DIpil Das

What’s the Story?

We discuss the US footwear market, presenting the market size, key growth drivers and a competitive landscape. We also cover four key trends among brands and retailers as they aim to better serve footwear demand. Our coverage includes non-sports and sports footwear. Non-sports footwear comprises flats, heels, leather shoes, sandals and slippers that are not worn for sports purposes. Sports footwear comprises both performance-oriented footwear (specifically designed for sporting activities such as basketball, football and running as well as outdoor activities including climbing, cycling and hiking) and non-performance-oriented footwear that could be worn for daily activities and casual occasions, such as non-performance sneakers designed by Converse, NIKE and Adidas.Why It Matters

Consumers have returned to working, socializing and exercising outside of their homes, leading to a revival in footwear sales following stay-at-home orders in 2020 and early 2021. We provide guidance for brands and retailers to navigate changes in consumer demand.US Footwear Market Outlook

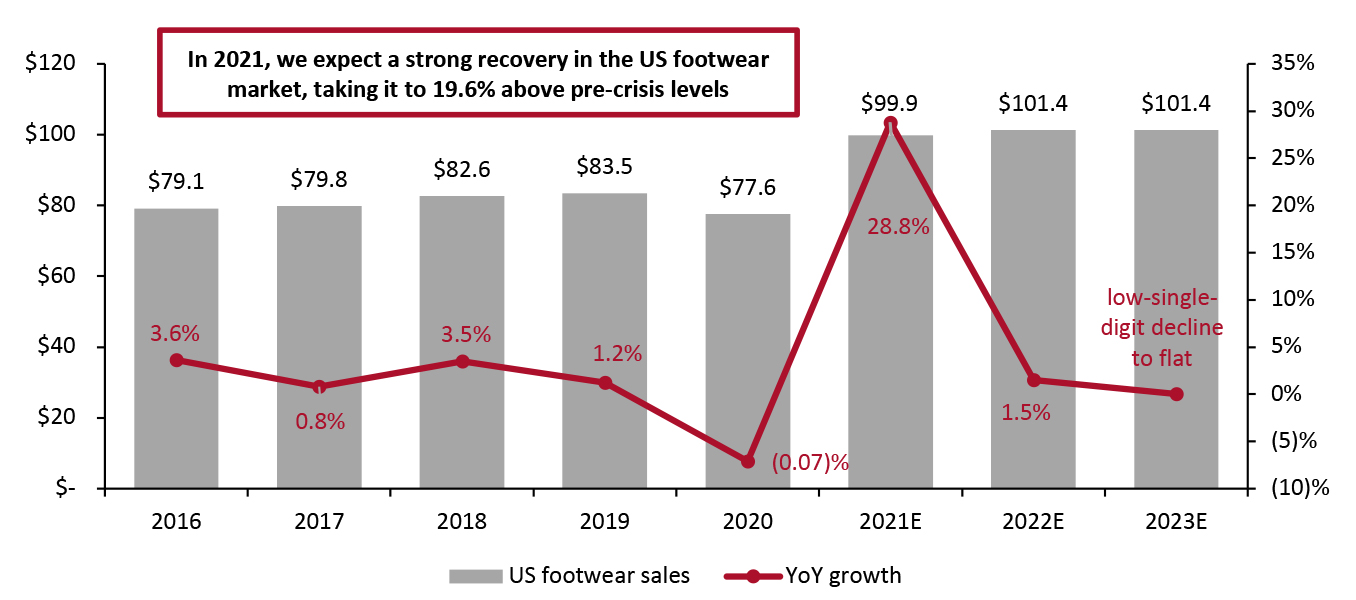

Market Size We estimate that the US footwear market will recover with very substantial 28.8% growth to $99.9 billion in 2021—some 19.6% above the levels of 2019. This follows a 7.1% decline to $77.6 billion in 2020 based on data from the Bureau of Economic Analysis (BEA) and takes consumer spending to around one-fifth higher than in 2019. We expect the market to grow by a stabilized low-single-digit percentage in 2022, following the rollout of vaccines and consumers returning to more regular ways of living, working and spending in 2021. In 2023, we expect the market to see a low-single-digit decline (up to flat).Figure 1. US Footwear Sales (Left Axis; USD Bil.) and YoY Growth (Right Axis; %) [caption id="attachment_136716" align="aligncenter" width="700"]

Source: Bureau of Economic Analysis/Coresight Research[/caption]

