albert Chan

What’s the Story?

The US men’s clothing market continues to become more casual, with a focus on comfort and activewear. Businesswear—including suits, ties and dress shirts—used to be a category mainstay but is becoming less important due to the shifts in societal norms over the past few years, with a more casual workplace environment. The Covid-19 pandemic has accelerated this shift, as many consumers had to work from home, and those that are returning to the office are still wearing casual attire.

Why It Matters

The men’s clothing market has been undergoing a category shift in which men are wearing more casual, sporty shirts and clothing to work and are wearing formalwear less.

Here are three reasons why menswear represents opportunities for retailers and brands right now:

- There is a white-space opportunity for brands and retailers, as consumers are shifting to wearing casualwear and athleticwear.

- The brands and retailers that are winning in this space are ones that are capturing consumer interest with technical innovation (such as Lululemon), brand connection through a story or collaboration (Tommy Hilfiger with its sustainability efforts and Lewis Hamilton collection) or something unique with an unexpected collaboration (The North Face x Gucci and Champion’s collaborations). Brands and retailers can rarely put out a product for a product’s sake; it must have a differentiator.

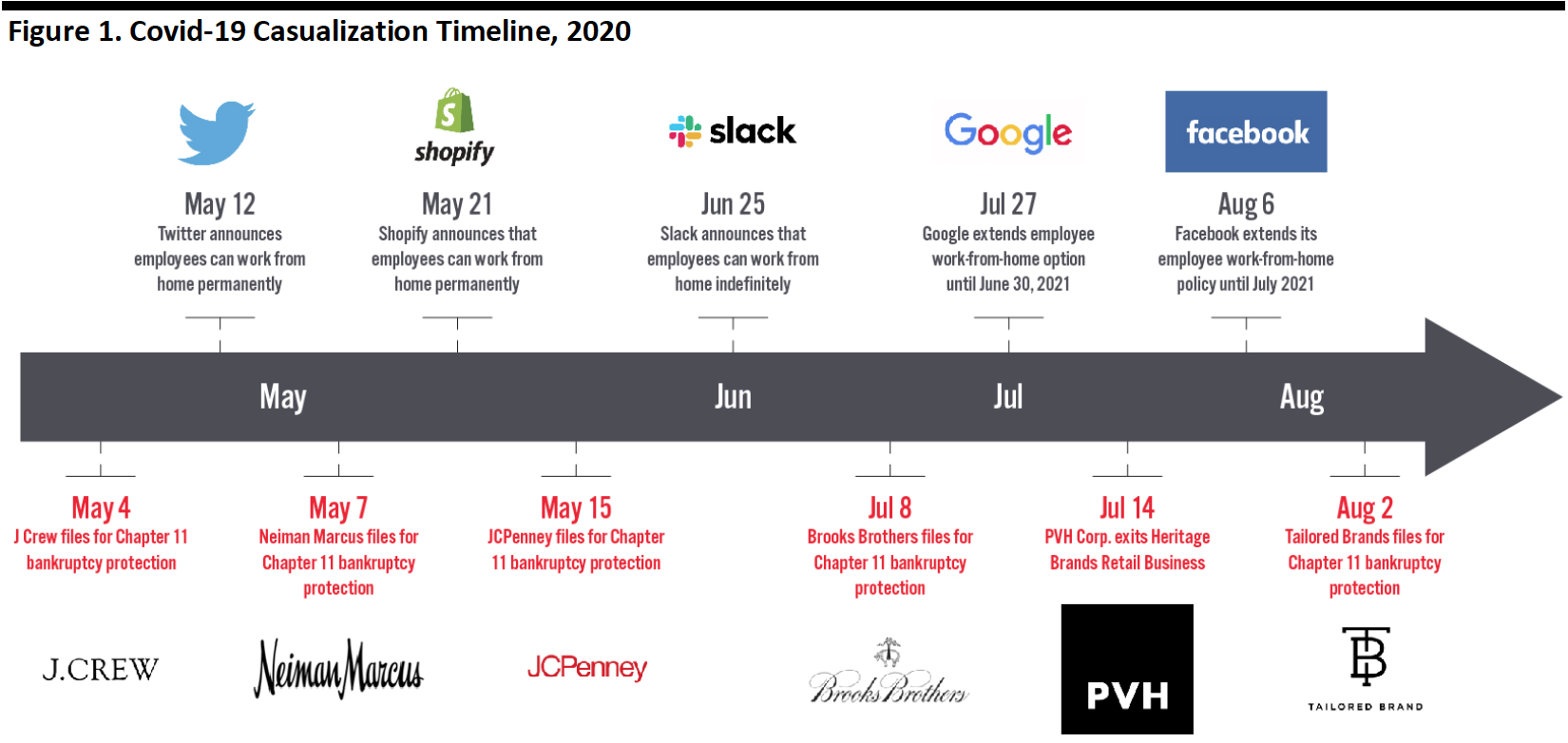

- Many consumers continue to work from home, and major companies including Google, Facebook, Slack and Twitter have announced that employees are now able to work from home permanently or indefinitely. There are also fewer in-person industry events and conferences for consumers to attend due to the coronavirus crisis, which further supports more casual wardrobe and footwear choices.

