Executive Summary

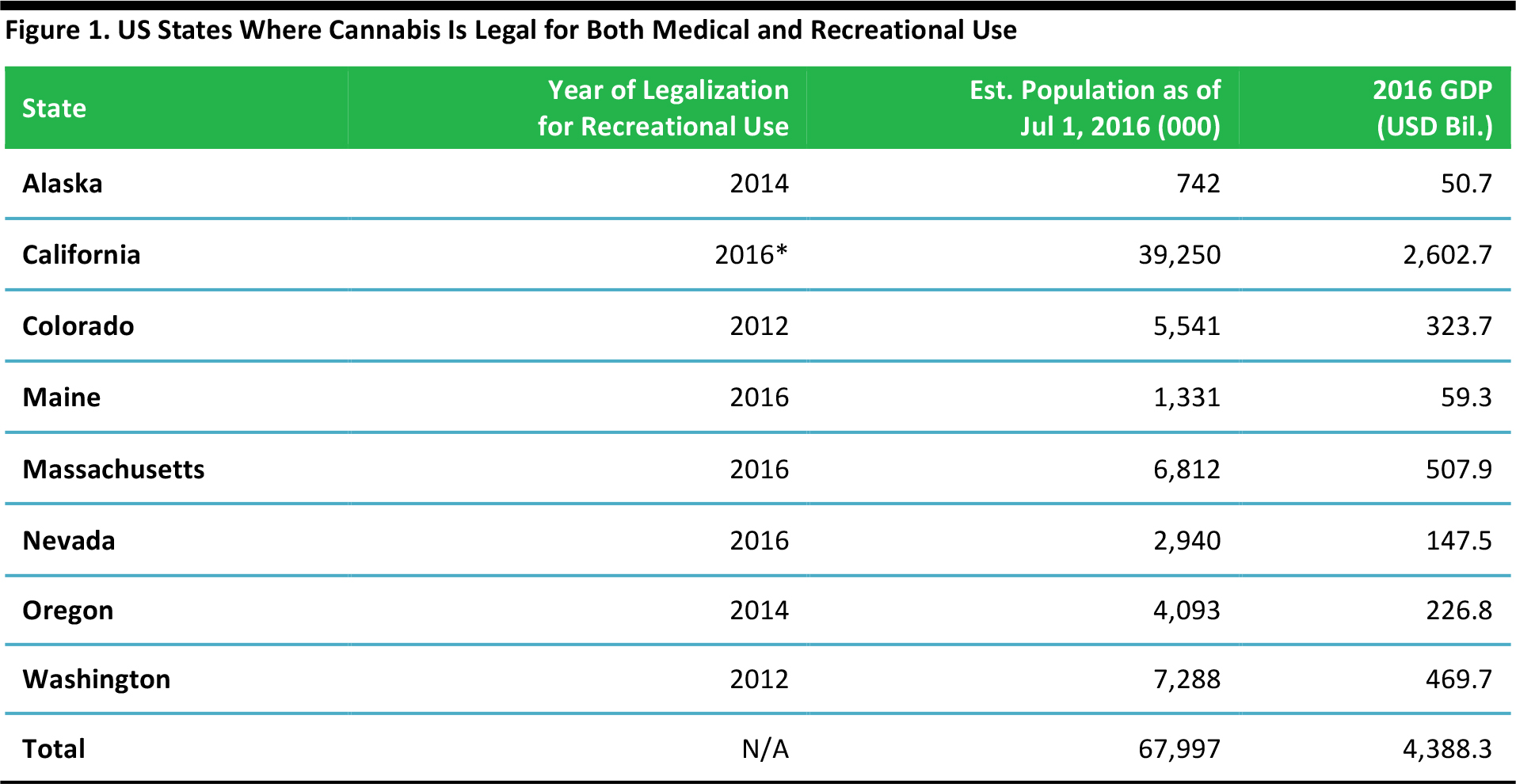

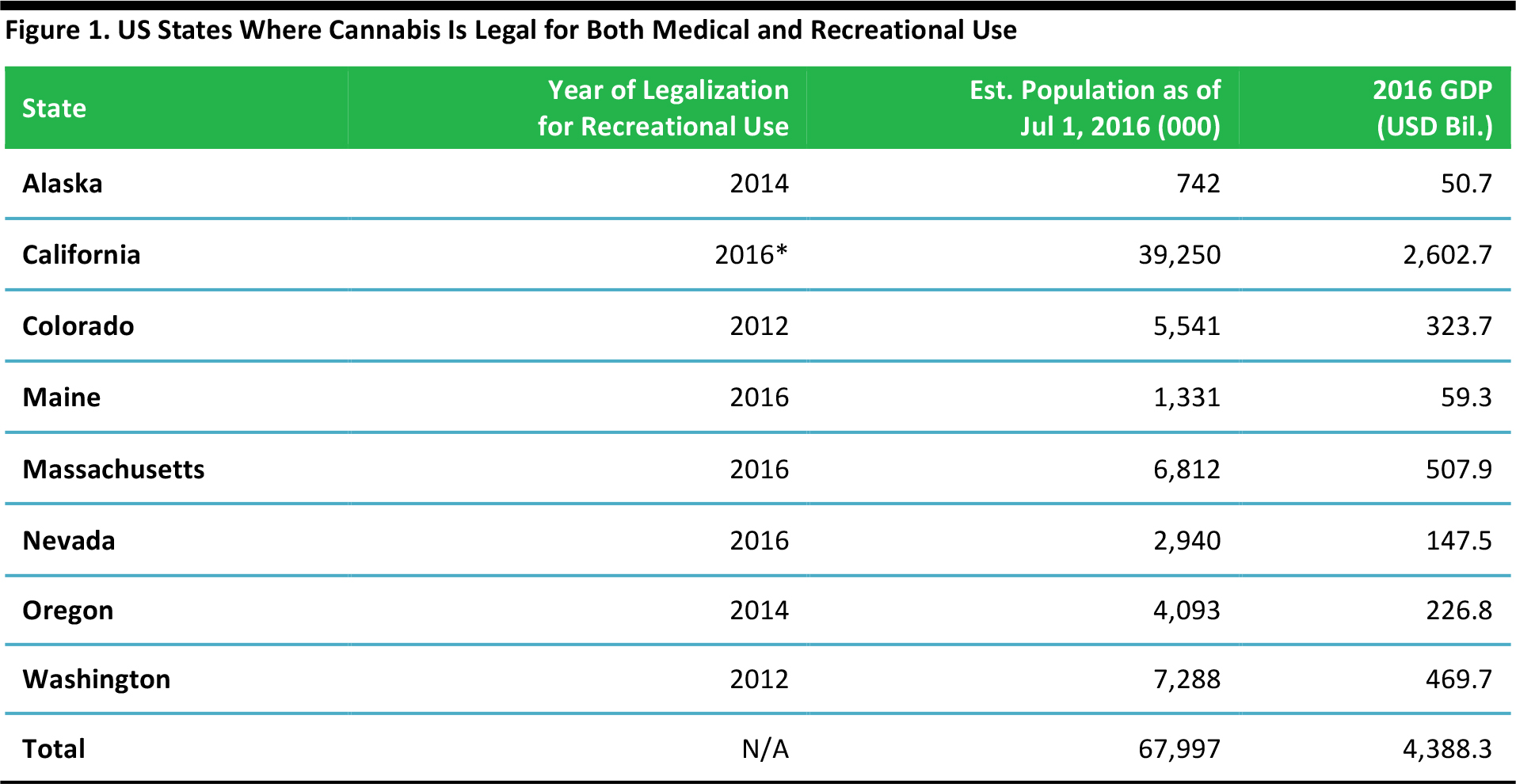

Since 2012, a number of US states, including Colorado, Washington and, most recently, California, have passed legislation legalizing the recreational use of cannabis products. At the time of writing, eight states have legalized recreational marijuana. Considered together, these states represent 21% of the total US population and 24% of total US GDP. Other US states and neighboring Canada are expected to follow suit, meaning that the North American market for legal marijuana is likely to grow further.

