DIpil Das

What’s the Story?

In this report, we discuss the US swimwear market, including the market size and competitive landscape. We also cover the three main market drivers and four key trends we are seeing. We define swimwear as a category of clothing that can be worn for swimming, including bikinis, one-piece swimsuits, shorts and trunks for men and women. We exclude beach clothing such as beach kaftans, dresses and shirts and swim accessories/gear such as ear plugs, goggles and nose clips.Why It Matters

The pandemic has driven a host of changes in the US apparel industry, including in terms of swimwear demand. As pandemic-related restrictions are easing, we review the US swimwear market amid the recovery in overall US apparel sales.US Swimwear Market: Coresight Research Analysis

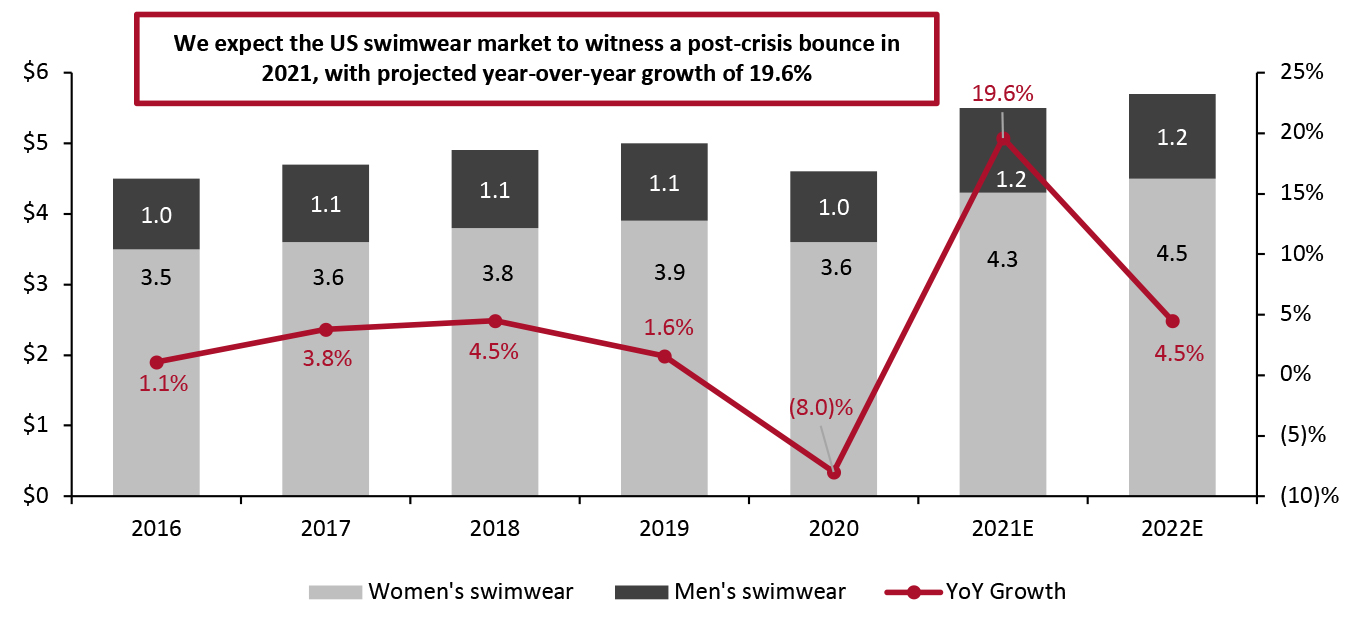

Market Size We estimate that US women’s and men’s swimwear sales declined by 8.0% amid the pandemic in 2020. This decline was, however, less severe than the total apparel market, which declined by 12.2% in 2020. We expect US women’s and men’s swimwear sales to exceed pre-crisis levels and total $5.5 billion in 2021, representing year-over-year growth of 19.6%—slightly outpacing our estimated recovery of the total US apparel and footwear market. This will see swimwear capture 1.7% of the total US apparel market in 2021. We expect the market to grow at a more stable mid-single-digit rate in 2022. By category, the sales shares of women’s and men’s swimwear have been stable over the past few years, at 78% and 22%, respectively.Figure 1. US Adult Swimwear Sales (Left Axis; USD Bil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_133930" align="aligncenter" width="726"]

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

The decline in the swimwear category in 2020 was likely concentrated in the first quarter of 2020 at the onset of the pandemic, with many companies reporting recovery in the subsequent quarters, as shown in Figure 2.

