Introduction: The Time for Sustainability in Retail Is Now

Interest in sustainability did not go away with the arrival of Covid-19; it was just momentarily superseded by concerns of health, employment, household finance and access to essentials. Consumers’ values and priorities have shifted: With less need for new fashion, some consumers have increased their focus on brand values that resonate with them personally, from inclusivity to manufacturing origin. This shift has resulted in heightened consumer awareness of sustainability; Coresight Research’s

survey of US consumers on August 26 found that for 29% of respondents, sustainability was more of a factor when shopping because of the crisis.

Investor interest is growing as well. Investment management firm BlackRock noted that as investors sought to rebalance their portfolios during coronavirus-led market turmoil, they increasingly preferred sustainable funds over more traditional ones. In the first quarter of 2020, global, sustainable, open-ended funds (mutual funds and exchange-traded funds) brought in $40.5 billion in new assets, a 41% increase year over year. US sustainable funds attracted a record $7.3 billion for the quarter.

For businesses, the pandemic has revealed the fragility of global supply chains and disparate workforces. The business community is looking to achieve environmental sustainable practices that do not add cost but instead provide cost savings. The good news is that many sustainable business practices are profitable in the intermediate to long term, although they involve some upfront cost and require the learning of new processes and ways of doing business.

Employees, investors and consumers expect sustainability to be addressed at the companies for which they work, in which they invest and by the brands from which they buy. Consumers expect it—and demand it—and use social media to out companies that are remiss. According to the Boston Consulting Group, 75% of consumers believe sustainability is ‘very important,’ with more than a third willing to walk away from their preferred brand due to lack of sustainability initiatives.