Covid-19 Casualization Acceleration: A Timeline

Over the past four months, numerous companies have filed for Chapter 11 bankruptcy protection amid the pandemic. In addition to department store chains, two legacy men’s business retailers—specializing in suits and work attire—have done so: Brooks Brothers on July 8; and Tailored Brands (parent company of Men’s Wearhouse and Jos. A. Bank) on August 2. This signals a definitive shift in the market, from professional attire to casualwear.

At the same time, major companies have announced that their employees can work from home permanently or indefinitely. With companies big and small making decisions about the need to have physical offices, there are downstream effects on the apparel industry—impacting how many consumers will purchase apparel, what type of apparel they will buy and how often they will shop. In the short term, the consumer will be purchasing more casualwear; this trend does not appear to be going away.

Figure 1 highlights major company work-from-home announcements and retail Chapter 11 bankruptcy filings that impact the US menswear market.

[caption id="attachment_118625" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Menswear Is Becoming More Casual and Competitive: A Deep Dive

Due to the dramatic shifts in spending during the pandemic, retailers and brands that were not necessarily operating in the casualwear and activewear space took notice of this growing opportunity—and new players such as Lululemon are doubling down on their focus. In addition, some traditional players including Hanesbrands’ Champion brand, The North Face and Tommy Hilfiger are collaborating and focusing on Gen Z.

We look at the growing competitive casualwear and activewear space in the US and discuss what brands and retailers are doing to differentiate themselves.

Overall Menswear Market Set To Decline by 12.9% in 2020

The US menswear market totaled approximately $91.4 billion in 2019, according to Euromonitor International. Coresight Research estimates that the market will see a decline of 12.9% in 2020, to $79.6 billion.

