Nitheesh NH

What’s the Story?

The Coresight Research Think Tank series delves into the trends and segments that we have identified as presenting growth opportunities in retail in 2021 and beyond. We provide a definitive overview of each topic and its impact on retail. In this report, we explore the community group-buying market in China. We discuss the consumer shopping journey via group buying and the market’s competitive landscape. We also present five key advantages of the community group-buying model and its future in the international retail ecosystem.Why It Matters

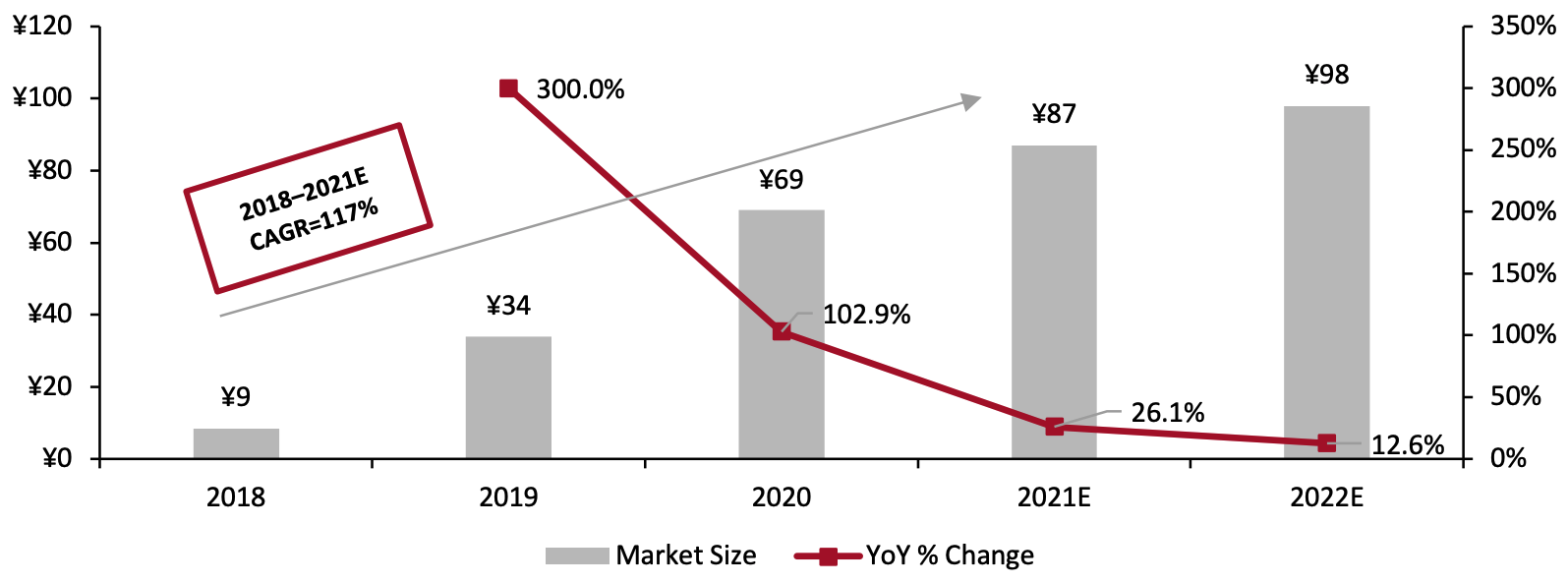

Community group buying is a multibillion-dollar industry in China, and it has expanded rapidly amid the Covid-19 pandemic, as the model enables shoppers to avoid visiting brick-and-mortar stores for essential grocery purchases—therefore reducing their social contact. The community group-buying model can enable retailers to strategically expand their consumer base by building strong communities around their brands and gaining access to community leaders’ networks. It also enables brands and retailers to shift older inventory—a considerable advantage in the current environment, given excess inventory issues due to pandemic-induced supply chain friction and temporary store closures. We estimate that China’s community group-buying market will total ¥87 billion ($13.4 billion) in 2021, representing 26.1% year-over-year growth, as shown in Figure 1. This would see community group buying account for 0.2% of total retail sales—which are set to reach ¥42.6 trillion ($6.6 trillion)—in 2021, up from retail sales penetration of just 0.02% in 2018. The industry’s near-term growth is likely to be in the grocery category, as the daily bulk delivery model for community group buying is primarily designed to cater for fresh-food demand. However, we see opportunities for other categories to leverage the group-buying model—internationally as well as in China. Numerous Internet giants have branched out to enter the community group-buying market in China in light of increased interest in 2020 and strong future growth potential. Figure 1. The Community Group-Buying Market in China (RMB Bil.) [caption id="attachment_125130" align="aligncenter" width="720"] Source: 100ec/Coresight Research[/caption]

Source: 100ec/Coresight Research[/caption]

Community Group Buying: A Think Tank

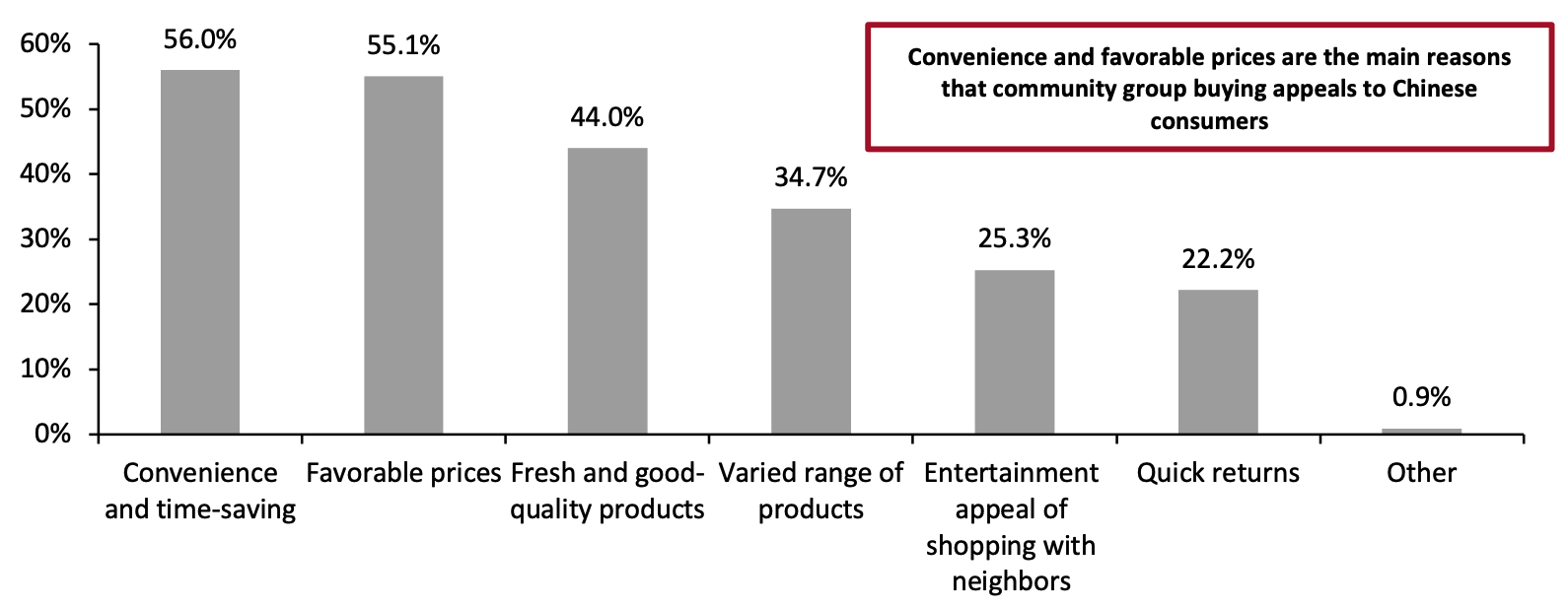

What Is Community Group Buying? Community group buying centers around bulk buying and delivery, whereby consumers living in close proximity can group together to access discounts on joint purchases. A community group-buying platform works as an intermediary, approaching suppliers to list their products. Suppliers include farmers and factories that produce fast-moving consumer goods (FMCG), such as everyday household products. Advantages of Community Group Buying for Consumers Low prices are a fundamental driver of the model, with a 2020 iiMedia survey finding that 55.1% of Chinese consumers perceive community group-buying platforms as offering more favorable prices than other online shopping platforms selling the same goods. Targeting price-conscious consumers—particularly in lower-tier cities in China—is a key strategy for retailers leveraging this model, and we discuss these benefits later. However, the same survey saw the highest proportion of consumers state that convenience is a primary advantage of the model. This is likely to have been driven recently by the Covid-19 pandemic, with consumers being more reluctant to visit brick-and-mortar stores. Figure 2. Consumers’ Perceptions of the Advantages of Community Group Buying in China, 2020 (% of Respondents) [caption id="attachment_125131" align="aligncenter" width="720"] Respondents could select more than one option

