DIpil Das

What’s the Story?

The US women’s underwear industry is in a state of transition, after undergoing a transformation over the past few years. The industry’s number-one retailer, Victoria’s Secret (whose parent company is L Brands), is at a crossroads—with shifts away from traditional retail providing growth opportunities for emerging brands as well as industry giants.Why It Matters

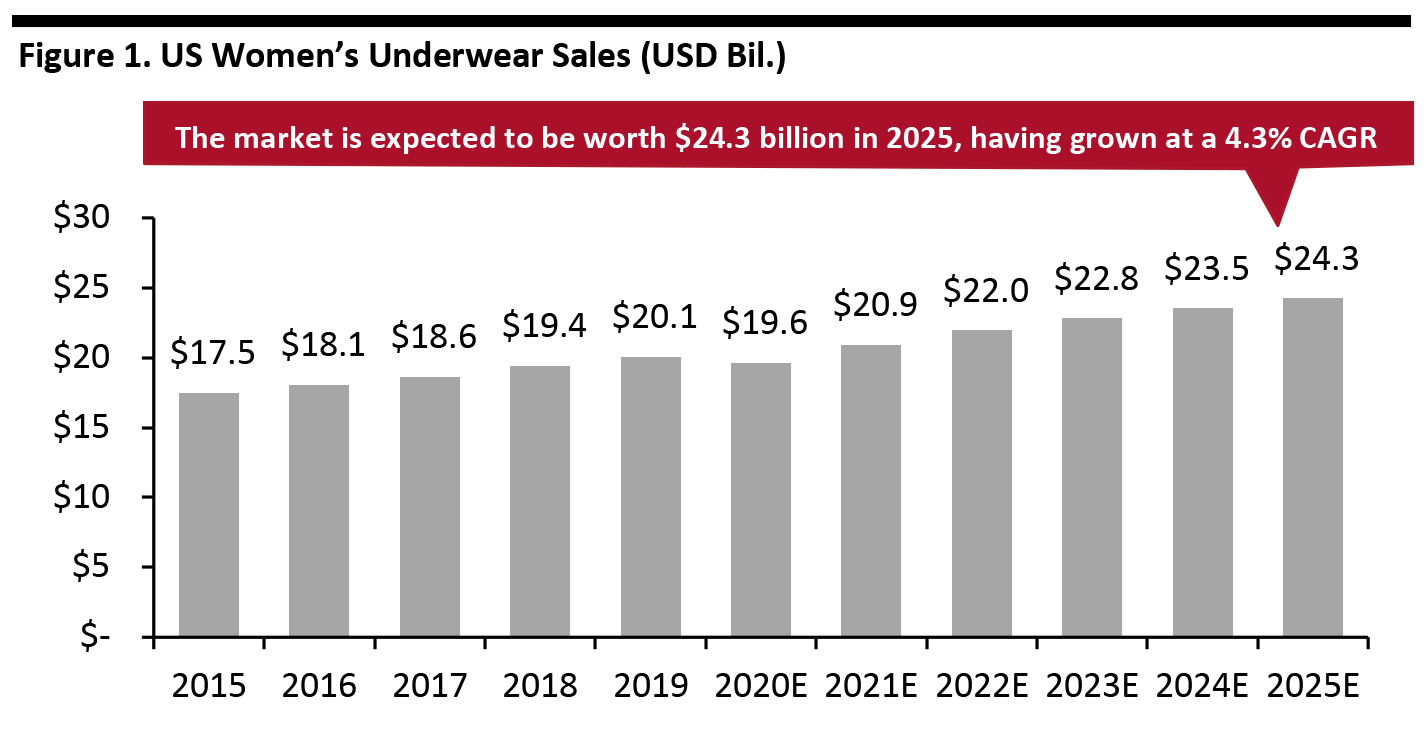

Driven by shifting consumer expectations and evolving lifestyle choices, the $19.6 billion US women’s intimates industry is showing distinct signs of opportunity and is expected to grow at a 4.3% CAGR from 2020 to 2025, according to Statista Consumer Market Outlook.- Victoria’s Secret, the most recognizable US women’s underwear brand, is adapting to market forces and a changing consumer. The retailer announced that it will close 250 stores in North America in 2020, equivalent to 23% of its fleet in the region. Its North America store revenue has been consistently declining, most notably by 7.7% year over year in 2019.

- Inclusivity, body positivity and diversity are seeing increased consumer focus as they look for brands to offer a full range of sizes, model representation and color choices. Consumers are seeking brands that take action to authenticate and differentiate themselves.

- Intimates styles are blurring into athletic wear, apparel and shapewear. Athletic-wear companies are increasingly entering into the intimates market with sports bras. This is likely to continue, as the sports bra is increasingly being styled as a fashion accessory within new fitness trends and among the growing number of women and girls playing sports.