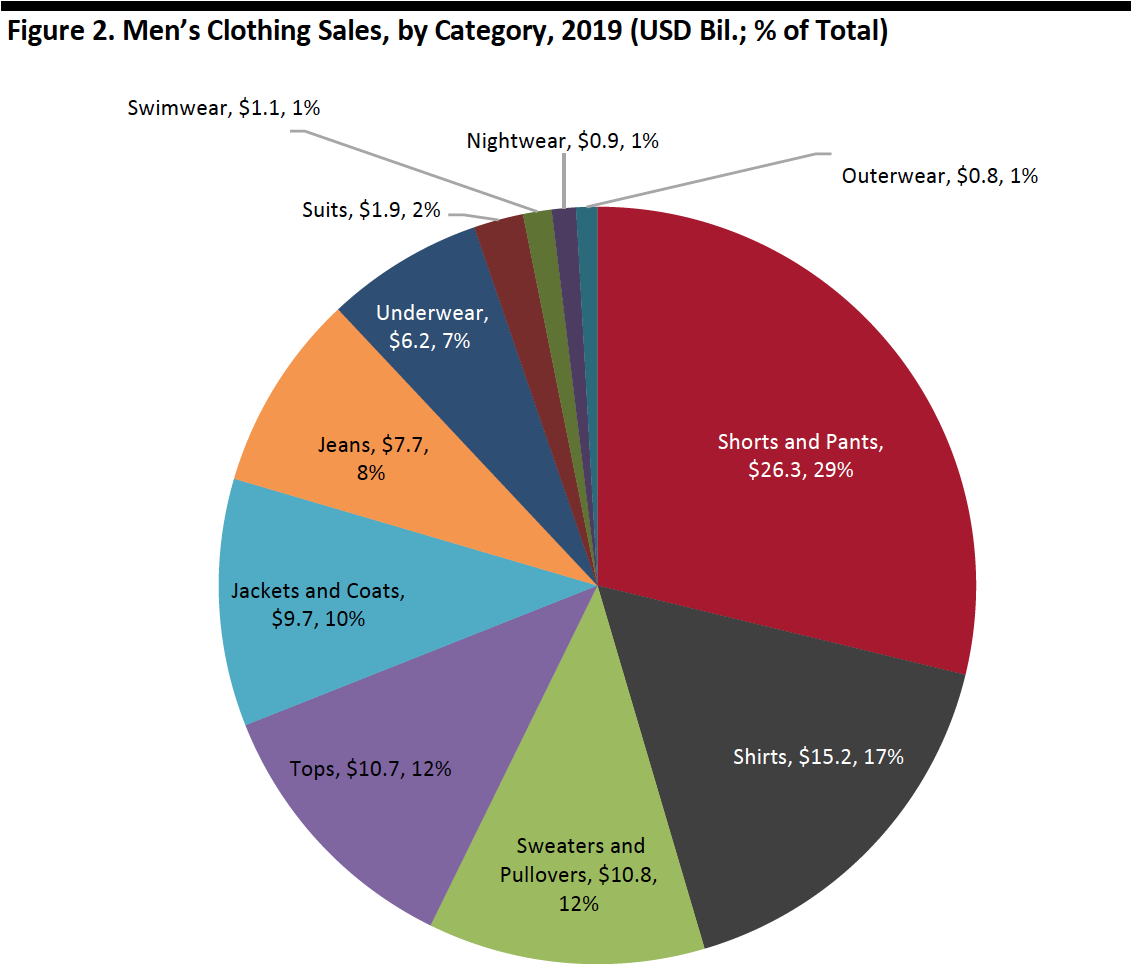

The three largest menswear apparel categories account for 58% of total spending on men’s apparel in the US in 2019, according to Euromonitor International: Shorts and pants comprise the largest category, with a 29% share of total sales, followed by shirts (17%) and sweaters and pullovers (12%). Suits saw less than $2 billion in revenue last year, representing less than 2% of the total market. This category was therefore one of the four smallest in the menswear market, which together totaled $4.8 billion, or 5.2% of total sales.

[caption id="attachment_118627" align="aligncenter" width="550"] Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

Source: Euromonitor International Limited 2020 © All rights reserved[/caption]

The Top 10 Menswear Brands: Athletic, Casual and Comfort See Growth While Denim and Professional/Luxury Decline

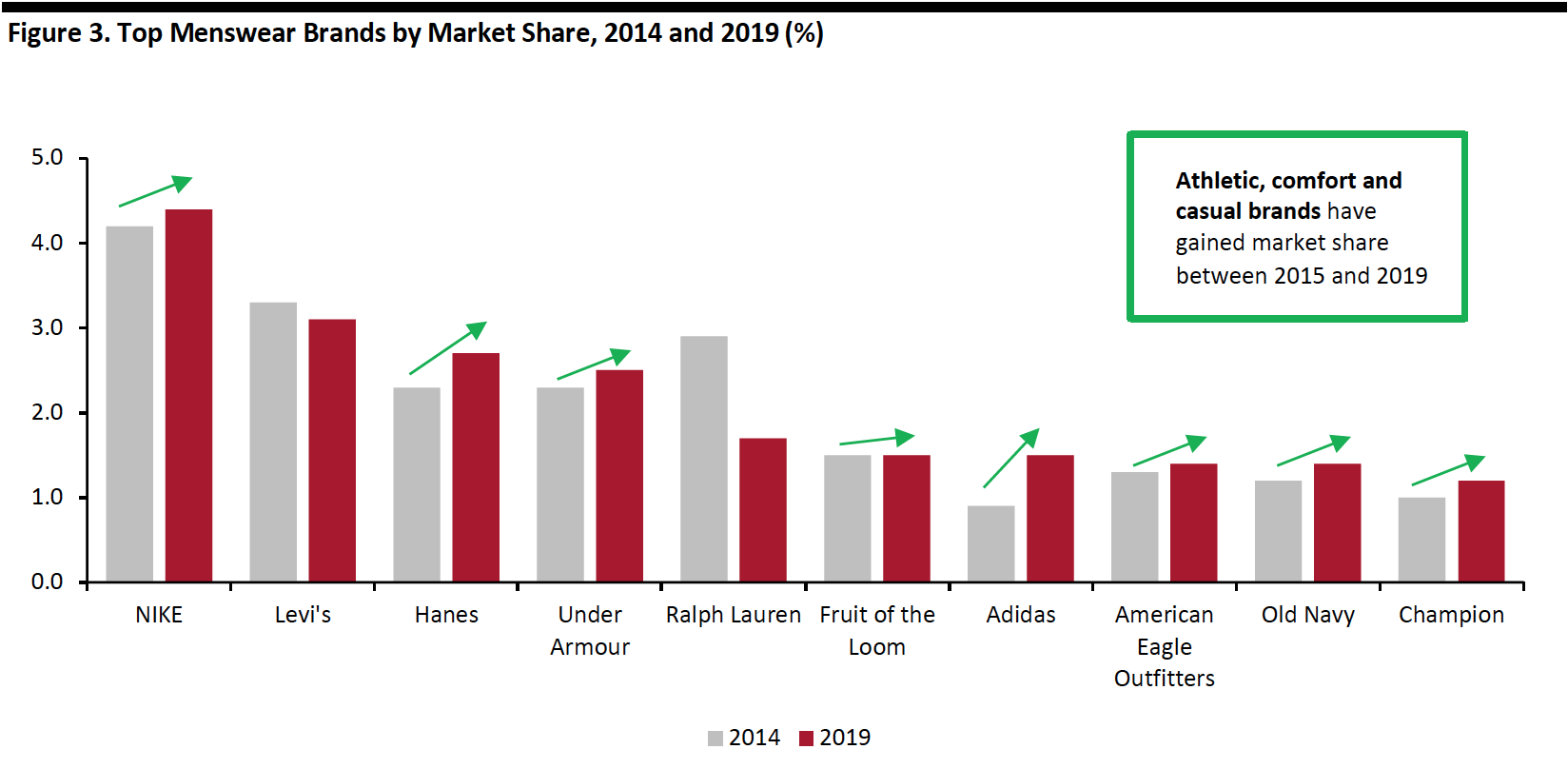

Within the US menswear market, the top 10 brands comprised only 21.4% of the market last year, according to Euromonitor International. NIKE is the leading brand, with a market share of 4.4% in 2019.

