What is Pinduoduo?

Pinduoduo, roughly translated as “buy more together,” is the fastest-growing social e-commerce app in China and also a mini program within WeChat. Users can receive steep discounts of as much as 90% off on certain products if they invite enough friends to buy together. This social e-commerce feature has made it popular amongst budget shoppers in lower-tier cities in China, and the app is scaling up rapidly.

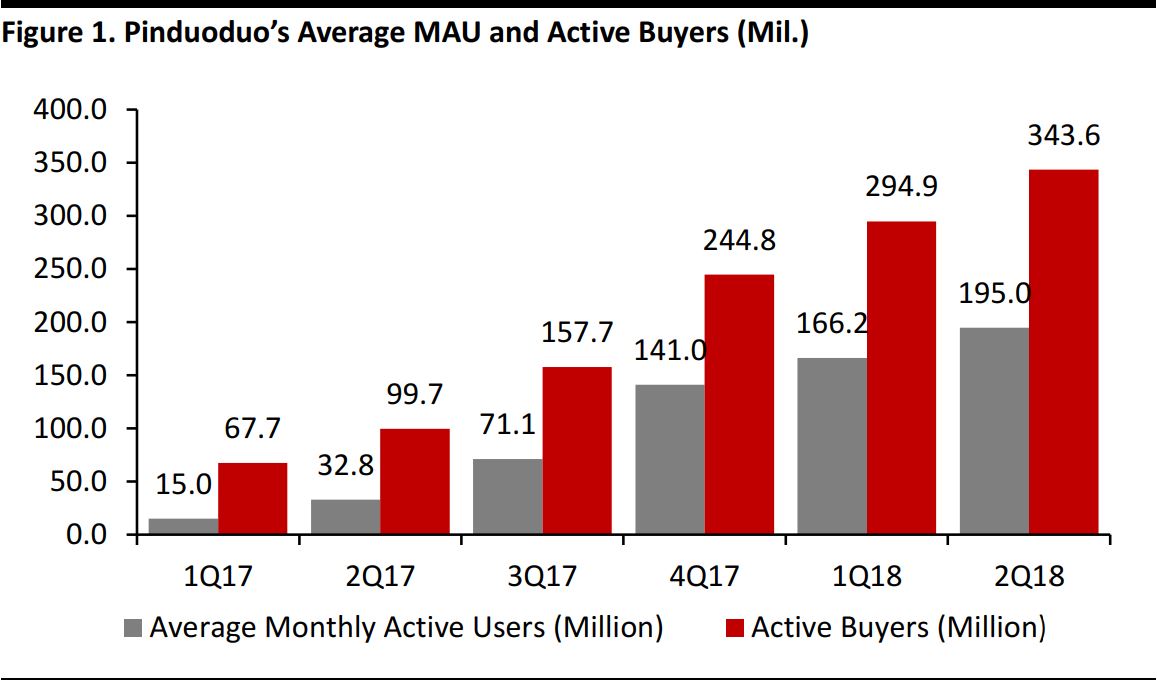

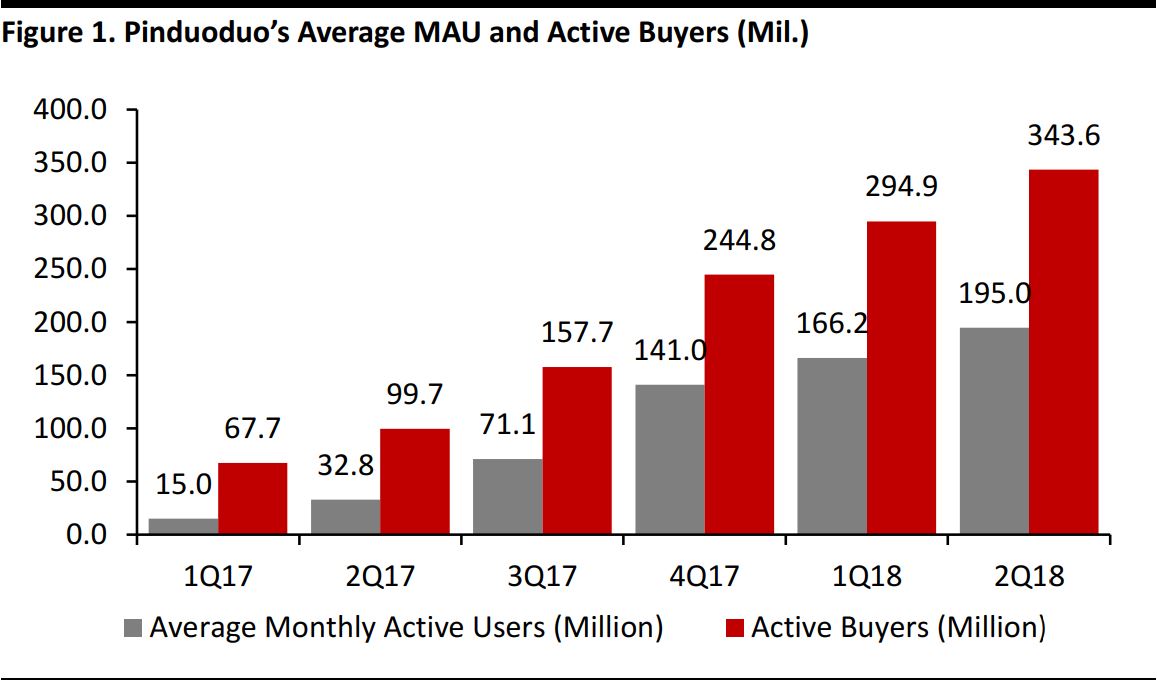