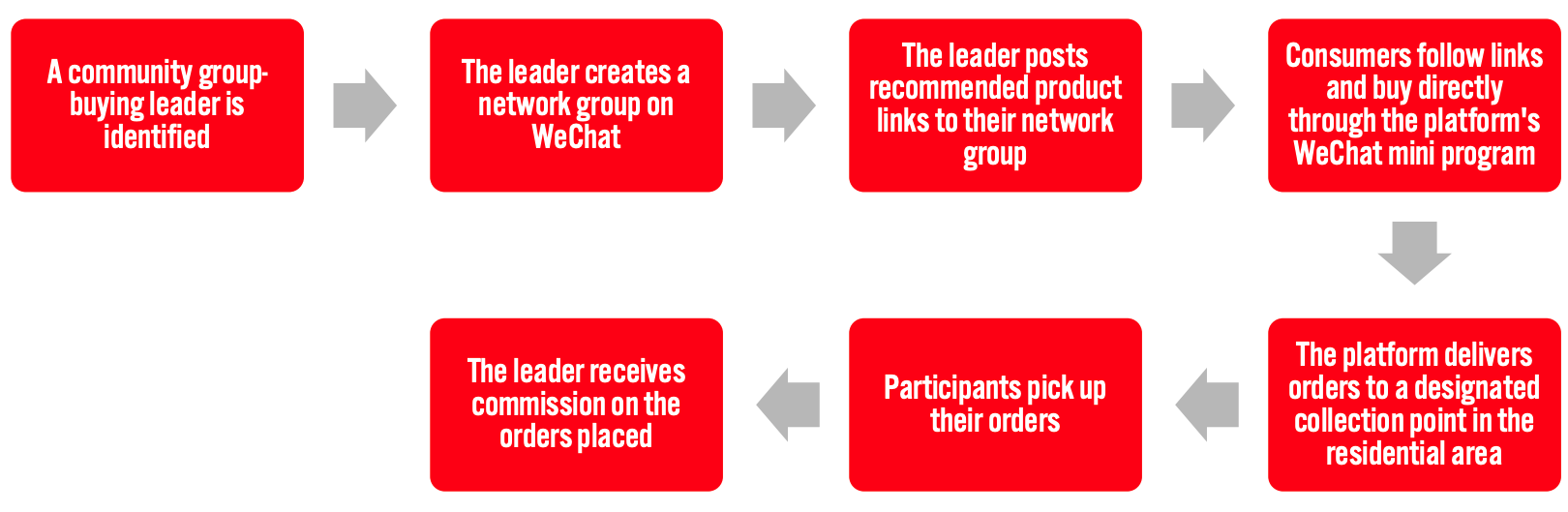

Respondents could select more than one optionSource: iiMedia/Coresight Research[/caption] The Digital Shopping Journey Community group buying utilizes a group leader who provides product recommendations to their network, effectively becoming a micro-influencer or sales representative for consumers in a given residential area. The leader takes responsibility for maintaining relationships within the network and organizing purchases for participants, who typically live in the same apartment building or housing area. Platforms post hiring information for consumers to apply to be community leaders and encourage current leaders to recommend people to be leaders in other communities: The platforms select the leaders. Often, convenience store operators are community group-buying leaders, as they are typically well known within a community. Stay-at-home parents also commonly sign up to be group leaders. In the later section on the future of community group buying, we discuss why providing incentives for leaders is a key part of the model. Appointed leaders can create a network group on China’s WeChat super app. WeChat groups usually enjoy high user stickiness, partly due to the app’s ubiquitous status, with around 1.2 billion monthly active users globally, as of the first quarter of 2020, according to the company. The leader posts product links in the WeChat group, which comprises a network of community residents. These links, which may be chosen by the leader based on particular promotions or recommendations, direct the group’s members to the group-buying platform’s WeChat mini program, where they can place their order. Community-group buying platforms do not operate store-based fulfillment—where stores hold inventory and distribute orders—in the same way as fresh e-commerce platforms with offline stores, such as Alibaba and JD.com. Instead, they arrange to receive goods from partner vendors and store products in a central warehouse, before distributing them to local warehouses that are closer to consumers. This enables orders to be eligible for next-day delivery if they are placed before a certain cut-off time. Orders are delivered to a designated collection point, such as a community center, where consumers are then responsible for picking up their own orders. The group-buying business model has some similarities to the traditional “agency” mail-order model (whereby an individual would be an agent for a mail-order business in their neighborhood or community and earn commission on sales) and a direct-sales model, such as is employed by beauty company Avon. Figure 3. Community Group Buying via WeChat in China: The Consumer Journey [caption id="attachment_125132" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

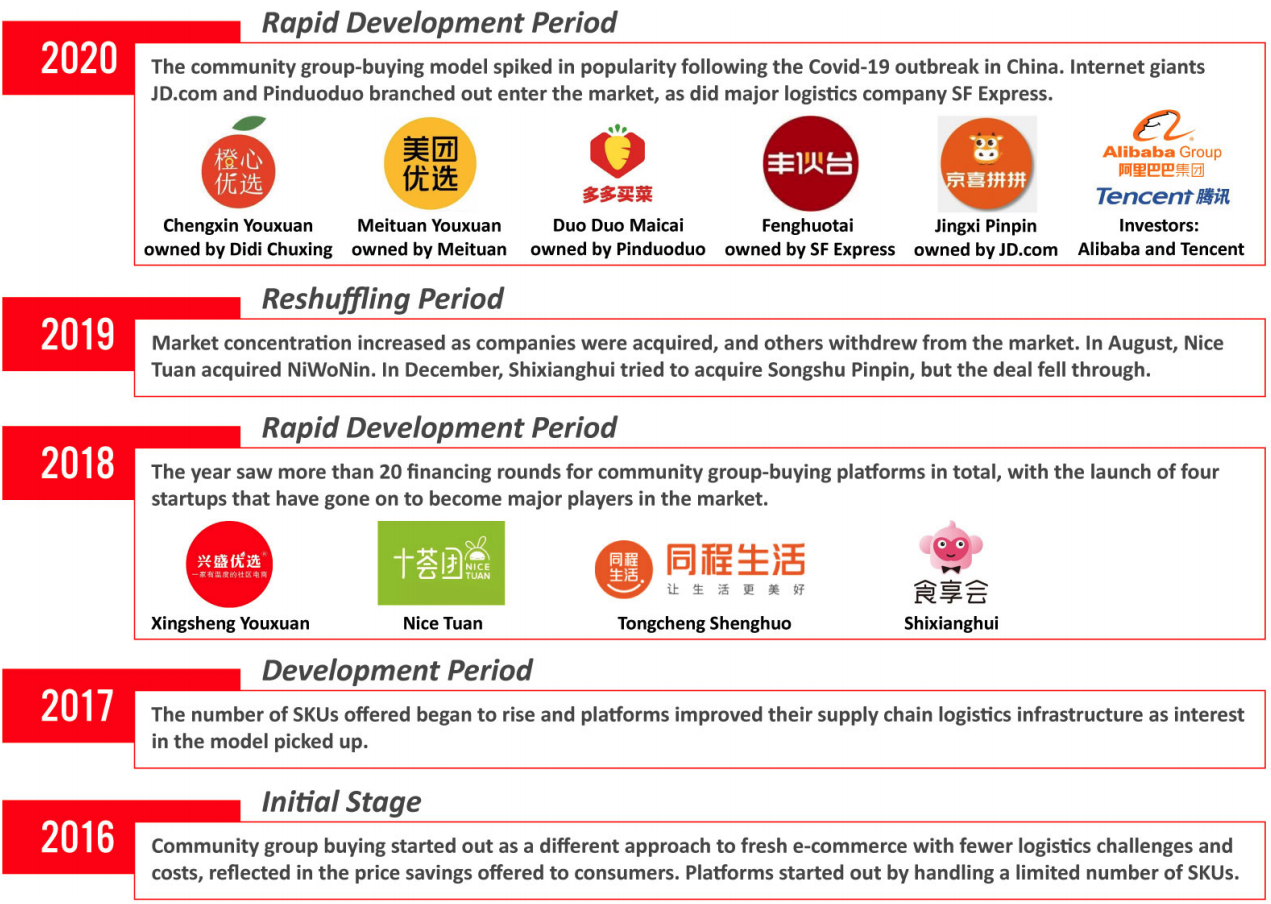

Timeline of Market Developments

The community group-buying model was established in response to the logistics challenges of grocery e-commerce and to target price-conscious consumers. The main areas serviced by community group-buying platforms are Tier 2, Tier 3 and Tier 4 cities (which we discuss in further detail later in this report), due to the low-cost characteristics of the model.