We can see category trends by looking at the five-year growth of the top 10 menswear brands:

- The athleticwear category is the largest, and the top three athletic brands—Adidas, NIKE and Under Armour—have seen the largest gains over the past five years, from a combined market share of 7.4% in 2015 to 8.4% in 2019.

- Casual brands American Eagle Outfitters, Champion and Old Navy have collectively grown from 3.5% of the market to 4.0%.

- Comfort/essential-wear brands—Fruit of the Loom and Hanes—have increased their share from 3.8% to 4.2%.

- Denim brand Levi’s has seen a 0.2% decline, while professional, upscale attire brand Ralph Lauren has declined by 1.2%.

Note: American Eagle Outfitters and Old Navy refer to the clothing menswear brands associated with these retailers

Note: American Eagle Outfitters and Old Navy refer to the clothing menswear brands associated with these retailersSource: Euromonitor International Limited 2020 © All rights reserved[/caption]

White Space in Activewear and Casualwear; Major Retailers Cite Growth Opportunities

Sales of men’s tops and sweaters/sweatshirts totaled $21.5 billion in 2019, and these two categories together comprised 23.6% of the menswear market, according to Euromonitor International. This is a growth opportunity as consumers are looking for more sporty, comfortable trends in the wake of the pandemic.

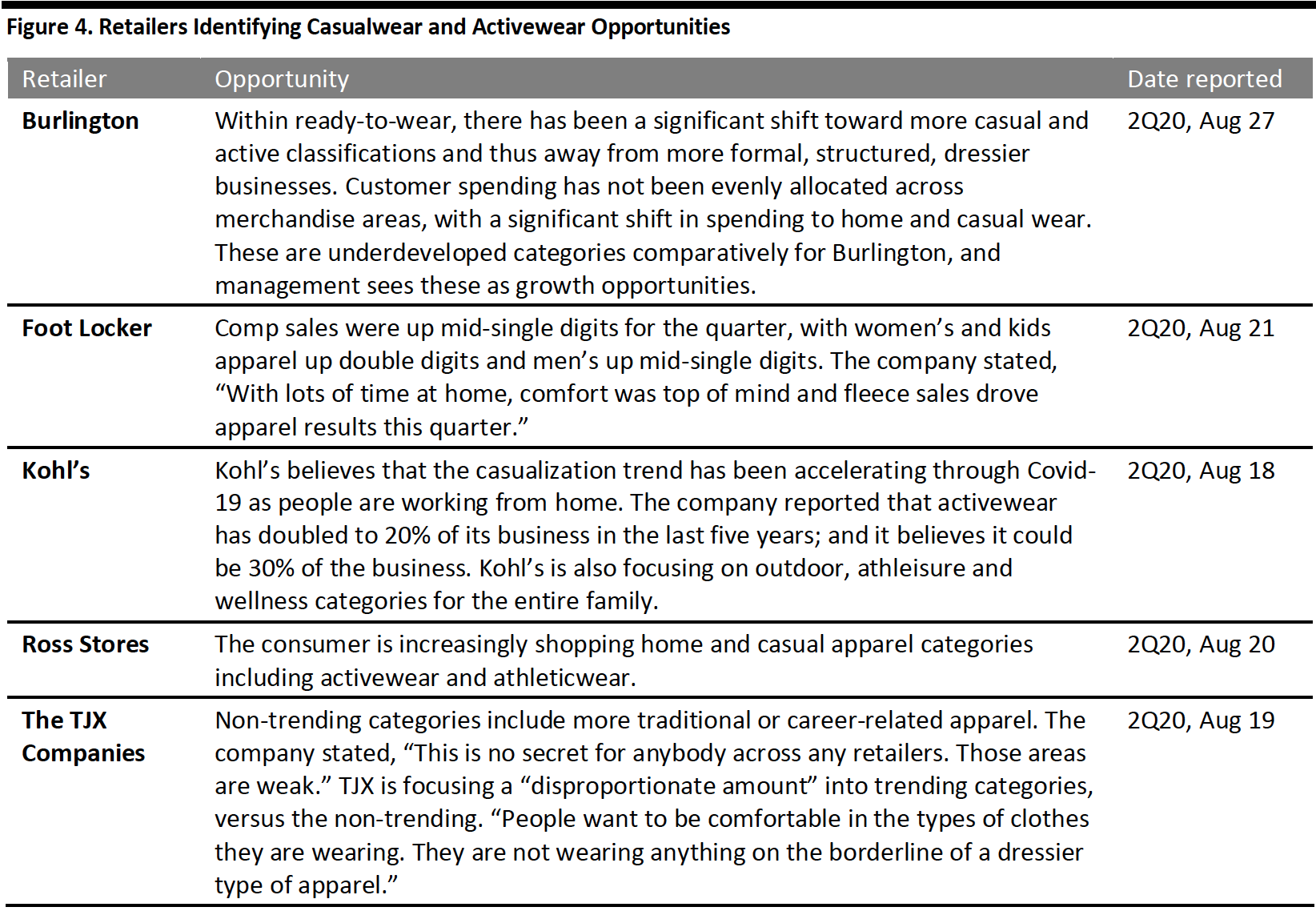

Major US apparel brands and retailers have recognized the consumer shift and highlighted the white-space opportunity in men’s casualwear and activewear in their recent earnings calls, as summarized in Figure 4.