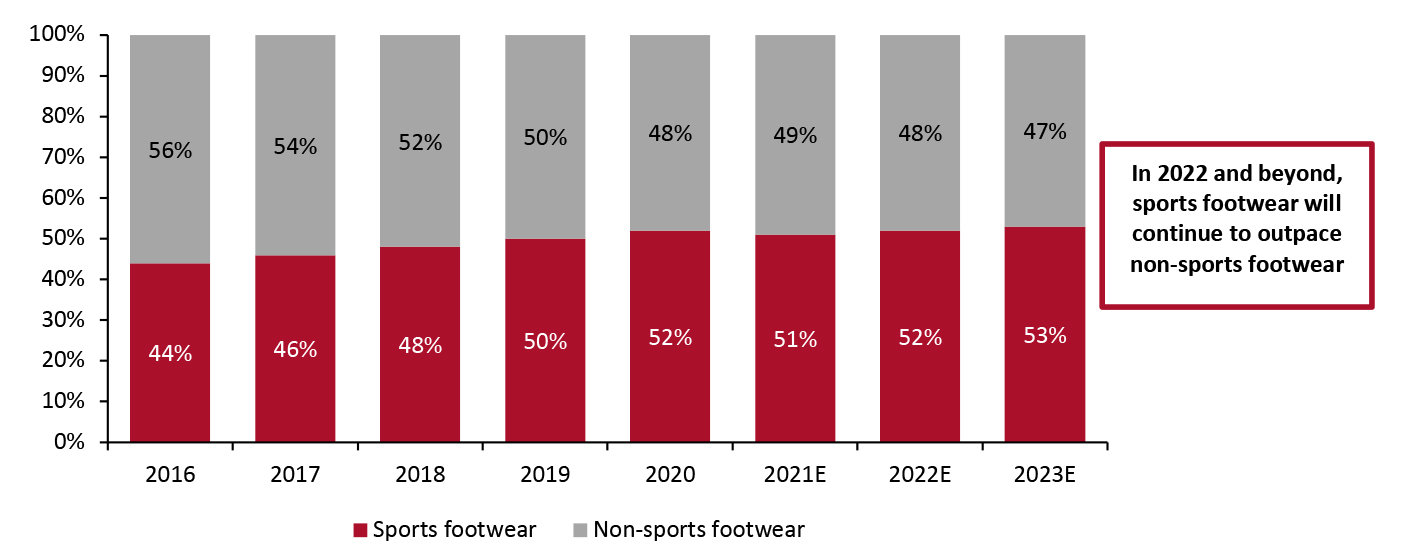

By category, sports footwear picked up a two-percentage-point share from non-sports footwear in 2020, according to Euromonitor International, which can be attributed to supported by the casualization trend. In 2021, we expect sales of non-sports footwear to grow faster than sports footwear and regain some lost market share with a renewal in consumer demand for occasion wear. Non-sports footwear will regain a one-percentage-point share from sports footwear in 2021, according to Euromonitor.

However, in 2022 and beyond, sports footwear will continue to outpace non-sports footwear as the impact of the casualization trend will have more longevity than pandemic-related pent-up demand for occasion wear.

Source: Bureau of Economic Analysis/Coresight Research[/caption]

By category, sports footwear picked up a two-percentage-point share from non-sports footwear in 2020, according to Euromonitor International, which can be attributed to supported by the casualization trend. In 2021, we expect sales of non-sports footwear to grow faster than sports footwear and regain some lost market share with a renewal in consumer demand for occasion wear. Non-sports footwear will regain a one-percentage-point share from sports footwear in 2021, according to Euromonitor.

However, in 2022 and beyond, sports footwear will continue to outpace non-sports footwear as the impact of the casualization trend will have more longevity than pandemic-related pent-up demand for occasion wear.

Figure 2. US Footwear Market by Category Share (%) [caption id="attachment_136717" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

