Nitheesh NH

Introduction

What’s the Story? The Coresight Research Think Tank series delves into the trends and segments that we have identified as presenting growth opportunities in retail. We provide a definitive overview of each topic and its impact on retail. Coresight Research has identified corporate evolution as a key trend to watch in retail and a component trend of Coresight Research’s RESET framework for change. That framework provides retailers with a model for adapting to a new world marked by consumer-centricity, in 2022 and beyond (see the end of this report for more details). In this Think Tank, we discuss key retail sectors for M&A, analyze the trajectory of brands and retailers entering M&A transactions from 2021 to year-to-date as of April 30, 2022, and present three strategies for retail players to capitalize on growth opportunities in M&A. Furthermore, we present our insights on the future of M&A in retail in 2022 and beyond. We present a full list of recently completed retail-focused US M&A transactions in the appendix of this report.- Read our separate reports on how retailers can capitalize on growth opportunities in other areas of corporate evolution: initial public offerings (IPOs), special purpose acquisition companies (SPACs) and venture capital (VC) funding.

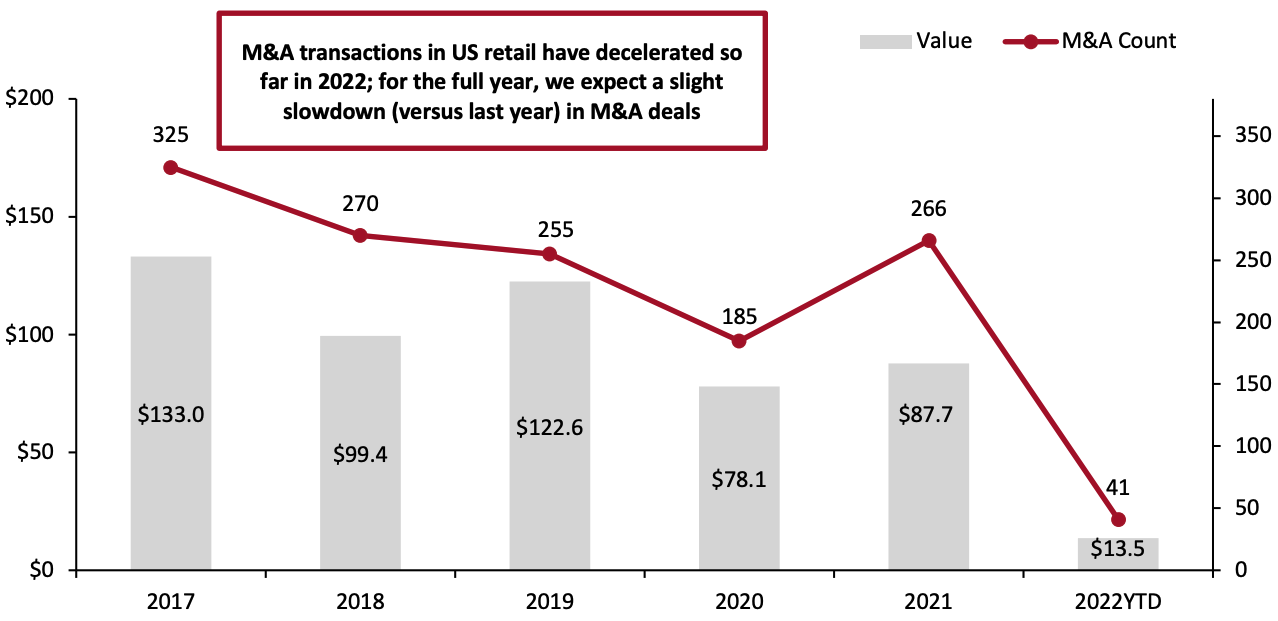

YTD as of April 30, 2022

YTD as of April 30, 2022Source: S&P Capital IQ/Coresight Research[/caption]

