DIpil Das

What’s the Story?

The Coresight Research Think Tank series delves into the trends and segments that we have identified as presenting growth opportunities in retail in 2021 and beyond. We provide a definitive overview of each topic and its impact on retail. In this report, we assess what the rapid expansion of SPACs means for US retailers and brands. We discuss key retail sectors for SPACs, the trajectory of brands and retailers entering public markets through SPACs from 2016 to 2020, and retail-focused SPAC developments in the pipeline for 2021. We present the opportunities and challenges for private retailers and brand owners seeking to enter the public market via SPACs, as well as an overview from an investor perspective. We provide our insights into why the future of SPACs in retail is booming for 2021 and beyond. We focus on US SPAC trends, with the inclusion of notable global data.Why It Matters

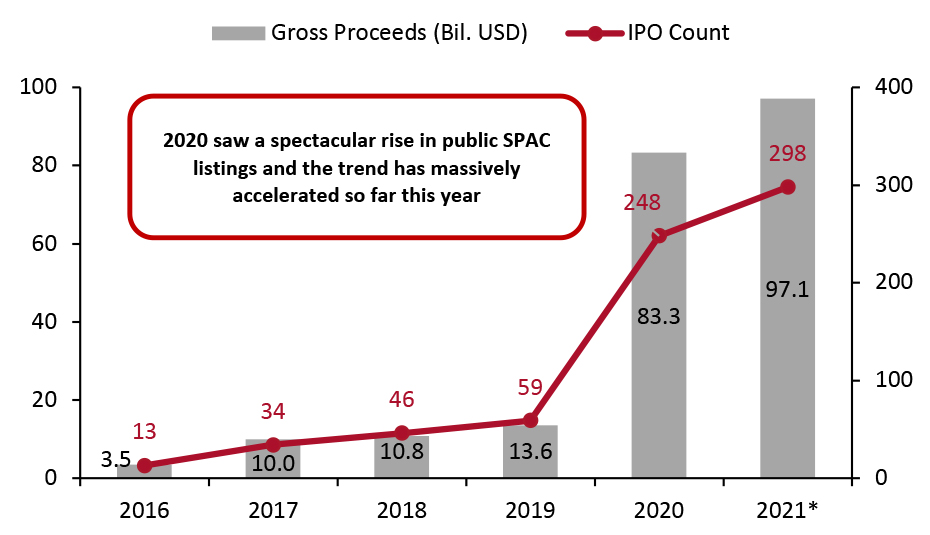

While SPACs were long considered a “last resort” for private companies that could not go public via a regular initial public offering (IPO) or attract takeover interest from strategic or financial investors, this alternate route to going public has recently become one of the hottest trends in the US capital markets. SPACs represent around 40% of the entire global public listing market, as of September 2020, with US-based SPACs accounting for nearly 85% of the global SPAC market. SPACs provide strong opportunities for brands and retailers to enter the public market and access funds for business expansion. In 2016, just 13 SPACs were listed on US stock exchanges, valued at $3.5 billion, with this number spiking to 248 SPAC IPO debuts in 2020, raising a significant $83 billion, according to data and analysis firm SPACInsider. Moreover in 2020, US SPACs were leveraged to complete five merger transactions among retailers, brands and retail tech firms, raising a total of $1.7 billion, according to SPAC tracker tool provider SPAC Track. The trend has massively accelerated in the first quarter of 2021—as of April 1, 298 SPACs have been listed for IPOs in the US, raising $97.1 billion and already surpassing the full-year tally for 2020. Around 35 of the SPACs listed so far, which have gross IPO proceeds of $10.3 billion, are looking for mergers and acquisitions in the consumer sector. We expect the trend to further expand throughout this year and beyond, driven by anticipated continued low-interest rates and strong equity market momentum.Figure 1. Gross Proceeds of US SPAC IPOs and IPO Count, 2016–2021 YTD* [caption id="attachment_125566" align="aligncenter" width="725"]

*As of April 1, 2021

*As of April 1, 2021 Source: SPACInsider [/caption]

