albert Chan

What’s the Story?

For many consumers, the pandemic has led to or exacerbated disruptions to sleep, reflected in the coinage of the term “Covid-somnia” by sleep neurologists. Consumers are becoming increasingly conscious of their sleep quality and encompassing sleep health within the wellness movement, benefiting a wide range of products that aid sleep.

In this report, we present our estimates of the size and trajectory of the US sleep economy and discuss four product segments, including key players within each one.

Why It Matters

We expect wellness concerns to be the number-one driver of discretionary spending growth worldwide—more so than any other of our global trends for 2021.

Poor quality or insufficient sleep is an issue for many US consumers. Consumers are sleeping worse than before—43% of Americans described their sleep as poor or fair, based on Better Sleep Council’s 2020 State of America’s Sleep Survey, compared to 38% in 2019. Concerns over the economy and individual’s health amid the pandemic in 2020 also likely contributed to poor sleep.

As consumers’ concerns related to physical and mental health grow, the sleep economy is emerging as a multibillion-dollar pillar of the wellness market.

US Sleep Economy

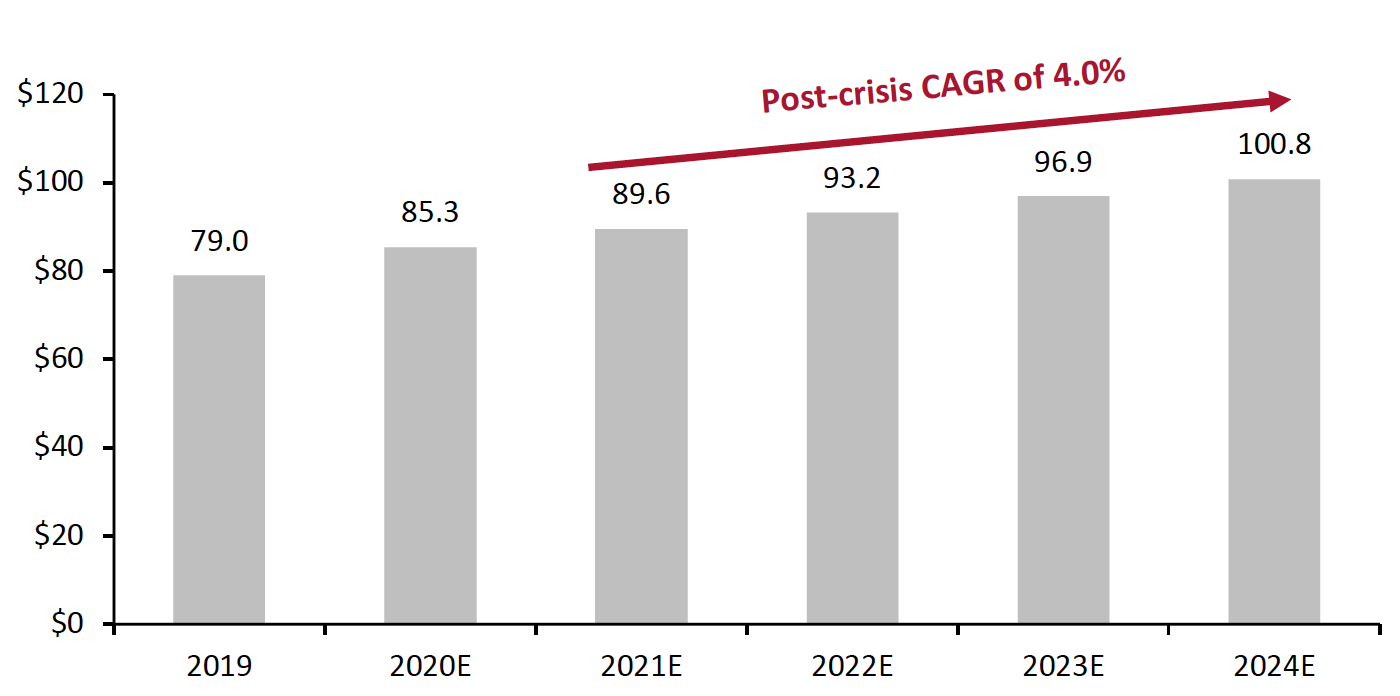

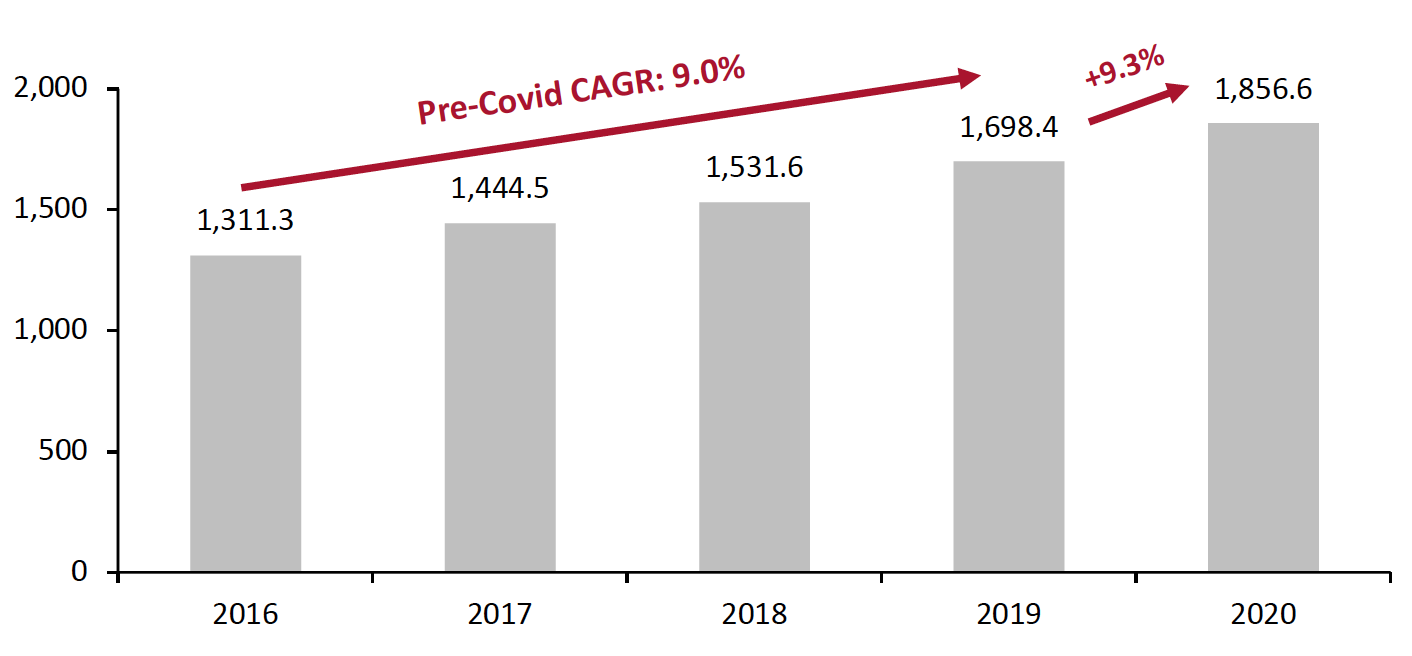

Coresight Research estimates that the US sleep economy grew 8.0% to $85.3 billion in 2020, and is set to grow at a CAGR of 4% to over $100 billion in 2024.

The sleep economy market size in Figure 1 comprises the following product categories and services that are marketed as improving sleep: ambience optimization (including lighting, sound, scents, temperature and humidity), bedding, bedroom furniture, pajamas, pet sleeping products, airplane sleep accessories, tracking wearables, sleep supplements, sleep-apnea-treatment devices, sleep services and medical diagnostic services.

We discuss four key segments in this report—bedding, tracking wearables, ambience optimization and sleep services.

Figure 1. US Sleep Economy Market Size (USD Bil.)

[caption id="attachment_130040" align="aligncenter" width="550"] Source: Frost & Sullivan/Coresight Research[/caption]

Source: Frost & Sullivan/Coresight Research[/caption]

Key Segments

While consumers have historically relied on over-the-counter and prescription medications to manage sleep issues, we are seeing increased popularity in alternative solutions to improving sleep quality.

