albert Chan

What’s the Story?

The coronavirus pandemic has resulted in many people having to spend prolonged periods of time at home, thus boosting their desire to be outside. Following the lifting of stay-at-home measures, the outdoor apparel and footwear industry is set to benefit from the heightened importance of outdoor activities, promising substantial future growth opportunities.

Why It Matters

Although the Covid-19 crisis has negatively impacted sales in the US outdoor clothing, footwear and accessories category, this category remains resilient and appears to be one of the few to retain strong demand. Furthermore, this niche market has the potential to grow significantly as many retailers look to tap demand among beginners to outdoor activities.

US Outdoor Apparel and Footwear Market: In Detail

Our Estimates for 2020

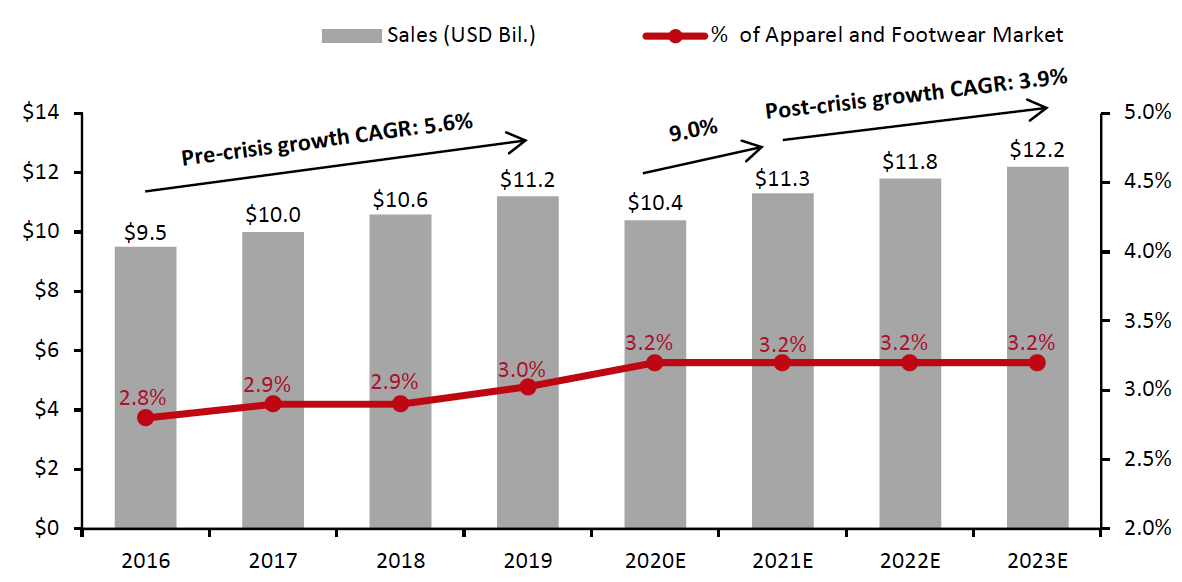

Coresight Research estimates that the US outdoor apparel and footwear market will decline by 6.8% in the full-year 2020 to around $10.4 billion, led by the coronavirus crisis. The outdoor category accounts for a small share of the total US apparel and footwear market: just 3.2% of all sales in 2020, we estimate.

The outdoor apparel and footwear market includes clothing, such as shorts, trousers, tops, jackets & coats, sweatshirts, underwear, hosiery, headwear, gloves and scarves; and footwear, such as boots and shoes, designed to facilitate the practicing of outdoor sports, such as climbing, trekking, mountaineering, trail running, mountain biking, hiking, skiing, kayaking and snowboarding, among other activities.

Outlook for 2021

Against undemanding comparatives, we estimate a 9% increase in outdoor apparel and footwear sales in 2021, in line with the Coresight Research’s estimate of total apparel and footwear retail sales growth of 9% in 2021. The growth in the US outdoor apparel and footwear market will be driven by increased consumer interest in active lifestyles and a surge in participation in outdoor activities and recreation. Anticipating post-crisis demand, many brands and retailers are already expanding their outdoor apparel and footwear assortment, for example, Dick’s Sporting Goods (which we discuss later in this report).

Between 2021 and 2023, we expect the outdoor apparel and footwear market to grow at a CAGR of 3.9% to total $12.2 billion (see Figure 1).