Changes and Opportunities in the US Women’s Underwear Industry

Booming US women’s underwear sales are expected to total $19.6 billion in 2020. This includes bras, briefs, bathrobes, negligees, nightwear, lingerie and corsetry, according to Statista Consumer Market Outlook. As shown in Figure 1, the industry is expected to grow from at a 4.3% CAGR from 2020 to 2025—a significant increase compared to the previous five-year period of 2015–2020, when the industry grew at a 2.3% CAGR. [caption id="attachment_115091" align="aligncenter" width="700"] Includes bras, briefs, bathrobes, negligees, nightwear, lingerie and corsetry

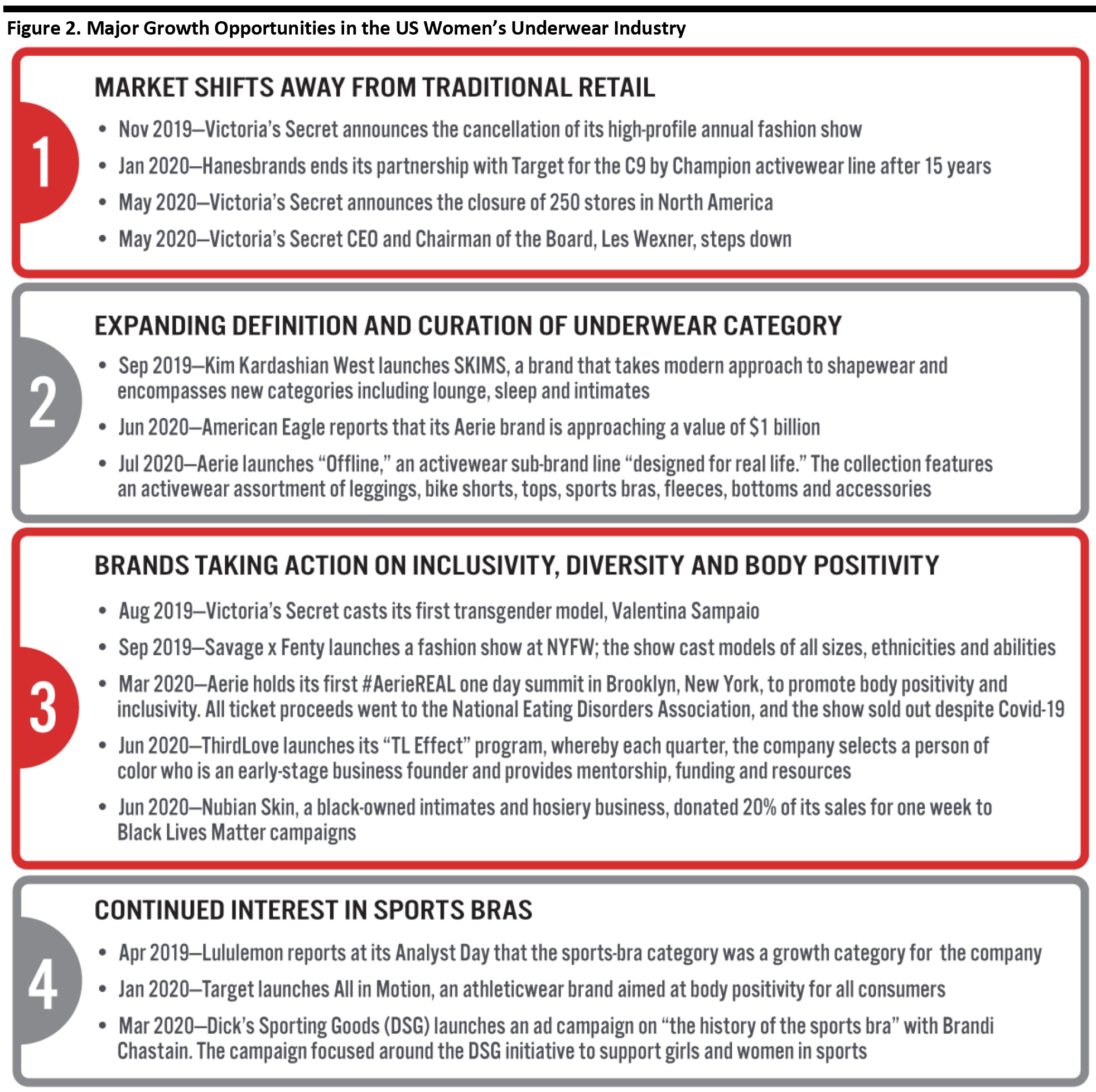

Includes bras, briefs, bathrobes, negligees, nightwear, lingerie and corsetry Source: Statista Consumer Market Outlook [/caption] In the subsequent sections, we look at recent changes in the industry and the opportunities for growth. Industry Announcements: A Barometer of Change and Future Growth Opportunities Over the past year, the entire retail industry has experienced market shifts due to Covid-19, as well as heightened brand and consumer awareness of the need for diverse representation and changes to the product types and channels on which consumers are focusing. Figure 2 highlights major growth areas within the US women’s underwear industry and recent significant industry announcements in each—which we discuss in this report. [caption id="attachment_115092" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Market Shifts away from Traditional Retail

Victoria’s Secret, the number-one retailer of US women’s intimates, has undergone organizational changes and experienced fluctuations in consumer demand—with notable declines in recent retail revenues.