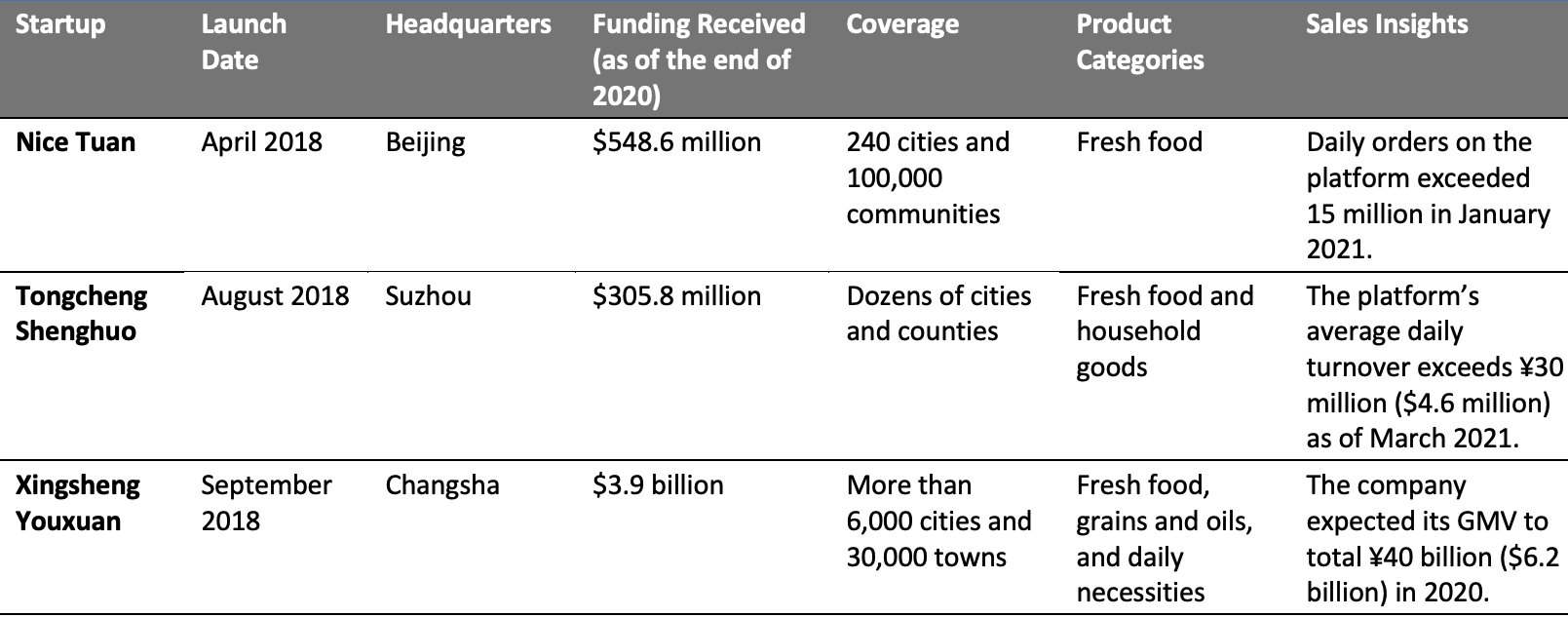

The market comprises dedicated startups as well as Internet giants that have branched out into community group buying.

Key players include startups Nice Tuan, Tongcheng Shenghuo and Xingsheng Youxuan, which have become major platforms since their launch in 2018.

Chinese Internet giants Pinduoduo and JD.com both launched dedicated community group-buying platforms in 2020, marking their entry into this section of the group-buying market: Jingxi Pinpin is JD.com’s community group-buying platform; and Duo Duo Macai is a community group-buying extension of Pinduoduo’s mobile-commerce group-buying platform. Major Chinese logistics carrier SF Express also ventured into the market with the launch of its integrated community group-buying platform Fenghuotai.

Figure 4 provides an overview of the competitive landscape of China’s community group-buying market. We discuss key market players in detail later in this report.

Figure 4. Timeline of Developments in the Community Group-Buying Market in China

[caption id="attachment_125133" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

Timeline of Market Developments

The community group-buying model was established in response to the logistics challenges of grocery e-commerce and to target price-conscious consumers. The main areas serviced by community group-buying platforms are Tier 2, Tier 3 and Tier 4 cities (which we discuss in further detail later in this report), due to the low-cost characteristics of the model.

The market comprises dedicated startups as well as Internet giants that have branched out into community group buying.

Key players include startups Nice Tuan, Tongcheng Shenghuo and Xingsheng Youxuan, which have become major platforms since their launch in 2018.

Chinese Internet giants Pinduoduo and JD.com both launched dedicated community group-buying platforms in 2020, marking their entry into this section of the group-buying market: Jingxi Pinpin is JD.com’s community group-buying platform; and Duo Duo Macai is a community group-buying extension of Pinduoduo’s mobile-commerce group-buying platform. Major Chinese logistics carrier SF Express also ventured into the market with the launch of its integrated community group-buying platform Fenghuotai.

Figure 4 provides an overview of the competitive landscape of China’s community group-buying market. We discuss key market players in detail later in this report.

Figure 4. Timeline of Developments in the Community Group-Buying Market in China

[caption id="attachment_125133" align="aligncenter" width="720"] Source: iiMedia/Coresight Research[/caption]

Five Key Advantages of the Community Group-Buying Model for Retailers

In this section, we provide insights into the major advantages of community group buying from a retailer perspective. We discuss five key benefits of this model, drawing comparisons with fresh-food e-commerce platforms and physical supermarkets.

Figure 5. Retailer Perspective: Advantages of the Community Group-Buying Model

Source: iiMedia/Coresight Research[/caption]

Five Key Advantages of the Community Group-Buying Model for Retailers

In this section, we provide insights into the major advantages of community group buying from a retailer perspective. We discuss five key benefits of this model, drawing comparisons with fresh-food e-commerce platforms and physical supermarkets.

Figure 5. Retailer Perspective: Advantages of the Community Group-Buying Model

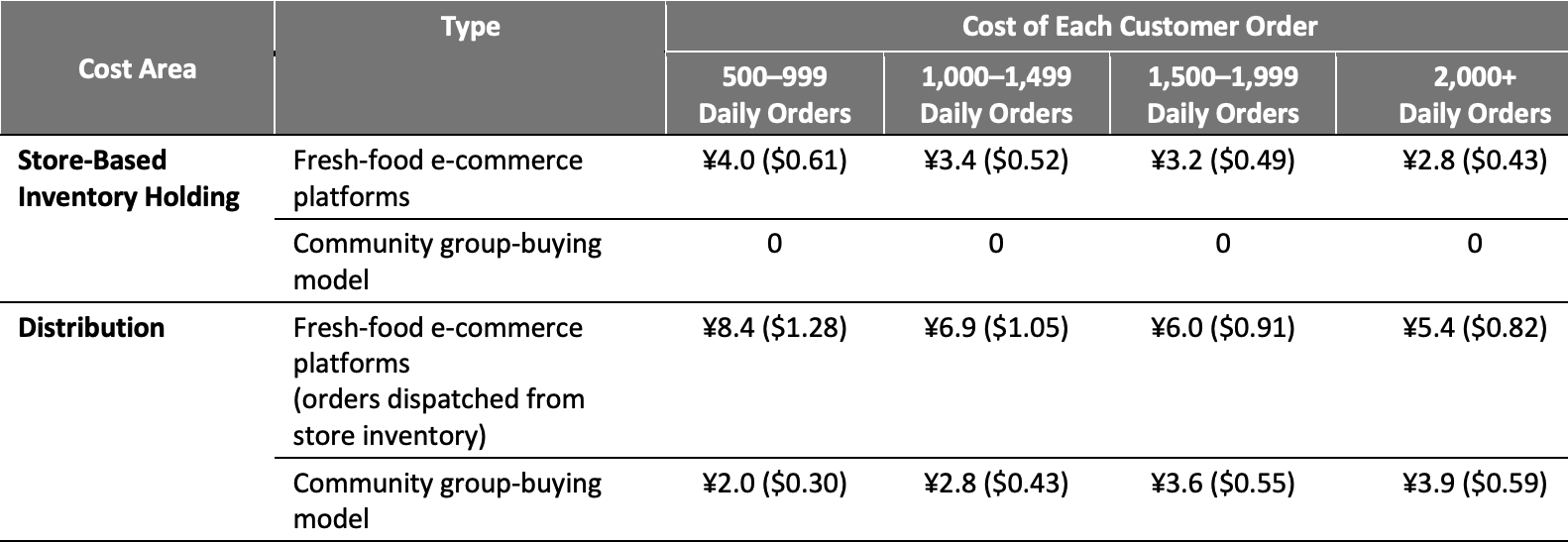

1. Reduced Fulfillment and Distribution Costs

The community group-buying model has the advantage of reducing fulfillment costs. In the traditional distribution channel, products need several layers of distribution, such as wholesalers at place of origin and wholesalers at place of sale, to reach consumers. With the community group-buying model, retailers have more direct access to consumers, without requiring those layers.

