| Date |

Development |

| May, 2022 |

The TJX Companies issues allergy alert and recalls certain vegan chocolate products because they may contain undeclared milk. |

| April, 2022 |

The TJX Companies announces plans to expand and accelerate environmental goals as part of the Company’s ongoing environmental sustainability strategy. As part of its global efforts, TJX is aiming to: achieve net zero greenhouse gas (GHG) emissions in its operations by 2040; source 100% renewable energy in its operations by 2030; divert 85% of its operational waste from landfill by 2027; shift 100% of the packaging for products developed in-house by its product design team to be reusable; and recyclable, or contain sustainable materials by 2030. |

| February 2022 |

The TJX Companies reports revenues for its fiscal 2021 fourth quarter, of $13.9 billion, up 26.6% from its 2020 fourth quarter and 13.5% from its 2019 fourth quarter. TJX open-only stores sales were up 10% overall. By banner, Marmaxx revenue increased by 10%, HomeGoods by 22%, TJX Canada by 1%, and TJX International and Europe were down 2%. For the full fiscal year, TJX reports revenues of $49.4 billion, up 54.2% from fiscal 2020 and 18.8% from fiscal 2019. For the full fiscal year, TJX open-only stores sales were up 15% overall. By banner, Marmaxx increased by 13%, HomeGoods by 32%, TJX Canada by 8%, and TJX International and Europe by 6%. |

| November 2021 |

The TJX Companies reports revenues for its fiscal 2021 third quarter, of $12.5 billion, up 23.9% from the third quarter of 2020 and 19.9% from the third quarter of 2019. TJX open-only comp store sales were up 14% overall. By banner, Marmaxx increased by 11%, HomeGoods 34%, TJX Canada 8%, and TJX International and Europe 10%. |

| August 2021 |

The TJX Companies reports revenues for its second quarter of $12.1 billion, up 81.1% from the same period in 2020 and 23.5% from 2019. TJX open-only comp store sales were up 20% overall. By banner, Marmaxx increased by 18%, HomeGoods 36%, TJX Canada 18% and TJX International and Europe 12%. |

| September 2021 |

The TJX Companies announces the launch of its HomeGoods online store, HomeGoods.com. TJX stated that it believes this move will help to position the company to take market share from its competitors in the home category. |

| May 2021 |

The TJX Companies reports revenues for its first quarter of $10.1 billion, up 128.8% from the year-ago quarter, which recorded $4.4 billion, and up 8.7% from the same period in 2019. TJX open-only comp store sales were up 16% overall. By banner, Marmaxx increased by 16%, HomeGoods 40%, TJX Canada 9% and TJX International and Europe 11%. |

| February 2021 |

The TJX Companies reports revenues for its fourth quarter of $10.9 billion, down 10.7% from $12.2 billion in the year-ago quarter. TJX open-only comp store sales were down by 3% overall. By banner, Marmaxx decreased by 7%; HomeGoods increased by 12%; TJX Canada decreased by 4%; and TJX International and Europe increased by 2%. For the full fiscal year 2020, the company reported revenue of $32.1 billion, down 23.0% from fiscal year 2019. TJX open-only comp store sales were down by 4% overall for the year. By banner, Marmaxx (7)%; HomeGoods 13%; TJX Canada (8)% and TJX International and Europe (2)%. |

| November 2020 |

The TJX Companies reports revenue for its third quarter of $10.1 billion, down 3.2% from $10.5 billion in the year-ago quarter. TJX open-only comp store sales were down 5% overall. By banner, Marmaxx (10)%; HomeGoods 15%; TJX Canada (7)% and TJX International and Europe (6)%. |

| November 2020 |

The TJX Companies reports that it has temporarily closed 470 stores due to local government mandates in response to the Covid-19 global pandemic. The majority of these stores are located in Europe. |

| November 2020 |

The TJX Companies reports strength in its home, beauty and activewear categories across Marmaxx, TJX Canada and TJX International. It reports shifting its buying to these higher-demand categories. |

| November 2020 |

The TJX Companies announces plans to open at least 100 stores in 2021. There are no confirmed figures given but TJX states it will be a “3% range of store openings as a percent of growth.” |

| November 2020 |

The TJX Companies announces plans to roll out e-commerce on HomeGoods.com in 2021. |

| November 2020 |

The TJX Companies announces that it added 100 new vendors in 2020. The company now sources from 21,000 vendors globally. |

| October 2020 |

The TJX Companies announces at a press conference that it is building a 2 million-square-foot distribution center in El Paso, Texas. |

| June 2020 |

The TJX Companies begins to reopen its stores after being closed due to the Covid-19 pandemic. |

