Web Developers

EXECUTIVE SUMMARY

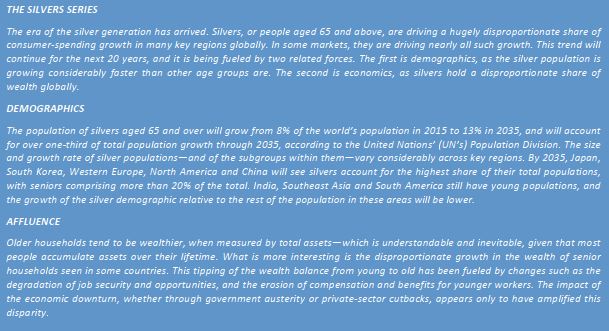

Around the world, many countries are witnessing fast growth in their silver populations. As seniors become a larger proportion of the overall population, government funding, market trends in care services and technological developments are all shaping the senior-care and assisted-living industry. We estimate that global public spending on long-term health and social care totaled approximately $1.40 trillion in 2015. The OECD expects the sector to grow at an average rate of 4.0% per year. So, at constant 2015 prices, we expect such spending to reach approximately $1.46 trillion this year and around $1.71 trillion in 2020. In the US, According to the US Centers for Disease Control and Prevention (CDC), some 8.76 million people in the US used LTC services in 2014 (the most recent year for which data are available). Seniors increasingly prefer to age in place—to live in their own homes and communities as independently as possible—and lower costs for in-home care have likely driven more seniors around the world to opt for home care over institutional care. Innovations such as online senior-care marketplaces are thriving in countries where technology and Internet adoption are high, but will be adopted more slowly in emerging countries that are less technologically advanced. Sales of connected technology, sensors and cameras will likely grow as more seniors opt for in-home care. It looks likely that many countries that already have significant or growing silver populations, as well as restrained budgets, will implement policies that encourage seniors to live in their own homes for longer. We expect in-home care to continue to gain share over assisted-living facilities, and we expect to see more technology-driven solutions to the problem of caring for an aging society. Imagine you live on the East Coast of the United States and your older parents live hundreds of miles away on the West Coast, but you are able to look after them almost as well as you could if you lived right next door. That is now possible, thanks to technology. A host of new services and marketplaces is helping families find on-demand caregivers for parents and loved ones, monitor if they are taking their medication on time and easily check in on them regularly.

Imagine you live on the East Coast of the United States and your older parents live hundreds of miles away on the West Coast, but you are able to look after them almost as well as you could if you lived right next door. That is now possible, thanks to technology. A host of new services and marketplaces is helping families find on-demand caregivers for parents and loved ones, monitor if they are taking their medication on time and easily check in on them regularly.

Nursing homes were once viewed as the main option for seniors who were no longer able to live independently at home. However, over time, in-home care services and assisted-living communities evolved to help seniors with their nonmedical daily needs, such as bathing, dressing, eating, shopping and housekeeping.

In this, the second report in our Silvers Series, we examine how providing seniors with assistance in everyday living has evolved into a thriving industry. We look at:

Nursing homes were once viewed as the main option for seniors who were no longer able to live independently at home. However, over time, in-home care services and assisted-living communities evolved to help seniors with their nonmedical daily needs, such as bathing, dressing, eating, shopping and housekeeping.

In this, the second report in our Silvers Series, we examine how providing seniors with assistance in everyday living has evolved into a thriving industry. We look at:

- The needs of those silvers who require care, in order to understand the range of services provided in the industry;

- The differences between in-home care and assisted living;

- How much the industry is worth globally and in the US, in particular;

- Global trends in long-term care (LTC) for seniors; and

- How senior care is being transformed by technology and alternative ways of providing care.

WHAT SENIORS NEED AND HOW SERVICES CAN BE DELIVERED

We concentrate on two areas of senior care: in-home care and assisted living. In-home care uses professional caregivers to provide help with everyday tasks in the client’s home. This is also referred to as domiciliary care, social care or homecare. Assisted living uses skilled caregivers to provide care to residents of communal facilities and centers. Along with room and board, these centers feature staff who assist residents with daily tasks such as bathing, dressing, eating and taking medication, as well as with socializing and mobility. Some facilities provide more complex care services—for instance, hospice care for those who are terminally ill or care for those with serious health conditions. In this report we focus on the segment of the industry that assists clients with daily activities based on their individual needs.Routine Tasks May Become Challenging with Age

While some silvers need specific care as a result of illness or disability, many look to in-home care or assisted living to help them deal with everyday issues, including:- Mobility: help with getting to places and moving around.

