DIpil Das

What’s the Story?

The Coresight Research Think Tank series delves into the trends and segments that we have identified as presenting growth opportunities in retail in 2021 and beyond. We provide a definitive overview of each topic and its impact on retail. In this report, we discuss why Chinese consumers are at the forefront of luxury consumption—not just in terms of market size but also in the ways they seek and purchase luxury. We present our market trajectory estimates and four key trends within the growth of China’s luxury consumption. We also cover selected luxury brands and companies in China, and the role of e-commerce giants Alibaba and JD.com in facilitating China’s luxury ecosystem. This report includes insights from our conversations with key personnel at Alibaba Group and JD.com.Why It Matters

Among the major global markets, the US has historically been the biggest consumer of luxury. China, however, with the sheer scale of its youthful and working consumers, looks poised to be the biggest consumer of luxury by 2025. These compelling data points indicate that brands and retailers should be paying attention to the Chinese luxury consumer:- China’s personal luxury market accounted for 18.2% of the global luxury market in 2020, up from 12.4% in 2019, Coresight Research estimates. Our market sizes refer to domestic spending on luxury in China.

- We estimate that China’s personal luxury goods market reached $56.6 billion in sales in 2020, up 31.0% from $43.2 billion in 2019, primarily due to repatriation of spending by Chinese consumers from overseas to the domestic market as travel was restricted during the year. We expect the market to grow at a CAGR of 15.8–16.2%, reaching $117.7–120.0 billion and accounting for 25.0% of the global luxury goods market by 2025.

Figure 1. China: Personal Luxury Goods Sales (USD Bil., Left Axis) and Year-over-Year Growth (%, Right Axis) [caption id="attachment_130887" align="aligncenter" width="726"]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

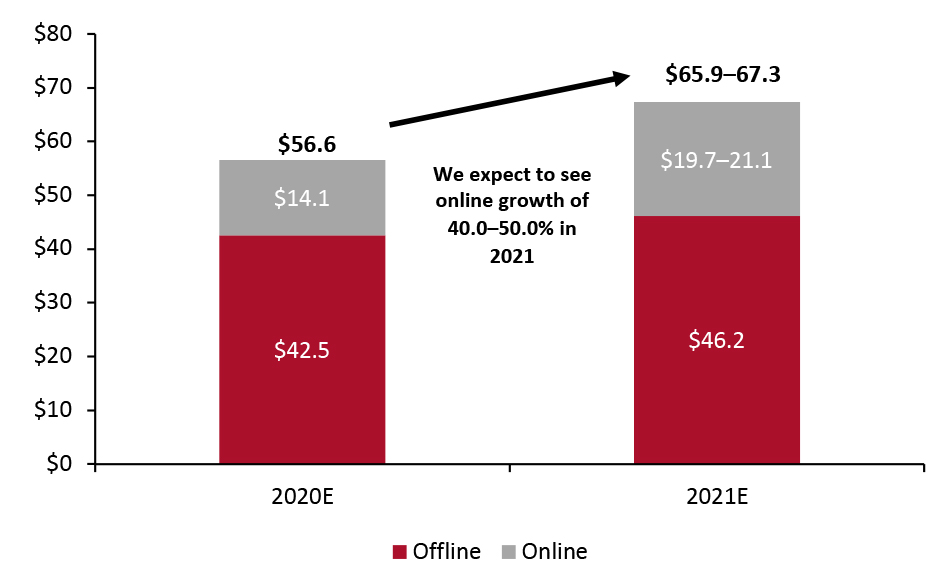

- E-commerce in China accounted for 24.9% of total retail in 2020, according to the latest data from the National Bureau of Statistics (NBS). We estimate that online retail comprised a similar share of total personal luxury sales in Mainland China, equating to some $14.1 billion in online sales.

- In 2021, we expect to see online luxury retail growth of 40.0–50.0%, amounting to $19.7–$21.1 billion in sales, moderating from some 104.0% growth in 2020. In 2020, some retailers saw over 100% online sales growth—for instance, Kering reported triple-digit online growth in its Asia Pacific markets in 2020.

- Overall, we expect China’s luxury retail market to grow 16.4–18.9% in 2021, reaching $65.9–$67.3 billion, as shown in Figure 2.