M&A in US Retail: A Think Tank

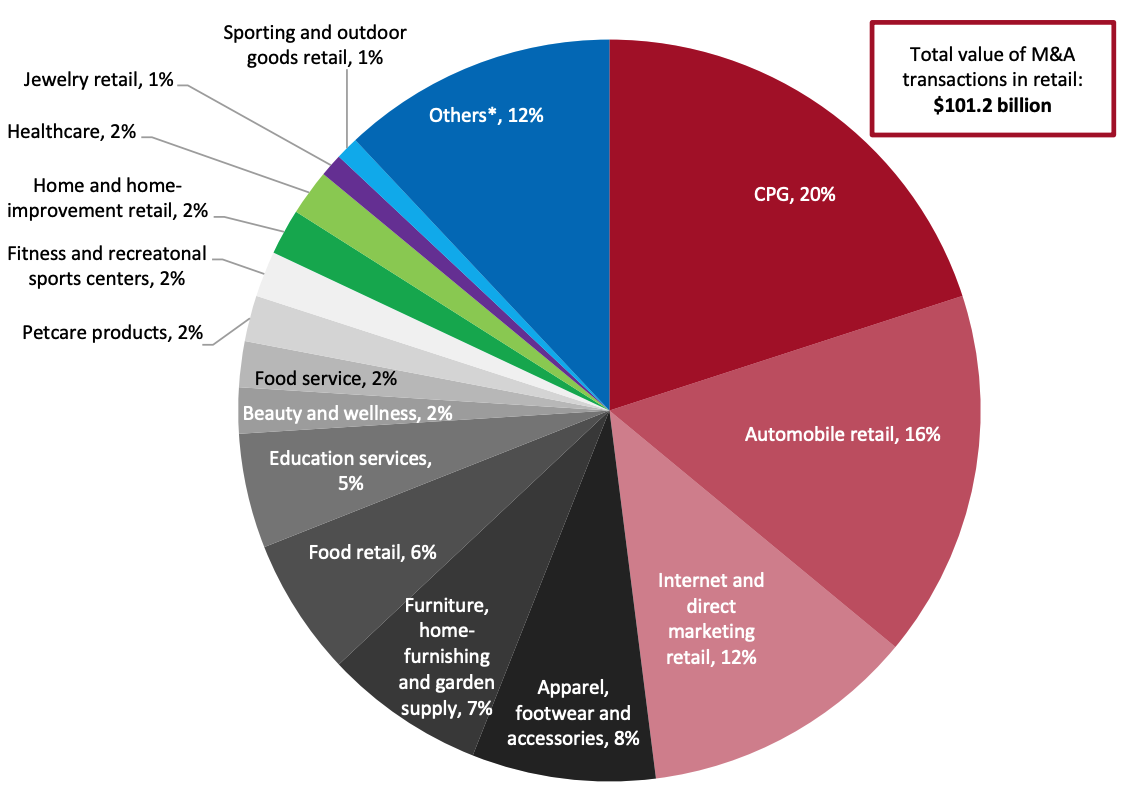

Key Retail Sectors Witnessing M&A Activity Between January 1, 2021, and April 30, 2022, we saw diverse consumer and retail-focused M&A activity in the US, with consumer packaged goods (CPG) companies, which sell consumer packaged foods and meat as well as beverages, witnessing the highest value of M&A transactions, comprising about 20% of the total $101.2 billion value of M&A transactions in the focus period, according to Coresight Research analysis of S&P Capital IQ data. Apparel, footwear and accessories, automotive retail, beauty and wellness, food retail, furniture, home-furnishing and garden supply retail, education services, and Internet and direct marketing retail all had a substantial number of transactions, each between 5% and 16% of total completed M&A transactions in the sector. Combined, these industries contributed about 75% of M&A transactions (both in terms of M&A count and valuation) in the sector during the period in question, according to Coresight Research analysis of S&P Capital IQ data. Below, we present examples of six key completed retail-focused M&A transactions from January 1, 2021, to April 30, 2022, organized via sector—with the value of each transaction exceeding $100 million. We also highlight key themes in these sectors with respect to M&A transactions. Please see the appendix for a full list of the 307 noteworthy, completed retail-focused M&A transactions in the US during the period. Apparel, Footwear and Accessories Apparel and footwear companies accounted for 8% of the total retail-focused completed M&A transactions between January 1, 2021, and April 30, 2022. We expect portfolio redefinitions to continue fueling M&A activity in the apparel and footwear sector, with larger companies showing resilience and remaining focused on value creation strategies. In 2022 and beyond, capability expansion will likely be a key focus as apparel and footwear brand owners and retailers enhance digital capabilities and logistics through M&A transactions, as well as expand product offerings and geographical reach. Below, we discuss in detail two recent noteworthy M&A transactions involving apparel and footwear companies. In March 2022, brand management company Authentic Brands Group completed the acquisition of sportswear brand Reebok from Adidas for €2.1 billion ($2.5 billion). Lately, Authentic Brands has been acquiring renowned apparel and footwear brands and department stores to build its portfolio, including Eddie Bauer, Forever 21 and JCPenney. While filing for an IPO in July 2021, Authentic Brands noted that its roster of over 30 brands generates nearly $10 billion in annual gross merchandise value (GMV). The acquisition of Reebok adds athletic gear to its growing portfolio. Authentic Brands plans to maintain Reebok’s footprints across e-commerce, retail and wholesale channels.- Croc’s Acquisition of Hey Dude for $2.5 Billion