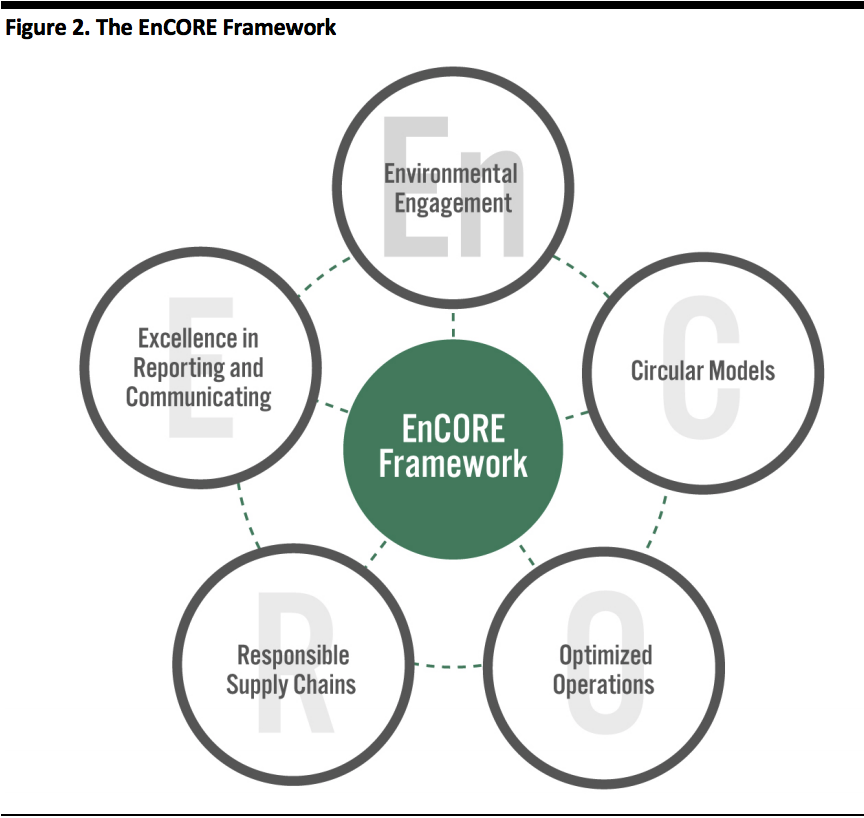

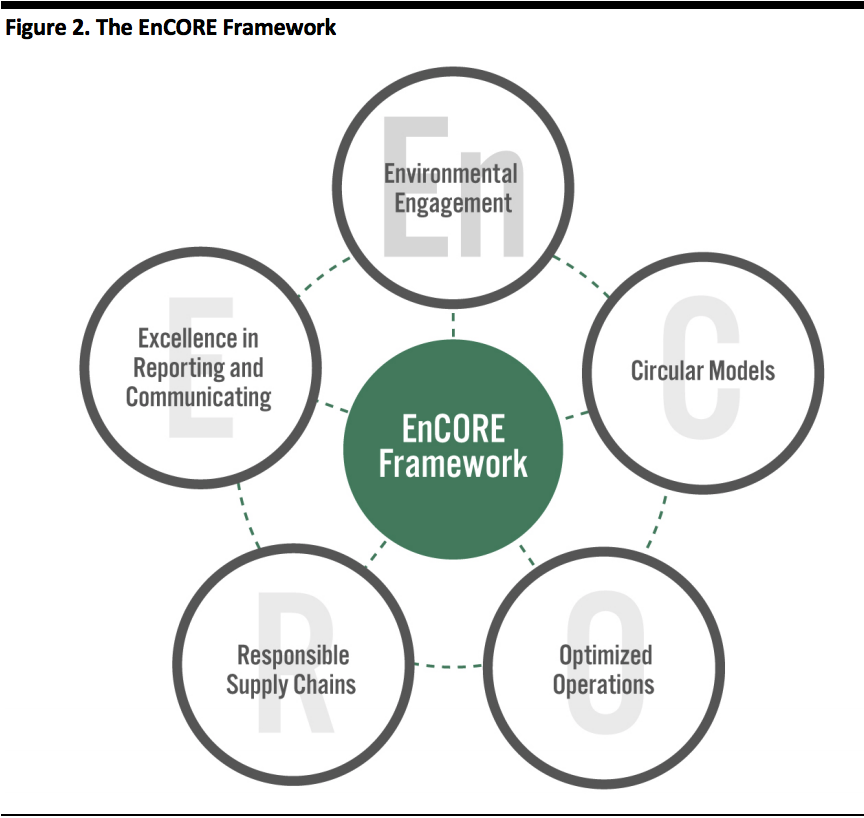

In this report, sponsored by IBM, we discuss Coresight Research’s EnCORE framework, which is designed to help retailers and brands frame their approach to sustainability.

So, What Is Sustainability?