- Emotional needs: seniors who live alone may experience loneliness and have other psychological needs.

- Personal care: help with personal grooming, bathing and dressing.

- Nutrition: help with preparing meals; some seniors may also need help with consuming them.

GLOBAL PUBLIC EXPENDITURE ON LTC IS ESTIMATED TO REACH $1.71 TRILLION IN 2020

As with any community services sector, private companies, charitable organizations and government-run organizations provide services and facilities specifically to the silver population. Next, we examine the current size of the industry and the pace at which it is expected to grow. LTC, or long-term care, comprises health and social support services to people with chronic conditions and disabilities who need care on an ongoing basis. The health component of LTC spending relates to nursing and personal care services; it covers palliative care and care provided in LTC institutions or at home. LTC social expenditure primarily covers assistance with activities of daily living. We estimate that global public spending on long-term health and social care totaled approximately $1.40 trillion in 2015. The OECD expects the sector to grow at an average rate of 4.0% per year. So, at constant 2015 prices, we expect such spending to reach approximately $1.46 trillion this year and around $1.71 trillion in 2020. These figures include nursing and personal care services provided in institutions and at home, and include public spending only. While younger age groups are also provided with LTC services, OECD data also suggests that the majority of the recipients are silvers. On average, almost 80% of those receiving LTC services are 65 or over, with more than half of the total proportion of care recipients aged 80 and over. Our estimates are extrapolated from OECD data from 2013 (published in 2015 and the most recent year for which data are available) on health and social care spending for 12 countries. In these countries, the category accounted for an aggregate 1.7% share of GDP. We have assumed that figure was typical of global spending in 2013 and have estimated yearly figures for years after that based on the average annual real-term growth rate provided by the OECD. The data shown below are at constant 2015 prices. [caption id="attachment_91038" align="aligncenter" width="339"] Source: OECD/World Bank/Fung Global Retail & Technology[/caption]

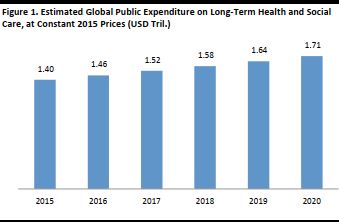

Of the 12 countries the OECD reports on, Poland spends the lowest share of its GDP on publicly funded LTC, at 0.4%, and the Netherlands spends the highest share, at 4.3%.

[caption id="attachment_91039" align="aligncenter" width="352"]

Source: OECD/World Bank/Fung Global Retail & Technology[/caption]

Of the 12 countries the OECD reports on, Poland spends the lowest share of its GDP on publicly funded LTC, at 0.4%, and the Netherlands spends the highest share, at 4.3%.

[caption id="attachment_91039" align="aligncenter" width="352"] Source: OECD[/caption]

To get an idea of total global spending on senior care through the private sector, we examined revenue data for 13,373 companies from 53 countries. We looked at firms listed in S&P Capital IQ’s company database that had listed as their primary activity “home healthcare services,” “assisted living services and facilities,” or “hospice services and centers.”

Not all of these types of companies cater exclusively to the 65+ market, but a substantial portion of them do. These companies reported total revenues of $134.2 billion in 2014 (the latest full year for which data are available) and, in aggregate, they posted a compound annual growth rate in revenues of 9.0% between 2009 and 2014—suggesting that this is a fast-growing sector.

These figures give an indication of the scale of the private sector offering in senior care. However, because they exclude nonprofit bodies such as hospitals, religious institutes and charities, as well as many privately owned companies, they do not paint a full picture of the broader sector. In addition, some geographies may be underrepresented in S&P Capital IQ’s company database. Our total includes public spending that is directed through private sector providers but excludes publicly operated care services.

Source: OECD[/caption]

To get an idea of total global spending on senior care through the private sector, we examined revenue data for 13,373 companies from 53 countries. We looked at firms listed in S&P Capital IQ’s company database that had listed as their primary activity “home healthcare services,” “assisted living services and facilities,” or “hospice services and centers.”