SPACs in Retail: A Think Tank

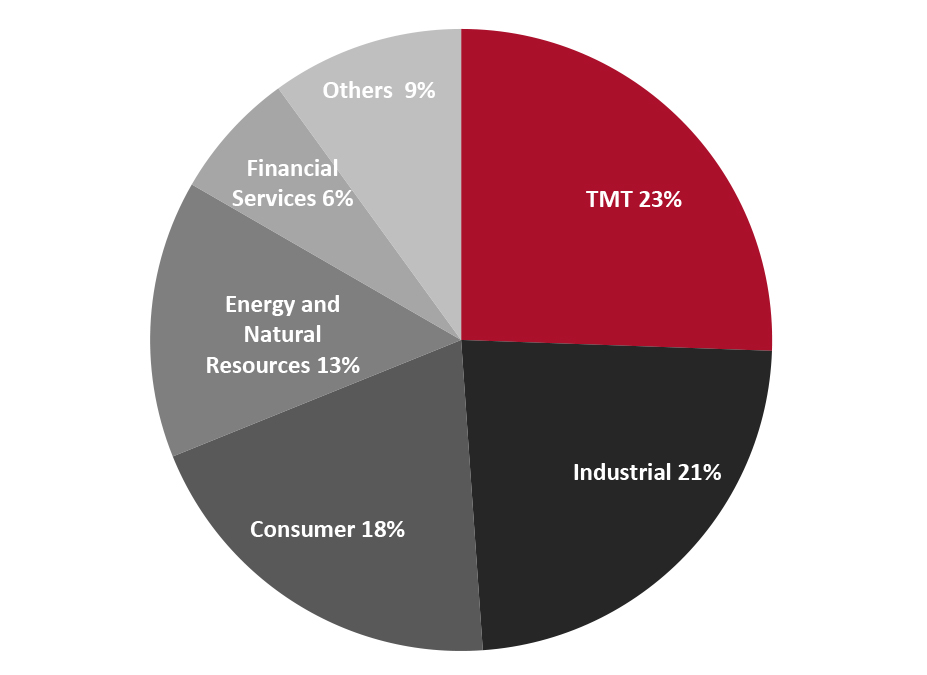

For private retailers looking to go public, a SPAC offers an attractive alternative to a traditional IPO. The formation of a SPAC means that it already has the structure to operate as a public company, providing a shell for the retailer it acquires to merge into—offering a less challenging go-public pathway than IPOs in many ways. We discuss the advantages and challenges of this route to public listing, as well as the specific stages of SPAC formation, in detail later in the report. Key Retail Sectors for SPACs SPACs have acquired and merged with companies in a myriad of industries, including energy and healthcare,with an increasing focus on the retail and technology, media and telecom (TMT) industries. From January 1, 2017, to September 30, 2020, the consumer sector (including retailers and brands) and the TMT industries comprised more than 40% of completed SPAC transactions across the globe, according to financial consultancy firm Duff & Phelps. We are seeing an increasing number of SPACs focusing on growing sectors in the technology fields, such as app software, automation and robotics, which have strong links to the retail ecosystem.Figure 2. Completed Global SPACs Transactions by Sector: January 1, 2017–September 30, 2020 [caption id="attachment_125567" align="aligncenter" width="725"]

Source: Duff & Phelps[/caption]

Brands and Retailers Entering Public Markets Through SPACs: 2016 to 2020

Globally, the consumer sector comprises more than 15% of total completed transactions by SPACs. In Figure 3, we list global retailers and brands that have been acquired by SPACs from 2016 to 2020 on their go-public pathway. Some 75% of these SPACs are US-based.

Source: Duff & Phelps[/caption]

Brands and Retailers Entering Public Markets Through SPACs: 2016 to 2020

Globally, the consumer sector comprises more than 15% of total completed transactions by SPACs. In Figure 3, we list global retailers and brands that have been acquired by SPACs from 2016 to 2020 on their go-public pathway. Some 75% of these SPACs are US-based.

Figure 3. Global Retailers and Brands Acquired by SPACs: 2016 to 2020 [wpdatatable id=849 table_view=regular]

Source: SPAC Track/Duff & Phelps Retail-Focused SPAC Activities in the Pipeline for 2021 Despite the impact of the pandemic on the retail environment, numerous retailers and brands are looking to SPACs as a means to going public. As of April 2, 2021, more than 80 US-based active and pre-IPO SPACs are seeking mergers related to retailers, brands and retail tech companies, according to SPAC Track. As US retail recovers, we will likely see an increasing number of retailers and brand owners entering the public market through SPACs. Below, we provide case examples for two active SPACs that have recently reached definitive merger agreements. Please see the report appendix for a full list of the 81 US-based active and pre-IPO SPACs seeking mergers in the consumer sector. We also discuss recent activity from REIT Simon Property Group following the mall operator’s move to form a SPAC earlier this year.