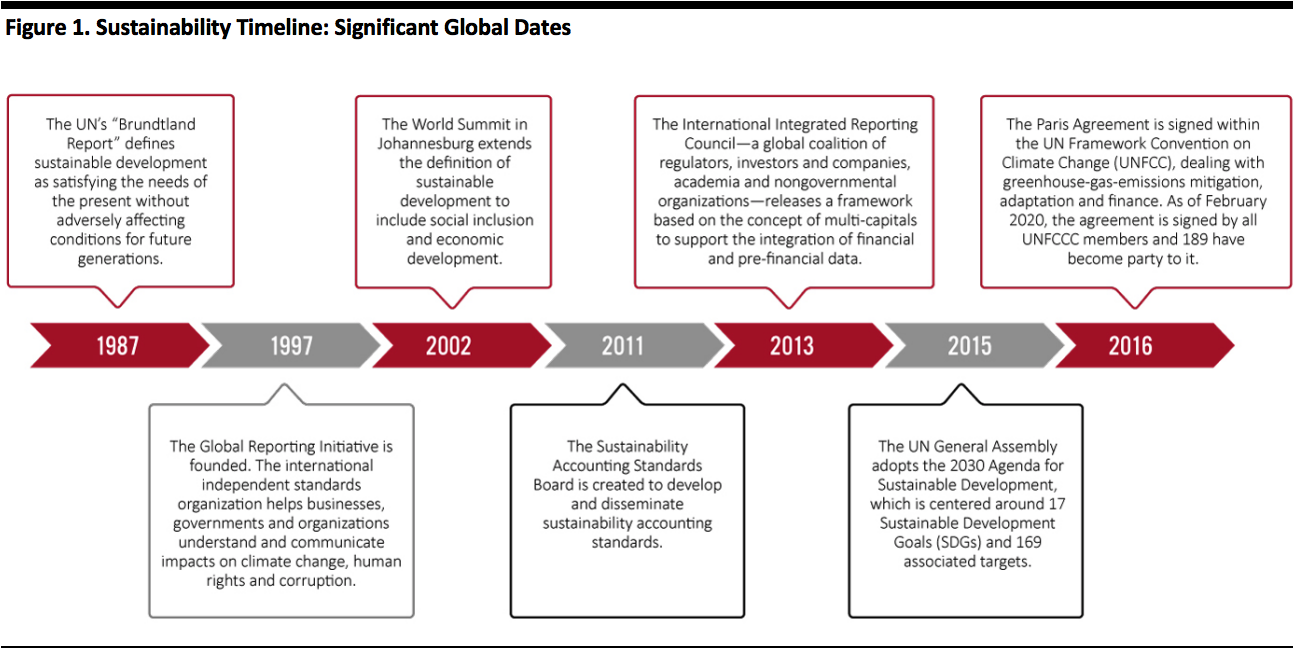

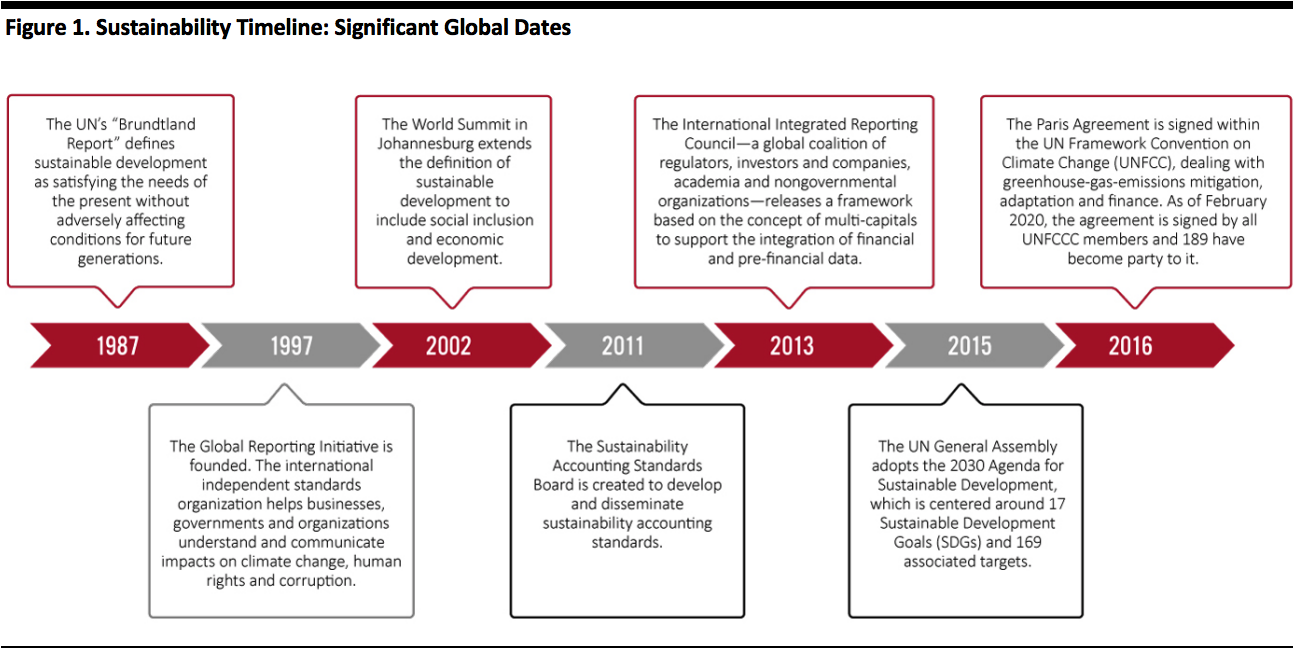

Sustainability is different things to different people. Its original meaning was simply that a process could be repeated over and over without ever running out of raw materials—i.e., the practice could be sustained indefinitely. The UN’s World Commission on Environment and Development is perhaps the most quoted on the definition of sustainable development as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” This definition originated in 1987 with the “Brundtland Report,” which introduced sustainable development and how it could be achieved.

In recent years, sustainability has come to mean much more, and the term now tends to include areas such as environmental practices, social responsibility and even corporate governance.

According to the US Environmental Protection Agency (EPA), “Sustainability is based on a simple principle: Everything that we need for our survival and well-being depends, either directly or indirectly, on our natural environment. To pursue sustainability is to create and maintain the conditions under which humans and nature can exist in productive harmony to support present and future generations.”

The following timeline highlights major milestones in the evolution of sustainability.

[caption id="attachment_116316" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

Navigating the sheer volume of issues that fall under the umbrella of sustainability is daunting. In this report, we simplify this for retail by narrowing the scope of sustainability to an environmental focus.

Supply chains are often the low-hanging fruit when it comes to delivering greater efficiency and driving sustainable practices: It is all about reducing waste, but greater efficiency and lower resource consumption can also mean lower costs. A long-term strategy with sustainability built in can deliver on the triple bottom line: people, profits and the planet—the three “P”s. In fact, corporations that plan with climate change in mind secure an 18% higher return on investment than companies that do not do so, according to Challenge.org

The three “P”s result in a fourth “P,” progress. Retailers are in a unique position to drive change, given the large number of vendors with which they work: Retail has a unique ability to influence sustainability practices across a large number of industry players.

EnCORE Framework for Environmental Sustainability in Retail

Coresight Research has developed the EnCORE framework to help retailers and brands frame their approach to sustainability. The framework comprises five components (see Figure 2), providing a model through which retailers can begin to internalize a sustainability strategy.

[caption id="attachment_116317" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption]

In the following sections, we outline the five components of EnCORE, discuss how companies can make progress in each of them and provide examples of companies that are taking the lead.

En: Environmental Engagement

Environmental engagement is the starting point to developing a sustainability strategy, and it begins with awareness of how your industry impacts the environment.

The key component of environmental awareness is understanding—of one’s own operations and supply chain (both internal and external processes), plus peer practices and incremental industry shifts. Businesses should seek the opinions of all stakeholders, including employees and investors, and seek to understand consumer demands and preferences on sustainability.

There are four ways in which retailers and brands can take advantage of external sources to bring knowledge, awareness and experience into their organizations:

- Lean on external research and draw on third-party information to deepen understanding of industry priorities and to build awareness of consumer demands. From a strategic perspective, external research informs and validates business decisions, improving the ability to gain competitive advantage.

- Engage advisory groups or specialist consultants to assist with a company review—providing input, conducting analysis and identifying risks and opportunities as well as offering assistance in developing sustainability objectives and creating an action plan. Look at sustainability strategies across other industries for inspiration.

- Work with environmentally focused nongovernmental organizations for examples of how to operate using fewer resources.

- Join with retail peers to determine sustainability best practices and leaders. Review corporate environmental and sustainability reports of best-in-class corporate citizens. Stay informed on new processes, technology, innovation and solutions.

Below, we outline selected environmental regulations and standards for US businesses. For a comprehensive list, see the appendix of this report.

- Title V of the Clean Air Act—Businesses that have glass manufacturing, metal processing, waste incineration units, chemical manufacturing and similar processing operations are required to obtain a state and local permit and annual certification of compliance. Permits are legally enforceable and state what facilities must do to control their air emissions.

- Clean Water Act—Businesses must meet local, state and federal requirements.