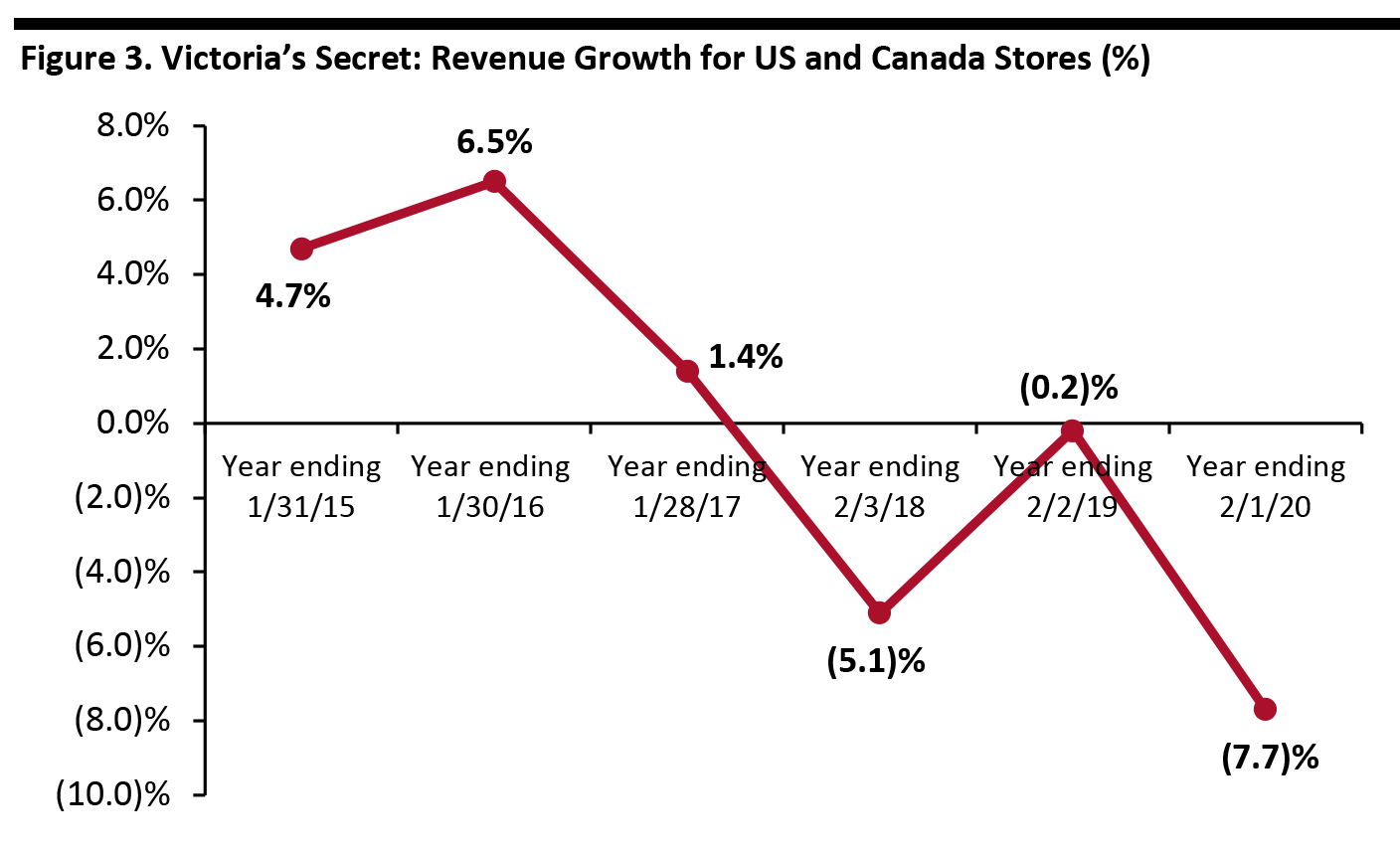

As of February 1, 2020, revenues for Victoria’s Secret US and Canada stores totaled $6.8 billion—down 7.7% from the year-ago period. This represents a 1.1% decline from 2015 to 2020. The company’s revenues have been on a downward trajectory since the year ended February 3, 2018, as shown in Figure 3.

[caption id="attachment_115093" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Market Shifts away from Traditional Retail

Victoria’s Secret, the number-one retailer of US women’s intimates, has undergone organizational changes and experienced fluctuations in consumer demand—with notable declines in recent retail revenues.

As of February 1, 2020, revenues for Victoria’s Secret US and Canada stores totaled $6.8 billion—down 7.7% from the year-ago period. This represents a 1.1% decline from 2015 to 2020. The company’s revenues have been on a downward trajectory since the year ended February 3, 2018, as shown in Figure 3.

[caption id="attachment_115093" align="aligncenter" width="700"] Source: Company reports[/caption]

A series of significant events in late 2019 and 2020 drew attention to Victoria’s Secret—the company had already been receiving industry attention and media criticism for its provocative marketing, unhealthy body imagery and lack of inclusivity among its models.

Source: Company reports[/caption]

A series of significant events in late 2019 and 2020 drew attention to Victoria’s Secret—the company had already been receiving industry attention and media criticism for its provocative marketing, unhealthy body imagery and lack of inclusivity among its models.

- Fashion Show Canceled: In November 2019, Victoria’s Secret canceled its infamous annual fashion show, which has aired on television since 2001. The runway show was part of the company’s brand-building and involved styling its models as “angels” with feathered wings as they walked down the runway in the company’s latest lingerie collections. The show always featured a signature piece—one year, there was a $1 million bra encrusted with diamonds. Although the cancellation of the runway show helped to demonstrate that Victoria’s Secret was listening to criticism of its dated approach, it also attracted negative attention that the company may have been looking to distance itself from.

- CEO Steps Down, Sale of Majority Stake Falls Through: The company’s CEO and Chairman of the Board, Les Wexner, announced in February 2020 that he would step down, which became official in May 2020. Wexner founded L Brands (known then as The Limited, Inc.) in 1963 and bought the Victoria’s Secret brand in 1982. Wexner agreed to sell a majority stake in Victoria’s Secret to private equity firm Sycamore Partners in February 2020, but the firm has since backed out of the sale.

- Store Closures: In the first quarter of 2020, the retailer announced the closure of 250 stores in North America, totaling 23% of its store fleet in the region. For this period, L Brands reported that comparable store sales at Victoria’s Secret were down 15% compared to the same period of 2019, and sales were down 46%.