Not all of these types of companies cater exclusively to the 65+ market, but a substantial portion of them do. These companies reported total revenues of $134.2 billion in 2014 (the latest full year for which data are available) and, in aggregate, they posted a compound annual growth rate in revenues of 9.0% between 2009 and 2014—suggesting that this is a fast-growing sector.

These figures give an indication of the scale of the private sector offering in senior care. However, because they exclude nonprofit bodies such as hospitals, religious institutes and charities, as well as many privately owned companies, they do not paint a full picture of the broader sector. In addition, some geographies may be underrepresented in S&P Capital IQ’s company database. Our total includes public spending that is directed through private sector providers but excludes publicly operated care services.

A BREAKDOWN OF THE HOMECARE AND ASSISTED-LIVING INDUSTRY IN THE US

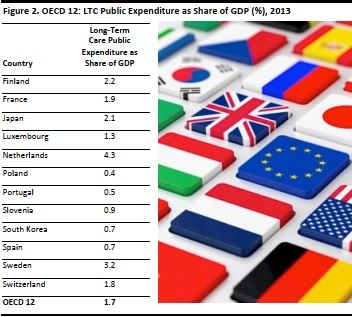

The cost of providing everyday care for silvers is substantial and growing. In the US alone, spending on assisted living (defined as “continuing care retirement communities and assisted-living facilities for the elderly” by the North American Industry Classification System—a standard used by Federal statistical agencies in classifying business establishments) was an estimated $60 billion in 2015, based on revenue information from the US Census Bureau. Spending in this sector has grown at an average annual rate of 5.9% in recent years. Given this growth, we expect US spending on assisted living to total $64 billion this year, and to rise to $80 billion in 2020. [caption id="attachment_91040" align="aligncenter" width="352"] Private sector only; excludes spending on public sector instutions. Source: US Census Bureau/Fung Global Retail & Technology [/caption]

Private sector only; excludes spending on public sector instutions. Source: US Census Bureau/Fung Global Retail & Technology [/caption]

Types of Care Providers

In the US, five main types of care providers serve the senior market:- Adult day services centers: nonresidential facilities that support the social, health, nutritional and daily living needs of adults in a community-based setting.

- Nursing homes: residential facilities for people with chronic illnesses, particularly elderly residents, many of whom may have difficulties with mobility, eating and daily living activities.

- Residential care communities: LTC facilities where the residents live together in a community; staff assist residents with everyday tasks as needed.

- Home health agencies: provide clients with in-home care services, as well as with skilled nursing services for those affected by illnesses and minor injuries.

- Hospices: provide support and services to those in the final stage of terminal illness; the main focus of hospices is on comfort and quality of life.

Nearly 3% of the US Population Uses the Industry’s Services

According to the CDC, some 8.76 million people in the US used LTC services in 2014 (the most recent year for which data are available). This is equivalent to almost 3% of the total US population. In 2014:- About 282,200 people in the US were enrolled in adult day service centers.

- Some 1,369,700 were residents in nursing homes.

- At least 835,200 were part of residential care communities.

*2013 data.

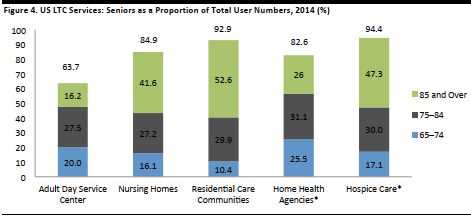

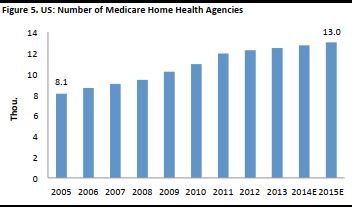

*2013 data. Source: CDC National Study of Long-Term Care Providers, 2014[/caption] As shown above, the majority of the users of these services were aged 65 and over; 63.7% of users of adult day service centers and more than 80% of users of each of the other LTC services fell into this age group, according to the CDC. Over the last decade or so, home health agencies have seen steady growth. The number of agencies that are part of the Medicare program (the federal health insurance program for people who are 65 or older) grew by 54% in the eight years from 2005. Although growth slowed in the most recent reported years, we anticipate that positive growth will continue as additional players enter the market. Our estimates suggest that the total number of home health agencies reached 13,000 in 2015. [caption id="attachment_91042" align="aligncenter" width="352"]