The “cannabusiness” market is growing fast. Specialist publication

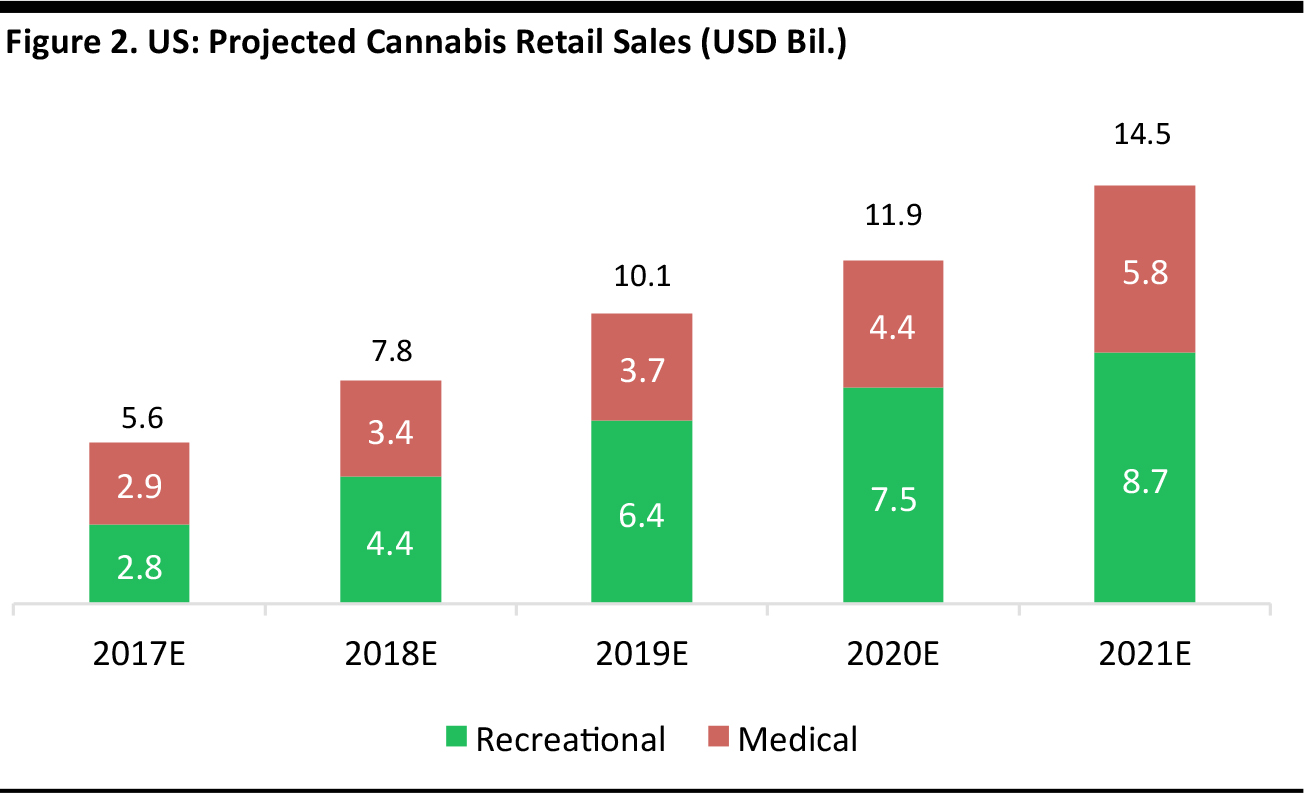

Marijuana Business Daily estimated that legal, recreational cannabis sales in the US increased by 80% year over year in 2016, reaching $1.8 billion, and that the total market—for both medical and recreational cannabis—reached some $4.0–$4.5 billion. The publication further estimated that the medical and recreational cannabis markets combined will reach $11.9–$17.1 billion by 2021.

Legal ambiguity is the main threat to the future expansion of the cannabis industry in the US. While eight states have legalized medical and recreational use of marijuana, cannabis production, trade and consumption is still illegal at the federal level in the US. This prevents cannabis companies from accessing banking services, which are regulated by federal laws and, in general, casts uncertainty on the prospects of the companies operating in the market, given that the legal framework could change.

The legal cannabis industry, by generating revenue and employment, has had a positive impact on the economies of the states in which it operates. In 2015, the cannabis industry in Colorado generated $121 million in excise tax revenue, 18,005 new full-time jobs, a number of new companies and demand for commercial properties, and increased tourism, according to research organization the Marijuana Policy Group.

The projected growth of the US cannabis industry has attracted investment in new businesses. According to financial advisory firm Viridian Capital Advisors, the legal cannabis industry raised more than $1 billion in funding in 2016, and

Marijuana Business Daily estimated that there were 21,000–33,000 legal cannabis businesses operating in the US last year. This implies that competitive pressure on companies operating in the market is growing, and that barriers to entry will be higher.

Despite growing competition, there are still plenty of opportunities for companies entering the cannabis market in the US. Most companies operating in the market remain profitable, and 18% of the industry players were considered very profitable in 2016, according to

Marijuana Business Daily. The legalization of recreational marijuana in California beginning in 2018 should unleash further growth.

Introduction

In this report, we provide an overview of the regulated cannabis market in the US and the impact that regulation of the sale of recreational cannabis products has had on the economies of the states that have legalized the production, retailing and consumption of such products.

We focus on the US states that have fully legalized the cultivation, consumption and sale of cannabis products for both medical and recreational use through a regulated market. Other countries that have not formally legalized the industry, such as the Netherlands and Spain—despite some having a very liberal attitude toward cannabis consumption—are not considered here.

Cannabis-Friendly States: A Quarter of the US Economy

Since 1996, the US has seen a wave of laws aimed at regulating the production, trade and consumption of cannabis products. California’s Proposition 215 in 1996 was the first legislation in the US to legalize medical marijuana usage and cultivation. Since 2012, a number of US states have legalized recreational use of cannabis products. According to public charity ProCon.org, as of 2017, cannabis is legal for medical use in 29 states. Of these, the eight states listed below have also legalized recreational use of cannabis products.

*Sales of recreational cannabis will start in January 2018.

Source: The Guardian/USA Today/BusinessInsider.com/CNN.com/The Boston Globe/The Washington Post/US Bureau of Economic Analysis/US Census Bureau/FGRT

*Sales of recreational cannabis will start in January 2018.

Source: The Guardian/USA Today/BusinessInsider.com/CNN.com/The Boston Globe/The Washington Post/US Bureau of Economic Analysis/US Census Bureau/FGRT

To provide a sense of the scale of the cannabis market in the US, we included the population and the GDP of each state listed above. Considered together, the states where cannabis is legal for both medical and recreational use represent 21% of the total US population and 24% of total US GDP. California’s economy alone is so large that it compares in absolute terms with some of the world’s most advanced economies, such as France and the UK.

The government of Canada is also planning to legalize cannabis products for recreational use, and it introduced legislation in April 2017 proposing that adults be allowed to buy small amounts of cannabis for personal use by June 2018. Canada would be the first G7 country to regulate the cannabis market and, given its proximity to the US and the strong trade links between the two countries, it is easy to imagine that legalization in Canada would further expand the market size for cannabis companies operating in the US.

Within the Americas, Uruguay is the one other nation that has legalized the cannabis market to date. The South American country fully legalized the production and sale of cannabis products in December 2013, but the market is tightly controlled by the state. Retail distribution is done through pharmacies, while production is licensed by the government to two companies, International Cannabis Corporation and Simbiosys. This system leaves little room for other private enterprises to serve the market.