Retailers and Brands Make Efforts To Differentiate Themselves in the US Menswear Space

Lululemon Is “Doubling Down” on Menswear, Having Seen 77% Growth in Three Years

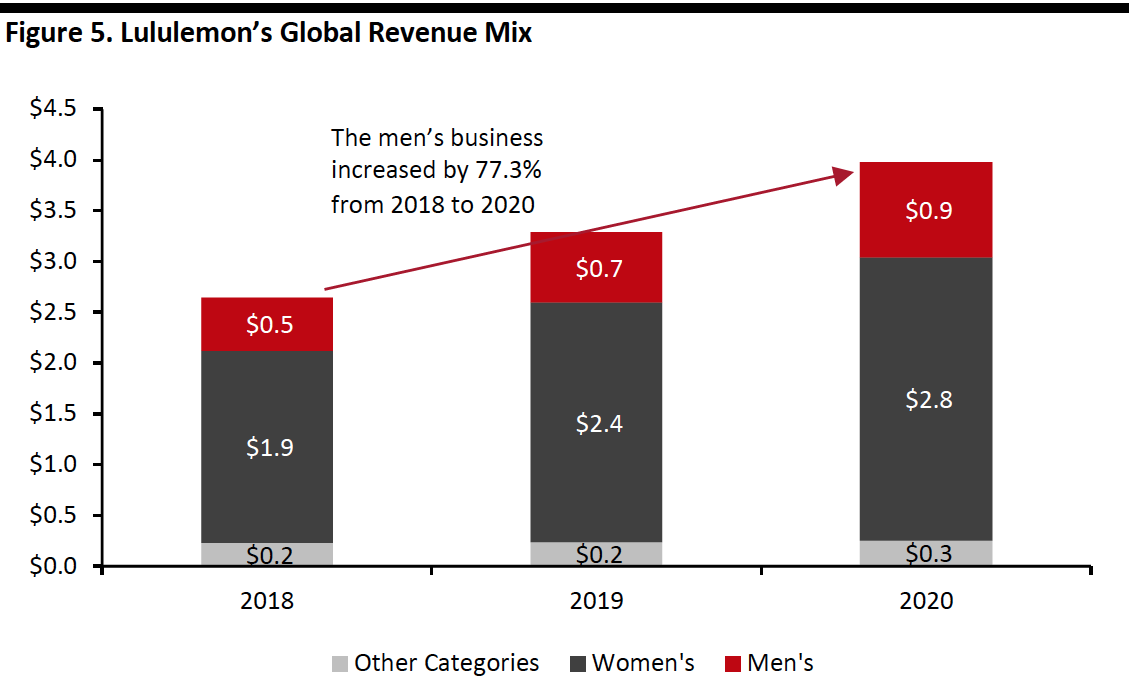

Over the past three years, the company has grown its men’s business from $0.5 billion to $0.9 billion—from 20% of its portfolio revenue to 23% of its revenue, as shown in Figure 5. Lululemon announced at its investor day on April 24, 2019 that it expects to double men’s sales by 2023 as part of its “Power of Three” growth plan.

[caption id="attachment_118630" align="aligncenter" width="550"] Lululemon reports its product categories at the global level; 72% of its sales were in the US in 2018–2020, and 28% of its sales were outside of the US.

Lululemon reports its product categories at the global level; 72% of its sales were in the US in 2018–2020, and 28% of its sales were outside of the US.Source: Company reports[/caption]

The company continues to innovate and build out its men’s category. In its second-quarter 2021 earnings report, Lululemon reported that its men’s business saw a sequential improvement relative to the first quarter.

- As at-home working and exercising continues, Lululemon has seen its male customers respond well to shorts, sweats and hoodies. The company’s merchant teams are pursuing these categories based on the shift in demand.

- The company is using its stores to build brand awareness, particularly among men. According to Lululemon, its stores act as a local hub for communities and gathering spots for ambassadors, as well as providing a connection to local studios.

- The company is continuing to innovate, with an On The Move collection that introduced new pant styles for men (and women); the collection is supported by the “Every Day is a Workout” campaign. The men’s Bowline pant uses Lululemon’s Utilitech fabric, which features abrasion resistance, four-way stretch and a natural feel.