- American Eagle’s Aerie Brand

Source: Company reports[/caption]

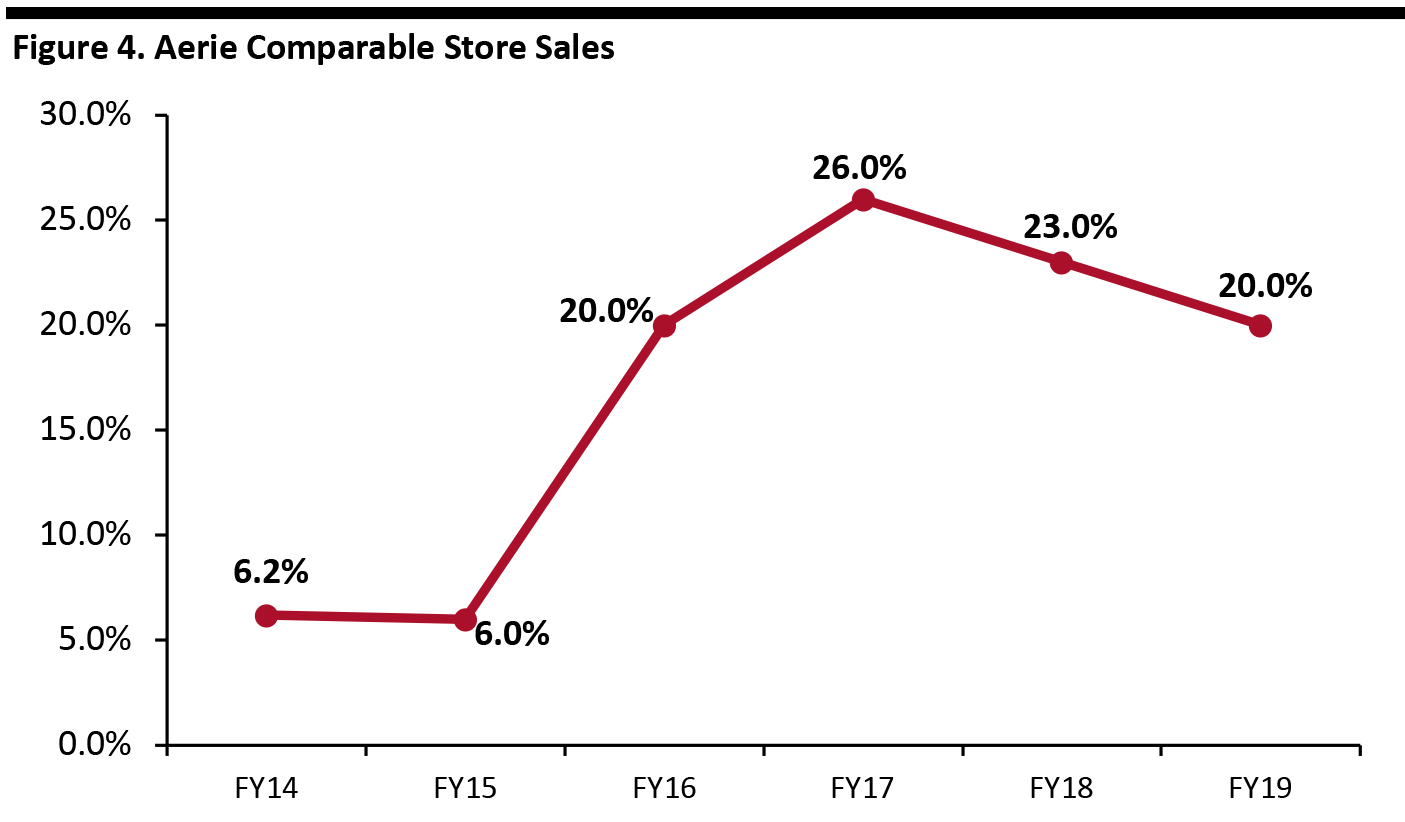

The company launched its #aerieREAL campaign in 2014, focusing on using models that are representative of a range of women and not using photoshop for its images. While this is a more mainstream practice today, Aerie was a pioneer in showing images of women in a more natural state, and consumers reacted positively to the relatability of the brand. The company held its first one-day #aerieREAL summit in Brooklyn, New York, in March 2020—100% of the proceeds went to the National Eating Disorder Association.