Source: Centers for Medicare & Medicaid Services/Fung Global Retail & Technology[/caption]

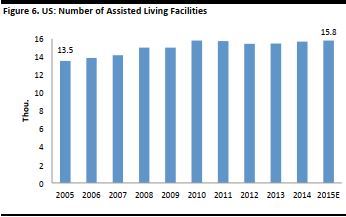

Growth in the assisted-living facility sector was less constant in recent years, implying that demand for home health agencies is growing faster than demand for assisted-living facilities. Our estimates suggest that the total number of US assisted living facilities approached 16,000 in 2015.

[caption id="attachment_91043" align="aligncenter" width="346"]

Source: Centers for Medicare & Medicaid Services/Fung Global Retail & Technology[/caption]

Growth in the assisted-living facility sector was less constant in recent years, implying that demand for home health agencies is growing faster than demand for assisted-living facilities. Our estimates suggest that the total number of US assisted living facilities approached 16,000 in 2015.

[caption id="attachment_91043" align="aligncenter" width="346"] Source: IMS Health/Fung Global Retail & Technology[/caption]

Another indicator of rising demand for home health agencies is that the number of home health aide jobs has been increasing.

Source: IMS Health/Fung Global Retail & Technology[/caption]

Another indicator of rising demand for home health agencies is that the number of home health aide jobs has been increasing.

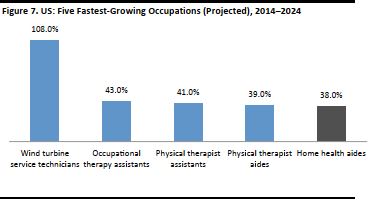

Home Health Aides: Among the Fastest Growing Occupations in the US

The US’s aging society is providing strong and growing demand for in-home care provided by home health aides. These aides provide routine, individualized healthcare services such as dressing wounds, administering medication and monitoring health, and may also provide personal care to silver clients, such as assisting them with bathing, dressing and grooming. The US Bureau of Labor Statistics states that home health aide is the fifth-fastest-growing occupation in the US, and projects 38% growth in the job category between 2014 and 2024—a rate that is much faster than the forecast rate for total employment growth in the US over the same period. [caption id="attachment_91044" align="aligncenter" width="370"] Source: US Bureau of Labor Statistics[/caption]

Source: US Bureau of Labor Statistics[/caption]

Cost and Increasing Preference for “Aging in Place” Are Driving the In-Home Care Sector

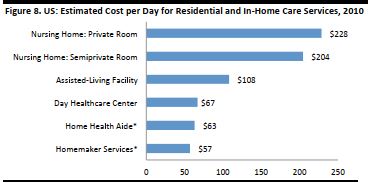

One factor that is likely driving the growth of home health agencies is cost. In many cases, it is less expensive for users to receive care at home than it is to move into a residential facility. Figures from the US Department of Health and Human Services show that there are major cost differences between these types of care. Based on that data, we estimate the following average costs per day for different types of care services: [caption id="attachment_91045" align="aligncenter" width="368"] 2010 is latest year for which data are available. Estimates are based on an average 30.5-day month.

2010 is latest year for which data are available. Estimates are based on an average 30.5-day month.*Estimated based on three hours of care per day.

Source: US Department of Health and Human Services/Fung Global Retail & Technology[/caption] Even if a user hired a full-time home health aide for a full eight hours per day, it would cost, on average, less than the monthly charges for care in a nursing home or in a one-bedroom unit at an assisted-living facility. A second, and likely stronger, factor influencing the growth of in-home care is seniors’ growing preference for aging in place, which the US Centers for Disease Control and Prevention define as “the ability to live in one’s own home and community safely, independently and comfortably, regardless of age, income or ability level.” Over 90% of seniors over age 65 prefer to stay in their homes as they age, according to the AARP.

