Web Developers

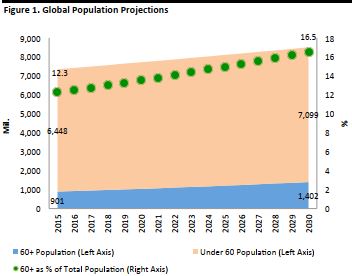

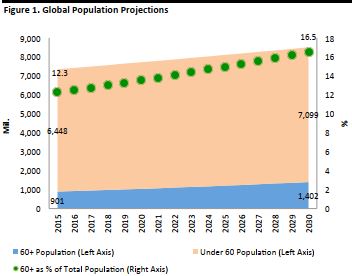

Millennials may be the demographic garnering the most headlines lately, but the aging and rapidly growing senior community deserves attention, too. The UN forecasts that the number of people aged 60 or older will grow by over 500 million between 2015 and 2030, raising the group’s share of the global population from 12.3% to 16.5%. This growth presents many business and economic opportunities for those engaged in “the silver economy,” especially for companies catering to seniors’ healthcare needs.

Source: UN Department of Economic and Social Affairs, Population Division: World Population Prospects: The 2015 Revision/International Labour Organization, World Social Protection Report 2014–15[/caption]

Source: UN Department of Economic and Social Affairs, Population Division: World Population Prospects: The 2015 Revision/International Labour Organization, World Social Protection Report 2014–15[/caption]

*Germany and France are included in W. Europe. The UK is included in N. Europe.

*Germany and France are included in W. Europe. The UK is included in N. Europe.

**China and Japan are included within E. Asia; we have also split these countries out.

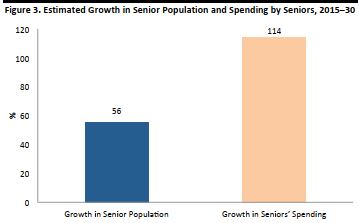

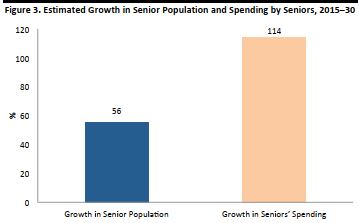

Source: UN Department of Economic and Social Affairs, Population Division: World Population Prospects: The 2015 Revision/International Labour Organization, World Social Protection Report 2014–15[/caption] The growth in senior population estimate is for those ages 60+; the growth in seniors’ spending estimate is for those ages 65+.

The growth in senior population estimate is for those ages 60+; the growth in seniors’ spending estimate is for those ages 65+.

Source: UN Department of Economic and Social Affairs, Population Division: World Population Prospects: The 2015 Revision/International Labour Organization, World Social Protection Report 2014–15/Euromonitor International/FBIC Global Retail & Technology[/caption] *Japan figures are for 2013. Estimates are based on household consumer expenditure surveys, which record the age of the household reference person.

*Japan figures are for 2013. Estimates are based on household consumer expenditure surveys, which record the age of the household reference person.

Source: US Bureau of Labor Statistics/Office for National Statistics/Statistics Japan/FBIC Global Retail & Technology[/caption] Our estimates show that in all three countries, 65+ households overindex in spending on health relative to their share of households. In the US, they accounted for 31.4% of total spending on health while accounting for just 23.0% of households. In the UK, though the country has a healthcare system that is free at the point of need, 65+ consumers accounted for 39.4% of total spending on health while accounting for 27.8% of total households. In both the US and the UK, senior households underindex substantially on clothing, footwear and accessories. In the US, they accounted for 14.2% of total spending in the category and in the UK, they accounted for 14.4%. In Japan, 65+ households spend relatively strongly on clothing, footwear and accessories: this group’s 39.3% share of category spending comes close to its share of total households, which is 39.7%. This is likely due to the fact that older consumers are more affluent than younger ones in Japan and are therefore able to spend more on such semidiscretionary categories. As with seniors in the US and the UK, seniors in Japan spend substantially on health.

Senior households also underindex on spending in the electronics category. Does this mean seniors have less of an interest in technology? To answer that, we look in the next section at how technology adoption among seniors has changed in recent times.

In both the US and the UK, senior households underindex substantially on clothing, footwear and accessories. In the US, they accounted for 14.2% of total spending in the category and in the UK, they accounted for 14.4%. In Japan, 65+ households spend relatively strongly on clothing, footwear and accessories: this group’s 39.3% share of category spending comes close to its share of total households, which is 39.7%. This is likely due to the fact that older consumers are more affluent than younger ones in Japan and are therefore able to spend more on such semidiscretionary categories. As with seniors in the US and the UK, seniors in Japan spend substantially on health.

Senior households also underindex on spending in the electronics category. Does this mean seniors have less of an interest in technology? To answer that, we look in the next section at how technology adoption among seniors has changed in recent times.