Pinduoduo was launched in September 2015 by a former Google engineer, Colin Huang. In less than three years, the app has grown to have more than 300 million users. According to Pinduoduo’s filing with the US Securities and Exchange, its average monthly active users (MAU) saw significant growth of 1,200%, increasing from 15.0 million in the first quarter of 2017 to 195.0 million as of June 30, 2018.

Source: Pinduoduo/Coresight Research

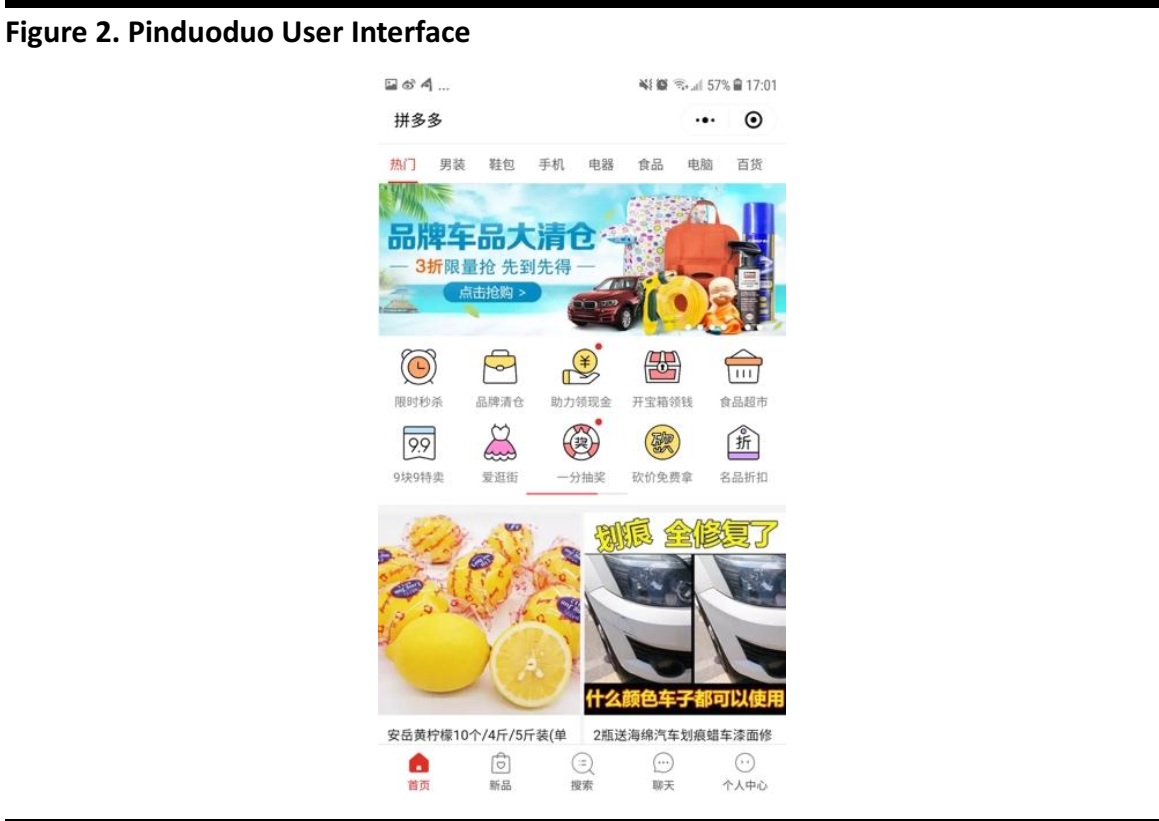

How Does it Work?