- Bark

- Stryve

- Simon Property Group

- Direct-to-consumer retail

- E-commerce

- Food and beverage retail

- Gaming, sports and e-sports retail

- Health and wellness retail

- Logistics

- Sustainable businesses

Figure 4. Benefits and Challenges of SPACs for Retailers [wpdatatable id=850 table_view=regular]

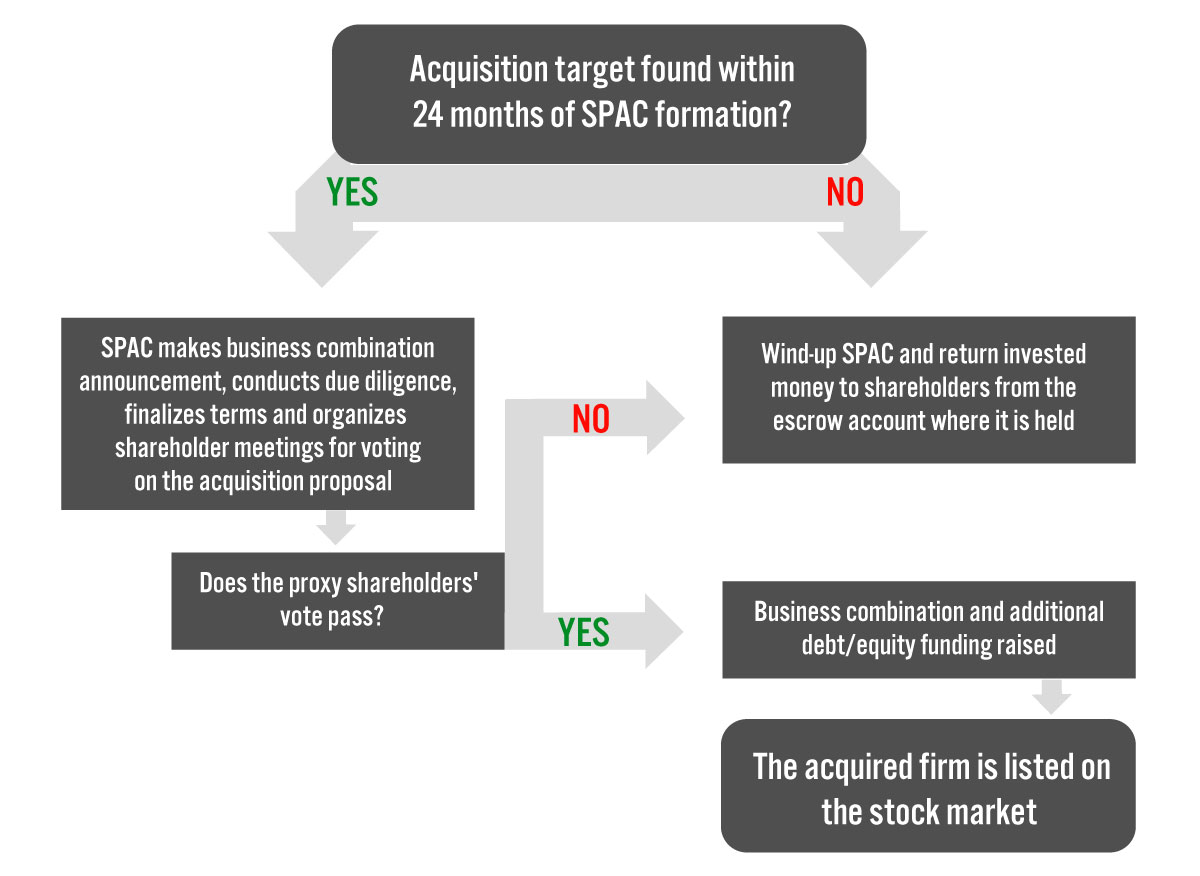

Source: Coresight Research Workings of a SPAC Private retailers can look to SPACs as an existing shell to merge into as a pathway to entering the public market. As highlighted in the Simon Property Group case example discussed above, companies and investors may form a SPAC as a means to target private retailers with strong investment potential in going public. Before we provide insights into the benefits and challenges of SPACs from an investment perspective in the subsequent section, we explore the workings of a SPAC in more detail. A SPAC is formed by a sponsor or an experienced management team with nominal invested capital, which translates to around a 20% stake (typically known as Class B founder shares and warrants) once the SPAC is publicly listed. The idea for SPACs among the founders of investment bank GKN Securities, with the first US SPAC listed in the 1990s. The management team leading the SPAC organizes investments from institutional and retail investors interested in the opportunity and then files for public listing. From the public listing of a SPAC, the sponsor has a 24-month window to identify, propose and complete a merger deal. Figure 5 shows the possible outcomes from this point up to a successful stock market listing.

