Nitheesh NH

What’s the Story?

As consumers migrated to sportswear and athleisure from around 2015, the US denim market endured a tough few years. However, it saw a revival from 2018, largely driven by new sustainable offerings, a wider range of denim fits, and fashion trends in streetwear and vintage, as well as the rise of casual workplace dress codes. Although the Covid-19 pandemic has interrupted the category’s newly positive trajectory this year, we expect denim to see a stronger period post-crisis than it did in the years before 2018. In this report, we look at key trends in the US denim market, including those that will help support a return to growth after 2020. We examine what retailers and brands are doing to better serve this market and leverage the opportunities it presents. Brands are implementing more sustainable manufacturing practices as well as investing in technological innovation to satisfy consumer demand. As denim continues to evolve, the market is expected to grow at a steady rate.Why It Matters

Denim has been an important apparel category for decades, due to its deep-rooted cultural relevance with most Americans. However, denim sales have fallen sharply amid the coronavirus crisis, with brands such as Lucky Brand Jeans and True Religion filing for bankruptcy, and Levi’s revenue declining. Meanwhile, athleisure retailers such as Lululemon are experiencing a sales lift. This report looks at how the category has been impacted by Covid-19 and the future growth drivers in the market. As consumers increasingly adopt comfortable apparel, existing denim brands are innovating and adding functionality to their products. More companies are also extending their product offerings into activewear and athleisure. We provide retailer and consumers insights into the future of denim in the US retail industry.Denim Market Overview