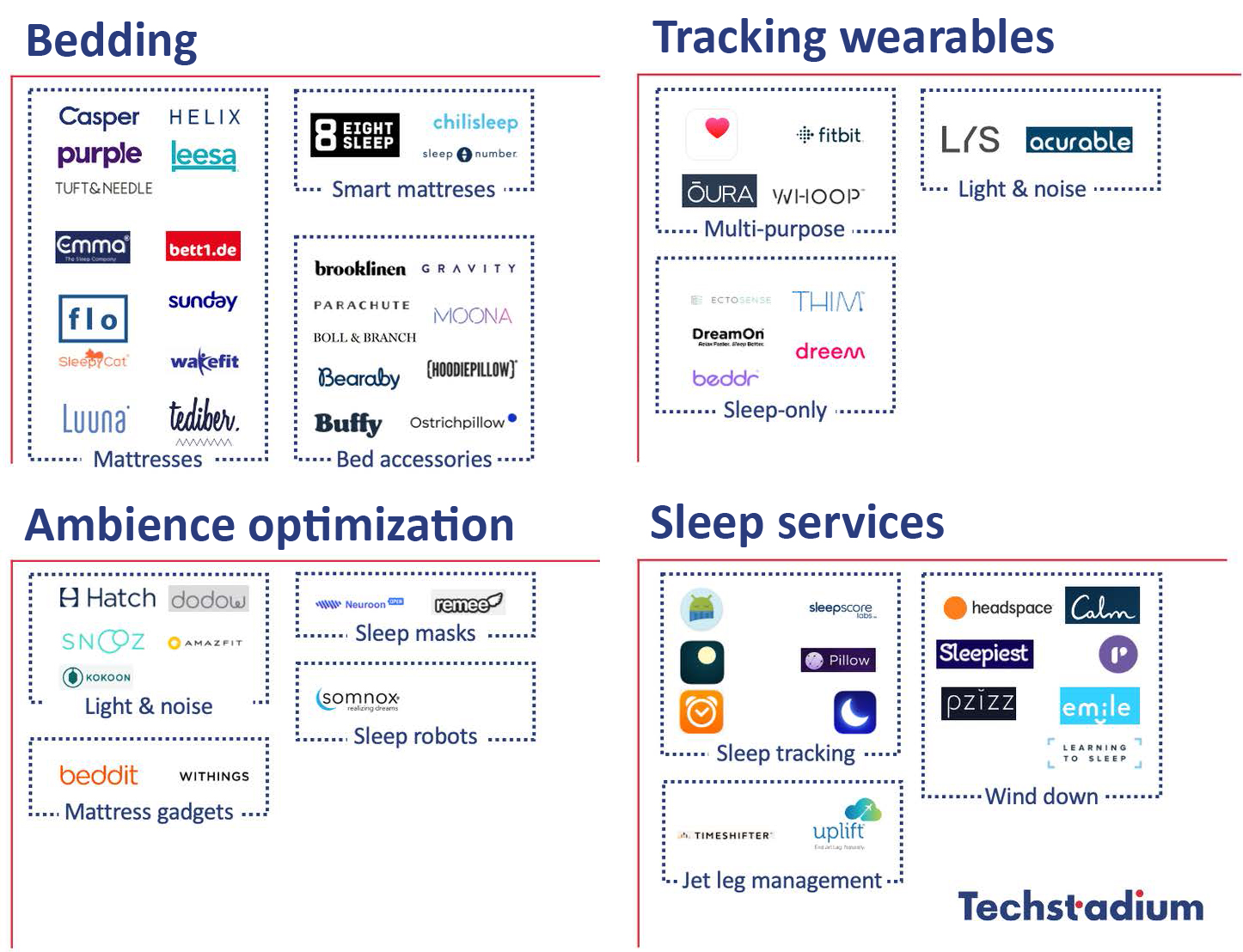

We discuss four key segments of the sleep economy, as presented in Figure 2, including notable innovators and their product offerings.

Figure 2. US Sleep Economy: Key Segments and Innovators

[caption id="attachment_130041" align="aligncenter" width="700"] Source: Techstadium[/caption]

1. Bedding

Source: Techstadium[/caption]

1. Bedding

The emergence of DTC newcomers such as Casper and Purple has disrupted and revitalized the mattress industry, with innovations in marketing, technology and online mattress delivery. These companies were well positioned to capitalize on the pandemic-driven spike in e-commerce in 2020: According to a survey conducted by The Better Sleep Council in November 2020, 54% of consumers who purchased a mattress in the past 60 days said their purchases were online, and the top purchase reason was related to Covid-19 or safety. This compared to 43% of mattress buyers in 2019 that bought their mattress online.

