Nitheesh NH

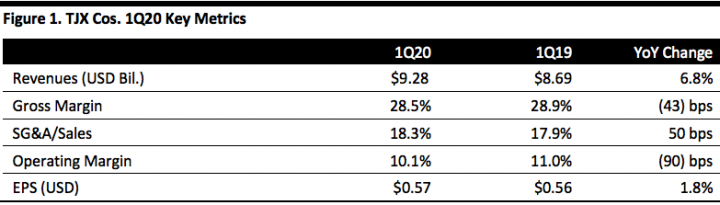

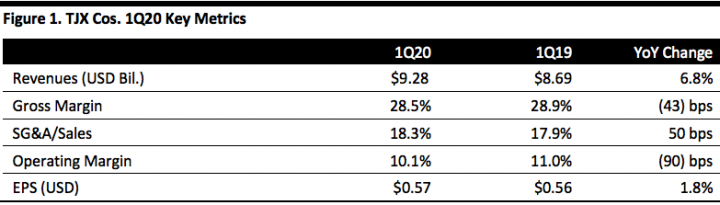

[caption id="attachment_89387" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q20 Results

The TJX Companies (TJX) fiscal 1Q20 revenues were $9.28 billion, up 6.8% year over year and beating the consensus estimate of $9.22 billion. The company reported 1Q20 EPS of $0.57, up 1.8% year over year, exceeding both the high end of its guidance range of $0.53-0.54 and the consensus estimate of $0.55.

The company saw comparable sales growth of 5.0%, versus a 3.0% increase in 1Q19, well ahead of the consensus estimate of a 3.6% increase. By division, Marmaxx, the company’s largest division, delivered a 6% comp increase, compared with a 4% increase last year. HomeGoods comps increased 1%, compared with 2% last year, while TJX Canada comps remained flat, versus a 3% increase last year, and TJX International comps increased 8%, compared with 1% last year.

The company commented that customer traffic was the primary driver of its comp store sales increases. According to management, the first quarter marks the 19th consecutive quarter of customer traffic increases at Marmaxx and TJX.

The company’s gross margin declined 43 bps year over year to 28.5%, due mainly to increased supply chain and freight costs. SG&A as a percent of sales increased 50 bps year over year to 18.3%, due primarily to a rise in staff wages and higher IT investments.

During the quarter, the company grew its store base by 75 stores globally, to 4,381. Management reported the potential to add approximately 1,719 stores over the long term in current markets, for a total of about 6,100 stores under its current banners.

For fiscal 2020, TJX has a strong remodel and relocation program: The company plans to remodel 275 stores this year and expects the number to go up as the chain matures over the next few years. TJX will also relocate more than 60 stores, almost double the number of last year.

Management expects inventory to come down over the year and said it believes TJX is in a strong position to leverage opportunities in the marketplace for branded merchandise. The company highlighted it has approximately 1,100 associates in its buying organization and that it sources goods from over 21,000 vendors across the globe.

The company reiterated it plans to launch Marshalls.com, an e-commerce site for Marshalls, by the end of this year. The site will offer a different mix than the stores, with the goal of maximizing multichannel engagement and driving incremental sales.

Management is confident the company is gaining significant market share across Europe as department store competitors close underperforming stores and report slower growth. The company also hopes to gain market share in the US home-fashion space with its HomeGoods business.

Outlook

For 2Q20, TJX anticipates diluted EPS to grow 5-7% to $0.61-0.62, compared to the prior year’s $0.58 and in line with the consensus estimate of $0.62. The company expects higher store wages and incremental freight costs to negatively impact second-quarter EPS growth by 2-3%. For 2Q20, the company forecasts comparable store sales growth of 2-3% at Marmaxx and on a consolidated basis.

For fiscal 2020, the company raised its guidance and now expects EPS of $2.56-2.61 versus prior guidance of $2.55-2.60 and compared with the consensus estimate of $2.61. On an adjusted basis, TJX expects EPS to increase 4-7% over the prior year’s adjusted $2.45, assuming a rise in store wages and incremental freight costs negatively impacts EPS growth by 3-4%. Adjusted EPS forecast for fiscal 2020 is based on estimated comparable store sales growth of 2-3% at Marmaxx and on a consolidated basis.

Source: Company reports/Coresight Research[/caption]

1Q20 Results

The TJX Companies (TJX) fiscal 1Q20 revenues were $9.28 billion, up 6.8% year over year and beating the consensus estimate of $9.22 billion. The company reported 1Q20 EPS of $0.57, up 1.8% year over year, exceeding both the high end of its guidance range of $0.53-0.54 and the consensus estimate of $0.55.