- Edgewell Personal Care Company’s Acquisition of Billie Inc. for $310 Million

- Hershey’s Acquisition of Dot's Pretzels and Pretzels Inc. for $1.2 Billion

- Hain Celestial Group’s Acquisition of That’s How We Roll for $261 Million

- Booking Holdings’ Acquisition of Getaroom for $1.2 Billion

Figure 2: US: Value of Completed Retail-Focused M&A Transactions, Breakdown by Retail Sector, January 1, 2021–April 30, 2022 (% of Total Value) [caption id="attachment_149837" align="aligncenter" width="700"]

*Others include M&A deals in book retail, cannabis retail, consumer electronics stores, diversified consumer services, fuel retail, industrial supply and electrical equipment, music instrument retail, film equipment and funeral homes

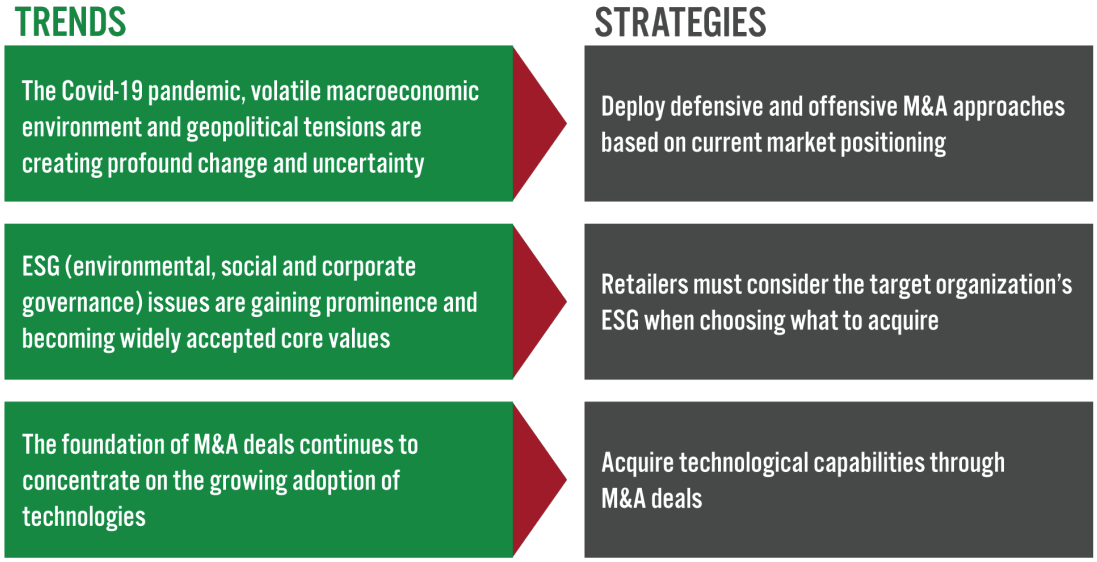

*Others include M&A deals in book retail, cannabis retail, consumer electronics stores, diversified consumer services, fuel retail, industrial supply and electrical equipment, music instrument retail, film equipment and funeral homesSource: S&P Capital IQ/Coresight Research[/caption] Key Strategies to Adapt to Recent Trends in M&A Trends are key aspects set to impact retailers’ future businesses—brands and retailers should invest in the right themes/trends so that their M&A deals become success stories. We present three key strategies that brand owners and retailers can adopt in response to recent M&A trends. We summarize these trends and strategies in Figure 3 and discuss each in detail below, with examples.

