albert Chan

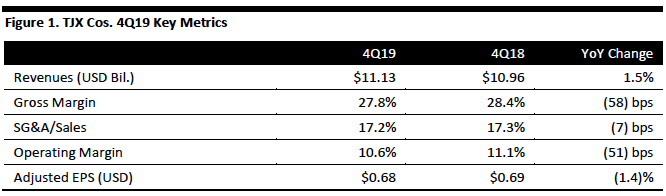

[caption id="attachment_78286" align="aligncenter" width="666"] Source: Company reports/Coresight Research[/caption]

4Q19 Results

TJX Cos. fiscal 4Q19 revenues were $11.13 billion, up 1.5% year over year and beating the consensus estimate of $11.02 billion. Annual revenues were $38.97 billion, up 8.7% from $35.86 billion the previous year. Management noted annual sales have more than doubled over the past 10 years.

The company reported 4Q19 adjusted EPS of $0.68, down 1.4% year over year but exceeding the high end of its guidance range of $0.66-0.67 and in line with the consensus estimate.

The company saw comparable sales growth of 6%, versus a 4% increase in the same period last year. For the full fiscal year, comparable sales increased 6%, versus a 2% increase the previous year. TJX Cos. reported that fiscal 2019 marked its 23rd consecutive year of comp sales growth.

By division, Marmaxx, the company’s largest division, delivered a 7% comp increase, compared with a 3% increase last year. HomeGoods comps increased 5%, compared with 3% last year, while TJX Canada comps increased 4%, versus 7% last year, and TJX International comps increased 5%, compared with 3% last year. The company said customer traffic was the primary driver of its comp store sales increases.

Management reported that its research indicated growth in new customers, including a significant share of millennials.

The company grew its store base by 236 stores globally, to 4,036. Management reported it sees the potential to add approximately 1,800 stores over the long term in its current markets, for a total of about 6,100 stores under its current banners.

Management reported it sees the company as a leader in innovation with a rapidly turning inventory. The company highlighted it has approximately 1,100 associates in its buying organization and that it sources goods from over 21,000 vendors.

The company announced it will launch Marshalls.com, an e-commerce site for Marshalls, later this year. The site will offer a different mix than is found in stores, with the goal of maximizing multichannel engagement and driving incremental sales. TJX Cos. is also rebranding Sierra Trading Post as Sierra.

The company announced it will be launching marketing initiatives across television and digital channels in 2019 to make shopping more exciting and rewarding. Management also announced plans to amplify its loyalty program to drive higher member engagement.

Outlook

For 1Q20, TJX Cos. anticipates diluted EPS of $0.53-0.54, compared with $0.56 in the same period last year and below the consensus estimate of $0.58. The company expects incremental freight costs, store wage increases and foreign currency to negatively impact first-quarter EPS growth by approximately 7%. For fiscal year 2020, the company expects EPS of $2.55-2.60, compared with the consensus estimate of $2.60.

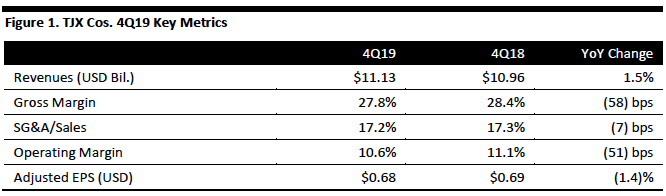

Source: Company reports/Coresight Research[/caption]

4Q19 Results

TJX Cos. fiscal 4Q19 revenues were $11.13 billion, up 1.5% year over year and beating the consensus estimate of $11.02 billion. Annual revenues were $38.97 billion, up 8.7% from $35.86 billion the previous year. Management noted annual sales have more than doubled over the past 10 years.

The company reported 4Q19 adjusted EPS of $0.68, down 1.4% year over year but exceeding the high end of its guidance range of $0.66-0.67 and in line with the consensus estimate.

The company saw comparable sales growth of 6%, versus a 4% increase in the same period last year. For the full fiscal year, comparable sales increased 6%, versus a 2% increase the previous year. TJX Cos. reported that fiscal 2019 marked its 23rd consecutive year of comp sales growth.

By division, Marmaxx, the company’s largest division, delivered a 7% comp increase, compared with a 3% increase last year. HomeGoods comps increased 5%, compared with 3% last year, while TJX Canada comps increased 4%, versus 7% last year, and TJX International comps increased 5%, compared with 3% last year. The company said customer traffic was the primary driver of its comp store sales increases.

Management reported that its research indicated growth in new customers, including a significant share of millennials.

The company grew its store base by 236 stores globally, to 4,036. Management reported it sees the potential to add approximately 1,800 stores over the long term in its current markets, for a total of about 6,100 stores under its current banners.

Management reported it sees the company as a leader in innovation with a rapidly turning inventory. The company highlighted it has approximately 1,100 associates in its buying organization and that it sources goods from over 21,000 vendors.

The company announced it will launch Marshalls.com, an e-commerce site for Marshalls, later this year. The site will offer a different mix than is found in stores, with the goal of maximizing multichannel engagement and driving incremental sales. TJX Cos. is also rebranding Sierra Trading Post as Sierra.

The company announced it will be launching marketing initiatives across television and digital channels in 2019 to make shopping more exciting and rewarding. Management also announced plans to amplify its loyalty program to drive higher member engagement.