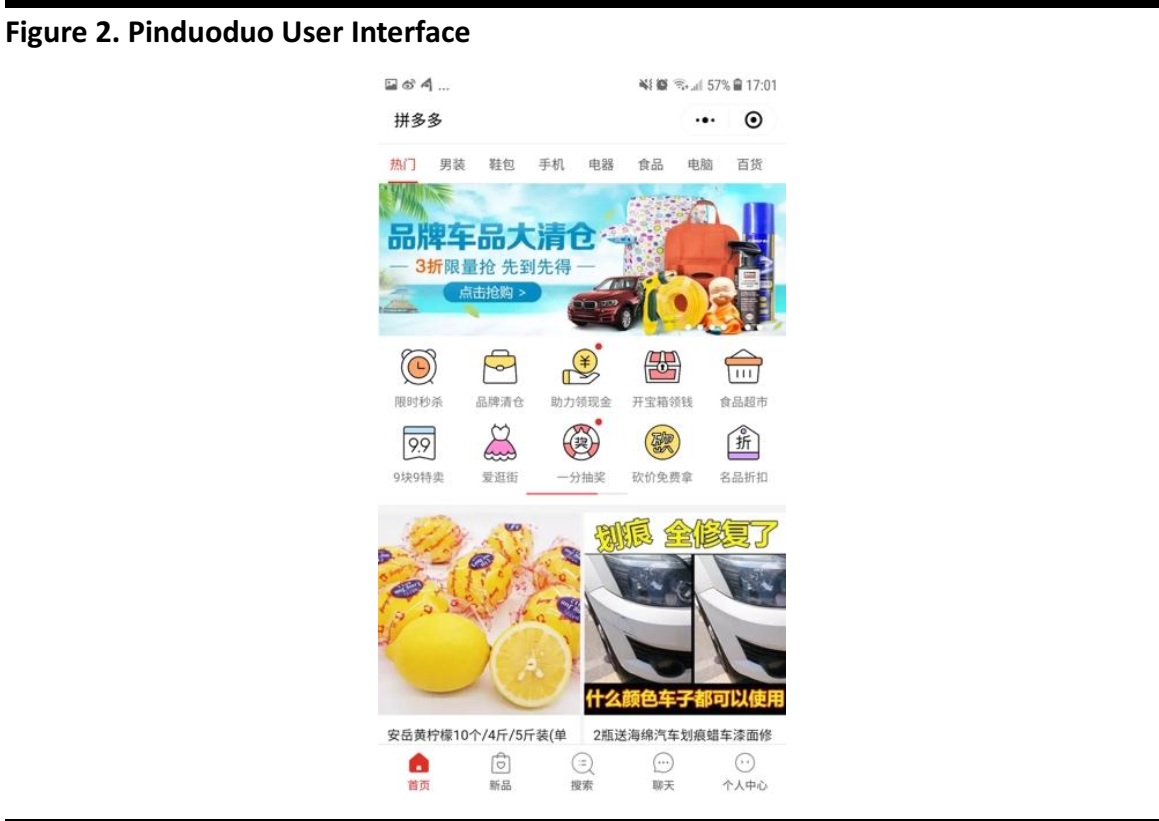

Pinduoduo’s e-commerce model has several features—namely group buying, asking friends to join in the bargain, flash coupons and red packets—predominantly based on social e-commerce which encourages consumers to share with their friends in their WeChat moments (similar to a Facebook user’s feed) or on group chats on WeChat in order to rally people together to get a better deal; the more friends they invite to join, the cheaper the product gets. The app has gamified the online shopping process with social e-commerce.