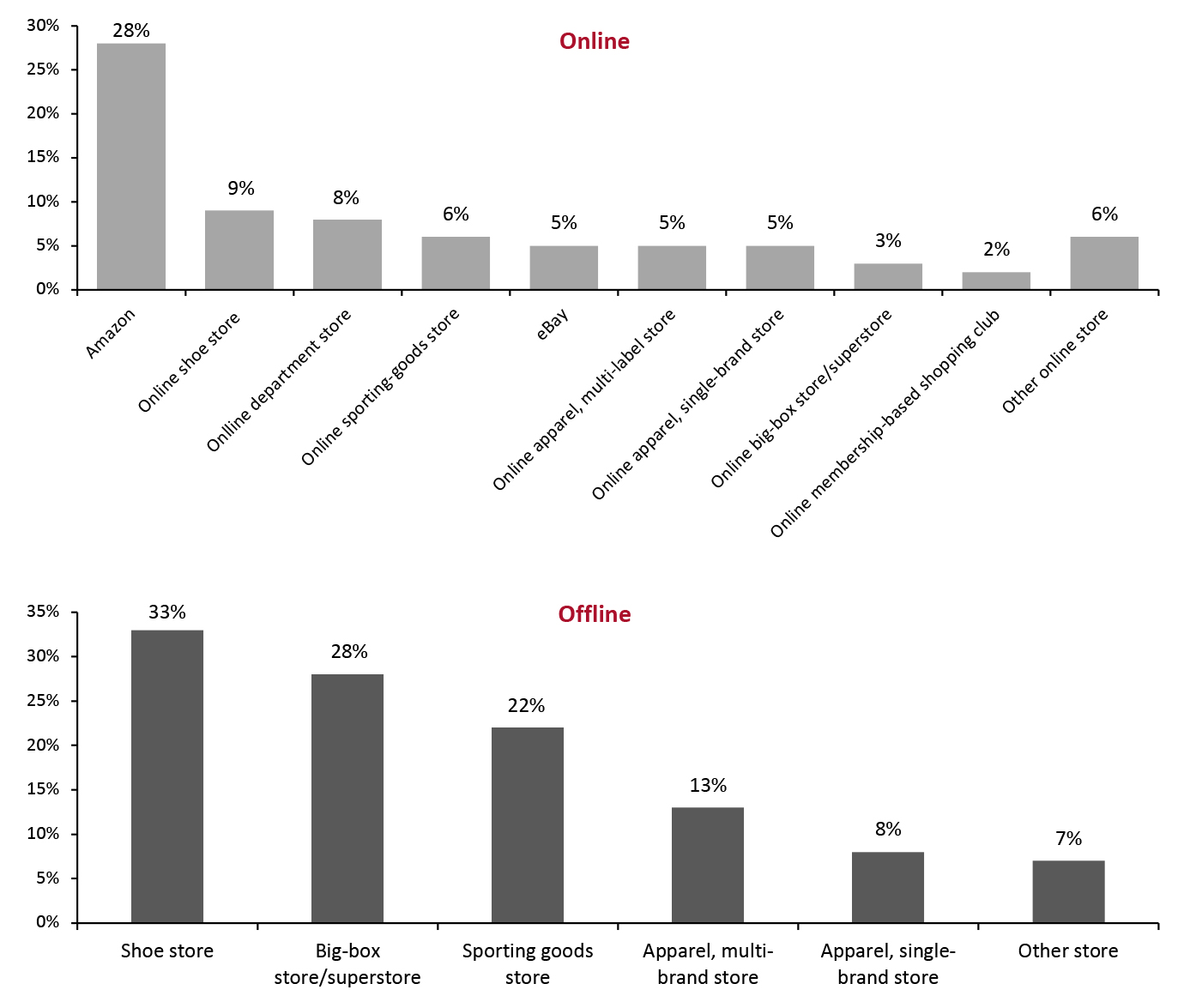

By distribution channel, we are seeing an inclination among US consumers toward buying footwear from specialty shoe stores for offline purchases and from e-commerce marketplaces such as Amazon for online purchases.

For online channels, 28% of US consumers purchased footwear from Amazon in the last 12 months, according to Statista’s August 2021 global consumer survey. The second option was online shoe stores with 9% of consumers, followed by 8% who had bought from online department stores.

For offline channels, 33% of US consumers had purchased footwear from specialty shoe stores, followed by 28% who bought from big-box stores or superstores, and 22% who bought from sporting-goods stores. We believe that more footwear brands and retailers will reduce their exposure to wholesale channels, and pivot toward increasingly direct-to-consumer (DTC) models or work with influential marketplaces such as Amazon.

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

By distribution channel, we are seeing an inclination among US consumers toward buying footwear from specialty shoe stores for offline purchases and from e-commerce marketplaces such as Amazon for online purchases.

For online channels, 28% of US consumers purchased footwear from Amazon in the last 12 months, according to Statista’s August 2021 global consumer survey. The second option was online shoe stores with 9% of consumers, followed by 8% who had bought from online department stores.

