albert Chan

Introduction

What’s the Story?

As the US economy recovers from the Covid-19 pandemic, inflationary pressures continue to have a significant impact on the costs of doing business, and this impact may remain elevated for some time.

In this report, we will drill down from the macro level to the critical fast-moving consumer goods (FMCG) retail category, providing insights into the current situation and presenting key strategies for retailers to handle the industry-wide challenge of rising costs more intelligently.

This report is sponsored by global measurement and data analytics company, NielsenIQ, which partners with global consumer goods companies and retailers to provide a forward-looking view into consumer behavior through comprehensive data sets and actionable insights.

Why It Matters

The US inflation rate is at a 39-year peak and is not likely to slow down in the near term. Initially viewing this inflation as transitory, the Federal Reserve indicated on December 15, 2021, that rising prices are likely to persist, signaling the likelihood of three interest-rate hikes in 2022. Jerome Powell, Fed Chair, said, “The pace of inflation is uncomfortably high… The economy no longer needs increasing amounts of policy support.”

Industry experts believe that inflationary pressures will continue in 2022. S&P Global Ratings’ Sector Lead, Consumer & Retail, Sarah Wyeth, said:

We [S&P] expect inflation to intensify as suppliers continue to pass on their own elevated costs. As consumers’ purchasing power declines, we expect it will be more difficult to pass on the costs. We expect this trend to emerge in the second half of 2022.

Drivers of this inflation include the following:

- Pandemic-fueled supply chain issues—Supply chain disruptions and bottlenecks have been stubbornly persistent since early 2020. Fuel price increases have had an amplifying effect on wholesale food prices, affecting both agricultural production and transportation costs.

- Labor shortages—Shortages of labor along key processes (with retailers and brands unable to fill critical roles) are contributing to a shortage of goods. Workers who remain employed have also taken more sick days due to Covid-19, according to the US Bureau of Labor Statistics (BLS).

- Strong consumer spending—Bolstered by Covid-19 stimulus and a rebound in the economy in 2021, US consumer spending is as strong as ever, with personal consumption expenditure having increased by $105 billion in November 2021 following a similar increases in October, according to the US Bureau of Economic Analysis. This contributes further to the mismatch in supply and demand.

Forward-thinking retailers must look to technology and data analytics to preserve margins while maintaining customer loyalty, and not simply pass rising costs to shoppers across the board.

Rethinking Retailers’ Response to Inflation: Coresight Research x NielsenIQ Analysis