Figure 2. China Luxury Market: Offline/Online Split (USD Bil.) [caption id="attachment_130903" align="aligncenter" width="724"]

Source: Company reports/NBS/Coresight Research[/caption]

Source: Company reports/NBS/Coresight Research[/caption]

Luxury Consumption in China: A Think Tank

Historically, a significant portion of Chinese luxury purchases have taken place overseas, due to high import duties in China and customers seeking to take home authentic prestige goods from their international trips. Over the last five years, however, Chinese luxury purchases are increasingly taking place in the domestic market due to reduced import duties and greater customs regulations on incoming parcels, by the Chinese government. Luxury brands are also narrowing the price gaps between their goods sold in their home markets and in China, making domestic purchasing more attractive. Restrictions on travel in 2020 and so far in 2021 have forced further repatriation of some luxury purchases to the domestic market, driving the recovery of luxury retail in China. Moreover, consumers in China have a high luxury purchase appetite and growing disposable income as younger populations enter the workforce. Combined with a mindset shift from experiencing to owning, Chinese consumers are on track to be the vanguard in luxury consumption. We cover three main aspects of China’s luxury retail market, as shown in Figure 3.Figure 3. Luxury Consumption in China: A Think Tank

Below, we discuss four key themes in China’s luxury retail market.

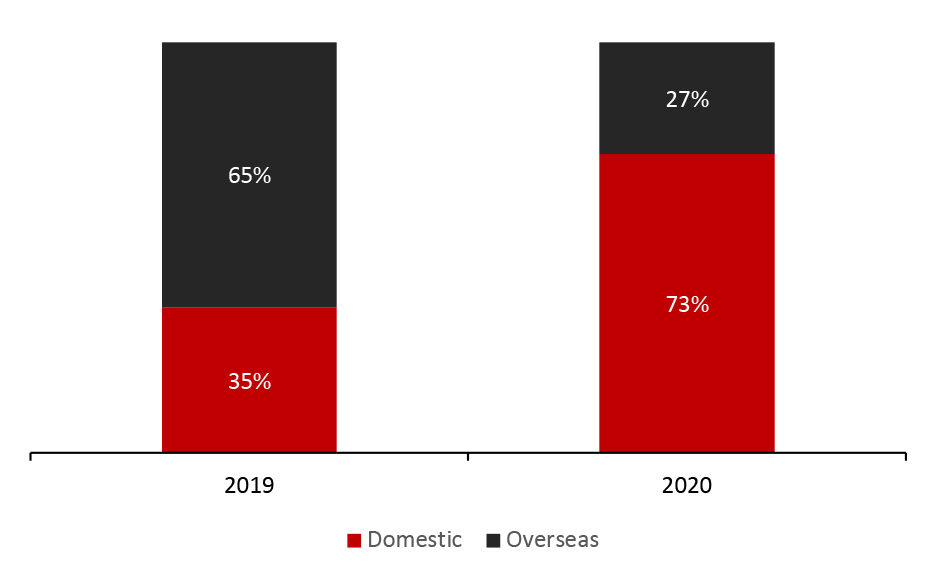

1. Repatriation of Luxury Consumption

As international travel remains restricted in the medium term, we expect Chinese consumers to continue to look to their domestic market for luxury consumption. In 2019, we estimate 35.0% of luxury consumption by Chinese consumers took place in China while the rest took place overseas. In 2020, around 73.0% of Chinese luxury consumption took place in the domestic market, based on our estimates.

Below, we discuss four key themes in China’s luxury retail market.

1. Repatriation of Luxury Consumption

As international travel remains restricted in the medium term, we expect Chinese consumers to continue to look to their domestic market for luxury consumption. In 2019, we estimate 35.0% of luxury consumption by Chinese consumers took place in China while the rest took place overseas. In 2020, around 73.0% of Chinese luxury consumption took place in the domestic market, based on our estimates.

Figure 4. Estimated Split Between Domestic and Overseas Luxury Consumption by Chinese Consumers [caption id="attachment_130890" align="aligncenter" width="725"]

Source: Company reports/Coresight Research[/caption]

Once consumers can travel freely again, we anticipate that this repatriation will moderate but do not expect the overseas purchase share to return to pre-pandemic levels. Chinese consumers are likely to be accustomed to buying certain products domestically and retain these purchase habits by then.

Coresight Research discussed this repatriation with Christina Fontana, Head of Fashion and Luxury at Tmall’s Luxury Division, with the insights confirming our expectation:

Source: Company reports/Coresight Research[/caption]

Once consumers can travel freely again, we anticipate that this repatriation will moderate but do not expect the overseas purchase share to return to pre-pandemic levels. Chinese consumers are likely to be accustomed to buying certain products domestically and retain these purchase habits by then.

