Introduction

Automated, unstaffed stores are popping up across the world’s the most dynamic retail markets. The convenience store, or c-store, sector in China and other advanced markets in Asia offers some of the most significant examples of such stores, where technology is used to run all operations, intervention by human employees is minimal and customers serve themselves.

In this report, we examine the rise of the unstaffed c-store format and how an ecosystem of tech startups, retailers and fast-moving consumer goods (FMCG) companies is enabling it to grow. We look at specific examples of unstaffed c-stores in China and South Korea that retailers have launched in collaboration with tech startups and discuss selected food and beverage manufacturers that have entered the c-store sector through unstaffed stores. We also analyze the tech enablers and business drivers that are encouraging the format’s growth.

We conclude the report by considering what role unstaffed stores will play in the future of the c-store channel and how companies are likely to use these innovative outlets as part of their multichannel strategies.

The Asian Unstaffed C-Store Ecosystem: Startups, Retailers and FMCG Companies

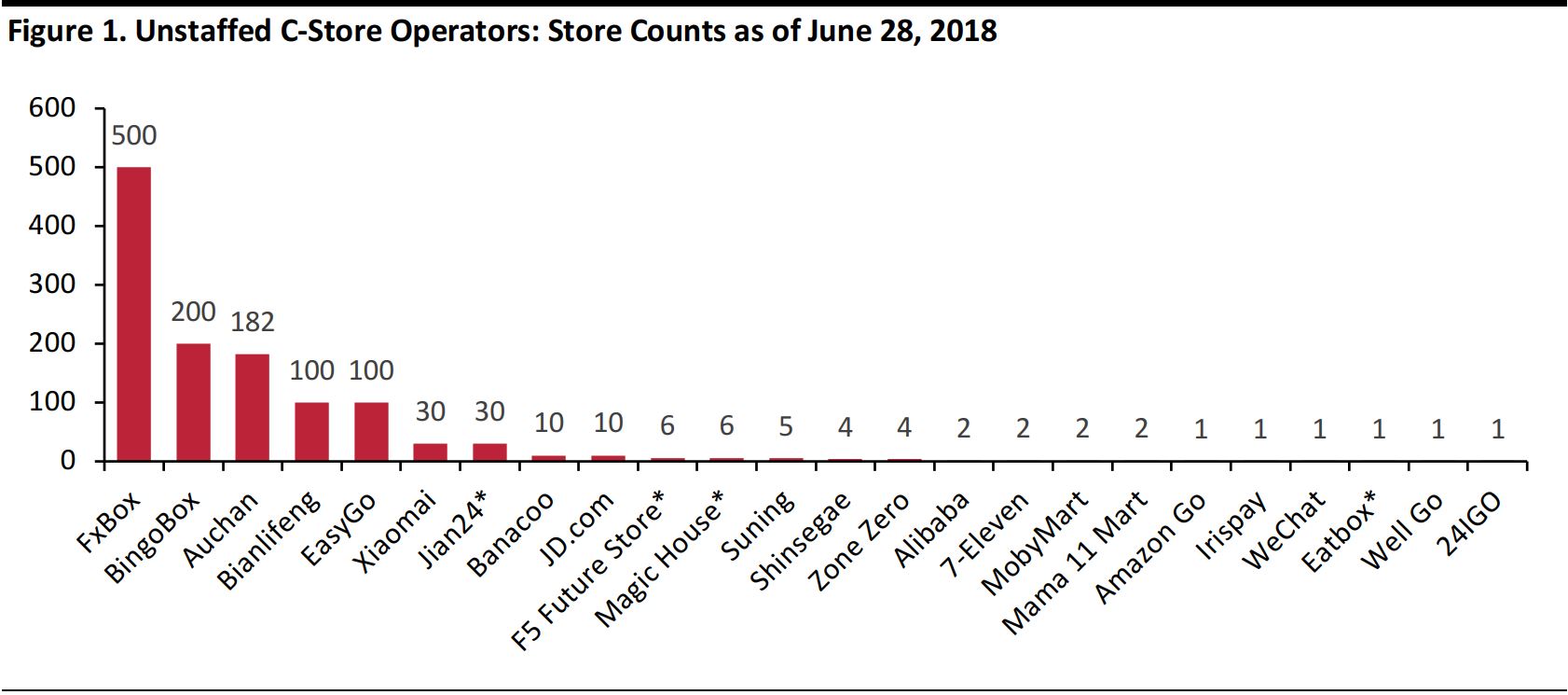

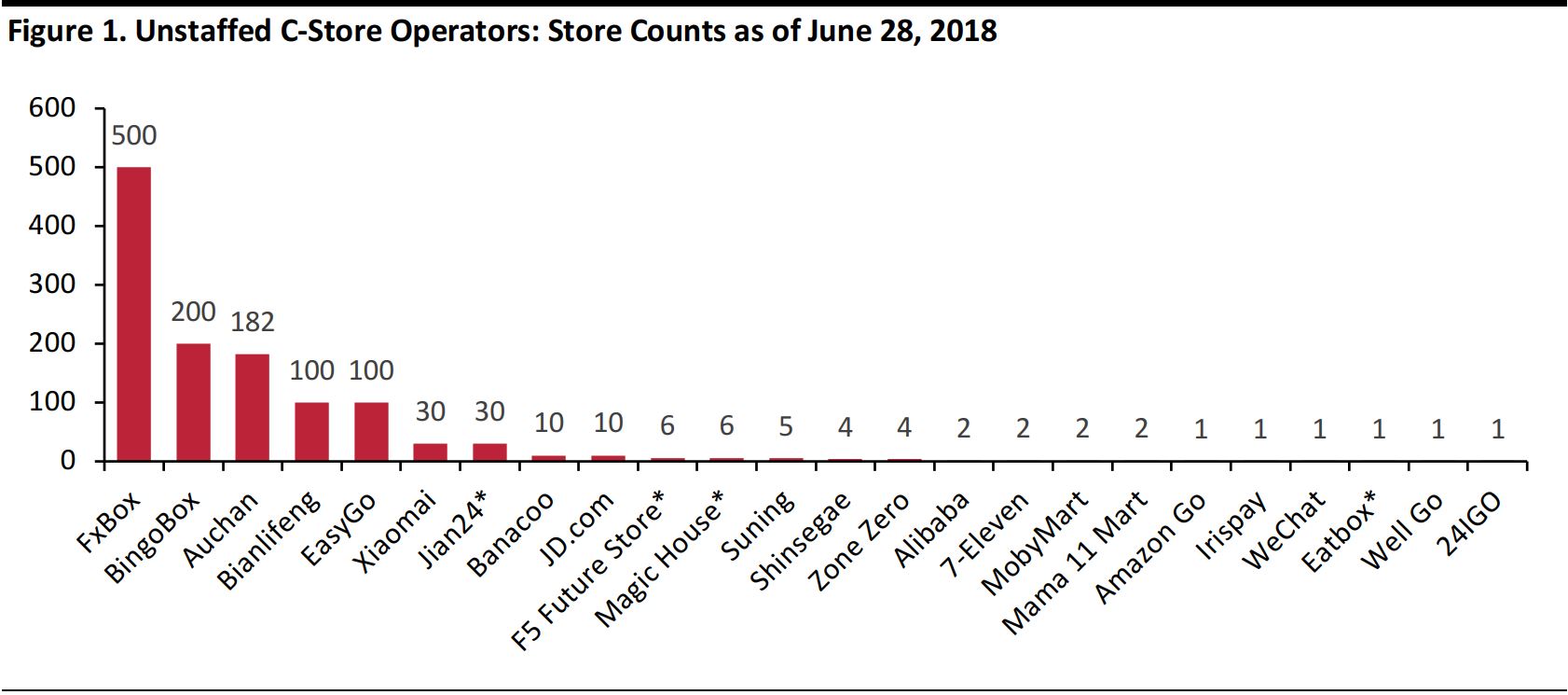

The emergence of the automated, unstaffed c-store format has prompted new players to enter the c-store sector, including tech startups such as BingoBox, which helped develop the technology that enables these stores to run. A number of established retailers have reacted to competitors by launching unstaffed