Nitheesh NH

What’s the Story?

Rapidly evolving consumer preferences, heightened competition among modern retailers and the complexity of their operations are putting an end to planning a retailer’s business operations with rules of thumb and spreadsheets. Retailers and brands are increasingly looking to adopt more analytical, integrated and efficient approaches to operations planning, taking advantage of recent advancements in artificial intelligence (AI) technology to better compete. Having the right quantities of the right products in the right place at the right time is critical for retailers to meet consumer demand and optimize margins. In this report, we analyze key findings of a June 2021 Coresight Research survey of 170 retail industry decision-makers in the US and Canada from three retail verticals to gauge AI maturity by industry: apparel, footwear and accessories; beauty; and home and home improvement. We asked respondents about their organizations’ use of analytics tools and platforms and the strategies employed across four key retail processes:- Allocation planning—the process of assigning individual item quantities to specific locations during specific periods

- Assortment planning—the process of selecting the products to sell in specific locations during specific periods

- Promotion management—the process of designing and implementing promotional strategies and campaigns to boost sales and achieve business objectives

- Forecasting—the process of predicting demand across products, segments as well as store locations during specific periods

Why It Matters

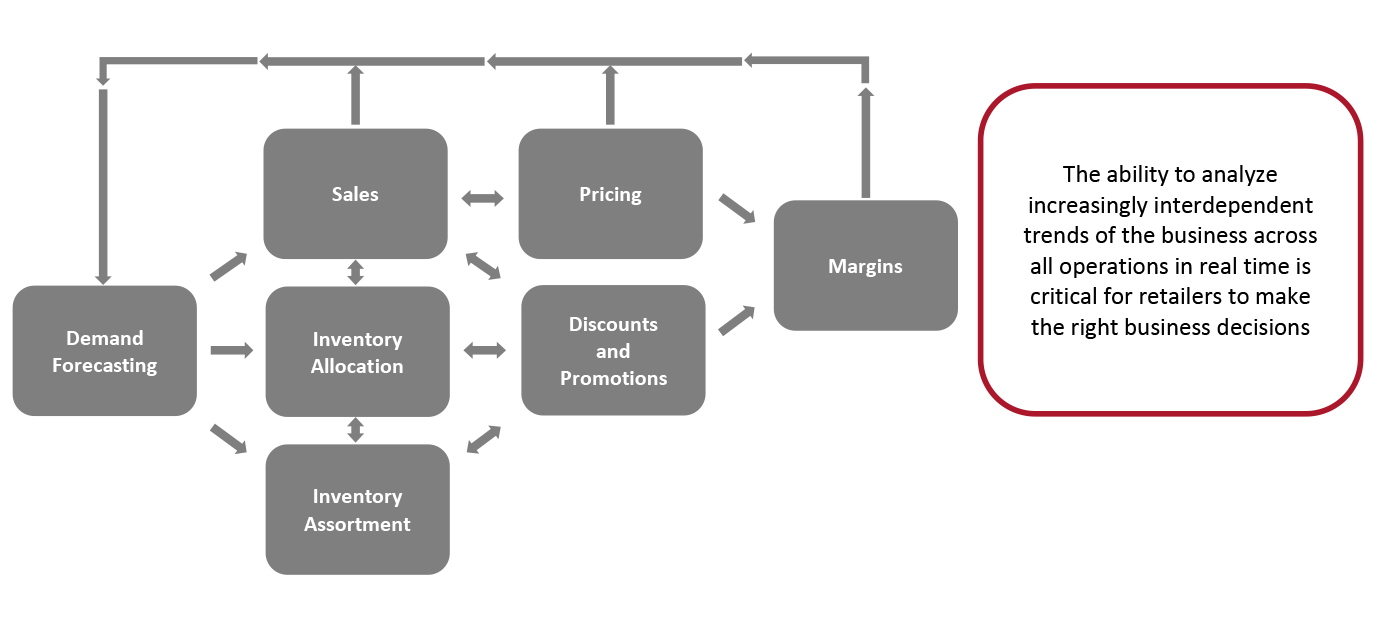

Anticipating and planning for demand lies at the core of every retailer’s operations, since demand planning affects nearly every other business function. The interconnectedness of retail operations from sales and inventory to pricing, promotions and ultimately, margins, is illustrated in Figure 1. Shifts in demand during the pandemic and continued uncertainty have exposed the limitations in traditional methods for allocation, assortment and promotion planning. More advanced methods are needed to address the modern retail supply chain and interdependencies across functional areas. Brands and retailers can utilize advanced tools to make their businesses smarter and more efficient, enabling them to keep pace with data-fueled e-commerce and technology-savvy competitors. AI can run round the clock to identify new ways to do business better, and machine learning (ML) can identify revenue and profit opportunities that are otherwise hidden.Figure 1. Interconnectedness of Retailer Operations and Resulting Data Flows [caption id="attachment_132648" align="aligncenter" width="700"]

Source: Coresight Research [/caption]

Using AI to more intelligently power operations across business functions—the inventory side and the customer side—is the next evolution in retail. Retailers and brands that do not incorporate modern tools will struggle to compete as e-commerce leaders and brands that already use AI/ML capabilities continue to gain market share.

Source: Coresight Research [/caption]

Using AI to more intelligently power operations across business functions—the inventory side and the customer side—is the next evolution in retail. Retailers and brands that do not incorporate modern tools will struggle to compete as e-commerce leaders and brands that already use AI/ML capabilities continue to gain market share.

The State of AI Adoption in 2021: Retail Survey Findings

We dive deeper into the current state of play of AI maturity in retail and look at what retail decision-makers across key industries are saying about their organizations’ current use of tools, platforms and strategies for managing critical retail functions. In Figure 2, we summarize our key findings discussed in this report and explore each of the four functional areas in detail below.Figure 2. Measuring the Impact of Suboptimal Current Processes and the Financial Benefits Since Adopting AI-Based Tools [wpdatatable id=1257]

Base: 170 retail industry decision-makers, surveyed in June 2021 Source: Coresight Research 1. Allocation Planning: Issues Such as Infrequent Stock Replenishment Impact the Bottom and Top Line Ensuring that the right quantity of product is at the right location at the right time is critical to successful allocation planning. In today’s rapidly shifting market landscape, retailers cannot afford to be caught running out of inventory and scrambling to replenish stock or be saddled with excess inventory due to an inability to recognize shifts in localized demand. Traditional approaches of looking at 12-month historical trends or even three-month trends are likely to miss changes in what’s happening on the ground now. Our research indicates that retail decision-makers draw a direct line between allocation planning issues and sales and profitability. We present related insights below.