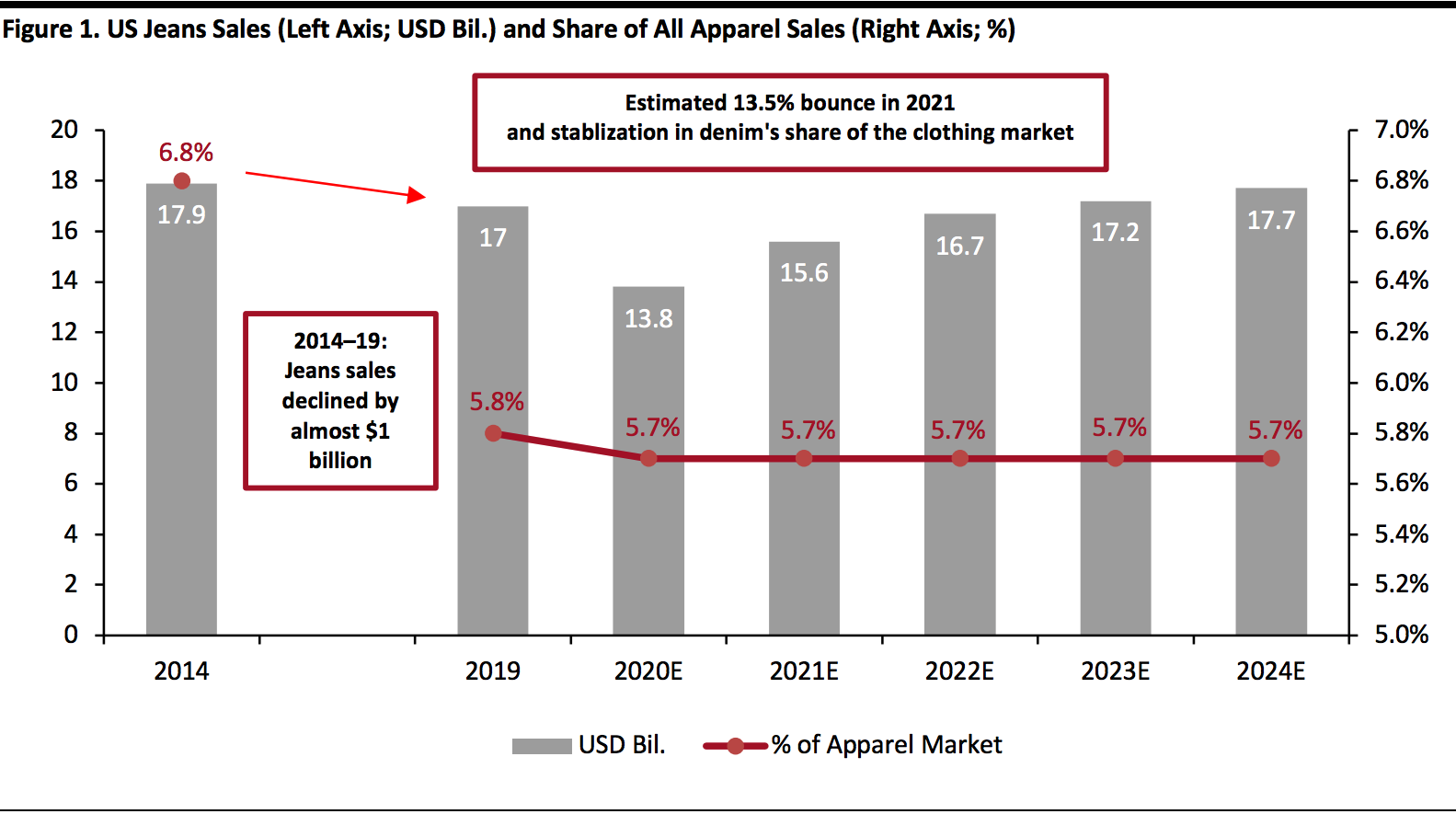

In the five years ended 2019, the US jeans market saw an almost $1 billion ($938 million) decline in annual sales. As charted in Figure 1, the decline represented a one-percentage-point attrition in terms of share of the US clothing market, as consumers opted for apparel alternatives such as sportswear. The market turned a corner in 2018, by returning to mildly positive growth. Following an estimated double-digit (18.9%) decline due to the Covid-19 crisis in 2020, Euromonitor International is predicting a 13.5% bounce in 2021, further recovery of 7.0% in 2022 and growth broadly in line with the total market in 2023—representing a stabilization of denim’s share of the clothing market. [caption id="attachment_119075" align="aligncenter" width="700"] Source: Euromonitor International Limited 2020 © All rights reserved/Coresight Research[/caption]

Within the $13.8 billion estimate for the total jeans market for 2020, women’s jeans account for $7.5 billion, and the men’s jeans market accounts for $6.2 billion, with the remainder attributed to childrenswear, according to Euromonitor International. We expect to see the women’s jeans share of the overall market grow by 2023.

We are already seeing denim brands focusing on expansion in the women’s market:

Source: Euromonitor International Limited 2020 © All rights reserved/Coresight Research[/caption]

Within the $13.8 billion estimate for the total jeans market for 2020, women’s jeans account for $7.5 billion, and the men’s jeans market accounts for $6.2 billion, with the remainder attributed to childrenswear, according to Euromonitor International. We expect to see the women’s jeans share of the overall market grow by 2023.

We are already seeing denim brands focusing on expansion in the women’s market:

- Wrangler introduced a women’s denim workwear line in March 2020.

- Fashion Nova partnered with American rapper Megan Thee Stallion in September 2020 to create a denim line specifically for tall women.

- Premium denim brand DL1961 recently launched a fall capsule range for women and girls that features sustainably made denim garments.

- Levi’s reported in its third-quarter 2020 earnings call that in its top 10 wholesale accounts, the women's business grew by 13% year over year, globally. Women's bottoms delivered half of the quarter's total levi.com growth, with strong performance in 501 shorts, crop, ribcage and 721 high-rise fits.

Source: Coresight Research

Trends for the US Denim Market

We discuss four trends in the US denim market, along with a number of factors that support our expectation for improved category performance post 2020. Trend 1: Casualization The casualization of apparel, including in workplaces (when people actually attend them), is transforming the denim market. As consumers have become increasingly accustomed to the comfort of sportswear (and, in 2020, increasingly accustomed to wearing what they like while working from home), many are also expecting greater comfort in their denim purchases. We are seeing brands upgrade their denim business strategy with a wider range of designs, crops and inseams for different body shapes and preferences. The trend of product offerings is also moving from rigid skinny jeans to modern cuts with looser fits, straight legs, high-rise cuts and ankle crop lengths. [caption id="attachment_119077" align="aligncenter" width="580"] Levi’s loose-fit, high-rise jeans (left); and Athleta’s straight-leg ankle jeans (right)

Levi’s loose-fit, high-rise jeans (left); and Athleta’s straight-leg ankle jeans (right)Source: Levi’s/Athleta[/caption] Due to the influence of the pandemic and consumer shifts to apparel types with soft and elastic fabrics such as athleisure, denim categories such as jeggings and looser jeans styles will likely enjoy high sales in fall/winter 2020 and into 2021. Straight leg, wide leg, high rise and flares were the top-selling denim fits in the first quarter of 2020, with miniskirts, shirts and shorts just behind, according to market intelligence firm Edited. Figure 3. Selected Denim Brands’ and Retailers’ Product Strategies and Recent Offerings [wpdatatable id=546]

Source: Company reports

Trend 2: Sustainable Denim Conscious consumption is gaining traction, and denim is leading the sustainable fashion trend in the US. We are seeing more denim brands implement eco-friendly manufacturing processes in response to growing consumer demand for sustainability. It is important that retailers and brands adopt sustainable practices that minimize the environmental impact of their products and operations. In August 2020, Coresight Research found that 29% of US consumers believe the coronavirus crisis has made sustainability more of a factor in purchase decisions. As shown in Figure 4, more denim brands now focus on fabric innovation to reduce reliance on traditional fabrics, such as virgin cotton, as well as looking for more dyes that minimize harmful chemical use and reduce water consumption. Popular responsible fabric alternatives including Tencel. Brands are also disclosing more information about the manufacturing process of their products, from fibers to finished goods. We expect to see sustainable fibers and product recyclability be key themes for the denim market over the next five years. Figure 4. Selected Denim Sellers’ Actions on Sustainability [wpdatatable id=547]Source: Company reports/Coresight Research

