DIpil Das

What’s the Story?

We discuss the US eyewear market, including market size and key growth drivers. We also present the competitive landscape and headwinds that players are facing to understand what brands and retailers are doing to better serve the market. Our coverage of eyewear includes contact lenses, corrective eyeglasses and sunglasses. This comprises both eyeglass frames and lenses, as well as spectacle accessories such as glasses, cleaning cloths and lens cleaning/storage solutions. We exclude activewear glasses such as ski goggles, swimming goggles and computer-powered smart glasses.Why It Matters

The pandemic has driven a host of changes in the US eyewear market—increased reliance on screen-based devices such as laptops and mobile phones for working, studying, entertainment and socializing from home has led to greater need for corrective glasses among consumers. In addition, amid the shift to e-commerce, the market is seeing a rise in online sales and digitally native eyewear brands. As consumers gradually return to more normal ways of living and traveling, we are seeing recovery in sunglasses sales.The US Eyewear Market: Coresight Research Analysis

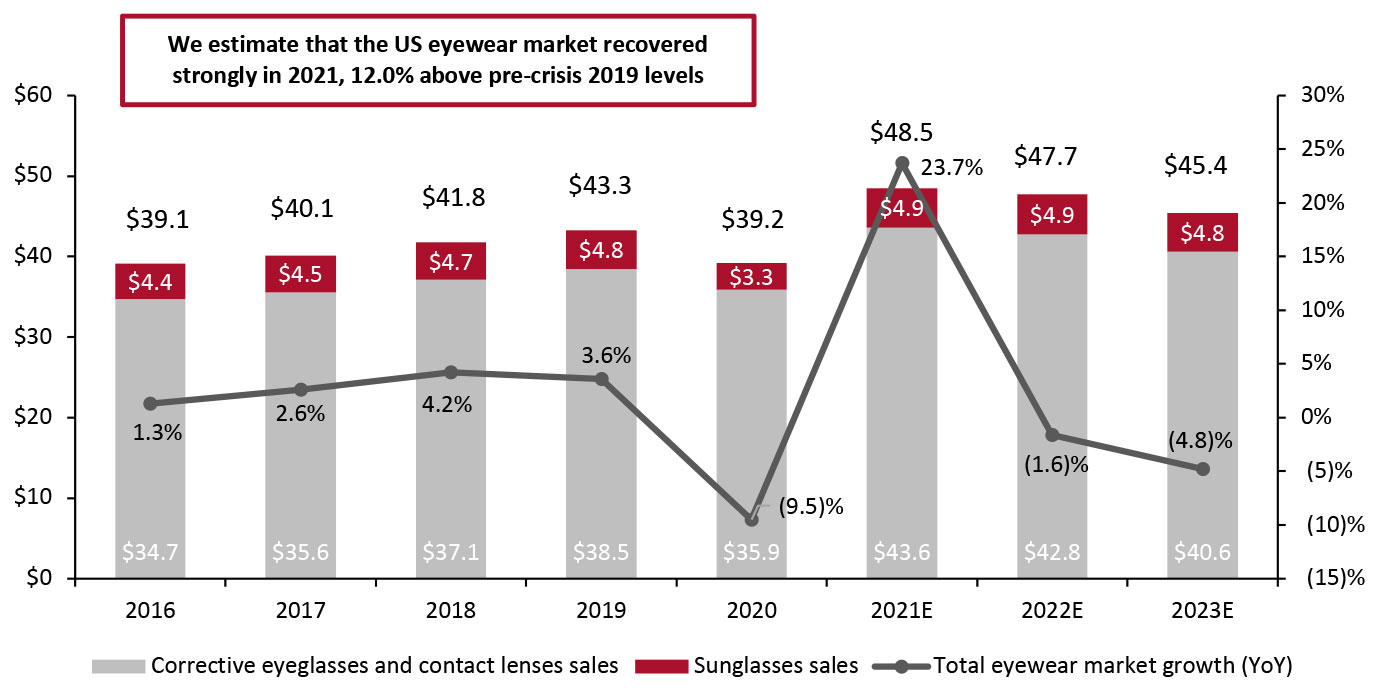

Market Size Amid a retail boom in 2021, including a bounceback in the wider accessories market, Coresight Research estimates that US sales of eyewear to consumers recovered with 23.7% growth in 2021, reaching $48.5billion. We expect demand to ease from that peak with low-single-digit declines in 2022 and 2023 taking total sales closer to the levels seen before the pandemic. Total US eyewear sales declined by 9.5% to $39.2 billion in 2020 amid the pandemic, according to the US Bureau of Economic Analysis (BEA) and Statista. Strong recovery in 2021 can largely be attributed to consumers’ pent-up demand as they delayed eye tests and new eyewear purchases due to store closures and lockdowns in 2020. In discretionary eyewear (such as sunglasses), growth has been supported by stimulus payments to consumers, which boosted fashion accessories markets overall. In addition, myopia (short-sightedness) is becoming increasingly common, driving demand for corrective eyewear products. By category, corrective eyeglasses and contact lenses capture the majority share of the US eyewear market, as shown in Figure 1. Sales in this category declined by 6.7% to $35.9 billion in 2020, according to BEA data, impacted by the store closures during the pandemic. We estimate that sales of corrective eyeglasses and contact lenses recovered with 21.4% growth in 2021, reaching $43.6 billion. We expect pent-up demand to moderate in 2022 and 2023, leading the market to decline by a low-single-digit percentage each of those years. The sunglasses category was among the hardest hit in 2020 due to travel restrictions, store closure and pandemic-driven economic constraints. US sunglasses sales declined by 31.3% to $3.3 billion in 2020, based on Statista data. We estimate that sunglasses sales recovered with 48.5% growth in 2021, reaching $4.9 billion, and we expect to see flat growth in 2022 as travel restrictions gradually ease and consumers return to more normal living patterns. We expect the category to see a low single-digit percentage decline in 2023, returning to more normalized spending levels.Figure 1. US Eyewear Sales by Categories (Left Axis, USD Bil.) and YoY % Change (Right Axis) [caption id="attachment_138643" align="aligncenter" width="701"]

Source: BEA/Statista/Coresight Research[/caption]