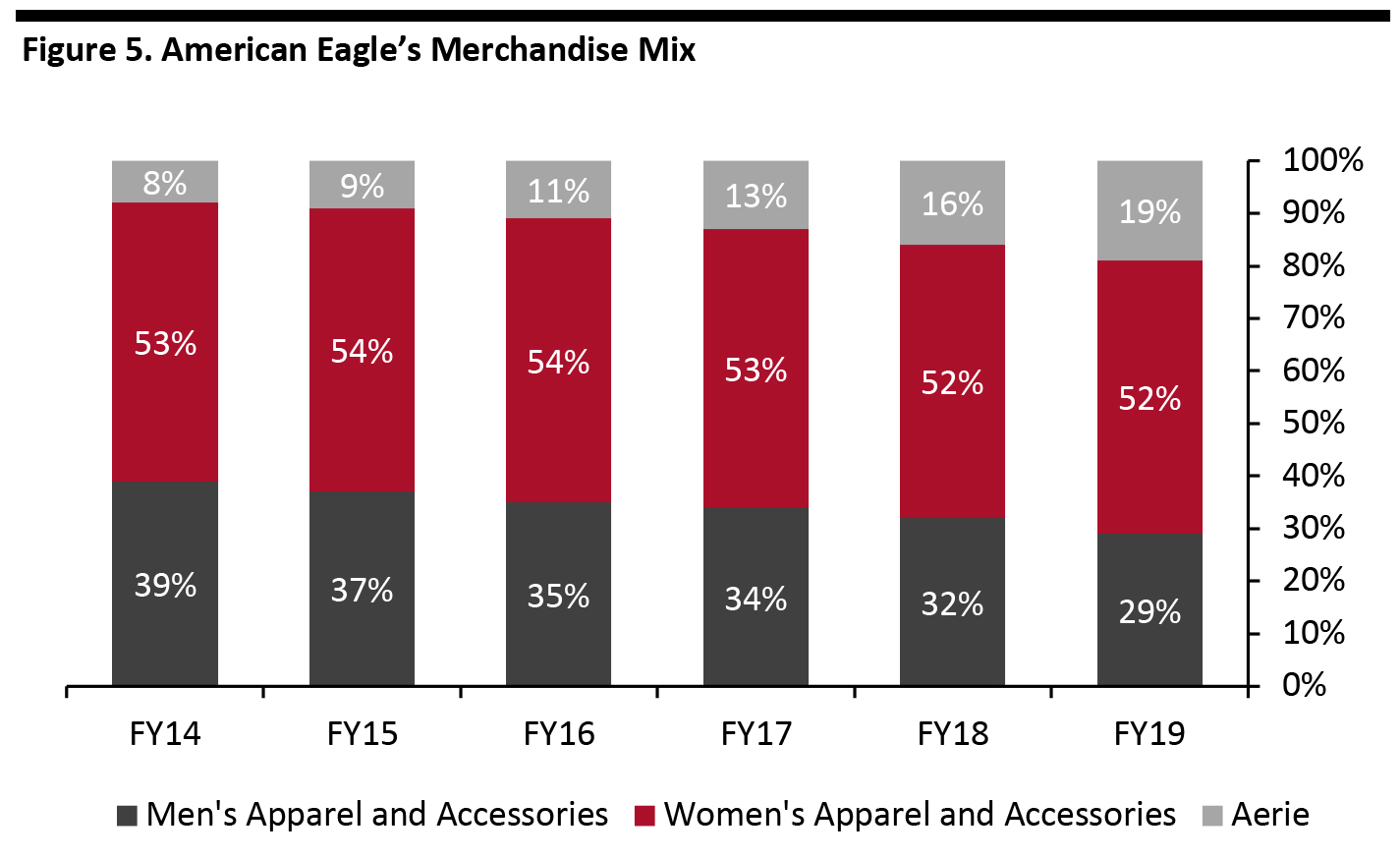

Aerie has continued to diversify its brand beyond intimates and has grown to make up nearly one-fifth of American Eagle’s merchandise mix, as shown in Figure 5: In just five years, Aerie has expanded from 8% of American Eagle’s merchandise mix to 19% in fiscal year 2019.

[caption id="attachment_115095" align="aligncenter" width="700"]

Source: Company reports[/caption]

The company launched its #aerieREAL campaign in 2014, focusing on using models that are representative of a range of women and not using photoshop for its images. While this is a more mainstream practice today, Aerie was a pioneer in showing images of women in a more natural state, and consumers reacted positively to the relatability of the brand. The company held its first one-day #aerieREAL summit in Brooklyn, New York, in March 2020—100% of the proceeds went to the National Eating Disorder Association.

Aerie has continued to diversify its brand beyond intimates and has grown to make up nearly one-fifth of American Eagle’s merchandise mix, as shown in Figure 5: In just five years, Aerie has expanded from 8% of American Eagle’s merchandise mix to 19% in fiscal year 2019.

[caption id="attachment_115095" align="aligncenter" width="700"] Source: Company reports[/caption]

Aerie has helped to expand the definition of intimates into loungewear and casual wear. It has created an entire market around apparel pieces that are designed to look effortlessly thrown together—often appealing to Gen Z college students. In July 2020, Aerie launched Offline, a sub-brand collection of activewear and accessories built for movement and comfort. The company described Offline as an expansion of its “Chill. Play. Move” collection into soft, cozy and comfortable activewear. The collection features an activewear assortment of leggings, bike shorts, tops, sports bras, fleeces, bottoms and accessories. It will be initially be exclusively available online at aerie.com, but the company also plans to open two retail store locations by the end of 2020.

This highlights that the Aerie brand, which just encompassed intimates when it was created, has expanded into a lifestyle brand that now also offers loungewear, sleepwear and activewear.

Source: Company reports[/caption]

Aerie has helped to expand the definition of intimates into loungewear and casual wear. It has created an entire market around apparel pieces that are designed to look effortlessly thrown together—often appealing to Gen Z college students. In July 2020, Aerie launched Offline, a sub-brand collection of activewear and accessories built for movement and comfort. The company described Offline as an expansion of its “Chill. Play. Move” collection into soft, cozy and comfortable activewear. The collection features an activewear assortment of leggings, bike shorts, tops, sports bras, fleeces, bottoms and accessories. It will be initially be exclusively available online at aerie.com, but the company also plans to open two retail store locations by the end of 2020.

This highlights that the Aerie brand, which just encompassed intimates when it was created, has expanded into a lifestyle brand that now also offers loungewear, sleepwear and activewear.