THE GLOBAL CARE INDUSTRY

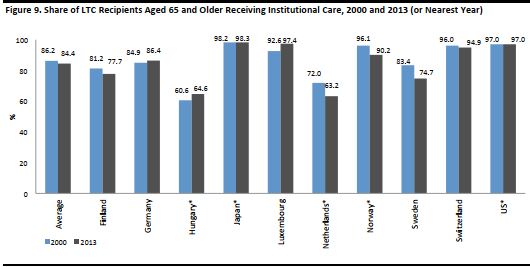

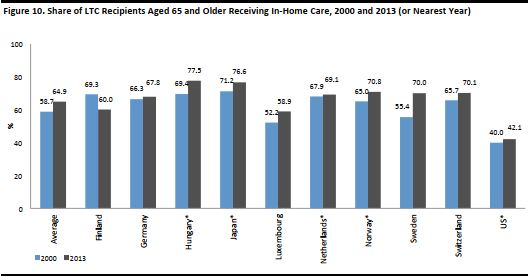

Many countries have witnessed a shift from institutional care to in-home care as the primary or preferred option for the aging population. In some countries, the difference is marginal, but in others, the proportion of seniors receiving institutional care has dropped sharply while the proportion receiving care at home has risen—likely indicating a growing preference for aging in place. For the 10 countries shown in the graph below, the average change in the proportion of seniors receiving in-home care (a 6.2 percentage-point increase) is significant, especially compared with the average change in the proportion of seniors receiving institutional care (a 1.8 percentage-point decrease). More seniors are using care services overall, but we do seem to be seeing a gradual global shift away from institutional care and toward in-home care. The latest data, published in 2015, are for 2013. [caption id="attachment_91047" align="aligncenter" width="530"] *2000 and 2013 data were unavailable for these countries, so data from the closest available years were used: 2001 for Norway, 2002 for Japan, 2004 for Hungary and the Netherlands, and 2011 for the US.

*2000 and 2013 data were unavailable for these countries, so data from the closest available years were used: 2001 for Norway, 2002 for Japan, 2004 for Hungary and the Netherlands, and 2011 for the US.Source: OECD/Fung Global Retail & Technology[/caption] [caption id="attachment_91048" align="aligncenter" width="528"]

*2000 and 2013 data were unavailable for these countries, so data from the closest available years were used: 2001 for Norway, 2002–2006 for Japan, 2004 for Hungary and the Netherlands, and 2007 for the US.

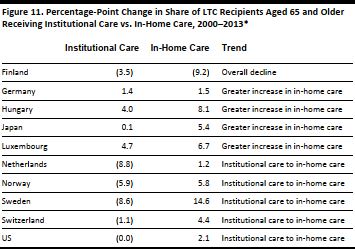

*2000 and 2013 data were unavailable for these countries, so data from the closest available years were used: 2001 for Norway, 2002–2006 for Japan, 2004 for Hungary and the Netherlands, and 2007 for the US.Source: OECD/Fung Global Retail & Technology[/caption] Among our 10 sample countries, the overall trend is clear: in-home care has grown at a faster clip than institutional care has. In five of our selected countries, institutional care declined while in-home care increased. [caption id="attachment_91049" align="aligncenter" width="355"]

*Or nearest available years: 2001 for Norway, 2002 for Japan (Institutional care), 2002–2006 for Japan (In-home care), 2004 for Hungary and the Netherlands, 2011 for the US (Institutional care) and 2007 for the US (In-home care).

*Or nearest available years: 2001 for Norway, 2002 for Japan (Institutional care), 2002–2006 for Japan (In-home care), 2004 for Hungary and the Netherlands, 2011 for the US (Institutional care) and 2007 for the US (In-home care). Source: OECD/Fung Global Retail & Technology[/caption]

AUSTERITY CONTRIBUTES TO MOVE TOWARD IN-HOME CARE

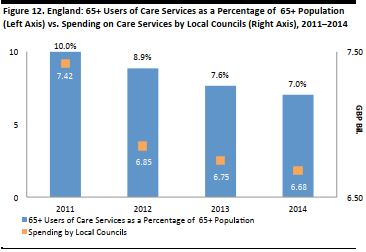

In some countries, government austerity measures have contributed to these shifts in the senior-care industry. In England, for example, between 2011 and 2014, the proportion of those aged 65 and older receiving care as a percentage of the total 65-and-older population declined from 10.0% to 7.0%. This was likely due to a drop in spending on care for the over-65s by the social services departments of Councils with Adult Social Services Responsibilities (the local councils) in England. [caption id="attachment_91050" align="aligncenter" width="366"] Source: UK Health and Social Care Information Centre/NHS/Office for National Statistics/Fung Global Retail & Technology[/caption]

Austerity measures implemented in England have impacted the amount of government funds available to spend on senior care. In the UK, by 2014, about 150,000 elderly people who would have previously received personal care and assistance did not qualify to receive any because they failed the more stringent eligibility criteria introduced to limit access to care, according to the Financial Times.