Source: Deloitte Global Mobile Consumer Survey[/caption]

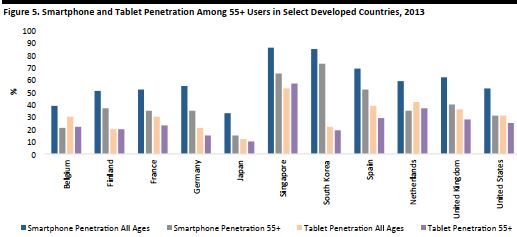

While overall technology adoption levels have been low among seniors compared to the rest of the population, it is evident that more seniors are becoming tech-savvy over time. This factor, along with the demographic’s rapid growth, and its disproportionate spending on health, have likely sped the momentum of collaboration between senior healthcare and technology companies. In the next section, we focus on healthcare and the healthcare tech opportunities presented by the growing silver demographic.

Source: Deloitte Global Mobile Consumer Survey[/caption]

While overall technology adoption levels have been low among seniors compared to the rest of the population, it is evident that more seniors are becoming tech-savvy over time. This factor, along with the demographic’s rapid growth, and its disproportionate spending on health, have likely sped the momentum of collaboration between senior healthcare and technology companies. In the next section, we focus on healthcare and the healthcare tech opportunities presented by the growing silver demographic.

[caption id="attachment_90968" align="aligncenter" width="345"]

[caption id="attachment_90968" align="aligncenter" width="345"] Source: World Bank[/caption]

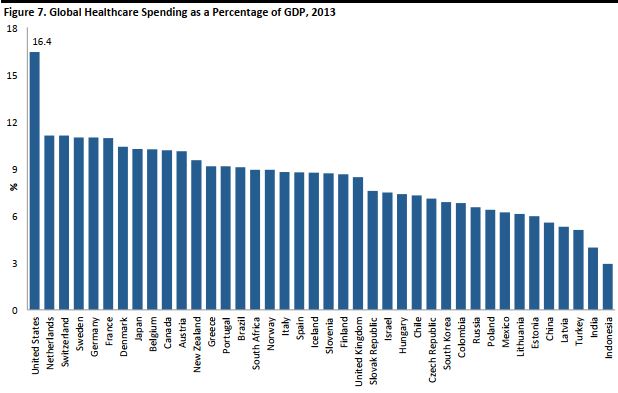

According to the Organisation for Economic Co-operation and Development (OECD), in 2013 in the US, healthcare spending accounted for nearly 16.4% of GDP, which was about five percentage points higher than its nearest rival—and without achieving universal coverage.

[caption id="attachment_90969" align="aligncenter" width="618"]

Source: World Bank[/caption]

According to the Organisation for Economic Co-operation and Development (OECD), in 2013 in the US, healthcare spending accounted for nearly 16.4% of GDP, which was about five percentage points higher than its nearest rival—and without achieving universal coverage.

[caption id="attachment_90969" align="aligncenter" width="618"] Source: OECD.org[/caption]

Source: OECD.org[/caption]

Novartis’s portfolio of smart inhalers for treating chronic obstructive pulmonary disease (COPD): Pharmaceutical giant Novartis collaborated with Qualcomm to develop smart inhalers for patients suffering with COPD. The disease is said to mostly affect people in their later years, although there have been instances of patients under age 65 being diagnosed with it.

The smart inhalers help patients self-administer the prescribed drugs to treat COPD. The inhalers detect and record real-time data about their usage, including the time used and other information relevant to patients and physicians. This information is then transmitted to a patient’s smartphone and the Novartis app, through which healthcare providers can access it.

[caption id="attachment_90976" align="aligncenter" width="352"]

Novartis’s portfolio of smart inhalers for treating chronic obstructive pulmonary disease (COPD): Pharmaceutical giant Novartis collaborated with Qualcomm to develop smart inhalers for patients suffering with COPD. The disease is said to mostly affect people in their later years, although there have been instances of patients under age 65 being diagnosed with it.

The smart inhalers help patients self-administer the prescribed drugs to treat COPD. The inhalers detect and record real-time data about their usage, including the time used and other information relevant to patients and physicians. This information is then transmitted to a patient’s smartphone and the Novartis app, through which healthcare providers can access it.

[caption id="attachment_90976" align="aligncenter" width="352"] Source: Novartis.com[/caption]

Source: Novartis.com[/caption]

MocaHeart by MocaCare: This device tracks the user’s rate and cardiovascular health. The user places his or her thumb on a sensor on the device, which measures the user’s blood flow velocity. The device then uses the blood velocity to calculate heart rate, blood oxygen levels and cardiovascular health, displaying the information on the user’s smartphone.