The Rapid Expansion of the US Cannabis Industry

Data on the actual size of the cannabis industry in the US are still scarce, given that the country is still in the early days of legalization and that there are several limitations on the way information is collected. The US federal government does not track the cannabis market, as cannabis cultivation and sale are still not legal at the federal level. In addition, there are differences in the way each state approaches the industry, most companies that operate in the cannabis sector are privately owned and tax returns for medical dispensaries are not publicly available—all of which make data collection difficult.

Marijuana Business Daily estimated that legal recreational cannabis sales in the US increased by 80% year over year in 2016, to $1.8 billion, and that the total market—including both medical and recreational cannabis—reached $4.0–$4.5 billion.

Source: iStockphoto

For 2017,

Marijuana Business Daily estimates that legal recreational marijuana sales in the US could grow by up to 61% year over year, to $2.6–$2.9 billion, while legal recreational and medical marijuana sales could grow by 35% year over year, to $5.1–$6.1 billion.

Historical data for the recreational cannabis market are available for the states of Colorado and Washington, which pioneered the regulation of the recreational cannabis business in 2012. These figures show the remarkable growth of the market in the years following legalization

- In Colorado, legal sales of cannabis products increased by 42.5% in one year, from $699.2 million in 2014 to $996.2 million in 2015, according to the Marijuana Policy Group. Sales of recreational cannabis increased by 87.7% in one year, from $313.2 million in 2014 to $587.8 million in 2015.

- In Washington, legal cannabis product retail sales jumped from $323 million in 2015 to $696 million in 2016, representing growth of 115% in just one year, according to 502 Data, a website that tracks statistics for the cannabis industry of Washington.

With large states such as California now entering the recreational marijuana market,

Marijuana Business Daily estimates that US recreational cannabis retail sales will reach $7.1–$10.3 billion by 2021. The publication further estimates that the combined medical and recreational cannabis market will reach $11.9–$17.1 billion by 2021.

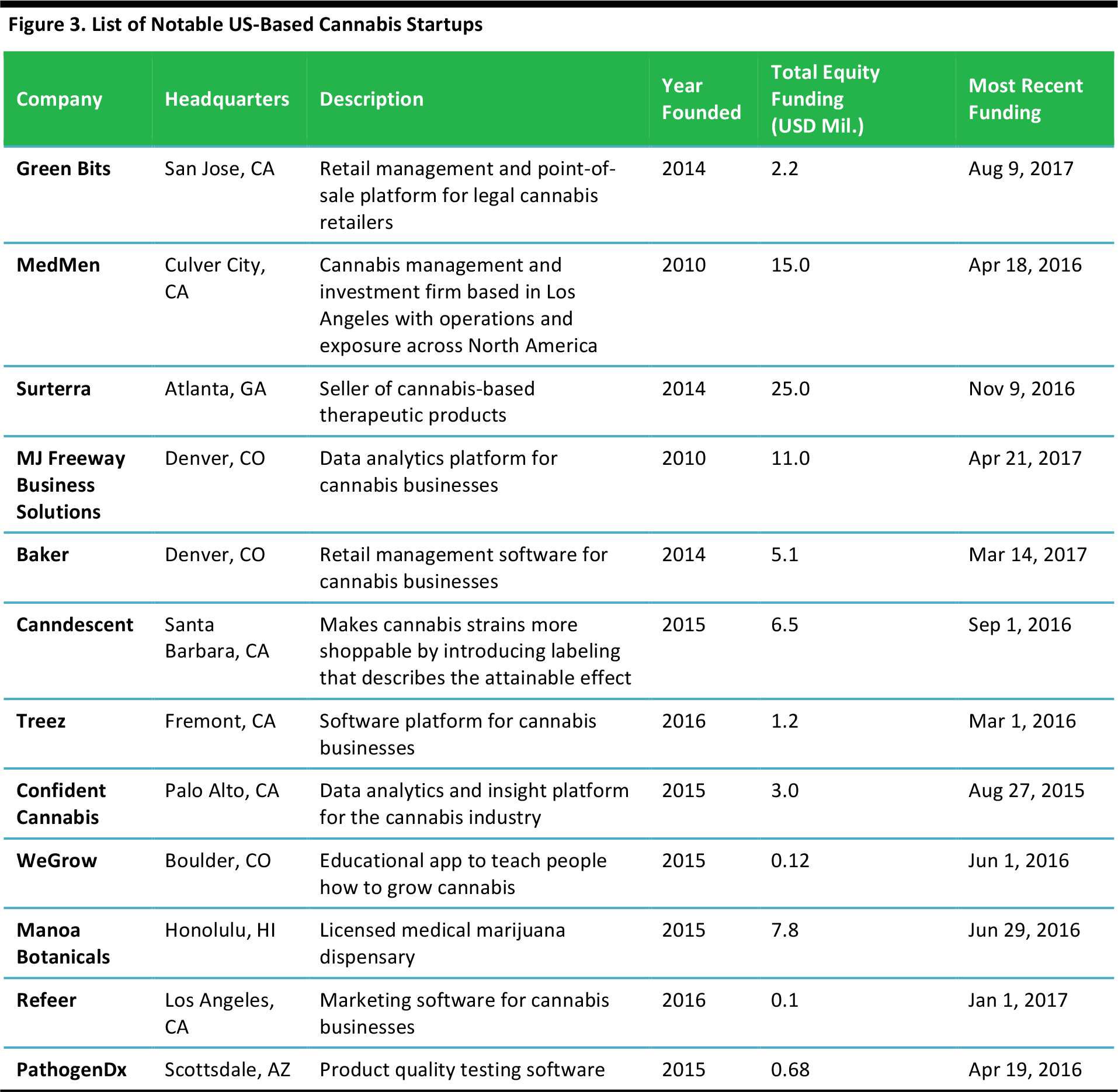

The graph below shows the midpoint of the annual sales value ranges estimated by

Marijuana Business Daily for the US cannabis market for the period 2017–2021. The graph indicates that total cannabis sales will grow by 159% during the next four years, while recreational marijuana sales will grow by 216%.