For offline channels, 33% of US consumers had purchased footwear from specialty shoe stores, followed by 28% who bought from big-box stores or superstores, and 22% who bought from sporting-goods stores. We believe that more footwear brands and retailers will reduce their exposure to wholesale channels, and pivot toward increasingly direct-to-consumer (DTC) models or work with influential marketplaces such as Amazon.

Figure 3. US Footwear Purchases by Channel, Online and Offline (% of Respondents) [caption id="attachment_136718" align="aligncenter" width="700"]

Source: Statista[/caption]

Market Drivers

We present the three main drivers of growth in the US footwear market in 2021 and beyond.

1. Vaccinations and Consumers’ Return to More Normal Behavior

While 2020 saw pandemic-led retail shutdowns, 2021 has brought vaccine rollouts in the US, which offered a path out of the pandemic and anticipated footwear market recovery.

In the US, 68.3% of the population aged 12 and above are fully vaccinated and 78.8% aged 12 and above have had at least one vaccine does, as of November 7, 2021, according to the Centers for Disease Control and Prevention. The US has ease Covid-19 restrictions and store closures, with many offices reopening in September 2021—albeit with hybrid attendance policies—which could drive the recovery of the footwear sales, especially for flats, heels and other leather shoes.

We are seeing the return of in-person events such as weddings and parties—for instance, 47% of couples who planned to wed in 2020 planned to celebrate in 2021 or later instead, according to the Knot 2020 Real Weddings Study (Covid-19 edition). The revival of in-person events will drive new footwear purchases.

Additionally, the recovery of travel in the US is now fully under way, with consumers who have accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. A return to travel would result in welcome gains for tourism-related shoes such as sandals and walking or hiking shoes.

2. Three Rounds of Stimulus Checks

Our March 2021 consumer survey found that US shoppers used or plan to use the third stimulus checks on discretionary retail categories, which likely fueled the strong apparel and footwear spending witnessed in the first half of 2021. We found that more consumers reported using their first and second stimulus checks on bills and necessities.

Product shortages and supply chain bottlenecks may have thrown cold water on the consumer spending surge, leave some stimulus dollars in consumers’ wallets. We expect consumer spending to increase in the second half of 2021, driving key categories such as apparel and footwear.

3. Consumer Hype in Sneaker Culture

The sports footwear market is buoyed by “sneaker culture,” spanning mass market to luxury, proving to be one of the most visible manifestations of fashion in footwear. We have seen a proliferation of sneakers sold at normal prices by brands including Adidas, LV and NIKE but are then valued much higher on resale platforms such as StockX. We expect the sneaker mania to continue as new colors and a limited quantity of new shoes will be issued to limited buyers, making the price premiums likely to stay high and driving the total footwear market.

Competitive Landscape

The US footwear market is relatively consolidated compared to the total apparel and footwear market, with the top 10 footwear brands accounting for 38.8% of sales in 2020, according to data from Euromonitor International.

NIKE captured the largest share in 2020, as shown in Figure 5, followed by Adidas and Skechers—although NIKE is the only brand with a double-digit share. After these three super brands, market share falls to the low-single digits per brand.

We expect the market to become increasingly concentrated in the next few years, with the top five leaders (NIKE, Adidas, Skechers, Ugg and New Balance) acquiring greater shares. Among the top 10 footwear brands in the country, eight are US domestic brands, indicating the strength of US-originated shoe brands.

Source: Statista[/caption]

Market Drivers

We present the three main drivers of growth in the US footwear market in 2021 and beyond.

1. Vaccinations and Consumers’ Return to More Normal Behavior

While 2020 saw pandemic-led retail shutdowns, 2021 has brought vaccine rollouts in the US, which offered a path out of the pandemic and anticipated footwear market recovery.

In the US, 68.3% of the population aged 12 and above are fully vaccinated and 78.8% aged 12 and above have had at least one vaccine does, as of November 7, 2021, according to the Centers for Disease Control and Prevention. The US has ease Covid-19 restrictions and store closures, with many offices reopening in September 2021—albeit with hybrid attendance policies—which could drive the recovery of the footwear sales, especially for flats, heels and other leather shoes.

We are seeing the return of in-person events such as weddings and parties—for instance, 47% of couples who planned to wed in 2020 planned to celebrate in 2021 or later instead, according to the Knot 2020 Real Weddings Study (Covid-19 edition). The revival of in-person events will drive new footwear purchases.

Additionally, the recovery of travel in the US is now fully under way, with consumers who have accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. A return to travel would result in welcome gains for tourism-related shoes such as sandals and walking or hiking shoes.