[caption id="attachment_90979" align="aligncenter" width="356"]

MocaHeart by MocaCare: This device tracks the user’s rate and cardiovascular health. The user places his or her thumb on a sensor on the device, which measures the user’s blood flow velocity. The device then uses the blood velocity to calculate heart rate, blood oxygen levels and cardiovascular health, displaying the information on the user’s smartphone.

[caption id="attachment_90979" align="aligncenter" width="356"] Source: Mocacare.com[/caption]

Source: Mocacare.com[/caption]

VitalSnap: This app, developed by a company called Validic, enables users to record health data and transmit it to care providers or a patient portal. The user takes a picture of the information from a personal health-monitoring device (such as a blood glucose meter or blood pressure monitor) via his or her smartphone camera, then uploads it to the VitalSnap app, which can deliver the information to healthcare providers.

VitalSnap: This app, developed by a company called Validic, enables users to record health data and transmit it to care providers or a patient portal. The user takes a picture of the information from a personal health-monitoring device (such as a blood glucose meter or blood pressure monitor) via his or her smartphone camera, then uploads it to the VitalSnap app, which can deliver the information to healthcare providers.

GreatCall’s phones, wearables and services: GreatCall worked with Samsung to develop smartphones that are easier for seniors to use. The phones come with preloaded apps and emergency numbers, and even have a special button on the keypad for users to instantly connect with GreatCall’s support center staff. The company helps users get 24/7 access to nurses and doctors, and provides a personal operator service for other services. Users are also given daily health tips and a check-in or wellness call. At CES 2016, GreatCall also unveiled a wearable device that links to both the user’s phone and its services.

[caption id="attachment_90984" align="aligncenter" width="302"]

GreatCall’s phones, wearables and services: GreatCall worked with Samsung to develop smartphones that are easier for seniors to use. The phones come with preloaded apps and emergency numbers, and even have a special button on the keypad for users to instantly connect with GreatCall’s support center staff. The company helps users get 24/7 access to nurses and doctors, and provides a personal operator service for other services. Users are also given daily health tips and a check-in or wellness call. At CES 2016, GreatCall also unveiled a wearable device that links to both the user’s phone and its services.

[caption id="attachment_90984" align="aligncenter" width="302"] Source: Steelpointcp.com[/caption]

Source: Steelpointcp.com[/caption]

GrandCare Systems: Health-monitoring systems from GrandCare allow caregivers to view readings and reports remotely, and administer to patients remotely. Through simple questions on the screen, the interactive systems ask patients about their health and if they have taken their prescribed medicines. Alerts can be sent to caregivers if patients miss any scheduled medication.

Such systems can also be connected to sensors throughout a house to help with tending to patients with Alzheimer’s disease. If the patient leaves the house, the sensors quietly send an alert to an assigned person so that they can track the patient’s whereabouts.

[caption id="attachment_90986" align="aligncenter" width="363"]

GrandCare Systems: Health-monitoring systems from GrandCare allow caregivers to view readings and reports remotely, and administer to patients remotely. Through simple questions on the screen, the interactive systems ask patients about their health and if they have taken their prescribed medicines. Alerts can be sent to caregivers if patients miss any scheduled medication.

Such systems can also be connected to sensors throughout a house to help with tending to patients with Alzheimer’s disease. If the patient leaves the house, the sensors quietly send an alert to an assigned person so that they can track the patient’s whereabouts.

[caption id="attachment_90986" align="aligncenter" width="363"] Source: Grandcare.com[/caption]

Fitness wearables: There are a number of wearable fitness trackers for seniors on the market now, including the Tempo wristband, which tracks and “learns” the wearer’s sleep, meal, activity and other habits. Once it does, it checks for each activity at the stipulated time, and if a user misses a meal or has not woken up at the usual time, the smartphone app linked to the tracker notifies the caregiver.

Source: Grandcare.com[/caption]

Fitness wearables: There are a number of wearable fitness trackers for seniors on the market now, including the Tempo wristband, which tracks and “learns” the wearer’s sleep, meal, activity and other habits. Once it does, it checks for each activity at the stipulated time, and if a user misses a meal or has not woken up at the usual time, the smartphone app linked to the tracker notifies the caregiver.

UnaliWear’s Kanega voice-controlled wristband looks like a watch and comes with many functions not available on the typical fitness tracker. It provides medication reminders to the wearer, including how each dose should be taken. If wearers wander off and lose their way, it tells them how to get home, and if they need help or emergency assistance, the wristband communicates with an operator who will arrange for help.

[caption id="attachment_90988" align="aligncenter" width="379"]

UnaliWear’s Kanega voice-controlled wristband looks like a watch and comes with many functions not available on the typical fitness tracker. It provides medication reminders to the wearer, including how each dose should be taken. If wearers wander off and lose their way, it tells them how to get home, and if they need help or emergency assistance, the wristband communicates with an operator who will arrange for help.