Meanwhile, research from Age UK, one of the country’s largest charities and campaign groups for seniors, found that about 900,000 people aged 65 and above have unmet needs for social care, as the numbers of people receiving home care, home-delivered meals, and vital equipment and adaptations to their homes dropped dramatically between 2010 and 2014.

Government funding and public policies play a vital role in social care administration globally, and will eventually influence demand for particular types of care. There are, however, some companies and countries that have adopted innovative ideas to address the provision of care that growing silver populations require. We take a look at some of these in the next section.

Source: UK Health and Social Care Information Centre/NHS/Office for National Statistics/Fung Global Retail & Technology[/caption]

Austerity measures implemented in England have impacted the amount of government funds available to spend on senior care. In the UK, by 2014, about 150,000 elderly people who would have previously received personal care and assistance did not qualify to receive any because they failed the more stringent eligibility criteria introduced to limit access to care, according to the Financial Times.

Meanwhile, research from Age UK, one of the country’s largest charities and campaign groups for seniors, found that about 900,000 people aged 65 and above have unmet needs for social care, as the numbers of people receiving home care, home-delivered meals, and vital equipment and adaptations to their homes dropped dramatically between 2010 and 2014.

Government funding and public policies play a vital role in social care administration globally, and will eventually influence demand for particular types of care. There are, however, some companies and countries that have adopted innovative ideas to address the provision of care that growing silver populations require. We take a look at some of these in the next section.

NEW CONCEPTS, TECHNOLOGY AND BUSINESS MODELS TO TRANSFORM SENIOR CARE

Traditionally, families have cared for their senior loved ones by employing staff to look after their needs, by helping them move into care communities or retirement homes, or by caring for them directly. New technology, however, has enabled many families to participate more directly in administering care to their elderly loved ones and has enabled many seniors to live independently for longer. In fact, AngelList, an online startup and investing platform, lists 297 companies related to elder care, with an average valuation of $4.9 million as of June 6, 2016.Online Senior-Care Marketplaces

The disruption that Uber and Airbnb have brought to their respective industries is well documented. The companies have succeeded by connecting people as consumers and suppliers of services. Now, we are seeing online marketplaces such as Hometeam and CareFamily do the same in the senior-care sector. Two of the better known marketplaces, Honor and HomeHero, are profiled below. [caption id="attachment_91054" align="alignleft" width="123"] Source: Joinhonor.com[/caption]

Honor: Honor was founded by Seth Sternberg in August 2014. The company’s motto is, “We’re building Honor for our own parents, and we’re building it for you too.” Honor helps families find caregivers online after an initial in-person assessment with a care specialist to identify the client’s care needs and formulate a care plan.

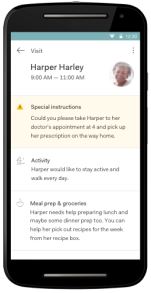

After the assessment, families and individuals can schedule appointments with caregivers either online or through Honor’s mobile app. Families and/or care specialists communicate with caregivers through the app to let them know the activities they would like the senior client to be assisted with. Caregivers help with a range of tasks, such as preparing meals, shopping for groceries and taking the client to doctor’s appointments.

[caption id="attachment_91062" align="aligncenter" width="350"]

Source: Joinhonor.com[/caption]

Honor: Honor was founded by Seth Sternberg in August 2014. The company’s motto is, “We’re building Honor for our own parents, and we’re building it for you too.” Honor helps families find caregivers online after an initial in-person assessment with a care specialist to identify the client’s care needs and formulate a care plan.

