Nitheesh NH

What’s the Story?

In this report, we discuss the US handbag market, including market size and competitive landscape. We also cover the main market drivers, key trends and headwinds we are seeing.Why It Matters

As we gradually emerge from the pandemic, consumers are returning to activities outside of their homes, and brands and retailers such as Guess?, Kering and Tapestry are seeing a revival in sales of handbags (also referred to as purses). We review the market to establish how brands and retailers can best serve consumers in an ever-changing retail environment.The US Handbag Market: Coresight Research Analysis

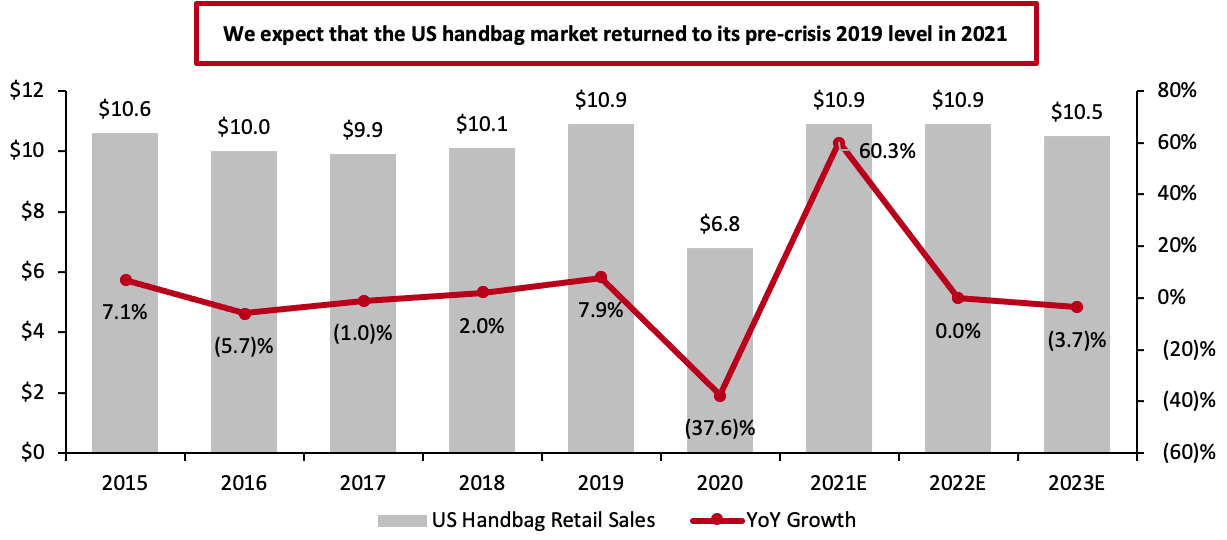

1. Market Size US handbag retail sales declined by 37.6% to $6.8 billion in 2020 amid the pandemic, according to international travel organization Travel Goods Association. We estimate that the market recovered with 60.3% growth in 2021, reaching pre-crisis levels at $10.9 billion—driven by increased discretionary spending power, stimulus payments and return to more regular ways of living, working and spending. As stimulus tailwinds taper away and consumer discretionary spending normalizes, we expect the market to remain flat in 2022 and decline by a single-digit rate in 2023, as shown in Figure 1.Figure 1. US Handbag Retail Sales (Left Axis, USD Bil.) and Year-over-Year Growth (Right Axis, %) [caption id="attachment_138745" align="aligncenter" width="700"]

Source: Travel Goods Association/Coresight Research[/caption]

