DIpil Das

In the US, the traditional shopping mall format is facing sustained challenges, driven principally by the digitalization of the shopping journey. The migration of shopping online is the key challenge: We estimate that around 20% of total US nonfood retail sales will be online in 2019. Moreover, the easy accessibility of product information online means that product discovery is no longer a competitive advantage for malls.

Faced with dwindling shopper traffic and store closures, property owners are therefore inviting non-traditional tenants to drive traffic to shopping centers. In this report, we look at the opportunities for mall owners to revitalize shopping centers in 2020.

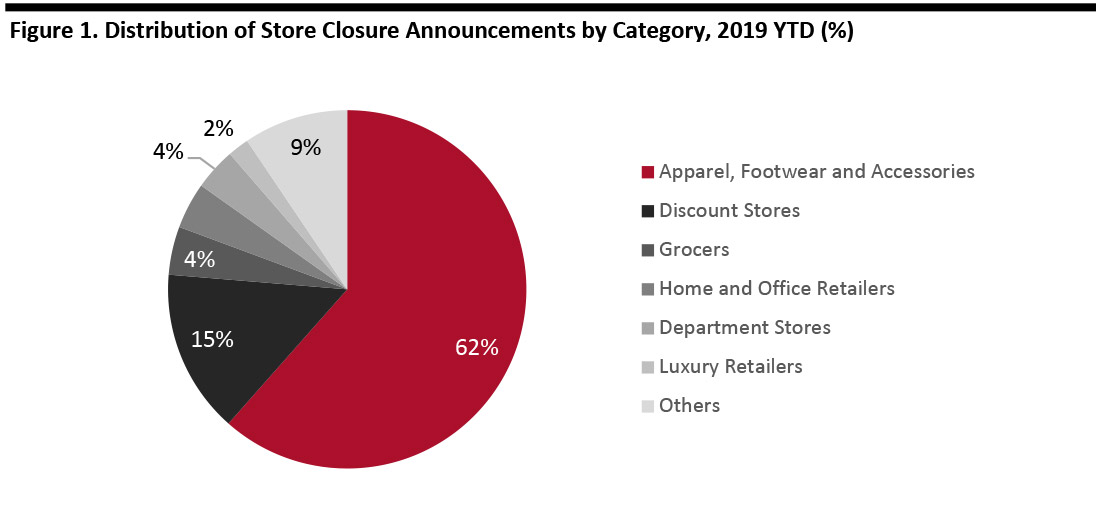

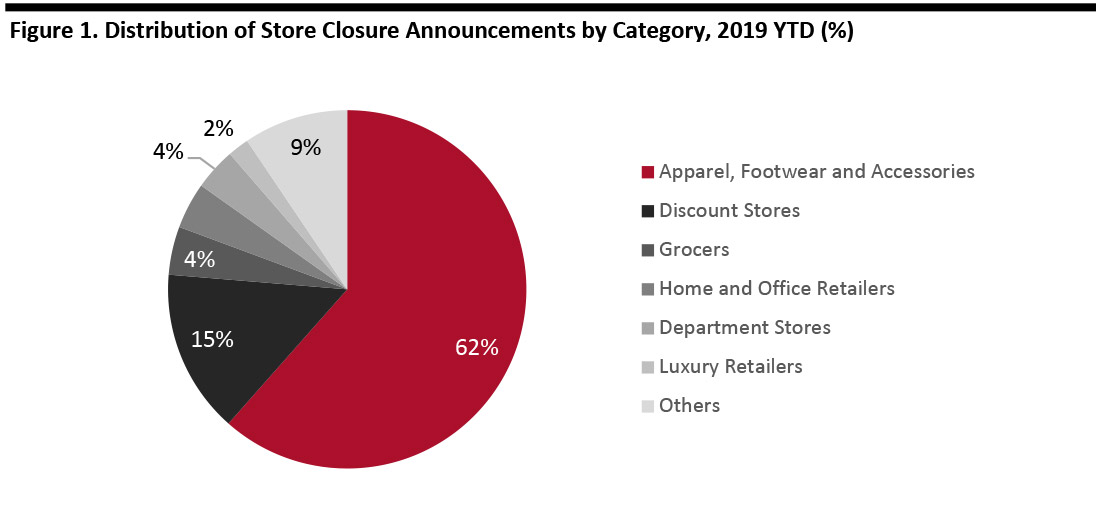

Vacant Space Is Being Driven by Apparel Slowdown

Mass store closures by apparel and footwear retailers is a significant challenge for shopping malls. A number of apparel brands and retailers are closing stores and are on the edge of bankruptcy: Last year, this sector accounted for 38% of the total 5,844 announced store closures in the US. This year has seen a significant increase, with the apparel sector contributing 62% of the 9,037 closures in 2019 so far. (For more store openings and closures data, see the new Coresight Research Retail Store Databank here.)