Prior to the new entrants, the US mattress industry was highly consolidated, dominated by a handful of manufacturers and retailers. The post-2010 entry of DTC bedding companies included Tuft & Needle in 2012, Capser and Leesa in 2014, and Ghost Bed, Helix Sleep and Purple in 2015. These companies provide mattresses at lower prices than conventional retailers, offer easy delivery with “bed-in-a-box” technology and allow shoppers to trial products over a long period.

Moreover, these companies see success by anchoring their products within popular consumer trends such as wellness—often targeted at younger customer groups. For instance, Casper advertises sleep as the “third pillar of wellness” to elevate its products from essential to desirable products. Appealing to charitable lifestyle choices, Leesa donates a bed to a child in need for every 10 mattress it sells.

Key Players: Sales Growth

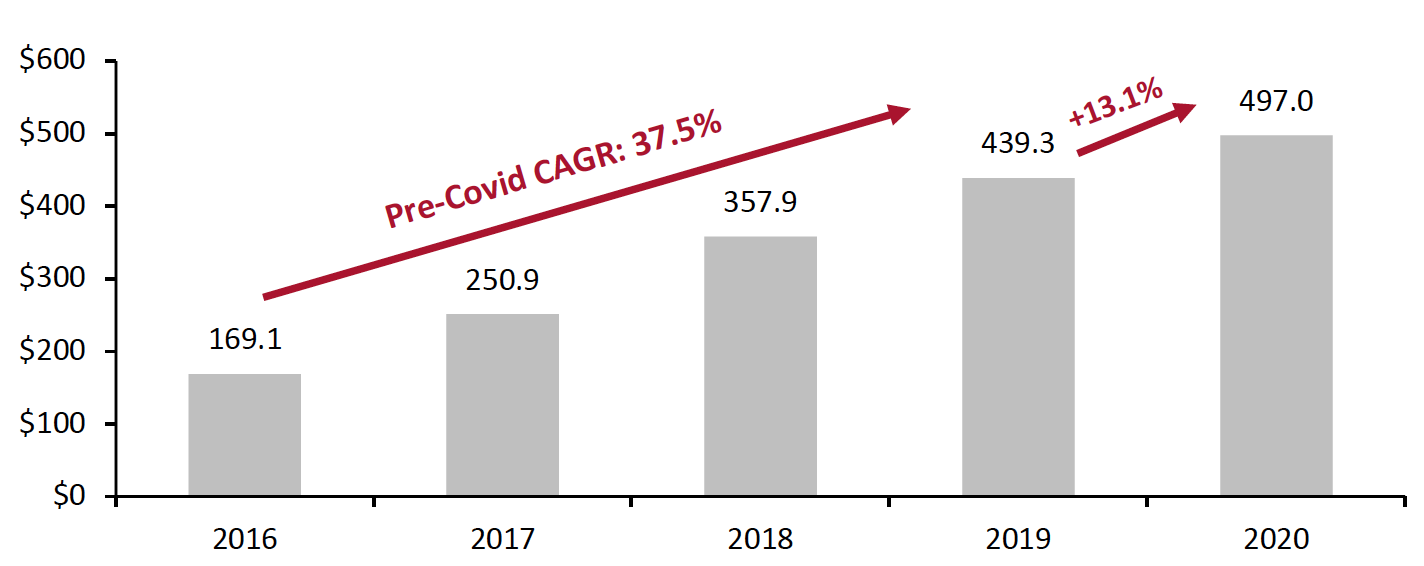

- Casper Casper dominates the US online mattress market, accounting for a 37% share in 2019, according to data firm Edison Trends. The company complements its online business with an offline footprint—with 67 sleep shops in North America as of 2020 and 21 physical retail partnerships. Moreover, Casper has been diversifying its portfolio, which management identified as a key focus for 2021 in the company’s fourth-quarter earnings call. As of the end of 2020, the company offers 40 products, including a full line of mattresses at different price points, as well as pillows, sheets, a portable bedside light and a weighted blanket designed to calm anxiety, among other items.As shown in Figure 3, Casper saw robust growth of 13.1% in 2020, despite the negative impact of the pandemic. In its fourth-quarter earnings call, the company’s CEO and Co-Founder Phillip Krim stated that consumer trends regarding increased suburbanization and heightened focus on health and wellness will continue to strengthen the demand for Casper’s products.