Figure 1. US Outdoor Apparel and Footwear Sales (USD Bil.) and as a Percentage of Total Apparel and Footwear Sales

[caption id="attachment_120923" align="aligncenter" width="700"] Source: Euromonitor International Limited 2020 © All rights reserved/Coresight Research[/caption]

Source: Euromonitor International Limited 2020 © All rights reserved/Coresight Research[/caption]

Key Growth Drivers

Outdoor apparel and footwear comprise a growing category that benefits from consumers’ increasing participation in outdoor activities, which is expected to be positively driven by a number of factors, as shown in Figure 2.

Figure 2. Key Drivers of Growth in the US Outdoor Apparel and Footwear Market

| Drivers | |

| Increasing interest in fitness and healthy lifestyles |

Since the beginning of the Covid-19 pandemic, 20% of US consumers are spending more time outdoors, according to May 2020 survey by public relations firm CGPR. The survey also found that more than 82% of US consumers discovering outdoor activities for the first time will continue to stay engaged even after coronavirus-led restrictions are lifted, paving the way for growth in the outdoor retail market. In the past two decades, obesity among the US population has grown drastically. The age-adjusted prevalence of obesity increased from 30.5% in 1999–2000 to 42.4% in 2017–2018, according to a survey by the National Center for Health Statistics (NCHS) and the National Health and Nutrition Examination. However, in recent years, there has been growing interest in active lifestyles and outdoor activities, which bodes well for the outdoor apparel and footwear industry. |

|

Spending more time at home and less willingness—and fewer options—to participate in indoor activities |

Since people continue to have to spend more time in their homes, they are placing greater value on exploring outdoors. In an October 2020 survey by The Harris Poll, 65% of Americans said that they try and get out of the house as often as they can, and another 65% said that they are looking to participate in safe outdoor activities. Furthermore, reduced indoor leisure options and less willingness to participate in indoor activities (due to the risk of exposure to the virus) could further support the growth of the outdoor apparel market. |

|

Emergence of deurbanization trend |

Post Covid-19, a deurbanization trend is emerging in the US. Nearly 40% of the US urban population would consider moving out of populated areas into rural areas after the pandemic is over, according to an April 2020 survey of 2,050 US adults conducted by The Harris Poll. Similarly, this summer, suburban areas have experienced more interest from home buyers, quicker home sales and stronger improvement of price growth as compared to urban areas, according to data released by realtor.com in September 2020. As people escape city life and move towards rural areas, they are more likely to explore outdoor activities and recreation. |

Source: CGPR/NCHS/The Harris Poll/Coresight Research

Competitive Landscape

The US outdoor apparel and footwear market is a highly competitive commercial niche, with several brands and retailers holding strong positions.

Major US Outdoor Retailers

- Big 5 Sporting Goods

- Dick’s Sporting Goods

- L.L.Bean

- REI Co-op

- Direct-to-consumer (DTC) retailers, such as Backcountry and Evo, are steadily gaining share of outdoor apparel and footwear sales and, in many instances, have become the preferred source for shopping outdoor products.

- Online giant Amazon has continued to expand its outdoor apparel and footwear offerings, with a focus on value pricing and an extensive selection.

- Recently, Walmart and European outdoor retail giant Decathlon have forayed into the US outdoor industry. In May 2020, Walmart launched two competitively priced private-label outdoor brands: Allforth clothing and camping gear; and Lithic, which is focused on hiking and adventures. Decathlon entered the US market in 2019 with the launch of an online site and the opening of two physical locations.

Major Outdoor Brand Owners

- Deckers Outdoor Corporation

- Columbia Sportswear

- The North Face (VF Corporation)