The company saw comparable sales growth of 5.0%, versus a 3.0% increase in 1Q19, well ahead of the consensus estimate of a 3.6% increase. By division, Marmaxx, the company’s largest division, delivered a 6% comp increase, compared with a 4% increase last year. HomeGoods comps increased 1%, compared with 2% last year, while TJX Canada comps remained flat, versus a 3% increase last year, and TJX International comps increased 8%, compared with 1% last year.

The company commented that customer traffic was the primary driver of its comp store sales increases. According to management, the first quarter marks the 19th consecutive quarter of customer traffic increases at Marmaxx and TJX.

The company’s gross margin declined 43 bps year over year to 28.5%, due mainly to increased supply chain and freight costs. SG&A as a percent of sales increased 50 bps year over year to 18.3%, due primarily to a rise in staff wages and higher IT investments.

During the quarter, the company grew its store base by 75 stores globally, to 4,381. Management reported the potential to add approximately 1,719 stores over the long term in current markets, for a total of about 6,100 stores under its current banners.

For fiscal 2020, TJX has a strong remodel and relocation program: The company plans to remodel 275 stores this year and expects the number to go up as the chain matures over the next few years. TJX will also relocate more than 60 stores, almost double the number of last year.

Management expects inventory to come down over the year and said it believes TJX is in a strong position to leverage opportunities in the marketplace for branded merchandise. The company highlighted it has approximately 1,100 associates in its buying organization and that it sources goods from over 21,000 vendors across the globe.

The company reiterated it plans to launch Marshalls.com, an e-commerce site for Marshalls, by the end of this year. The site will offer a different mix than the stores, with the goal of maximizing multichannel engagement and driving incremental sales.

Management is confident the company is gaining significant market share across Europe as department store competitors close underperforming stores and report slower growth. The company also hopes to gain market share in the US home-fashion space with its HomeGoods business.

Outlook

For 2Q20, TJX anticipates diluted EPS to grow 5-7% to $0.61-0.62, compared to the prior year’s $0.58 and in line with the consensus estimate of $0.62. The company expects higher store wages and incremental freight costs to negatively impact second-quarter EPS growth by 2-3%. For 2Q20, the company forecasts comparable store sales growth of 2-3% at Marmaxx and on a consolidated basis.

For fiscal 2020, the company raised its guidance and now expects EPS of $2.56-2.61 versus prior guidance of $2.55-2.60 and compared with the consensus estimate of $2.61. On an adjusted basis, TJX expects EPS to increase 4-7% over the prior year’s adjusted $2.45, assuming a rise in store wages and incremental freight costs negatively impacts EPS growth by 3-4%. Adjusted EPS forecast for fiscal 2020 is based on estimated comparable store sales growth of 2-3% at Marmaxx and on a consolidated basis.

Source: Company reports/Coresight Research[/caption]

1Q20 Results

The TJX Companies (TJX) fiscal 1Q20 revenues were $9.28 billion, up 6.8% year over year and beating the consensus estimate of $9.22 billion. The company reported 1Q20 EPS of $0.57, up 1.8% year over year, exceeding both the high end of its guidance range of $0.53-0.54 and the consensus estimate of $0.55.

The company saw comparable sales growth of 5.0%, versus a 3.0% increase in 1Q19, well ahead of the consensus estimate of a 3.6% increase. By division, Marmaxx, the company’s largest division, delivered a 6% comp increase, compared with a 4% increase last year. HomeGoods comps increased 1%, compared with 2% last year, while TJX Canada comps remained flat, versus a 3% increase last year, and TJX International comps increased 8%, compared with 1% last year.

The company commented that customer traffic was the primary driver of its comp store sales increases. According to management, the first quarter marks the 19th consecutive quarter of customer traffic increases at Marmaxx and TJX.

The company’s gross margin declined 43 bps year over year to 28.5%, due mainly to increased supply chain and freight costs. SG&A as a percent of sales increased 50 bps year over year to 18.3%, due primarily to a rise in staff wages and higher IT investments.

During the quarter, the company grew its store base by 75 stores globally, to 4,381. Management reported the potential to add approximately 1,719 stores over the long term in current markets, for a total of about 6,100 stores under its current banners.

For fiscal 2020, TJX has a strong remodel and relocation program: The company plans to remodel 275 stores this year and expects the number to go up as the chain matures over the next few years. TJX will also relocate more than 60 stores, almost double the number of last year.

