DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

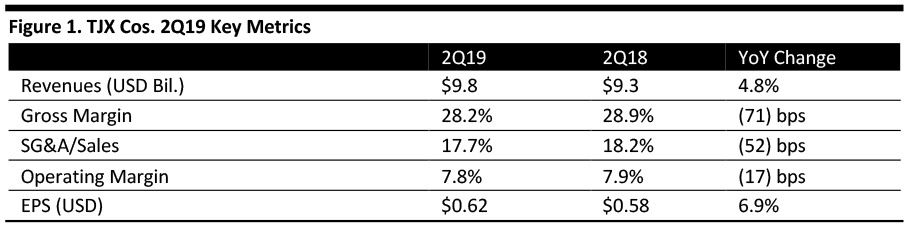

The TJX Companies (TJX) reported 2Q19 revenues of $9.8 billion, up 4.8% year over year and lower than the consensus estimate of $9.9 billion. The company reported 2Q19 earnings per share of $0.62, up 6.9% year over year and even with the consensus estimate of $0.62.

The company saw comparable sales growth of 2.0%, slower than the 6.0% increase in 2Q18 and lower than the consensus estimate of a 3.1% increase.

By division, Marmaxx, the company’s largest division, delivered a 2% comp increase, compared with a 7% increase last year. HomeGoods comps were flat compared with 3% last year, while TJX Canada delivered a 1% increase versus a 6% increase last year, and TJX International comps increased 6%, compared with 4% last year.

The company commented that customer traffic was the primary driver of its comp store sales increases. According to management, the first quarter marks the 20th consecutive quarter of customer traffic increases at Marmaxx and TJX.

The company reiterated it plans to launch Marshalls.com, an e-commerce site for Marshalls, by the end of this year. The site will offer a different mix than the stores, with the goal of maximizing multichannel engagement and driving incremental sales. Management said the goal is to have 75% to 80% differentiated products in the Marshalls online business.

The company included a small negative tariff impact in its full year guidance for the merchandise it has committed to and is planning to offset this impact through opportunities in the favorable buying environment and expense savings. However, the company has not yet committed to most of its merchandise for the fourth quarter and reported it is difficult to forecast the impact on vendor and competitor pricing, consumer demand, potential tariff pass-throughs and changes in the value of the Chinese currency.

During the quarter, the company grew its store base by 31 globally, to 4,412 stores.

Outlook

For 3Q19, TJX Cos. raised its EPS forecast from $0.61-0.62 to $0.63-0.65, compared to the consensus estimate of $0.68. The company expects comps of 1-2% compared to the consensus of 2.4%. For fiscal 2020, TJX Cos. affirmed guidance of $2.56-2.61 compared to the consensus of $2.61. The company reaffirmed comps of 2-3% compared to the consensus of 3.3%.