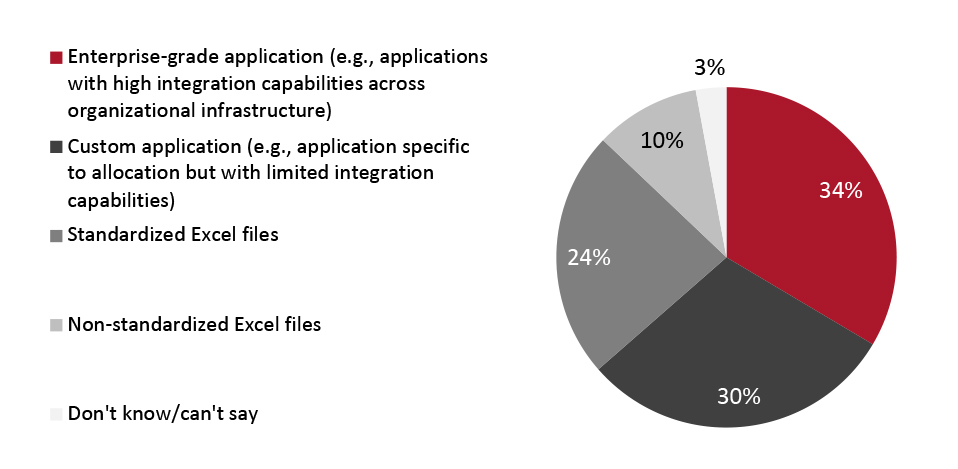

- Legacy tools are still predominately used for allocation planning—The majority of respondents (64%) use Excel files or custom applications—i.e. tools with limited integration functionality across assortment and promotion management etc.—for allocation planning, while only around one-third of respondents reported that they use enterprise-grade applications with high integration capabilities across the organizational infrastructure.

Figure 3. Tools/Platforms Currently Used for Allocation Planning (% of Respondents) [caption id="attachment_132649" align="aligncenter" width="700"]

Base: 170 retail industry decision-makers, surveyed in June 2021

Base: 170 retail industry decision-makers, surveyed in June 2021 Source: Coresight Research [/caption]

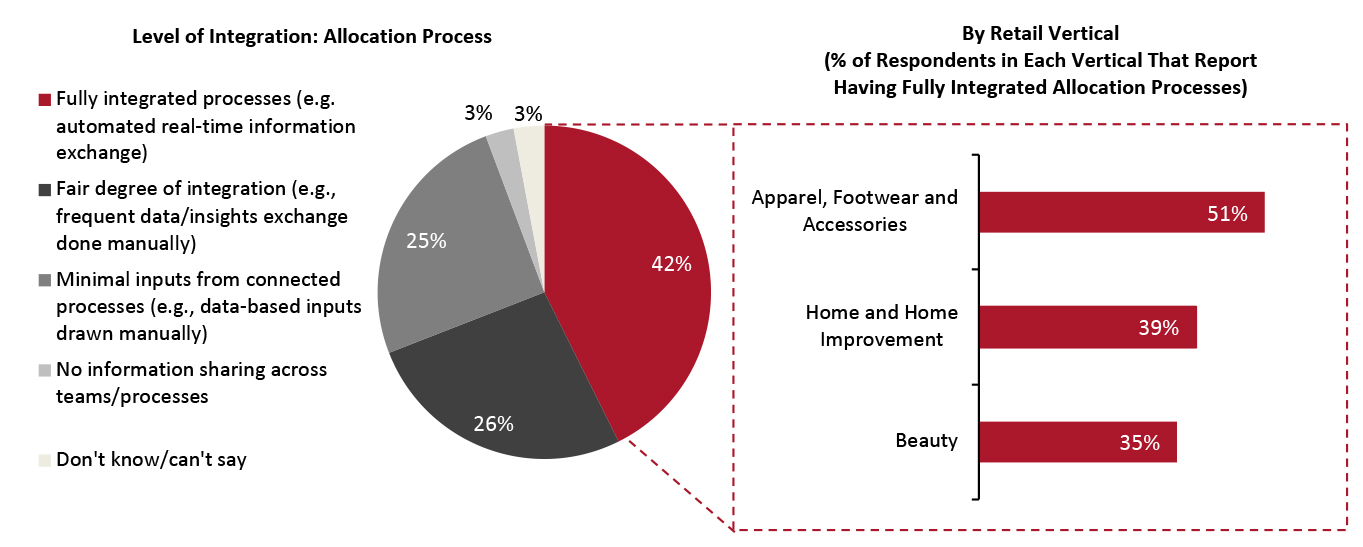

- Interestingly, the proportion of respondents that report having fully integrated processes—which involve performing allocation planning together with assortment and promotions planning in a feedback loop to align objectives and optimize outcomes—is higher than the 34% that use enterprise-grade applications. However, less than half of all respondents (42%) report having fully integrated processes.

- Assessing the level of integration by retail vertical, apparel, footwear and accessories appears to be ahead in deploying fully integrated allocation planning processes, with 51% of respondents in this vertical reporting that they have fully integrated processes. This compares to 39% of respondents in the home and home-improvement vertical and 35% in the beauty vertical.