- Patagonia

Selected Outdoor Brands and Retailers: Performance in Their Latest Quarters

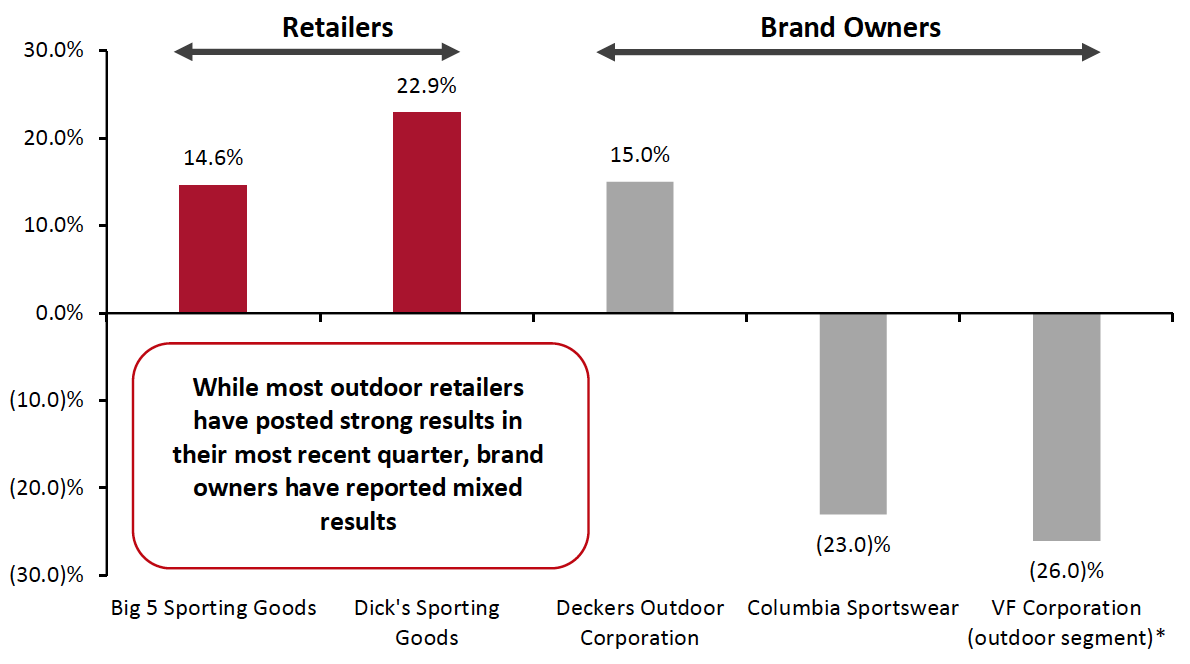

Most US retailers specializing in outdoor apparel and footwear, such as Big 5 Sporting Goods and Dick’s Sporting Goods, have posted strong year-over-year revenue growth in their latest quarterly earnings. On the other hand, brand owners in this sector reported mixed results in their recent quarter. While some brand owners, such as Deckers Outdoor Corporation, have posted strong year-over-year revenue growth in their latest quarterly earnings, a few, such as Columbia Sportswear and VF Corporation, reported continued negative growth. However, on a sequential basis (quarter-over-quarter), all three companies reported strong improvement in their performance (which we discuss in more detail in Figure 4).

Figure 3. Selected US Outdoor Brands and Retailers: Sales Growth in the Most Recent Quarter (YoY % Change)

[caption id="attachment_120900" align="aligncenter" width="700"] Big 5 Sporting Goods’ third quarter of fiscal 2020 ended on September 27, 2020; Dick’s Sporting Goods’ third quarter of fiscal 2021 ended on October 31, 2020; Deckers Outdoor Corporation’s second quarter of fiscal 2021 ended on September 30, 2020; Columbia’s third quarter of the fiscal 2020 ended on September 30, 2020; and VF Corporation’s second quarter of the fiscal 2021 on September 26, 2020

Big 5 Sporting Goods’ third quarter of fiscal 2020 ended on September 27, 2020; Dick’s Sporting Goods’ third quarter of fiscal 2021 ended on October 31, 2020; Deckers Outdoor Corporation’s second quarter of fiscal 2021 ended on September 30, 2020; Columbia’s third quarter of the fiscal 2020 ended on September 30, 2020; and VF Corporation’s second quarter of the fiscal 2021 on September 26, 2020*Sales growth of VF Corporation’s outdoor segment in constant dollars. Only VF Corporation segregate outdoor segment’s revenues among the five companies presented in the chart

Source: Company reports[/caption]

Below, we assess the recent quarterly performances of the above five brands and retailers in more detail and summarize key commentary from company executives on the outdoor segment.