Figure 3. Casper: Annual Sales (USD Mil.) [caption id="attachment_130042" align="aligncenter" width="550"]

Source: Company reports[/caption]

Source: Company reports[/caption]

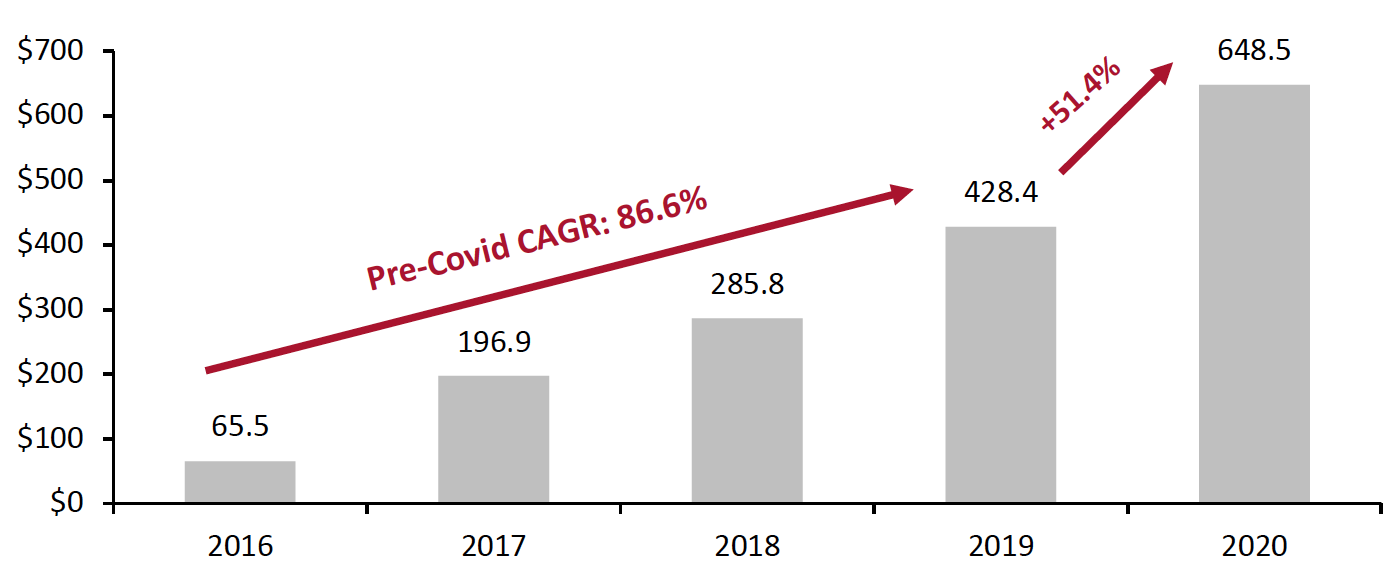

- Purple Utah-based Purple is Casper’s closest competitor, comprising 32% of the US online mattress market in 2019. The company’s proprietary gel technology, referred to as Hyper-Elastic Polymer, underpins many of its comfort-driven products, which the brand claims are ergonomically designed to relieve pain.Purple has developed several wholesale partnerships with large retailers such as Bed Bath & Beyond, Macy’s and Mattress Firm. As shown in Figure 4, the company’s sales grew 51.4% year over year to reach $648.5 million in 2020. In its 2020 fourth-quarter earnings call, management noted that strong topline growth was driven by the DTC channel, which saw a sales increase of 83% year over year in 2020.

Figure 4. Purple: Annual Sales (USD Mil.)

[caption id="attachment_130043" align="aligncenter" width="550"] Source: Company reports[/caption]

Source: Company reports[/caption]

- Sleep Number Founded in 1987, Sleep Number has become a leader in sleep innovation. For instance, the company’s Sleep Number smart bed uses artificial intelligence (AI) to provide tailored insights based on a SleepIQ score that the company claims will improve sleep quality. Moreover, the company also offers a Climate360 smart bed, which uses advanced temperature technology to create the ideal microclimate for each sleeper. The company has a massive offline presence of over 600 stores, as of March 2021.In 2020, Sleep Number recorded solid sales growth of 9.3%, as shown in Figure 5. Shelly Ibach, CEO of the company said sales growth was driven by demand for its Climate360 bed, which has accelerated as consumers increasingly prioritize health and wellbeing in their spending. Since the company transitioned all of its mattresses to smart beds in the third quarter of 2018, demand has grown by 12% on average.