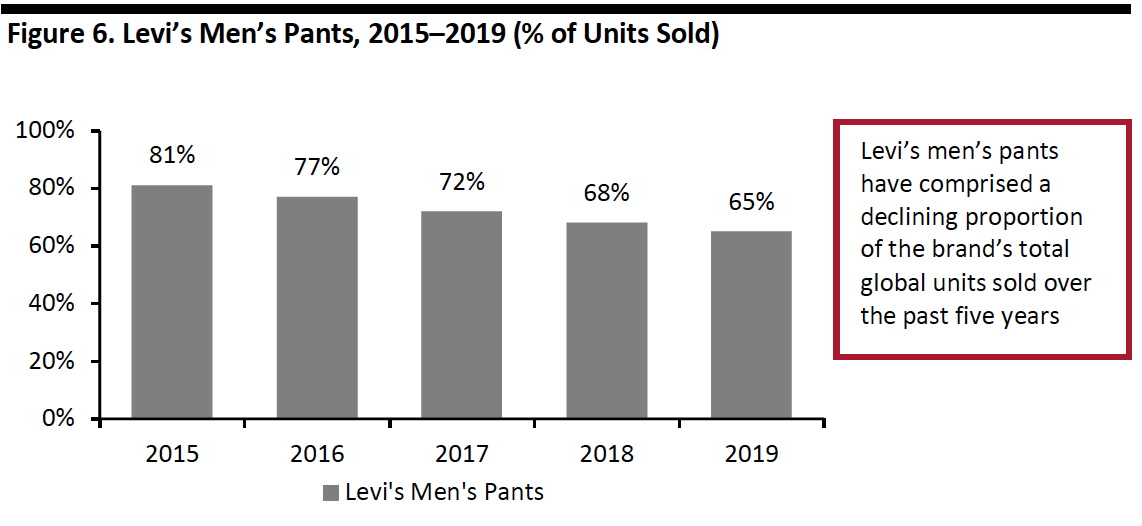

Levi’s Is Diversifying: Focusing on Tops and Responding to Demand for Comfort

Levi’s, founded in 1853, is nearly synonymous with denim and, until recently, has been focused on pants. The company is now diversifying into other growth categories: The tops category grew at a faster rate than pants from 2015 to 2018, at a CAGR of 31% versus 3% for pants. According to the Levi Strauss Annual Report 2020 (published in January this year), the company is focusing on growing its tops business.

Men’s denim, a $7.7 billion category in 2019, slowly declined from 2014 to 2019 at a (0.7)% CAGR overall, whereas men’s tops, a $10.7 billion category, has grown at a 3.4% CAGR in the same timeframe, according to Euromonitor International.

As shown in Figure 6, Levi’s men’s pants—which includes jeans, casual pants and dress pants—have declined as a proportion of the company’s total global portfolio units sold.

[caption id="attachment_118634" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

However, Levi’s stated in its Annual Report 2020 that it is “actively focused on maintaining and strengthening” its men’s bottoms business, which it expected to continue to be a key driver of operating results. The company also highlighted that it would update its men’s pants offering to include “fabrics with added stretch for greater comfort” and respond to “the ongoing consumer trend toward casualization in fashion.”

On its third-quarter 2020 earnings call, Levi’s reported that it continues to see opportunities to capitalize on the consumer shift to comfortable clothing; it sees opportunities for growth outside of denim across its portfolio, such as tops and outerwear.

Walmart Launches a Private Label; Focuses on Re-entering the Market with Value, Casual Clothing Brand for Men

On September 21, 2020, Walmart launched Free Assembly, a private-label value brand with 25 pieces for men priced between $9 and $45. The brand was in development for over two years, according to the company’s press release, with styles that include simple designs, quality fabrics and modern silhouettes. The collection is designed to comprise wardrobe staples that are easy to mix, layer and assemble freely.

The collection is led by Dwight Fenton, who most recently led design at Bonobos. In his interview on Walmart.com, Fenton said that he was excited about designing the collection for Walmart because the company’s size and scale is a powerful platform to bring a brand to the market while holding true to style, quality and value. Fenton emphasized that the pieces are meant to be closet staples, and his five picks for men are the Selvedge Slim Fit Jeans, Two-pocket Flannel Shirt, Carpenter Pants, Everyday Short Sleeve Tee and the Quilted Bomber Jacket.

PVH Corp. Positions Calvin Klein and Tommy Hilfiger for Casualization and Athleisure; Exits Heritage Formal Business

PVH Corp., parent company of the Calvin Klein and Tommy Hilfiger brands, is prioritizing its brands for recovery out of Covid-19, focusing on key growth categories and developing product franchises connected to where the consumer is going—with a focus on casual essentials and athleisure. On PVH Corp.’s second-quarter 2020 earnings call (for the quarter ended August 2, 2020), management highlighted that both categories experienced better-than-expected performance across all markets and channels, as the casual lifestyles that the Calvin Klein and Tommy Hilfiger brands represent were even more relevant with consumers spending more time at home.