Retail Sales Units and Average Selling Price

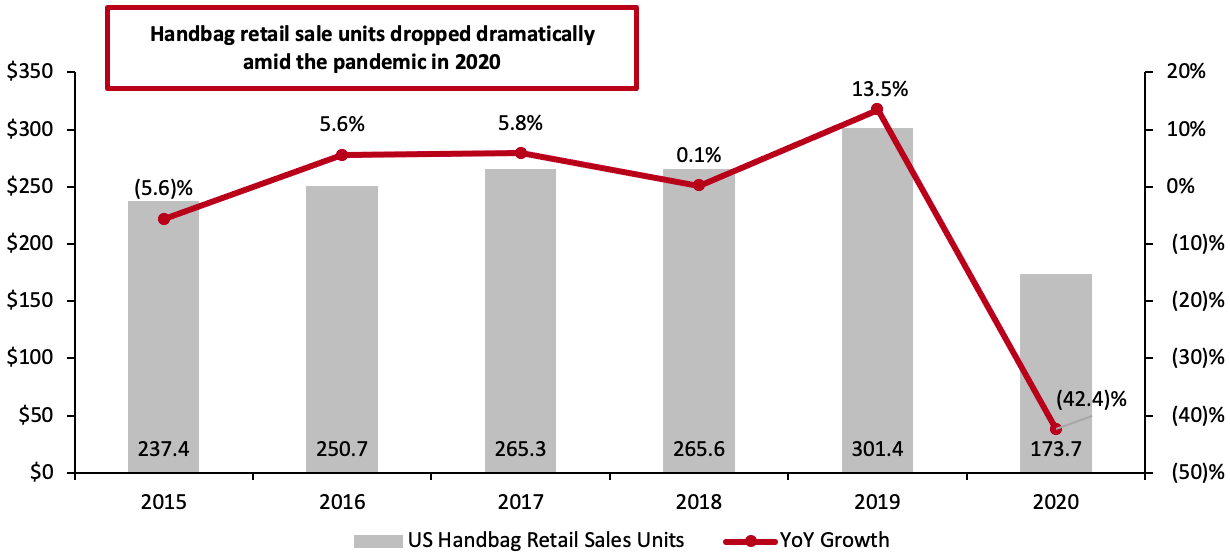

Unit sales in US handbag retail declined by 42.4% to 173.7 million in 2020 amid the pandemic, according to the Travel Goods Association. Between 2016 and 2018, unit sales were in the range of 250–260 million with a spike in 2019 to 301.4 units.

Source: Travel Goods Association/Coresight Research[/caption]

Retail Sales Units and Average Selling Price

Unit sales in US handbag retail declined by 42.4% to 173.7 million in 2020 amid the pandemic, according to the Travel Goods Association. Between 2016 and 2018, unit sales were in the range of 250–260 million with a spike in 2019 to 301.4 units.

Figure 2. US Handbag Retail Sales Units (Left Axis, Million Units.) and Year-over-Year Growth (Right Axis, %) [caption id="attachment_138746" align="aligncenter" width="700"]

Source: Travel Goods Association/Coresight Research[/caption]

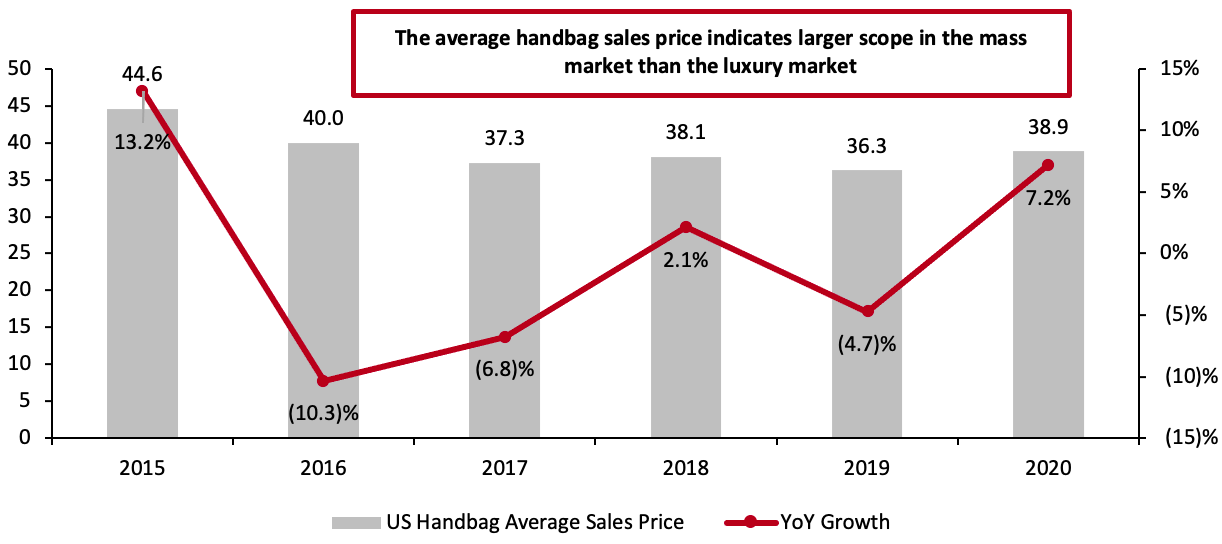

We have calculated the average handbag sale price, based on US handbag retail sales and the number of units sold (Figure 2).