Previously, apparel and footwear retailers were a vital component, sometimes the biggest tenant, of malls. Their store closures are leaving vacant space in shopping centers, which provides property owners with the opportunity to transform traditional retail malls into next-generation shopping destinations for consumers.

[caption id="attachment_100790" align="aligncenter" width="700"] As of November 29, 2019

As of November 29, 2019

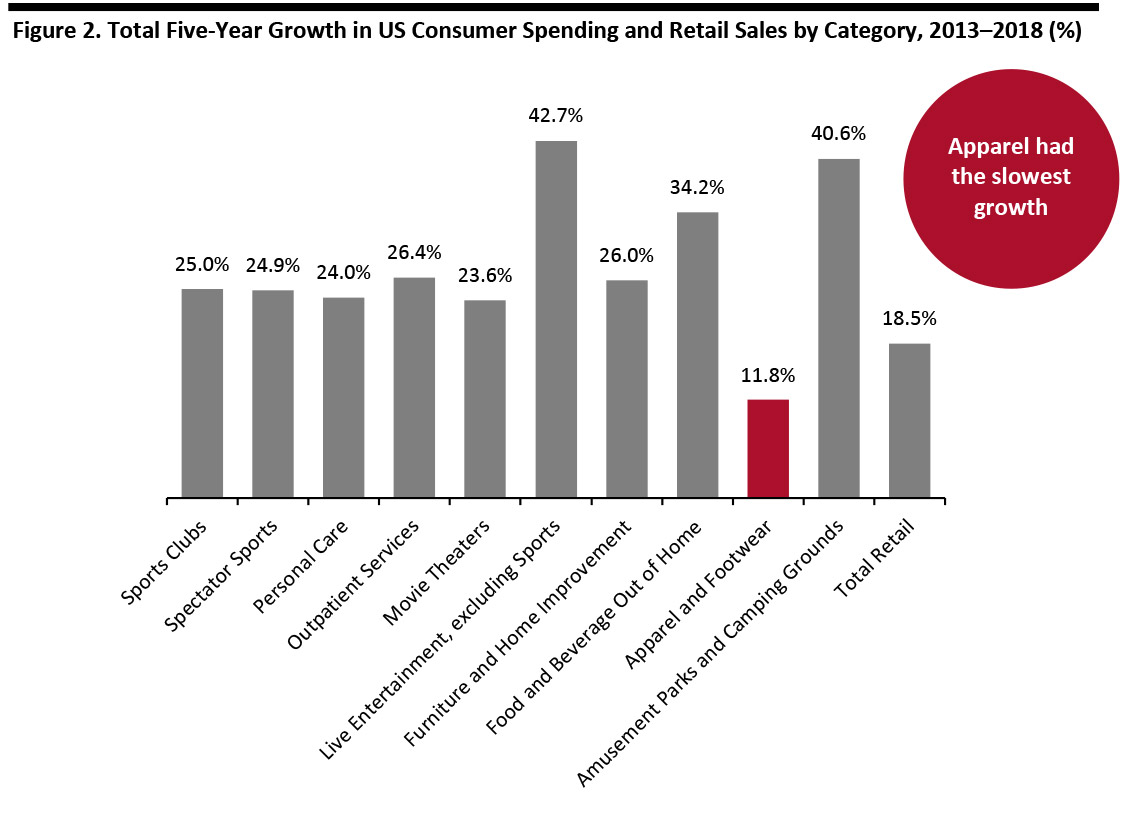

Source: Company reports/Coresight Research[/caption] E-Commerce Can Be an Opportunity As Well As a Threat Although e-commerce may be influencing the closure of some brick-and-mortar stores, physical retail offers the opportunity for shoppers to experience the products of digitally native brands. In fact, having a physical presence may create a halo effect for these online retailers. In a study in 2018, ICSC found that the presence of brick-and-mortar stores boosts retailers’ web traffic in the markets where the stores are present. Furthermore, when consumers shop online within 15 days of making a purchase in store, data suggests that there is a direct correlation between spending across the two channels. For instance, an initial $100 in-store purchase could lead to an average net spending of $267. This also stands true when a purchase is made online first—an initial $100 online transaction could lead to an average net spending of $231. In its 2019 Investor Day, Brookfield Property Partners shared that the company has seen digitally native brands take approximately 2.5 million square feet of leasing that was made available due to retailers’ bankruptcies. The company stated that some of the space has been taken by movie theaters, reiterating the entertainment trend. Similarly, startups in various industries—from automobile to health and beauty products—are absorbing spaces in shopping centers. In some cases, they only stay for a short time. Pop-ups and other limited-time stores illustrate property owners’ utilization of available space to attract traffic. Pop-ups are not limited to startups: Heritage brands and retailers are leveraging this method to test new formats and stay relevant to consumers. New Tenants for Malls Many nontraditional tenants are moving into malls. In 2018, grocers represented 10% of the total announced store openings in the US and some of them are