Figure 4. Level of Integration Between Allocation Planning and Assortment or Promotion Planning (% of Respondents) [caption id="attachment_132650" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 170 retail industry decision-makers, surveyed in June 2021

Source: Coresight Research [/caption]

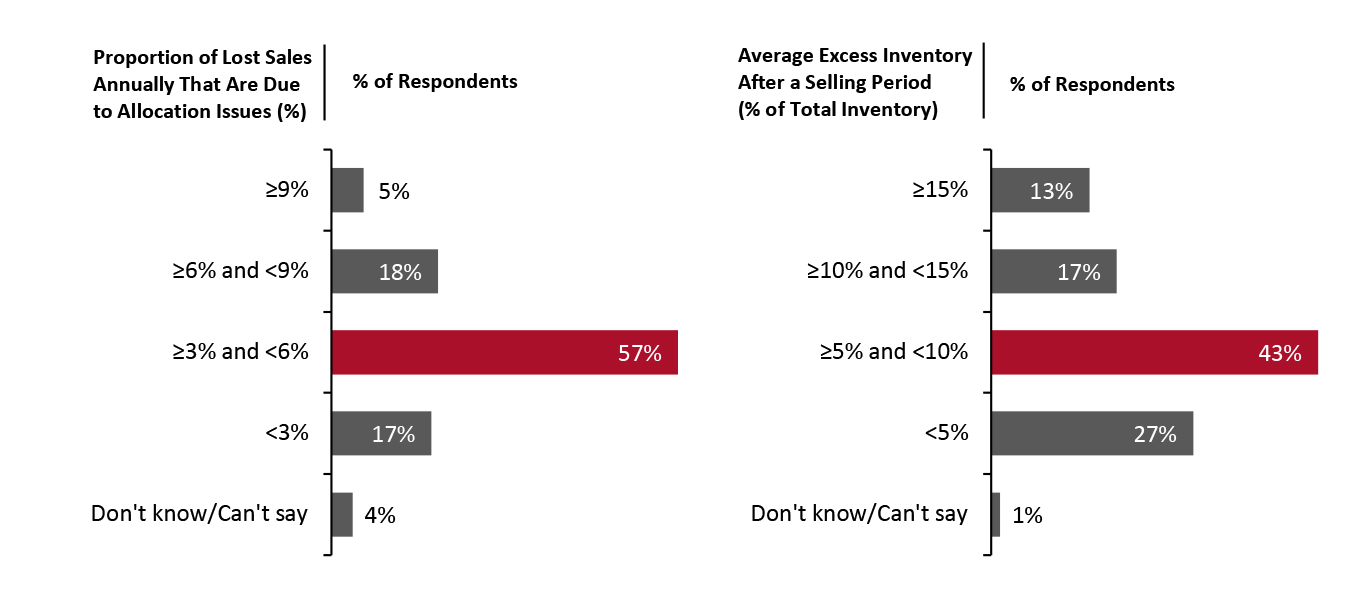

- Allocation issues are perceived to be directly impacting sales and profitability—80% of respondents estimate lost sales of 3% or greater due to allocation issues such as infrequent stock replenishment, and 23% of respondents report that these issues comprise 6% of lost sales or greater. Around 73% of respondents say they have 5% or greater excess inventory on average after a selling period, with 30% of respondents pegging the excess at 10% or greater.

Figure 5. Impact of Allocation Issues on Sales (Left) and Average Excess Inventory (Right) [caption id="attachment_132651" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 170 retail industry decision-makers, surveyed in June 2021

Source: Coresight Research [/caption] 2. Assortment Planning: Enterprise-Grade Applications Yield Significant Cost Savings Retailers need the ability to rationalize their product assortments, optimizing for depth and breadth to prevent over or under buying with the flexibility to view, manage and adjust assortments throughout the planning process. Our research indicates that most retailers are still using traditional approaches to assortment planning and are therefore likely missing out on opportunities to build localized product assortments based on product attributes and actual demand at the store level. Only one-third of all respondents have adopted enterprise-grade applications, indicating opportunity for retailers to modernize their assortment planning processes and take advantage of more advanced, integrated approaches to optimize product mix on store shelves.

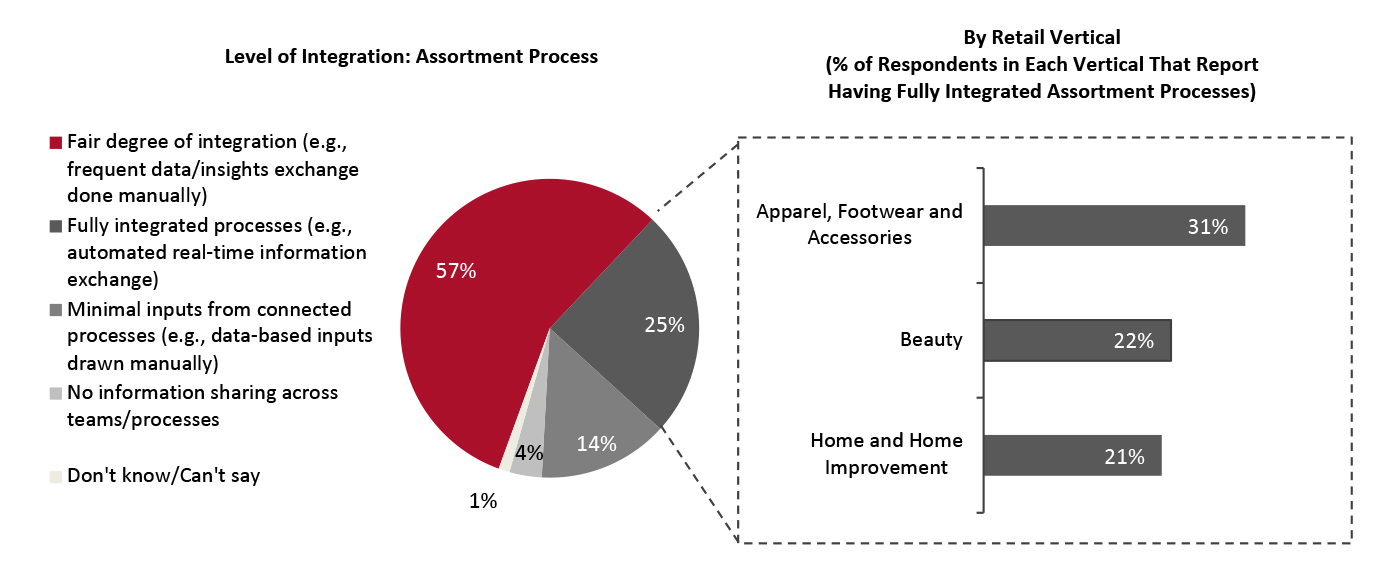

- Only one-quarter of respondents reported that the assortment process is fully integrated (i.e., integrated with allocation and promotion planning), suggesting that assortment planning lags allocation planning in adopting more modern, integrated approaches.

- By retail vertical, apparel, footwear and accessories appears to be ahead in deploying fully integrated assortment processes, with 31% of respondents in this vertical reporting that they have fully integrated processes. This compares to 22% of respondents in the beauty vertical and 21% in the home and home-improvement vertical.