The Inflationary Environment

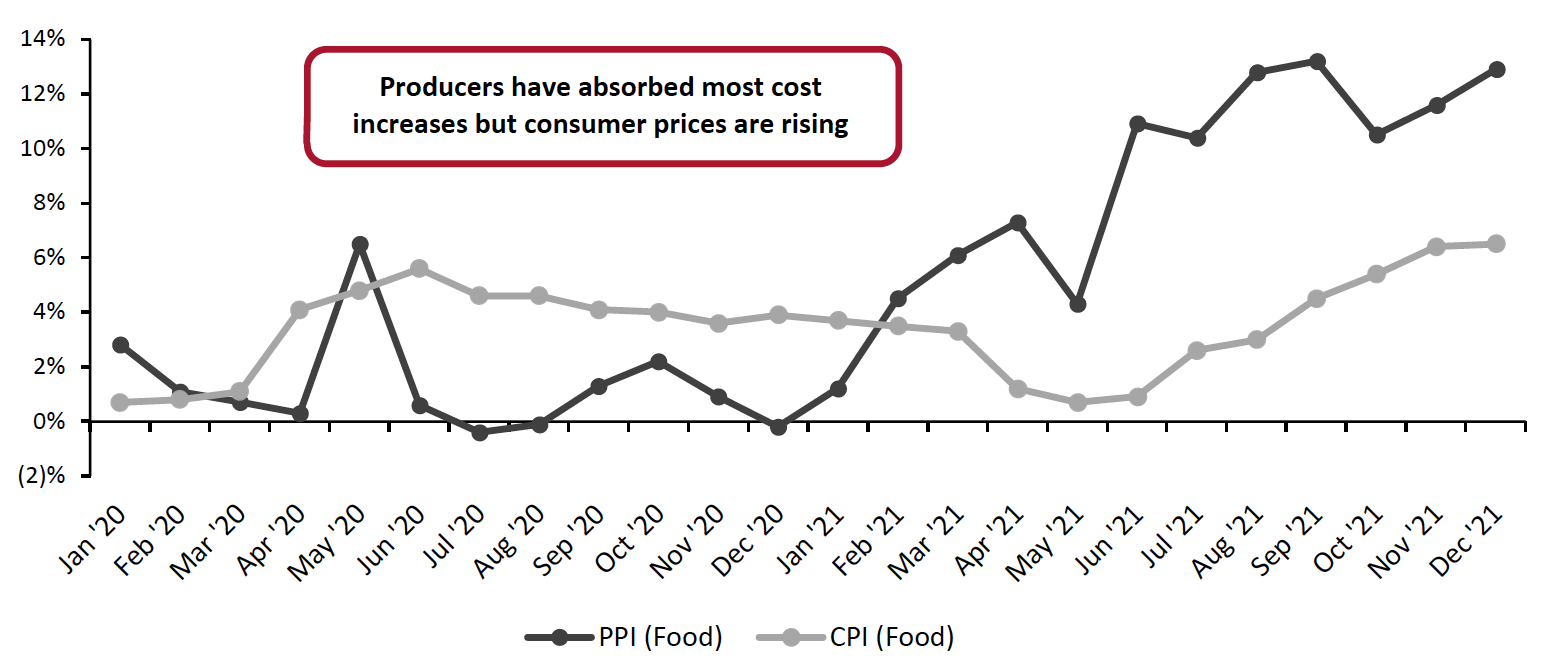

Producer prices and consumer prices increased during 2021 at the highest rates in decades, putting pressure on already squeezed retailer margins. We view the producer price index (PPI), published by the US BLS, as an important benchmark of output costs in the food industry because of the extent of domestic production.

While producer price increases have led the way, consumer prices are quickly following suit as companies are forced to pass on cost increases to retailers and, ultimately, to their consumers. The core CPI (consumer price index) increased by 7.0%, year over year, in December 2021, with the CPI for food rising 6.5% (latest data available). In Figure 1, we can see that the PPI for food has been steadily rising over the past 12 months, and this increase is being closely followed by the CPI.

Figure 1. US Food at Home: Producer Price Index (PPI) vs. Consumer Price Index (CPI) (YoY % Change)

[caption id="attachment_142295" align="aligncenter" width="700"] Data not seasonally adjusted

Data not seasonally adjustedSource: BLS[/caption]