[caption id="attachment_90988" align="aligncenter" width="379"] Source: Carepredict.com/Unaliwear.com[/caption]

Source: Carepredict.com/Unaliwear.com[/caption]

BodyGuardian Remote Monitoring System: The BodyGuardian sensor is a small wireless device that is fixed to a patient’s chest with a medical-grade adhesive gel. It records real-time readings of a user’s average heart rate, breaths per minute, activity level and other vital signs to perform an electrocardiogram. The sensor can be linked to a patient’s smartphone and to the company’s PatientCare platform to enable caregivers to monitor the patient’s health more closely.

[caption id="attachment_90990" align="aligncenter" width="382"]

BodyGuardian Remote Monitoring System: The BodyGuardian sensor is a small wireless device that is fixed to a patient’s chest with a medical-grade adhesive gel. It records real-time readings of a user’s average heart rate, breaths per minute, activity level and other vital signs to perform an electrocardiogram. The sensor can be linked to a patient’s smartphone and to the company’s PatientCare platform to enable caregivers to monitor the patient’s health more closely.

[caption id="attachment_90990" align="aligncenter" width="382"] Source: Preventicesolutions.com[/caption]

Honor: Honor is a service that brings together seniors and caregivers through its website and mobile app. Qualified caregivers are screened and enrolled in Honor’s database, where seniors can search for them according to their needs and location. Honor’s caregivers offer services that include medication reminders, helping patients stay active, personal care and hygiene, and check-in visits.

[caption id="attachment_90991" align="aligncenter" width="408"]

Source: Preventicesolutions.com[/caption]

Honor: Honor is a service that brings together seniors and caregivers through its website and mobile app. Qualified caregivers are screened and enrolled in Honor’s database, where seniors can search for them according to their needs and location. Honor’s caregivers offer services that include medication reminders, helping patients stay active, personal care and hygiene, and check-in visits.

[caption id="attachment_90991" align="aligncenter" width="408"] Source: Joinhonor.com[/caption]

Source: Joinhonor.com[/caption]

WHAT IS THE SILVER ECONOMY?

The European Commission defines the silver economy as “the economic opportunities arising from the public and consumer expenditure related to population aging and the specific needs of the population over 50.” The senior population certainly has needs and wants unique to its age group, and these result in significant differences in its spending patterns and priorities.INTRODUCING THE SILVERS SERIES

In this series of reports, we will focus on those ages 65 and older. However, our analysis relies heavily on United Nations (UN) data that segment the older age groups into those ages 60+ and those ages 80+ because the UN is one of the most comprehensive sources of comparable global data on population by age, including forecasts for demographic change. Our reports will explore three important market segments that comprise the silver economy: senior healthcare technology, senior homecare, and senior fun and leisure. Senior healthcare tech refers to devices and services that specifically cater to seniors’ health needs. Senior homecare refers to devices and services that enable seniors to carry out everyday tasks and caregivers and children to provide better care for the seniors in their charge. The senior fun and leisure segment includes devices, apps and services that enable seniors to lead more socially connected lives. In this first report in the series, we explore the global senior healthcare market and the latest tech emerging in this segment. But first, we outline some of the numbers—in terms of population, spending and device usage—that underpin the growth opportunities in the silver economy.

THE SILVERS CONTEXT: THE GLOBAL AGING TREND, IN NUMBERS

The senior population is growing across the globe, and people are living longer in many regions. As we noted above, UN data segments the older age groups into 60+ years and 80+ years—so the following data differ slightly from this report’s focus on the 65+ age group. In absolute terms, the UN forecasts that the 60+ age group will swell by just over 500 million between 2015 and 2030, accounting for 44% of the total global population growth of 1,152 million that is expected over the period. That means that the 60+ population will grow from 12.3% of the global population in 2015 to 16.5% of the global population in 2030, according to UN forecasts. The 60+ population was 901 million in 2015, the UN estimates, and will reach 1,402 million in 2030. [caption id="attachment_90961" align="aligncenter" width="352"] Source: UN Department of Economic and Social Affairs, Population Division: World Population Prospects: The 2015 Revision/International Labour Organization, World Social Protection Report 2014–15[/caption]

Source: UN Department of Economic and Social Affairs, Population Division: World Population Prospects: The 2015 Revision/International Labour Organization, World Social Protection Report 2014–15[/caption]