Emanuel Chirico, Chairman and CEO of PVH Corp., said that the company’s dress-shirt, neckwear and suits businesses totaled less than 5% of its overall sales in 2019. The company announced the exit of its Heritage Brands business on July 2, 2020 in North America, which included Arrow, Geoffrey Beene, Izod and Van Heusen (and intimates brands Warner’s, Olga and True & Co). PVH Corp. reported that its Heritage Brands business was under significant pressure during the second quarter—the casualization trend that is being accelerated by Covid-19 has worked against its formalwear and work product categories. Mid-tier department store bankruptcies negatively impacted the Heritage business.

The brand has an ongoing collaboration with Formula 1 racecar driver Lewis Hamilton, on the Tommy x Lewis collection. On September 15, 2020, the partnership launched its fifth collection, which emphasizes sustainability, comfort and casualness. The line includes hoodies, joggers, jackets, T-shirts, beanies, neck warmers, sweaters, sweatshirts, bomber jackets, and backpacks and pouches.

[caption id="attachment_118636" align="aligncenter" width="550"] Tommy Hilfiger and Lewis Hamilton in an interview on February 18, 2020

Tommy Hilfiger and Lewis Hamilton in an interview on February 18, 2020Source: 10Magazine, YouTube[/caption] [caption id="attachment_118637" align="aligncenter" width="350"]

Tommy X Lewis Collection

Tommy X Lewis CollectionSource: usa.tommy.com[/caption]

Outdoor and Activewear Brands Collaborate with Unexpected Brand Partners

Unexpected brands and designers are working together to create unique collections—usually designers with different points of view or design aesthetics, which makes the final output more interesting and surprising.

- The North Face x Gucci: In September 2020, Gucci and The North Face hinted at a collaboration on social media by posting a short video and a flag bearing both brands’ names. Luxury brand Gucci reported to WWD in a statement that it would be “bringing a collaboration to life in the coming months that celebrates the rich heritage of both brands.” The North Face, owned by VF Corporation, is known for its highly functional outerwear and activewear, particularly fleece. We expect that this unexpected collaboration between an outdoor retailer and a luxury brand will generate a lot of attention and consumer excitement, because it is interesting and new and is the first time that the brands have collaborated together.

The North Face x Gucci

The North Face x GucciSource: Gucci Official Instagram[/caption]

- Jimmy Choo x Timberland: Another unexpected collaboration is between luxury shoe designer Jimmy Choo and outdoor boot maker Timberland. The brands launched a boot in September 2020 that features a Swarovski crystal collar fused with outdoor utility for “off-duty glamour.” The limited-edition men’s boots retail for $1,295. While this report does not cover footwear, this example epitomizes two different brands coming together to showcase their unique styles, celebrating each brand’s heritage and aesthetic in the final product.

Jimmy Choo x Timberland Boot

Jimmy Choo x Timberland BootSource: jimmychoo.com[/caption]