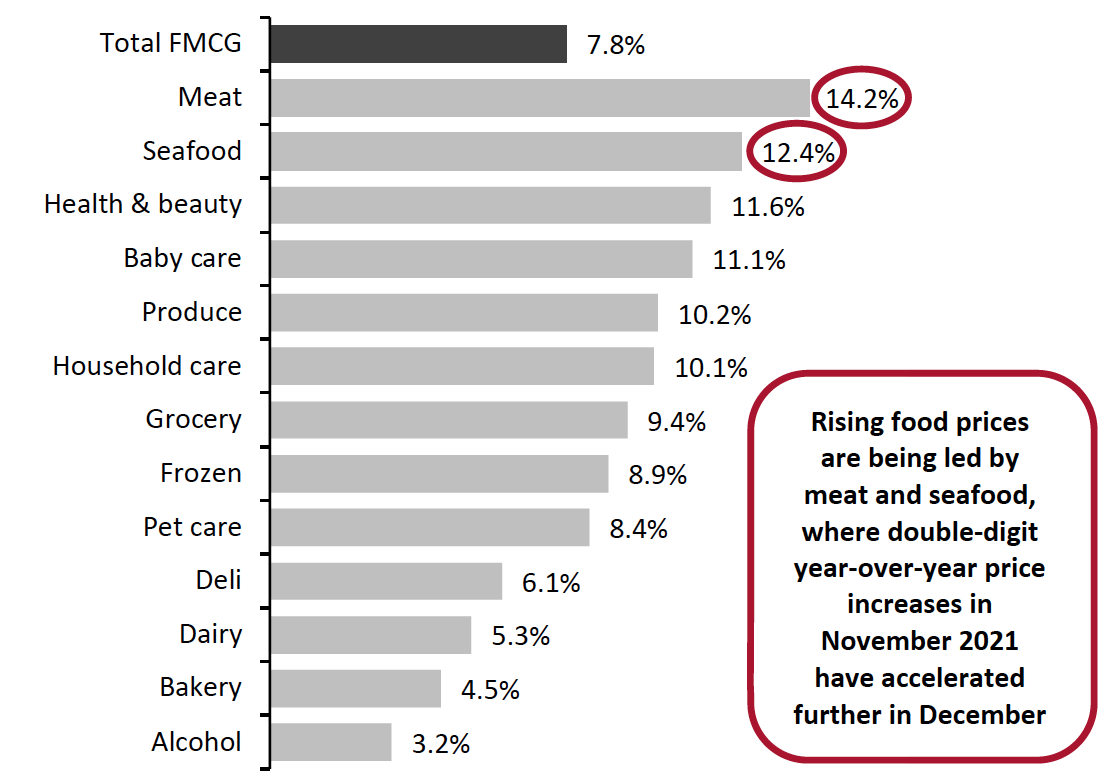

While prices of important consumer staples are surging, inflationary pressures vary by category and market segment. Rising food prices are being led by meat and seafood, which both saw double-digit year-over-year price increases in November 2021; meat and seafood operators cannot meet increased demand as they struggle to find enough workers amid a tight labor market. We show average price growth across FMCG categories in Figure 2.

In this inflationary environment, retailers and brands increasingly need to turn to data and technology to better understand the full picture of evolving consumer preferences and so preserve margins and share of wallet. Even though price increases may be unavoidable, by considering complete, detailed market data and having the tools to analyze likely impacts, retailers and brands can work together to minimize the negative effects of cost increases such as negative customer perceptions and market share declines.

Figure 2. US FMCG Average Price Growth, December 2021* (YoY %)

[caption id="attachment_142296" align="aligncenter" width="550"] *Latest data available

*Latest data availableSource: NielsenIQ Retail Measurement Services (RMS)[/caption]

Market and Consumer Response

Leading CPG (consumer packaged goods) companies such as General Mills, Kraft Heinz and Mondelez International have all indicated that additional price increases on their products are coming. For example, the average price increase on Kraft Heinz products in 2022 will be 5%, with some products increasing as much as 20%, according to the company, representing some of the highest increases in decades.

As prices rise, consumer buying behavior and sentiment is shifting:

- Consumers are making trade-off decisions between spending categories—meat and seafood volumes have declined year over year in recent months while the deli and bakery categories have trended upward (see Figure 3 in the following section).

- Consumers are focused on value, so are looking for less-expensive product alternatives. According to industry executives, price-sensitive shoppers are buying cheaper types of meat such as bone-in chicken and pork, as well as turning to store-brand meat products.

- Consumers are cooking more at home and spending less at restaurants.

In this environment, it is critical for retailers to understand and adapt to changing consumer needs and priorities. Retailers cannot afford to be caught running out of inventory and scrambling to replenish stock or be saddled with excess inventory due to an inability to recognize shifts in consumer demand. This widespread unpredictability represents an important hurdle that retailers must navigate.

So, what can retailers do to cope with the inflationary pressures and evolving consumer trends? Retailers and brands should leverage the latest available technologies and data insights to better deal with these challenges and more intelligently pass on costs to consumers depending on the category. More complete, granular and timely data on the latest consumer buying trends can help retailers and brands understand how consumers respond to prices increases differently depending on the category, testing long-held beliefs on price elasticities with real data.

Phil Lempert, CEO and Founder of SupermarketGuru.com and Retail Dietitians Business Alliance, said:

It is all about the data. Monitor consumer shopping behaviors and product availability in order to determine which foods are in demand and focus retail assortments on those. The days of 45,000 SKUs are in the past—focus, focus, focus, and satisfy shoppers' needs and wants.