Another major feature of community group buying is that it requires less capital and carries less inventory risk, as the pre-sale model enables the platform to source products from partner vendors once demand has been defined from consumers’ orders. Sourced products are stored briefly in a central warehouse before distribution to local warehouses that are closer to consumers, as previously discussed. This allows the platform to define demand ahead of acquiring inventory, which greatly reduces the risk of capital and inventory turnover.

According to Pinduoduo, “By matching demand from local communities with supply from local farms, Pinduoduo is able to reduce transportation time, minimize wastage and cut down on the costs of logistics. This is especially so for leafy vegetables, which are more prone to spoilage if they must travel long distances.”

Furthermore, since community group-buying platforms do not operate store-based fulfillment (as stated earlier), they have zero store-based inventory holding costs (see Figure 6).

The cost of distribution per order is also much lower for community group-buying platforms than fresh-food e-commerce platforms. Although the latter benefit from economies of scale, community group-buying platforms save costs by making daily bulk deliveries to service a community in one go, rather than completing many individual deliveries. As some distribution companies have segmented charging rules—the heavier the weight, the higher the charge—greater numbers of daily orders may increase the cost of distribution per order in the community group-buying model. However, the increase is minimal and the total cost per order remains far below the costs of distribution for fresh-food e-commerce platforms.

Figure 6. Average Cost Comparison Between Community Group-Buying Platforms and Fresh-Food E-Commerce Platforms* in 2020

[caption id="attachment_125135" align="aligncenter" width="720"]

1. Reduced Fulfillment and Distribution Costs

The community group-buying model has the advantage of reducing fulfillment costs. In the traditional distribution channel, products need several layers of distribution, such as wholesalers at place of origin and wholesalers at place of sale, to reach consumers. With the community group-buying model, retailers have more direct access to consumers, without requiring those layers.

Another major feature of community group buying is that it requires less capital and carries less inventory risk, as the pre-sale model enables the platform to source products from partner vendors once demand has been defined from consumers’ orders. Sourced products are stored briefly in a central warehouse before distribution to local warehouses that are closer to consumers, as previously discussed. This allows the platform to define demand ahead of acquiring inventory, which greatly reduces the risk of capital and inventory turnover.

According to Pinduoduo, “By matching demand from local communities with supply from local farms, Pinduoduo is able to reduce transportation time, minimize wastage and cut down on the costs of logistics. This is especially so for leafy vegetables, which are more prone to spoilage if they must travel long distances.”

Furthermore, since community group-buying platforms do not operate store-based fulfillment (as stated earlier), they have zero store-based inventory holding costs (see Figure 6).

The cost of distribution per order is also much lower for community group-buying platforms than fresh-food e-commerce platforms. Although the latter benefit from economies of scale, community group-buying platforms save costs by making daily bulk deliveries to service a community in one go, rather than completing many individual deliveries. As some distribution companies have segmented charging rules—the heavier the weight, the higher the charge—greater numbers of daily orders may increase the cost of distribution per order in the community group-buying model. However, the increase is minimal and the total cost per order remains far below the costs of distribution for fresh-food e-commerce platforms.

Figure 6. Average Cost Comparison Between Community Group-Buying Platforms and Fresh-Food E-Commerce Platforms* in 2020

[caption id="attachment_125135" align="aligncenter" width="720"] *Platforms that operate store-based fulfillment, with store-adjacent warehouses of 5,382 square feet, on average, in Tier 2 and Tier 3 cities

*Platforms that operate store-based fulfillment, with store-adjacent warehouses of 5,382 square feet, on average, in Tier 2 and Tier 3 citiesSource: Tianfeng Securities/Coresight Research[/caption] 2. Minimal SKUs Community group-buying platforms operate with a significantly smaller range of stock-keeping units (SKUs) compared to online platforms, such as fresh-food e-commerce platforms and e-commerce sites operated by grocery chains. The benefits of managing fewer SKUs include reduced land or rent costs associated with storage, and increased efficiency in the picking/packing process. In 2020, the number of SKUs on community group-buying platforms Xingsheng Youxuan and Nice Tuan were all within 1,000, according to Tianfeng Securities—compared to around 10,000 at Alibaba’s New Retail grocery chain Freshippo. Figure 7. SKU Comparison Between Different Online Platforms [caption id="attachment_125136" align="aligncenter" width="720"]

Freshippo and Yonghui operate online platforms

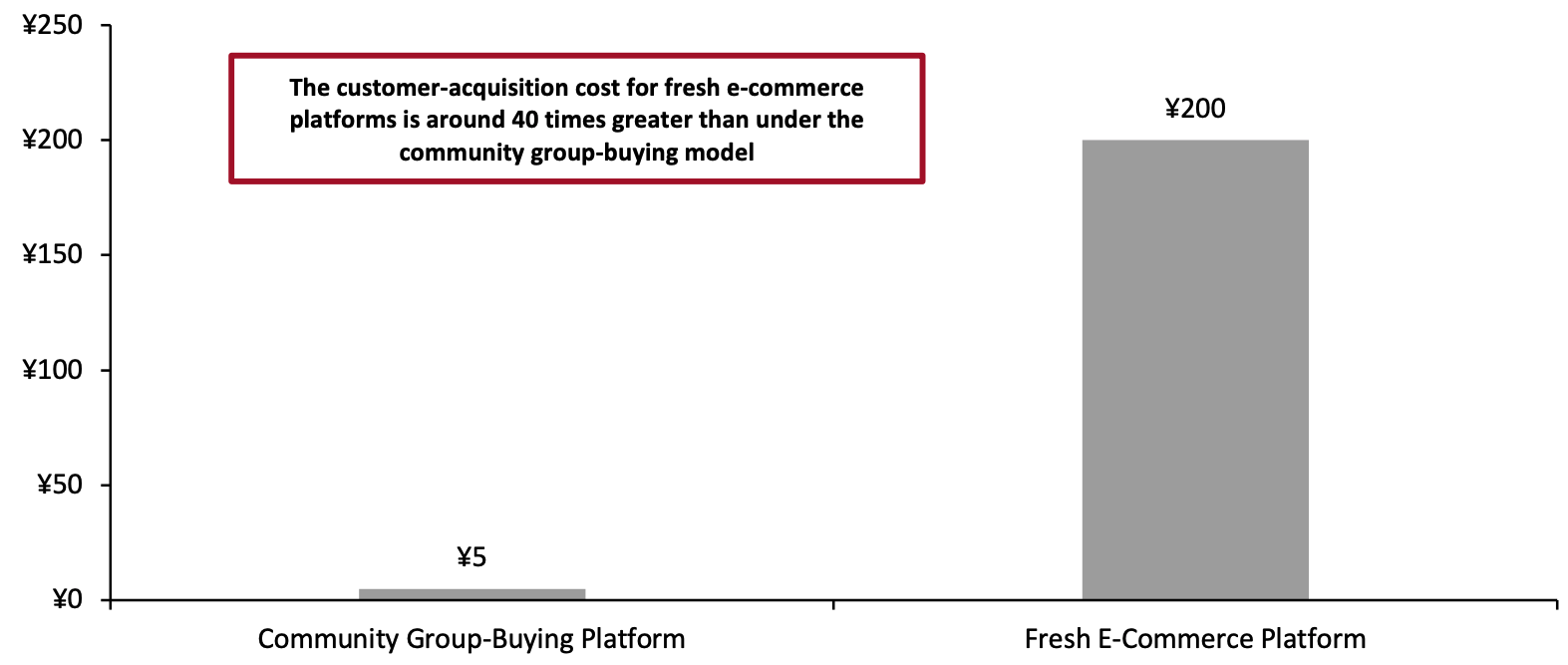

Freshippo and Yonghui operate online platformsSource: Tianfeng Securities/Coresight Research[/caption] 3. Savings in Customer-Acquisition Costs As community leaders are using their social network to attract shoppers to join their community buying group, consumer acquisition costs are also lower than traditional e-commerce. On average in 2020, traditional e-commerce platforms (i.e., those that do not include a similar social element to community group buying), spent at least ¥200 ($31) to obtain new consumers, but that cost reduced to ¥5 ($0.80) for platforms using the community group-buying model, according to financial services company Kaiyuan. Figure 8. Customer-Acquisition Cost Comparison: Community Group-Buying Platform vs. Fresh-Food E-Commerce Platform (RMB per Customer) [caption id="attachment_125137" align="aligncenter" width="720"]

Source: Kaiyuan/Coresight Research[/caption]