- Section 402—National Pollutant Discharge Elimination System (NPDES): An NPDES permit regulates direct discharges from point sources to surface waters, including wastewater treatment plants or stormwater from the facility during rain events.

- Section 404—Wetlands: A permit is required before the discharge of dredged or fill materials into US waters and wetlands, unless the activity is exempt (certain farming and forestry).

- Resource Conservation and Recovery Act—A state or EPA regional office permit is required for the generation, treatment, transportation, storage and disposal of hazardous wastes. The EPA website also provides access to resources for corporate environmental stewardship, and legal experts can formalize actions into a company sustainability policy.

- National Emission Standards for Hazardous Air Pollutants (NESHAP)—NESHAP sources are known or suspected causes of cancer or other serious health effects. The EPA conducts inspections of facilities, subject to regulations, and of the processes and emissions points; hazardous waste combusters, certain types of chemical manufacturing, glass manufacturing and other source categories are indicated on the EPA website.

Once retailers understand the issues, they should be bold. Companies should develop a plan around the sustainability issues where they can have an immediate and direct impact, while establishing a longer-term sustainability strategy and vision comprising specific sustainability goals. Retailers should look to collaborate across their business ecosystem and work with vendors, service providers and other retailers to improve the environment. By increasing the number of companies addressing environmental sustainability in business operations, costs should decline and profits improve.

C: Circular Models

Retailers and brands can adopt circular models to minimize the environmental impact of their products and maximize the recirculation of materials back into use.

As opposed to a linear business model, in which inputs come in one end and products out the other, circular models emphasize the optimization of resources and the elimination of single-use products—so many materials re-enter at the start of the cycle. The key to building circular models is to design waste out of processes across the supply chain and choose materials that can be used in closed loops—i.e., materials are brought back into the production process, and resources are continually repurposed in a recycle and reuse loop.

Retailers striving towards zero waste should measure consumption, waste and recycling rates to find opportunities for improvement, and often, the end of a product’s life is a good place to start. Product quality and durability are requisite for a successful circular business model, and warranties and repair services are a means of extending a product’s life. For example, VF Corporation offers warranties and repairs through its Eagle Creek, Eastpak and The North Face brands, while “Clothes the Loop” is active at approximately 150 The North Face stores worldwide for shoppers to extend the life of clothing from any brand in any condition.

Rental and resale services tap into consumers’ growing demand for sustainable business models, complemented by the growth in the sharing-economy mindset (exhibited by the success of Airbnb and Uber Technologies). Retailers are increasingly adding resale services to their offerings to capitalize on this trend—driving store traffic, attracting new consumers and promoting a circular economy at the same time.

Sustainable end-of-life processes include recommerce, recycling, upcycling and recovery programs that reuse or repurpose products, often deconstructed and incorporated back into the production cycle. The apparel market provides numerous examples of such programs:

- Patagonia’s recycle, repurpose and repair programs.

- Everlane’s reuse of materials to create sustainable cashmere and denim.

- Clothing brand Eileen Fisher was an early advocate of sustainability. It champions the notion of “buy less, make less” as a sustainable solution and moved the apparel industry from a “take-make-waste” model toward a circular one. The Eileen Fisher brand launched its take-back program, Eileen Fisher Renew, in 2009—through which it resells used Eileen Fisher items. The program has taken back approximately 1.4 million units; this represents less than 2% of the total number of units produced since the company’s 1984 founding, suggesting significant opportunity. According to the brand’s founder, Eileen Fisher, it “employs about 30 people in Renew [as of April 2020]… and it is a profitable piece of the business.” Additionally, Fisher believes that take-back initiatives present a “huge opportunity for a lot of companies to do.”

- Reimagining, reinventing and disrupting existing business models for more sustainable solutions is fundamental at VF Corp. and its brand portfolio. In addition to piloting rental and recommerce (The North Face Renewed), a focus on sustainable design led to the 2019 launch of Futurelight at The North Face, the brand’s most efficacious technical product line as well as its most sustainable material (or the product with the smallest footprint). The North Face worked with like-minded suppliers and vendors in the development of Futurelight, which is constructed with 90% recycled materials. Furthermore, VF Corp. has trained 36% of its European design team in circular design principles. By beginning with circularity at a product’s inception, VF Corp. can extend the useful life of materials, which is key to reducing the company’s total environmental footprint.

Technology has delivered some solutions in the form of digitally native rental and resale services that have grown rapidly, enabling consumers to monetize clothing, accessories, jewelry, home goods and art that they no longer want—and which otherwise may end up in the landfill.

Meanwhile, taboos against secondhand goods have also dissipated, benefiting online startups such as ThredUP and The RealReal, in addition to thrift stores and consignment services. This has also spawned many new rental programs. Although rental services involve additional shipping and product dry cleaning, it is still a greener option than fast fashion, which results in overproduction that has detrimental effects on the environment.

Consumer acceptance of secondhand goods is gaining momentum in other sectors, too:

- Outdoor retailer Recreational Equipment Inc. (REI) sells used sleeping bags, tents, apparel, portable showers, bags, ski poles, snowboards and other gear and recently expanded its rental program to 75% of its brick-and-mortar stores.

- At VF Corp’s Kipling, a rental model is in pilot as the company targets large-scale commercialization of brand-led recommerce and rental circular business models.