In the following section, we dive deeper into the data-driven strategies that retailers can adopt to help mitigate current challenges and rethink their response to rising costs.

Data-Driven Strategies to Navigate Inflationary Pressures

1. Price Optimization

Retailers need to take a data-driven approach to determining optimal pricing. Armed with more complete data and advanced pricing science (made available through partners), retailers can identify which products are most important to shoppers and analyze various pricing scenarios to find a balance between satisfying customers, driving increased sales and optimizing profit margins.

- Competitive pricing analytics

After just a few clicks or taps, consumers can quickly do their own online price comparisons across retailers and brands. Retailers need a full picture across not just their own products but those of their competitors. Omnichannel SKU (stock-keeping unit)-level visibility is critical to being able to develop dynamic pricing strategies that link with assortment, allocation and promotion planning, as all of these areas are highly interdependent, and conditions vary depending on location. Achieving such a comprehensive view is simply not possible without the use of modern technologies.

Data Impact, a NielsenIQ company, is one example of an innovator that leverages AI technology to help retailers and brands optimize pricing through location-based analytics, which provides visibility into local SKU-level data. Data Impact enables brands to watch pricing across all e-commerce sites by SKU and by store, daily. Gregoire Argand, Head of Digital, Marketing and E-Commerce at PepsiCo, said, “Data Impact’s decision-making tool addresses our omnichannel needs, ensuring that data from every online point of sale is collected, cleaned and retrieved easily through the tool.”

Mark Hawthorne, former Head of Data, Analytics and Strategic Pricing at Albertsons, said:

Competitive analysis is hugely important. A lot of retailers have had a view of what their competitors are doing but being able to analyze that down to the price zone, geographic area and being able to make adjustments – for example, understanding that Walmart has 120-ish milk price zones but the rest of the store falls into a broader band, those things are important for retailers so they can adjust their strategy and nickel and dime their way to hitting their margins by not broadly adjusting pricing when they don’t need to.

- Price elasticities and product, brand-specific price sensitivity

Price elasticity is a measure of how responsive customer demand is for a product based on its price. Some products have a more immediate response to price changes because they’re non-essential or because there are many substitutes available. Having a better understanding of individual product elasticities (changes in demand for a product in relation to changes in its price) and how they vary can help brands and retailers to predict consumers’ response to price increases by category, providing insight into the likelihood of successful price changes. The regular price elasticity of a product is the percentage sales decline that would result from a price increase of 1%.

Consumer sensitivity to price varies by product, depending on many variables— including demographic profiles, how highly they value a product or category, and how easily they can find an acceptable cost-effective substitute.