Source: Marijuana Business Daily/FGRT

The growth estimates outlined above reflect the fact that the legal cannabis market is likely to increase substantially for the next few years, as it is a new market that will be going through the first stage of growth. In the longer run, growth is expected to slow down as the market matures.

Regulatory Ambiguity Could Hinder Future Growth

The ambiguity regarding the legal status of the cannabis industry is the main threat to its future expansion in the US. While many states have legalized medical and recreational use of marijuana, the production, trade and consumption of cannabis are still illegal at the federal level, leaving a window of uncertainty that affects operators within the industry. In particular:

- Cannabis businesses remain concerned about possible intervention to enforce federal laws. The threat of federal intervention is the top concern within the American marijuana industry, according to a survey undertaken in 2017 by Marijuana Business Daily.

- Cannabis businesses cannot access banking services, since banks need to comply with federal laws that still consider cannabis firms’ activities as violations of federal drug laws. Banks could face penalties for enabling marijuana sales transactions. Accordingly, very few banks currently offer banking services to firms related to the cannabis business.

This lack of access to banking services has had severe consequences for cannabis businesses. Since they cannot access banking services, cannabis businesses must operate on a cash basis, which raises safety concerns, as the businesses become easy targets for thieves. Moreover, cannabis businesses cannot rely on banks for access to funding, and institutional investors are prevented from investing in the industry. As a result, the cannabis industry mostly relies on private investors, venture capital and private equity firms for funding.

The Cannabis Industry Is Good for the Economy

By generating revenue and jobs, the regulated cannabis industry contributes to the economy of those states in which it operates. The legal cannabis industry generates tax revenue for state and local authorities and jobs for the local workforce. Income earned by employees in the cannabis industry is, in turn, spent on products and services such as groceries and housing. The real estate sector benefits from the space used as business premises by retailers and growers. Ancillary industries, such as plant-growing equipment providers and logistics services, also benefit from the growth of the cannabis industry, while cannabis-related tourism provides a further economic benefit.

In Colorado, the legal cannabis industry generated $2.4 billion in economic output in 2015, according to the Marijuana Policy Group. Given that cannabis product sales in Colorado that year totaled $996.2 million, that means that every dollar spent on cannabis generated $2.40 of economic impact.

In comparison, in 2015, the economic impacts from the total retail trade and business services in Colorado were $1.90 and $2.30, respectively, according to the Marijuana Policy Group. Because the different regulatory environments in each state discourage interstate business operations, the cannabis market is highly localized, and its economic impact tends to be higher than that of other industries.

If we take the economic impact of the cannabis industry in Colorado as a model for the US ($2.40 for each dollar spent) and consider that total legal cannabis sales in 2017 are estimated to reach approximately $5.6 billion, we can estimate that the total economic impact of the cannabis industry in the US will be $13.4 billion in 2017.

Marijuana Business Daily provides an even more positive outlook of the impact of the cannabis industry on the US economy. The publication estimates that the total economic impact of the industry in 2017 will be $16.0–$18.0 billion and will soar to $70 billion annually by 2021.

Source: iStockphoto

As a first mover, Colorado can provide a factual example of the impact of the cannabis industry on state economies. The Marijuana Policy Group lists the following as some of the economic benefits the industry has brought to Colorado:

- In 2015, marijuana was the second-largest excise tax revenue source, at $121 million—three times higher than alcohol.

- Warehouse space that was previously underutilized is now in great demand for indoor cultivation operations, manufacturing and warehousing.

- The Front Range—the urban corridor that includes the city of Denver—has seen a significant increase in the number of new cannabis-related businesses and it is now labeled “the Silicon Valley of Cannabis.”

- The cannabis industry generated 18,005 new full-time jobs in 2015 in Colorado. Of these, 12,591 were directly connected with the cannabis production and retail industry, while 5,414 were generated by ancillary industries and the increased consumer spending generated by those employed in the cannabis industry.

- The legalization of recreational marijuana has prompted cannabis tourism in Colorado. Tourism operators such as My 420 Tours organize cannabis-themed vacations with visits to greenhouses and dispensaries.

Demand for cannabis products from out-of-state visitors to Colorado grew from 8.9 metric tons in 2014 to 14.0 metric tons in 2015, an increase of 57.3%. Demand from out-of-staters is expected to reach 55.1 metric tons in 2020, according to the Marijuana Policy Group.

