Web Developers

EXECUTIVE SUMMARY

Market Growth

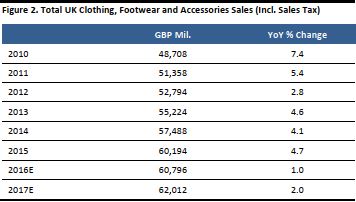

The UK apparel market has enjoyed strong growth in recent years:- British shoppers spent £60.2 billion on clothing and footwear in 2015, up nearly 5% year over year, according to our analysis of data from the UK’s Office for National Statistics (ONS).

- Between 2010 and 2015, the market grew by £11.5 billion, or almost 24%.

- Spending grew at a compound annual growth rate of 4.3% in the last five years.

- We estimate that UK apparel sales will grow at a subdued pace of 1.0% year over year, to £60.8 billion, in 2016.

- For the ten months ended October 2016, average monthly clothing and footwear sales grew by 1.0%.

- For 2017, we forecast a minor sales growth rebound, to around 2.0%.

E-Commerce

Almost a quarter of all apparel sales are now made online: e-commerce accounted for 23% of total UK apparel sales as of June 2016, up from 21% in 2015. For the period ended July 31, 2016, online fashion sales grew by 7.5% year over year, while store sales declined by 3%, according to Kantar Worldpanel. Based on our forecast that total apparel sales will grow by approximately 2.0% next year, we anticipate that online category sales will grow by approximately 9.0%–10.0%. [caption id="attachment_90878" align="aligncenter" width="413"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

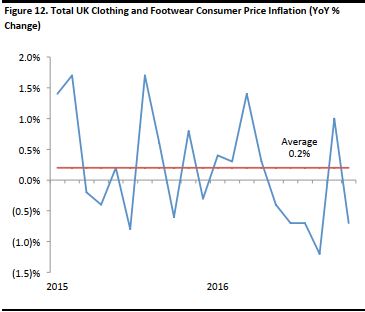

Inflation

The depreciation of the pound will increase sourcing costs in apparel. Looking ahead to 2017, we envisage apparel inflation remaining low, at about 0.0%–1.0%. The apparel market faces exceptionally strong competition, arising in large part from growth in capacity (i.e., the number of players), and this will keep a lid on price increases. We believe that certain retailers will be able to withstand the lackluster market conditions and continue to post strong sales at the expense of weaker incumbents. We also believe that pure plays such as ASOS, Boohoo.com and Zalando will continue to gain sales in the UK market at the expense of department stores and apparel specialist chains. Additionally, we expect to see continued outperformance by retailers that are exposed to the athleisure trend and by premium lifestyle brands and retailers. [caption id="attachment_90879" align="aligncenter" width="519"] Source: Fung Global Retail & Technology[/caption]

Source: Fung Global Retail & Technology[/caption]

INTRODUCTION

In this report, we bring together the latest data and forecasts for the UK apparel retail market and look ahead to the prospects for the market into 2017. We provide market sizes and segmentation, discuss the ongoing weakness in UK apparel sales, look at inflation and the potential impact of the depreciation of the pound, and consider the consensus forecasts for performance at major fashion retailers in 2017. For the purposes of this report, we define apparel as the total of clothing, footwear and apparel accessories. [caption id="attachment_90880" align="aligncenter" width="350"] Source: Shutterstock[/caption]

We divide the report into two main sections:

The Market: In this section, we provide data and insight into the size, segmentation and prospects for the apparel market.

The Retailers: In this section, we look at individual retailers, including their expected top-line performance in 2017.

Source: Shutterstock[/caption]

We divide the report into two main sections:

The Market: In this section, we provide data and insight into the size, segmentation and prospects for the apparel market.

The Retailers: In this section, we look at individual retailers, including their expected top-line performance in 2017.

THE MARKET

The £60 Billion UK Apparel Market Slows Sharply

The UK apparel market has enjoyed strong growth in recent years:- British shoppers spent £60.2 billion on apparel in 2015, up nearly 5% year over year, according to our analysis of data from the ONS.