Source: Euromonitor International Limited 2021 © All rights reserved/Coresight Research[/caption]

The decline in the swimwear category in 2020 was likely concentrated in the first quarter of 2020 at the onset of the pandemic, with many companies reporting recovery in the subsequent quarters, as shown in Figure 2.

Figure 2. Selected List of Retailer/Brand’s Reporting on Swimwear [wpdatatable id=1318 table_view=regular]

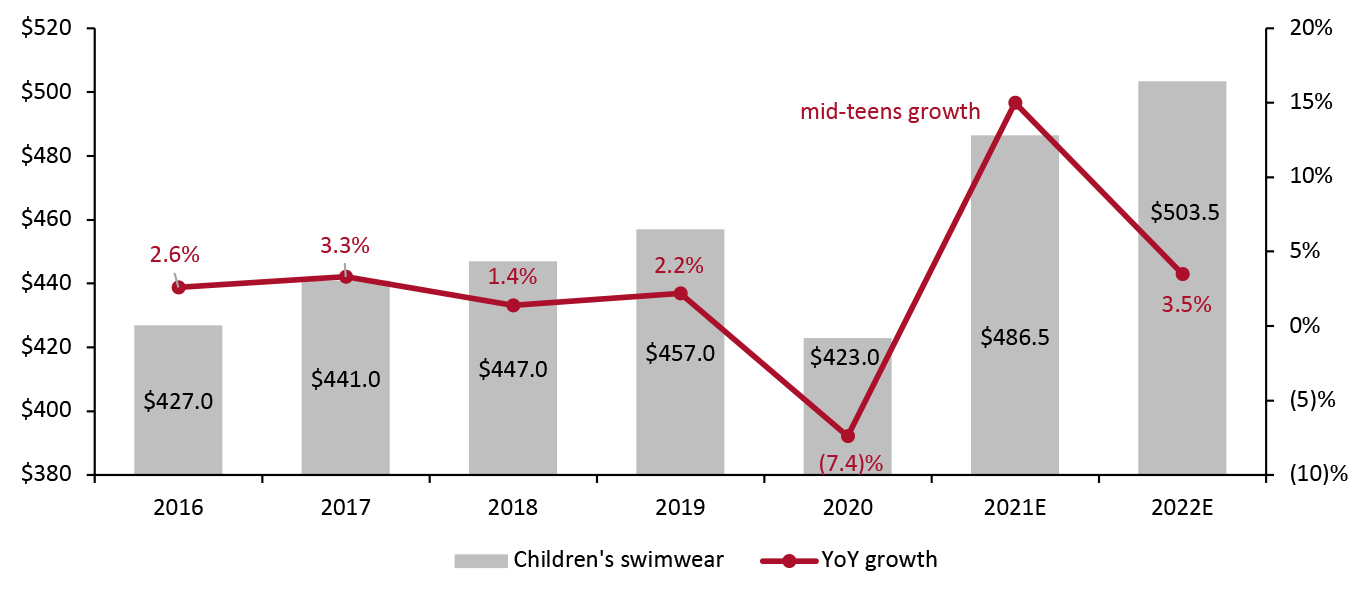

Source: Company reports Children’s swimwear market Children’s swimwear sales in the US declined by 7.4% to $423 million in 2020, according to Statista—a slight outperformance versus the 8.0% decline in adult swim products. We expect the children’s market to grow at a mid-teens rate in 2021. This is slightly slower than the adult market, as children’s swimwear recovers from a slightly stronger base and in part because of a slower rollout of vaccinations among children. Only about 40% of children ages 12 to 15 have been fully vaccinated as of September 2021, compared with 66% of adults, according to federal data.

Figure 3. US Children’s Swimwear Sales (Left Axis; USD Mil.) and Sales Growth (Right Axis; YoY % Change) [caption id="attachment_133931" align="aligncenter" width="726"]

Source: Statista/Coresight Research[/caption]

Market Drivers

We present the three main drivers of growth in the US swimwear market in 2021.

1. Heightened Consumer Focus on Outdoor Aquatic Activities

The Covid-19 pandemic has heightened consumer focus on outdoor activities, such as visiting the sea and lakes to swim as well as visiting pools and water parks, which is a key driver of demand for swim clothing.