In preparation for the start of legal recreational marijuana sales in California in 2018, businesses in that state are already investing in cannabis-related tourism. America Green, an Arizona-based cannabis company, bought the town of Nipton, California, to turn it in a marijuana tourism destination. The town is located on the border with Arizona, three hours’ drive from Los Angeles and one hour from Las Vegas. With this project, America Green is demonstrating its ambition to show how the cannabis industry can revitalize the economy of peripheral areas in the US.

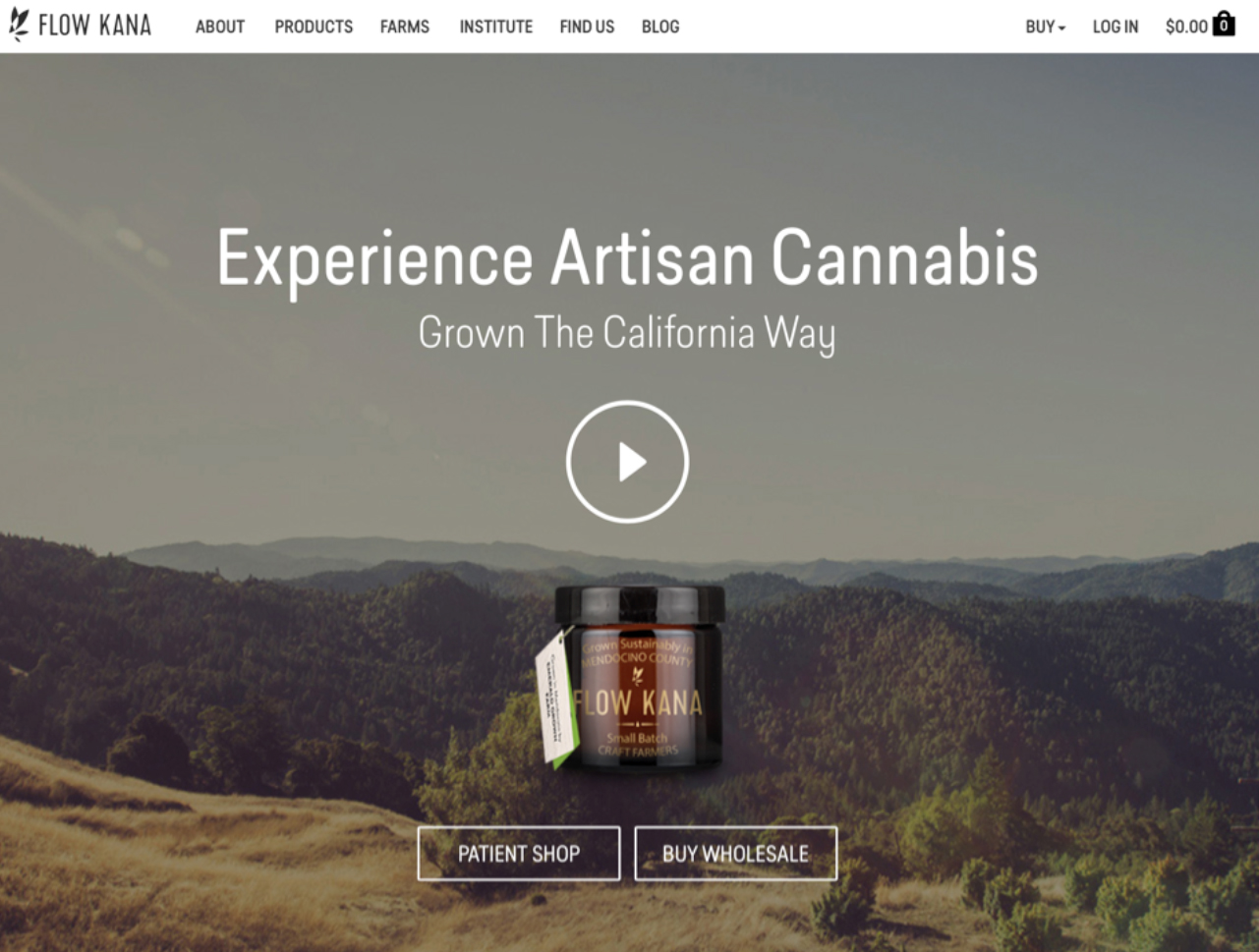

Some entrepreneurs see the potential of combining wine and cannabis tourism in Northern California. Industry association the Wine Industry Network organized a symposium on August 3 for wine industry operators to explore the opportunities that the legalization of cannabis presents to the California wine industry. The cannabis industry is already expanding in California’s wine-producing regions. In 2017, Flow Kana, a Californian cannabis business, bought an 80-acre property in Mendocino County—a wine-producing region in California—to turn it into a marijuana campus that includes research facilities and a wellness retreat.

Source: Flowkana.com

Competition Intensifies as the Market Expands

With the market for recreational marijuana projected to grow fast, investment in the industry is also continuing to grow. According to Viridian Capital Advisors, companies in the cannabis industry raised more than $1 billion in 2016. Also in 2016, private equity firm Tuatara Capital raised $93 million for investment in cannabis businesses, a record for the sector, according to news website BusinessInsider.com.

Source: iStockphoto

Companies entering the market are confronted with increasing competition.

Marijuana Business Daily estimated that there were 21,000–33,000 cannabis businesses in the US in 2016. At the time of writing, there were 859 companies listed as “marijuana startups” on new business directory AngelList, with an average valuation of $4.2 million.