Coresight Research discussed this repatriation with Christina Fontana, Head of Fashion and Luxury at Tmall’s Luxury Division, with the insights confirming our expectation:

There has been a reshoring of consumption in China, and we believe that it will not go back to pre-pandemic shopping patterns as people become more comfortable shopping from home.

In addition, Kevin Jiang, President of JD International Fashion and Lifestyle, confirmed to Coresight Research:Since the outbreak of the pandemic, domestic demand for luxury goods has been growing. As a result, attracting more and more luxury brands to fulfill consumer’s increasing demands has become a priority for JD Luxury.

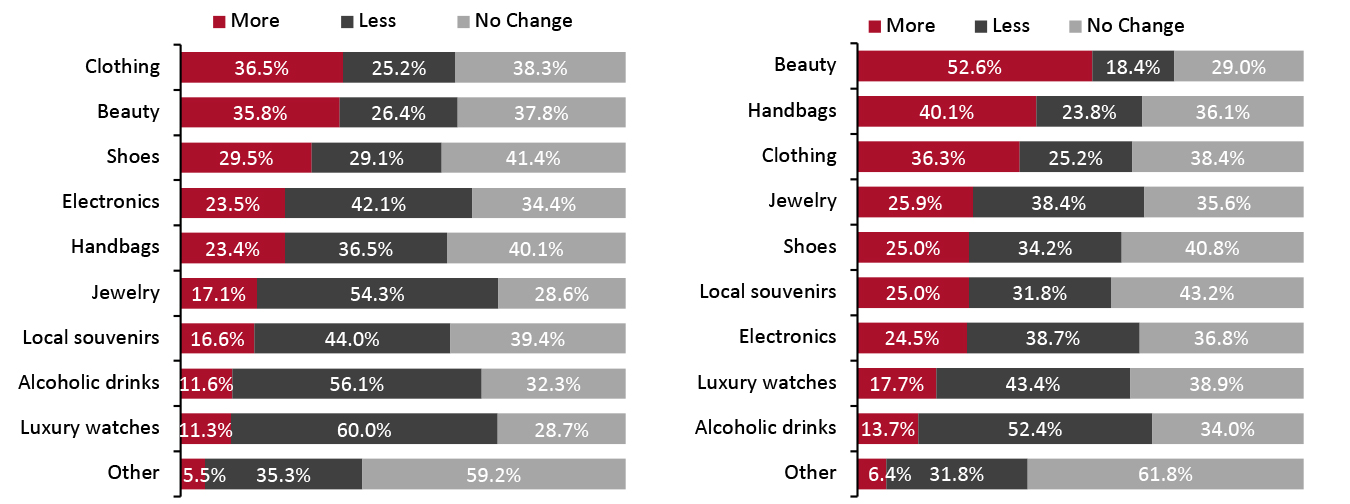

Furthermore, responses to Coresight Research’s sixth annual survey of Chinese outbound tourists indicate In September and October 2020, we surveyed 770 Chinese Internet users who had spent at least one night on a trip outside of Mainland China in the 12 months preceding the survey (referred to as travelers). Responses indicate that a greater proportion of travelers plan to spend more on luxury clothes and shoes on a trip within Mainland China than those that plan to do so overseas. This suggests that consumers plan to reserve more of their overseas spending budget for country-specific items that often start at higher price points, such as luxury watches and handbags, which they can bring back as a keepsake from their trip. As shown in Figure 5, around 36.5% expect to spend more on clothing and 29.5% expect to spend more on shoes during trips taken within China compared to their most recent previous trip. These figures are higher than overseas spending expectations: Some 36.3% of travelers who plan to buy luxury products on their next overseas trip expect to spend more on clothing and 25.0% expect to spend more on shoes compared to their most recent trip.Figure 5. Travelers: Spending Expectations for Their Next Trip in Mainland China (Left); Travelers: Luxury Spending Expectations on Their Next Overseas Trip (Right) (% of Respondents) [caption id="attachment_130891" align="aligncenter" width="726"]

Totals may not sum due to rounding

Totals may not sum due to rounding Base: 770 Internet users aged 18+ who have traveled in the past 12 months and expect to purchase on their next Mainland China trip (left); and 424 Internet users aged 18+ who have traveled in the past 12 months and will buy luxury products in their next overseas trip (right)

Source: Coresight Research [/caption] Major fashion brands and retailers have reported on the impact of luxury repatriation in their recent earnings updates.