After the assessment, families and individuals can schedule appointments with caregivers either online or through Honor’s mobile app. Families and/or care specialists communicate with caregivers through the app to let them know the activities they would like the senior client to be assisted with. Caregivers help with a range of tasks, such as preparing meals, shopping for groceries and taking the client to doctor’s appointments.

[caption id="attachment_91062" align="aligncenter" width="350"] Source: Homehero.org[/caption]

HomeHero: With a model similar to Honor’s, HomeHero lets families find, hire and manage in-home caregivers for seniors. Families and individuals look for caregivers online and can watch videos of them before they hire them. Families can access their account through HomeHero’s app and use it to communicate with caregivers. HomeHero also provides a home security camera that allows families to check in on their senior loved ones and make sure they are doing fine. The company has been partnering with hospitals since March 2016 to help families and seniors find caregivers.

Source: Homehero.org[/caption]

HomeHero: With a model similar to Honor’s, HomeHero lets families find, hire and manage in-home caregivers for seniors. Families and individuals look for caregivers online and can watch videos of them before they hire them. Families can access their account through HomeHero’s app and use it to communicate with caregivers. HomeHero also provides a home security camera that allows families to check in on their senior loved ones and make sure they are doing fine. The company has been partnering with hospitals since March 2016 to help families and seniors find caregivers.

Freelance Services Marketplace

Just like the marketplaces that help bring seniors and caregivers together, there are startups that connect users with freelancers who offer services such as housekeeping, errand running, cooking and others. TaskRabbit: TaskRabbit is an online marketplace that helps match providers of labor or services—such as furniture assembly, errand running or cleaning—with those in need of such services. Although the company targets consumers in all age groups, seniors who need help only occasionally with tasks can enlist the services of those registered on the site. Chefs for Seniors: This marketplace helps connect seniors with professional chefs who prepare meals in the customer’s home. Users can choose from three menu plans ranging from basic to gourmet, and include the preparation of ten meals per chef-visit. Sa3ed: This is a marketplace to help users find people able to provide assistance with services such as senior and special needs homecare, tutoring, babysitting, gardening, carpooling and other errands, in the Middle East. Though this is startup caters to all age groups, it is primarily positioned to cater to “domestic services,” so seniors can find people for those tasks that they need help with.Smart Devices and Apps

With the number of Internet-connected devices flooding the market, there are several that are disrupting the senior care industry. Smart devices help family caregivers provide remote care to seniors and, in some cases, can be an alternative to using the services of home care professionals. Alarm.com: Alarm.com’s system relies on household sensors and a wearable device worn by the user to allow caregivers to track the user’s activities. Sensors that detect activity are placed around the areas of a home that the user frequents; the information the sensors collect is then communicated to the app. Caregivers can use the app to check on the user’s safety, sleeping habits and other activities, including whether and when the user has taken medication. The system notifies the caregiver if it detects any nonroutine behavior by the user. [caption id="attachment_91063" align="aligncenter" width="295"] Source: Alarm.com[/caption]

Other similar systems are ADT’s Senior Safety system and the Lively medical alert watch. Several smart home security products, such as Samsung’s smart security systems and Google’s Nest cameras, can also be adapted and programmed for senior care despite being sold as general home security products.

Sen.se: This company has developed a system called Mother that works through a set of sensors that can be placed in various parts of a house or on objects or devices the client uses regularly, such as a pill box or a refrigerator. The sensors placed in the house track the senior’s movement, and a sensor can be carried to track physical activity. A sensor can even be placed on a water bottle or coffee mug to measure intake. The sensors can also monitor temperature in a room, and measure sleep and other activities.

[caption id="attachment_91064" align="aligncenter" width="346"]

Source: Alarm.com[/caption]

Other similar systems are ADT’s Senior Safety system and the Lively medical alert watch. Several smart home security products, such as Samsung’s smart security systems and Google’s Nest cameras, can also be adapted and programmed for senior care despite being sold as general home security products.

Sen.se: This company has developed a system called Mother that works through a set of sensors that can be placed in various parts of a house or on objects or devices the client uses regularly, such as a pill box or a refrigerator. The sensors placed in the house track the senior’s movement, and a sensor can be carried to track physical activity. A sensor can even be placed on a water bottle or coffee mug to measure intake. The sensors can also monitor temperature in a room, and measure sleep and other activities.