- US furniture and home décor retailer West Elm partnered with Rent the Runway to offer modern décor under the Rent the Runway concept, enabling short-term home décor rental with the option to buy later. Products include hand-selected bundles of pillows, throws, shams and quilts.

Charitable donations and give-back programs are another form of recycling that offers retailers the opportunity to build stronger ties with the community while also tackling a problem, and retailers can secure tax breaks as well.

- Uniqlo’s recycling program distributes wearable items to refugees and disaster victims, while unwearable clothing is made into paper products and plastic fuel pellets.

- VF Corp.’s Timberland and its nonprofit partner, Circularity, provide footwear for people in need in the US. In the UK, Timberland partners with TRIAD, a network of more than 1,500 charity clothing banks and charity shops.

- Zara provides used clothing to non-profit projects.

Sustainable options exist for excess inventory too. Rather than sending overages to the landfill, retailers should consider price markdowns, which would lower the impact on the retailer’s bottom line. Another option is selling to an off-price retailer such as Burlington, Marshalls or TJ Maxx, or to online discounters such as bluefly.com and overstock.com. These value retailers have seen increasing traffic in recent years as consumers seek out national brands at value prices while engaging in a treasure-hunt shopping experience. Ideally though, retailers and brands should better align supply and demand to reduce overages.

O: Optimized Operations

Supply chain aside, there are many opportunities for retailers to optimize operations using a more resource-efficient infrastructure and decarbonization technologies. Greater efficiency throughout the entire lifecycle cuts resource use and reduces a retailer’s environmental impact.

The 2030 Agenda for Sustainable Development was adopted by all UN Member States in 2015. It is described by the UN as a “blueprint to achieve a better and more sustainable future for all” and is centered around 17 Sustainable Development Goals (pictured below). Retailers can use the SDGs as a baseline to assess their sustainability profile and build a more sustainable business model.

[caption id="attachment_116319" align="aligncenter" width="700"]

The 17 Sustainable Development Goals of the UN’s 2030 Agenda for Sustainable Development

The 17 Sustainable Development Goals of the UN’s 2030 Agenda for Sustainable Development

Source: UN[/caption]

A number of the SDGs explicitly deal with the environment; we discuss these in more detail below.

The “clean water and sanitation” goal (SDG #6) seeks to address the world’s dwindling drinking water supplies, which have been exacerbated by increasing drought and desertification. Installing meters and tracking water usage throughout operations and the supply chain can help identify where the greatest opportunities are to cut water use. Low-flow technology, for example, can save water with minimal impact on the user experience. Water-efficiency treatment systems that return water for reuse after purification also reduces water usage—in addition to cutting costs.

Demand for cheap energy and an economy reliant on fossil fuels has led to climate change, which the UN addresses under “affordable and clean energy” (SDG #7). Investing in solar, wind and thermal power can help companies reduce their carbon emissions.

Technology can provide the means to reduce energy and material consumption. Examples include power capacitors, high-efficiency laundry machines, smart refrigerators and kitchen appliances, and power strips.

Lighting is an important element in physical retail, creating an ambiance that impacts the shopping experience and thus sales. However, lighting accounts for 35% of energy use in the US. The US Department of Energy estimates that energy-efficient lightbulbs could save $120 billion in annual energy costs. LED lights use only 12 watts for the same amount of light as a 60-watt incandescent bulb—and last 21 times longer. LED lights are more expensive up front, but they are cheaper in the long run thanks to the lower energy use.

Numerous retailers, such as IKEA, Sephora (owned by LVMH) and Walmart, have installed LED lighting, invested in solar energy and committed to timelines to achieve climate positivity. Furthermore, in addition to implementing longer-lasting LED lights, retailers including Dollar Tree and Kohl’s have implemented smart lighting systems to lower intensity during peak hours of the day, when natural lighting is greater. In 2019 alone, Kohl’s achieved energy savings of 31 million kilowatt-hours through its smart lighting system, equating to approximately $4 million in cost savings.

Lighting is not the only way to reduce operational costs of brick-and-mortar stores; heating and ventilation systems account for high energy usage too. Dollar Tree has introduced the use of a direct outdoor air system, which can reduce system operating costs by 50% compared to variable air volume systems.

Efficient lighting and other means of energy reduction are examples of how retailers can cut costs through sustainable infrastructure—smart buildings that reduce resource consumption. For example, insulation in roofs, walls and floors keep stores cool in the summer and warm in the winter, thereby cutting energy costs as well as carbon emissions.

Tapestry (parent company to Coach, Kate Spade and Stuart Weitzman) is optimizing its operations in alignment with SDG #7 to reduce its carbon footprint. The company is measuring its impact via Scope 1 (direct) and Scope 2 (indirect) CO2e greenhouse gas emissions—targeting a 20% reduction by 2025. The company achieved an overall 0.4% reduction in CO2 emissions across all stores from 2018 to 2019, as retrofitting stores with LED lights offset the impact of its 240,000-square-foot increase in total store space. Tapestry’s distribution centers reduced emissions by 2.2% in 2019 as well.

“Responsible consumption and production” (SDG #12) looks for firms to cut waste throughout the product lifecycle, from design to production to distribution, while delivering the same functional value (for example, a video conference may deliver the same outcome as air travel). In considering a product’s end-of-life at its conception, designs can be created with recirculation in mind, while looking for opportunities to minimize resource consumption.