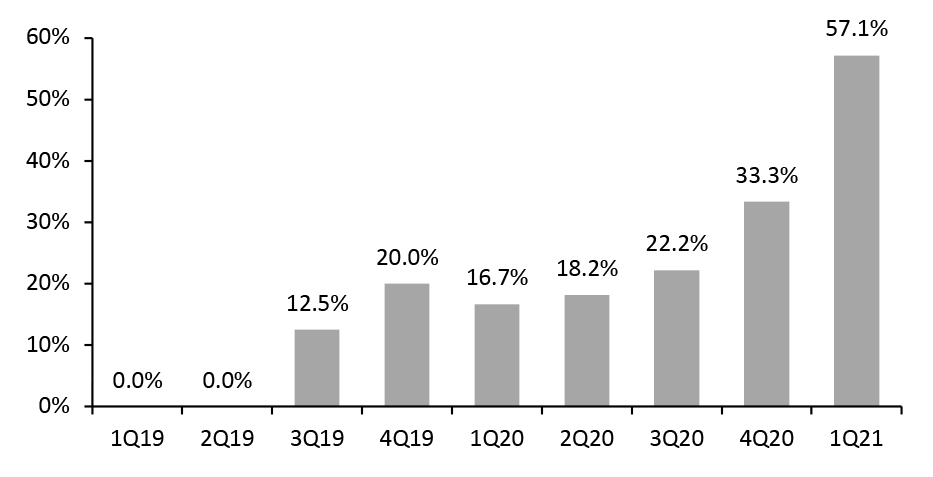

According to Pool Corporation, a distributor of swimming pools, supplies, equipment and related leisure products in the US, more consumers are visiting pools after they reopening starting January 2021 than prior to their closure, driving the company’s pool sales up 57.1% in the first quarter of 2021, as shown in Figure 4.

Moreover, indoor pools in fitness centers have reopened gradually since May 2021, driving swimmers back, though pools typically only allow two people per swim lane and require reservations.

Source: Statista/Coresight Research[/caption]

Market Drivers

We present the three main drivers of growth in the US swimwear market in 2021.

1. Heightened Consumer Focus on Outdoor Aquatic Activities

The Covid-19 pandemic has heightened consumer focus on outdoor activities, such as visiting the sea and lakes to swim as well as visiting pools and water parks, which is a key driver of demand for swim clothing.

According to Pool Corporation, a distributor of swimming pools, supplies, equipment and related leisure products in the US, more consumers are visiting pools after they reopening starting January 2021 than prior to their closure, driving the company’s pool sales up 57.1% in the first quarter of 2021, as shown in Figure 4.

Moreover, indoor pools in fitness centers have reopened gradually since May 2021, driving swimmers back, though pools typically only allow two people per swim lane and require reservations.

Figure 4. Pool Corporation: Sales Growth by Quarter (YoY %) [caption id="attachment_133932" align="aligncenter" width="726"]

Source: Pool Corporation[/caption]

2. Demand for At-Home Hot Tubs

In 2021, we are seeing more and more consumers buy hot tubs from retailers for use at home. Shoppers are turning to retailers such as Home Depot and Wayfair to avoid traveling to hot tub sales rooms. Hot tub suppliers including Sonoma Hot Tubs and Pool Supplies have sold out some types of hot tubs until 2022. We view this increasing demand for hot tubs as an important driver for the US swimwear market.

3. US Travel Recovery

The US travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis in 2020, according to data from the Transportation Security Administration.

The recovery of travel in the US is now fully under way, with consumers who have accrued pent-up spending power beginning to unleash their pandemic savings on experience spending. A gradual return to travel in 2021 would result in welcome gains for tourism-driven retail sectors and related apparel sectors including swimwear.