Figure 5. Sleep Number: Annual Sales (USD Mil.)

[caption id="attachment_130044" align="aligncenter" width="550"] Source: Company reports[/caption]

2. Tracking Wearables

Source: Company reports[/caption]

2. Tracking Wearables

Wearables ownership has been growing steadily in recent years, with the pandemic further increasing the popularity of smartwatches and wristbands—used by consumers to monitor their heart rate, sleep patterns and other body metrics.

In a March 2020 survey conducted by data analytics firm GlobalWebIndex, sleep tracking is among the top five motivations for smartwatch usage, with 40% of respondents using wearable devices to track their sleep. In addition to multi-purpose wearables, there are many specialized wearable sleep tracker offerings with advanced functions.

Key Players

- Dreem is a neurotechnology company offering devices to help people be “in control of their sleep.” The Dreem headband monitors brain activity to track sleep and uses sound stimulation to help people fall asleep faster and get deeper sleep. According to the company, 91% of its users fall asleep faster and more easily and 78% reported having less fragmented sleep using the device. Dreem has raised a total of $57 million as of the end of 2020.

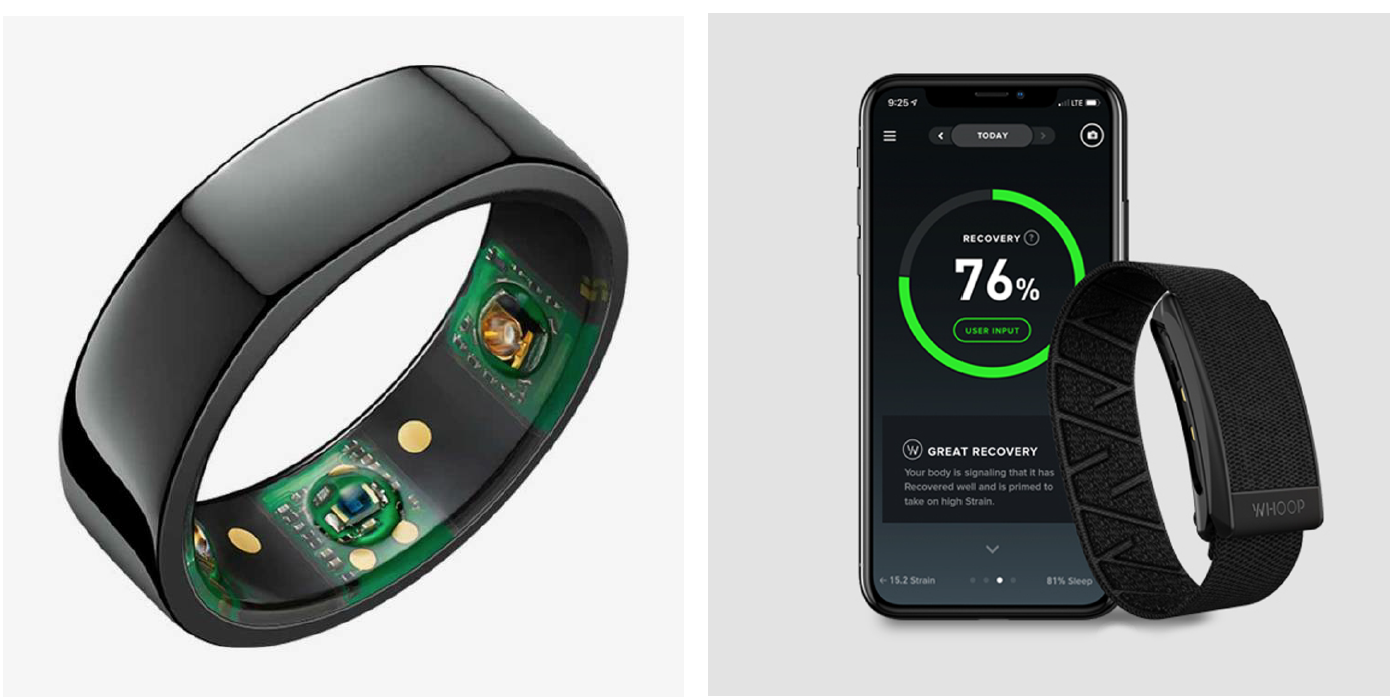

- Oura offers a wearable ring as a sleep and activity tracker. According to the company, the finger ring combines advanced sensor technology to record metrics including heart rate, respiratory rate, body temperature and night movement, feeds the insights into its AI-powered app to generate suggestions for users to improve their sleep quality. In March 2020, the company raised $28 million in a Series B funding round.