Market Drivers

We present six key drivers of growth in the US eyewear market.

1. Pent-Up Demand from Delayed Eyewear Purchases

Pent-up demand was a driver for the US eyewear market in 2021, especially for the corrective eyeglasses and contact lenses categories, as many consumers put off having eye tests or getting new glasses and prescriptions during pandemic-related lockdowns and store closures. In The Vision Council’s US consumer survey on Covid-19-related behavior changes conducted in March 2020, 44% of respondents indicated that they would postpone or cancel their eye exams during Covid-19. Among respondents who reported that they would postpone or cancel their eye exams, 56% stated that they would feel comfortable going to the eye doctor in person to make a purchase after the pandemic.

2. Increased Screen Time

A key driver for the US eyewear market is the proliferation of smartphones, laptops, tablets, TVs and other electronic devices, meaning consumers spend more time looking at electronic screens. Around 80% of US adults report using digital devices for more than two hours per day, with approximately 70% using two or more devices simultaneously, according to The Vision Council. Extensive screen time can be linked to eye problems such as myopia and farsightedness, which typically require glasses or lenses for correction. Increased reliance on digital screens amid the pandemic has heightened this concern. According to non-profit organization Prevent Blindness America, the prevalence of myopia in US adults was 20% in 2020 and is estimated at 23.9% in 2021.

Given that the impacts of the pandemic are still being felt in terms of screen time, we expect the prevalence of myopia and screen-related eye concerns to will continue to rise and drive the US eyewear market.

3. Aging Population in the US

The aging demographic of the US population is also a driver of the US eyewear market, with older consumers more likely to have presbyopia. According to the American Academy of Ophthalmology, Presbyopia is an “age-related condition where the eye's lens doesn't change shape as easily as it once did.”

The number of US consumers aged 65 and over has grown rapidly, increasing by 34.2% from 2010 to 2020 (an increase of 13.8 million people), according to US Census Bureau data released in June last year. This is driven by the population swell in the Baby Boomer generation (those born 1946–1964). For comparison, the number of US consumers aged under 65 has increased by 11.38% in the same period (an increase of 28.3 million people).

The growth in this population group is set to continue and will contribute to an increase in demand for prescription spectacles or contact lenses to correct Presbyopia.

4. Consumers’ Stable Frequency in Obtaining Eye Exams

With most optometrists recommending annual eye examinations as a preventive measure and to identify vision changes, the frequency of eye appointments is generally predictable (extenuating pandemics aside). This results in a frequent replacement cycle for spectacles and recurring revenue for the eyewear market. In addition, contact lenses have a fixed and predictable usage span.

In 2019, an estimated 196 million people who use vision correction devices in the US received 118 million eye exams in the year, implying an average interval between exams of 20 months, according to The Vision Council. The relatively stable frequency of eye examinations and corrective eyewear purchases contributes to growth in the US eyewear market.