Figure 6. Level of Integration Between Assortment Planning and Allocation and Promotion Planning (% of Respondents) [caption id="attachment_132652" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 170 retail decision-makers in the US, surveyed in June 2021

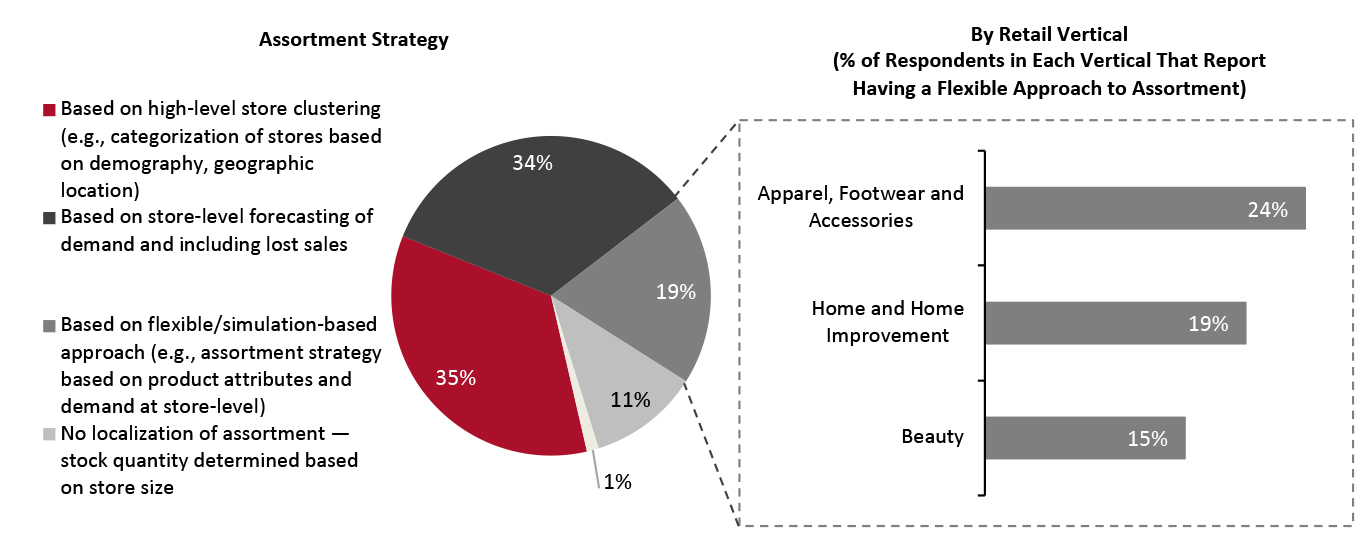

Source: Coresight Research [/caption] We asked respondents about the assortment strategies their organizations use—i.e., how they select the right mix of products to sell. Retailers that have adopted more flexible and intelligent strategies (leveraging AI) are better able to reduce inventory overbuys, reactive markdowns and stock-outs. Our research found that less than one-fifth of respondents have adopted such approaches, with the most common strategy instead being high-level store clustering based on demographics and location (see Figure 7).

- The apparel, footwear and accessories vertical leads the way in terms of using flexible/simulation-based approaches to assortment, with nearly one-quarter of respondents in this vertical reporting that they use such an approach.

Figure 7. Assortment Strategies Currently Used (% of Respondents) [caption id="attachment_132653" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 170 retail decision-makers in the US, surveyed in June 2021

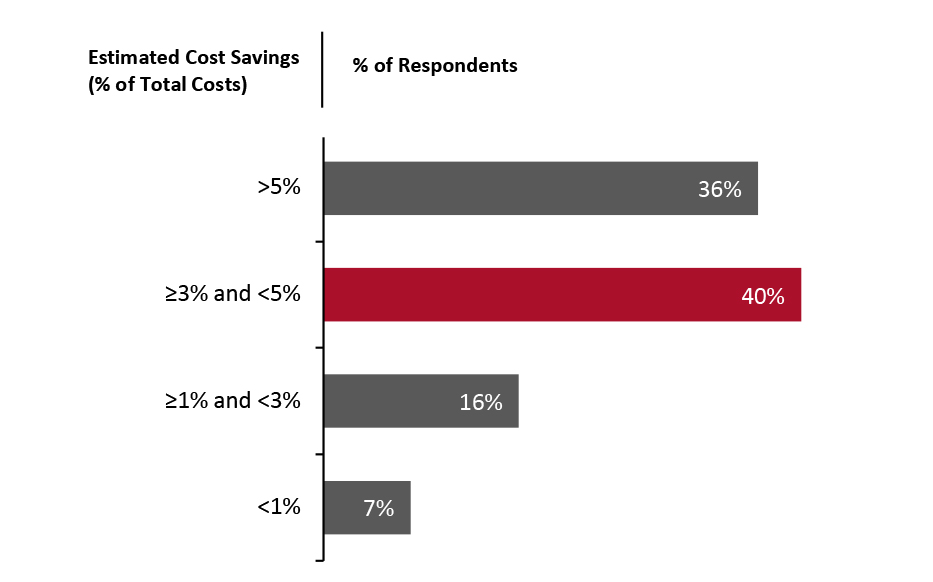

Source: Coresight Research [/caption] Our survey found that the adoption of enterprise-grade applications for assortment planning yields significant cost savings:

- Among respondents whose organizations have adopted enterprise-grade applications for assortment planning, 76% reported that they have achieved cost savings of 3% or greater as a result, and 36% indicate cost savings of greater than 5%.