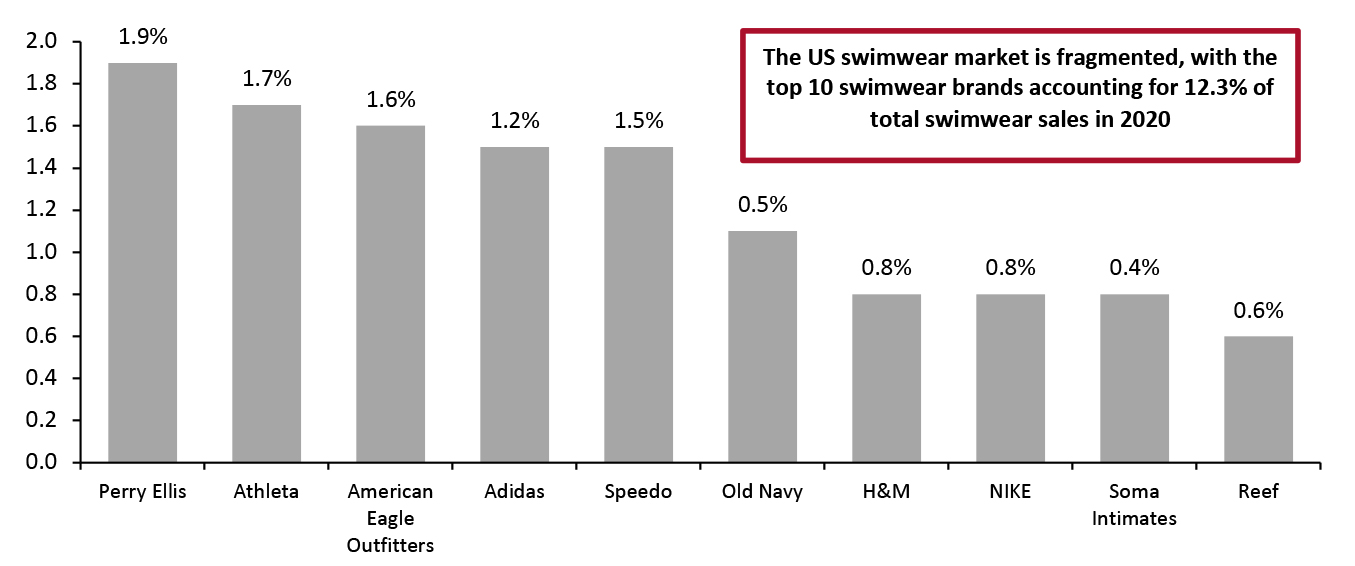

Competitive Landscape

The US swimwear market is fragmented, with the top 10 swimwear brands accounting for only 12.3% of US swimwear sales in 2020, according to Euromonitor International—as shown in Figure 4.

We expect the market to remain fragmented over the next three to five years. This can be attributed to apparel brands and retailers launching new swimwear lines to capture share of the growing market. Secondly, we expect to see an increase in new digitally native swimwear brands, which will also contribute to the fragmentation.

Source: Pool Corporation[/caption]

2. Demand for At-Home Hot Tubs

In 2021, we are seeing more and more consumers buy hot tubs from retailers for use at home. Shoppers are turning to retailers such as Home Depot and Wayfair to avoid traveling to hot tub sales rooms. Hot tub suppliers including Sonoma Hot Tubs and Pool Supplies have sold out some types of hot tubs until 2022. We view this increasing demand for hot tubs as an important driver for the US swimwear market.

3. US Travel Recovery

The US travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis in 2020, according to data from the Transportation Security Administration.

The recovery of travel in the US is now fully under way, with consumers who have accrued pent-up spending power beginning to unleash their pandemic savings on experience spending. A gradual return to travel in 2021 would result in welcome gains for tourism-driven retail sectors and related apparel sectors including swimwear.

Competitive Landscape

The US swimwear market is fragmented, with the top 10 swimwear brands accounting for only 12.3% of US swimwear sales in 2020, according to Euromonitor International—as shown in Figure 4.

We expect the market to remain fragmented over the next three to five years. This can be attributed to apparel brands and retailers launching new swimwear lines to capture share of the growing market. Secondly, we expect to see an increase in new digitally native swimwear brands, which will also contribute to the fragmentation.

Figure 5. Top 10 US Swimwear Brands: Market Share, 2020 (%) [caption id="attachment_133933" align="aligncenter" width="725"]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

Digitally Native Swimwear Brands in Swimwear’s Competitive Landscape

Digitally native vertical brands (DNVBs) have seen success within the US apparel market amid the pandemic-accelerated shift to e-commerce. Swimwear DNVBs also benefiting from the easing of travel restrictions. For example, Summersalt is reporting strong sales performance in 2021 and expects its sales to grow 100% in the year.