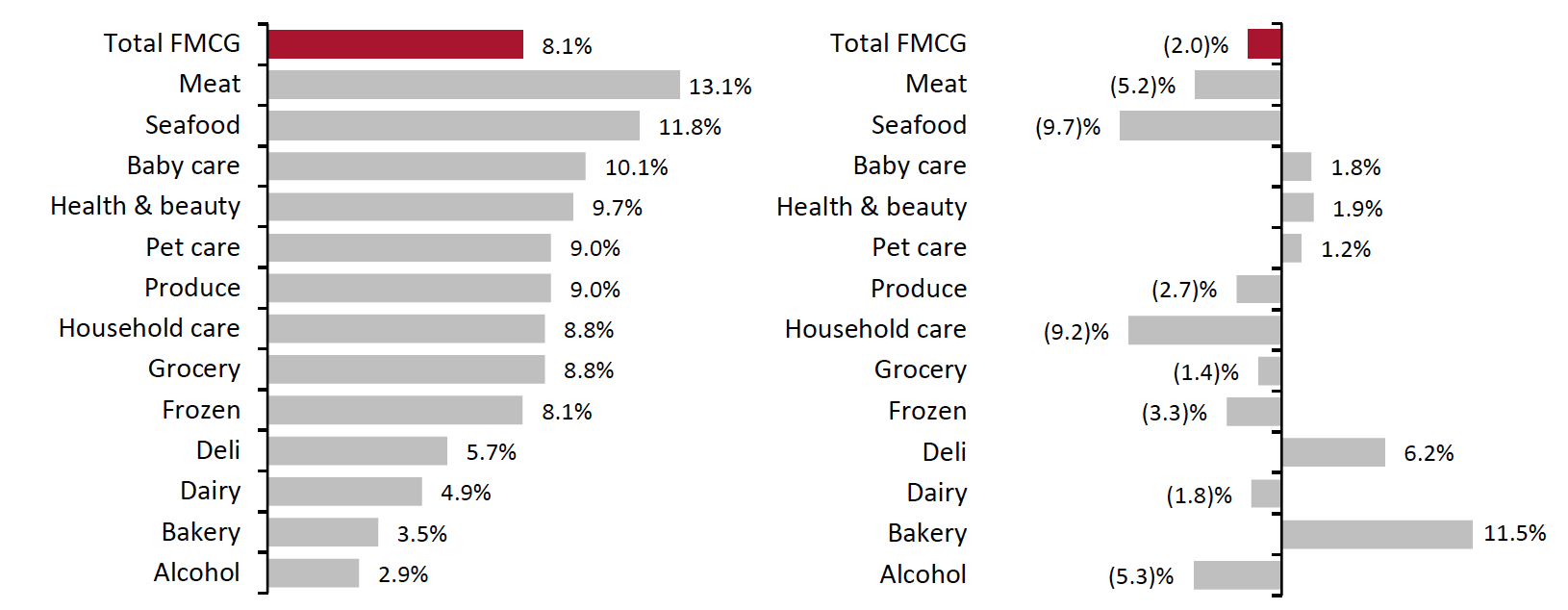

Implied product elasticities in the most recent data from NielsenIQ RMS (charted in Figure 3) suggest that consumers may be shifting to buying meat substitutes more readily than cutting back on categories such as baby care and health & beauty, which may be more inelastic. Price-sensitive consumers may also find it easier to eat meat less frequently, but when parents need diapers, they cannot go without; they can only do a comparison shop to find the best deal.

The latest data also show that demand for deli and bakery products is up, with the former being a potential meat substitute and both experiencing lower-than-average price increases over the past three months.

Figure 3. US FMCG Average Price Growth (Left; YoY %) vs. Unit Sales Volume Growth (Right; YoY %), 12 Weeks Ended January 1, 2022*

[caption id="attachment_142297" align="aligncenter" width="700"] *Latest data available

*Latest data availableSource: NielsenIQ RMS[/caption]

Looking below the category level, an understanding of brand-specific price sensitivity is critical to mitigating risk from price increases. A category’s overall elasticity can conceal significant variation across individual brands: Premium products from market leaders with strong customer loyalty may be more inelastic than mainstream products from follower brands.