As more companies and investment funds enter the market, the barriers to entry for new businesses are increasing and startup costs are rising rapidly. In early 2016, about 70% of cannabis companies said they reached break-even or profitability in one year, while so far in 2017, that percentage has dropped to 55%, according to surveys conducted by

Marijuana Business Daily.

In Colorado, the industry has already started to consolidate, with larger and more competitive companies growing, while smaller, less competitive firms struggle. Some have already exited the market, according to the Marijuana Policy Group. High compliance costs have also contributed to the consolidation of the industry in Colorado, as many smaller operations face difficulty in properly complying with the state’s complex regulations governing the legal cannabis sector.

Despite the increasing competition and increasing barriers to entry, the industry retains plentiful opportunities, particularly given the upcoming legalization of recreational cannabis in large markets such as California and Canada.

Most of the companies operating in the industry are still young and profitable businesses. According to

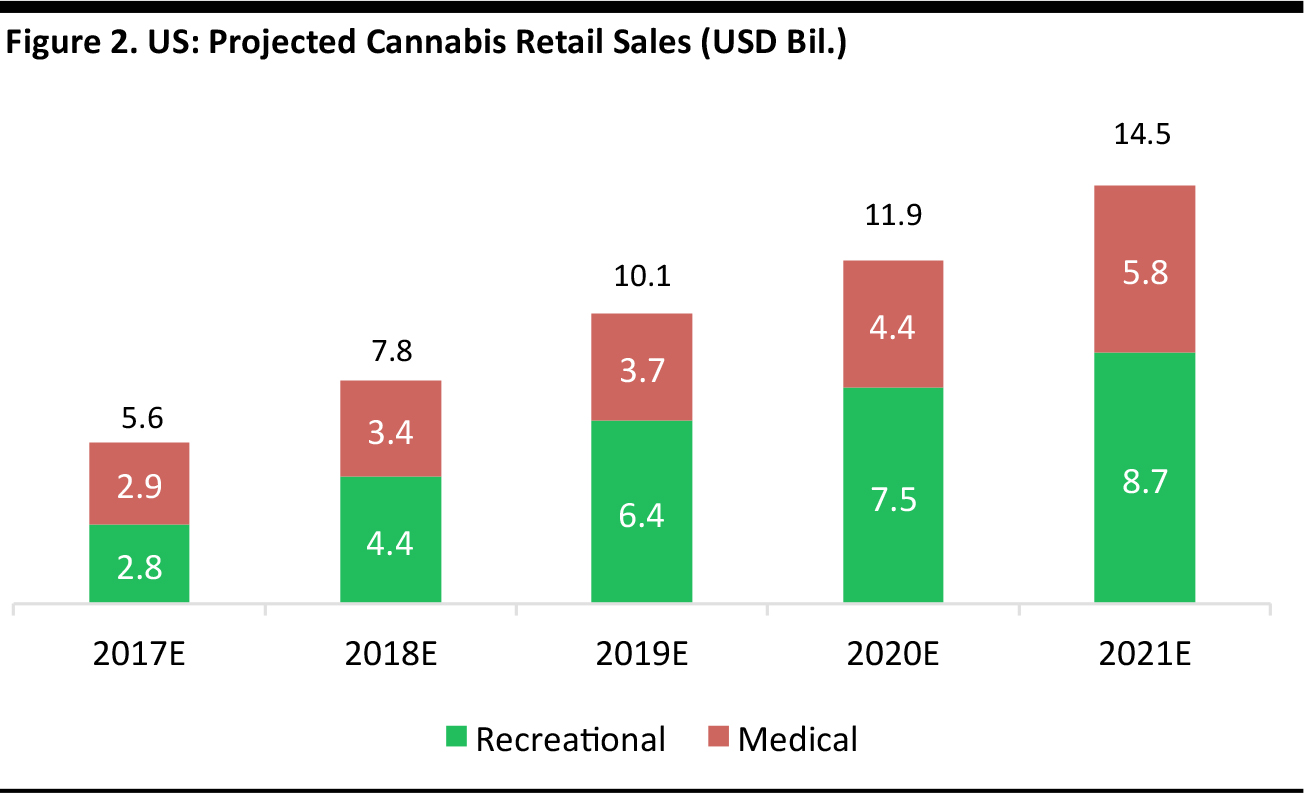

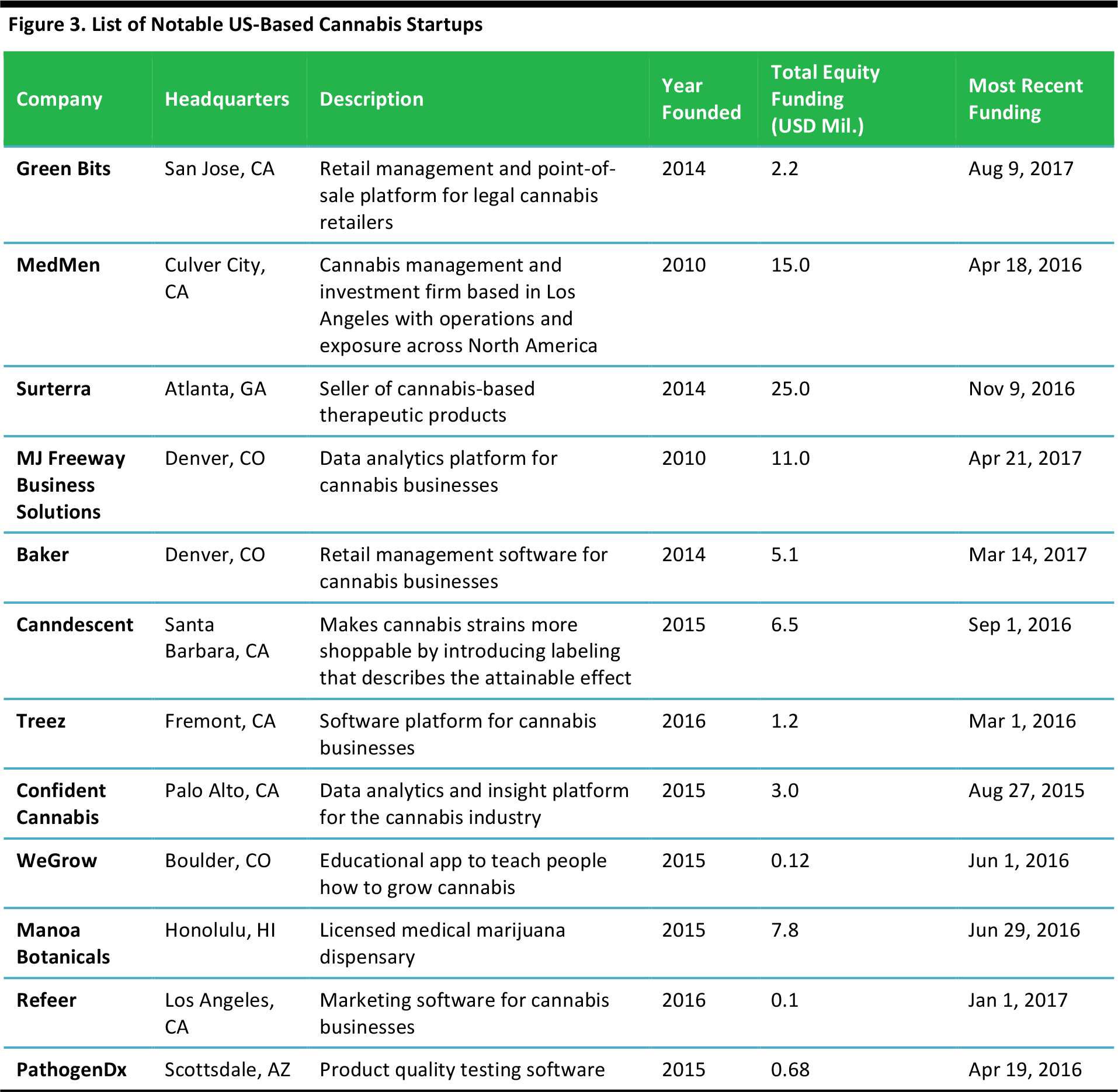

Marijuana Business Daily, 59% of medical marijuana dispensaries and recreational marijuana stores in the US in 2016 were either modestly profitable (41% of such companies) or very profitable (18% of such companies). The table below lists some notable examples of cannabis startups.

Source: Crunchbase.com

As the table above shows, the cannabis industry is still dominated by young companies. Cannabis startups focus on several aspects of the industry, from production of strains to the creation of apps and software platforms for data analytics, marketing and retail management.

Key Takeaways

As of 2017, eight US states have legalized the production, retail and consumption of medical and recreational cannabis. These states represent 21% of the total US population and almost a quarter of the country’s GDP.