Outlook

For 1Q20, TJX Cos. anticipates diluted EPS of $0.53-0.54, compared with $0.56 in the same period last year and below the consensus estimate of $0.58. The company expects incremental freight costs, store wage increases and foreign currency to negatively impact first-quarter EPS growth by approximately 7%. For fiscal year 2020, the company expects EPS of $2.55-2.60, compared with the consensus estimate of $2.60.

Source: Company reports/Coresight Research[/caption]

4Q19 Results

TJX Cos. fiscal 4Q19 revenues were $11.13 billion, up 1.5% year over year and beating the consensus estimate of $11.02 billion. Annual revenues were $38.97 billion, up 8.7% from $35.86 billion the previous year. Management noted annual sales have more than doubled over the past 10 years.

The company reported 4Q19 adjusted EPS of $0.68, down 1.4% year over year but exceeding the high end of its guidance range of $0.66-0.67 and in line with the consensus estimate.

The company saw comparable sales growth of 6%, versus a 4% increase in the same period last year. For the full fiscal year, comparable sales increased 6%, versus a 2% increase the previous year. TJX Cos. reported that fiscal 2019 marked its 23rd consecutive year of comp sales growth.

By division, Marmaxx, the company’s largest division, delivered a 7% comp increase, compared with a 3% increase last year. HomeGoods comps increased 5%, compared with 3% last year, while TJX Canada comps increased 4%, versus 7% last year, and TJX International comps increased 5%, compared with 3% last year. The company said customer traffic was the primary driver of its comp store sales increases.

Management reported that its research indicated growth in new customers, including a significant share of millennials.

The company grew its store base by 236 stores globally, to 4,036. Management reported it sees the potential to add approximately 1,800 stores over the long term in its current markets, for a total of about 6,100 stores under its current banners.

Management reported it sees the company as a leader in innovation with a rapidly turning inventory. The company highlighted it has approximately 1,100 associates in its buying organization and that it sources goods from over 21,000 vendors.

The company announced it will launch Marshalls.com, an e-commerce site for Marshalls, later this year. The site will offer a different mix than is found in stores, with the goal of maximizing multichannel engagement and driving incremental sales. TJX Cos. is also rebranding Sierra Trading Post as Sierra.

The company announced it will be launching marketing initiatives across television and digital channels in 2019 to make shopping more exciting and rewarding. Management also announced plans to amplify its loyalty program to drive higher member engagement.

Outlook

For 1Q20, TJX Cos. anticipates diluted EPS of $0.53-0.54, compared with $0.56 in the same period last year and below the consensus estimate of $0.58. The company expects incremental freight costs, store wage increases and foreign currency to negatively impact first-quarter EPS growth by approximately 7%. For fiscal year 2020, the company expects EPS of $2.55-2.60, compared with the consensus estimate of $2.60.

Source: Company reports/Coresight Research[/caption]

4Q19 Results

TJX Cos. fiscal 4Q19 revenues were $11.13 billion, up 1.5% year over year and beating the consensus estimate of $11.02 billion. Annual revenues were $38.97 billion, up 8.7% from $35.86 billion the previous year. Management noted annual sales have more than doubled over the past 10 years.

The company reported 4Q19 adjusted EPS of $0.68, down 1.4% year over year but exceeding the high end of its guidance range of $0.66-0.67 and in line with the consensus estimate.

The company saw comparable sales growth of 6%, versus a 4% increase in the same period last year. For the full fiscal year, comparable sales increased 6%, versus a 2% increase the previous year. TJX Cos. reported that fiscal 2019 marked its 23rd consecutive year of comp sales growth.

By division, Marmaxx, the company’s largest division, delivered a 7% comp increase, compared with a 3% increase last year. HomeGoods comps increased 5%, compared with 3% last year, while TJX Canada comps increased 4%, versus 7% last year, and TJX International comps increased 5%, compared with 3% last year. The company said customer traffic was the primary driver of its comp store sales increases.

Management reported that its research indicated growth in new customers, including a significant share of millennials.

The company grew its store base by 236 stores globally, to 4,036. Management reported it sees the potential to add approximately 1,800 stores over the long term in its current markets, for a total of about 6,100 stores under its current banners.

Management reported it sees the company as a leader in innovation with a rapidly turning inventory. The company highlighted it has approximately 1,100 associates in its buying organization and that it sources goods from over 21,000 vendors.

The company announced it will launch Marshalls.com, an e-commerce site for Marshalls, later this year. The site will offer a different mix than is found in stores, with the goal of maximizing multichannel engagement and driving incremental sales. TJX Cos. is also rebranding Sierra Trading Post as Sierra.

The company announced it will be launching marketing initiatives across television and digital channels in 2019 to make shopping more exciting and rewarding. Management also announced plans to amplify its loyalty program to drive higher member engagement.

Outlook

For 1Q20, TJX Cos. anticipates diluted EPS of $0.53-0.54, compared with $0.56 in the same period last year and below the consensus estimate of $0.58. The company expects incremental freight costs, store wage increases and foreign currency to negatively impact first-quarter EPS growth by approximately 7%. For fiscal year 2020, the company expects EPS of $2.55-2.60, compared with the consensus estimate of $2.60.