Figure 8. Estimated Cost Savings Since the Introduction of Enterprise-Grade Application for Assortment Planning [caption id="attachment_132654" align="aligncenter" width="725"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 55 retail decision-makers in the US who have introduced enterprise-grade applications for assortment planning, surveyed in June 2021

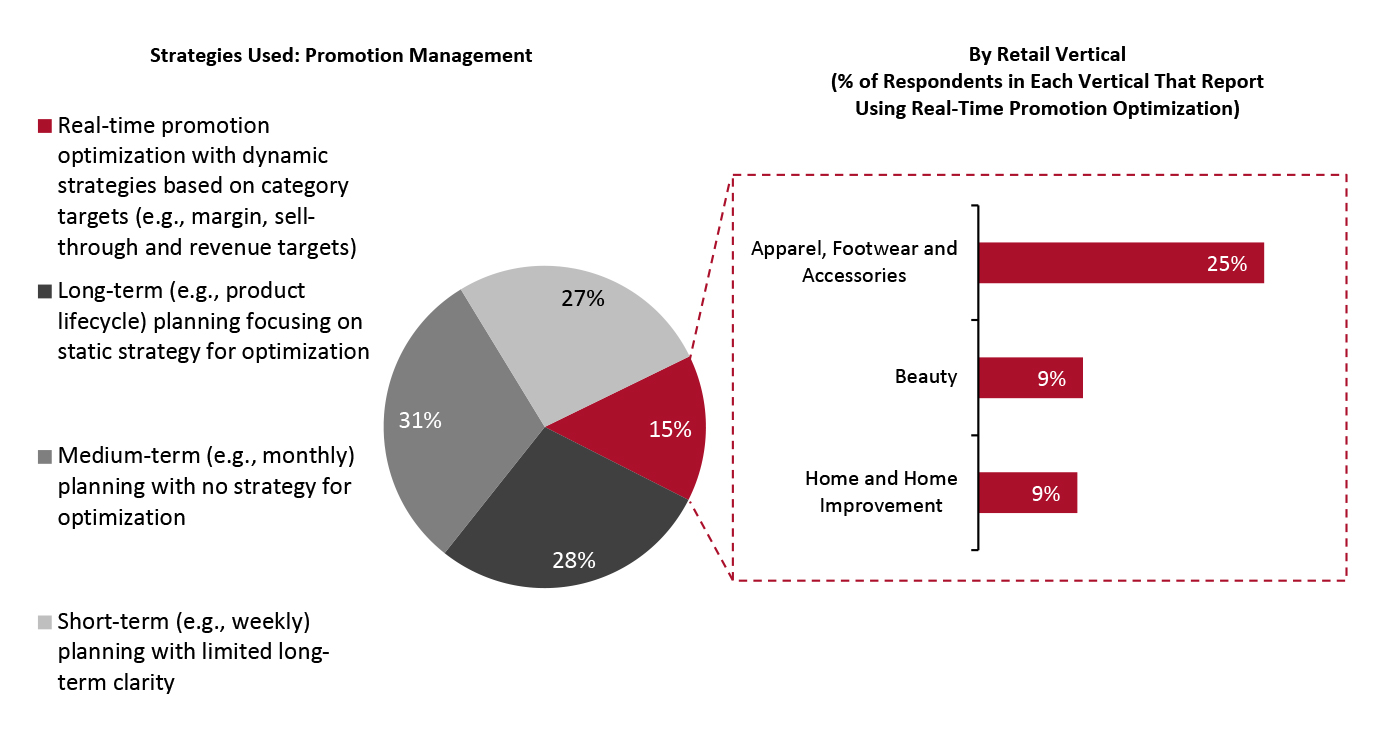

Source: Coresight Research [/caption] 3. Promotion Management: Most Retailers Use Static Promotion Strategies Not unlike other processes, promotion management has traditionally been more of an art than a science, with retailers putting a lot of effort into promotion calendars based on static strategies with limited insight into the most impactful revenue-generating opportunities. Static strategies use traditional promotional campaigns that are not updated based on SKU-level performance or external changes in consumer demand. According to our survey findings, the majority (nearly 60%) of organizations use static promotion management strategies or no strategy at all, as they have long- and medium-term approaches to planning promotions. Although 27% use short-term planning, they have limited long-term clarity.

- Dynamic, real-time strategies for promotions optimization are only just beginning to be adopted—Only 15% of respondents say they employ real-time promotions optimization with dynamic strategies based on category targets (e.g., margin, sell-through and revenue targets). By retail vertical, apparel, footwear and accessories is ahead of the curve in this space, with 25% of respondents in this vertical reporting that they use dynamic strategies, versus only 9% in beauty and home and home improvement.

Figure 9. Strategies for Promotions Optimization (% of Respondents) [caption id="attachment_132655" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 170 retail industry decision-makers, surveyed in June 2021

Source: Coresight Research [/caption]

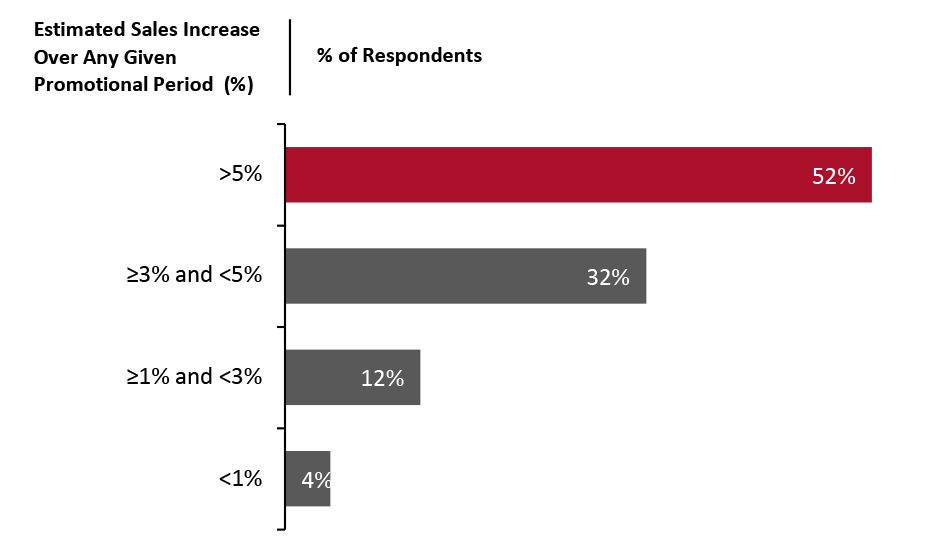

- Although still in early stages of adoption, retailers that have implemented dynamic strategies for promotion optimization indicate significant sales uplifts—52% of respondents who reported that they use dynamic strategies reported a sales increase of greater than 5% as a result.