Management expects inventory to come down over the year and said it believes TJX is in a strong position to leverage opportunities in the marketplace for branded merchandise. The company highlighted it has approximately 1,100 associates in its buying organization and that it sources goods from over 21,000 vendors across the globe.

The company reiterated it plans to launch Marshalls.com, an e-commerce site for Marshalls, by the end of this year. The site will offer a different mix than the stores, with the goal of maximizing multichannel engagement and driving incremental sales.

Management is confident the company is gaining significant market share across Europe as department store competitors close underperforming stores and report slower growth. The company also hopes to gain market share in the US home-fashion space with its HomeGoods business.

Outlook

For 2Q20, TJX anticipates diluted EPS to grow 5-7% to $0.61-0.62, compared to the prior year’s $0.58 and in line with the consensus estimate of $0.62. The company expects higher store wages and incremental freight costs to negatively impact second-quarter EPS growth by 2-3%. For 2Q20, the company forecasts comparable store sales growth of 2-3% at Marmaxx and on a consolidated basis.

For fiscal 2020, the company raised its guidance and now expects EPS of $2.56-2.61 versus prior guidance of $2.55-2.60 and compared with the consensus estimate of $2.61. On an adjusted basis, TJX expects EPS to increase 4-7% over the prior year’s adjusted $2.45, assuming a rise in store wages and incremental freight costs negatively impacts EPS growth by 3-4%. Adjusted EPS forecast for fiscal 2020 is based on estimated comparable store sales growth of 2-3% at Marmaxx and on a consolidated basis.

Source: Company reports/Coresight Research[/caption]

1Q20 Results

The TJX Companies (TJX) fiscal 1Q20 revenues were $9.28 billion, up 6.8% year over year and beating the consensus estimate of $9.22 billion. The company reported 1Q20 EPS of $0.57, up 1.8% year over year, exceeding both the high end of its guidance range of $0.53-0.54 and the consensus estimate of $0.55.

The company saw comparable sales growth of 5.0%, versus a 3.0% increase in 1Q19, well ahead of the consensus estimate of a 3.6% increase. By division, Marmaxx, the company’s largest division, delivered a 6% comp increase, compared with a 4% increase last year. HomeGoods comps increased 1%, compared with 2% last year, while TJX Canada comps remained flat, versus a 3% increase last year, and TJX International comps increased 8%, compared with 1% last year.

The company commented that customer traffic was the primary driver of its comp store sales increases. According to management, the first quarter marks the 19th consecutive quarter of customer traffic increases at Marmaxx and TJX.

The company’s gross margin declined 43 bps year over year to 28.5%, due mainly to increased supply chain and freight costs. SG&A as a percent of sales increased 50 bps year over year to 18.3%, due primarily to a rise in staff wages and higher IT investments.

During the quarter, the company grew its store base by 75 stores globally, to 4,381. Management reported the potential to add approximately 1,719 stores over the long term in current markets, for a total of about 6,100 stores under its current banners.

For fiscal 2020, TJX has a strong remodel and relocation program: The company plans to remodel 275 stores this year and expects the number to go up as the chain matures over the next few years. TJX will also relocate more than 60 stores, almost double the number of last year.

Management expects inventory to come down over the year and said it believes TJX is in a strong position to leverage opportunities in the marketplace for branded merchandise. The company highlighted it has approximately 1,100 associates in its buying organization and that it sources goods from over 21,000 vendors across the globe.

The company reiterated it plans to launch Marshalls.com, an e-commerce site for Marshalls, by the end of this year. The site will offer a different mix than the stores, with the goal of maximizing multichannel engagement and driving incremental sales.

Management is confident the company is gaining significant market share across Europe as department store competitors close underperforming stores and report slower growth. The company also hopes to gain market share in the US home-fashion space with its HomeGoods business.

Outlook

For 2Q20, TJX anticipates diluted EPS to grow 5-7% to $0.61-0.62, compared to the prior year’s $0.58 and in line with the consensus estimate of $0.62. The company expects higher store wages and incremental freight costs to negatively impact second-quarter EPS growth by 2-3%. For 2Q20, the company forecasts comparable store sales growth of 2-3% at Marmaxx and on a consolidated basis.

For fiscal 2020, the company raised its guidance and now expects EPS of $2.56-2.61 versus prior guidance of $2.55-2.60 and compared with the consensus estimate of $2.61. On an adjusted basis, TJX expects EPS to increase 4-7% over the prior year’s adjusted $2.45, assuming a rise in store wages and incremental freight costs negatively impacts EPS growth by 3-4%. Adjusted EPS forecast for fiscal 2020 is based on estimated comparable store sales growth of 2-3% at Marmaxx and on a consolidated basis.