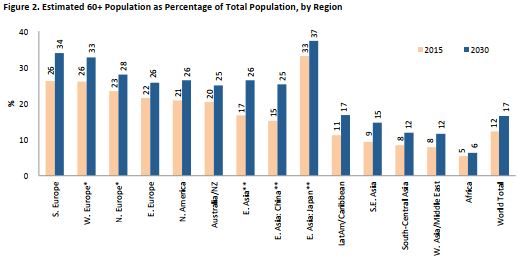

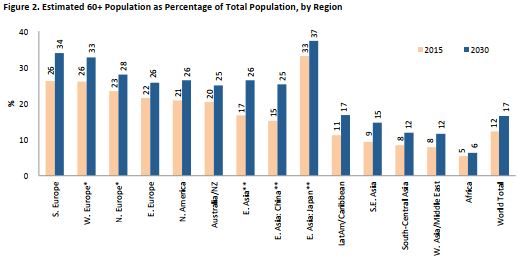

Majority of Regions to See 60+ Group Comprise Quarter of Population by 2030

Currently, just two regions see those ages 60+ accounting for more than one-quarter of their total: Southern Europe and Western Europe (within the East Asia region, Japan also sees this). By 2030, Northern Europe, North America, Australia/New Zealand and China will have joined them. It may surprise some readers that North America currently ranks relatively low by this measure, but it is Europe, and especially Southern and Western Europe, where the aging issue is most prominent. Japan is exceptional among major economies for the scale of its older population. But where Japan is now—with one-third of the population aged 60 or older—Southern and Western Europe will be in 2030, UN forecasts suggest. So, Japan is a country that can provide insight when considering the opportunities and challenges of an aging population. [caption id="attachment_90962" align="aligncenter" width="519"] *Germany and France are included in W. Europe. The UK is included in N. Europe.

*Germany and France are included in W. Europe. The UK is included in N. Europe.**China and Japan are included within E. Asia; we have also split these countries out.

Source: UN Department of Economic and Social Affairs, Population Division: World Population Prospects: The 2015 Revision/International Labour Organization, World Social Protection Report 2014–15[/caption]

THE SILVERS CONTEXT: CONSUMERS 65+ TO SPEND AROUND $10 TRILLION ANNUALLY BY 2020

The spending power wielded by this growing demographic group is significant. Seniors account for a disproportionate share of total consumer spending worldwide, and we expect their total global spending to more than double between 2015 and 2030. FBIC Global Retail & Technology’s provisional estimates, based on population forecasts from the UN and spending forecasts from Euromonitor International, suggest that:- In 2015, consumers aged 65 and older spent around $7 trillion globally on goods and services. This was equivalent to a little over 17% of total worldwide consumer spending last year.

- Seniors will account for around $10 trillion in consumer spending in 2020, or approximately 19% of the worldwide total.

- In 2030, seniors will account for around $15 trillion of consumer spending, or approximately 23.5% of the global total.

The growth in senior population estimate is for those ages 60+; the growth in seniors’ spending estimate is for those ages 65+.

The growth in senior population estimate is for those ages 60+; the growth in seniors’ spending estimate is for those ages 65+. Source: UN Department of Economic and Social Affairs, Population Division: World Population Prospects: The 2015 Revision/International Labour Organization, World Social Protection Report 2014–15/Euromonitor International/FBIC Global Retail & Technology[/caption]

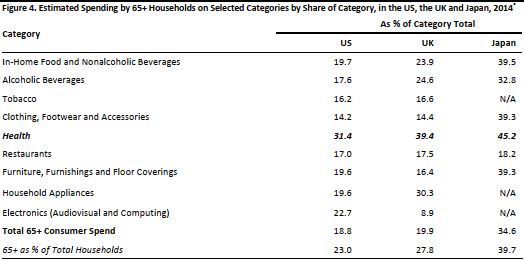

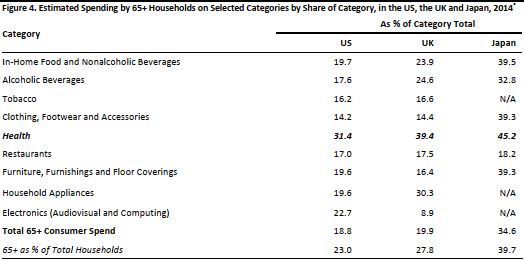

Estimated Spending by 65+ Households on Selected Categories

For insight on seniors’ spending, we turn to data on the spending patterns of 65+ households in the US, the UK and Japan. These countries give an indication of spending across three continents, but they are also notable for other factors:- The US has the largest global market for seniors: US consumers ages 65+ spent an estimated $2.2 trillion in 2014.

- The UK has witnessed a shift of wealth to older age groups, helped by seniors’ protection from government austerity measures and rising residential property prices.

- In Japan, seniors make up a considerably larger proportion of the population than they do in other countries.

*Japan figures are for 2013. Estimates are based on household consumer expenditure surveys, which record the age of the household reference person.