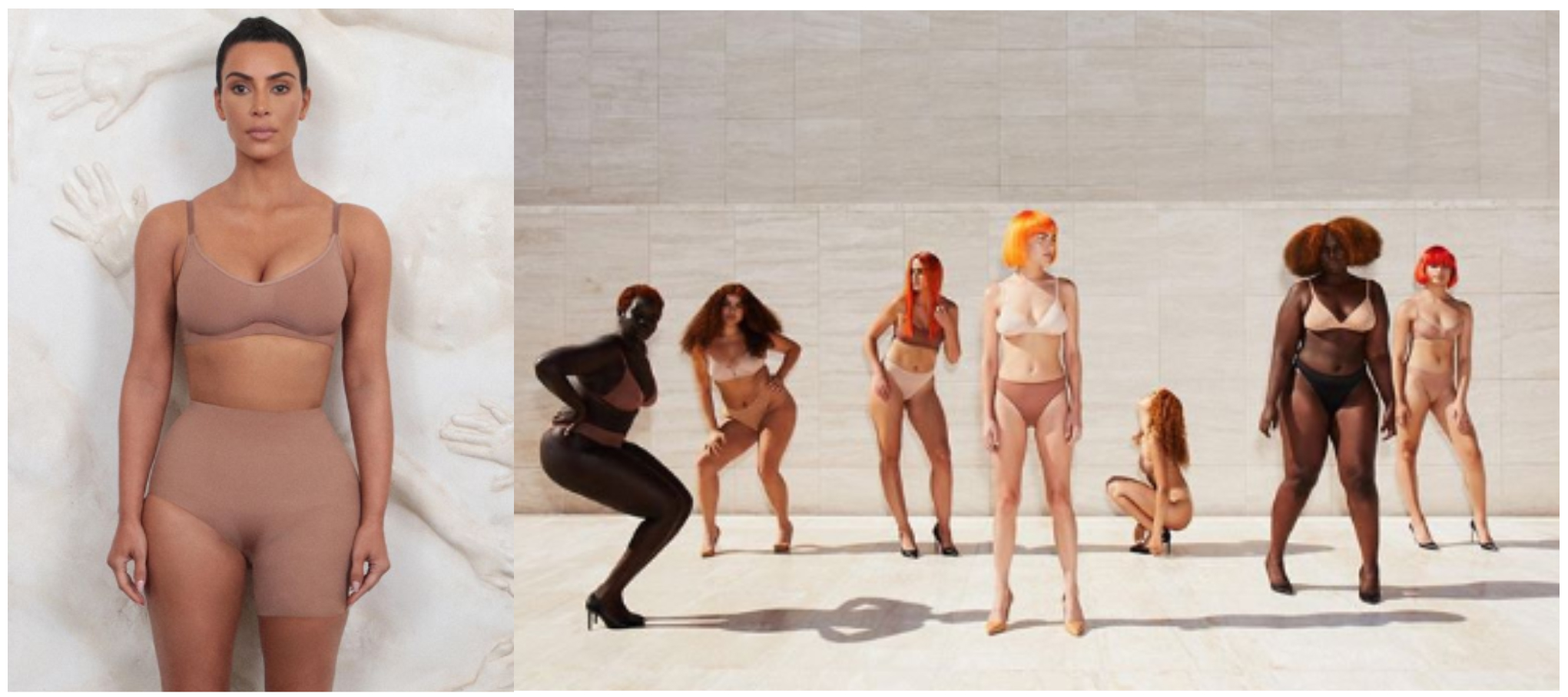

- Kim Kardashian West’s SKIMS Shapewear Brand

Kim Kardashian West, Founder of SKIMS, wearing the brand’s one-legged shapewear short; SKIMS mesh collection

Kim Kardashian West, Founder of SKIMS, wearing the brand’s one-legged shapewear short; SKIMS mesh collection Source: SKIMS Instagram [/caption] 3. Brands Taking Action on Inclusivity, Diversity and Body Positivity Inclusivity is no longer a differentiator—consumers expect brands and retailers to embrace differences in size, color and appearance in the sizes they stock and the models they use. Consumers have been seeking out more authentic advertising images, such as models that are representative of all women and embrace realistic standards of beauty as opposed to photoshopped perfection. There is a growing transition among intimates brands towards embracing sizes, models, lingerie tones and conversation topics that represent today’s consumer. Many consumers are looking for brands that go beyond a product and take actions to back up their narrative on social issues. Below are a few examples of intimates brands that are taking a stand on inclusivity, diversity and body positivity:

- ThirdLove is a brand known for its inclusiveness in bra fit. The brand launched in 2013 as a DTC brand, offering over 78 sizes and a fit-finder tool. ThirdLove has millions of consumer data points that help the company to continuously refine the design of its bras. Founder Heidi Zak explained that she launched ThirdLove in response to her personal experience of poorly fitting bras. Zak gave a recent virtual presentation on how ThirdLove has adapted and evolved since Covid-19. She highlighted that the company created a program called the “TL Effect” to help to create a future “where company founders reflect the demographics of the country.” She said that if ThirdLove can contribute to the success of more female founders of color, they in turn will be able to hire and mentor others. The program works by selecting an early stage, consumer-facing company that is run by a woman of color every quarter. ThirdLove will provide mentorship, a grant and resources to the founder of that company. Zak said that she sees the TL Effect as mutually beneficial, as her company is able to listen and learn from other founders’ experiences and points of view, which may help to bring about change within the company and wider community.

