Source: Company reports

4Q15 RESULTS

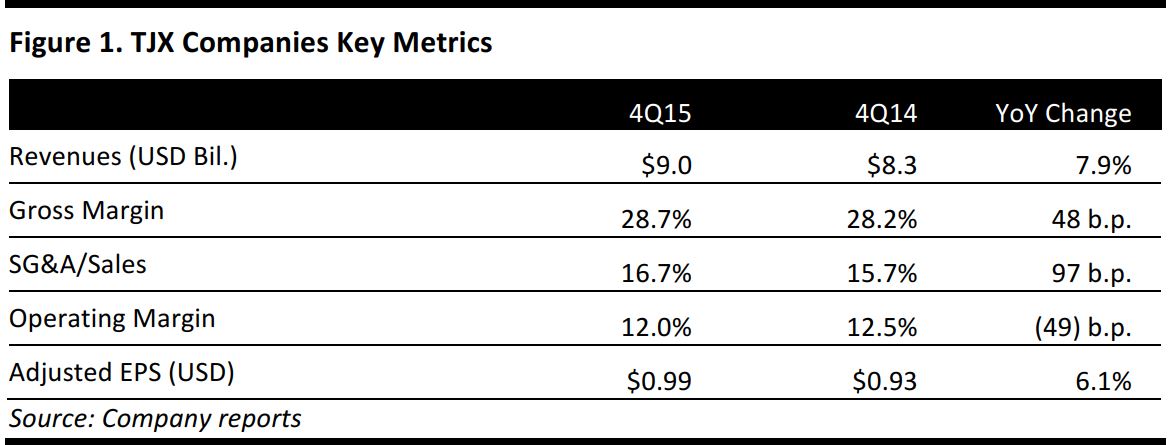

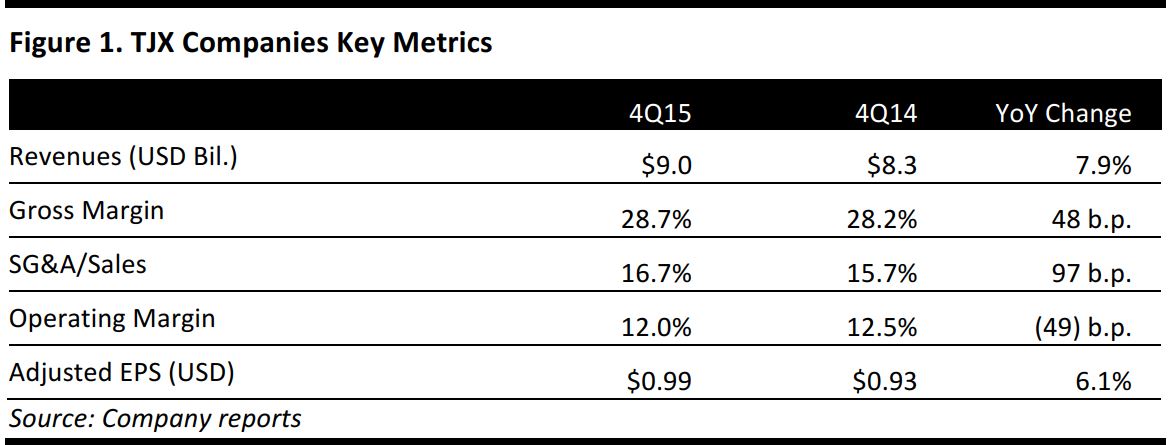

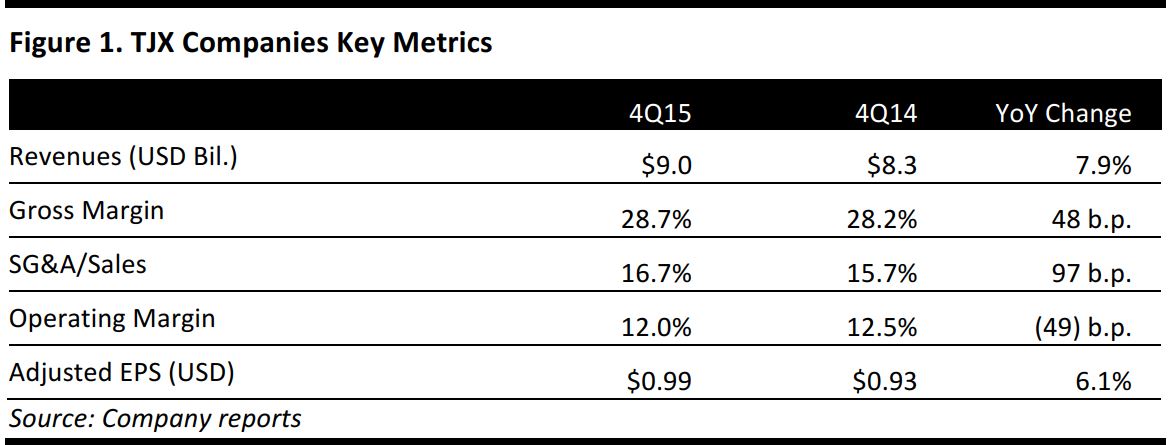

The TJX Companies reported 4Q15 net sales of $9.0 billion, up 7.9% year over year, driven by increases in customer traffic. Management believes that the company is gaining market share globally. Total comps of 6% comprised 6% comps for Marmaxx, 7% comps for Home Goods in the US, 14% comps for TJX Canada and 1% comps at TJX International in Europe and Australia.

The company was able to raise its gross margin by 48 basis points year over year, and management commented that it was still able to offer outstanding values.

EPS was $0.99, beating the consensus estimate by a nickel and representing a 6.1% increase year over year.

The company also announced a plan to repurchase approximately $1.5–$2.0 billion of TJX stock during 2016. TJX Companies is also raising its quarterly dividend by a nickel, to $0.26 per share.

2015 RESULTS

Net sales in 2015 were $30.9 billion, up 6.4%, and were driven by 5% comps. 2015 marked the first year that revenues exceeded $30 billion. Management commented that 2015 represents the company’s 20th consecutive year of positive comps and EPS growth. Full-year comps were 4% for Marmaxx, 8% for Home Goods, 12% for TJX Canada and 4% for TJX International.

2015 EPS was $3.33, exceeding the $3.29 consensus estimate and up 5.9% from the prior year.

OUTLOOK

2016

For 2016, management expects 1%–2% comp growth, which would put revenues in the range of $31.2-$31.5 billion.

Diluted EPS is expected to be $3.29–$3.38, down 1%–2% year over year, versus the consensus estimate of $3.62.This guidance includes currency effects and wage growth expected to hurt EPS growth by 4% each.

1Q16

For 1Q16, management expects 2%–3% comps to be more than offset by currency effects of 2% and wage growth of 3%. This would put revenues down 2%–3%, to about $6.7 billion, compared to the consensus estimate of $7.2 billion.

Diluted EPS is expected to be $0.68–$0.70, compared to $0.69 in the year-ago quarter and versus the consensus estimate of $0.74.