*Japan figures are for 2013. Estimates are based on household consumer expenditure surveys, which record the age of the household reference person.Source: US Bureau of Labor Statistics/Office for National Statistics/Statistics Japan/FBIC Global Retail & Technology[/caption] Our estimates show that in all three countries, 65+ households overindex in spending on health relative to their share of households. In the US, they accounted for 31.4% of total spending on health while accounting for just 23.0% of households. In the UK, though the country has a healthcare system that is free at the point of need, 65+ consumers accounted for 39.4% of total spending on health while accounting for 27.8% of total households.

In both the US and the UK, senior households underindex substantially on clothing, footwear and accessories. In the US, they accounted for 14.2% of total spending in the category and in the UK, they accounted for 14.4%. In Japan, 65+ households spend relatively strongly on clothing, footwear and accessories: this group’s 39.3% share of category spending comes close to its share of total households, which is 39.7%. This is likely due to the fact that older consumers are more affluent than younger ones in Japan and are therefore able to spend more on such semidiscretionary categories. As with seniors in the US and the UK, seniors in Japan spend substantially on health.

Senior households also underindex on spending in the electronics category. Does this mean seniors have less of an interest in technology? To answer that, we look in the next section at how technology adoption among seniors has changed in recent times.

In both the US and the UK, senior households underindex substantially on clothing, footwear and accessories. In the US, they accounted for 14.2% of total spending in the category and in the UK, they accounted for 14.4%. In Japan, 65+ households spend relatively strongly on clothing, footwear and accessories: this group’s 39.3% share of category spending comes close to its share of total households, which is 39.7%. This is likely due to the fact that older consumers are more affluent than younger ones in Japan and are therefore able to spend more on such semidiscretionary categories. As with seniors in the US and the UK, seniors in Japan spend substantially on health.

Senior households also underindex on spending in the electronics category. Does this mean seniors have less of an interest in technology? To answer that, we look in the next section at how technology adoption among seniors has changed in recent times.

THE SILVERS CONTEXT: OLDER CONSUMERS ARE INCREASINGLY DIGITALLY CONNECTED

Internet usage and online shopping participation rates are, naturally, lower among older age groups: seniors have not had the advantage of growing up with this technology, as millennials have. But in developed Internet economies, online penetration rates for seniors are now close to where average penetration rates stood a few years ago. In the UK, for instance, some 70% of 65–74-year-olds use the Internet at least once a week (65–74 is the upper age band for the Eurostat survey data we use). The average Internet penetration among the total UK population was about 80% in 2010. In the US, meanwhile, some 58% of consumers aged 65+ were Internet users as of May 2015, up from 57% in January 2014, according to the Pew Research Center. As a share of total online shoppers in the US, however, those 65 and older remain underrepresented: they account for just 10% of total online shoppers, but make up nearly 19% of the adult population, according to an April 2015 survey by Business Insider.Device Usage Among Seniors

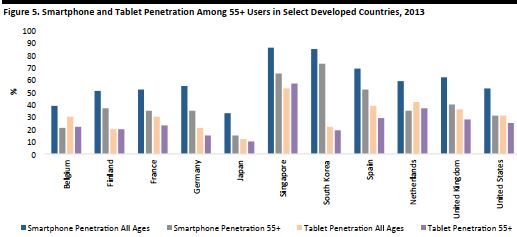

Mobile device usage has also increased among seniors lately. According to Deloitte’s 2013 Global Mobile Consumer Survey, smartphone adoption is growing rapidly among those 55 and older in developed countries. While older consumers have been slower to adopt smartphones, they are only slightly behind the total population in terms of adopting tablets. In fact, in Singapore, tablet use among the 55+ age group has outpaced its use among the total population. It is likely that many seniors find tablets’ larger displays and icons more readable and their touchscreens more convenient to use. [caption id="attachment_90966" align="aligncenter" width="517"] Source: Deloitte Global Mobile Consumer Survey[/caption]

While overall technology adoption levels have been low among seniors compared to the rest of the population, it is evident that more seniors are becoming tech-savvy over time. This factor, along with the demographic’s rapid growth, and its disproportionate spending on health, have likely sped the momentum of collaboration between senior healthcare and technology companies. In the next section, we focus on healthcare and the healthcare tech opportunities presented by the growing silver demographic.

Source: Deloitte Global Mobile Consumer Survey[/caption]

While overall technology adoption levels have been low among seniors compared to the rest of the population, it is evident that more seniors are becoming tech-savvy over time. This factor, along with the demographic’s rapid growth, and its disproportionate spending on health, have likely sped the momentum of collaboration between senior healthcare and technology companies. In the next section, we focus on healthcare and the healthcare tech opportunities presented by the growing silver demographic.