c-stores of their own in collaboration with tech startups. Even FMCG manufacturers have entered the c-store space by opening unstaffed stores. In the section that follows, we discuss some of the startups, retailers and FMCG companies that operate unstaffed c-stores in China and South Korea. First, though, we show store counts, as of June 28, 2018, for each of the unstaffed c-store operators we identified, and we note that Asian firms dominate in terms of store numbers.

*Estimate based on prior company statements

Source: Company reports

*Estimate based on prior company statements

Source: Company reports

Startup: BingoBox, an Unstaffed C-Store

BingoBox is a startup that was launched in 2016. It has raised total funding of $94.7 million from Fosun Capital and other investors, according to Crunchbase. As of the end of 2017, BingoBox operated 200 stores in Mainland China, according to the South China Morning Post, and the company has plans for further expansion in Hong Kong, South Korea and Malaysia.

Source: BingoBox

BingoBox stores rely mainly on RFID technology, although the company has announced that it is upgrading to artificial intelligence (AI) and image recognition technology in its operations. All products in the unstaffed stores are labeled with an RFID tag that allows the company to track their movement in-store.

Customers access a BingoBox shop by scanning a QR code with the WeChat app installed on their smartphone. When they are done shopping, they pay via WeChat Pay or Alipay by scanning their items at the self-checkout. To prevent theft, the stores are outfitted with cameras that check that customers are taking out only items they have paid for. Customer support is available at checkout, where shoppers can video call a shop assistant if they have any questions or issues.

The stores are designed to be easy to relocate. BingoBox has partnered with grocery retailer Auchan to supply the outlets with inventory.

The technology behind BingoBox’s operations is less sophisticated than that used by Amazon for its unstaffed Amazon Go format in the US. Amazon Go, which first opened to the public in January 2018, deploys computer vision, sensor fusion and deep learning. However, BingoBox’s model is cheaper and easier to deploy than Amazon’s, and Amazon had to test the Amazon Go format for an entire year before launch. Currently, there is only one Amazon Go store in operation, in Seattle, Washington.

Startup: Wheelys’ MobyMart, an Unstaffed, Mobile C-Store

Wheelys is a startup that introduced MobyMart, an unstaffed, mobile c-store concept. Customers request the c-store when they need to buy something from it via an app on their smartphone. Then, much like an Uber car, the self-driving c-store drives to the shopper’s location. Shoppers interface with the store via smartphone and enter, browse product information and pay via app. A holographic shop associate assists shoppers in the store.

Source: MobyMart

MobyMart was founded in 2017 and has raised $200,000 in funding, according to Crunchbase. Wheelys collaborates with the Hefei University of Technology in China to incorporate self-driving technology. The mobile store has been beta tested in Shanghai.