moving into malls. In 2018, Wegmans took space vacated by JCPenney in the Natick Mall and opened a 146,500-square-foot grocery store in Massachusetts. Similarly, in late 2018, discount grocer Lidl opened a 36,000-square-foot store in Staten Island Mall in New York. In the past five years, US consumers’ spending on apparel and footwear grew by only 11.8%, much slower than the 18.5% growth in total retail sales, indicating the spending shift away from clothing, as discussed above. In the chart below, we compare five-year growth for selected consumer-spending categories and retail sales. Products that include cannabidiol (CBD) as an ingredient have seen surging popularity, such as in the beauty sector. Hemp-derived CBD sales in the US are expected to reach $646 million in 2022, 84% more than the estimated $352 million sales in 2019, according to New Frontier Data. CBD companies are partnering with property owners to fill vacancies in malls. For example, Green Growth Brands has opened 116 stores in Simon Property Group malls, 101 in Brookfield properties, 27 in Westfield locations and seven in Taubman shopping centers, as of September 2019. To read more about the CBD hype, read our report: Can CBD Save the Mall? Wellness is another significant consumer trend. Spending at sports clubs and fitness centers expanded by 25.0% in the US from 2013 to 2018. Premium lifestyle brands such as SoulCycle and Equinox have also moved into various shopping centers and are creating new programs in standalone studios in order to enter new markets by leveraging their brand equity. For example, Equinox opened a fitness club, a co-working space and a luxury hotel in Hudson Yards in New York. Finally, people are willing to spend on products for their pets. Total spending in the pet market is expected to reach $75.38 billion in 2019, up 4% from 2018, according to the American Pet Products Association. Property owners are inviting pet-friendly or pet-focused stores to take space in shopping centers in order to tap into this market. Shifting Discretionary Spending A shift in the composition of discretionary spending away from apparel and toward entertainment and experiences is another challenge for shopping malls. In the chart below, we compare five-year growth for selected consumer-spending categories and retail sales. Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

