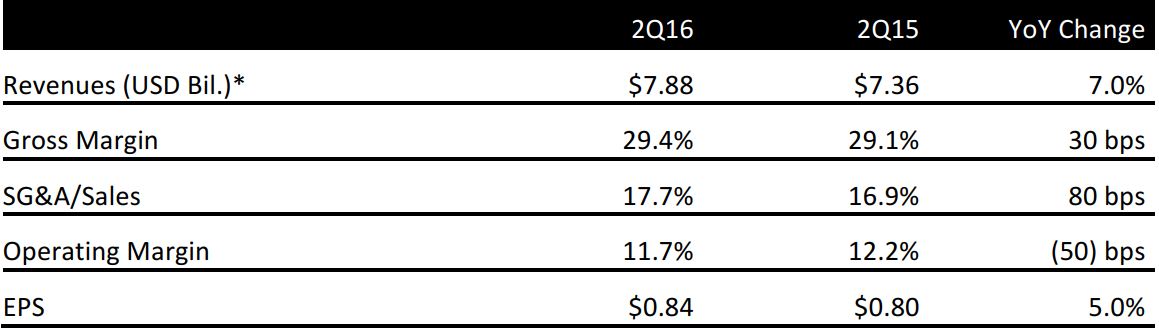

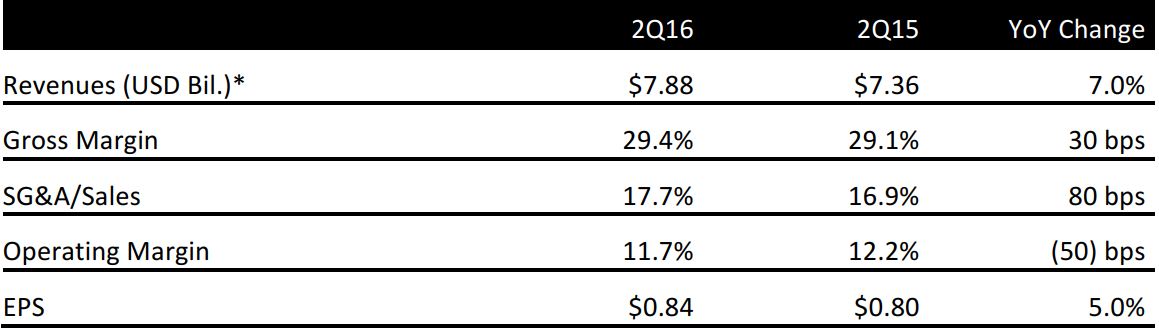

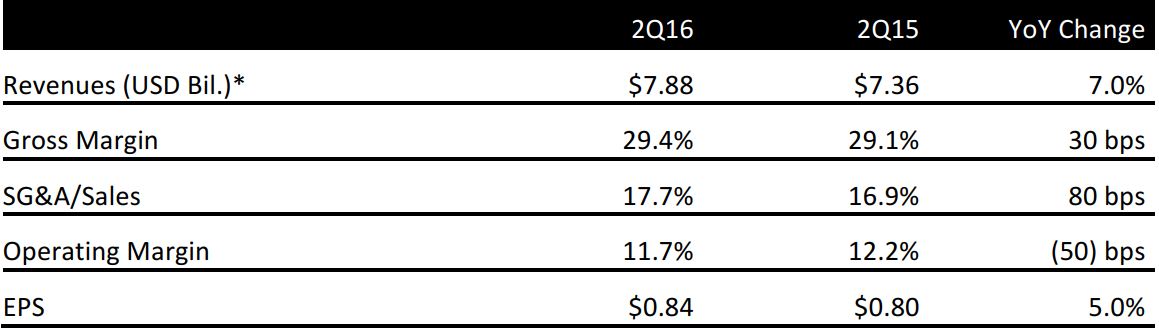

Source: Company reports

2Q16 RESULTS

The TJX Companies reported 2Q16 EPS of $0.84 versus the consensus estimate of $0.81.

Total revenues were $7.88 billion, above expectations of $7.85 billion. Comps were up 4%, beating expectations of 3.5%, and were almost completely driven by higher traffic. The period marked the seventh consecutive quarter in which comps were primarily driven by increases in traffic. Units per transaction increased, while average ticket declined by slightly more than planned. Both the apparel (including accessories) and home categories performed well.

Marmaxx comps increased by 4%. Segment margins declined by 30 basis points as wage increases and costs associated with a lower average ticket weighed on merchandise margins.

Home Goods comps increased by 5%. The division’s margins were up 50 basis points despite wage increases due to a very strong increase in merchandise margins.

TJX Canada comps were up 9%. Excluding foreign currency, margins were down 150 basis points due to the negative impact that the year-over-year decline in the Canadian dollar had on merchandise margins.

TJX International comps were up 2%. Sales in the UK were lower than planned, although trends leading up to the Brexit vote were very strong. Comps in the UK were positive at the start of the third quarter. Margins excluding foreign currency were down 260 basis points due to a combination of the Trade Secret integration in Australia and investments to support growth and wage increases.

During the period, the company added 14 stores, for a total of 3,675 at the end of the second quarter. Square footage was up 5% over the prior-year period.

2016 OUTLOOK

Management provided 3Q16 EPS guidance of $0.83–$0.85 versus consensus of $0.90. Comps are expected to increase by 2%–3% for the period, compared with consensus of 3%. Marmaxx comps are expected to increase by 2%–3%. Revenues are expected to be $8.1–$8.2 billion, below consensus of $8.24 billion.

The third quarter is off to a solid start, according to management, which sees plentiful opportunities for the second half of the year.

For 4Q16, EPS is expected to be $0.98–$1.00 based on expected comp growth of 1%–2%.

For the full year, the company raised its EPS outlook to $3.39–$3.43 from $3.35–$3.42 previously, based on 3%–4% expected comp growth. The increase is based on better performance in the second quarter. By division, comps are expected to increase by 3% at Marmaxx (up from 2%–3% previously), by 4%–5% at Home Goods (unchanged), by 7%–8% at TJX Canada (up from 6% previously) and by 2%–3% at TJX International (unchanged).

Looking a bit further out, in 2017, the company expects wage increases to have a negative impact of 3% on EPS, and foreign exchange is expected to negatively affect margins and EPS growth.