Figure 3. Three Key Strategies for Retailers to Adapt to Trends in M&A [caption id="attachment_149838" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Deploy Defensive and Offensive M&A Approaches Based on Current Market Positioning

The Covid-19 pandemic and the volatile macroeconomic environment have created profound change and uncertainty. As brands and retailers seek to protect their core addressable markets, accelerate business transformation and position themselves to expand market share, we expect them to deploy both defensive and offensive M&A approaches going forward.

Defensive M&A Approach: In a defensive M&A approach, one company acquires another company as a defense against market downturns or potential takeovers. This strategy is all about safeguarding market share and includes acquiring smaller rivals.

Source: Coresight Research[/caption]

1. Deploy Defensive and Offensive M&A Approaches Based on Current Market Positioning

The Covid-19 pandemic and the volatile macroeconomic environment have created profound change and uncertainty. As brands and retailers seek to protect their core addressable markets, accelerate business transformation and position themselves to expand market share, we expect them to deploy both defensive and offensive M&A approaches going forward.

Defensive M&A Approach: In a defensive M&A approach, one company acquires another company as a defense against market downturns or potential takeovers. This strategy is all about safeguarding market share and includes acquiring smaller rivals.

- For instance, in March 2022, underwear retailer Victoria’s Secret acquired a minority stake in a DTC beachwear and lifestyle brand, Frankies Bikinis, for $18 million. Through this acquisition, Victoria’s Secret looks to strengthen its existing swimwear offerings and attract new shoppers to its DTC channel.

- For example, in April 2022, South Korea-based beauty and personal care company LG Household and Health Care acquired a majority stake in US-based beauty and personal brand The Crème Shop for $120 million. The Crème Shop, which operates a multi-channel distribution model, including mass retail via retail partners such as CVS, Macy’s, Ulta Beauty and Urban Outfitters, has a robust following among Gen Z and millennials, owing to the brand’s affordable price and high quality. Through this acquisition, LG Household and Health Care plans to expand its presence in the North American beauty and personal care industry.

- Earlier, in August 2021, LG Household and Health Care acquired a 56% stake in the US-based haircare company Boinca for $101 million. Boinca is widely known for its high-end Arctic Fox brand, which remains popular among young shoppers, mainly due to its consistent opposition to testing of products on animals. Through this acquisition, LG expanded its presence in the North American premium hair care market, as the company is looking to curb its reliance on the China market.

- For instance, in April 2022, Switzerland-based beauty company Wella Company entered an agreement to acquire the US-based fast-growing eco-ethical and natural haircare brand Briogeo, which is also one of the largest Black-owned brands in the country. The financial terms of the transaction were not disclosed.

- Through this acquisition, Wella aims to support Briogeo’s strategy to excel in sustainable beauty and bolster the former’s ESG propositions. In the acquisition press release, Annie Young-Scrivner, CEO of Wella Company, said

Briogeo aligns with Wella Company's deep commitment to building a company with Diversity, Equity, and Inclusion (DEI) and Environmental, Social and Governance (ESG) embedded into its core. The addition of the Briogeo portfolio of prestige hair care complements Wella Company's ambitions to deliver more diverse products for all hair types, while expanding clean and green products across its portfolio offerings.

- Similarly, in December 2021, France-based investment group Eurazeo acquired the US-based clean and sustainable beauty brand Beekman 1802 for $62 million. Beekman is widely popular for its commitment to authenticity, kindness and sustainability—It is the first and only certified microbiome-friendly brand at Ulta Beauty stores. In the acquisition press release, Adrianne Shapira, Managing Director at Eurazeo Brands, said that Beekman resonates with today’s beauty shoppers seeking aspirational yet clean and sustainable products. Eurazeo aims to capitalize on its industry expertise to enable Beekman to reach consumers on a global scale in the medium term.

- In December 2021, sportswear giant NIKE acquired digital sneakers manufacturer RTFKT for an undisclosed amount. NIKE has been developing its metaverse capabilities in-house and RTFKT, with its advanced capabilities in blockchain authentication and augmented reality (AR), games engines and non-fungible tokens (NFTs), can speed up the process. In the acquisition press release, NIKE’s CEO John Donahoe said

This acquisition is another step that accelerates Nike’s digital transformation and allows us to serve athletes and creators at the intersection of sport, creativity, gaming and culture. Our plan is to invest in the RTFKT brand, serve and grow their innovative and creative community and extend Nike’s digital footprint and capabilities.