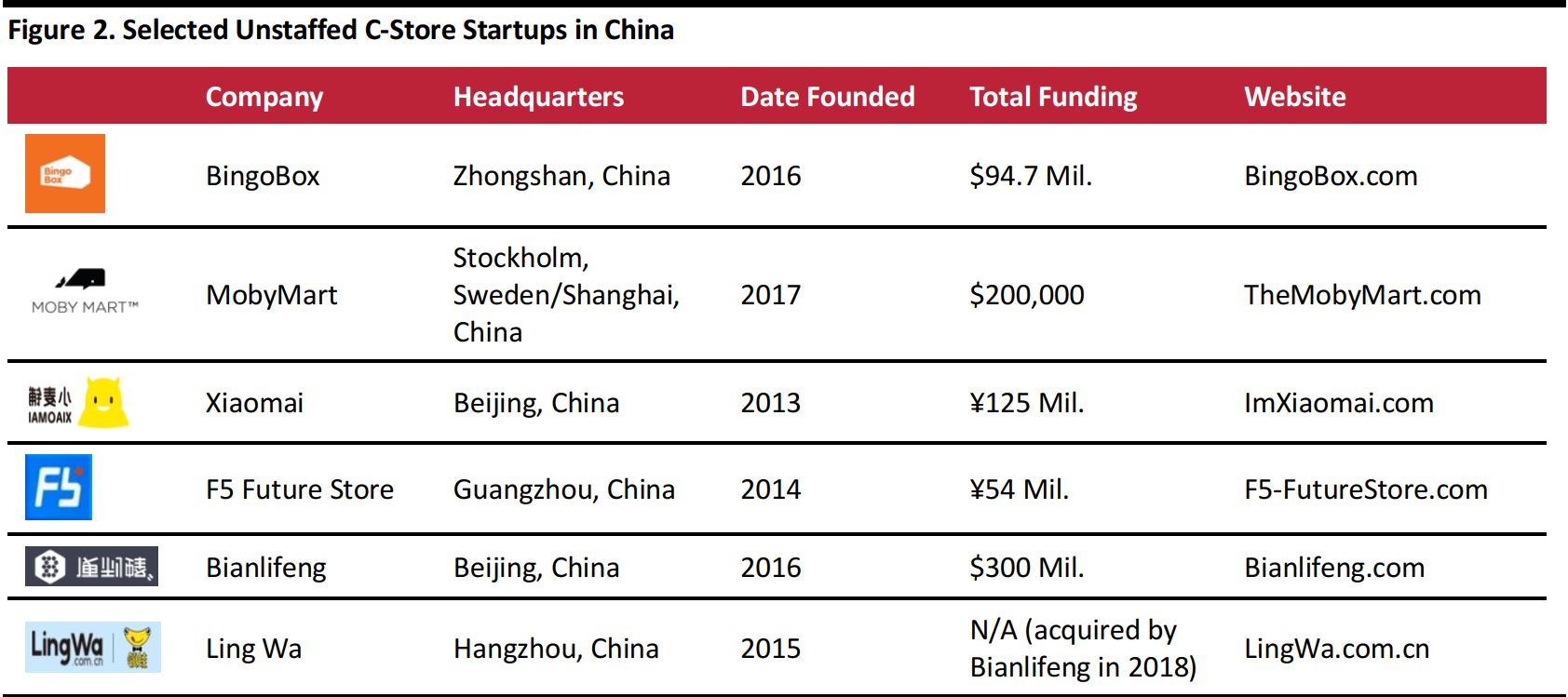

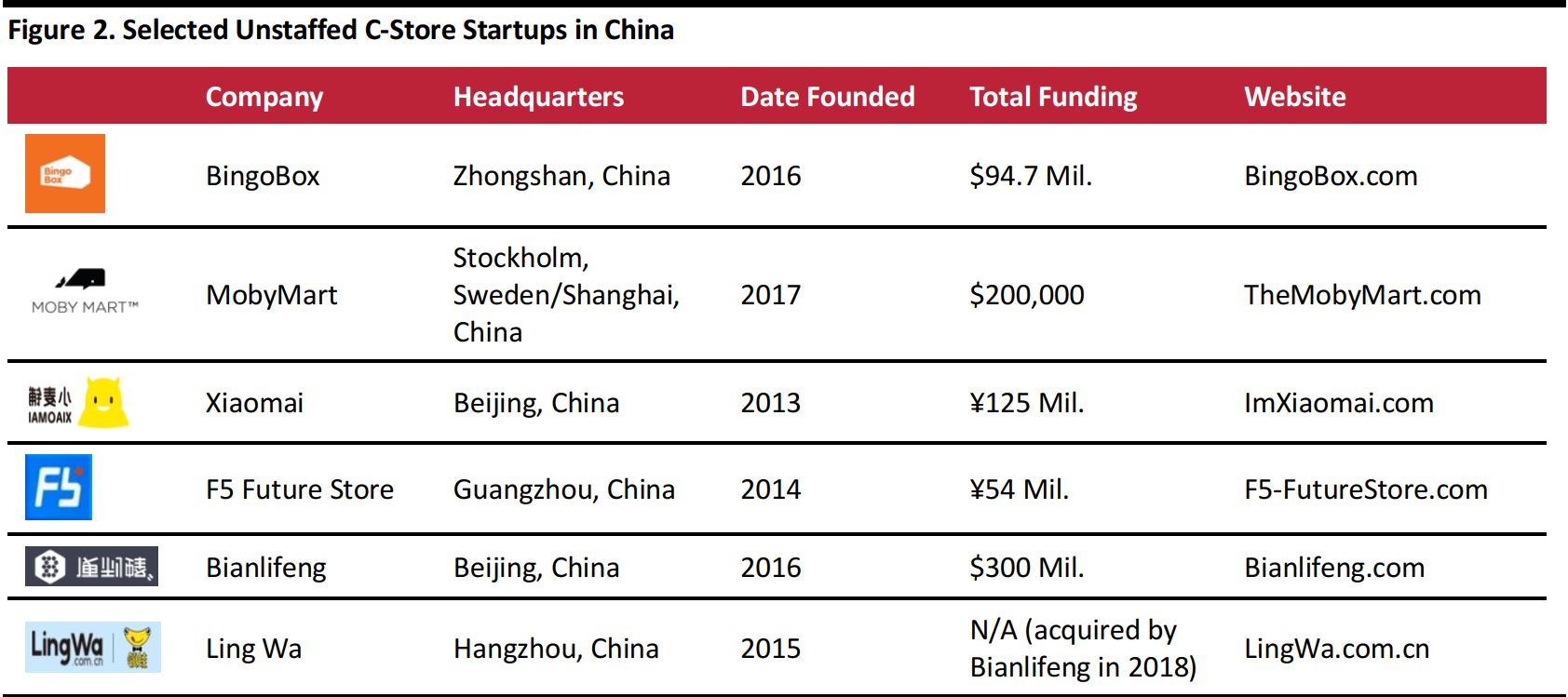

A number of other startups in China are also developing unstaffed stores. The table below lists key information for selected Chinese startups that are operating in the space.

Source: Crunchbase.com/AllTechAsia.com/ChinaMoneyNetwork.com

Retailer: Auchan Minute

In addition to its collaboration with BingoBox, retailer Auchan has also launched its own-branded automated outlets. The company unveiled its Auchan Minute format—a fully digital, unstaffed c-store—in Shanghai in October 2017 through a partnership with tech firm Hisense.

Source: Auchan-Retail.com

Auchan Minute stores are just 194 square feet in size, and they offer only 500 SKUs. Shoppers use WeChat via their smartphone to enter the store, select items and pay.

Retailer: 7-Eleven Signature

Convenience store operator 7-Eleven launched its 7-Eleven Signature format in May 2017 at Lotte World Tower in Seoul, South Korea. 7-Eleven Signature stores have no staff; customers gain entry and pay for items simply by scanning their hand at the door and at checkout, with no need to use a credit card or even a smartphone app. This is possible thanks to a biometric verification system that reads the pattern of the veins in a shopper’s hand. Shoppers provide their biometric information ahead of time, when they apply for a Lotte Card, a popular credit card in South Korea.

Source: InsideFMCG.com.au

New Entrants to the C-Store Space: FMCG Companies

Technological advances have led to increased efficiencies and reduced operational costs in retail, and these improvements have encouraged even nonretail companies to experiment with the c-store channel as part of their broader multichannel strategies. In China, some FMCG companies are already testing unstaffed c-stores. Beverage company Wahaha, for example, entered the c-store space last year by launching TakeGo, an unstaffed store format that might best be described as a large, high-tech vending machine.