2. Three Rounds of Stimulus Checks

Our March 2021 consumer survey found that US shoppers used or plan to use the third stimulus checks on discretionary retail categories, which likely fueled the strong apparel and footwear spending witnessed in the first half of 2021. We found that more consumers reported using their first and second stimulus checks on bills and necessities.

Product shortages and supply chain bottlenecks may have thrown cold water on the consumer spending surge, leave some stimulus dollars in consumers’ wallets. We expect consumer spending to increase in the second half of 2021, driving key categories such as apparel and footwear.

3. Consumer Hype in Sneaker Culture

The sports footwear market is buoyed by “sneaker culture,” spanning mass market to luxury, proving to be one of the most visible manifestations of fashion in footwear. We have seen a proliferation of sneakers sold at normal prices by brands including Adidas, LV and NIKE but are then valued much higher on resale platforms such as StockX. We expect the sneaker mania to continue as new colors and a limited quantity of new shoes will be issued to limited buyers, making the price premiums likely to stay high and driving the total footwear market.

Competitive Landscape

The US footwear market is relatively consolidated compared to the total apparel and footwear market, with the top 10 footwear brands accounting for 38.8% of sales in 2020, according to data from Euromonitor International.

NIKE captured the largest share in 2020, as shown in Figure 5, followed by Adidas and Skechers—although NIKE is the only brand with a double-digit share. After these three super brands, market share falls to the low-single digits per brand.

We expect the market to become increasingly concentrated in the next few years, with the top five leaders (NIKE, Adidas, Skechers, Ugg and New Balance) acquiring greater shares. Among the top 10 footwear brands in the country, eight are US domestic brands, indicating the strength of US-originated shoe brands.

Figure 4. Top 10 US Footwear Brands: Market Share, 2020 (%) [caption id="attachment_136719" align="aligncenter" width="700"]

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

Figure 6 presents commentary from major brands and retailers on footwear sales in the US market.

Source: Euromonitor International Limited 2021 © All rights reserved[/caption]

Figure 6 presents commentary from major brands and retailers on footwear sales in the US market.

Figure 5. Selected List of Brands/Retailers Reports on Footwear [wpdatatable id=1464 table_view=regular]

Source: Company reports Footwear Market Trends We present four key trends in the US footwear market. 1. The Hype of Sneaker Culture We have seen a proliferation of sneakers sold at normal prices by brands such as NIKE, Adidas and LV but are then valued much higher on resale platforms such as StockX, as shown in Figure 7. We have also seen a rise in high-end sneakers designed by luxury brands such as Balenciaga, Coach, Fendi, Gucci and Prada that sell at high prices and sell out quickly. According to StockX, the top three most popular footwear brands in 2020 were Jordan (an average of 54% price premium), NIKE (46%) and Adidas (32%). The top three styles were Air Jordan 1, Adidas Yeezy 350 and NIKE Air Force 1. In the next three to five years, we expect the sneaker hype to continue as new colors and a limited quantity of new shoes will be issued to limited buyers, making the price premiums likely to stay high.

Figure 6. Selected Sneakers: Retail Prices vs. Resale Prices on StockX [wpdatatable id=1465 table_view=regular]

Source: StockX 2. Sustainability in Footwear Sustainable Materials We are seeing a wave of sustainable footwear offerings by brands and retailers such as Adidas, NIKE and Steve Madden as consumers have become more focused on sustainability. According to a survey by Coresight Research and Blue Yonder in January 2021, 65.6% of US consumers believe that sustainability is an important factor in choosing where to buy apparel and footwear. With shopping choices being influenced by consumers’ growing awareness of environmental sustainability, there are likely to be opportunities in sustainable apparel and footwear products, sustainable fabrics and textiles in the near future. Footwear is one popular category that uses sustainable materials, as exemplified by the recent launches presented in Figure 8. We have seen a spike in new sustainable footwear offerings in 2021. In addition, some key footwear brands, such as Crocs, have committed overall sustainability goals in their businesses although they have not released specific products. We expect the sustainability trend to sustain over the long term.

Figure 7. Selected US Footwear Brands and Retailers: Launches of Sustainable Products in 2021 [wpdatatable id=1467 table_view=regular]

Source: Company reports Footwear Recycling Programs We are also seeing the rise of take-back and recycling programs in the footwear market. Much like other fashion take-back programs launched by retailers and brands such as Reformation, Levi’s and The North Face, footwear take-back programs allow consumers to recycle unwanted footwear in selected stores or by shipping them back for a reward. We expect more footwear players to launch recycling programs and expand the programs to areas outside of the US, too. Among major footwear brands and retailers, NIKE and Timberland both operate prominent recycling programs.