Figure 4. Selected US Outdoor Brands and Retailers: Key Commentary on Performance in the Most Recent Quarter

| Retailers | Commentary |

| Big 5 Sporting Goods | Total sales increased by 14.6% in the third quarter of fiscal 2020, a substantial improvement over the 5.4% decline in the second quarter and representing the strongest sales performance in the company’s 65-year history. Growth was driven by strong recreational trends as more people look to stay active and healthy amid the current pandemic. The company said that it is witnessing exceptional sales strength across a broad array of its outdoor recreational product categories, and management expects the ongoing consumer shift to recreation and fitness to benefit its business in the long run. |

| Dick’s Sporting Goods | The company’s sales increased by 22.9% in the third quarter of fiscal 2021 versus 20.1% growth in the second quarter. Growth was driven by a 19.6% increase in average ticket size. Private-label brands’ comps outperformed the company’s average by over 10%: DSG has grown to become the company’s largest vertical brand within one year of its launch. Management said that the strength of its diverse category portfolio helped it capitalize on the favorable shifts in consumer demand as the trends across outdoor activities and active lifestyle continued throughout the third quarter. CEO Edward Stack said, “One of the places where we think there is a great opportunity is the outdoors, and we have been working on this even prior to Covid. Now, with what's happened with the virus, I think it's even more timely.” Dick’s Sporting Goods is launching Public Lands, an outdoor concept focused on protecting the environment and getting people outdoors and participating in camping, hiking, biking, kayaking and fishing. The company plans to open two Public Lands stores in 2021, one in August and another in October. Stack said, “We think that the overlap between the products that we carry in this new concept and the products we carry in Dick’s will be somewhere around 20%, but this [Public Lands] will be more elevated equipment, apparel, footwear, at elevated price points with elevated brands [and] elevated service.” |

| Brand Owners | Commentary |

| Deckers Outdoor Corporation | Deckers Outdoor Corporation’s sales increased by 15.0% in the second quarter of fiscal 2021, compared to 2.3% growth in the first quarter of fiscal 2021, driven by strong demand for its outdoor brands, including UGG and HOKA. UGG saw a 187% increase in US customer acquisition and a 155% increase in customer retention, versus last year. The majority of the growth for UGG came from younger consumers aged 18 to 34, which represented 40% of online purchases in the US during the most recent quarter, versus 30% in the year-ago quarter. HOKA saw global sales growth of 83% in the second quarter. The company is experiencing better-than-expected demand for its brands and expects challenges related to order fulfillment in the third quarter. CEO David Powers said, “We are extremely pleased with our brand's performance and operational execution in the second quarter. With the demand we are experiencing in our brands, we are anticipating operational challenges related to DC [distribution center] capacity, inventory timing and availability, as well as third-party shipping logistics that will limit the upside of our brands in the third quarter.” |

| Columbia Sportswear | Total sales declined by 23% in the third quarter of fiscal 2020, a notable sequential improvement over the 40% decline seen in the second quarter. Furthermore, about $45 million of its fall 2020 shipments shifted into the fourth quarter due to production and logistics disruptions related to the pandemic. The company’s online sales grew 55%, and new customers buying product via Columbia.com grew 65%. The company saw strong demand for outdoor products in September, the best month of the quarter in terms of sales, as more people involved in outdoor activities. CEO Timothy Boyle said, “We saw increased consumption, especially of outdoor products, in September. It really helps when Anthony Fauci [lead member of White House Coronavirus Task Force] is telling people to go outside, and we were the beneficiary of that in September, where we had the best month of the quarter. When people are thinking about going outside, buying camping equipment and buying outerwear, they typically think first of sporting goods and outdoor stores—and that’s where we’ve seen significant improvement in businesses.” |

| VF Corporation | The company’s outdoor segment revenues declined by 26% (in constant dollars) in the second quarter of fiscal 2021, representing a substantial improvement over the 43% decline in the first quarter. The company attributes the negative sales growth in the second quarter to store closures and lower consumer demand versus last year. VF Corporation believes that growing interest in fitness and healthy lifestyles will bolster its outdoor segment over the next few years. CEO Steven Rendle said, “It is evident that secular trends in fitness, health and wellness, casualization and the desire to get outdoors and live an active lifestyle are accelerating. Our portfolio of brands sits at the epicenter of these fundamental tailwinds, which will be a meaningful contributor to growth in the years to come. And, as we came into the pandemic, the outdoor sector was in a position of growth as well, and I think this really bodes well for our brands and for the sector in general as people continue to focus on that outdoor activity, health and wellness.” |

Source: Company reports

The Impact of Covid-19

The coronavirus crisis substantially impacted the outdoor apparel and footwear market due to large-scale store closures and supply chain disruptions. However, recovery in recent months is being led by a surge in outdoor activities and recreation.