Athleticwear Brand Champion: Growth and Collaborations

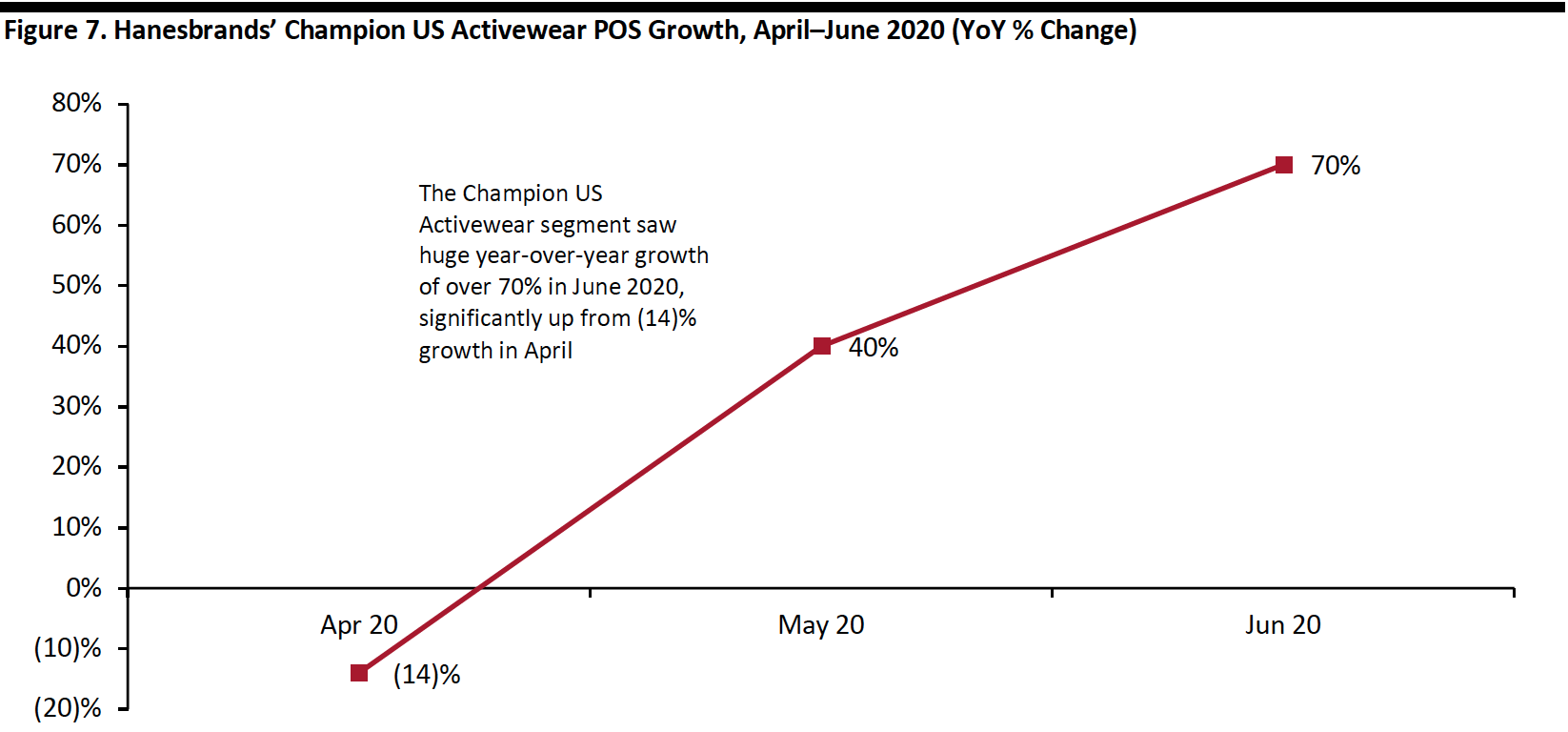

Hanesbrands reported in its second-quarter 2020 earnings call (for the quarter ended June 27, 2020) that within the US Activewear segment overall, its Champion brand saw point-of-sale (POS) increase from (14)% year-over-year growth in April to over 70% year-over-year growth in June, as consumers “continue to actively seek out the brand particularly within the online channel,” according to Hanesbrands’ CEO Gerald Evans. Sales through the Champion.com website increased nearly 200% in the second quarter, according to Hanesbrands.

[caption id="attachment_118642" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

Most notably over the past three years, Hanesbrands’ Champion brand has been actively launching new designs and collaborations, working with various fashion designers and brands. The brand has taken its “blank canvas” sweatshirt and modernized it by adding design elements such as vests, introducing gamer hoodies that accommodate large headsets, and launching themed collections. Recent collaborations include the following:

- Champion x General Mills: In March 2020, the brand partnered with high-end luxury designer Rick Owens on a collection featuring unique design elements such as an asymmetrical t-shirt, an embroidered sweatshirt “bodysuit” and mesh shorts.

- Rick Owens x Champion: In September 2020, Champion partnered cereal make General Mills to launch a limited-edition capsule collection featuring popular cereal branding on classic Champion apparel.

The above two examples highlight that the men’s sweatshirt is no longer ordinary and is becoming more unique to appeal to a varied consumer base—both men who are looking for luxury design elements as well as men who are seeking fun, kitschy designs.

[caption id="attachment_118644" align="aligncenter" width="550"] Champion x General Mills; Rick Owens x Champion

Champion x General Mills; Rick Owens x ChampionSource: Generalmills.com; Farfetch.com[/caption]

What We Think

We estimate that the $91.4 billion menswear market will decline by approximately 12.9% in 2020 to $79.6 billion due to the disruption in the apparel industry caused by the Covid-19 pandemic. With the shift in consumer emphasis toward casualwear, athleticwear and comfortwear, brands and retailers are shifting their category focus to stay relevant.

We expect the menswear space to become more competitive and crowded as more retailers and brands turn to the casualwear and athleticwear segments as opportunities for growth. During the first quarter of 2020, Burlington, Dick’s Sporting Goods, Foot Locker, Kohl’s, Ross Stores and TJX all identified growth opportunities in the casual and athletic space. Walmart also entered the space with a private-label, value, casual menswear offering. However, the largest established players in this space will benefit from the athleticwear and casualwear trend: Of the top 10 menswear brands, the eight athletic, comfort/essential and casualwear brands have experienced increasing market share over the past five years—and we expect this to continue.

Traditional menswear brands will have to stay agile to innovate into growth categories and broaden their portfolios to stay relevant. For example, as denim has trended downward by a (0.7)% CAGR from 2014 to 2019, Levi’s is diversifying its portfolio by branching out into tops, a category that has seen fast growth. In men’s pants, the brand is also innovating with fabrics with extra stretch for added comfort.

Furthermore, collaborations offer opportunities for menswear brands to appeal to wider audiences and drive consumer interest—particularly through unexpected partnerships, such as luxury with outdoor brands, or through limited-edition collections. Both parties in a collaboration can showcase their unique styles while extending their reach to their partner’s customer base. Social media is key to teasing and promoting such collaborations to boost consumer excitement.

It is essential that menswear brands differentiate themselves in the market moving forward—whether that be through value, technical innovation, unique design elements or collaborations. We expect that brands will increasingly find ways to connect with consumers as the space becomes more crowded and competitive; this will become necessary to thrive.