In Figure 6, we present a range of key DNVB swimwear players in the US market.

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

Digitally Native Swimwear Brands in Swimwear’s Competitive Landscape

Digitally native vertical brands (DNVBs) have seen success within the US apparel market amid the pandemic-accelerated shift to e-commerce. Swimwear DNVBs also benefiting from the easing of travel restrictions. For example, Summersalt is reporting strong sales performance in 2021 and expects its sales to grow 100% in the year.

In Figure 6, we present a range of key DNVB swimwear players in the US market.

Figure 6. Selected Swimwear DNVBs [wpdatatable id=1319 table_view=regular]

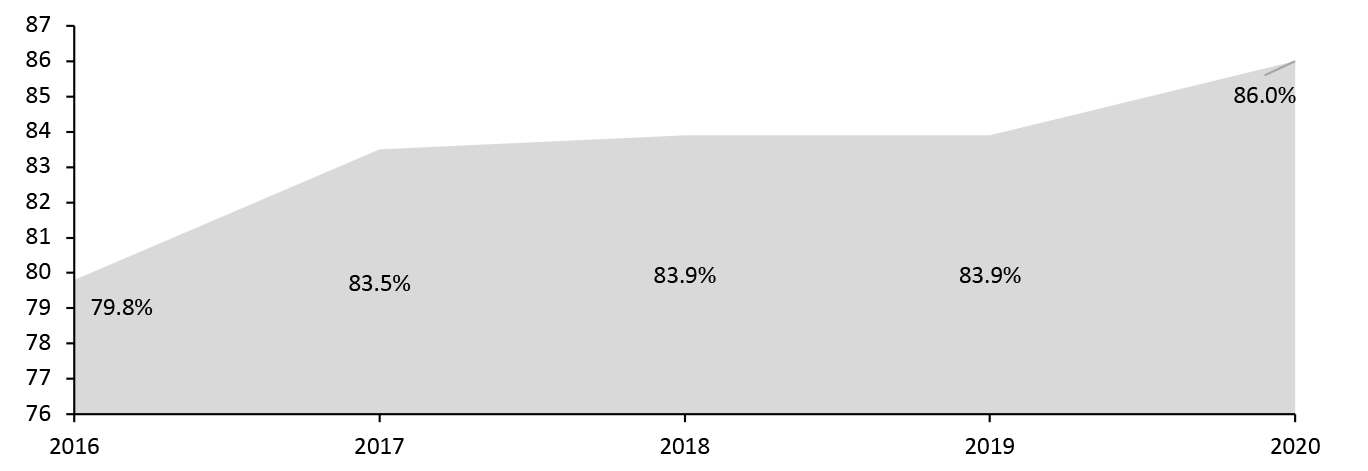

Source: Company reports Changing consumer preferences for shopping online have prompted many retailers to reevaluate their product mix and overall portfolio, driving a wave of mergers and acquisition (M&A) activity, especially among DNVBs and digitally native marketplaces. A prominent M&A case in swimwear is PVH’s sale of the Speedo North America business in January 2020 to Pentland Group, parent company of Speedo International Limited, for $170 million. The move was designed to optimize and streamline PVH’s Heritage Brands business in the ever-evolving retail environment. Private-Label and Small Brands in Swimwear’s Competitive Landscape We discuss sales by swimwear private labels and small brands (those that rank outside of the top 22 swimwear brands by revenue, according to Euromonitor). Private-label sales data are not available publicly. Sales of swimwear private labels and by small brands in the US capture a large share of the total swimwear market, with the proportion increasing rapidly from 2016 to 2020, based on Euromonitor International data.

Figure 7. US Swimwear Private Labels and Small Brands: Market Share, 2016–2020 (%) [caption id="attachment_133934" align="aligncenter" width="726"]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

The following major retailers and department stores have launched swimwear private labels to capture share of the growing market:

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

The following major retailers and department stores have launched swimwear private labels to capture share of the growing market:

- Among Amazon’s 87 apparel private labels, 10 brands (Cable Stitch, Coastal Blue, Common District, Dayana, Isle Bay Linens, Mae, Ocean Blues, Orchid Row, Trailside Supply Co and Wild Oasis Beachwear) offer swimwear.

- Kohl’s apparel private labels such as Apt. 9, Croft & Barrow, Jumping Beans, SO and Sonoma Goods for Life all offer swimwear.