The market is projected to grow fast. Sales of recreational marijuana grew by 80% year over year, to $1.8 billion, in 2016, and sales are expected to reach $11.9–$17.1 billion in 2021, according to

Marijuana Business Daily.

Legal ambiguity is the main threat to the industry’s expansion, as it limits cannabis companies’ access to credit and banking services and creates uncertainty about the prospects of the companies operating in the sector.

By generating revenue and jobs, the regulated cannabis industry has a positive impact on the economies of those states in which it operates. In Colorado, the industry generated $121 million in excise tax revenue and 18,005 new full-time jobs in 2015. It also resulted in increased tourism, the founding of a number of new companies and increased demand for commercial properties.

The growth of the industry attracts investment and new businesses, and implies growing competitive pressure for companies already in the market and higher barriers to entry for new entrants. According to Viridian Capital Advisors, the industry raised more than $1 billion in 2016, while the number of cannabis businesses in the US was estimated at 21,000–33,000 that year, according to

Marijuana Business Daily.

There are still plenty of opportunities for companies entering the US cannabis market. About a quarter of the industry players were very profitable in 2016, according to

Marijuana Business Daily, while the legalization of recreational marijuana in large markets such as California should unleash substantial further growth.

�

*Sales of recreational cannabis will start in January 2018.

Source: The Guardian/USA Today/BusinessInsider.com/CNN.com/The Boston Globe/The Washington Post/US Bureau of Economic Analysis/US Census Bureau/FGRT

*Sales of recreational cannabis will start in January 2018.

Source: The Guardian/USA Today/BusinessInsider.com/CNN.com/The Boston Globe/The Washington Post/US Bureau of Economic Analysis/US Census Bureau/FGRT