As shown in Figure 3, the average sales price from 2016 to 2020 remained in the range of $36–$40, indicating larger scope in the mass market than the luxury market for handbags. The average sales price increased from $36.3 in 2019 to $38.9 in 2020, implying greater buoyancy at the higher end of the market than in the lower-priced, mass-market segment.

Source: Travel Goods Association/Coresight Research[/caption]

We have calculated the average handbag sale price, based on US handbag retail sales and the number of units sold (Figure 2).

As shown in Figure 3, the average sales price from 2016 to 2020 remained in the range of $36–$40, indicating larger scope in the mass market than the luxury market for handbags. The average sales price increased from $36.3 in 2019 to $38.9 in 2020, implying greater buoyancy at the higher end of the market than in the lower-priced, mass-market segment.

Figure 3. US Handbag Average Sales Price (Left Axis, USD) and Year-over-Year Growth (Right Axis, %) [caption id="attachment_138748" align="aligncenter" width="700"]

Source: Travel Goods Association/Coresight Research[/caption]

2. Market Drivers

We have identified three key drivers in the US handbag market.

Vaccinations and Consumers’ Return to Normal Living and Spending Behaviors

Vaccine rollouts in 2021 have offered a path out of the pandemic in 2021—82.1% of the population aged 12 and over have had at least one dose as of November 24, 2021, according to the Centers for Disease Control and Prevention.

We are seeing recovery in the US handbag market as consumers attend more gatherings and events outside of their homes. Consumer avoidance of shops in general is below 20%, according to our US consumer survey, and has trended downward in October and November. Avoidance of malls/shopping centers among US consumers has also seen a downward trajectory through October and November 2021.

Stimulus Cash and Lockdown Savings

Stimulus cash and savings accumulated during lockdown periods are high-level drivers for the US handbag market.

We have seen an increase in spending on discretionary categories such as jewelry, watches, bags and luggage since early 2021—the proportion of respondents buying bags or luggage in-store increased to 4.0% in the week ended November 29, 2021, from 1.1% in the week ended January 4, 2021, according to our US consumer trackers. The proportion of respondents buying bags or luggage online increased to 4.3% in the week ended November 29, 2021, from 2.7% in the week ended January 4, 2021.

Inflation

We see inflation as an important driver of the US handbag market for its impact on increasing handbag prices. The US inflation rate rose 6.8% in November 2021 year over year—the highest increase since 1982, according to Bureau of Labor Statistics.

3. Competitive Landscape

The US handbag market is fragmented, with mass merchandisers such as Target and Walmart and Target; e-commerce platforms such as Amazon; specialty retailers such as H&M; and department stores such as Macy’s; as well as over 100 handbag brands competing in the market.

Brands and retailers disclose information on handbag revenue differently, as noted for each entry in Figure 4.

Source: Travel Goods Association/Coresight Research[/caption]

2. Market Drivers

We have identified three key drivers in the US handbag market.

Vaccinations and Consumers’ Return to Normal Living and Spending Behaviors

Vaccine rollouts in 2021 have offered a path out of the pandemic in 2021—82.1% of the population aged 12 and over have had at least one dose as of November 24, 2021, according to the Centers for Disease Control and Prevention.

We are seeing recovery in the US handbag market as consumers attend more gatherings and events outside of their homes. Consumer avoidance of shops in general is below 20%, according to our US consumer survey, and has trended downward in October and November. Avoidance of malls/shopping centers among US consumers has also seen a downward trajectory through October and November 2021.

Stimulus Cash and Lockdown Savings

Stimulus cash and savings accumulated during lockdown periods are high-level drivers for the US handbag market.

We have seen an increase in spending on discretionary categories such as jewelry, watches, bags and luggage since early 2021—the proportion of respondents buying bags or luggage in-store increased to 4.0% in the week ended November 29, 2021, from 1.1% in the week ended January 4, 2021, according to our US consumer trackers. The proportion of respondents buying bags or luggage online increased to 4.3% in the week ended November 29, 2021, from 2.7% in the week ended January 4, 2021.

Inflation

We see inflation as an important driver of the US handbag market for its impact on increasing handbag prices. The US inflation rate rose 6.8% in November 2021 year over year—the highest increase since 1982, according to Bureau of Labor Statistics.

3. Competitive Landscape

The US handbag market is fragmented, with mass merchandisers such as Target and Walmart and Target; e-commerce platforms such as Amazon; specialty retailers such as H&M; and department stores such as Macy’s; as well as over 100 handbag brands competing in the market.