The Rise of Entertainment

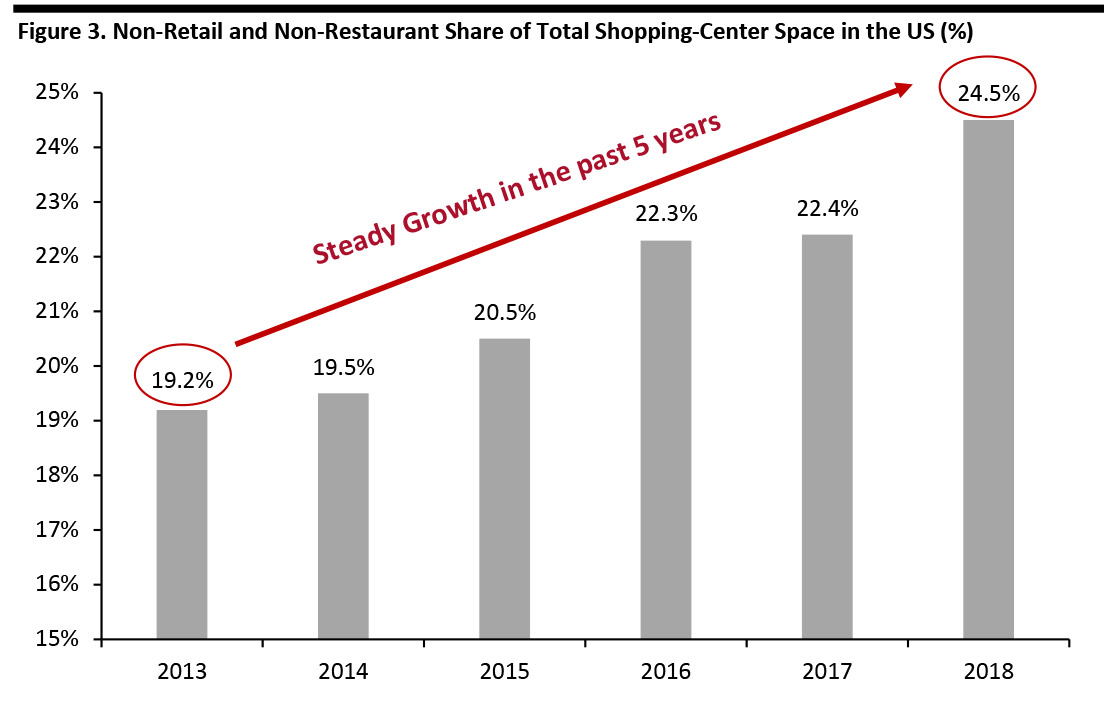

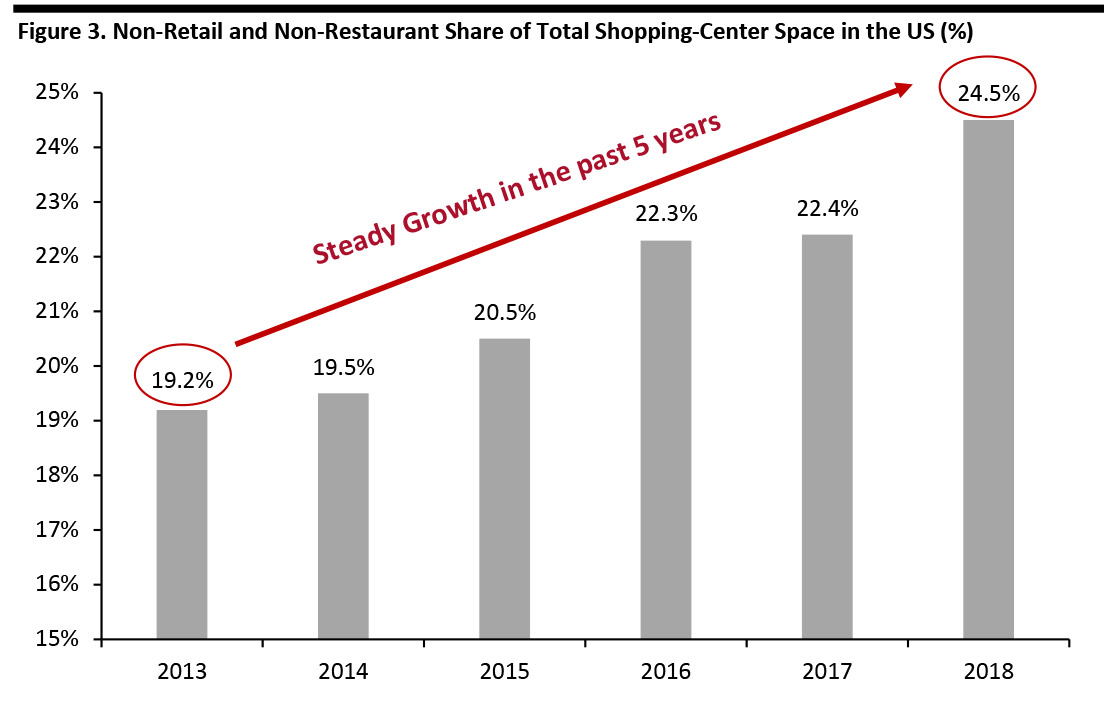

Realizing that traditional retail malls are no longer appealing to consumers in the digital age, property owners have been working for a few years to introduce a richer entertainment mix. The increasing integration of entertainment in shopping malls is well supported by data from the International Council of Shopping Centers (ICSC) and CoStar Realty Information. Non-retail, non-restaurant services represented 24.5% of all US shopping-center space in 2018, up from 19.2% in 2013. Considering the massive number of retail store closures in 2019, we expect that this share will continue to grow as more space becomes available.