Figure 5. Formation and Working of SPACs [caption id="attachment_125574" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

In the instances where a shareholder vote passes, which requires a higher majority than the 51% norm, investors that voted against the transaction can still retract their funds, which are all held in an escrow account until this point. Where the required majority of votes is not reached, sponsors may look and propose another target company within the 24-month window following the SPAC’s formation.

Below, we provide insights into SPACs as an investment opportunity.

Investor Perspective: Are SPACs a Good Investment?

Investors in SPACs can range from well-known institutional investors, underwriters and private equity (PE) funds to individual investors.

Figure 6 explores five benefits and five challenges of SPACs from an investor perspective.

Source: Coresight Research[/caption]

In the instances where a shareholder vote passes, which requires a higher majority than the 51% norm, investors that voted against the transaction can still retract their funds, which are all held in an escrow account until this point. Where the required majority of votes is not reached, sponsors may look and propose another target company within the 24-month window following the SPAC’s formation.

Below, we provide insights into SPACs as an investment opportunity.

Investor Perspective: Are SPACs a Good Investment?

Investors in SPACs can range from well-known institutional investors, underwriters and private equity (PE) funds to individual investors.

Figure 6 explores five benefits and five challenges of SPACs from an investor perspective.

Figure 6. Benefits and Challenges of SPACs from an Investor Perspectives [wpdatatable id=851 table_view=regular]

*Warrants are financial instruments that grants the holder of the instrument (in this case institutional investors) the right to acquire a particular stock (in this case stock of new company formed after the merger of the target company with the SPAC) at a predetermined price within a stipulated time period. On exercise of such warrants, fresh shares are issued by the issuer company (new company formed after merger of target company with SPAC). Source: Coresight Research Our Insights on the SPAC Boom and Future Prospects The rise in popularity of SPACs has been apparent in recent years, with gross proceeds from US SPAC IPOs and the number of listings increasing from 2016, as shown above in Figure 1. Last year, we saw unprecedented growth in SPAC activities amid the pandemic, with SPACs accounting for 55% of the US IPO activity versus 28% in 2019, according to SPAC Analytics data. The growth momentum has accelerated in 2021, with SPACs accounting for over 75% of the total US IPO activity in year-to-date in 2021. We discuss five key reasons behind the significant rise in SPACs in 2020 and our insights into the positive outlook for SPACs in 2021 and beyond. 1. Extreme market volatility US stock markets witnessed extreme volatility amid the coronavirus pandemic in 2020. Numerous, retailers and brand owners, including Cole Haan and Madewell, chose to defer their IPOs scheduled for 2020 or withraw them altogether out of apprehension that volatility would hamper their public debut. SPACs provide an alternate route to traditional IPOs and allow the target company to negotiate its own fixed valuation with the SPAC sponsors. This is particulalry beneficial amid voltatile markets and will likely prove to be a key attraction of SPACs for retailers looking to go public via the model in 2021. 2. Impact of federal measures and regulation on the model’s reputation The US Federal Reserve System lowered interest rates amid the pandemic, facilitating a low opportunity cost for investment in SPACs. Combined with strong equity performance, this makes SPACs an attractive investment option. This came against the backdrop of greater SEC involvement in the regulation of SPACs in recent years, which has boosted the reputation of the model in the investment world. The SEC regulates redemption and voting rights, ensuring benefits for all parties involved and reducing potential conflicts of interest, which we discussed in Figure 6. Moreover, in 2020, the reputation of the SPAC model was boosted by billion-dollar investments from high-profile fund managers, such as Bill Ackman and Chamath Palihapitiya, into US SPACs Perishing Square Tontine Holding and Social Capital Hedosophia Holdings Corp. Similarly, renowned companies inclding DraftKings and Nikola entered the public market via SPACs in 2020, boltering the reputation of SPACs in the financial market. In addition, major banks, such as Bank of America, Barclays Capital, Credit Suisse, Goldman Sachs and Merrill Lynch formalized their own SPAC businesses in 2020, further raising the profile of SPACs. 3. Rise of speculative investments and interest from the private equity market With a new uptrend in global stock markets driven by massive liquidity, speculators invested significantly in SPACs in 2020, bolstering the global SPAC market. We expect entrepreneurial speculative firms to continue to invest in SPAC formations to capitalize on volatile capital markets to make a short-term profit, although this may come at the cost of small individual investors. Moreover, we are seeing interest from private equity (PE) firms in the SPAC model. The reverse merger structure of SPACs enables deals with a more modest outlay over the cost of traditional acquisition and investment. As a PE firm sponsoring a SPAC typically acquires 2–3% of the shares offered in a SPAC public listing, they gain access to a large stake in a target company business with less upfront investment. Last year saw PE firms sponsor SPACs including Millennium Management, with the purchase of a 7.8% stake in SPAC Redball Acquisition Corp, which completed a $575 million IPO in August 2020. If PE-backed SPACs prove successful, the SPAC model could become a key player in how private equity firms run their businesses within the next couple of years 4. Forward-looking disclosure requirements and increased speed compared to traditional IPOs Unlike the traditional IPO pathway, SPACs require target companies to provide forward-looking projections and disclosures as part of negotiations, which is attractive to investors, particularly in the current uncertain environment. Furthermore, SPAC IPOs typically list target companies within a much shorter timeframe versus traditional IPOs. 5. Underwriting credibility for IPOs We have seen many traditional IPOs coming under scrutiny, most recently after Deliveroo saw its share price slump immediately following its March 31 IPO. Other high-profile IPOs, including Airbnb, DoorDash and ZoomInfo, saw large increases in initial share prices relative to the original IPO prices on their first trading days, suggesting that underwriting prices were lower than anticipated by public investors, questioning underwriters’ credibility.