Electric and hybrid vehicles offer greater fuel efficiency and can significantly reduce greenhouse gas emissions (depending on how local electricity is generated, from coal or renewable sources). These vehicles are evolving rapidly, and retailers are shifting away from gas and diesel-powered transportation. At the end of 2018, there were over 1 million electric vehicles on US roads, and the Edison Electric Institute projects that this number will reach 18.7 million in 2030. France and the UK have a 2040 deadline for automakers to end sales of new gas-powered vehicles, and China, Germany and India may follow suit.

NFI, a third-party supply chain solutions provider, is an early adopter of sustainable supply chain business practices. The company has implemented a variety of clean technologies and equipment to reduce its carbon footprint in North America and drive its own and its customers’ sustainable supply chain initiatives. NFI has been recognized by the EPA as a SmartWay Partner and a SmartWay High Performer, reflecting its green trucking initiatives. The company is currently partnering with electric vehicle manufacturers to test these vehicles in Southern California, deploying battery-electric trucks between the Port of Los Angeles and local distribution centers. The cost of maintaining and running these trucks is cheaper than the diesel alternative, but the upfront capital investment is higher (though decreasing with scale). For now, subsidies in California aid the investment, and NFI intends to split the cost savings with its clients.

One-day deliveries are more environmentally damaging than deliveries with longer timelines due to added trips, so many retailers offer the option of more environmentally friendly deliveries that are later or consolidated.

Amazon has pledged to make half its deliveries net carbon neutral by 2030 and 100% by 2040, which will include the use of drones. American entrepreneur Jeff Bezos also committed $10 billion to his initiative, the Bezos Earth Fund, to fund nongovernmental organizations and scientists working to address climate change.

The transportation sector can play a significant role in reducing carbon emissions, from using fuel-efficient aircraft to truck routing and capacity optimization. Retailers can look to work with third-party logistics providers that optimize transportation with multi-modal delivery and load capacity considerations. Smart technology can plan vehicle routes, share vehicle information with road networks and optimize inventory to minimize waste.

Some retail companies have made transitioning away from fossil fuels a top priority, as the price per barrel of oil often ranges widely. Target predicts that such a move will save the company $200–300 million by 2040.

R: Responsible Supply Chains

A responsible supply chain is a key part of any retailer’s sustainability strategy. This value chain has perhaps the most environmental impact and so offers opportunities to find less-resource-intensive processes, more responsible sourcing, enhanced raw-material traceability and greater overall transparency for the consumer.

The retailer should incorporate non-polluting chemicals and eco-friendly raw materials from product design throughout the value chain—all the way to delivery of the product to the customer.

To achieve this, retailers could consider using compostable, biodegradable or recycled materials. Compostable material disintegrates through microbial activity or with decomposition treatment such as ultraviolet light, heat or oxygen, without emitting toxins. Biodegradable material naturally disintegrates without any soil toxicity. Eco-friendly materials, such as viscose, decompose with no environmental impact—something that cannot be said about polyester, plastic or nylon.

Partnerships can advance supply chain sustainability. Stella McCartney, a frontrunner in sustainability and ethical sourcing, has partnered with Italian label Candiani to create 100% biodegradable denim products made from biodegradable ingredients and plants. In addition, the denim also uses less water and energy during production.

Patagonia and REI, both founding members of the Sustainable Apparel Coalition (in a 2009 partnership with Walmart) maintain that partnering with other brands and suppliers is the best way to drive improvement in a shared supply chain.

The Patagonia Supply Chain Environmental Responsibility Program aims to measure and reduce environmental impacts of manufacturing its products and materials at supplier facilities worldwide. Utilizing industry-recognized tools and certification programs such as the Higg Index (developed by the Sustainable Apparel Coalition) and the “bluesign system,” Patagonia’s program recognizes environmentally responsible partners in the supply chain, approves and manages new and active suppliers and eliminates suppliers that do not meet its minimum requirements.

REI is a founding member of the Outdoor Industry Association Sustainability Working Group, an industry forum of 300+ outdoor brands, suppliers, manufacturers and other stakeholders. This group recently launched Climate Action Corps, which is supporting brands in measuring, reporting and collaboratively reducing greenhouse gas emissions.

Blockchain technology makes it easier to trace materials and products to deliver greater transparency. By eliminating the need for a payment intermediary/agent, blockchain facilitates faster transactions by allowing peer-to-peer cross-border transfers with digital currency. Retailers can leverage blockchain technology to better track and trace in the supply chain, as well as to enhance inventory management capabilities by creating a link to an item’s digital identity: Each time physical custody changes, the blockchain records it.

In mapping a supply chain, sustainable sourcing also means integrating suppliers that similarly address environmental performance factors. Suppliers down to the lowest component level should be encouraged to adopt the same sustainability strategy.

- Pull Supply Chain Strategy

Brands and retailers can migrate to a pull supply chain, in which customer demand drives manufacturing. A typical push supply chain is driven by long-term, although often faulty, projections based on inadequate data. A pull supply chain is leaner, minimizes waste and emphasizes the

consumption of goods rather than the

making of goods. For demand to prompt a manufacturing process to start, an integrated supply chain spanning all required production inputs is necessary. Real-time information-sharing abilities for multiple stakeholders, beginning with customer purchase across production, operations, supply chain and logistics, can reduce waste, manufacturing overages and inventory liquidations, better match supply and demand and improve full-price selling.