- In its fiscal 2020 earnings release, fashion house Kering highlighted the impact of localized sales on its sales recovery. The company stated that Gucci, which accounts for over half of group revenue, “recovered a robust and encouraging sales momentum with local customers, especially in Mainland China, which benefited from repatriation of demand.” Expecting this trajectory to continue through this year, Kering’s CEO François-Henri Pinault said on the company’s February 2021 earnings call that it plans to double the number of Gucci events that take place in China, including offline and online events. Pinault also stated on the call that the company does not expect the higher-than-usual local buying levels to decrease once tourism begins to return to normal

- LVMH stated on its first-quarter 2021 earnings call in April 2021, that it has seen “a bit less than 40%” growth in its total Chinese client base on a two-year basis (versus the first quarter of 2019), and that growth is much higher in China than in offshore markets.

- Kering’s brands Balenciaga and Gucci joined Alibaba’s luxury e-commerce platform Tmall Luxury Pavilion in 2020 to reach a wider group of Chinese consumers.

- Gucci has been operational in China’s digital ecosystem since 2017 with the launch of its Chinese website and WeChat mini program, which initially sold limited collections and eventually expanded to more categories. On December 21, 2020, Gucci opened its first flagship store on Tmall Luxury Pavilion, offering accessories, jewelry, leather goods, ready-to-wear and watches. In early February 2021, Gucci opened another flagship store exclusively for its beauty and fragrances products. Kering stated on its February earnings call that this collaboration with Tmall not only provides “an additional window [into the Chinese digital ecosystem], but also new clients that are not cannibalizing clients on the Gucci website or in Chinese stores.”

- LVMH’s Celine launched a WeChat mini program for e-commerce in 2020 (its previous WeChat mini program was purely for consumer engagement) and its Marc Jacobs brand doubled down on its online presence in China by opening a flagship store on Tmall Luxury Pavilion. Richemont’s Cartier also joined the luxury e-commerce platform in 2020.

Alibaba is always encouraging brands to use a blended technology approach. We have been seeing a marked acceleration in luxury the past three years, since the launch of Luxury Pavilion on Tmall, and we have been helping brands embrace technology. For example, we did Shanghai Fashion Week completely digitally on Tmall in April 2020. When it comes to the digitalization of brands, we tend to talk more about the consumer-facing aspects, but it is equally important to digitalize the supply chain, warehousing and logistics to ensure brands can get the right product to the right place at the right time.

Capitalizing on the increased relevance of online luxury shopping amid the pandemic, Alibaba also launched a new luxury channel named Luxury Soho, in April 2020. With its off-price offering, Luxury Soho targets younger luxury consumers who are price-sensitive but value premium experiences and craftmanship. Alibaba launched Luxury Soho when travel was at a standstill, and brands had amassed unsold stock, providing an outlet to offload inventory. The company reported that Moschino sold out of all of its stock within three weeks of launch, indicating that Chinese consumers were seeking out luxury purchasing opportunities even amid the pandemic. 3. High Luxury Purchase Appetite in China Chinese consumers have demonstrated strong demand for luxury retail despite the impacts of the pandemic, as reflected in the strong double-digit market growth reported in 2020. Luxury purchase appetite is notably higher in China’s smaller cities, according to a report by digital luxury magazine Luxe Digital—some 45% of middle-income consumers in Tier 2 and Tier 3 cities in China are interested in purchasing luxury goods, versus 37% in Tier 1 cities. This is in line with insights from JD.com’s Kevin Jiang, who informed Coresight Research:[The company is observing] faster customer growth in Tier 3, Tier 4 and Tier 5 or below cities, at 51% year over year, [as well as] stronger purchasing power with higher average order values (AOV) [in these cities], which recorded 255% growth year over year in 2020.