- Between 2010 and 2015, the market grew by £11.5 billion, or almost 24%.

- Spending grew at a compound annual growth rate of 4.3% in the last five years.

- We estimate that UK apparel sales will grow at a subdued pace of 1.0% year over year, to £60.8 billion, in 2016.

- For the ten months ended October 2016, apparel sales grew by 1.0% year over year.

- For 2017, we forecast a minor sales growth rebound, to around 2%.

Source: ONS/Fung Global Retail & Technology[/caption]

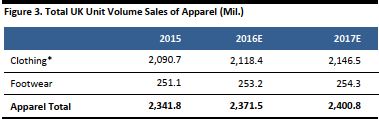

Some 2.1 billion units of clothing and 253 million units of footwear will be sold in the UK this year, according to Euromonitor International’s estimations. We note that these figures were last updated in January 2016, which was in the early stages of the apparel downturn and before the Brexit referendum was held.

[caption id="attachment_90882" align="aligncenter" width="379"]

Source: ONS/Fung Global Retail & Technology[/caption]

Some 2.1 billion units of clothing and 253 million units of footwear will be sold in the UK this year, according to Euromonitor International’s estimations. We note that these figures were last updated in January 2016, which was in the early stages of the apparel downturn and before the Brexit referendum was held.

[caption id="attachment_90882" align="aligncenter" width="379"] *Including clothing accessories such as belts and hats

*Including clothing accessories such as belts and hatsSource: Euromonitor International[/caption]

Segmentation

Clothing made up almost 79% of the total UK apparel market in 2015, we estimate, based on ONS data. This segmentation equates to 2015 sales of:- £47.5 billion in clothing

- £9.4 billion in footwear

- £3.3 billion in apparel accessories

Source: ONS/Fung Global Retail & Technology[/caption]

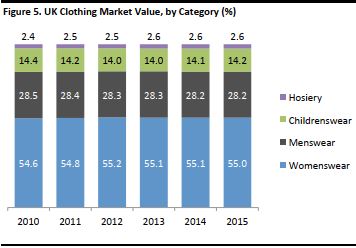

Within the core category of clothing, womenswear makes up the largest portion of the UK market, accounting for 55% of sales in 2015. Euromonitor says that menswear lost share of the total clothing market over the five years through 2015, but a wealth of other sources suggest that growth in menswear has outpaced, and is still outpacing, growth in womenswear. For example, research firm Mintel says that menswear is growing at a faster clip than womenswear is, and the company’s analysts forecast that menswear will grow by 22.5% in the five years through 2020.

[caption id="attachment_90884" align="aligncenter" width="356"]

Source: ONS/Fung Global Retail & Technology[/caption]

Within the core category of clothing, womenswear makes up the largest portion of the UK market, accounting for 55% of sales in 2015. Euromonitor says that menswear lost share of the total clothing market over the five years through 2015, but a wealth of other sources suggest that growth in menswear has outpaced, and is still outpacing, growth in womenswear. For example, research firm Mintel says that menswear is growing at a faster clip than womenswear is, and the company’s analysts forecast that menswear will grow by 22.5% in the five years through 2020.

[caption id="attachment_90884" align="aligncenter" width="356"] Source: Euromonitor International/Fung Global Retail & Technology[/caption]

Source: Euromonitor International/Fung Global Retail & Technology[/caption]

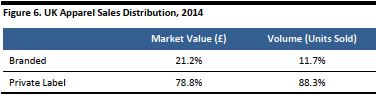

Private Label in Fashion

The UK clothing market is dominated by private label merchandise. In 2014, branded merchandise accounted for just 21.2% of UK apparel sales, versus 78.8% for private label, according to Kantar Worldpanel. Given that average prices are lower for private label items, the skew is even stronger in volume terms. [caption id="attachment_90885" align="aligncenter" width="376"] Source: Kantar Worldpanel[/caption]

In the UK, private label is particularly dominant in the denim category, currently accounting for 85% of sales, by value, versus 15% under brands, according to Kantar Worldpanel. However, the denim category has been declining due to the upward trend of athleisure, and sales of jogging pants and tights have been outperforming sales of jeans.