- Among Macy’s 18 private labels only Bar III offers swimwear.

- Among Target’s 20 apparel private labels, four offer swimwear—All in Motion, Kona Sol, Shade and Shore, and Xhilaration.

- Three of Walmart’s three private-label brands, Avia, No Boundaries, and Time and Tru, offer swimwear.

Figure 8. Selected US Apparel Brands and Retailers: Swimwear Market Entries in 2021 [wpdatatable id=1320 table_view=regular]

Source: Company reports 2. Inclusivity Inclusivity in retail comprises providing equal access for people who might otherwise be excluded or marginalized. This touches every part of an organization, both internally and externally, and can be reflected in the sizes and styles of apparel offerings by swimwear brands.

- Size-Inclusive Swimwear

Figure 9. Selected US Apparel Brands and Retailers: Size-Inclusive Product Launches in 2021 [wpdatatable id=1321 table_view=regular]

Source: Company reports

- Gender-Neutral Swimwear

From left to right: a unisex swim tank sold by Outplay, swim shorts with sunset stripes sold by TomboyX, and loose fit swim top sold by Modli

From left to right: a unisex swim tank sold by Outplay, swim shorts with sunset stripes sold by TomboyX, and loose fit swim top sold by Modli Source: Outplay/TomboyX/Modli [/caption] 3. Sustainability We are seeing a wave of sustainable swimwear offerings by big brands such as NIKE and small brands such as Summersalt amid an increase in consumer awareness of the environmental impact of fashion supply chains. In April 2021, NIKE launched the Icon Collection, its first line of swimwear made with sustainable fabrics, comprising 25 different prices. Summersalt launched a new sustainable swimwear collection in early 2021, which is made of a fabric containing 78% recycled polyamid. According to a survey by Coresight Research and Blue Yonder in January 2021, 65.6% of US consumers believe that sustainability is an important factor in choosing where to buy apparel and footwear. With shopping choices being influenced by consumers’ growing interest in environmental sustainability, there are opportunities in sustainable apparel and swimwear products in the near future. Swimwear is already a popular category for the use of fabrics that are marketed as sustainable. Recycled nylon (used by Athleta, Everlane and Patagonia) and recycled polyamide (used by Summersalt) are among the most popular fibers used by swimwear brands that aim to promote sustainability.

Figure 10. Two Key Sustainable Fabrics Used in Swimwear [wpdatatable id=1317 table_view=regular]

Source: Company reports 4. Tech-Driven Functionality Technology has become an indispensable part of the swimwear market. We are seeing more brands and retailers leverage technology to improve product functionality and cost-efficiency. Fast-dry fabric technologies, speed improvement and sun-protective technologies have become popular ways to enhance functionality and comfort for wearers.

- The North Face sells swim shorts with advanced material technology. The company’s Class V pull-on swim shorts use its proprietary patented Flashdry technology to push moisture to the surface of a fabric for quick evaporation that keeps wearers dry and comfortable. The shorts are made of recycled nylon and are equipped with a durable water repellent (that helps to resist moisture and stains.

- Speedo sells a tech-enabled swimsuit, developed to support swimmers covering long distances and optimize speed. The company’s proprietary Valor design enables a wide range of motion and core stability support through a specially layered fabric. The swimming suits cost approximately $450 and are approved by FINA (the international federation recognized by the International Olympic Committee for administering international competitions in water sports).

- Sun Pop Life sells a kids' swimwear collection with fabrics that offer antimicrobial UPF 50+ skin protection to prevent sunburn.

What We Think

Implications for Apparel Brands and Retailers- We predict a post-crisis bounce in US adult swimwear sales in 2021, which will total $5.5 billion, representing year-over-year growth of 19.6%. The fast-growing market offers opportunities for apparel retailers and brands to expand in the market.

- The need for inclusivity and sustainability has changed consumer expectations regarding swimwear styles, sizes and fabrics. Traditional brands and retailers should look to leverage the growing trends to innovate swimwear products.

- Opportunities exist for digitally native swimwear brands given their strong business models, innovative technologies and delivery of positive brand messages such as motivating customers to keep fit and active.

- Technology-enhanced fabrics have become an indispensable part of the swimwear market. We believe more retailers and brands will leverage technology to improve product functionality and cost-efficiency.