Trend 3: Denim Brands Collaborations We are seeing ongoing cross-branding and celebrity collaborations for denim even in this volatile retail environment in 2020. Collaborating with denim brands will help retailers expand into complementary markets and attract new customers.- Lee, another subsidiary brand of Kontoor Brands, collaborated with men’s clothing brand Alfie to debut a collection of White Oak selvedge denim in October 2020.

- Levi’s has been at the forefront of brand collaboration.

- Earlier in 2020, the brand launched a spring collection focused on youthful optimism in partnership with celebrities Hailey Bieber and Jaden Smith.

- The brand also collaborated with New Balance on denim-clad sneakers, which sold out everywhere within seconds of the product’s launch on October 29, 2020, including on newbalance.com and Alibaba’s Tmall e-commerce platform.

- Levi’s has announced plans to team up with Danish fashion brand Ganni on an exclusive rental-only capsule collection, which will feature three staple denim pieces, a button-down shirt, 501 jeans and a shirt dress—all of which have been made from upcycled vintage Levi’s products and repurposed denim.

- LEGO and Levi’s launched a new collaboration on limited-edition “wearable art” apparel in October 2020.

- J Brand’s collaboration with Halpern on a capsule collection launched on September 3, 2020. The collection merges colors, patterns and textures for a series of stand-out looks. J Brand has previously worked with emerging designers and fashion figures such as Bella Freud, Christopher Kane and Kozaburo Akasaka.

- Wrangler has looked to collaborations to reach a younger and more diverse consumer base. In May 2020, the brand collaborated with music artists Diplo on for the release of his highly anticipated country album. The brand also worked with the Marley family to launch a limited-edition collection and reggae influencers to revive singer-songwriter Bob Marley's favorite Wrangler styles.

Levi’s collaboration with New Balance on denim sneakers (left); and J Brand’s collaboration with Halpern

Levi’s collaboration with New Balance on denim sneakers (left); and J Brand’s collaboration with HalpernSource: Levi’s/J Brand[/caption] Trend 4: Technology-Fueled Transformation The denim market continues to diversify, driven by consumer desires for comfort, performance and style. This trend presents innovation opportunities as retailers evolve to meet consumer demand. More companies are using technological innovation to create synthetic fibers that can offer enhanced functionality for denim or optimize supply chains.

- Levi’s uses F.L.X laser finishing technology to reduce lead times to better match inventory with current demand trends.

- Fiber production company LYCRA offers a DUALFX fiber technology that is designed to address customer requirements for high-stretch jeans that keep their shape. Traditionally, stretchy jeans would become loose and shapeless after multiple wears, but LYCRA uses dual-core and bi-component yarns to create a high-stretch fabric that has recovery power.

- Tencel’s Refibra technology is now used to make sustainable denim cellulosic fibers such as Lyocell and modal fibers that are tailored to a sustainable lifestyle due to the low amounts of water used in production.

- COOLMAX Invista’s technology is helping brands to create jeans, jackets and shirts that are easy to care for and transport moisture away from the body to keep the wearer cool and dry.

- Good American leverages power-stretch technology to produce comfortable jeans that adapt to the shape of the wearer’s body.

What We Think

Implications for Apparel Brands and Retailers- We believe a post-crisis recovery will drive denim to grow significantly in 2021, although the US denim market has seen an estimated double-digit (18.9%) decline due to the Covid-19 crisis in 2020. Denim retailers and brands should adjust their product mix to suit consumers seeking value, by offering economy and standard denim in the next three to five years.

- The rising casualization trend is impacting the category, with a move away from tight, skinny styles to modern cuts with straight legs and high-rise designs. We recommend that denim brands and retailers diversify their offerings to include more casual styles such as jeggings, straight jeans and high-rise ankle crop jeans.

- As consumers are becoming more conscious of the importance of sustainability, it is important for denim brands to reduce environmental impacts with water-saving technologies and sustainable fibers.

- Denim is evolving to carry more performance functions, such as moisture management and thermal control. In the future, we expect to see more brands leveraging advanced technologies to add performance functions, improve product durability and optimize denim’s flexible fit.

- Cross-brand and celebrity collaborations in denim are still growing as a way to drive consumer engagement and increase brand awareness. In this increasingly digital world, we see a promising future in online collaboration between brands and between brands and celebrities.

Source for all Euromonitor data: Euromonitor International Limited 2020 © All rights reserved