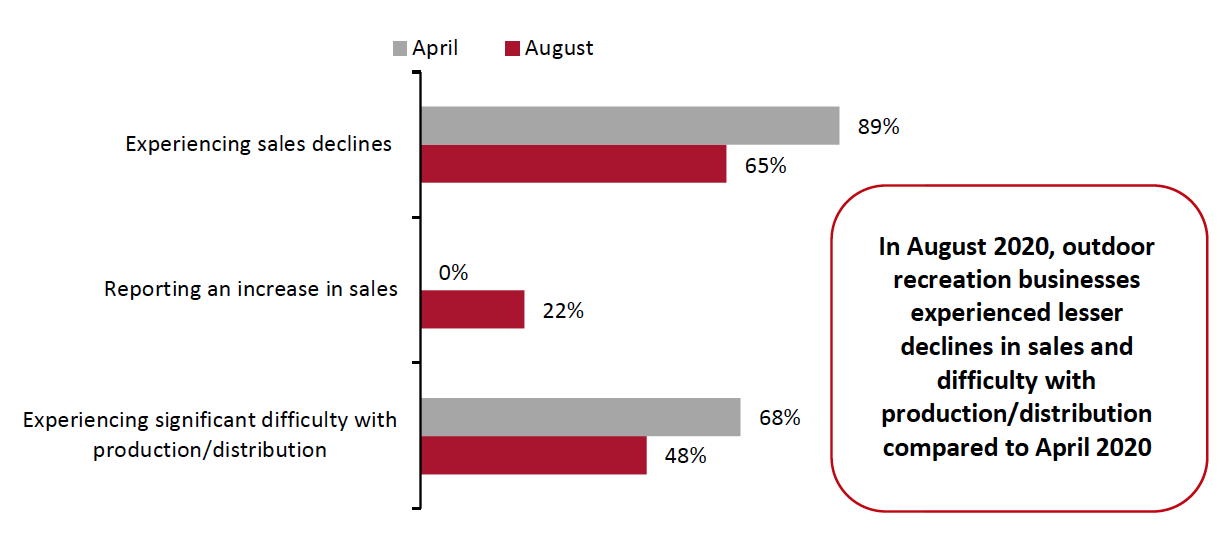

As of August 2020, 65% of outdoor recreation businesses, including hiking, skiing, biking, camping, horseback riding and power sports, reported a decline in sales, with 17% witnessing a decrease of 50% or greater, according to surveys by Outdoor Recreation Roundtable of 23 national outdoor recreation trade associations (including Outdoor Industry Association and America Outdoors), representing over 25,000 outdoor industry businesses. This was an improvement versus April, when 89% of the outdoor industry reported a decline in sales, with 39% witnessing a decrease of 50% or greater. Furthermore, in August, 22% of outdoor businesses reported an increase in sales; none saw this in April. We present selected findings from the survey in Figure 5.

The survey findings indicate that the outdoor recreation industry has witnessed a strong rebound since the onset of the pandemic, with fewer outdoor businesses witnessing sales declines, and a few seeing sales increase, in August compared to April. This improvement is mainly due to the pick-up in outdoor activities and recreation, which has resulted in demand for appropriate clothing, footwear and related products.

Figure 5. Select Findings from Outdoor Recreation Roundtable Surveys: The Outdoor Industry Pulse amid the Pandemic (in April 2020 and August 2020)

[caption id="attachment_120901" align="aligncenter" width="700"] Source: Outdoor Recreation Roundtable[/caption]

Source: Outdoor Recreation Roundtable[/caption]

Recent Innovations in the Outdoor Apparel and Footwear Market

In October 2020, Columbia Sportswear launched the Omni-Heat Dot jacket for men and women, which the company describes as “the outdoor industry’s first external thermal shield to protect from the cold.” The jacket features thousands of multi-layered black dots made of aluminum, which capture solar heat and trap warmth to keep consumers warmer in cold weather. Combined with Columbia’s Omni-Heat 3D thermal-reflective lining, this new textile is Columbia’s most advanced outdoor solution to date.

Columbia Sportswear said that it will continue to launch innovations in the outdoor marketplace in 2021. In spring 2021, the company plans to launch Omni-Freeze Zero Ice, a sweat-activated cooling fabric that takes on heat by enhancing moisture management and evaporative cooling. For fall 2021, the company plans to introduce Omni-Heat Infinity jackets, which have a pattern of gold dots that reflect more body heat to provide instant warmth without compromising breathability.