Source: Kantar Worldpanel[/caption]

In the UK, private label is particularly dominant in the denim category, currently accounting for 85% of sales, by value, versus 15% under brands, according to Kantar Worldpanel. However, the denim category has been declining due to the upward trend of athleisure, and sales of jogging pants and tights have been outperforming sales of jeans.

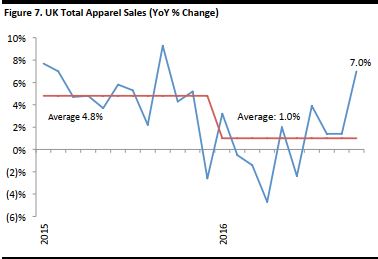

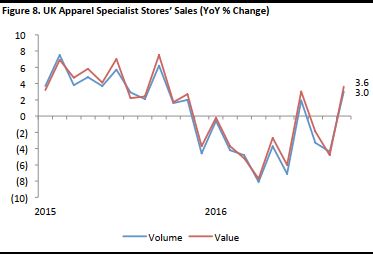

2016 the Toughest Year for UK Apparel Since 2009

The downturn in the apparel market has been sudden and severe. It began in later 2015, when a warm autumn initially appeared to be hitting fashion sales. An exceptionally weak Christmas 2015 and a poor performance through 2016 have made clear, however, that the downturn is not principally due to weather. Kantar Worldpanel reported that apparel, footwear and accessories sales declined for four consecutive months up to September 25, in the biggest downturn in UK fashion since 2009. UK apparel sales declined by £700 million in the 52 weeks ended September 25. The data charted below are from the ONS, and show the sporadic negative growth seen so far this year. The latest data at the time of writing showed a sudden jump in category sales, helped by colder weather, but we do not anticipate this kind of growth continuing in the near term. [caption id="attachment_90886" align="aligncenter" width="378"] Through October 2016

Through October 2016 Source: ONS/Fung Global Retail & Technology[/caption] The slowdown has been even sharper for apparel specialist stores than for the market as a whole, principally because the sector has been losing share to Internet-only retailers. In value and volume terms, 2016 has been a very poor year for the specialist sector. The slump reached its low point (so far) in April, when specialist stores saw an 8.1% value decline. Major names in the sector, including Marks & Spencer (M&S), Next, Primark, New Look and Gap, have reported falling underlying sales. [caption id="attachment_90887" align="aligncenter" width="373"]

Through October 2016

Through October 2016Source: ONS[/caption] According to a PwC survey, apparel stores closed at a faster rate than any other type of store in the UK in the first six months of 2016. A net 95 women’s and men’s clothing stores shut their doors in the first six months of 2016. An additional 87 fashion shops that carried accessories and jewelry also closed.

Why the Downturn?

We think one reason for the weakness in apparel is that British consumers are prioritizing spending on leisure services over spending on physical products. While apparel sales dwindled, in the second quarter of 2016 (latest ONS data), consumers grew their spending by 9.0% on recreational and sporting services, by 5.4% on hotels, and by 4.7% on dining out. The UK’s second-biggest apparel retailer, Next, flagged the hit to the apparel sector earlier this year, when its management noted: There may be a cyclical move away from spending on clothing back into areas that suffered the most during the credit crunch…travel, recreation and going out. Given the strength of the UK economy, including high employment levels, low inflation and solid wage growth, there is little fundamental reason why shoppers should have limited their apparel spending so sharply in the past year. In this context, the explanation put forward by Next appears to be the most likely.2017 Outlook

We believe that the softness in the UK apparel market will continue in 2017. As noted above, we believe UK apparel sales will grow at a muted pace of around 2.0% in 2017, well below the average annual growth rates of approximately 4% in the past few years. One positive factor for 2017 growth is that it will be measured against the undemanding comparatives of this year. However, we see several reasons for weakness continuing into 2017:- If, as we believe, the apparel category is being impacted at least in part by a cyclical shift to spending on leisure services instead of apparel, there is little reason to expect a near-term bounce back.