4. Appealing to Price-Conscious Consumers

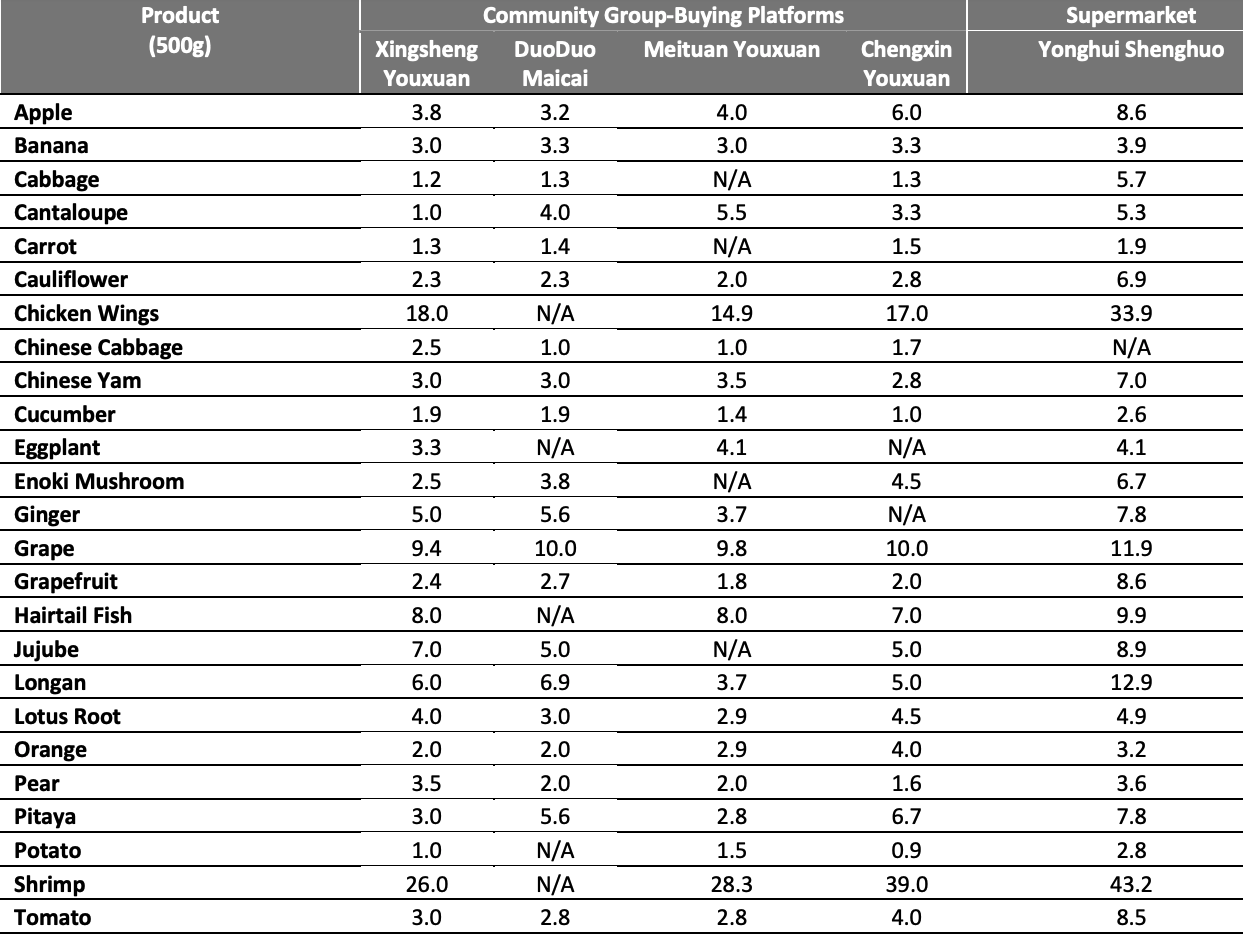

Platforms that use the community group-buying model can reflect savings in reduced costs and bulk purchases from suppliers in the prices offered to consumers.

Figure 9 provides a price comparison of popular products between several community group-buying platforms and supermarket Yonghui Shenghuo. Prices offered by the supermarket are higher for all product categories compared to those offered by the community group-buying platforms. For example, shoppers are charged ¥4.9 ($0.76) to buy 500g of tomatoes from our supermarket example, whereas community group-buying platforms offer the same quantity of tomatoes at prices starting from ¥2.8 ($0.43).

This price distinction is also reflected in consumers’ perception of value offerings from community group-buying platforms, as we outlined in Figure 2.

Figure 9. Price Comparison: Community Group-Buying Platforms (Average) vs. Supermarket (RMB)

[caption id="attachment_125138" align="aligncenter" width="720"]

Source: Kaiyuan/Coresight Research[/caption]

4. Appealing to Price-Conscious Consumers

Platforms that use the community group-buying model can reflect savings in reduced costs and bulk purchases from suppliers in the prices offered to consumers.

Figure 9 provides a price comparison of popular products between several community group-buying platforms and supermarket Yonghui Shenghuo. Prices offered by the supermarket are higher for all product categories compared to those offered by the community group-buying platforms. For example, shoppers are charged ¥4.9 ($0.76) to buy 500g of tomatoes from our supermarket example, whereas community group-buying platforms offer the same quantity of tomatoes at prices starting from ¥2.8 ($0.43).

This price distinction is also reflected in consumers’ perception of value offerings from community group-buying platforms, as we outlined in Figure 2.

Figure 9. Price Comparison: Community Group-Buying Platforms (Average) vs. Supermarket (RMB)

[caption id="attachment_125138" align="aligncenter" width="720"] N/A indicates that the product is not sold by the retailer.

N/A indicates that the product is not sold by the retailer.Source: Company reports/Coresight Research[/caption] 5. Focus on Lower-Tier Market Opportunities The main areas serviced by community group-buying platforms are Tier 2, Tier 3 and Tier 4 cities, due to the low-cost characteristics of the model. Consumers in Tier 1 cities are typically less price-sensitive and they have a variety of options for fresh-food delivery, such as fresh-food e-commerce platforms Freshippo and Dingdong Maicai. Around 70% of community group-buying leaders across platforms in China are from Tier 3 and Tier 4 cities, as of November 2020, according to Kaiyuan. Markets outside of Tier 1 present a large market for consumption. We believe that Tier 2, Tier 3 and Tier 4 are poised to play an increasingly significant role in driving retail consumption growth in China. Xingye Research estimates that online retail sales of physical goods in lower-tier markets will account for 45% of total online retail sales in China, worth some ¥8.1 trillion (around $1.25 trillion) by 2025. This would represent a CAGR of 18.25% from 2018 to 2025. Key Players in the Community Group-Buying Market Below, we discuss notable startups that operate the community group-buying model in China, as well as moves by Internet giants to branch out into the market. Startups We profile three notable community group-buying startups that have received significant funding between their launch in 2018 and the end of 2020: Nice Tuan, Tongcheng Shenghuo and Xingsheng Youxuan. (We discuss funding received by other startups later in this section, as it provides a useful indicator of interests in the capital market and reflects companies’ performances.) Figure 10. Community Group-Buying Startups in China [caption id="attachment_125139" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Nice Tuan

In August 2019, Nice Tuan officially announced the completion of its merger with previous rival NiWoNin. Since 2018, Nice Tuan has held four funding rounds and received investment from Alibaba Group, among other investors. In the first stage of cooperation, Alibaba implemented Nice Tuan pickup points across 1,000 of its Ling Shou Tong stores. Ling Shou Tong is Alibaba’s New Retail inventory management platform, which enables mom-and-pop stores to strengthen their brick-and-mortar presence, optimize product supply and increase sales.

Nice Tuan’s primary target market comprises families living in cities. According to the company, it serves 240 cities and 100,000 communities in China, operating with nearly 200,000 community leaders. Amid the pandemic in 2020, Nice Tuan reported the number of orders it received from the cities increased by more than 100%, year over year.

Nice Tuan’s GMV has grown rapidly since 2019, according to company reports:

Source: Company reports/Coresight Research[/caption]

Nice Tuan

In August 2019, Nice Tuan officially announced the completion of its merger with previous rival NiWoNin. Since 2018, Nice Tuan has held four funding rounds and received investment from Alibaba Group, among other investors. In the first stage of cooperation, Alibaba implemented Nice Tuan pickup points across 1,000 of its Ling Shou Tong stores. Ling Shou Tong is Alibaba’s New Retail inventory management platform, which enables mom-and-pop stores to strengthen their brick-and-mortar presence, optimize product supply and increase sales.

Nice Tuan’s primary target market comprises families living in cities. According to the company, it serves 240 cities and 100,000 communities in China, operating with nearly 200,000 community leaders. Amid the pandemic in 2020, Nice Tuan reported the number of orders it received from the cities increased by more than 100%, year over year.