HEALTHCARE SPENDING ACROSS THE GLOBE

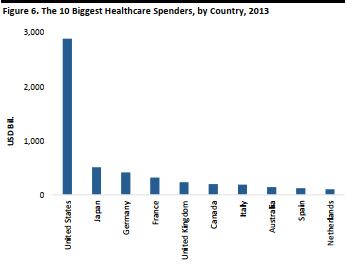

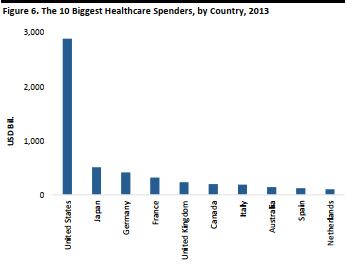

In order to gain insight on the healthcare tech market, we looked at the 10 countries that are spending the most on healthcare. According to data from the World Bank, the US topped all countries in terms of spending on healthcare in 2013: Americans spent a very substantial $2.9 trillion on healthcare that year. [caption id="attachment_90968" align="aligncenter" width="345"]

[caption id="attachment_90968" align="aligncenter" width="345"] Source: World Bank[/caption]

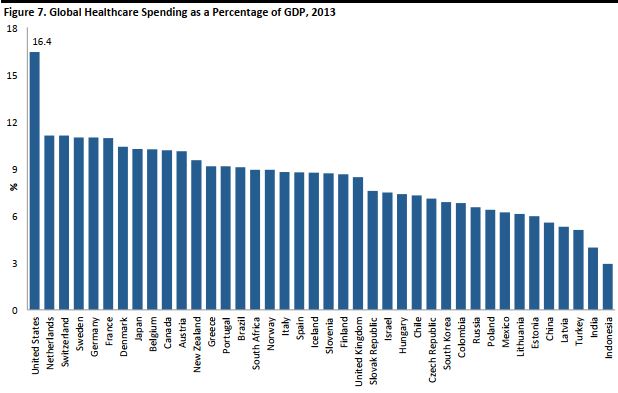

According to the Organisation for Economic Co-operation and Development (OECD), in 2013 in the US, healthcare spending accounted for nearly 16.4% of GDP, which was about five percentage points higher than its nearest rival—and without achieving universal coverage.

[caption id="attachment_90969" align="aligncenter" width="618"]

Source: World Bank[/caption]

According to the Organisation for Economic Co-operation and Development (OECD), in 2013 in the US, healthcare spending accounted for nearly 16.4% of GDP, which was about five percentage points higher than its nearest rival—and without achieving universal coverage.

[caption id="attachment_90969" align="aligncenter" width="618"] Source: OECD.org[/caption]

Source: OECD.org[/caption]

Healthcare Spending by Seniors

Our estimates suggest that seniors accounted for around 16.1%, or $1.3 trillion, of healthcare spending globally in 2015. This is an approximation extrapolated from data for the US, the UK and Japan and based on total healthcare spending figures from the World Bank. These figures are based on UN population data, and so represent consumers aged 60+. We further estimate that those ages 60+ will account for approximately 21.6%, or $3.5 trillion, of global healthcare spending in 2030. The World Bank says $7.36 trillion was spent on global healthcare in 2013, and we estimate this total to have risen to $16.30 trillion in 2015. Given that healthcare spending is a sizeable portion of public and private spending, especially in developed countries, many innovators have taken note of the commercial potential of this sector. And some early birds among healthcare providers have been joining forces with large pharmaceutical and tech companies to capitalize on the market opportunity. Healthcare tech startups have also sprung up to provide innovative and affordable healthcare and monitoring products. Below, we explore some of the exciting collaborative developments in the industry.THE HEALTHCARE TECH INDUSTRY

Health technology, as the World Health Organization describes it, is “the application of organized knowledge and skills in the form of devices, medicines, vaccines, procedures and systems developed to solve a health problem and improve quality of lives.” Healthcare tech has been immensely helpful in improving, and lengthening, people’s lives. Within the industry, technology has been developed to cater to the specific medical and health needs of the older population. BCC Research valued the global market for senior-care technology at $3.7 billion in 2014, and expects it to grow to $10.3 billion by 2020, at a CAGR of 18.8%. Below, we examine some of the drivers that will push growth in senior healthcare tech.Healthcare Technology and Senior Healthcare Technology Drivers

Healthcare tech has been enabled by two trends that mark our modern lives: instant accessibility and Big Data. Both can help improve patients’ quality of life and caregivers’ ability to perform their jobs.The Push Factors

Several factors are pushing healthcare technology, including:- An increase in the aging population and the resulting rise in demand for healthcare: The increase in the number of senior consumers will boost demand for senior healthcare, and many seniors living alone might eventually need to be cared for remotely, either by their children or by caregivers. Some seniors might even want access to their health data, in order to be able to use it to care for themselves as long as possible. Health tech can help seniors (and their caregivers) achieve this.