- Moreover, any ongoing political and macroeconomic uncertainty regarding the Brexit negotiations could further dent consumers’ willingness to make discretionary purchases, including apparel.

- As we chart below, UK consumers already spend more on apparel, on average, than do their peers in other major European economies, suggesting that there is substantial scope for Brits to flex their spending downward.

Source: Eurostat/ONS/Fung Global Retail & Technology[/caption]

Currency effects may provide some boost to the figures reported by the ONS into 2017. If UK retailers submit their total revenue figures, including overseas sales, to the ONS, the depreciation of the pound will strengthen reported apparel sales.

Source: Eurostat/ONS/Fung Global Retail & Technology[/caption]

Currency effects may provide some boost to the figures reported by the ONS into 2017. If UK retailers submit their total revenue figures, including overseas sales, to the ONS, the depreciation of the pound will strengthen reported apparel sales.

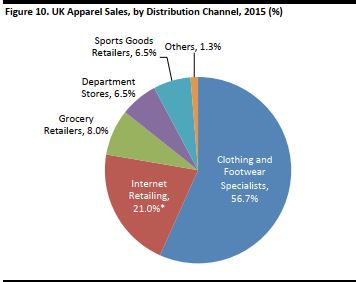

By Distribution Channel

More than half of all category sales are made through the brick-and-mortar stores of apparel specialist retailers. Apparel specialists generated £46.7 billion in sales in 2015, we estimate, based on ONS data. However, that total includes nonapparel sales such as homewares and beauty products. Almost a quarter of all UK fashion sales are now made online: e-commerce accounted for 23% of total apparel sales as of June 2016, up from 21% in 2015. For the period ended July 31, 2016, online apparel sales grew by 7.5% year over year, while store sales declined by 3%, according to Kantar Worldpanel. Within store-based retailing, grocery is a slightly larger channel than department stores and sports goods stores, according to Euromonitor data. Kantar Worldpanel says that grocery retailers, including their online sales, accounted for 10.1% of fashion spend as of June 2016. [caption id="attachment_90890" align="aligncenter" width="356"] *All online sales are included under Internet Retailing; all other channels sales are offline sales only.

*All online sales are included under Internet Retailing; all other channels sales are offline sales only.Source: Euromonitor International/Kantar Worldpanel/Fung Global Retail & Technology[/caption]

Online Prospects

Given that online sales grew by 7.5% in the current, weak context—and given that we expect a slight improvement in the overall apparel category next year—we expect online apparel sales growth to strengthen somewhat in 2017. Based on our forecast of total apparel sales growth of about 2.0% in 2017, we anticipate that online sales growth will strengthen to approximately 9%–10%. In the apparel specialist sector, online sales growth has outpaced total sales growth by an average of 770 basis points so far in 2016. In the graph below, we include a trend line to show the medium-term pattern in online sales by specialist stores. [caption id="attachment_90891" align="aligncenter" width="367"] Through October 2016 Source: ONS/Fung Global Retail & Technology [/caption]

Through October 2016 Source: ONS/Fung Global Retail & Technology [/caption]

Product Price Inflation: The Impact of Depreciation

It appears that the recent decline in the value of the British pound is beginning to translate into product price inflation and higher costs for some UK retailers. This is because imported goods, including imported apparel, are typically bought in US dollars. The pound has fallen by nearly 20% versus the US dollar since the June Brexit referendum. It recovered a little after Donald Trump was announced victor in the US presidential election. At the time of writing (mid-November), the pound is down 15% versus the dollar since the start of 2016. Given that most retailers have hedged their purchases at previous exchange rates, we do not see the depreciation of the pound as having led to recent shifts in clothing and footwear inflation. Looking ahead to 2017, we think that apparel inflation will remain low. The UK apparel market faces exceptionally strong competition, due in large part to growth in capacity (i.e., number of players), and this will keep a lid on price increases.- We anticipate that apparel price inflation will average 0.0%–1.0% in 2017.