Nice Tuan’s GMV has grown rapidly since 2019, according to company reports:

- January 2019—¥150 million ($23.2 million)

- April 2020—¥650 million ($100.8 million)

- October 2020—¥1 billion ($155.1 million)

Community group-buying platforms: Xingsheng Youxuan (left), Nice Tuan (middle) and Tongcheng Shenghuo (right)

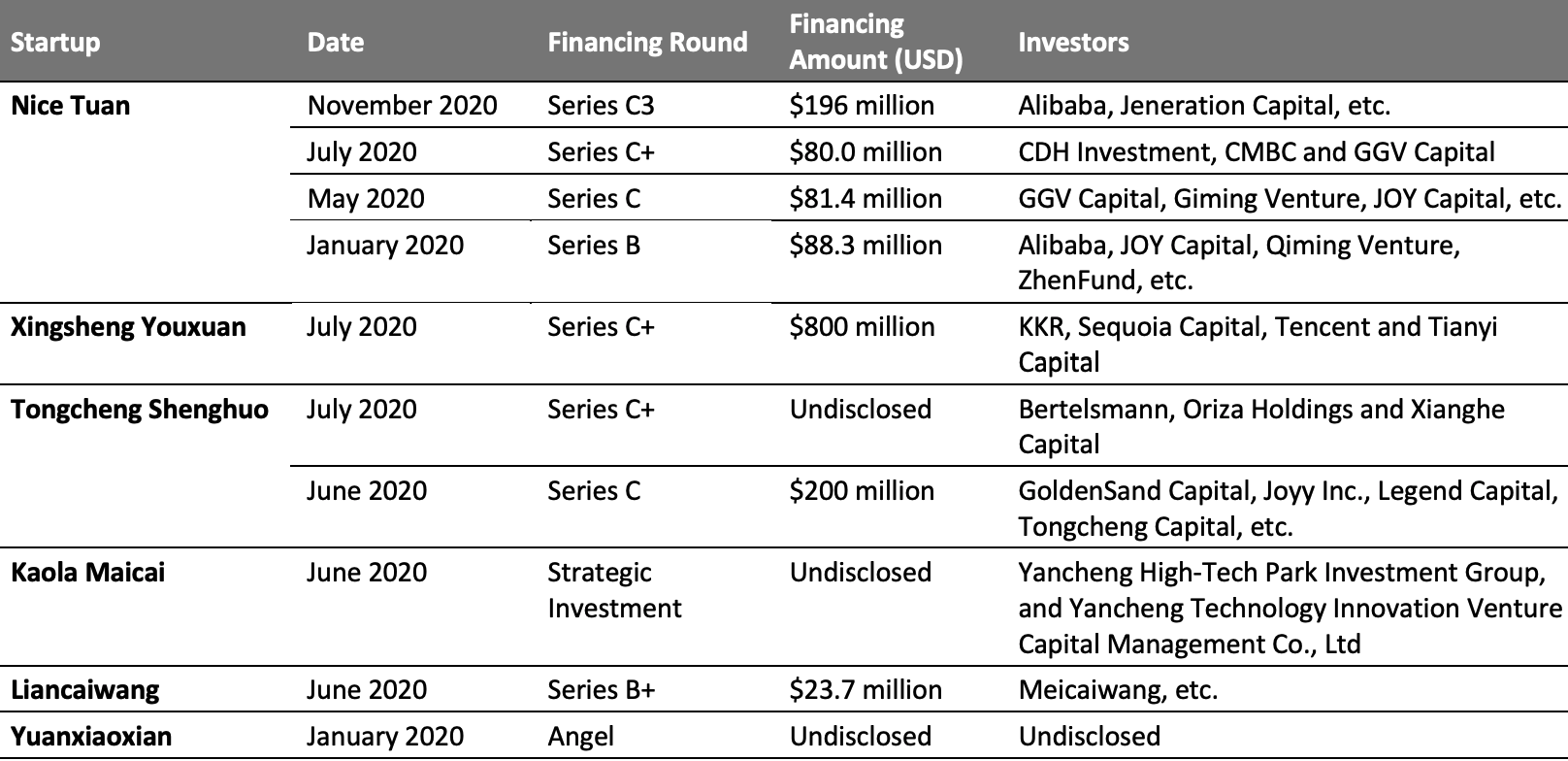

Community group-buying platforms: Xingsheng Youxuan (left), Nice Tuan (middle) and Tongcheng Shenghuo (right)Source: WeChat mini program[/caption] Startup Funding In 2020, community group-buying platforms received funding from various investors, including KKR, Sequoia Capital and Tencent. Notably, Nice Tuan received four rounds of investments in 2020, amounting to $445.7 million Figure 11. Community Group-Buying Startups: Financing in 2020 [caption id="attachment_125141" align="aligncenter" width="720"]

Source: Company reports/Coresight Research[/caption]

Internet Giants

We have seen numerous Internet giants in China launch community group-buying platforms recently to gain market share and increase sales.

Source: Company reports/Coresight Research[/caption]

Internet Giants

We have seen numerous Internet giants in China launch community group-buying platforms recently to gain market share and increase sales.

- Didi Chuxing, China’s largest ride-hailing platform, launched Chengxin Youxuan in June 2020, integrating the community group-buying feature into its main app.

- Food-delivery platform Meituan launched Meituan Youxuan in July 2020.

- Pinduoduo launched its own community group-buying service, Duo Duo Maicai, in August 2020.

- Alibaba announced at its Investor Day on September 28–30, 2020 that its grocery chain Freshippo will start to adopt the community group-buying model. Alibaba also invested in community group-buying platform Nice Tuan in November 2020.

- Walmart initiated testing for the community group-buying model in November 2020 in China. The retailer hired community leaders to run community-buying groups via WeChat, guiding customers to place orders and providing customer services. If the pilot goes smoothly, the retailer plans to expand this service in the near future.

- JD.com launched its dedicated community group-buying platform Jingxi Pinpin in December 2020, which currently serves 13 cities across China.

- China’s largest private courier SF Express launched community group-buying platform Fenghuotai officially in January 2021, after announcing its forthcoming entry into the market in 2020.

Source: Coresight Research[/caption]

Incentivizing Leaders To Boost Sales

The number community group-buying leaders per community varies depending on the size of the residential area and on consumer demand for the group-buying model. In their capacity as sales facilitators, leaders represent a major benefit for retailers that are looking to leverage the community group-buying model and reduce consumer-acquisition costs. Retailers should therefore look to provide incentives for leaders to expand their network and encourage group members to place orders.

Community group-buying leaders can be incentivized to encourage members to shop via the platform they represent through commission, based on the number of orders they facilitate in their group. Moreover, leaders can be offered rewards for inviting new consumers to join the community group, providing motivation for them to reach out to neighbors and expand the group network.