- Whoop sells its wearable device combined with a monthly subscription. It already accumulated over $200 million in funding at a $1.2 billion valuation in October 2020. Whoop’s technology tracks all four sleep stages, disturbances and respiratory rate to provide users recommended hours of sleep every day for recovery and health improvement.

Oura Ring (left) and Whoop wrist strap (right)

Oura Ring (left) and Whoop wrist strap (right)Source: Oura/Whoop[/caption] 3. Ambience Optimization

Ambience optimization offerings draw on the latest technology in aroma, haptics, light and sound to create a better sleep environment. The available solutions adjust ambient lighting and noise to optimize consumers’ circadian rhythms and use aromas to promote relaxation.

Key Players

- Dodow: The company offers a light projection device designed to help users fall asleep. The device projects a light pattern onto a ceiling to guide the user to adjust their breathing while lying in bed—reducing brain activity and speeding up the process of falling asleep. The company has more than 500,000 users as of May 2021 and claims that its device has helped users to reduce the time it takes them to fall asleep by 61%. According to the company, Dodow aims to provide a simple and economical alternative to sleeping pills.

- Hatch: The company offers a range of smart sleep products for newborns and adults. According to the company, its first sleep product, Hatch Rest, has helped more than 500,000 families to get a good night's rest. In 2020, Hatch introduced a new all-in-one product, which combines sleep sounds, a bedside reading light, a customized wind-down option and a sunrise alarm to help users fall asleep and wake up more easily.

- Philips: Electronics conglomerate Philips has developed numerous ambient lighting products targeted at improving sleep. The company’s SmartSleep Wake-up Light uses a combination of light, color and sound to simulate the effect of sunset and sunrise, claiming to help users to have a restful night and wake up refreshed.

- Somnox: The company has built the world’s first sleep robot, which uses breathing simulation to help users relax and get deep restorative sleep. According to the company, users reported falling asleep about 50% faster and improving sleep quality by 90% on average.

Somnox’s sleep robot

Somnox’s sleep robotSource: Somnox[/caption] 4. Sleep Services

App-based sleep and wind-down services are perhaps the most accessible and affordable wellness offering. Moreover, amid the pandemic, wellness app companies have seen huge numbers of downloads for services that provide support for anxiety and falling asleep. Meditation app Calm topped 3.9 million downloads in April 2020, followed by 1.5 million downloads of its competitor Headspace, according to app intelligence firm Sensor Tower. Top sleep-focused app services include:

- Pzizz: Integrating “music, sound effects and binaural beats,” the company claims that the recordings on its app help users fall asleep faster. The app uses an algorithm to generate a slightly different soundtrack each time consumers use it. Moreover, the app can be used as a morning alarm, providing a personalized wake-up audio to bring users out of their sleep.

- Pillow and Sleep Cycle: These two apps are integrated within Apple watches and both use biometric data from the smartwatch to monitor sleep duration and patterns. Based on the data, the apps’ algorithms offer personalized insights for better quality sleep.

- Sleepiest: The app provides a library of stories, sounds and meditations that claim to help users sleep better. Over two million people around the world are using the app, as of April 2021, according to the company.

What We Think

We see the sleep economy as a beneficiary of the pre-eminent health and wellness trend. As consumers continue to strive for a good night’s sleep and seek out effective solutions, we believe that demand will sustain and innovative products and services will fuel market growth. The broad range of product segments within the sleep economy represents robust opportunities for brands and retailers.

Implications for Brands/Retailers

- We see opportunities for bedding and home furniture companies to innovate in smart sleep versions of their products to target demand within the wellness trend. Brands and retailers should aim to provide connectivity between products and smart devices to compete with existing offerings, as well as gather data to offer personalized and actionable sleep insights.

- As there is a strong link between sleep and skin health, beauty brands and retailers should look to capitalize on the growing sleep care segment. We believe there is opportunity for beauty brands within the sleep market, especially in relation to pre-sleep relaxation and overnight collagen production.

Implications for Technology Vendors

- Technology vendors should continue to develop innovative sleep tracking solutions. They should look to continually improve algorithms that provide personalized sleep feedback and recommendations.