[caption id="attachment_91064" align="aligncenter" width="346"] Source: Sen.se[/caption]

Robots: Paro is a therapeutic robot designed to reduce its elderly senior companions’ stress and stimulate interaction between caregivers and those in their care. The robot can be programmed to respond to certain sounds and gestures.

[caption id="attachment_91065" align="aligncenter" width="358"]

Source: Sen.se[/caption]

Robots: Paro is a therapeutic robot designed to reduce its elderly senior companions’ stress and stimulate interaction between caregivers and those in their care. The robot can be programmed to respond to certain sounds and gestures.

[caption id="attachment_91065" align="aligncenter" width="358"] Source: Parorobots.com[/caption]

Revolve Robotics has developed a telepresence robot called Kubi. Caregivers and loved ones can use an iPad to see how elderly parents and relatives are doing and to communicate with them through video calls.

Source: Parorobots.com[/caption]

Revolve Robotics has developed a telepresence robot called Kubi. Caregivers and loved ones can use an iPad to see how elderly parents and relatives are doing and to communicate with them through video calls.

Alternative Ways of Caring

[caption id="attachment_91066" align="alignleft" width="92"] Source: Revolverobotics.com[/caption]

New technologies are not the only way in which senior care is being transformed. In various countries, new ways of caring and new ways of living are also being tested to manage the growing costs and challenges of senior care.

In 2004 in Japan, senior co-operatives (Koreikyo) were established to provide job opportunities for able seniors (aged 55–75) to care for older seniors who were less able. The system helps solve two issues: providing employment for seniors who are still able to work and finding caregivers who have a good understanding of older seniors’ needs.

Another newer care concept is co-housing communities, residential communities that are created and run by the residents themselves. The model has worked successfully for seniors in Denmark, Germany, Sweden and the US. Under this model, each household has its own independent home, but activities such as eating and management are shared.

In the Netherlands, student housing can be expensive, so some nursing homes and care facilities provide rent-free lodging to students in exchange for a stipulated number of volunteer hours per week. This helps senior residents make new friends, learn how to operate technology and receive assistance with other tasks that the students are allowed to assist with, thus reducing their dependence on paid caregivers. It also helps bring youthful energy into facilities that otherwise might be quite somber, and gives students the opportunity to both help and learn from the residents.

[caption id="attachment_91073" align="aligncenter" width="489"]

Source: Revolverobotics.com[/caption]

New technologies are not the only way in which senior care is being transformed. In various countries, new ways of caring and new ways of living are also being tested to manage the growing costs and challenges of senior care.

In 2004 in Japan, senior co-operatives (Koreikyo) were established to provide job opportunities for able seniors (aged 55–75) to care for older seniors who were less able. The system helps solve two issues: providing employment for seniors who are still able to work and finding caregivers who have a good understanding of older seniors’ needs.

Another newer care concept is co-housing communities, residential communities that are created and run by the residents themselves. The model has worked successfully for seniors in Denmark, Germany, Sweden and the US. Under this model, each household has its own independent home, but activities such as eating and management are shared.

In the Netherlands, student housing can be expensive, so some nursing homes and care facilities provide rent-free lodging to students in exchange for a stipulated number of volunteer hours per week. This helps senior residents make new friends, learn how to operate technology and receive assistance with other tasks that the students are allowed to assist with, thus reducing their dependence on paid caregivers. It also helps bring youthful energy into facilities that otherwise might be quite somber, and gives students the opportunity to both help and learn from the residents.

[caption id="attachment_91073" align="aligncenter" width="489"] Source: Wimp.com[/caption]

Source: Wimp.com[/caption]

KEY TAKEAWAYS

- Global public spending on long-term health and social care totaled approximately $1.40 trillion in 2015, according to our estimates, and at constant 2015 prices, we expect it to reach about $1.46 trillion in 2016 and nearly $1.71 trillion in 2020.

- In the US alone, spending on assisted living amounted to nearly $60 billion in 2015.

- OECD data for 10 countries suggests that a greater proportion of seniors who need long-term care are receiving this in the home, and a smaller proportion in institutional care.

- Innovations such as online senior-care marketplaces are thriving in countries where technology and Internet adoption are high, but will be adopted more slowly in emerging countries that are less technologically advanced.