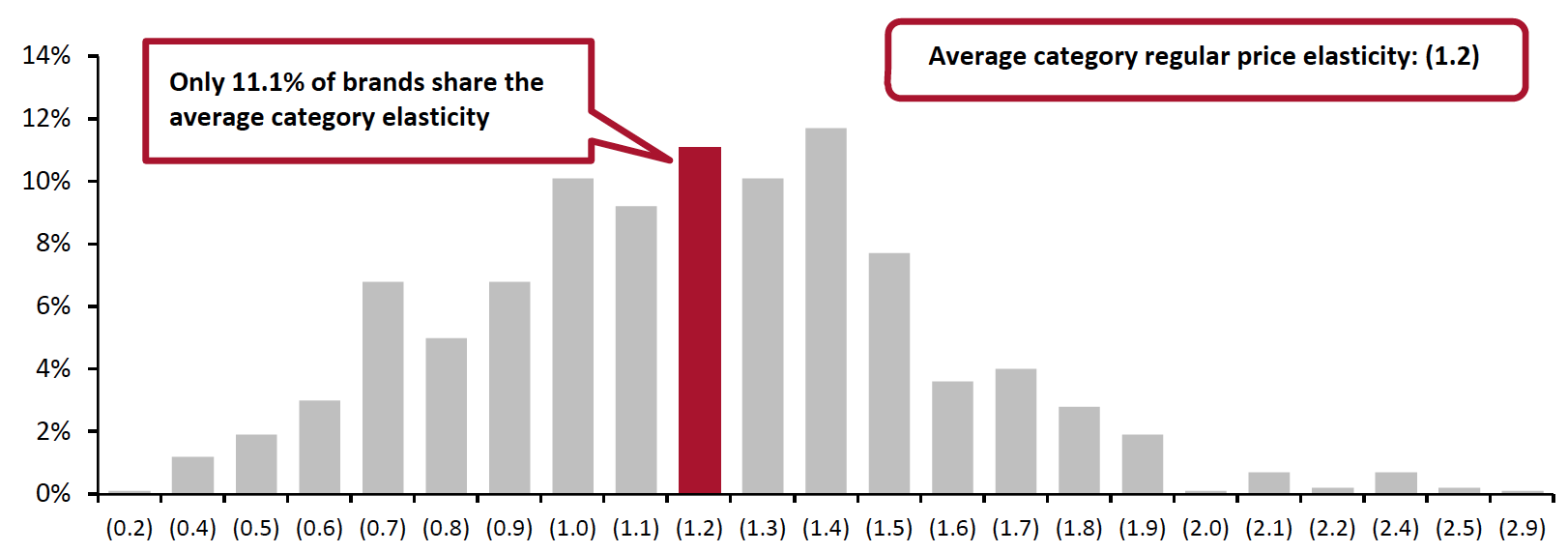

Taking US breakfast brands as an example, the regular price elasticity of the category as a whole is (1.2), meaning that for every 10% increase in price, there would be a 12% decline in sales. However, we see a wide range of elasticity by brand versus the overall category elasticity, with only 11% of brands at the average category elasticity (see Figure 4 below). Significant variation like this suggests to retailers that the impacts of price increases on a category will not be uniform: They will depend upon the positioning of each brand. The higher the elasticity for each brand, the more likely that consumers will be willing to switch brands or products, or simply not make a purchase.

Figure 4. Regular Price Elasticity of US Breakfast Brands (% of Brands)

[caption id="attachment_142298" align="aligncenter" width="700"] Source: NielsenIQ Inflation Horizons, November 2021[/caption]

Source: NielsenIQ Inflation Horizons, November 2021[/caption]

2. Assortment and Allocation Planning

Shifts in demand during the pandemic and continued changes due to rising prices have exposed limitations in traditional methods for allocation, assortment and promotion planning. In order for retailers to understand shopper responses, they need timely, detailed data and the tools to quickly interpret changes and take appropriate action accordingly.

- Knowing the customer

Having a deep understanding of your customer is critical during an inflationary environment, especially as customers continue to shift to online channels. With omnichannel customer-level analytics, retailers can have a more holistic view of their customers and understand that certain demographics shop in physical stores more often than others, for example. They can also gain visibility into how much each type of shopper spends on average and what else they buy if certain products are in their shopping carts.

A former Head of Category Management at one of the largest food and drug retailers in the US said:

From an omnichannel perspective, the ability to leverage product attribution beyond just the e-commerce business is very important. Most that are doing it now are doing it in the digital space but not across the store. There is an immense benefit to doing predictive analysis, social sentiment analysis… and to be able to quickly leverage the full-scale assortment you have in-store and online against what consumers are doing, in real time. That is a missing element of really activating omnichannel in total.

- Adjusting product assortments

Retailers need data to understand how their customers’ buying behavior is changing. For example, according to industry reports, retailers are working with suppliers on stocking larger quantities of lower cost meat products in response to shifts in meat-buying preferences—and in anticipation of the continuation of this behavior.