Figure 10. Estimated Sales Increase as a Result of Using Dynamic Strategies for Promotion Optimization [caption id="attachment_132658" align="aligncenter" width="725"]

Note: Use as directional guidance given relatively small sample size

Note: Use as directional guidance given relatively small sample size Base: 25 retail industry decision-makers who have deployed dynamic strategies for promotion management, surveyed in June 2021

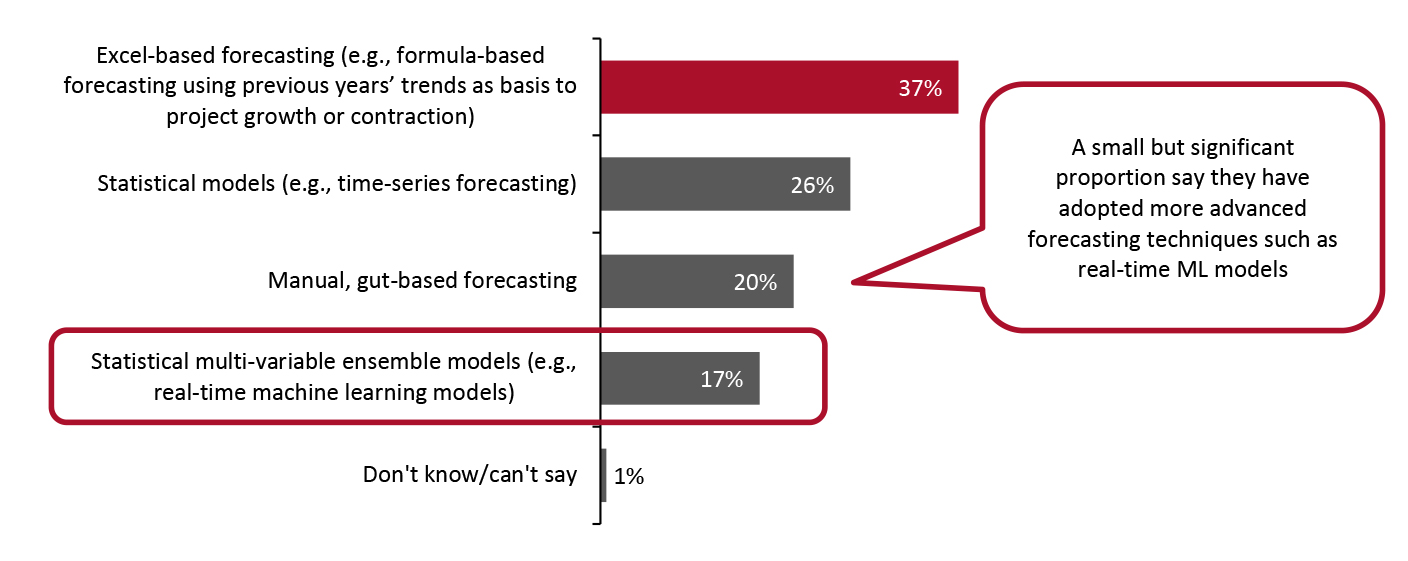

Source: Coresight Research [/caption] 4. Forecasting: Traditional Approaches Are Still the Norm; Most Organizations Update Forecasts Infrequently or Irregularly Demand forecasting lies at the core of every retailer’s operations and supply chain since it affects nearly every other retail business function—from sales and inventory to promotions and margins. Getting demand forecasting right can increase revenues, maintain margins and improve supply-chain efficiency. Retailers need robust tools to keep pace with data-fueled e-commerce companies, as well as with other retailers that have gained flexibility and new capabilities from moving to the cloud and adopting these advanced tools. Our research indicates that many retailers have yet to adopt more advanced forecasting techniques and should evaluate the benefits of more rigorous and robust demand forecasting offered by AI/ML solutions:

- Excel-based forecasting is the most common forecasting approach—with more than one-third of respondents relying on such capabilities.

Figure 11. Forecasting Capabilities in Retail Organizations (% of Respondents) [caption id="attachment_132659" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 170 retail industry decision-makers, surveyed in June 2021

Source: Coresight Research [/caption]

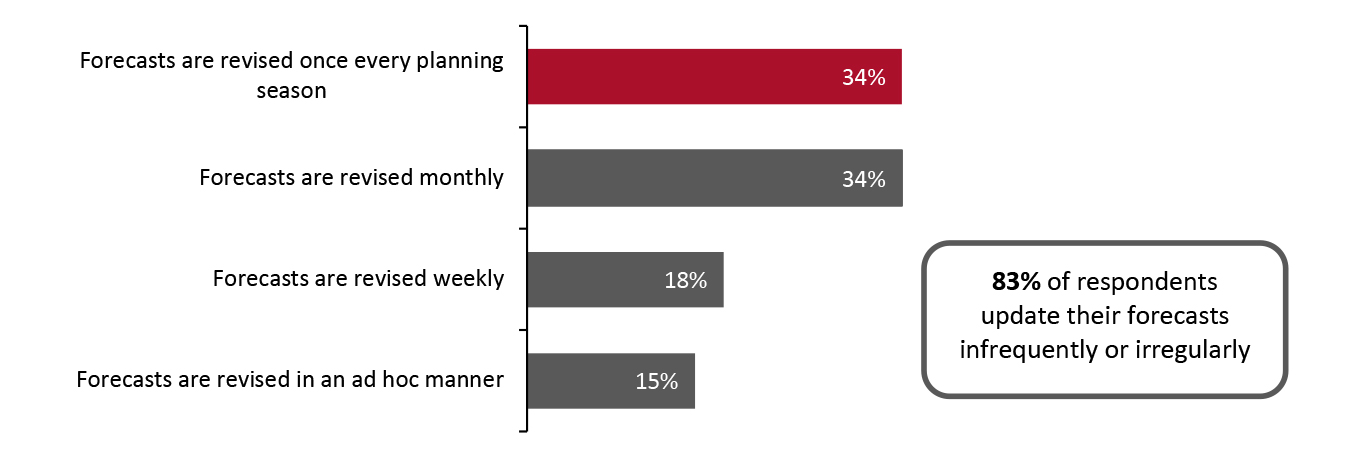

- The majority of retailers surveyed update their forecasts infrequently (once a month or once a planning season) or irregularly (ad hoc). Given rapidly evolving and localized demand conditions, infrequent and irregular updating of forecasts fails to account for the latest information, leaving retailers unable to optimize allocation, assortment and promotion planning processes and negatively impacting sales and margins.