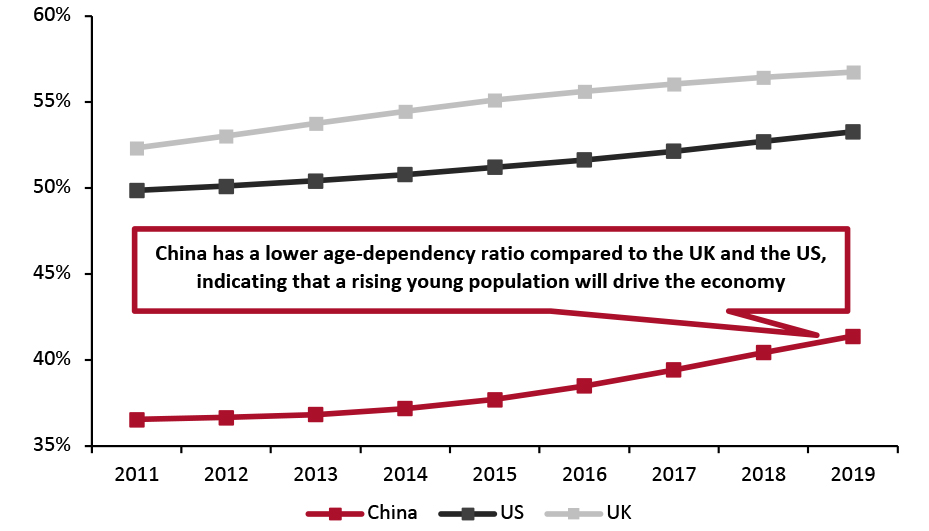

As city tiers in China are characterized by population size and GDP levels, the absolute consumer numbers in Tier 1 cities will likely be higher than Tier 2 and Tier 3 cities, but brands and retailers should look to tap into growth opportunities in lower-tier cities, most of which are not yet saturated in terms of physical footprints and brand choice in the same way as Tier 1 cities. Furthermore, residents of lower-tier cities also tend to have a greater proportion of disposable income to allocate to discretionary spending as living costs are lower than in Tier 1 cities. The rising number of first-time luxury consumers in smaller cities are likely to shop with a greater appetite and thus drive consumption. 4. China’s New Luxury Consumer: Young, Discerning and Spending The new rising class of young luxury consumers have significant spending power at their disposal now and will do in the years to come, as well as being more in touch with global trends than prior generations were, thanks to the proliferation of technology. As shown in Figure 6, China has a low age-dependency ratio—the proportion of those below 15 or over 64 years compared to the working population defined as those aged 15 to 64—in relation to other major markets, according to World Bank data. This denotes a trend of increasing numbers of younger, working consumers who will grow in income levels and wealth and be potential consumers of luxury. Based on the latest findings in the 2020 Fotile Hurun Wealth report published by the Hurun Research Institute, we estimate that there will be at least 7.2 million new young, wealthy consumers in China within the next decade. Coresight Research participated in the discussion of China’s new luxury consumer at “Retail’s Big Show” hosted by the National Retail Federation (NRF) in January 2021. The shoppers driving the phenomenon have been dubbed as those born after 1990 and who are attentive to quality, materials, product creation and the craftsmanship behind brands. According to Alibaba, this consumer group made 70% of purchases at Alibaba’s annual flagship shopping festival Singles’ Day in 2020, implying strong opportunity for luxury brands to connect and engage with them. Similarly, Kevin Jiang, President of JD International Fashion and Lifestyle told Coresight Research:Millennials (those born between 1980 and 1995), have come to form the largest segment of JD’s luxury consumers, with 67% growth in user numbers year over year in 2020. In addition, Gen Z consumers (born after 1995) are an emerging source of market growth, as well as having a powerful influence on increased digitalization. With the Gen Z influence on the rise, we see a visible trend of luxury players catering to their tastes through cross-brands collaboration, limited-editions [and] customized products. Gen Z’s digital-first nature [is] powering a continued increase in the digitalization of the luxury goods marketplace.

Figure 6. China, US and UK: Age-Dependency Ratio [caption id="attachment_130892" align="aligncenter" width="724"]

Source: World Bank[/caption]

Source: World Bank[/caption]

Key Luxury Companies/Brands in China

A number of international luxury companies have significant exposure to China, with several reporting in 2020 that China led their recovery in sales. Figure 7 lists the shares of revenues for selected top luxury companies from the China or Asia Pacific region. We have included revenues from Asia where the brands did not break out sales from China alone as China forms a significant portion of the sales within Asia Pacific region. We also discuss the growth and revenues for selected key luxury companies as well as their strategies for China. LVMH leads international brands in terms of revenues from Asia/China, with the revenues from the region for the 12 brands listed below amounting to nearly $40 billion in 2020.Figure 7. Selected Global Luxury Companies Share of Revenues From China or Asia Pacific [wpdatatable id=1165 table_view=regular]