Brands and retailers disclose information on handbag revenue differently, as noted for each entry in Figure 4.

Figure 4. The US Handbag Market: Selected Brands and Retailers, 2020 [wpdatatable id=1607] [wpdatatable id=1586] [wpdatatable id=1588] [wpdatatable id=1589] [wpdatatable id=1590]

Source: Company reports/Coresight Research

In Figure 5, we chart 2021 guidance from key players in the US handbag market, highlighting market trends identified by each company.Figure 5. Key Industry Player’s Guidance for 2021 [wpdatatable id=1591]

Source: Company reports/Coresight Research

4. Key Handbag Trends: Sustainability Increased Focus on Sustainability Amid growing environmental awareness among global consumers, handbag brands and retailers are increasingly improving their sustainability commitments. In the handbag market, material innovation has been a key development, in order to provide alternatives to leather deemed to have a reduced environmental impact. For instance, consumer searches for “vegan leather” increased by 69% year over year in 2020, averaging 33,100 per month, according to secondhand e-commerce platform Lyst. Since the beginning of 2020, Lyst has seen a 37% increase in searches for sustainability-related keywords, with the average monthly searches increasing from 27,000 in February 2019 to over 32,000 in February 2020. Handbag is among the most searched categories alongside those keywords. We expect brands and retailers to continue to capitalize on opportunities in sustainable purses in the near future. Figure 6 presents recent sustainability initiatives among handbag brands and retailers.Figure 6. Selected Handbag Brands and Retailers: Sustainability Initiatives [wpdatatable id=1592]

Source: Company reports

Resale Is Going Mainstream As consumers increasingly seek out value (both economic and ethics-based) in their purchases, fashion resale is steadily shifting into the mainstream. The US fashion resale market has evolved from a high-single-billion-dollar market in 2008 to be worth $20 billion in 2020, according to Coresight Research estimates. Although we estimate that the US fashion resale market declined by 5.2% in 2020 amid the pandemic, we anticipate that US fashion resale recovered in 2021 with growth in the mid-teens. Luxury handbag brands, once out of reach for most middle-class consumers, are now attainable via new forms of payment (such as Affirm), rental and subscription (such as Rent the Runway), and secondhand consignment (such as The RealReal and Poshmark). We are seeing resale platforms providing consumers with access to lightly used, authenticated designer purses at 50%–95% of the full retail price, fueling recommerce growth. For some popular bags, prices may rise above retail value— dependent on demand and limited-edition status. Popular handbag brands on The RealReal platform include Chanel, Gucci Hermès and Louis Vuitton, as shown in Figure 7.Figure 7. Selected Luxury Handbag Brands on The RealReal: Resale Details (2020) [wpdatatable id=1594]

Source: The RealReal

5. Headwinds We have identified two headwinds for the US handbag market. Supply Chain Disruptions Brands and retailers around the globe are facing increased port congestion and freight costs. This presents an issue for the US handbag market, especially since more than 90% of handbags sold in the US are imported from other countries as of November 2021, according to Travel Goods Association. Deliveries for handbags made domestically are also facing transportation delays amid worker shortages, with brands and retailers such as Fossil reporting issues with delivery schedules according to its earnings call on November 10, 2021. Rising Foreign Exchange Rates and Inflation For handbag retailers and brands imported into the US, rising foreign exchange rates are a headwind. For example, Kering’s revenue reached €3.9 billion ($4.4 billion) in the first quarter of fiscal 2021 but the company reported a 4.4 point foreign exchange conversion loss. The US dollar has been declining in value since March 2020. To tackle the headwind, we are seeing many luxury brands raising their product prices.What We Think

Implications for Brands/Retailers- We believe the US handbag market returned to its pre-crisis level in 2021 and we expect it to remain flat in 2022, as stimulus tailwinds fade.

- The average handbag sales price from 2016 to 2020 was $37–$40, indicating larger scope in the mass market than the luxury market for handbags. As luxury handbags brands and retailers are increasing their prices to mitigate the impact of the pandemic, we believe there are opportunities for the mass market to capture share.

- As consumers are becoming more conscious of the environmental impact of their purchases, handbag brands and retailers must make sure to engage in and promote their sustainability initiatives, such as resale.

- The handbag resale market is becoming more mainstream, driven by consumer interest in extending product lifestyles and accessing premium products at lower price points. We see opportunities for handbag brands and retailers to launch resale services or work with resale platforms. Gap, H&M and Nordstrom launched resale services in 2020 and leverage their established reputations to improve consumer trust in resale items.