| June 2020 |

The TJX Companies makes a pledge of $10 million in grant funding over the next two years to organizations that are actively working to support racial justice and equity. |

| April 2020 |

The TJX Companies makes temporary employee furloughs in response to Covid-19. President and CEO Ernie Herrman and Executive Chairman Carol Meyrowitz take base salary reductions of 30%, and the base salary of other executive officers is reduced by 20%. |

| March 2020 |

The TJX Companies closes all of its stores for at least two weeks and has temporarily closed its online businesses, its distribution centers and its offices, with associates working remotely where possible, due to the Covid-19 pandemic. |

| March 2020 |

The TJX Companies announces that T.J. Maxx has launched a game on social media, which it refers to as “#Maxximizing” with 5 influencers with product installations, “pods.” Consumers guess the price of the total price of the pod on Instagram, and those with the closest guess are entered for a chance to win the pod contents or a gift card to T.J. Maxx. |

| November 2019 |

The TJX Companies completes, through a wholly owned subsidiary, an investment of $225 million, excluding acquisition costs, for a 25% ownership stake in privately held Familia—an established, off-price apparel and home fashions retailer with more than 275 stores throughout Russia. |

| May 2019 |

The TJX Companies announces that T.J. Maxx has opened a distribution center in San Antonio, Texas. |

| April 2019 |

The TJX Companies announces plans to open a $170 million distribution facility for HomeGoods in Lordstown, Ohio, which will ship to more than 300 stores. |

| December 2018 |

The TJX Companies announces that Banco Santander S.A. has cut its holdings in shares of the company by 66.4% in the third quarter. A number of other hedge funds have also added to or reduced their stakes in TJX. |

| December 2018 |

The TJX Companies recalls approximately 21,500 ceramic and glass drawer knobs sold at T.J. Maxx, Marshalls and HomeGoods stores due to a laceration hazard. |

| November 2018 |

The TJX Companies expects rising freight and labor costs to impact full-year 2020 earnings by 2% each, it said on a post-earnings call on November 20, 2018. |

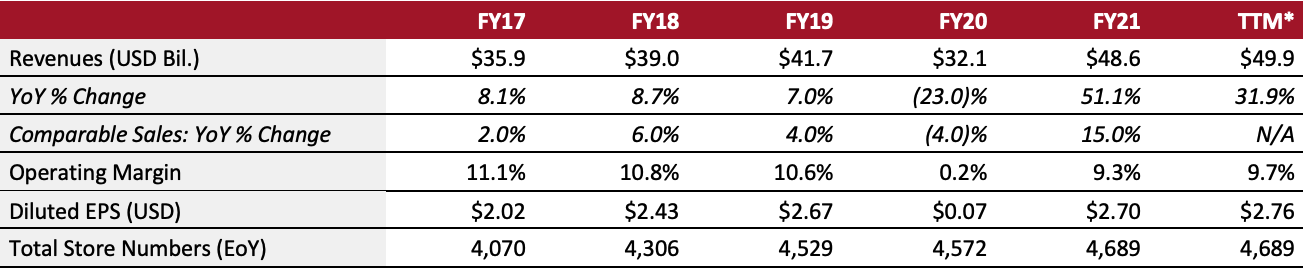

Fiscal year ends on January 30 of the following calendar year *TTM is for the period ending April 30, 2022[/caption]