Packaging needs a sustainability overhaul as well. Sustainable packaging not only reduces the use of single-use plastic, but reduces the amount of waste going into landfills. Recycled paper or cardboard, plant-based or non-GMO compostable packaging, and renewable packaging made from cork or wood pulp are all more sustainable solutions, from a waste point of view.

Cosmetics retailer Lush uses biodegradable cork container pots which are antibacterial, fire-retardant and water-resistant, and production is sustainable. The company plants trees to later harvest bark for the pots, stripping the bark in a rotating system that does not harm the trees. The cork grows back in nine years for re-harvesting.

In another example of advancing sustainability in packaging, Tapestry is aiming to use 75% recycled content in its packaging across all three of its brands by 2025.

E: Excellence in Reporting and Communicating

Consumers are demanding more transparency across the supply chain than ever before. Companies that provide this build consumer trust and loyalty. Increasingly, retailers and brands that share greater granularity across business processes are communicating and taking responsibility for their choices, demonstrating a willingness to be held accountable for their actions.

Communicating corporate commitment to sustainability and transparency includes audits, stakeholder engagement and being a role model in the industry—a champion of sustainable business practices with a focus on people and the planet.

A sustainability audit evaluates a company’s operations and practices against established standards. Developing a sustainability initiative means examining existing policies, setting benchmarks and establishing performance metrics. Companies can bring in expert consultants to assist with specific initiatives, assessing the value chain for compliance and developing short- or long-term projects. Sustainability audit checklists can address a variety of issues, including governance, workforce treatment, community engagement and environmental impact (such as waste reduction, water and energy conservation, and evaluation of production and supply chain processes).

The most common supply chain certifications are International Organization for Standardization (ISO) 9001 and ISO 14001. Companies for which sustainability is integral to their business strategy look for suppliers that are ISO-compliant. ISO 9001, Quality Management, establishes policies and procedures for planning and executing in the core business area; ISO 14001, Environmental Management, specifies requirements for managing environmental responsibility and provides a framework. Together, these standards address business issues and connect consumer demands on product transparency to the end result.

Retailers can demonstrate accountability and a commitment to sustainability through regular communication with stakeholders—customers, shareholders, staff and the community—to provide updates on the status of initiatives and audit results. This contributes to stakeholder trust in the brand, confidence and engagement.

A good communications program can also enhance consumer education and empowerment, enabling shoppers to make better-informed choices. The same holds true for staff. To achieve sustainability goals, companies need engaged employees.

With enhanced traceability, retailers can track where materials are grown and even follow them through production. Retailers that share this kind of information with consumers can build trust, as consumers feel they are making better-informed sustainability choices.

Investor communications can also be a key competitive differentiator. Ensuring the investment community is current on corporate progress toward sustainability goals can better position a company. Factors to consider include metrics on waste reduction, carbon emissions, supplier sustainability audits, yearly comparisons of fuel consumption, electricity consumption, waste disposal, water consumption and environmental incidents (spills, discharges). The list is long, but investors want this information to understand risk and enhance investment returns.

Finally, companies should communicate by being an advocate of good corporate citizenship with a sustainable business model. They should look to engage business partners and advocate industry-wide goals of transparency in reporting. Retailers can help other companies to activate EnCORE by becoming an example for the industry and a champion of sustainable goals and programs, including by providing transparency and excellence in reporting.

For example, Unilever CEO Paul Polman announced to shareholders at the beginning of his 10-year tenure that the company would adopt a long-term business model that would contribute to society and the environment. He even advised shareholders to put their money elsewhere if they did not agree. The result was the Unilever Sustainable Living Plan, created in 2010, which decoupled the company’s growth from its environmental footprint. Today, Unilever is on track to meet most of its commitments, including reducing its environmental impact by half, improving health and well-being for 1 billion people, and enhancing the livelihood for millions of its employees, suppliers and retailers.

In Unilever’s most recent performance summary through 2019, the company reported that it had reduced CO2 emissions at its factories by 65% in 2019 versus 2009—thus achieving its goal of a 50% reduction by 2020. The company also achieved a 96% reduction in total waste sent for disposal in the same time period, despite significantly higher volumes. Furthermore, Unilever’s “Sustainable Living Brands,” or those which it says have an environmental or social purpose—Dove, Lipton, Hellmann’s and Vaseline—have outperformed average growth at Unilever, at a rate of 69% faster than the rest of the business in 2018.

EnCORE is designed to be a repeating cycle, whereby the final component of one company’s EnCORE cycle—excellence in reporting and communication—can spark the first stage of another company’s cycle—environmental engagement. The framework can therefore trigger gains that extend beyond any one company adopting its approach.

Actions To Take

Get educated: Understand one’s own operations and supply chain and its impact on the environment. Discover peer standards and industry shifts. Know the relevant SDGs, legislation, regulations and information sources.

Benchmark your enterprise: Find relevant peers, exchange learnings and goals. Determine best practices and copy. Sustainable goals should not be competitive but collaborative. Appropriate benchmarks include the UN’s SDGs and the Sustainability Accounting Standards Board for Food Retailers & Distributors or Multiline and Specialty Retailers & Distributors.

