DIpil Das

What’s the Story?

In this report, we look at the US athleisure market—including sports apparel and footwear that can be worn for sports or casualwear purposes—and identify key drivers and trends in the market. In addition, we examine what retailers and brands are doing to better serve the market.Why It Matters

Athleisure has enjoyed great popularity over the last few years, driven by growing enthusiasm for fitness activities and increasing demand for comfortable casual wear, including in the workplace. Following the coronavirus pandemic in 2020, we expect athleisure to continue to show promising growth opportunities, reflecting the casualization of the workforce and increased stay-at-home fitness activities. As consumers increasingly adopt athleisure for daily wear, existing apparel brands are innovating and adding functionality to their product offerings. More and more companies are entering the athleisure category, with traditional apparel and footwear brands also extending their product offerings into athleisure, attracted by the category’s strong growth opportunities.Athleisure Market Overview

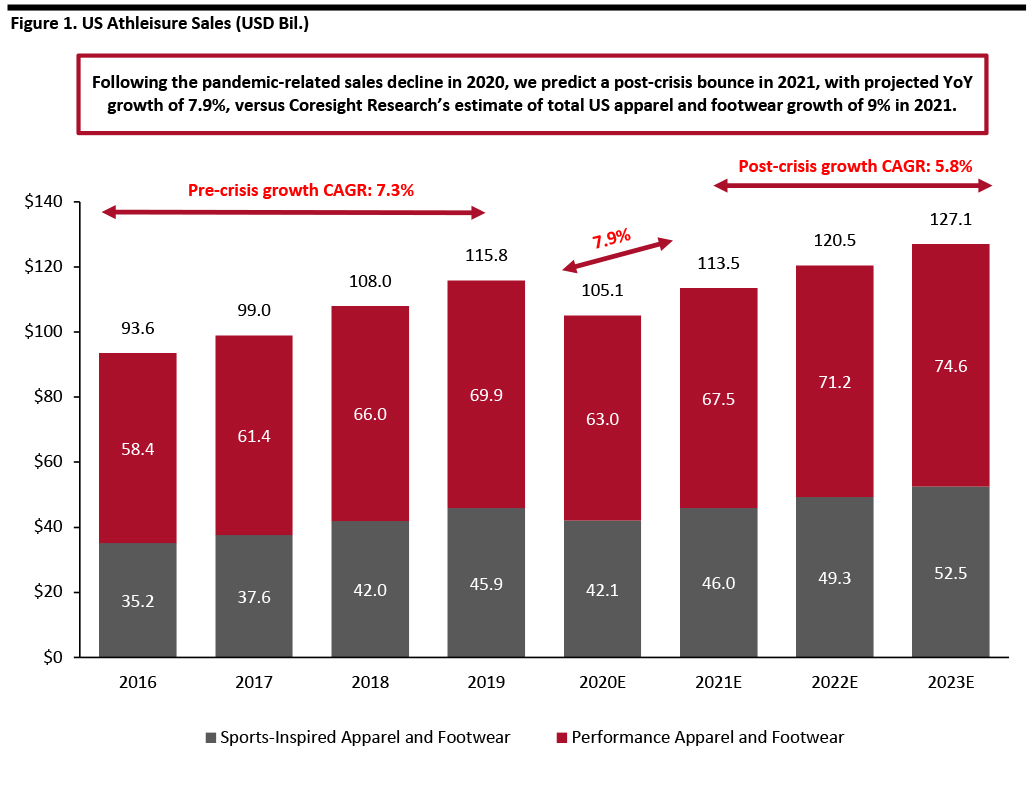

Market Size We define athleisure as a category of sportswear that can be worn for casual purposes. In theory, any sportswear item (excluding professional sports items) can be characterized as athleisure wear: The scope of the market can be established by estimating the size of the sportswear market, excluding sportswear for outdoor activities such as hiking, sailing and skiing. US athleisure sales are expected to total $105.1 billion in 2020, according to Euromonitor International and Coresight Research, with sports-inspired apparel and footwear contributing $42.1 billion and performance apparel and footwear comprising $63.0 billion. The $105.1 billion forecast in 2020 represents a pandemic-driven year-over-year decline of 9.2%. However, we predict a post-crisis bounce in 2021, with projected growth of 7.9%, and expect the market to grow at a CAGR of 6.5% between 2020 and 2023. We discuss the drivers behind this growth below. [caption id="attachment_119853" align="aligncenter" width="700"] Note: Performance clothing is characterised by new fibres and fabrics as well as innovative process technologies. Sports-inspired clothing includes non-performance/outdoor items by major sports brands as well as sports-inspired products offered by general apparel brands.

Note: Performance clothing is characterised by new fibres and fabrics as well as innovative process technologies. Sports-inspired clothing includes non-performance/outdoor items by major sports brands as well as sports-inspired products offered by general apparel brands. Source: Euromonitor International Limited 2020 © All rights reserved/Coresight Research [/caption] Key Market Drivers We identify three main drivers of growth in the US athleisure market.