Figure 12. Frequency of Forecast Revisions (% of Respondents) [caption id="attachment_132660" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding <>brBase: 170 retail industry decision-makers, surveyed in June 2021

Totals may not sum to 100 due to rounding <>brBase: 170 retail industry decision-makers, surveyed in June 2021 Source: Coresight Research [/caption]

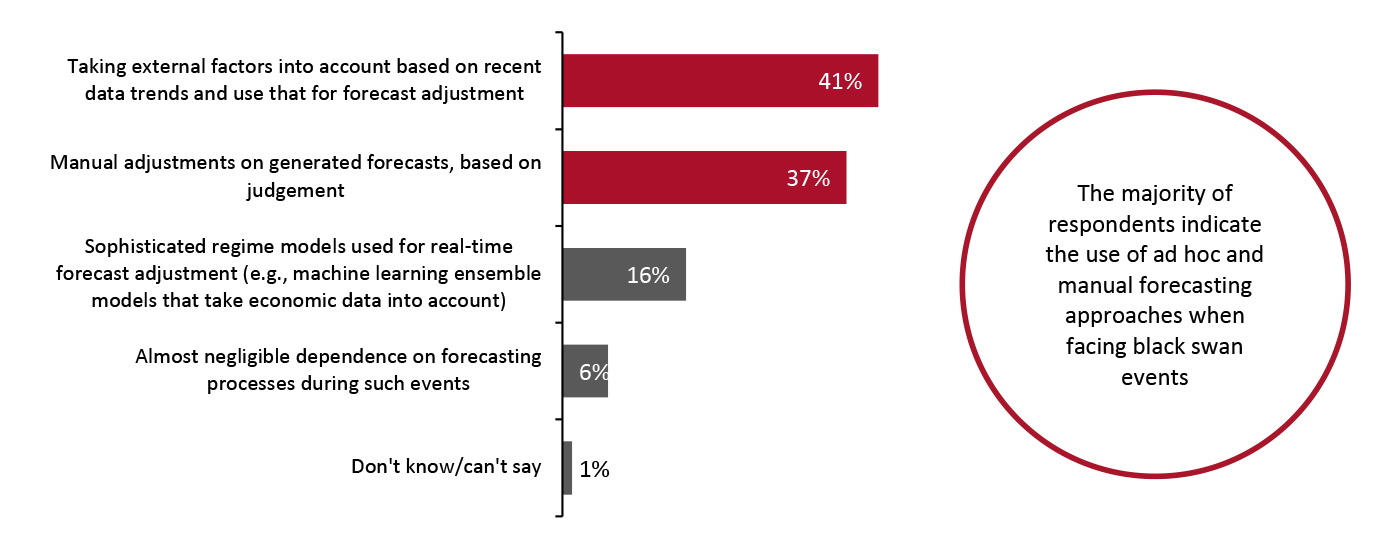

- Regarding forecasting approaches to handle black swan events such as Covid-19, only 16% of respondents say their organizations use sophisticated regime models. While black swan events are exceedingly difficult to predict, our research indicates that many organizations could benefit from adopting more advanced forecasting approaches to assess potential impacts of disruptive events more quickly and comprehensively.

Figure 13. Forecasting Approaches to Black Swan Events Such as Covid-19 (% of Respondents) [caption id="attachment_132661" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 170 retail industry decision-makers, surveyed in June 2021

Source: Coresight Research [/caption]

Interestingly, many survey respondents were unable to estimate the category-level demand forecasting accuracy at their organizations: Some 58% did not provide an estimate. Among all respondents, 17% estimate 80–90% accuracy and 16% reported accuracy higher than 90%. We believe a key reason for this result is that many organizations lack the capability to measure the performance of the forecasting methods used across processes.

Key Challenges Retailers Face in Adopting AI

Evaluating the best path forward and then successfully implementing a solution within existing IT systems can be a daunting task for an organization. Below, we identify the key challenges in adopting AI solutions.- Demonstrating practical value: Cutting through the hype and buzz around AI to show return on investment through practical use cases can be a challenge for retailers in getting buy-in from executives—especially in a challenging environment for additional expenditures, where the cost of some solutions can be prohibitive.

- Data quality and complexity: While retailers are increasingly flooded with data, data integrity across silos and disparate systems can make it difficult to assess what’s happening in the business at a granular level and reconcile data quality. Many retailers still lack consistent, objective analysis of item-level performance, which then limits available insight to inform decisions across key functional areas e.g., allocation, assortment and promotion management and planning.

- Organizational inertia/change management: As shown in our research, many organizations are still using custom applications with limited integration across retail operations, and organizations have different levels of maturity in data-driven decision-making capabilities. Many retailers still rely on syndicated data or 52-week trailing demand data and use national planning processes, as managing different assortments at the individual store level is complex.

