories to achieve market expansion, we expect them to strengthen their sustainable offerings across categories too.

Figure 8. Selected Examples of Apparel Categories Using Sustainable Textiles [wpdatatable id=866 table_view=regular]

Source: Company websites/Coresight Research

What We Think

Implications for Brands/Retailers- With consumers’ rising interest in fitness and healthy lifestyles, there are opportunities for activewear brands and retailers to tap demand for performance activewear, not necessarily designed for professional athletes but with added functions such as temperature management, quick-dry properties and sweat-proofing.

- Retailers need to adapt to consumer preferences around sustainability, recognizing that sustainability can influence consumers’ purchasing decisions. Sourcing sustainable textiles is a way to attract shoppers’ attention. Many retailers are now offering merchandise made from sustainable fabrics, and we expect this to be a long-term trend, presenting opportunities for brands and retailers to capture market share.

- Retailers can choose to partner with a third-party technology firm to create proprietary technologies, or work on their own innovations. Proprietary technologies can offer brands and retailers a strategic advantage in the competitive landscape, but this can be a more costly and time-intensive option than entering into a partnership.

- There are some headwinds to the growth of upcycling in apparel, including longer production times, higher labor costs and the need for smarter designs to make use of random material scraps, compared to traditional apparel production. Retailers need to create solutions to balance costs and profits if they want to launch upcycling collections. Patagonia addresses these problems by using the same shape and style for merchandise, rather than offering lots of different designs; it is only the fabric that changes between products, depending on the materials available.

- We believe there are opportunities for technology companies to create innovative textile solutions—particularly in performance wear and the arena of sustainability. Popular areas of application include temperature management, fabric upcycling and innovative fabrics that use less water and can be recycled multiple times.

Source for all Euromonitor data: Euromonitor International Limited 2021 © All rights reserved