- In 2021, apparel and footwear specialist Gap Inc. acquired two technology companies to expand its digital capabilities. In October 2021, Gap acquired artificial intelligence (AI) and machine learning startup Context-Based 4 Casting (CB4), which utilizes predictive analytics and demand sensing to transform retail operations, enhance the customer experience and boost revenues. Earlier, in August 2021, Gap acquired the e-commerce startup Drapr, which is built on technology that lets shoppers quickly create 3D avatars and virtually try on clothing. The financial terms of both the transactions were not disclosed.

Figure 3: Key Factors Impacting M&A in US Retail

| Driving Forces | Potential Headwinds |

| 1. Broader trend of expanding core portfolios: With brands and retailers continuing their search to expand their portfolios, we expect M&A activity in retail to remain substantial in 2022—although lower than in 2021. Post-acquisition, the acquiring retailers can channel resources into core/growing segments and key markets of the target company, away from non-core business segments and non-strategic markets. | 1. Rising inflation and interest rates: To counter inflation, in May 2022, the US Central Bank raised interest rates by 50 basis points (bps) to a target rate range of 0.8% to 1.0%. The increase is the highest since 2000 and follows a 25-bps increase in March 2022—the first raise since 2018. In mid-June 2022, the Federal Reserve hiked rates by a further 75 basis points. Furthermore, the Central Bank signaled more interest rate increases in 2022. An increase in interest rates could cool down M&A activity as a leveraged buyout is one of the most common strategies used in M&A, where the acquirer uses a substantial amount of borrowed funds to meet the cost of acquisition. |

| 2. Enhancing operational resilience and business transformation: As retailers’ conventional business models are coming under threat due to rapid innovation, many companies are looking to M&A transactions to overhaul their businesses, including digitalizing, integrating vertically and diversifying their supply chains. Furthermore, we expect retailers to continue to capitalize on M&A to build resilience and agility against the ongoing headwinds, such as supply chain disruptions. For instance, in December 2021, apparel and footwear specialist American Eagle Outfitters acquired logistic service provider Quiet Logistics for $360 million. Earlier, in August 2021, the retailer acquired logistic company AirTerra. | 2. Proposed increase in US corporate tax: On March 28, 2022, the Democrats in the US House of Representatives proposed an increase in the corporate tax rate to 28.0% from 21%. We believe the proposed increase in the US corporate tax rate could decrease the attractiveness of investment in US companies while leading to more investment overseas. Nevertheless, the proposed tax changes are still under discussion and are heavily opposed by Republicans and business lobbies. |

| 3. Private equity firms seeking value-creation opportunities in carve-outs: M&A deals led by private equity (PE) firms have been on an impressive run as PE firms across the globe are looking for value-creation prospects in carve-outs—the partial divestitures of business units in which parent companies sell stakes of subsidiaries to outside private investors. In the first quarter of 2022, 32.4% of M&A deals in the retail and consumer goods sector in North America involved a PE fund, up from 30.4% in the first quarter of 2021, according to the US-based financial data and software provider PitchBook. In 2021, “dry powder” (the amount of committed but unallocated capital firms have on hand) held by PE firms across the globe rose to $3.4 trillion according to UK-based data provider Preqin. Due to this huge available reserve, we expect the M&A activity in 2022 to remain substantial. We see apparel and footwear companies, beauty and wellness brands, CPG companies and Internet and direct marketing retailers as likely points of interest for these private equity buyers. | 3. Legal and regulatory scrutiny: The tightening regulatory environment in the US could likely create headwinds for M&A dealmakers in 2022, particularly those agreements that invite antitrust or foreign direct investment (FDI) inquiry. In January 2022, the a joint public investigation to review M&A rules, including the role of potential and nascent competition, to clamp down on corporate mergers, mainly in technology markets, and strengthen law enforcement. We believe that the rising scrutiny and protectionism could impact cross-border M&A activity. |

Source: US Federal Reserve Board/FTC/DOJ/PitchBook/Preqin/Coresight Research

Key Considerations for US Retailers Entering M&A Transactions Brand owners and retailers may reach a point at which M&A becomes the most efficient way to expand operations, drive competitive advantage or save the company from going out of business. However, like any other major financing transaction, M&A deals involve complex processes and ample due diligence—retailers should not underestimate the resource commitment required. We discuss key considerations, including the source of M&A financing, assets versus stock deal decisions and tax implications at various phases of a M&A, along with the benefits and challenges of M&As for retailers, in our separate M&A in Retail report published in July 2021.What We Think