Build a plan: Conduct a sustainability assessment and internal review, identify priorities, risks and opportunities. Establish sustainability goals that include reductions in greenhouse gas emissions and use of natural resources, as well the implementation of more efficient transportation and better use of water and energy—plus involvement in the community.

Be Bold: Develop a sustainability plan that designates responsible departments, allocates funding, establishes a timeline, sets short- and long-term milestones, implements policies and measures success. Do not forget to engage with stakeholders and communicate the plan, evaluating progress and report results as you go.

Lower costs: Reduce water usage, reduce energy use and cut waste. Long-term investments should include renewable energy technology and electric vehicles.

Track metrics: Use audit tools such as software and checklists to measure results against goals, schedule regular audit team inspections and supplier audits.

Timeline: Assessment should take four to six months, and developing a sustainability plan can take six to nine months. Technology investments and installation will take three to nine months. Publish annual progress reports that cover actions taken, results and next steps.

Revisit your plan and iterate. Sustainability is a journey. Achieve goals and make new ones. Be realistic and stretch by setting applicable and challenging targets. Engage employees and make it fun.

People, profits and the planet = progress.

Appendix: Environmental Regulations and Standards for US Businesses

- Federal Insecticide, Fungicide and Rodenticide Act (FIFRA)—1910

- Federal Food, Drug, and Cosmetic Act (FFDCA)—1938

- Title V of the Clean Air Act—1956

- National Environmental Policy Act of 1969 (NEPA)—1970

- Clean Water Act (CWA) – Section 402—1972

- National Pollutant Discharge Elimination System (NPDES)—1972

- Endangered Species Act (ESA)—1973

- Safe Drinking Water Act (SDWA)—1974

- Toxic Substances Control Act (TSCA)—1976

- Resource Conservation and Recovery Act (RCRA)—1976

- Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA or Superfund)—1980

- Emergency Planning & Community Right-To-Know Act (EPCRA)—1986

- National Emission Standards for Hazardous Air Pollutants (NESHAP)—1990

- Pollution Prevention Act (PPA)—1990

- Oil Pollution Act of 1990—1990

- Food Quality Protection Act (FQPA)—1996

- Chemical Safety Information, Site Security and Fuels Regulatory Relief Act—2000

Source: Coresight Research[/caption]

Navigating the sheer volume of issues that fall under the umbrella of sustainability is daunting. In this report, we simplify this for retail by narrowing the scope of sustainability to an environmental focus.

Supply chains are often the low-hanging fruit when it comes to delivering greater efficiency and driving sustainable practices: It is all about reducing waste, but greater efficiency and lower resource consumption can also mean lower costs. A long-term strategy with sustainability built in can deliver on the triple bottom line: people, profits and the planet—the three “P”s. In fact, corporations that plan with climate change in mind secure an 18% higher return on investment than companies that do not do so, according to Challenge.org

The three “P”s result in a fourth “P,” progress. Retailers are in a unique position to drive change, given the large number of vendors with which they work: Retail has a unique ability to influence sustainability practices across a large number of industry players.

Source: Coresight Research[/caption]

Navigating the sheer volume of issues that fall under the umbrella of sustainability is daunting. In this report, we simplify this for retail by narrowing the scope of sustainability to an environmental focus.

Supply chains are often the low-hanging fruit when it comes to delivering greater efficiency and driving sustainable practices: It is all about reducing waste, but greater efficiency and lower resource consumption can also mean lower costs. A long-term strategy with sustainability built in can deliver on the triple bottom line: people, profits and the planet—the three “P”s. In fact, corporations that plan with climate change in mind secure an 18% higher return on investment than companies that do not do so, according to Challenge.org

The three “P”s result in a fourth “P,” progress. Retailers are in a unique position to drive change, given the large number of vendors with which they work: Retail has a unique ability to influence sustainability practices across a large number of industry players.

Source: Coresight Research[/caption]

In the following sections, we outline the five components of EnCORE, discuss how companies can make progress in each of them and provide examples of companies that are taking the lead.

En: Environmental Engagement

Environmental engagement is the starting point to developing a sustainability strategy, and it begins with awareness of how your industry impacts the environment.

The key component of environmental awareness is understanding—of one’s own operations and supply chain (both internal and external processes), plus peer practices and incremental industry shifts. Businesses should seek the opinions of all stakeholders, including employees and investors, and seek to understand consumer demands and preferences on sustainability.

There are four ways in which retailers and brands can take advantage of external sources to bring knowledge, awareness and experience into their organizations:

Source: Coresight Research[/caption]

In the following sections, we outline the five components of EnCORE, discuss how companies can make progress in each of them and provide examples of companies that are taking the lead.

En: Environmental Engagement

Environmental engagement is the starting point to developing a sustainability strategy, and it begins with awareness of how your industry impacts the environment.

The key component of environmental awareness is understanding—of one’s own operations and supply chain (both internal and external processes), plus peer practices and incremental industry shifts. Businesses should seek the opinions of all stakeholders, including employees and investors, and seek to understand consumer demands and preferences on sustainability.

There are four ways in which retailers and brands can take advantage of external sources to bring knowledge, awareness and experience into their organizations:

The 17 Sustainable Development Goals of the UN’s 2030 Agenda for Sustainable Development

The 17 Sustainable Development Goals of the UN’s 2030 Agenda for Sustainable Development