Source: ThirdLove.com[/caption]

Source: ThirdLove.com[/caption]

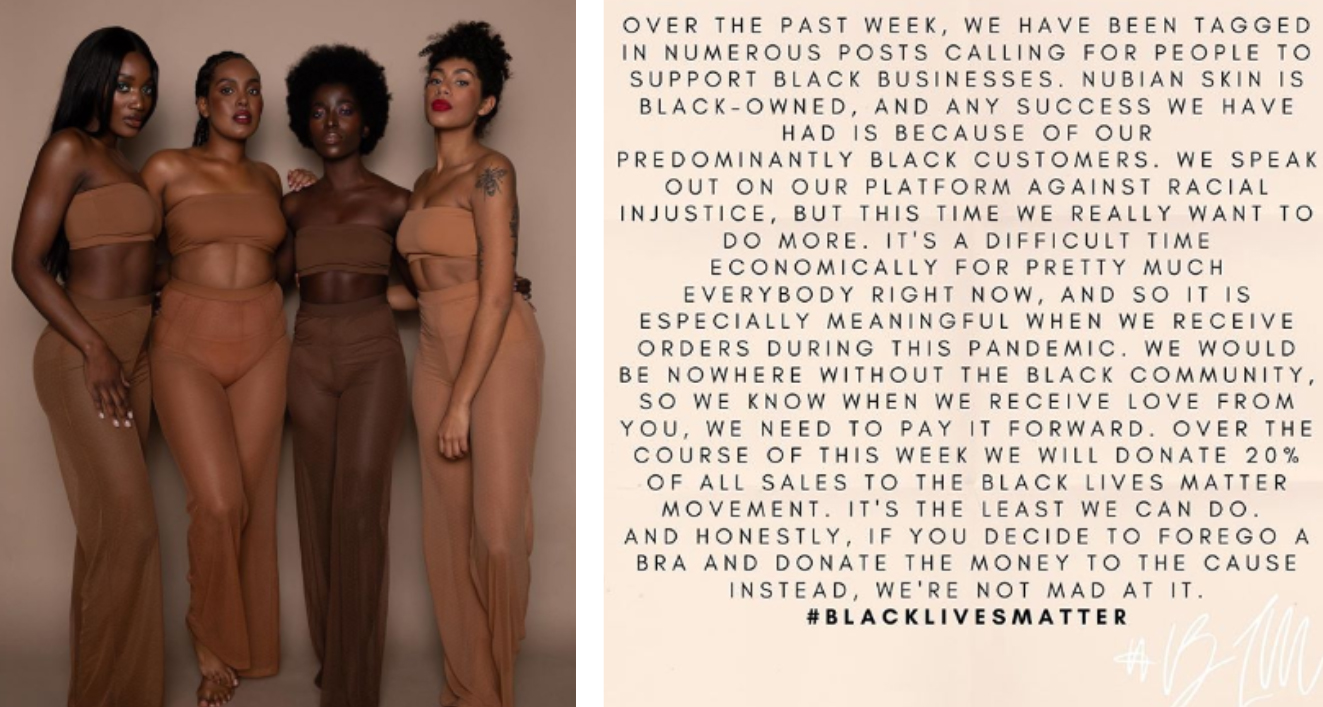

- Nubian Skin, a lingerie and hosiery brand based in London, UK (but with a presence in the US), was launched in October 2014. It offers products in different skin tone colors for women of color—cinnamon, café au lait, berry and caramel. The brand’s founder, Ade Hassan, details on the company website that the inspiration for Nubian Skin came out of her own frustration at not being able to find products for her own skin tone. The company offers shapewear, intimates, hosiery and swimwear in sizes that run from XS–XXL and from 30B to 40G for bras. In June 2020, Hassan donated 20% of the company’s sales over a week-long period to Black Lives Matter initiatives. As shown in the Nubian Skin Instagram post below, Hassan explained that, “Nubian Skin is black-owned, and any success we have had is because of our predominately black customers. We speak out on our platform against racial injustice, but this time we really want to do more.”

Source: Nubian Skin Instagram[/caption]

Source: Nubian Skin Instagram[/caption]

- Savage x Fenty was launched as a 40-piece collection by Rihanna in May 2018. The collection, which carried sizes XS to 3X and seven shades of nude, sold out within one month. In September 2019, the brand held a fashion show as part of NYFW that included models of different sizes, abilities and gender identities. In 2017, Rihanna launched a beauty brand carrying 40 shades of foundation and an emphasis on inclusion—her 2018 collection is known for this same philosophy. Most recently, Rihanna launched a casting search for the new faces of her summer Savage x Fenty campaign.

Savage x Fenty models are representative of a range of women

Savage x Fenty models are representative of a range of women Source: SavagexFenty Instagram [/caption] 4. Continued Interest in Sports Bras Women are increasingly choosing to wear athletic bras for everyday activities, according to market research firm The NPD Group. While consumers still list exercise as the number-one reason for wearing sports bras, nearly one-quarter of women indicated that they also choose sports bras for at-home wear or errand-running. The amount of women purchasing sports bras is growing—from 38% in 2015 to 45% in 2018, according to NPD data. Many athleticwear and sports apparel companies are focusing on the sports-bra category:

- Dick’s Sporting Goods launched a sports-bra empowerment advertising campaign in March 2020, focusing on the history of the sports bra. The campaign features Brandi Chastain, renowned US women’s soccer player who famously celebrated her winning penalty kick in the 1999 World Cup Finals by taking of her shirt—revealing her sports bra. The Dick’s Sporting Goods ad highlights that the sports bra is a symbol of empowerment for women to play sports and achieve the goals that they set. The campaign followed Dick’s Sporting Goods’ 2020 Women’s Initiative offering a three-year, $5 million grant to the US Soccer Foundation's “United for Girls” initiative, which is aimed at increasing opportunities for girls and young women to benefit from soccer. The company also announced that it is the official merchandise vendor for the Stand Beside Her softball tour (a series of competitions and training opportunities for the USA Softball Women’s National Team in preparation for the 2020 Tokyo Olympic Games), although the tour has since seen postponements and cancellations due to the coronavirus pandemic. Dick’s Sporting Goods’ initiatives to support women in sports will further encourage category growth expansion of athletic apparel for girls and women, including sports bras.