Summary

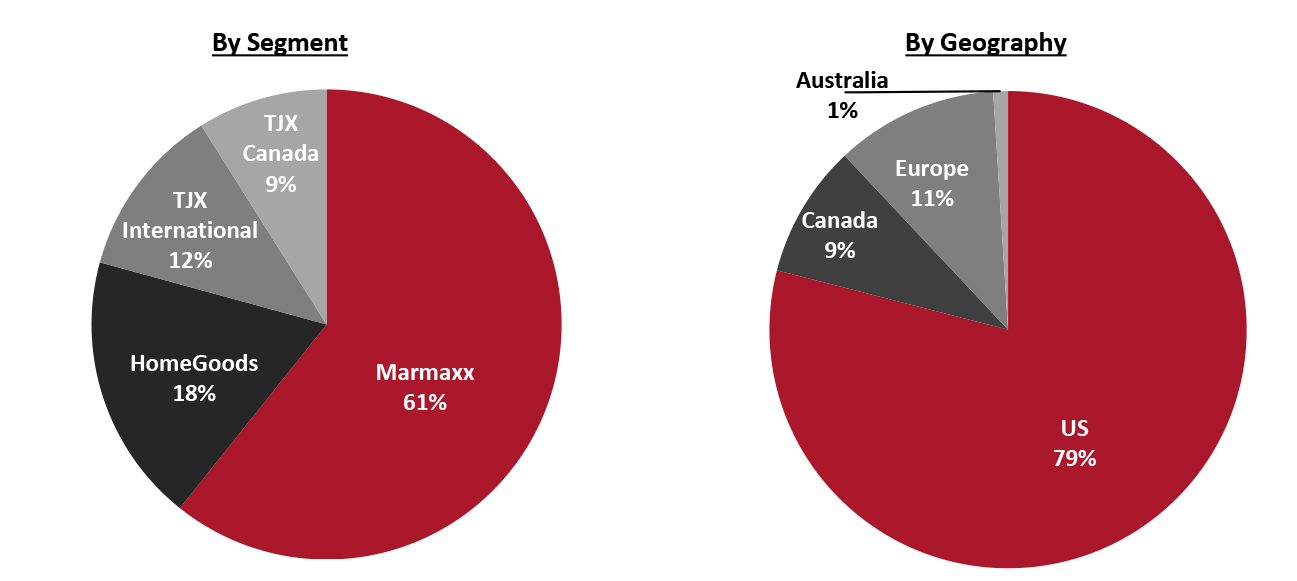

The TJX Companies is an off-price apparel and home-fashions retailer selling accessories, apparel, bath and beauty, food products, footwear, home, jewelry and other merchandise. It operates through four segments: Marmaxx, HomeGoods, TJX Canada and TJX International. The company operates stores under the HomeGoods, HomeSense, Marshalls, Sierra Post, T.J. Maxx, TK Maxx and Winners banners and operates e-commerce sites including TJMaxx.com, TKMaxx.com and SierraTradingPost.com. The company was founded in 1956 and is headquartered in Framingham, Massachusetts. As of January 29, 2022, The TJX Companies operates a total of 4,689 stores, including 3,380 in the US, 695 in Europe, 546 in Canada and 68 in Australia.

Company Analysis

Coresight Research insight: The company’s strategy centers on opportunistic buying—it operates with more than 1,000 associates in 16 buying offices in 12 countries, purchasing from more than 100 countries. The company takes advantage of opportunities to acquire merchandise at substantial discounts that regularly arise from the production and flow of inventory in the apparel and home marketplace. This diversified buying strategy is a strong positive, enabling the company to obtain varied and unique products through a variety of global vendors—and allows the company to maintain a steady flow of new inventory into its stores. However, a downside of this approach is the proliferation of stock-keeping units (SKUs) and difficulty in aligning these SKUs with consumer trends. It also presents challenges for online product management, both in terms of the difficulty uploading many different SKUs on a constant basis and from the perspective of the customer—search and discovery online is difficult. Additionally, it requires that the company’s buyers have deep knowledge of its customers.

Fiscal year ends on January 30 of the following calendar year *TTM is for the period ending April 30, 2022[/caption]

Summary

The TJX Companies is an off-price apparel and home-fashions retailer selling accessories, apparel, bath and beauty, food products, footwear, home, jewelry and other merchandise. It operates through four segments: Marmaxx, HomeGoods, TJX Canada and TJX International. The company operates stores under the HomeGoods, HomeSense, Marshalls, Sierra Post, T.J. Maxx, TK Maxx and Winners banners and operates e-commerce sites including TJMaxx.com, TKMaxx.com and SierraTradingPost.com. The company was founded in 1956 and is headquartered in Framingham, Massachusetts. As of January 29, 2022, The TJX Companies operates a total of 4,689 stores, including 3,380 in the US, 695 in Europe, 546 in Canada and 68 in Australia.

Company Analysis

Coresight Research insight: The company’s strategy centers on opportunistic buying—it operates with more than 1,000 associates in 16 buying offices in 12 countries, purchasing from more than 100 countries. The company takes advantage of opportunities to acquire merchandise at substantial discounts that regularly arise from the production and flow of inventory in the apparel and home marketplace. This diversified buying strategy is a strong positive, enabling the company to obtain varied and unique products through a variety of global vendors—and allows the company to maintain a steady flow of new inventory into its stores. However, a downside of this approach is the proliferation of stock-keeping units (SKUs) and difficulty in aligning these SKUs with consumer trends. It also presents challenges for online product management, both in terms of the difficulty uploading many different SKUs on a constant basis and from the perspective of the customer—search and discovery online is difficult. Additionally, it requires that the company’s buyers have deep knowledge of its customers.

Source: Company reports[/caption]

Company Developments

Source: Company reports[/caption]

Company Developments