- The Bank of England has forecast that overall UK inflation will average 2.7% in 2017.

Through October 2016

Through October 2016Source: ONS[/caption] It is likely that the pound will remain at a weakened level, since the consequences of the Brexit referendum are still unclear and since there is uncertainty about Britain’s economic prospects. Thus far, the impact on product prices has been offset by many retailers having hedged unfavorable currency exposure in anticipation of a possible pound collapse following the Brexit vote. However, the benefits of currency hedging contracts will decrease going into the second half of 2017, according to S&P Capital IQ. The British Retail Consortium expects nonfood store prices to rise in the first half of 2017, as there is a limit to how much retailers can absorb in costs without raising prices. Recent comments from major retailers have been mixed. Next warned that it may have to hike prices next year by up to 5%. M&S recently stated that it will do its best not to raise prices and to offset cost increases through sourcing efficiencies and other means. Primark stated that it is very much committed to maintaining its value proposition and price leadership for its customers. There is likely to be a three-way split on rising input costs—between suppliers, retailers and consumers. However, the highly competitive nature of the UK apparel market means that the consumer is likely to be the least impacted of these.

Benefits of a Lower Pound

Some retailers and brands stand to benefit from the decline in the pound. However, the beneficiaries are not likely to be big, mass-market, store-based retailers, but rather luxury brands and Internet-only retailers. According to Deloitte, the UK is currently the least expensive market in which to purchase luxury goods, with 64% of luxury products selling for less in the UK than in the US, China and France. The weak pound should also benefit tourist spending during the Christmas and festive holiday season. For retailers with substantial international operations, depreciation flatters their reported revenues. Internet-only retailers stand to benefit in particular. ASOS, for example, generates approximately 57% of its revenues from international markets, while Boohoo.com derives around one-third of its revenues overseas. ASOS has stated that it is benefiting from the weakness in the pound, and that it is enjoying a currency tailwind. Assuming UK retailers submit their total revenue figures to the ONS as part of the retail sales survey, this depreciation effect may offer some lift to the sales growth for apparel reported by the ONS—even if it will not reflect the strength of UK-based sales.THE RETAILERS

The UK’s Biggest Apparel Retailers

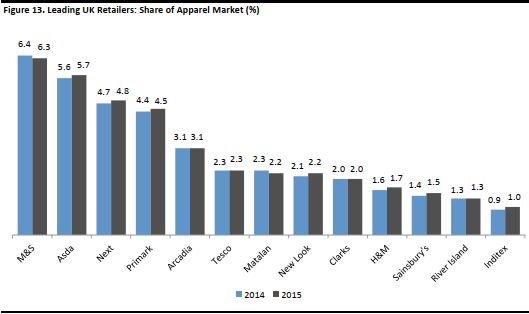

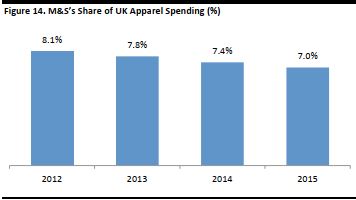

M&S is the largest UK apparel retailer. However, it has been losing market share in the past few years. [caption id="attachment_90893" align="aligncenter" width="529"] Source: Euromonitor International[/caption]

The figures above are from Euromonitor. Our own data give market leader M&S a slightly larger share of the apparel market, and they show that the retailer has been losing between 30 and 40 basis points of share each year in the recent past.

[caption id="attachment_90894" align="aligncenter" width="356"]

Source: Euromonitor International[/caption]

The figures above are from Euromonitor. Our own data give market leader M&S a slightly larger share of the apparel market, and they show that the retailer has been losing between 30 and 40 basis points of share each year in the recent past.