- Casualization: We anticipate a sustained shift toward casualization over the next three years, with consumers opting to wear athleisure while working more at home and workplaces increasingly relaxing dress codes.

- Wellness: The Covid-19 pandemic has heightened consumer focus on health and wellness, which is a key driver of demand for athleisure products. An increasing number of health-minded individuals are participating in at-home fitness or in outdoor public spaces. Consumers are also showcasing their healthy lifestyles on social media, posting photos of themselves dressed in activewear, participating in healthy activities and preparing healthy meals.

- Millennial spending power: Millennials, born between 1980 and 2000, comprise roughly 25% of the US population, according to the US Census Bureau. As this generation enters its prime working and spending years, the athleisure market is likely to benefit, as it represents the go-to apparel choice for many millennials. More so than older generations in general, young consumers view fitness and health as a reflection of their lifestyle values, often using social media platforms such as Instagram to share what they are wearing and the fitness activities they are participating in. Athleisure therefore suits such a lifestyle, incorporating fitness, comfort and style.

- Levi’s launched a cottonized hemp denim range featuring its comfort-oriented “high loose” and “stay loose” styles. The brand has also launched a new line of stretchy jeans and has opened a research lab to investigate new ways to make stretchy pants.

- ADAY recently launched its first line of suits featuring stretchy, wrinkle-free fabric.

- Banana Republic has launched Super-Stretch Legging-Fit Jeans that look like officewear pants.

Figure 2. Trending Categories Within Athleisure [wpdatatable id=577 table_view=regular]

Source: Coresight Research Luxury Brands Are Embracing Athleisure Athleisure is engaging young luxury shoppers, with brands such as Balenciaga, Gucci and Louis Vuitton designing branded hoodies, sweatshirts and sneakers to target millennial consumers that value the perceived high social status of luxury brands. Millennials have been driving the “wellness as a luxury” trend for several years now, participating in premium workout and fitness classes, using wearables to track fitness and wearing athleisure fashion as a signifier of their lifestyle. We are increasingly seeing fashion designers team up with sports brands to create co-branded clothing for sports or gym-to-the-office styles. We expect this trend to continue for the next three to five years.

- Dior and NIKE joined forces for the first time in December 2019 to produce the limited-edition Jordan x Dior sneakers collection.

- Louis Vuitton partnered with the NBA (National Basketball Association) to create a menswear capsule collection for the spring/summer 2021 season, featuring a grey cashmere tracksuit, a blue hooded leather jacket and monogram jeans.

- Chanel and Fendi have also incorporated streetwear styles into their looks to appeal to millennials. For example, Chanel has created designer items suited for both sports and work purposes, including leggings, branded sports bras and a sports dress with a crew neck.

- Under Armour is leading the market with advanced technologies. Its All-Season Gear range is based on technology that enables apparel to trap in heat to keep the wearer’s core warm while moving perspiration away quickly to stay dry. The brand’s UA Coolswitch technology provides a coating on the inside of the fabric, which it claims pulls heat away from the wearer’s skin, assisting body-temperature regulation and extending performance time.

Figure 3. Selected Brands/Retailers in the US Athleisure Market [wpdatatable id=578 table_view=regular]

Source: Coresight Research Traditional Sportswear Companies

- Adidas US continues to execute campaigns and athleisure product launches, as the company saw positive demand for casualwear categories during Covid-19 lockdowns. The company is building a new lifestyle franchise, ZX 2K, and has already seen successful integration with the first limited drops in May 2020, delivering 100% sell-through. The Adidas Originals ZX 2K BOOST sneaker has a newly wrapped sole to suit the wearer’s everyday lifestyle, according to the company. Adidas claims that the UltraBOOST sneaker continues to be the most searched running shoe globally on Google. In addition, Adidas athleisure brand YEEZY remains strong and continues to bring excitement to the market, with all YEEZY 350 and YEEZY 700 drops achieving close to 100% sell-through.

- New Balance has launched athleisure styles to suit consumer preferences, including lifestyle shoes, knitted maxi dresses, bomber jackets and animal-print crew shirts. New Balance claims to be committed to providing products in both function and fashion, blending performance technology with style. This approach means that the company optimizes its manufacturing processes to allow for high levels of quality and customization.

- NIKE’s competitive advantage in the athleisure market is driven by its long history in the traditional athletic apparel segment and its ability to connect with consumers. During the pandemic, NIKE used its apps to directly engage with consumers focused on health and wellness at home. NIKE has also launched many athleisure styles, including pants made from soft cotton and featuring a wide-leg design, ribbed pants with a cropped-leg cut and a relaxed-fit satin jacket.

NIKE’s ribbed pants with a wide-leg design (left) and satin jacket with a loose fit and smooth fabric (right)

NIKE’s ribbed pants with a wide-leg design (left) and satin jacket with a loose fit and smooth fabric (right) Source: NIKE [/caption]

- The North Face has launched athleisure products that prioritize comfort, such as its Flight Futurelight Jacket, a trail running jacket that protects wearers from the rain. The brand’s parent company, VF Corporation, reported in its latest earning call on October 16 that it expects spending in active categories to continue to be positively influenced by trends of health/wellness and casualization.