- NIKE launched its refurbished program on April 14, 2021, to extend the lifespan of its footwear. The shoes being recycled are inspected, given a condition grade and priced. The shoes then go back onto NIKE shelves to be resold. Consumers can scan a QR code on the shoe box to see the shoe’s history and condition grade.

A shoebox for NIKE’s recycled footwear scheme, featuring a QR code on the shoe box that gives more information about the condition of the shoes inside

A shoebox for NIKE’s recycled footwear scheme, featuring a QR code on the shoe box that gives more information about the condition of the shoes inside Source: NIKE [/caption]

- Timberland launched its take-back program in August 2021, in partnership with circular fashion company ReCircled. Consumers can return footwear, accessories and apparel to Timberland stores, either for repair and resale, or recycling.

Source: Soles4Souls[/caption]

3. Collaborations

Collaboration Among Footwear Brands and Retailers

We are seeing more footwear retailers and brands launch products in collaboration with each other, aiming to leverage the unique strengths of each brand and take advantage of surprising partnerships to generate intrigue. Collaboration between footwear brands that incorporate new styles and colors is a concept that has proven successful in the market. The strategic mix provides a novelty that often attracts younger consumers and provides shoppers with a more affordable way to access two footwear brands.

We expect to see more footwear brands and retailers use joint product creation to meet consumers’ needs and drive excitement going forward.

Source: Soles4Souls[/caption]

3. Collaborations

Collaboration Among Footwear Brands and Retailers

We are seeing more footwear retailers and brands launch products in collaboration with each other, aiming to leverage the unique strengths of each brand and take advantage of surprising partnerships to generate intrigue. Collaboration between footwear brands that incorporate new styles and colors is a concept that has proven successful in the market. The strategic mix provides a novelty that often attracts younger consumers and provides shoppers with a more affordable way to access two footwear brands.

We expect to see more footwear brands and retailers use joint product creation to meet consumers’ needs and drive excitement going forward.

Figure 8. Selected Same-Industry Footwear Collaboration in 2021 [wpdatatable id=1468 table_view=regular]

Source: Company reports Collaboration with Brands or Retailers in Other Sectors Crossovers between footwear brands and other sector’s products are particularly popular too, and these unusual mashups can easily spike social media attention. We have seen footwear brands launch collaboration with film franchises, accessories companies, beauty brands and other seemingly irrelevant sectors such as bike production.

Figure 9. Selected Different-Industry Footwear Collaboration in 2021 [wpdatatable id=1469 table_view=regular]

Source: Company reports Collaboration with Celebrities We expect that celebrity and influencers will play an increasingly important role in driving consumer purchasing decisions in the future: Celebrity or influencer endorsement is one of the most coveted forms of marketing. Footwear brands can seek out collaborations in product development and utilize existing celebrity and influencer fanbases to engage with new audiences and drive direct sales.

Figure 10. Selected Footwear Collaboration with Celebrities in 2021 [wpdatatable id=1470 table_view=regular]

Source: Company reports 4. Tech-Driven Functionality Technology plays an important role in the footwear market, especially in sports footwear. We are seeing more brands and retailers leverage technology to improve product functionality and cost efficiency. Figure 12 provides a list of technology innovations used by major footwear brands.

Figure 11. Major Footwear Brands’ Technologies [wpdatatable id=1471 table_view=regular]

Source: Company reports

What We Think

Implications for Footwear Brands and Retailers- We expect the US footwear market to see a very strong recovery with 28.8% growth in 2021. Although non-sports footwear will grow faster than sports footwear this year amid pent-up demand for occasion wear, we see sports footwear as a great opportunity for footwear retailers to adjust product and service offerings and drive sales in 2022 and beyond.

- By distribution channels, we are seeing an inclination toward buying footwear from specialty shoe stores and e-commerce marketplaces such as Amazon. We believe that more footwear brands and retailers will reduce their exposure to wholesale channels such as department stores, and pivot to a DTC model or work with marketplaces such as Amazon.

- We are seeing a wave of sustainable footwear offerings by retailers and brands including Adidas, NIKE and Steve Madden. We expect the sustainability trend to sustain in the long term. There are opportunities to expand take-back and recycling programs in the footwear market to appeal to consumer awareness of the environmental impacts of the fashion industry.