[caption id="attachment_90894" align="aligncenter" width="356"] Based on nearest fiscal years to calendar years

Based on nearest fiscal years to calendar yearsSource: Company reports/ONS/Fung Global Retail & Technology[/caption]

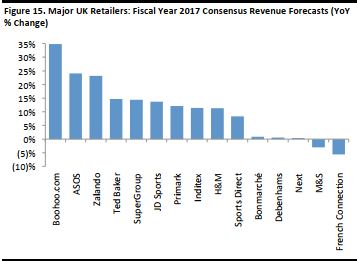

The Consensus View of 2017 Performance

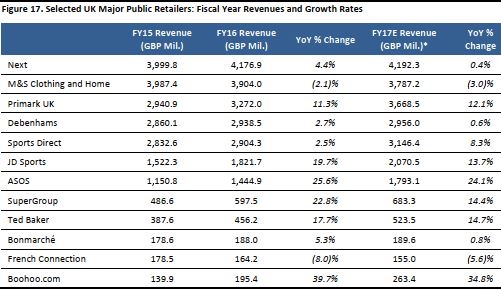

In this section, we look ahead to the expected performance of major retailers in 2017, based on the consensus estimates among analysts polled by S&P Capital IQ. Of the major retailers charted below, M&S and French Connection are the only ones that are expected to deliver negative annual sales growth in 2017. Internet pure plays, premium lifestyle brands (such as Ted Baker and SuperGroup), sports-fashion stores (such as JD Sports) and fast-fashion retailers are expected to be the outperformers. é The estimates below are for total sales, including any non-UK revenues, except for Primark and M&S. For global players such as Inditex and H&M, the figures are therefore unlikely to be indicative of their UK prospects. [caption id="attachment_90895" align="aligncenter" width="357"] Estimates as of November 15, 2016

Estimates as of November 15, 2016Source: Company reports/S&P Capital IQ/Citibank[/caption]

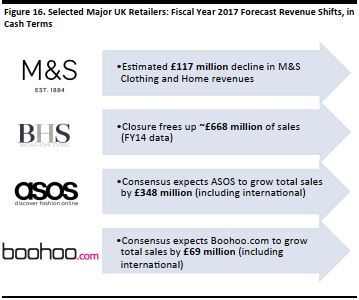

Major Market Dynamics in Cash Terms

We think that looking at the biggest changes in cash terms helps to illustrate the scale of the major dynamics in the market. The closure of BHS this year and the consensus estimate for declining sales at M&S suggest big shifts in cash terms in the midmarket. In fiscal year 2015, fashion apparel online pure plays Boohoo.com, ASOS, Missguided and PrettyLittleThing captured combined UK net sales of approximately £700 million; based on growth at publicly traded ASOS and Boohoo.com, this total is likely to jump to more than £900 million in fiscal 2016 and to break the £1 billion barrier in fiscal 2017. To put this in perspective, Zara’s UK sales totaled £495 million in fiscal 2015 and £535 million in fiscal 2016, while M&S lost £83 million in apparel sales in fiscal 2015. [caption id="attachment_90896" align="aligncenter" width="359"] Source: Company reports/S&P Capital IQ/Citibank[/caption]

Source: Company reports/S&P Capital IQ/Citibank[/caption]