- Skechers remains a go-to footwear brand in the athleisure market by designing and delivering comfort, innovation, style and quality at a reasonable price. The company is currently focusing on its athletic lifestyle footwear and a variety of fits under Skechers Sport and Skechers active lines, including casual slip-on styles for men and women.

- Under Armour claims to differentiate its products in the athleisure market through continuous innovation. Its running apparel includes the Fly-By and Launch shorts and the Iso-Chill short-sleeved shirt, which utilize a unique material to disperse body heat, helping consumers to stay cool in the heat of the summer. The company saw strong demand in the second quarter of 2020 for a number of products, including its Play Up short, Infinity Sports bra and Meridian pants, demonstrating the overall strength of the company’s athleisure portfolio.

- Athleta is Gap Inc.’s fastest growing brand. Established as a lifestyle brand in the growing athleisure market, it offers a range of athleisure-style pants, such as its Camo Farallon Jogger designed for commuting, work and travel, as well as dresses and rompers.

- Carbon 38 has seen success in its function-led apparel offerings. The company focuses on launching smaller, female-founded brands that align with its philosophy of empowering women. The company offers a range of athleisure products such as its Sculpt Jacket, a hooded zip-front top layer made from lightweight and stretchy fabric.

- Lululemon focuses its strategy oncontinuous innovation in four key areas: Run, Train, Yoga and On The Move. Lululemon’s products leverage technical innovation and performance fabrics, which are ideal for enabling the work-from-home lifestyle that has grown exponentially in the Covid-19 world. The company’s innovations include its fast-drying Everlux fabric, wind-resistant fabrics and apparel items with detachable hoods. It has also launched athleisure pants for men that are made with abrasion-resistant fabric. Building upon its endeavors in athleisure, the company acquired at-home fitness innovator, MIRROR, in June 2020.

Carbon 38’s Sculpt jacket (left); Lululemon’s Power Y Tank with Everlux fabric (right)

Carbon 38’s Sculpt jacket (left); Lululemon’s Power Y Tank with Everlux fabric (right) Source: Carbon 38, Lululemon [/caption]

- Outdoor Voices is positioned as a lifestyle brand that brings comfort and performance to apparel. The company has reportedly raised over $60 million since its launch in 2014 and achieved approximately $40 million in revenue in 2019. The company offers signature sets for different activities. For example, its Rec Kit comes in a textured compression fabric, which is recommended for low- or medium-intensity activities. The RecTrek Pants, which are designed with a relaxed fit and durable stretch fabric for mobility, are very popular on the website.

- EleVen, a lifestyle brand founded by tennis professional Venus Williams, provides fashion-forward tennis and everyday looks for on and off the court. The brand features functional and fashionable workout gear.

- Ivy Park is an activewear brand co-founded by singer Beyoncé and Topshop. On April 4, 2019, Beyoncé announced a partnership between Ivy Park and Adidas. One of the recent launches in collaboration with Adidas is a body-positive collection comprising 200 pieces, including tanks with built-in sports bras, mesh-detailed sporty tops, open-back sweatshirts, striped bodysuits, joggers and logo-heavy sweatshirts.

- Mission Statement is a line of “luxury athleisure” designed by actress Hilary Swank specifically to be functional, fashionable and practical.

- Continuing its expansion in the fashion industry, Amazon launched its first private athleisure brand Aurique in September 2018.

- Dick’s Sporting Goods announced the launch of DSG, a private-label line of athletic gear and apparel, in August 2019. The new brand is now sold exclusively through the retailer and offers a variety of athleisure for women, men and children, such as cotton jersey open-leg pants.

- Target launched a new private-label activewear and sporting goods brand in January 2020, named “All in Motion.” It features activewear for men, women and kids and uses a size-inclusive assortment that incorporates quality, durable fabrics and sustainably sourced materials.

What We Think

Implications for Apparel Brands and Retailers- US athleisure sales will total almost $105.1 billion in 2020, according to Euromonitor International and Coresight Research, which represents a pandemic-driven year-over-year decline of 9.2%. We predict a post-crisis bounce in 2021, with projected growth of 7.9%, which offers opportunities for apparel retailers to grow in the market.

- Athleisure has changed consumer expectations regarding comfort and fit of their apparel. Traditional brands and retailers should look to leverage athleisure features or risk losing consumers to athleisure brands. We expect the boundaries between athleisure and sportswear and casual wear will continue to blur.

- Retailers and brands are expanding offerings in athleisure, including leggings, hoodies, tops, bottoms and shoes and are incorporating technology into products to make them more functional and comfortable. We expect retailers to continue to offer more athleisure items over the next five years.

- The major trends driving the athleisure market are consumer’s desire for comfort and wellness. Millennials are the target consumer group that also requires style and performance because of their pursuit for an athleisure lifestyle. Opportunities exist for new brands whose unique selling points span innovative technologies or a deliverable of positive brand messages such as motivating customers to keep fit through persistence, never give up on challenges.