Industry Best Practices

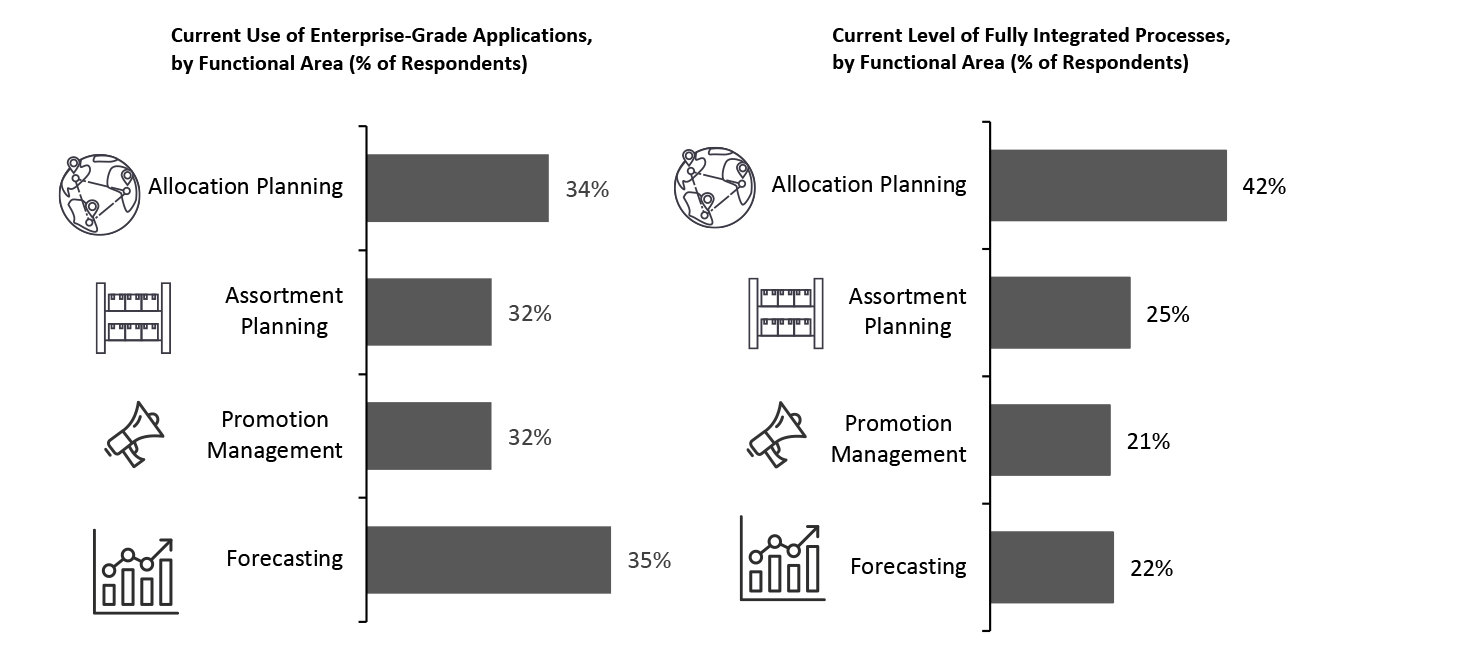

Our survey reveals that the adoption of AI in retail is still in its early days: Only about one-third of respondents say they currently use enterprise-grade applications, with most instead using approaches that lack full integration of planning across functional areas and are yet to take advantage of real-time information exchange for process (see Figure 14). As we have discussed in this report, organizations that stay the course with traditional methods face significant costs while retailers that adopt AI can realize significant financial benefits.Figure 14. The State of AI Adoption: Current Use of Enterprise-Grade Applications and Level of Integration with Other Processes [caption id="attachment_132662" align="aligncenter" width="700"]

Totals may not sum to 100 due to rounding

Totals may not sum to 100 due to rounding Base: 170 retail industry decision-makers, surveyed in June 2021

Source: Coresight Research [/caption] Although AI maturity in allocation, assortment and promotion planning may not yet be widespread, retailers continue to look for ways to make use of more granular data to better forecast consumer demand. Mainstream adoption of AI will require more deployments and experimentation to figure out what works best for each organization, with flexibility in execution a key consideration for a successful implementation. Many vendors in the business intelligence, data analytics and data-visualization industry segment offer tools that can be used for incorporating AI methodologies into retail operations, including traditional technology leaders such as IBM, Microsoft, Oracle and SAP. However, it is likely that solutions offered as part of a large software platform are not specifically designed for retail demand forecasting and planning. These solutions may also lack seamless integration into other parts of retail supply chain management platforms and may be more challenging to implement than standalone solutions from AI innovators. We believe several steps can be taken to progress AI maturity, considering industry best practices for retail:

- Making the business case

- Focus AI implementation strategy on practical use cases that address specific problems with easy-to-explain, transparent measurement of performance and return on investment.

- Start in one area first. Experiment and evaluate to become comfortable before expanding.

- Dealing with complexity

- Partner with an industry-specific retail solution provider that offers a flexible, purpose-built platform designed to handle the complexity and interconnectedness of retail operations data, with experience in overcoming data quality issues—both real and perceived.

- Any effective system needs to be able to adapt, including in the way human input is taken on board to refine results and processes as depending on the retail function, experienced workers will sometimes have more insight especially if historical data are limited

- Overcoming inertia

- Engage stakeholders across functional areas to understand practical concerns and the changes required to adapt business processes and break down siloes.

- Build awareness of available options across solutions providers and an understanding of the financial benefits as well as the costs and risk of continuing to do things the traditional way or with legacy tools.

The State of AI Adoption: The Path Forward

In an increasingly competitive environment, retailers can no longer rely on rules of thumb and spreadsheets to operate their businesses. Fortunately, a broad array of methodologies and software vendors are available to meet retailers’ needs. Furthermore, with the move to cloud-based architectures, software offerings are modular and can interconnect via application program interfaces—increasing the interoperability of software provided by different vendors and reducing time to achieving value. We believe that retailers can benefit most from working with solutions providers that have designed purpose-built AI platforms specifically for retail and the interconnectedness of retail operations. Specialty retailers such as crafts and fabrics company JOANN are realizing the benefits of partnering with solutions providers to implement purpose-built AI platforms. JOANN operates over 850 stores and stocks some 100,000 product SKUs, resulting in nearly 100 million individual store/SKU combinations—a staggering level of data volume and complexity that had become unmanageable using traditional techniques and tools such as spreadsheets. Partnering with Impact Analytics, a leading retail-focused AI software company, JOANN implemented the AllocateSmart solution to transform its allocation business process from a monthly to weekly cadence, enabling JOANN to gain real-time visibility into item-level performance down to the individual store/SKU level. This solution allows JOANN to pick up on the latest localized trends much faster and be far more accurate in predicting what will sell where; the retailer can therefore optimize inventory levels at the most granular level to minimize both product shortages and margin-draining excess inventory. Based on our survey analysis, we underline three key solution attributes that enable retailers to successfully embed AI into core business processes and gain the greatest return on investment:- Flexible

- Solutions that are modular and can plug into existing systems have the benefit of faster implementation of only a few months or less, depending on where an organization is on its digital transformation journey and its openness to change.

- Enterprise-grade

- Solutions worth investing in should not only offer the latest AI technologies such as real-time ML models, but also should facilitate integration of the planning process across business processes. Decisions across allocation, assortment and promotion planning need to be made in a continuous feedback loop to achieve more nimble operations and better meet evolving consumer demand.

- Purpose-built

- Solutions built specifically for retail have the advantage of being designed to address retail’s complex core functions in a more lightweight and customizable way than larger, industry-agnostic business intelligence and analytics solutions. Easier to deploy and customize, these solutions often provide faster time to value and can also be more effective in the long run.

Methodology

This study is based on the analysis of data from an online survey of 170 retail industry decision-makers in the US and Canada. Respondents in the survey satisfied the following criteria:- Company annual revenues of $200 million and above

- Employee count of any number (from companies with under 100 employees to those with over 3,000 employees)

- Industries such as apparel, footwear and accessories, beauty, home and home improvement

- Departments such as analytics and customer insight, category management, marketing, merchandising, operations management, planning and strategy, product sourcing/procurement