Source: TakeGo

At TakeGo, the items a customer picks up are automatically placed into the shopper’s digital shopping cart. Customers are then billed automatically via Alipay when they leave the store.

Shanghai-based DeepBlue Technology, a startup founded in 2014, developed the technology behind TakeGo, which uses a combination of computer vision, biometric identification and machine learning. Wahaha and DeepBlue started a partnership in 2017 for TakeGo’s launch.

Other food and beverage companies, including dried fruit specialist Laiyifen and dairy company Yili, are currently rolling out plans to enter the unstaffed c-store market.

Disruptive Tech, Increased Efficiencies: The Rise of Unstaffed C-Stores

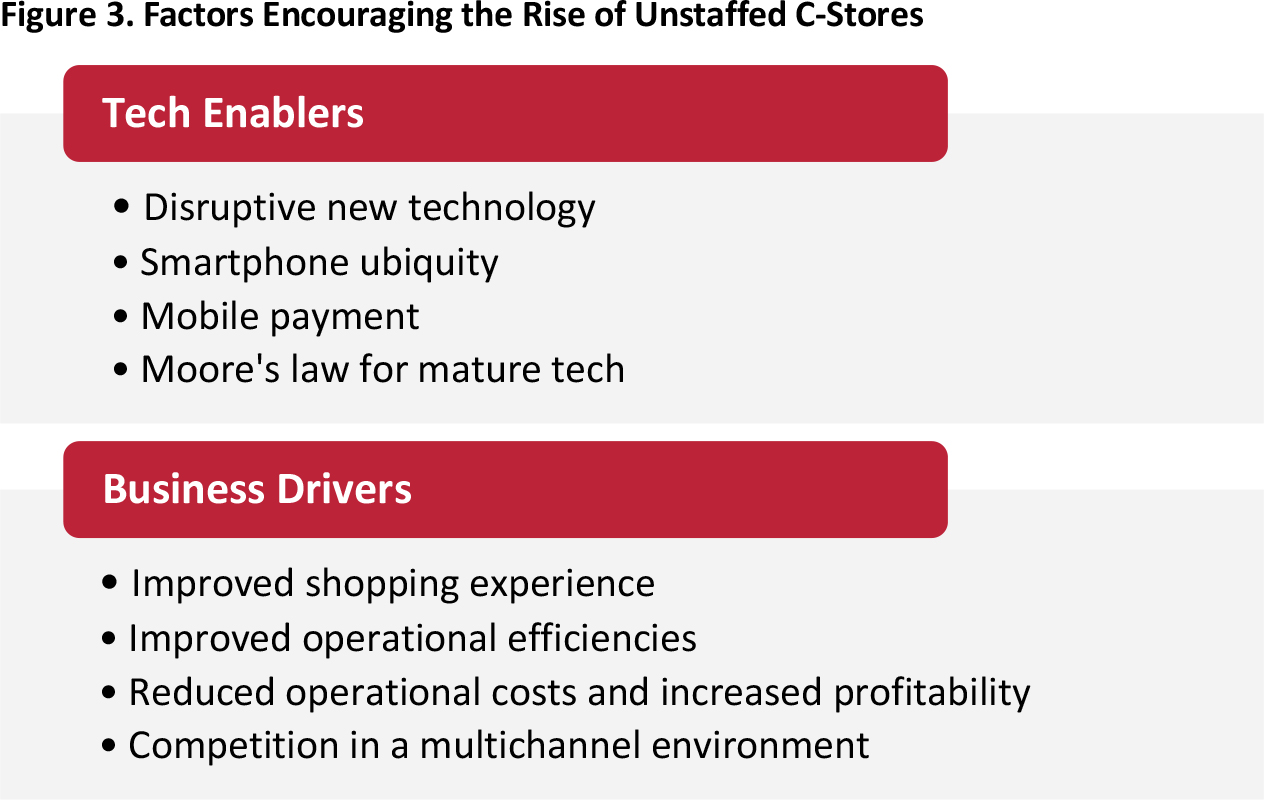

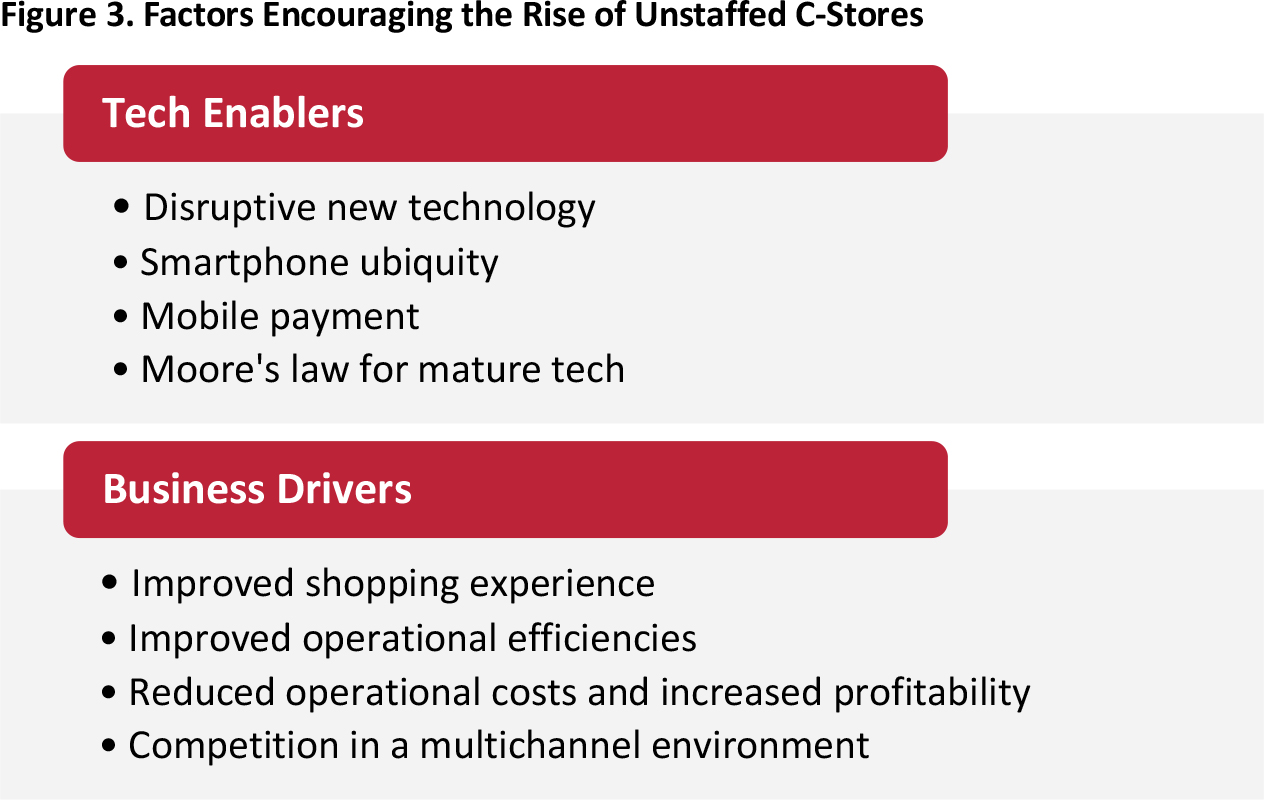

Two types of factors have contributed to the emergence and rise of unstaffed c-stores:

- Tech enablers: developments in technology that make it possible for retailers to operate unstaffed stores.

- Business drivers: business factors that make it advantageous for retailers to adopt the unstaffed store format.

Source: Coresight Research

The technology enablers supporting the rise of unstaffed c-stores include:

- Disruptive technologies: Developments in AI, computer vision and machine learning have made it possible for retailers to digitalize the in-store shopping experience in new ways. Retailers are investing extensively in tech startups that develop disruptive technologies. For example, retail giants Alibaba and Suning have taken stakes in tech startup SenseTime, a developer of facial recognition, a technology that enables payment via face scan at staffless checkouts.