Retailers’ Forecast 2017 Growth in Detail

The majority of department stores and traditional retailers continue to overpurchase inventory that has to be cleared with steep discounting activity. Internet pure plays tend to have more nimble and customer-centric business models, which allow them to quickly adapt to changing customer demands and fashion trends. Compared with most fashion retailers, pure plays offer unmatched product choice and constant style evolution. They are gaining traction because their product offerings focus on current weather trends instead of on seasonal items for months ahead. This is especially relevant nowadays, as weather patterns have proven volatile in the past few months. In addition, these retailers keep expanding their customer delivery and return options, and they have excelled at customer service and relationship management by offering personalized content. Analysts expect Boohoo.com and ASOS to report the highest sales growth rates of all the major UK apparel retailers in 2016, with annual sales for each increasing by more than 20%. These estimates are for the two companies’ total sales, including any non-UK revenues. Retailers that are exposed to the ongoing trend in athleisure and the casualization of womenswear have also sustained positive growth. According to Kantar Worldpanel, the UK women’s activewear market is worth £267 million and the category grew by 13.4% year over year in the 52 weeks ended July 31, 2016. We think there is also space in the market for lifestyle brands and retailers, such as Ted Baker and SuperGroup/Superdry, and we note the continuing momentum of fast-fashion retailers Inditex and H&M. Finally, we believe that those retailers that offer product newness and innovation and that have fast supply chains will emerge as outperformers as well. Zara, for example, should outperform in 2017. The data below are based on analysts’ consensus estimates, as recorded by S&P Capital IQ. We do not have data for privately owned firms such as Arcadia nor for general retailers for whom apparel is a minor contributor to sales, such as grocery retailers. The figures show the companies’ total sales, including any non-apparel revenues and any non-UK revenues, except for Primark, for which we have included UK sales only. The M&S figures exclude its Food division. [caption id="attachment_90897" align="aligncenter" width="501"] *Analysts’ consensus estimates except for M&S and Primark, for which Citibank estimates were used; estimates as of November 15, 2016

*Analysts’ consensus estimates except for M&S and Primark, for which Citibank estimates were used; estimates as of November 15, 2016Source: Company reports/S&P Capital IQ/Citibank[/caption]

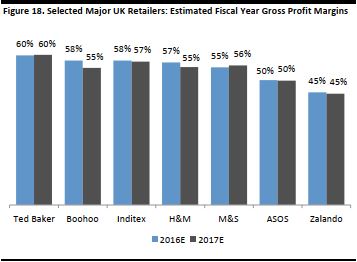

Gross Margin Prospects

The strong US dollar’s impact on sourcing costs has already affected retailers’ gross margins. Even retailers that pass on some of the costs arising from the depreciation of the pound will likely need to take some hit in order to limit price increases. Below, we chart the current consensus estimates for major retailers’ gross margins in 2017. [caption id="attachment_90899" align="aligncenter" width="357"] Source: Company reports/S&P Capital IQ[/caption]

[caption id="attachment_90898" align="aligncenter" width="354"]

Source: Company reports/S&P Capital IQ[/caption]

[caption id="attachment_90898" align="aligncenter" width="354"] Source: Shutterstock[/caption]

Source: Shutterstock[/caption]

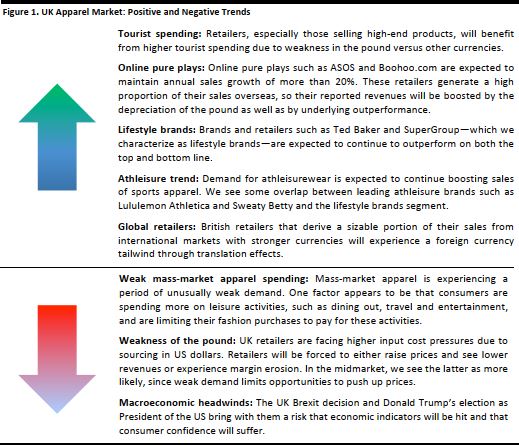

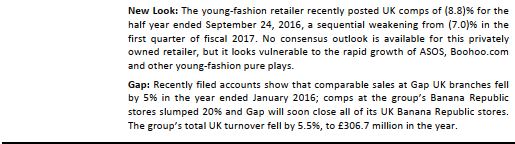

Winners and Losers in 2017

In our view, apparel pure plays such as Zalando, ASOS, Boohoo.com, Amazon and Missguided will continue to take share from department stores and specialty apparel retailers such as M&S, Next, Matalan, New Look and Gap. Below, we highlight which retailers we believe will emerge as outperformers and laggards in 2017. [caption id="attachment_90901" align="aligncenter" width="515"]

[caption id="attachment_90901" align="aligncenter" width="515"] Source: Company reports/Fung Global Retail & Technology[/caption]

Source: Company reports/Fung Global Retail & Technology[/caption]