*Burberry’s FY21 revenues are estimated based on the company’s outlook for full-year revenue growth. Currency conversions are based on average 2020 foreign exchange rates. Source: Company reports/Coresight Research Burberry: In its first-half report for the period ended September 26, 2020, Burberry reported that saw “significant digital adoption” in Mainland China. Furthermore, the company opened its first social retail store in Shenzhen Bay in an exclusive partnership with Tencent in July 2020. The store blends “the physical and social worlds in a digitally immersive retail experience, dubbed “a store of tomorrow for today,” in Burberry’s press release. Shoppers can use a WeChat mini program inside the store to find product information, discover personalized experiences and games or share their experiences with their networks. Since its launch, the store has exceeded the company’s expectations and is drawing new and younger consumers to the brand. With its use of technology and ability to engage with younger consumers, Burberry seems ahead of the curve compared to a number of luxury brands in tapping China’s growing young luxury consumer segment. Kering: The company’s CEO François-Henri Pinault remarked at Kering’s earnings call on February 17, 2021, that he does not expect to see a decline in local customer purchases even if travel returns to normal. The company has already broadened its digital strategy in China with the launch of Gucci and Gucci Beauty on Tmall’s Luxury Pavilion, as we discussed within our second theme. Moncler: On the company’s earnings call in February 2021, Moncler CEO Remo Ruffini said that “China will become even more of a focus” in 2021 and beyond. Moncler will look at clienteling to target new and existing local consumers. Ruffini stated that the company will look to emphasize digital communications with a dedicated site for China due to launch in September 2021. Alibaba and JD.com: Enabling China’s Luxury Ecosystem Alibaba and JD.com play a significant role in facilitating China’s luxury ecosystem and supporting luxury brands in the move toward digitalization. We discuss recent key developments. As well as launching platforms for luxury brands, such as Tmall Luxury Pavilion and Luxury Soho as previously discussed, Alibaba has also recently incorporated a number of interactive tools to attract younger consumers. In September 2020, Alibaba ran a festival named “Z Selection,” featuring a curated collection of 100 top luxury products aimed at Gen Z and millennial consumers. The products were chosen by a team of fashion editors and designers as well as Alibaba’s fashion trend-forecasting unit based on trends observed among Gen Z and millennial consumer cohorts. Alibaba’s Cristina Fontana told Coresight Research:

Young people are digital-first, so it is normal for them to shop online, and we give brands the opportunity to craft the perfect message for each audience. We provide tools on Tmall to customize messaging based on the target audience. Many consumers in China are new luxury consumers and are discovering brands daily, so there are many ways for brands to communicate with the audience. One of our top sportswear brands, for example, has 80 target audiences—each with a tailored messaging strategy.

In addition, JD.com has been providing support for luxury brands amid the pandemic, launching an omnichannel solution in September 2020, which integrates brands’ offline inventory with their online JD.com store. This allows brands to handle brands to manage their own packaging and delivery while opening up consumer access to a greater selection of products, including more expensive collections. In April 2021, JD.com revealed a customized a mini program on its platform for Louis Vuitton. Users simply search “LV” in JD.com’s app to enter the Louis Vuitton virtual store. JD.com also offers a white-glove delivery service, named JD Luxury Express, for chauffeured hand-delivery of items bought by its online luxury shoppers, providing an additional element of exclusivity in the last mile.[caption id="attachment_130893" align="aligncenter" width="724"]

JD Luxury Express, JD.com’s chauffeured delivery service for luxury purchases[/caption]

JD Luxury Express, JD.com’s chauffeured delivery service for luxury purchases[/caption]

What We Think

The sheer size of China’s consumer population, its spending ability and appetite for luxury are poised to propel the market to a position of global leadership in luxury consumption by 2025. Retailers and brands should take advantage of the early stages of this explosion and position themselves strategically in a burgeoning market. Implications for Brands/Retailers- Luxury brands and retailers should explore digital capabilities such as e-commerce platforms and livestreaming to engage with local consumers and let go of traditional selling methods hinged on in-person or in-store customer experiences.

- The new luxury consumer in China is young and perceptive and enjoys a host of tools to understand and engage with a brand, such as social media and gamification. Brands and retailers should provide unique experiences to keep these consumers engaged in a time when choices are many and attention spans are short. They could look to brands that have succeeded with their innovative approaches, such as Burberry, to reach new consumers.

- As brands and retailers look to local consumer markets, they are likely to scout for locations that provide them best access to the new-age Chinese luxury consumer. Real estate firms should provide such access and fit out physical spaces with technology to enable brands to incorporate in-store digital tools easily.

- Brands and retailers may look to host pop-ups to provide new and exciting experiences. Real estate firms should identify spaces suitable for such short-term events and market them accordingly.

- As luxury brands are looking to accelerate their digital strategies rapidly, technology providers should provide tools and applications that can be deployed with minimal effort and investment.