5. Expansion of Telemedicine for Eye Exams

Telemedicine (also known as telehealth) allows consumers to access health care remotely, usually via a virtual technology platform. Many vision-care providers are providing telemedicine options to meet evolving consumer demand for contact-free or more convenient eye appointments, which we see as an important driver in the eyewear market. Telemedicine offers multiple advantages, including greater accessibility and convenience in appointment-making, highly trackable data and shareable information, reduced costs for both patients and providers, and often more immediate and personalized care for patients.

6. US Travel Recovery

The US travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis, according to data from the Transportation Security Administration, and stores in areas that depend on tourism have been especially impacted. Travel saw some recovery in the US in 2021, with consumers who accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. A greater return to travel in 2022 would result in welcome gains for tourism-driven retail categories such as sunglasses.

Competitive Landscape

The US eyewear market is fragmented, with the top 10 franchised service providers and independent eyewear retailers accounting for less than 30% of US eyewear sales in 2020.

Among the top 10 eyewear service providers and retailers presented in Figure 2, nine are US-based, showing the strong market positioning of domestic eyewear players.

Source: BEA/Statista/Coresight Research[/caption]

Market Drivers

We present six key drivers of growth in the US eyewear market.

1. Pent-Up Demand from Delayed Eyewear Purchases

Pent-up demand was a driver for the US eyewear market in 2021, especially for the corrective eyeglasses and contact lenses categories, as many consumers put off having eye tests or getting new glasses and prescriptions during pandemic-related lockdowns and store closures. In The Vision Council’s US consumer survey on Covid-19-related behavior changes conducted in March 2020, 44% of respondents indicated that they would postpone or cancel their eye exams during Covid-19. Among respondents who reported that they would postpone or cancel their eye exams, 56% stated that they would feel comfortable going to the eye doctor in person to make a purchase after the pandemic.

2. Increased Screen Time

A key driver for the US eyewear market is the proliferation of smartphones, laptops, tablets, TVs and other electronic devices, meaning consumers spend more time looking at electronic screens. Around 80% of US adults report using digital devices for more than two hours per day, with approximately 70% using two or more devices simultaneously, according to The Vision Council. Extensive screen time can be linked to eye problems such as myopia and farsightedness, which typically require glasses or lenses for correction. Increased reliance on digital screens amid the pandemic has heightened this concern. According to non-profit organization Prevent Blindness America, the prevalence of myopia in US adults was 20% in 2020 and is estimated at 23.9% in 2021.

Given that the impacts of the pandemic are still being felt in terms of screen time, we expect the prevalence of myopia and screen-related eye concerns to will continue to rise and drive the US eyewear market.

3. Aging Population in the US

The aging demographic of the US population is also a driver of the US eyewear market, with older consumers more likely to have presbyopia. According to the American Academy of Ophthalmology, Presbyopia is an “age-related condition where the eye's lens doesn't change shape as easily as it once did.”

The number of US consumers aged 65 and over has grown rapidly, increasing by 34.2% from 2010 to 2020 (an increase of 13.8 million people), according to US Census Bureau data released in June last year. This is driven by the population swell in the Baby Boomer generation (those born 1946–1964). For comparison, the number of US consumers aged under 65 has increased by 11.38% in the same period (an increase of 28.3 million people).

The growth in this population group is set to continue and will contribute to an increase in demand for prescription spectacles or contact lenses to correct Presbyopia.

4. Consumers’ Stable Frequency in Obtaining Eye Exams

With most optometrists recommending annual eye examinations as a preventive measure and to identify vision changes, the frequency of eye appointments is generally predictable (extenuating pandemics aside). This results in a frequent replacement cycle for spectacles and recurring revenue for the eyewear market. In addition, contact lenses have a fixed and predictable usage span.

In 2019, an estimated 196 million people who use vision correction devices in the US received 118 million eye exams in the year, implying an average interval between exams of 20 months, according to The Vision Council. The relatively stable frequency of eye examinations and corrective eyewear purchases contributes to growth in the US eyewear market.

5. Expansion of Telemedicine for Eye Exams

Telemedicine (also known as telehealth) allows consumers to access health care remotely, usually via a virtual technology platform. Many vision-care providers are providing telemedicine options to meet evolving consumer demand for contact-free or more convenient eye appointments, which we see as an important driver in the eyewear market. Telemedicine offers multiple advantages, including greater accessibility and convenience in appointment-making, highly trackable data and shareable information, reduced costs for both patients and providers, and often more immediate and personalized care for patients.