[caption id="attachment_100785" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

The Rise of Entertainment

Realizing that traditional retail malls are no longer appealing to consumers in the digital age, property owners have been working for a few years to introduce a richer entertainment mix. The increasing integration of entertainment in shopping malls is well supported by data from the International Council of Shopping Centers (ICSC) and CoStar Realty Information. Non-retail, non-restaurant services represented 24.5% of all US shopping-center space in 2018, up from 19.2% in 2013. Considering the massive number of retail store closures in 2019, we expect that this share will continue to grow as more space becomes available.

[caption id="attachment_100785" align="aligncenter" width="700"] Source: ICSC/CoStar Realty Information[/caption]

In recent years, mall operators have brought in a number of movie theatres and restaurants, as well as other entertainment options such as indoor skiing. For example, the American Dream Meadowlands complex in New Jersey has 55% of its total space allocated to entertainment and dining and only 45% to retail. The complex is set to feature a movie theater, ice rink, Nickelodeon Universe indoor amusement park, DreamWorks Water Park, ski hill, aquarium, Legoland and two 18-hole miniature golf courses.

Which Categories Could Find a Place in the Mall Next?

Due to consumers placing increased value on economics and ethics, recommerce and thrift shopping are going mainstream. Property owners can bring resale and thrift stores into shopping centers to enhance their portfolio. This year, online thrift store ThredUP estimated the resale apparel market to be worth $7 billion and expects it to reach $23 billion in 2023. In August 2019, Macy’s announced that it will partner with ThredUP to sell secondhand clothes in store, taking advantage of this booming trend. Fashion resale platform The Realreal and handbag reseller Rebag have been opening a number of brick-and-mortar stores with plans for more, proving to be potential tenants for shopping malls.

Besides, thrift stores also have the potential to enter shopping centers. Nonprofit organization Goodwill Industries operates more than 3,200 thrift stores in the US. The company is undergoing a makeover—starting with the appearances of these stores—to attract younger consumers (read more details in our Apparel Resale Goes Mainstream report).

Property owners should also look to leverage the growth in spending on health services, as reflected by the 26.4% five-year growth in outpatient services shown in figure 3. Services such as dentist offices are potential tenants for malls.

In China, day care and education services for children are being established in malls. Toy manufacturer Mattel partnered with Chinese conglomerate Fosun Group to open a child development club in Fosun’s shopping center in Shanghai. Perhaps this could be another opportunity for US mall operators.

Key Insights

In 2020, we expect mall owners to continue to turn to nontraditional shopping-center tenants. For example, grocery retailers and sports clubs are becoming more common sights in shopping centers. Pop-up shops and digitally native brands are providing alternative options to fill the vacancy left by apparel stores—these create a physical presence to facilitate brand discovery and drive sales.

In addition, we expect to see a further increase in the percentage of leased space taken up by the entertainment sector, in line with consumers’ increasing demand for services and experiences.

Source: ICSC/CoStar Realty Information[/caption]

In recent years, mall operators have brought in a number of movie theatres and restaurants, as well as other entertainment options such as indoor skiing. For example, the American Dream Meadowlands complex in New Jersey has 55% of its total space allocated to entertainment and dining and only 45% to retail. The complex is set to feature a movie theater, ice rink, Nickelodeon Universe indoor amusement park, DreamWorks Water Park, ski hill, aquarium, Legoland and two 18-hole miniature golf courses.

Which Categories Could Find a Place in the Mall Next?

Due to consumers placing increased value on economics and ethics, recommerce and thrift shopping are going mainstream. Property owners can bring resale and thrift stores into shopping centers to enhance their portfolio. This year, online thrift store ThredUP estimated the resale apparel market to be worth $7 billion and expects it to reach $23 billion in 2023. In August 2019, Macy’s announced that it will partner with ThredUP to sell secondhand clothes in store, taking advantage of this booming trend. Fashion resale platform The Realreal and handbag reseller Rebag have been opening a number of brick-and-mortar stores with plans for more, proving to be potential tenants for shopping malls.

Besides, thrift stores also have the potential to enter shopping centers. Nonprofit organization Goodwill Industries operates more than 3,200 thrift stores in the US. The company is undergoing a makeover—starting with the appearances of these stores—to attract younger consumers (read more details in our Apparel Resale Goes Mainstream report).

Property owners should also look to leverage the growth in spending on health services, as reflected by the 26.4% five-year growth in outpatient services shown in figure 3. Services such as dentist offices are potential tenants for malls.

In China, day care and education services for children are being established in malls. Toy manufacturer Mattel partnered with Chinese conglomerate Fosun Group to open a child development club in Fosun’s shopping center in Shanghai. Perhaps this could be another opportunity for US mall operators.