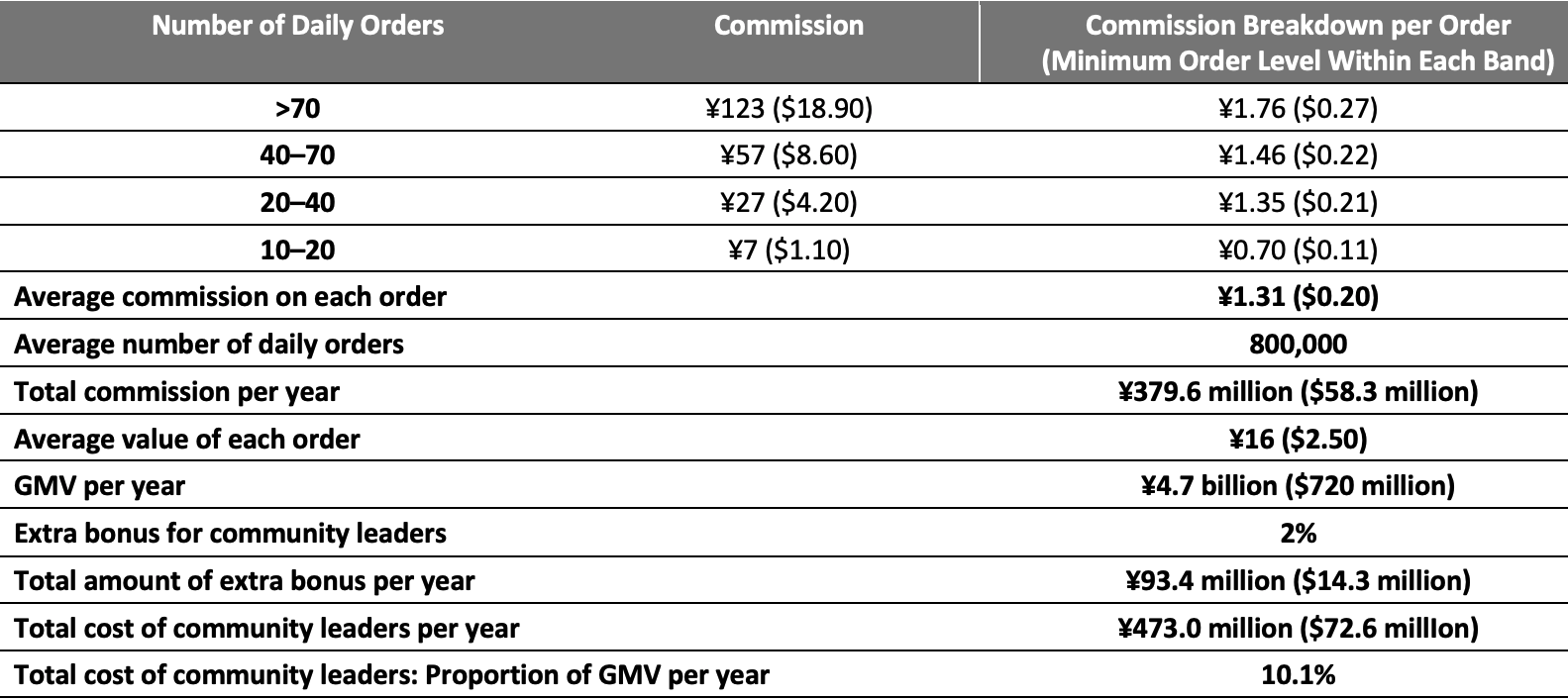

Figure 13 outlines community group-buying platform Meituan Youxuan’s commission mechanism for community leaders in Changsha, Hunan province: The more orders a community leader facilitates per day, the higher the rate of commission (which is fixed; it is not a percentage of an order’s value). Meituan Youxuan also sets aside 2% of its GMV as a bonus to give out on top of commission for community leaders. Based on the platform’s daily order average of 800,000 in Hunan and its average order value of ¥16 ($2.50), annual GMV for the province amounted to around ¥4.7 billion ($728 million) last year, according to Tianfeng Securities. Community leader bonuses, therefore, totaled an estimated ¥93.4 million ($14 million) in Hunan in 2020.

Figure 13. Meituan Youxuan’s Reward Scheme for Community Leaders in Changsha, Hunan Province in 2020

[caption id="attachment_125143" align="aligncenter" width="720"]

Source: Coresight Research[/caption]

Incentivizing Leaders To Boost Sales

The number community group-buying leaders per community varies depending on the size of the residential area and on consumer demand for the group-buying model. In their capacity as sales facilitators, leaders represent a major benefit for retailers that are looking to leverage the community group-buying model and reduce consumer-acquisition costs. Retailers should therefore look to provide incentives for leaders to expand their network and encourage group members to place orders.

Community group-buying leaders can be incentivized to encourage members to shop via the platform they represent through commission, based on the number of orders they facilitate in their group. Moreover, leaders can be offered rewards for inviting new consumers to join the community group, providing motivation for them to reach out to neighbors and expand the group network.

Figure 13 outlines community group-buying platform Meituan Youxuan’s commission mechanism for community leaders in Changsha, Hunan province: The more orders a community leader facilitates per day, the higher the rate of commission (which is fixed; it is not a percentage of an order’s value). Meituan Youxuan also sets aside 2% of its GMV as a bonus to give out on top of commission for community leaders. Based on the platform’s daily order average of 800,000 in Hunan and its average order value of ¥16 ($2.50), annual GMV for the province amounted to around ¥4.7 billion ($728 million) last year, according to Tianfeng Securities. Community leader bonuses, therefore, totaled an estimated ¥93.4 million ($14 million) in Hunan in 2020.

Figure 13. Meituan Youxuan’s Reward Scheme for Community Leaders in Changsha, Hunan Province in 2020

[caption id="attachment_125143" align="aligncenter" width="720"] Source: Tianfeng Securities/Coresight Research[/caption]

Western brands and retailers looking to leverage the community group-buying model to target price-conscious and convenience-driven consumers can learn from such incentivization programs in China to make optimal use of leaders’ social networks, expand their consumer bases and drive down customer-acquisition costs.

Expansion of Product Categories

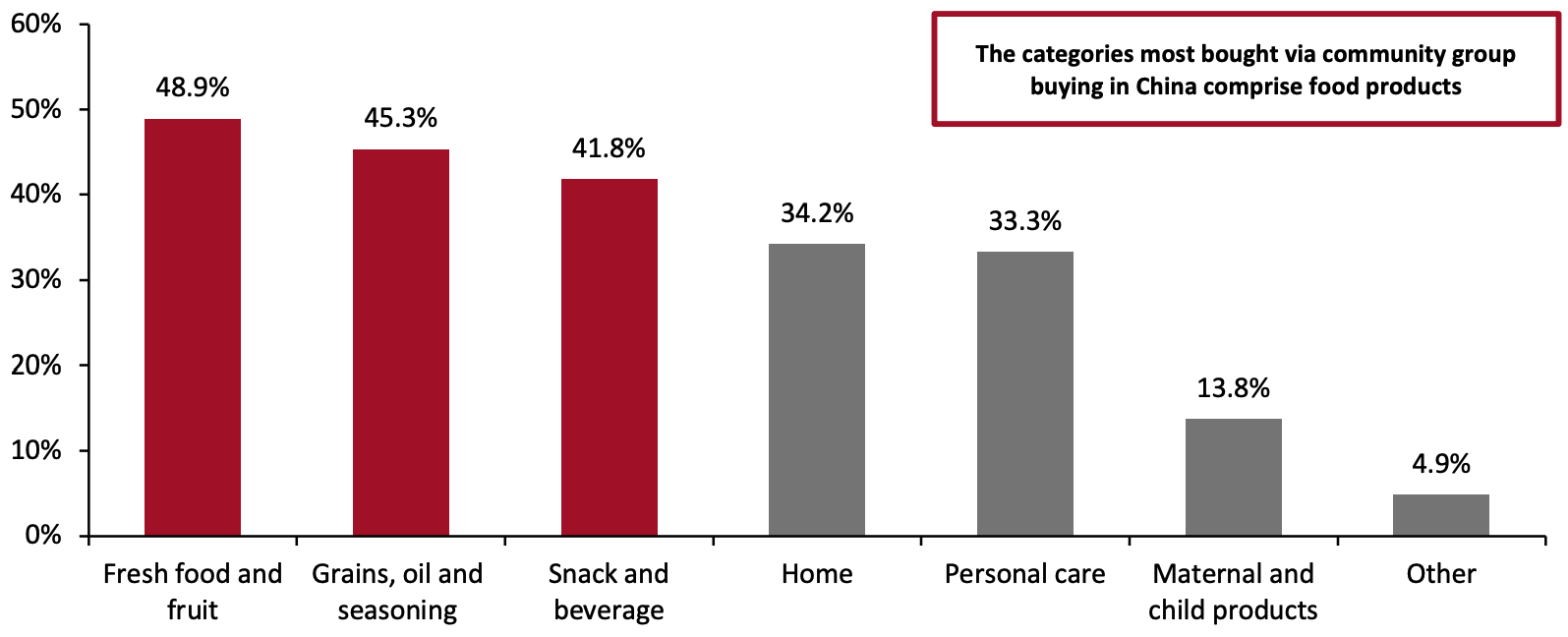

Although some community group-buying platforms offer apparel, beauty and FMCG products, all platforms primarily sell fresh food. The consumption frequency of grocery products lends itself to the community group-buying model, which differentiates itself based on low-cost, daily deliveries of bulk-bought items.

The Covid-19 pandemic has increased the popularity of online grocery shopping due to lockdowns and consumer reluctance to visit stores (to minimize risk of exposure to the virus); community group buying has made grocery e-commerce more accessible and reduced the need for consumers to visit high-traffic areas, as they can instead collect orders from the designated location in their residential area.

According to a 2020 survey conducted by research firm iiMedia, around 48.9% of Chinese consumers that use community group-buying platforms said they use the platforms to purchase fresh food and fruit, while 45.3% stated that they buy grains, oil and seasoning (see Figure 14).

Figure 14. Chinese Consumers That Use Community Group-Buying Platforms: Products They Purchase (% of Respondents)

[caption id="attachment_125144" align="aligncenter" width="720"]

Source: Tianfeng Securities/Coresight Research[/caption]

Western brands and retailers looking to leverage the community group-buying model to target price-conscious and convenience-driven consumers can learn from such incentivization programs in China to make optimal use of leaders’ social networks, expand their consumer bases and drive down customer-acquisition costs.

Expansion of Product Categories

Although some community group-buying platforms offer apparel, beauty and FMCG products, all platforms primarily sell fresh food. The consumption frequency of grocery products lends itself to the community group-buying model, which differentiates itself based on low-cost, daily deliveries of bulk-bought items.