In 2022, we expect a slowdown (versus last year) in retail-focused M&A deals in the US, due to elevated uncertainty in relation to reduced consumer demand in retail, interest rate increases, growing legal scrutiny and supply chain challenges (aggravated by geopolitical tensions). In addition, the growing risks of a US recession could lead to the abandonment of considerable potential M&A deals in 2022. Nevertheless, we expect portfolio redefinitions to continue fueling deals in 2022, with larger companies showing resilience and remaining focused on value creation strategies. Capability expansion will continue to be a key focus as retailers and brand owners enhance digital capabilities, financial technology and logistics through M&A transactions, as well as expanding product offerings and geographical reach. An increased focus on ethical and sustainable issues will also drive investments in M&A in the retail market. Similarly, we expect substantial levels of PE investments through 2022 to continue to drive M&A activity despite high inflation and the recent increase in interest rates. We think that investment in the Internet and direct marketing retail sector will be the best bet for M&A deal activity amid the current uncertain environment as technology companies are growing at a rapid pace across the globe—moreover, earnings in technology companies usually depend less on economic growth. In addition, in 2022 and beyond, we expect the retail and consumer goods M&A pipeline to broaden in terms of sector representation, including more sectors that are experiencing a solid recovery from the Covid-19 pandemic—such as the beauty and wellness sector. Implications for Brand Owners and Retailers- While consolidation may be inevitable for brands and retailers facing imminent distress, deal-making may be the best and fastest way to fill urgent gaps in resources, skills and technologies that they need to create value going forward.

- We see e-commerce as a substantial opportunity for US retailers to adjust product and service offerings and drive sales. Furthermore, we believe that growing online demand will drive consolidation in the industry, with leading players ramping up M&A activity to expand their digital businesses.

- As the world of M&A is evolving, brands and retailers should remain cognizant of the current trends prevailing in the global retail landscapes when devising their M&A strategies. Developing a well-defined and comprehensive strategy in response to trends for each function and geography across the entire enterprise will be helpful to retailers to maximize M&A’s synergies.

- As discussed in our Playbook on M&A in retail, outlining a structured approach that breaks down a complex M&A integration into defined phases, steps and deliverables can help retailers maximize M&A benefits—such as revenue and cost synergies, expansion of market share and enhanced customer bases—while minimizing risks, including diseconomies of scale.

- In case a major restructuring of the target company is required after a merger, the acquirer and target company must discuss it beforehand to ensure that all stakeholders, including employees, investors and suppliers, agree on the defined strategies set by the acquiring company.

About Coresight Research’s RESET Framework

Coresight Research’s RESET framework for change in retail serves as a call to action for retail companies. The framework aggregates the retail trends that our analysts identify as meaningful for 2022 and beyond, as well as our recommendations to capitalize on those trends, around five areas of evolution. To remain relevant and stand equipped for change, we urge retailers to be Responsive, Engaging, Socially responsible, Expansive and Tech-enabled. Emphasizing the need for consumer-centricity, the consumer sits at the center of this framework, with their preferences, behaviors and choices demanding those changes. RESET was ideated as a means to aggregate more than a dozen of our identified retail trends into a higher-level framework. The framework enhances accessibility, serving as an entry point into the longer list of more specific trends that we think should be front of mind for retail companies as they seek to maintain relevance. Retailers can dive into these trends as they cycle through the RESET framework. The components of RESET serve as a template for approaching adaptation in retail. Companies can consolidate processes such as the identification of opportunities, internal capability reviews, competitor analysis and implementation of new processes and competencies around these RESET segments. Through 2022, our research will assist retailers in understanding the drivers of evolution in retail and managing the resulting processes of adaptation. The RESET framework’s constituent trends will form a pillar of our research and analysis through 2022, with our analysts dedicated to exploring these trends in detail. Readers will see this explainer and the RESET framework identifier on further reports as we continue that coverage.Figure 4. RESET Framework [caption id="attachment_149839" align="aligncenter" width="500"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Appendix

Appendix Figure 1: US Completed Retail-Focused M&A Transactions from January 1, 2021, to April 30, 2022 [wpdatatable id=2060]

*Acquirer information not available Source: S&P Capital IQ/company reports/Coresight Research