Key Insights

In 2020, we expect mall owners to continue to turn to nontraditional shopping-center tenants. For example, grocery retailers and sports clubs are becoming more common sights in shopping centers. Pop-up shops and digitally native brands are providing alternative options to fill the vacancy left by apparel stores—these create a physical presence to facilitate brand discovery and drive sales.

In addition, we expect to see a further increase in the percentage of leased space taken up by the entertainment sector, in line with consumers’ increasing demand for services and experiences.

As of November 29, 2019

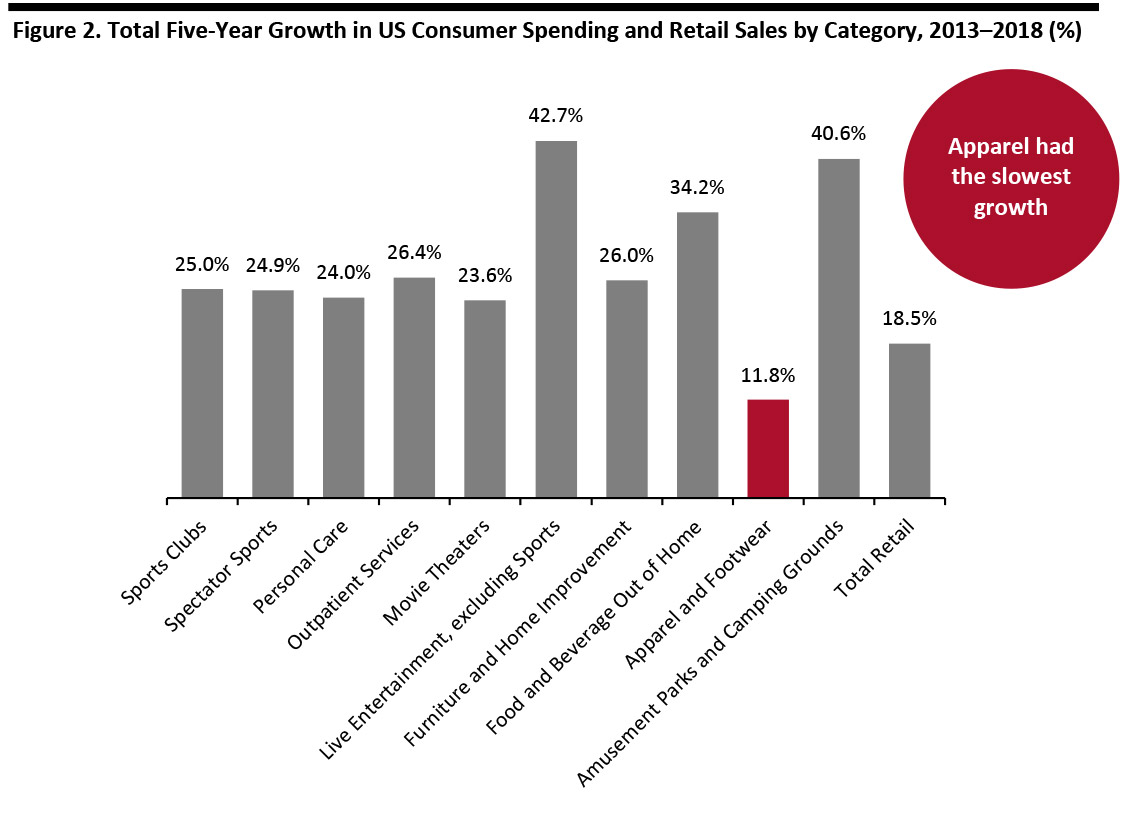

As of November 29, 2019 Source: Company reports/Coresight Research[/caption] E-Commerce Can Be an Opportunity As Well As a Threat Although e-commerce may be influencing the closure of some brick-and-mortar stores, physical retail offers the opportunity for shoppers to experience the products of digitally native brands. In fact, having a physical presence may create a halo effect for these online retailers. In a study in 2018, ICSC found that the presence of brick-and-mortar stores boosts retailers’ web traffic in the markets where the stores are present. Furthermore, when consumers shop online within 15 days of making a purchase in store, data suggests that there is a direct correlation between spending across the two channels. For instance, an initial $100 in-store purchase could lead to an average net spending of $267. This also stands true when a purchase is made online first—an initial $100 online transaction could lead to an average net spending of $231. In its 2019 Investor Day, Brookfield Property Partners shared that the company has seen digitally native brands take approximately 2.5 million square feet of leasing that was made available due to retailers’ bankruptcies. The company stated that some of the space has been taken by movie theaters, reiterating the entertainment trend. Similarly, startups in various industries—from automobile to health and beauty products—are absorbing spaces in shopping centers. In some cases, they only stay for a short time. Pop-ups and other limited-time stores illustrate property owners’ utilization of available space to attract traffic. Pop-ups are not limited to startups: Heritage brands and retailers are leveraging this method to test new formats and stay relevant to consumers. New Tenants for Malls Many nontraditional tenants are moving into malls. In 2018, grocers represented 10% of the total announced store openings in the US and some of them are moving into malls. In 2018, Wegmans took space vacated by JCPenney in the Natick Mall and opened a 146,500-square-foot grocery store in Massachusetts. Similarly, in late 2018, discount grocer Lidl opened a 36,000-square-foot store in Staten Island Mall in New York. In the past five years, US consumers’ spending on apparel and footwear grew by only 11.8%, much slower than the 18.5% growth in total retail sales, indicating the spending shift away from clothing, as discussed above. In the chart below, we compare five-year growth for selected consumer-spending categories and retail sales. Products that include cannabidiol (CBD) as an ingredient have seen surging popularity, such as in the beauty sector. Hemp-derived CBD sales in the US are expected to reach $646 million in 2022, 84% more than the estimated $352 million sales in 2019, according to