The Covid-19 pandemic has increased the popularity of online grocery shopping due to lockdowns and consumer reluctance to visit stores (to minimize risk of exposure to the virus); community group buying has made grocery e-commerce more accessible and reduced the need for consumers to visit high-traffic areas, as they can instead collect orders from the designated location in their residential area.

According to a 2020 survey conducted by research firm iiMedia, around 48.9% of Chinese consumers that use community group-buying platforms said they use the platforms to purchase fresh food and fruit, while 45.3% stated that they buy grains, oil and seasoning (see Figure 14).

Figure 14. Chinese Consumers That Use Community Group-Buying Platforms: Products They Purchase (% of Respondents)

[caption id="attachment_125144" align="aligncenter" width="720"] Respondents surveyed in 2020. Respondents could select multiple options.

Respondents surveyed in 2020. Respondents could select multiple options.Source: iiMedia[/caption] We expect the community group-buying model to expand into other categories. However, there are challenges in expanding into apparel categories, as the complexity of sizing requirements makes consumers more cautious about committing to online orders and adds complexity for the retailer in offering a range of sizes and handling returns. For this reason, apparel and footwear products on community group-buying platforms tend to be loungewear and items to be worn at home, which have a loose fit; this means that sizing requirements are less precise. We believe that categories such as beauty are a better fit for the community group-buying model. Nice Tuan already provides beauty products on its platform at a low price point, and there is room in the market for other platforms to follow suit. [caption id="attachment_125145" align="aligncenter" width="320"]

Nice Tuan offers items in the beauty category

Nice Tuan offers items in the beauty categorySource: WeChat mini program[/caption] Expansion of the Model Within China We think the community group-buying model has strong replication capabilities within China, with the potential to quickly expand and break even in a short period of time. Community group buying does not require construction of warehouses, and the overall model is lighter than other fresh-food retail formats—with fewer SKUs and lower distribution costs. Following its establishment in July 2020, Meituan Youxuan expanded across 12 provinces in China in just three months, demonstrating the rapid expansion potential that community group buying offers. The platform entered the market in Guangdong province, in the cities of Guangzhou and Foshan, in August 2020. Community group-buying sales in the two cities exceeded ¥100 million ($15.5 million) within 45 days, according to the company. Following its entry in Guangdong, Meituan Youxuan went on to launch successively in 14 other cities in the province within two months. Expansion of the Model Internationally We are starting to see community group-buying models operate in markets outside of Mainland China. In Hong Kong, One Stop Fresh, an online fresh-food retailer, has leveraged the community group-buying model across wider areas than is typically the case—members of the same group live in an area that consists of several residential compounds, rather than just one apartment block or housing compound. As Hong Kong is densely populated, basing the group-buying model on slightly broader areas is feasible. In India, apps DealShare and Mall91 also leverage this model:

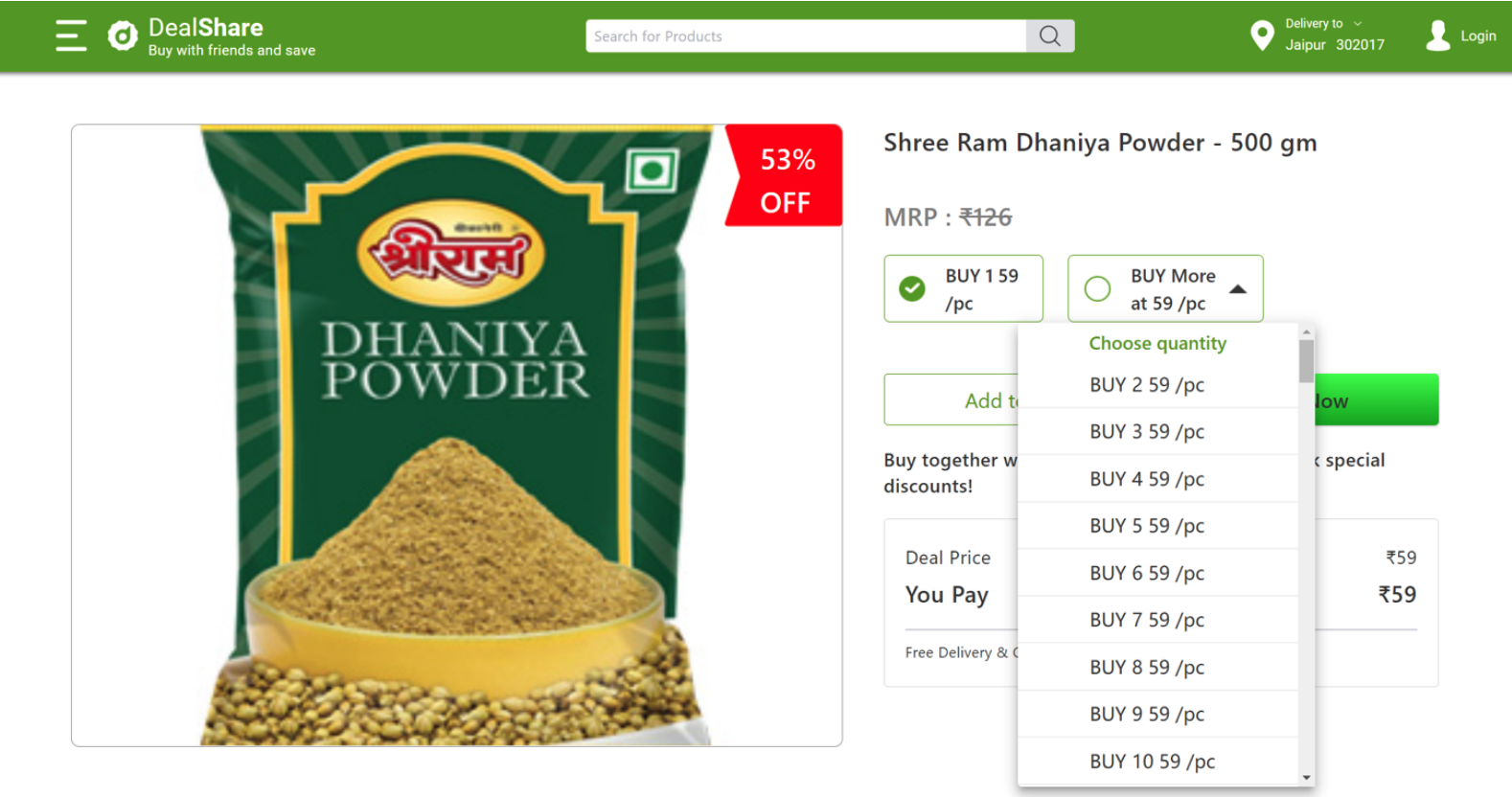

- Established in September 2018, DealShare is a multicategory consumer product platform that targets consumers located in small cities and rural regions. DealShare sources products from local merchants and provides deep discounts and rewards to shoppers that engage in group-buying with friends and family. The app allows users to share unique links for products or deals via WhatsApp so the group can benefit from a discounted price. DealShare has 400,000 customers as of February 2021, providing unbranded apparel, beauty and household products.

DealShare’s provides greater discounts when buyers purchase items in groups

DealShare’s provides greater discounts when buyers purchase items in groupsSource: DealShare[/caption]

- Mall91 works in a similar manner—with the exception that users earn commission when those in their network buy products through links they have shared, usually via a community group-buying WhatsApp group. According to the company, it currently reaches 2,000 small towns across India.

What We Think

Community group buying is seeing great success in China as a new concept compared to other traditional retail formats, and it offers many advantages for brands and retailers, such as increased revenue from bulk buying, as well as savings in logistics. Community-group buying can also support brands and retailers in tapping a more diverse customer base. For example, with young customers and elderly consumers living in the same community, community buying groups enable platforms to target a varied consumer base brought together by one community leader. Implications for Brands/Retailers- The model is being adopted in Hong Kong with some iterations. In Mainland China, it is based on users living in the same residential compound, while in Hong Kong, community buying groups may span several residential compounds as the city is so densely populated.

- We are seeing platforms use the community group-buying model in India too. We expect the model to continue to gain popularity outside of China, partly due to its benefits of reduced distribution costs.

- With its popularity in markets outside of Tier 1 cities, brands and retailers can work with community group-buying platforms to capitalize on growing consumption among lower-tier markets in China.

- Brands and retailers can leverage existing micro-influencers (consumers that are well-known in their local area) or train others as group-buying leaders. This is not dissimilar to the ways that some media agencies train individuals in how to be a social media influencer).

- Brands could use community group buying to strategically expand their consumer base by building strong communities around their brands and gaining access to community leaders’ networks. Consumers can discuss product-related topics with their groups, and access product recommendations from group leaders.

- This community group-buying model also enables brands to promote older inventory, by providing promotions and incentivizing consumers to purchase older inventory with attractive pricing.