- Advances in technology and the Internet of Things (IoT): New developments in technology are driving innovators to find varied applications for them, which will push growth in markets such as healthcare tech.

- The rising cost of seniors’ healthcare: As the cost of caring for seniors rises, it increases the financial and social burden on healthcare providers and governments. Technology can help ease this burden by boosting productivity.

The Pull Factors

Considering the many applications of tech in caring for seniors, the market has a few distinct drivers that are pulling more consumers toward it:- Instant access to first aid/immediate care: Health tech can, in some instances, provide a level of instant care to patients until medical personnel arrives to help with treatment.

- Move from paper to electronic medical records or electronic health records: Many hospitals, clinics and general practitioners have already moved from maintaining paper health records to maintaining electronic records. However, much patient data still needs to be physically collected and entered manually into a system. Digital health devices are able to do this, saving time and increasing accessibility.

- The move toward preventive healthcare in the global healthcare business model: Health tech can help doctors, nurses and caregivers deliver preventive care rather than just curative care, and institutions now aim to grow around this model in order to provide improved care.

- Data collection: Devices are now able to collect and store certain data about a patient’s health and body conditions without the patient having to write it down, narrate it or convey it and without a caregiver having to physically collect it. Some devices can be plugged in to a main system, and IoT-enabled devices can send information to a database instantly, allowing caregivers to access and maintain it in one place.

PROFILES: SENIOR HEALTHCARE TECH PRODUCTS

At the CES 2016 trade show, an event called the Silvers Summit was dedicated to the latest developments in technology for seniors. Some of the products demonstrated included: Source: Novartis.com[/caption]

Source: Novartis.com[/caption]

Source: Mocacare.com[/caption]

Source: Mocacare.com[/caption]

Source: Steelpointcp.com[/caption]

Source: Steelpointcp.com[/caption]

GrandCare Systems: Health-monitoring systems from GrandCare allow caregivers to view readings and reports remotely, and administer to patients remotely. Through simple questions on the screen, the interactive systems ask patients about their health and if they have taken their prescribed medicines. Alerts can be sent to caregivers if patients miss any scheduled medication.

Such systems can also be connected to sensors throughout a house to help with tending to patients with Alzheimer’s disease. If the patient leaves the house, the sensors quietly send an alert to an assigned person so that they can track the patient’s whereabouts.

[caption id="attachment_90986" align="aligncenter" width="363"]

GrandCare Systems: Health-monitoring systems from GrandCare allow caregivers to view readings and reports remotely, and administer to patients remotely. Through simple questions on the screen, the interactive systems ask patients about their health and if they have taken their prescribed medicines. Alerts can be sent to caregivers if patients miss any scheduled medication.

Such systems can also be connected to sensors throughout a house to help with tending to patients with Alzheimer’s disease. If the patient leaves the house, the sensors quietly send an alert to an assigned person so that they can track the patient’s whereabouts.

[caption id="attachment_90986" align="aligncenter" width="363"] Source: Grandcare.com[/caption]

Fitness wearables: There are a number of wearable fitness trackers for seniors on the market now, including the Tempo wristband, which tracks and “learns” the wearer’s sleep, meal, activity and other habits. Once it does, it checks for each activity at the stipulated time, and if a user misses a meal or has not woken up at the usual time, the smartphone app linked to the tracker notifies the caregiver.

Source: Grandcare.com[/caption]

Fitness wearables: There are a number of wearable fitness trackers for seniors on the market now, including the Tempo wristband, which tracks and “learns” the wearer’s sleep, meal, activity and other habits. Once it does, it checks for each activity at the stipulated time, and if a user misses a meal or has not woken up at the usual time, the smartphone app linked to the tracker notifies the caregiver.

Source: Carepredict.com/Unaliwear.com[/caption]

Source: Carepredict.com/Unaliwear.com[/caption]

Source: Preventicesolutions.com[/caption]

Honor: Honor is a service that brings together seniors and caregivers through its website and mobile app. Qualified caregivers are screened and enrolled in Honor’s database, where seniors can search for them according to their needs and location. Honor’s caregivers offer services that include medication reminders, helping patients stay active, personal care and hygiene, and check-in visits.

[caption id="attachment_90991" align="aligncenter" width="408"]

Source: Preventicesolutions.com[/caption]

Honor: Honor is a service that brings together seniors and caregivers through its website and mobile app. Qualified caregivers are screened and enrolled in Honor’s database, where seniors can search for them according to their needs and location. Honor’s caregivers offer services that include medication reminders, helping patients stay active, personal care and hygiene, and check-in visits.

[caption id="attachment_90991" align="aligncenter" width="408"] Source: Joinhonor.com[/caption]

Source: Joinhonor.com[/caption]