6. US Travel Recovery

The US travel industry—comprising both domestic and international trips—has been hit hard by the pandemic: Air travel declined by more than 90% at the peak of the crisis, according to data from the Transportation Security Administration, and stores in areas that depend on tourism have been especially impacted. Travel saw some recovery in the US in 2021, with consumers who accrued unprecedented pent-up spending power beginning to unleash their pandemic savings on experience spending. A greater return to travel in 2022 would result in welcome gains for tourism-driven retail categories such as sunglasses.

Competitive Landscape

The US eyewear market is fragmented, with the top 10 franchised service providers and independent eyewear retailers accounting for less than 30% of US eyewear sales in 2020.

Among the top 10 eyewear service providers and retailers presented in Figure 2, nine are US-based, showing the strong market positioning of domestic eyewear players.

Figure 2. Top 10 US Eyewear Retailers: Revenue (USD Bil.) [wpdatatable id=1573 table_view=regular]

National Vision Holdings Inc. operates a select number of Walmart Vision Center locations so the revenue includes part of Walmart Vision Center’s revenue. Source: Company reports/Vision Monday/Coresight Research Digitally Native Eyewear Brands and Retailers in the Competitive Landscape Over the last two decades, many digitally native retailers and brands have emerged online to sell directly to consumers via their own websites, with some later expanding to include a brick-and-mortar presence. Digitally native eyewear brands and retailers that sell in the US have seen success in recent years—with the pandemic-driven shift to e-commerce proving conducive to the success of their business models. The current competitive landscape of US digitally native eyewear brands and retailers is dominated by Warby Parker ($394 million global revenue in 2020), EyeglassesUSA.com ($374 million global revenue in 2020) and Zenni Optical ($329 million global revenue in 2020).

Figure 3. Selected List of US Digitally Native Eyewear Brands and Retailers: Revenue (USD Mil.) [wpdatatable id=1574 table_view=regular]

Source: Company reports/ecommerceDB Eyewear E-Commerce Total US online eyewear sales reached $2.0 billion in 2020 and $2.9 billion in 2021, according to Statista. That equates to e-commerce penetration of 5.1% of the total market in 2020 and 5.9% in 2021. Although e-commerce sales are currently low within the total market, we are increasingly seeing consumers using online tools to learn about eyewear products, prices and sellers, and we expect the penetration rate to increase in the next few years. According to The Vision Council, 30% of eyeglass buyers went online to compare prices, find spectacle frames, or locate eyewear professionals in 2020, and 80% of consumers who bought eyewear said they would use the Internet for assistance with future purchases. This indicates that the eyewear online shopping trend is set to stay—companies that provide digital sales, advice and virtual try-on services will benefit from this trend. Eyewear brands and retailers are expanding their digital capabilities in light of this shift toward online. We are seeing virtual try-on as the first service provided by eyewear retailers and brands looking to implement digital transformation.

Figure 4. Selected List of US Eyewear Retailers: Digital Transformation Activities [wpdatatable id=1575 table_view=regular]

Source: Company reports Eyewear Market Headwinds We highlight two principal headwinds in the US eyewear market. 1. Supply Chain Costs Increases in component costs and shipping costs, alongside longer lead times and supply shortages, could disrupt eyewear supply chains. The following factors are likely to impact supply chain costs:

- Components: The prices of materials typically used for eyewear, such as aluminum, flexon, model silver, stainless steel, titanium, wood and zylonite have seen increases in 2021.

- Shipping: Key US carriers including FedEx, UPS and USPS are levying more on shipping.

- Lead times: Shipping times have increased due to congestion at ports for unloading goods and distributing them via land transport

- Shortages: There have been a variety of labor shortages, which were exacerbated during the pandemic, largely due to lockdowns and international trade relations.

What We Think

Implications for Traditional Eyewear Brands/Retailers- Pent-up demand for delayed eyewear purchases, increased screen time, the aging population and travel recovery in the US drove strong recovery in the eyewear market in 2021. Although we expect spending to normalize in 2022 and 2023 with low-single-digit declines, we believe that the almost-$50 billion US eyewear market presents major opportunities for eyewear brands and retailers to capture—particularly given that it is highly fragmented.

- Traditional eyewear brands and retailers may still face limited traffic in their physical locations as the impact of the pandemic persists. This makes online transformation increasingly important. Increasing online sales capabilities and virtual try-on services are good starting points.

- Digitally native eyewear brands should refine their strong digital presences, fast delivery offerings and digital consumer engagement strategies to capitalize on opportunities in the market.

- Digitally native eyewear brands need to differentiate themselves from mass eyewear retailers and brands, such as offering low prices or sustainably made eyeglasses.