- Prioritizing growing categories that may be less price-sensitive

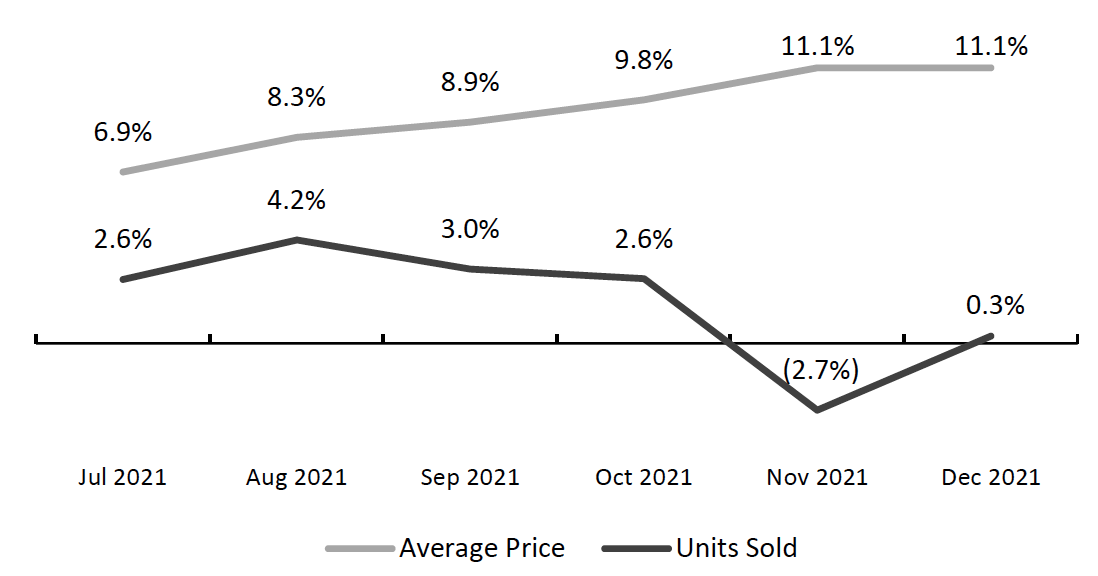

After better understanding how product elasticities can vary by category, retailers can prioritize products that may be more inelastic and less likely to decline. For example, prepared foods volumes saw growth in 2021 despite double-digit year-over-year price increases, implying that prepared foods may not be as sensitive to price increases as other categories (see Figure 5).

Figure 5. US Prepared Foods*: Average Price Growth (YoY %) vs. Unit Sales Volume Growth (YoY %)

[caption id="attachment_142299" align="aligncenter" width="550"] *Includes prepared foods across the bakery, dairy, deli, frozen, grocery and meat departments

*Includes prepared foods across the bakery, dairy, deli, frozen, grocery and meat departmentsSource: NielsenIQ RMS[/caption]

- Rationalizing SKU and assortment optimization

This is critical during inflationary periods, and advanced technology solutions support this operation. Shelf-edge analytics is enabling real-time visibility into SKU/store-level out-of-stocks and helping improve performance to ensure the right products are in the right place at the right time. Digital-shelf solutions can provide a powerful analytics tool that allows companies to keep an eye on the digital shelf across all e-commerce sites, so they can fix out-of-stocks in real time and improve discoverability by understanding how their products are showing up on the digital shelf.

Wyeth said:

Inventory optimization will be an area of focus as retailers must be disciplined in any safety stock build so that they do not slip back into pre-pandemic cycles of promotional activity that hurts margins… The pandemic is an opportunity to reset their philosophy of optimal inventory in a way that balances pricing power with capitalizing on the full extent of consumer demand.

3. Promotion Management

Promotion management has traditionally been more of an art than a science in retail, especially in grocery. Promotion strategies based on rules of thumb and how things have been done in the past are not enough in the current environment; they provide limited insight into the most impactful revenue-generating opportunities and may focus too much on the short term.

A former Head of Data, Analytics and Strategic Pricing at one of the largest food and drug retailers in the US said:

Retailers more than ever before are open to automation and having a black box make a decision for them. Prior to Covid, they were very hesitant to move down that path. There might have been a few visionaries that would go that way but I think markdown optimization / promotion optimization is vital. Within that, integrating all of the competitive and customer elements so that you’re evaluating a lifetime value component not just a short-term impact of a price adjustment.

- Advanced technology enables dynamic approaches

Personalized promotions tailored to local conditions can help retailers optimize promotion planning and mitigate margin pressures.

- Personalized promotions can offset price increases

When consumers perceive that they are spending more for the same baskets each week, they may be more motivated to shop around in search of more favorable pricing. To ensure that frequent shoppers don’t feel they are facing continued price increases, retailers should consider offering promotions on the products that matter most to them to bring those product prices back down. Since inflation is on people’s minds, tactics like this can secure shopper loyalty.