New Frontier Data. CBD companies are partnering with property owners to fill vacancies in malls. For example, Green Growth Brands has opened 116 stores in Simon Property Group malls, 101 in Brookfield properties, 27 in Westfield locations and seven in Taubman shopping centers, as of September 2019. To read more about the CBD hype, read our report: Can CBD Save the Mall? Wellness is another significant consumer trend. Spending at sports clubs and fitness centers expanded by 25.0% in the US from 2013 to 2018. Premium lifestyle brands such as SoulCycle and Equinox have also moved into various shopping centers and are creating new programs in standalone studios in order to enter new markets by leveraging their brand equity. For example, Equinox opened a fitness club, a co-working space and a luxury hotel in Hudson Yards in New York. Finally, people are willing to spend on products for their pets. Total spending in the pet market is expected to reach $75.38 billion in 2019, up 4% from 2018, according to the American Pet Products Association. Property owners are inviting pet-friendly or pet-focused stores to take space in shopping centers in order to tap into this market. Shifting Discretionary Spending A shift in the composition of discretionary spending away from apparel and toward entertainment and experiences is another challenge for shopping malls. In the chart below, we compare five-year growth for selected consumer-spending categories and retail sales.

- US consumers’ spending on apparel and footwear grew by only 11.8% over those five years, much slower than the 18.5% growth in total retail sales, indicating the spending shift away from clothing, as discussed above.

- Among the major spending categories, live entertainment saw the biggest growth rate, 42.7%, followed by amusement parks and camping grounds, 40.6%.

- The “food and beverage out of home” category also saw strong growth, of 34.2%.

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

The Rise of Entertainment

Realizing that traditional retail malls are no longer appealing to consumers in the digital age, property owners have been working for a few years to introduce a richer entertainment mix. The increasing integration of entertainment in shopping malls is well supported by data from the International Council of Shopping Centers (ICSC) and CoStar Realty Information. Non-retail, non-restaurant services represented 24.5% of all US shopping-center space in 2018, up from 19.2% in 2013. Considering the massive number of retail store closures in 2019, we expect that this share will continue to grow as more space becomes available.

[caption id="attachment_100785" align="aligncenter" width="700"]

Source: US Bureau of Economic Analysis/US Census Bureau/Coresight Research[/caption]

The Rise of Entertainment

Realizing that traditional retail malls are no longer appealing to consumers in the digital age, property owners have been working for a few years to introduce a richer entertainment mix. The increasing integration of entertainment in shopping malls is well supported by data from the International Council of Shopping Centers (ICSC) and CoStar Realty Information. Non-retail, non-restaurant services represented 24.5% of all US shopping-center space in 2018, up from 19.2% in 2013. Considering the massive number of retail store closures in 2019, we expect that this share will continue to grow as more space becomes available.