What We Think

While SPACs have previously been considered outside of the mainstream; the model is becoming increasingly conventional as a route to entering the public market. We expect SPACs to continue to see accelerated growth momentum in 2021, driven by the continued low-interest rates, bolstered reputation and strong equity market momentum. We anticipate that SPACs will stay relevant as we gradually emerge from the coronavirus pandemic, providing opportunities for retailers and brand owners to use forward-looking projections to access capital. PE firms are likely to be a significant great catalyst for SPACs going forward, with access to expansive networks and financial resources, as well as industry and negotiation expertise enabling them to sponsor multiple SPACs at once. Furthermore, more venture capital funds are likely to enter the fray to diversify liquidity for their private companies. With a robust pipeline of active and pre-IPO SPACs in the US for 2021 (see the Appendix for the full list) and growing familiarity with SPAC transactions among US capital markets, we are likely to see a substantial amount of SPAC negotiations over the next two years, with notable impacts on both the merger and acquisitions and IPO markets. Nevertheless, traditional IPOs will continue to be relevant, with many companies believing that IPOs can provide better valuation and autonomy prospects. In fact, the boom in the SPAC market, as SPACs are recognized as a legitimate alternative to IPOs, may prompt efficiency improvements in the IPO process itself. Implications for Retailers and Brand Owners- As the SPAC merger process is only the beginning of a retailer’s journey to the public market, retailers should consider the long-term consequences. It is important that a retailer partners with SPAC sponsors that are backed by investors with relevant industry experience.

- Private retailers and brand owners looking to enter the public market via SPACs should ensure that they are well-informed ahead of negotiating their fixed valuation with sponsors. With a 20% equity stake typically reserved for SPAC sponsors having a dilutive effect on target shareholders post-merger, retailers should analyze the impact in the context of the full transaction economics, along with the uses and sources of financing.

- Retailers going public should prepare themselves to comply with financial reporting requirements, tax considerations, restructuring activities and human resource management.

- As a SPAC transaction requires public disclosure of forward-looking projections, there is an opportunity for retailers to tell a more in-depth story in terms of the investment thesis.

Appendix: SPACs in Retail

Appendix Figure 1. US: Active and Pre-IPO SPACs Targeting Retail Industries [wpdatatable id=852 table_view=regular]

Green indicates definitive agreements Source: SPAC Track