- Smartphones: The ubiquity of smartphones has been very important to the development of unstaffed stores. Most of the digital interaction between shopper and store in an unstaffed store, such as scanning product codes for more information and paying at checkout, occurs via the shopper’s smartphone.

- Mobile payment: The mobile wallets offered by apps such as WeChat Pay and Alipay in China, and Apple Pay and Android Pay in many other markets, introduced a further element of automation to the store experience, and mobile payments are now a key part of shopping at many unstaffed c-stores. As we have discussed in a previous report, mobile payments are ubiquitous among Chinese urban consumers.

- Moore’s law for mature tech: Moore’s law roughly says that technology tends to become cheaper and smaller in size as it matures. Based on that concept, we expect to see operators in the unstaffed c-store space increasingly deploy technology that has been in use for a long time and that has become more affordable and reliable over time.

The case of RFID technology helps to illustrate how Moore’s law works. RFID has been around for decades, but it was formerly too expensive to be adopted widely in retail. Over the years, the cost of passive RFID tags decreased dramatically, making their use in retail environments viable. Now, some passive RFID tags cost only 10 cents each.

Also crucial to the adoption of RFID technology in retail is the fact that it has become considerably more reliable over time. In a brick-and-mortar scenario, RFID readers must be able to track items with extremely high accuracy, especially at self-checkout, in order to prevent shoppers from leaving the store with items that they have not paid for, whether intentionally or unintentionally.

The main business drivers supporting the rise of unstaffed c-stores include:

- Improved shopping experience: Technologies that speed up in-store processes improve the shopping experience for customers. At checkout, various tech applications can reduce or eliminate wait times for shoppers or enable self-checkout.

- Improved operational efficiencies: For retailers, these same technologies that speed up in-store operations can improve efficiencies. Applications that reduce checkout time benefit not only customers, but retailers, too.

- Cost reduction and increased profitability: Automated, unstaffed stores require human labor only for replenishment and maintenance, so these formats typically involve lower labor costs. The stores can also potentially generate higher revenue per unit of retail space: the self-checkout area in an unstaffed store is smaller than the typical staffed checkout area in a regular store, leaving more space for product display in the automated store.

Unstaffed stores’ lower operational costs also enable retailers to serve geographic areas that are less busy, as the stores require less footfall to generate profit. The advantages of the format encourage new entrants, such as food and beverage manufacturers, to venture into the c-store channel.

- Competing in a multichannel environment: Unstaffed stores give c-store retailers an edge as they face competition from online grocery retailers and they encourage players outside the c-store sector to enter the space as part of a broader multichannel strategy.

Our View: Unstaffed Stores and the Future of the C-Store Channel

Unstaffed c-stores have started to appear in some of the world’s most dynamic retail markets. Supporting the growth of the format are tech enablers such as AI and computer vision and business drivers such as increased efficiencies and lower operational costs. In China, the sector is showing particular dynamism and we have seen the development of an ecosystem of tech startups, retailers and even FMCG manufacturers working together and competing in the unstaffed c-store space in the country.

We can be sure that technology will play a key role in c-stores in the future. However, it is too early to tell whether the unstaffed c-store represents the future of convenience grocery retail. In our view, the most likely scenario is that we will see more digitalized c-stores where human employees are assisted by technology such as computer vision and AI that is deployed to enhance the shopping experience. We think that retailers and FMCG manufacturers will use unstaffed c-stores to complement, rather than replace, staffed c-stores and digital formats as part of their multichannel strategies, and that human interaction will remain an important part of the shopping experience.

That said, we expect more retailers to use unstaffed c-stores to reach underserved areas with lower traffic, where the cost of running staffed c-store would be economically unviable. These retailers are likely to use such stores to provide services such as click-and-collect in addition to food and other typical c-store products.

*Estimate based on prior company statements

Source: Company reports

*Estimate based on prior company statements

Source: Company reports