[caption id="attachment_100785" align="aligncenter" width="700"] Source: ICSC/CoStar Realty Information[/caption]

In recent years, mall operators have brought in a number of movie theatres and restaurants, as well as other entertainment options such as indoor skiing. For example, the American Dream Meadowlands complex in New Jersey has 55% of its total space allocated to entertainment and dining and only 45% to retail. The complex is set to feature a movie theater, ice rink, Nickelodeon Universe indoor amusement park, DreamWorks Water Park, ski hill, aquarium, Legoland and two 18-hole miniature golf courses.

Which Categories Could Find a Place in the Mall Next?

Due to consumers placing increased value on economics and ethics, recommerce and thrift shopping are going mainstream. Property owners can bring resale and thrift stores into shopping centers to enhance their portfolio. This year, online thrift store ThredUP estimated the resale apparel market to be worth $7 billion and expects it to reach $23 billion in 2023. In August 2019, Macy’s announced that it will partner with ThredUP to sell secondhand clothes in store, taking advantage of this booming trend. Fashion resale platform The Realreal and handbag reseller Rebag have been opening a number of brick-and-mortar stores with plans for more, proving to be potential tenants for shopping malls.

Besides, thrift stores also have the potential to enter shopping centers. Nonprofit organization Goodwill Industries operates more than 3,200 thrift stores in the US. The company is undergoing a makeover—starting with the appearances of these stores—to attract younger consumers (read more details in our Apparel Resale Goes Mainstream report).

Property owners should also look to leverage the growth in spending on health services, as reflected by the 26.4% five-year growth in outpatient services shown in figure 3. Services such as dentist offices are potential tenants for malls.

In China, day care and education services for children are being established in malls. Toy manufacturer Mattel partnered with Chinese conglomerate Fosun Group to open a child development club in Fosun’s shopping center in Shanghai. Perhaps this could be another opportunity for US mall operators.

Key Insights

In 2020, we expect mall owners to continue to turn to nontraditional shopping-center tenants. For example, grocery retailers and sports clubs are becoming more common sights in shopping centers. Pop-up shops and digitally native brands are providing alternative options to fill the vacancy left by apparel stores—these create a physical presence to facilitate brand discovery and drive sales.

In addition, we expect to see a further increase in the percentage of leased space taken up by the entertainment sector, in line with consumers’ increasing demand for services and experiences.

Source: ICSC/CoStar Realty Information[/caption]

In recent years, mall operators have brought in a number of movie theatres and restaurants, as well as other entertainment options such as indoor skiing. For example, the American Dream Meadowlands complex in New Jersey has 55% of its total space allocated to entertainment and dining and only 45% to retail. The complex is set to feature a movie theater, ice rink, Nickelodeon Universe indoor amusement park, DreamWorks Water Park, ski hill, aquarium, Legoland and two 18-hole miniature golf courses.

Which Categories Could Find a Place in the Mall Next?

Due to consumers placing increased value on economics and ethics, recommerce and thrift shopping are going mainstream. Property owners can bring resale and thrift stores into shopping centers to enhance their portfolio. This year, online thrift store ThredUP estimated the resale apparel market to be worth $7 billion and expects it to reach $23 billion in 2023. In August 2019, Macy’s announced that it will partner with ThredUP to sell secondhand clothes in store, taking advantage of this booming trend. Fashion resale platform The Realreal and handbag reseller Rebag have been opening a number of brick-and-mortar stores with plans for more, proving to be potential tenants for shopping malls.

Besides, thrift stores also have the potential to enter shopping centers. Nonprofit organization Goodwill Industries operates more than 3,200 thrift stores in the US. The company is undergoing a makeover—starting with the appearances of these stores—to attract younger consumers (read more details in our Apparel Resale Goes Mainstream report).

Property owners should also look to leverage the growth in spending on health services, as reflected by the 26.4% five-year growth in outpatient services shown in figure 3. Services such as dentist offices are potential tenants for malls.

In China, day care and education services for children are being established in malls. Toy manufacturer Mattel partnered with Chinese conglomerate Fosun Group to open a child development club in Fosun’s shopping center in Shanghai. Perhaps this could be another opportunity for US mall operators.

Key Insights

In 2020, we expect mall owners to continue to turn to nontraditional shopping-center tenants. For example, grocery retailers and sports clubs are becoming more common sights in shopping centers. Pop-up shops and digitally native brands are providing alternative options to fill the vacancy left by apparel stores—these create a physical presence to facilitate brand discovery and drive sales.

In addition, we expect to see a further increase in the percentage of leased space taken up by the entertainment sector, in line with consumers’ increasing demand for services and experiences.