Source: Dick’s Sporting Goods’ television ad, featuring Brandi Chastain

Source: Dick’s Sporting Goods’ television ad, featuring Brandi Chastain Source: YouTube [/caption]

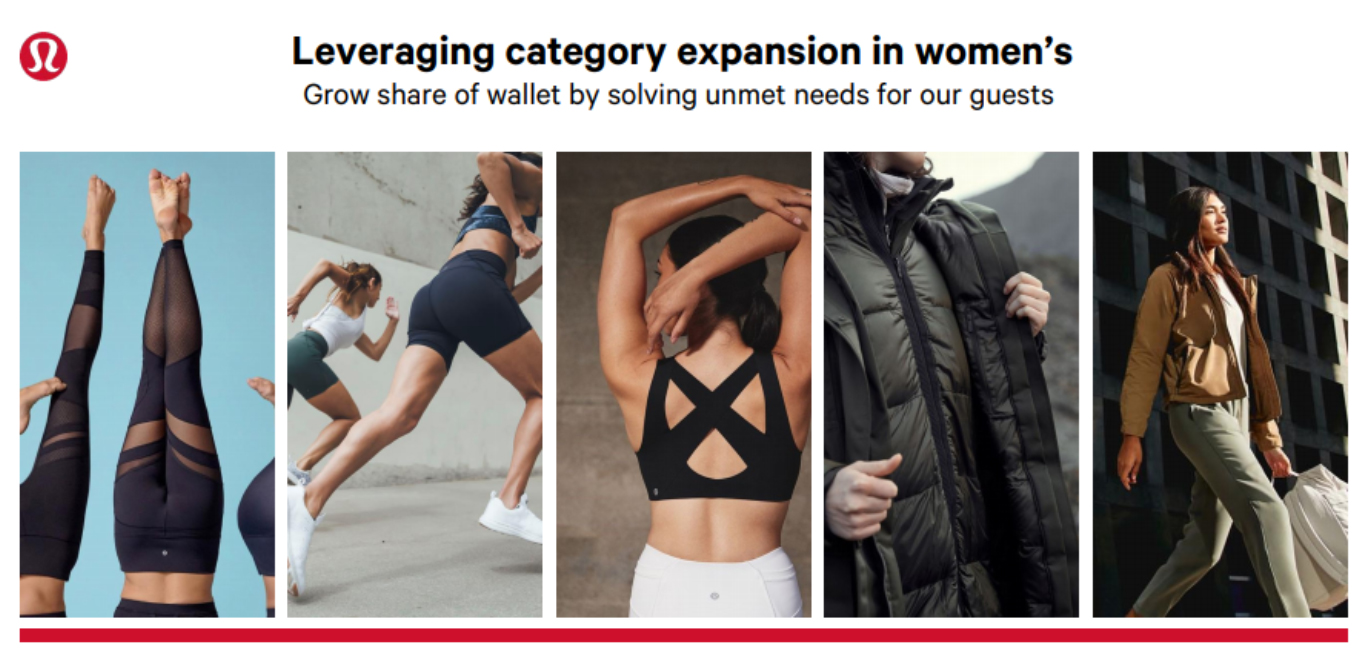

- At its April 2019 Analyst Day, Lululemon reported that the sports-bra category was a target area of growth for the company, and one with unmet needs.

Source: Company reports[/caption]

As an update to this progress, in its second-quarter 2020 earnings report, Lululemon stated that it was very excited about opportunities within the bra category. Its team continues to innovate and develop bra products that will launch in the coming quarters, as it “sees the whitespace opportunity within the category.” The company reported that it is pleased with the results so far and is continuing to make investments in this category.

Source: Company reports[/caption]

As an update to this progress, in its second-quarter 2020 earnings report, Lululemon stated that it was very excited about opportunities within the bra category. Its team continues to innovate and develop bra products that will launch in the coming quarters, as it “sees the whitespace opportunity within the category.” The company reported that it is pleased with the results so far and is continuing to make investments in this category.

- In its second-quarter 2020 earnings call, NIKE reported that it remained “intently focused on apparel that matters most to the female athlete: bras and tights.” Its Indy Light-Support Sports Bra led the way for sales in the quarter.

What We Think

2020 has been a radical year for the intimates industry due mainly to key announcements from industry-leading retailer Victoria’s Secret. However, particularly in light of Covid-19 adjustments, there are significant opportunities within this space for brands and retailers. Implications for Brands and Retailers- Authenticity is a key consumer priority. In addition to incorporating inclusive and diverse brand imagery and promises, brands must take action to stand up for causes that resonate with their consumer.

- There are opportunities for athleticwear and sports apparel companies to capitalize on continued growth of the sports-bra category. Consumers are very interested in this segment—wearing sports bras for fashion and comfort as well as for sports.

- There is room to position intimates as a lifestyle category related to fun and comfort instead of simply bras and underwear. Thinking expansively has helped companies like Aerie and SKIMS to reach customers by offering loungewear, cozy and comfortable clothes, activewear, sleep clothes, robes and shapewear. Aerie has seen double-digit growth for 21 straight quarters and expects to reach $1 billion in sales in 2020.