[caption id="attachment_120902" align="aligncenter" width="700"] Columbia Sportwear’s Omni-Heat jackets for men and women

Columbia Sportwear’s Omni-Heat jackets for men and womenSource: Columbia Sportwear[/caption]

The North Face (owned by VF Corporation) launched FUTURELIGHT jackets, pants and bibs in its Flight Series, Steep Series and Summit Series collections in October 2019. Developed using nanospinning technology, FUTURELIGHT apparels are lightweight (Summit Series jackets weigh around 340 grams or 12 ounces) and offer breathable, waterproof protection. The nanospinning process creates nano-level holes, allowing high porosity (letting air move through the materials and providing more venting while maintaining waterproofness). Furthermore, the nanospinning technology allows The North Face designers to adjust breathability, weight, stretch, construction (knit or woven) and texture of the fabric for specific uses, such as aerobic pursuits or protection against harsh, wet climates.

Within four months of its launch, The North Face saw four times the sales volume in its Flight Series, Steep Series and Summit Series products that feature the FUTURELIGHT technology. Furthermore, management said that the performance of FUTURELIGHT jackets and pants well exceeded the company’s expectations during the 2019 holiday season.

[caption id="attachment_120903" align="aligncenter" width="700"] North Face’s Summit L5 LT FUTURELIGHT™ jackets for men and women

North Face’s Summit L5 LT FUTURELIGHT™ jackets for men and womenSource: Backcountry[/caption]

What We Think

Retailers can take the following measures to make the most of the opportunity in the outdoor apparel and footwear market:

- Encourage participation in outdoor activities. Brands and retailers should organize training, workshops and outdoor activities that appeal to consumers who do not have much experience in the outdoor industry. For example, outdoor apparel specialist L.L.Bean offers free educational classes and organizes overnight camping to week-long trips for $275–$4,000. The company found that about 25% of participants of their trips become repeat customers, and those who participate in one of their paid outdoor experiences spend an average of 30% more with the company in the following year.

- Engage consumers through company values, mission or sustainability initiatives. When shopping for outdoor apparel and footwear, more and more consumers are making their purchase decisions based on brand values. As a result, many brands and retailers are looking to connect with consumers over a particular mission—for example, outdoor brand Patagonia engages customers on several social issues, including the environment and sustainability.

- Enhance experiential retail. Outdoor brands and retailers should transform their stores to a community and experience hub by adapting across various dimensions of the businesses, from marketing and branding to legal. For example, outdoor retailer Outdoor Voices hosts various community events, such as group runs and other activities, at its retail locations.

Adopt a multichannel strategy. Outdoor retailers should sell their products across multiple channels—including brick-and-mortar stores, web stores and marketplaces such as Amazon and eBay—to seize new market opportunities and deliver exceptional customer experiences. Furthermore, retailers should be able to add or remove their products from these channels as market opportunities shift. To implement a robust multichannel strategy, outdoor brands and retailers need to invest in the right technology that integrates their operational workflows, thus ensuring efficient management of inventory, orders, returns and shipping, and customer data.

The Way Ahead

We expect the US outdoor apparel and footwear market to grow at a strong pace over the next couple of years, driven by increasing participation in outdoor activities and recreation owing to growing interest in fitness and healthy lifestyles, the emergence of the deurbanization trend and less willingness to participate in indoor activities.

While we believe that most outdoor apparel and footwear categories will perform well in the long term, some categories might face a few short-term challenges due to restrictions on travel and group sizes (large groups are required for certain outdoor activities, such as skiing and snowboarding). Nevertheless, these challenges can be overcome with the implementation strong safety measures and continued awareness of, and adherence to, social distancing.

Implications for Brands and Retailers

- With growing interest in fitness and healthy lifestyles, there are opportunities for brands and retailers to tap demand among beginners to outdoor activities by organizing activities, training and workshops.

- As the outdoor apparel and footwear landscape remains highly competitive, brands can stand out by offering innovative products, such as Columbia Sportswear launching its Omni-Heat and Omni-Freeze Zero Ice jackets.

- Outdoor companies can also engage customers on several social issues, such as sustainability.

- With most outdoor brands and retailers witnessing a surge in online orders, they should look to expand their digital and omnichannel capabilities to enhance their customer base.

Source for all Euromonitor data: Euromonitor International Limited 2020 © All rights reserved