- Loyalty programs can impact pricing

Retailer and brand loyalty cannot be taken for granted during inflationary times; loyalty programs are key to maintaining shopper confidence. When setting prices, retailers should consider offering attractive deals to their most loyal shoppers.

4. Retailer-Supplier Collaboration

Retailers are recognizing that they need to be competitive on the products that matter most to their customers, with many pushing back (where they can) on price increases from brands and suppliers. Faced with the challenge of balancing these considerations with the reality of higher producer costs, tighter retailer-supplier collaboration is more important than ever to maintain sales volumes and keep the customer.

According to NielsenIQ—based on the company’s experience with its clients—retailers and suppliers have seen 2%–3% growth in overall sales when they have achieved full transparency in data sharing, including sales, inventory, basket and customer data. This is because they can easily and efficiently mine data and embed their insights into decision-making processes.

- Retailers are responding to the inflationary environment in different ways, from pushing back on price increases for key products, to delaying implementing price increases for a few more months, to strategically lowering margins to mitigate impacts on customers and suppliers. Among the largest supermarket chains, Kroger is delaying when price increases take effect and challenging its vendors on the rate of increases.

- With increased competition from numerous channels and the growing prevalence of omnichannel shopping, both retailers and suppliers understand the importance of delivering an optimal customer experience. Retailers’ transparency on parameters such as in-store metrics, promotional campaigns and shopper loyalty can lead to analytics-driven demand forecasting that keeps customers at the center.

- Leveraging technology to improve collaboration is key. NielsenIQ enables retailers to align their strategies with their suppliers through its Supplier Collaboration cloud-based solution, which enables companies to jointly act on shared, valuable insights.

- Adjusting package size is one way in which retailers, brokers and suppliers are working together to limit the passing on of cost increases to consumers—for example, reducing the product size or weight of bakery products such as bagels, where customers might prefer a slightly smaller bagel at the price they are used to rather than buy a more expensive bagel.

What We Think

In this environment, retailers and suppliers need to have access to comprehensive data and analytics and lean into new tools and technologies to maintain growth and profitability. Retailers need timely, reliable and accurate data since market conditions are changing dramatically with inflation. New data and technologies can help retailers plug into multiple dataflows to gain a fuller picture of consumer and competitor trends.

Fortunately, a broad array of methodologies and software vendors are available to meet retailers’ needs. We are already seeing companies accelerate their investments in technology as they recognize the value of data and insights in overcoming challenges.

Technologies leveraging data and analytics to enable deeper insights can help overcome current challenges through comprehensive price optimization based on a complete market view; improved assortment and allocation planning; more impactful promotions management; and tighter retailer-supplier collaboration.

Armed with predictive analytics and complete data, retailers can better evaluate the potential impacts of cost increases and demonstrate those impacts to vendors during negotiations. If vendors can see that smaller cost increases on certain products will lead to a better outcomes than larger cost increases, (as what they lose in margin they might make up for in volume, for example), they may be more flexible in negotiations, which can help reduce costs and minimize negative impacts on their customers.

While the current inflationary environment is an industry-wide challenge and threat, by using a more intelligent approach that benefits retailers, vendors and consumers alike, retailers can actually turn this situation into an opportunity to grow share, profits and strengthen price perception.

About NielsenIQ NielsenIQ is the leader in providing the most complete, unbiased view of consumer behavior, globally. Powered by a groundbreaking consumer data platform and fueled by rich analytic capabilities, NielsenIQ enables bold, confident decision-making for the world’s leading consumer goods companies and retailers. Using comprehensive data sets and measuring all transactions equally, NielsenIQ gives clients a forward-looking view into consumer behavior in order to optimize performance across all retail platforms. The company’s open philosophy on data integration enables the most influential consumer data sets on the planet. NielsenIQ delivers the complete truth. NielsenIQ, an Advent International portfolio company, has operations in nearly 100 markets, covering more than 90% of the world’s population. For more information, visit NielsenIQ.com.