Source: Pinduoduo/WeChat/Coresight Research

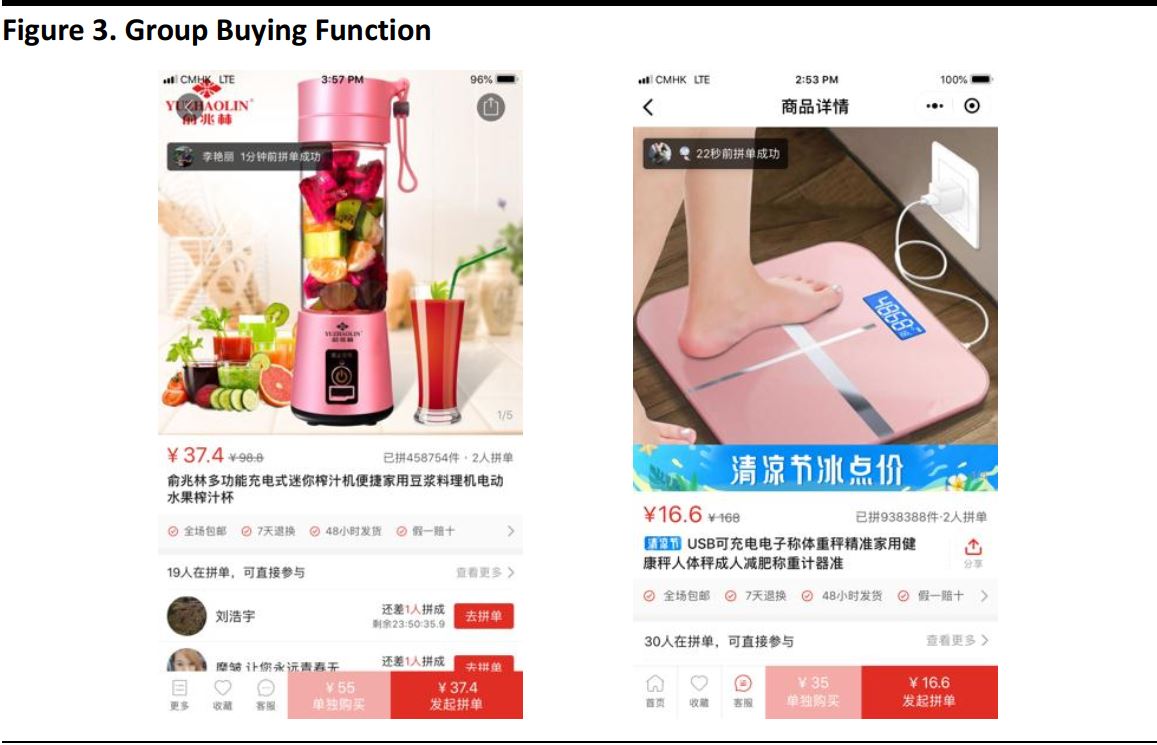

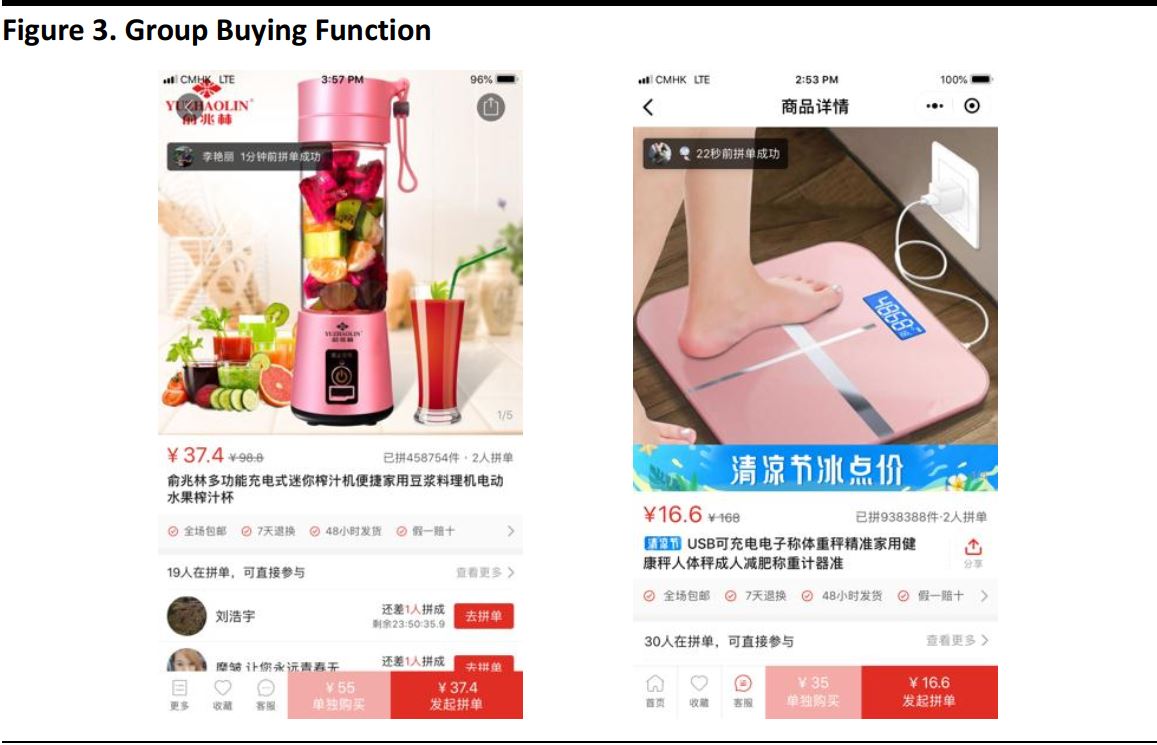

Group Buying

Group buying is the core function of the app. Each product has an official price and a group-buy discounted price. To get the discounted price, consumers need to find friends to join the group-buy deal, and once purchases, the goods will be shipped separately to the respective delivery addresses of the buyers.

Source: Pinduoduo/WeChat/Coresight Research

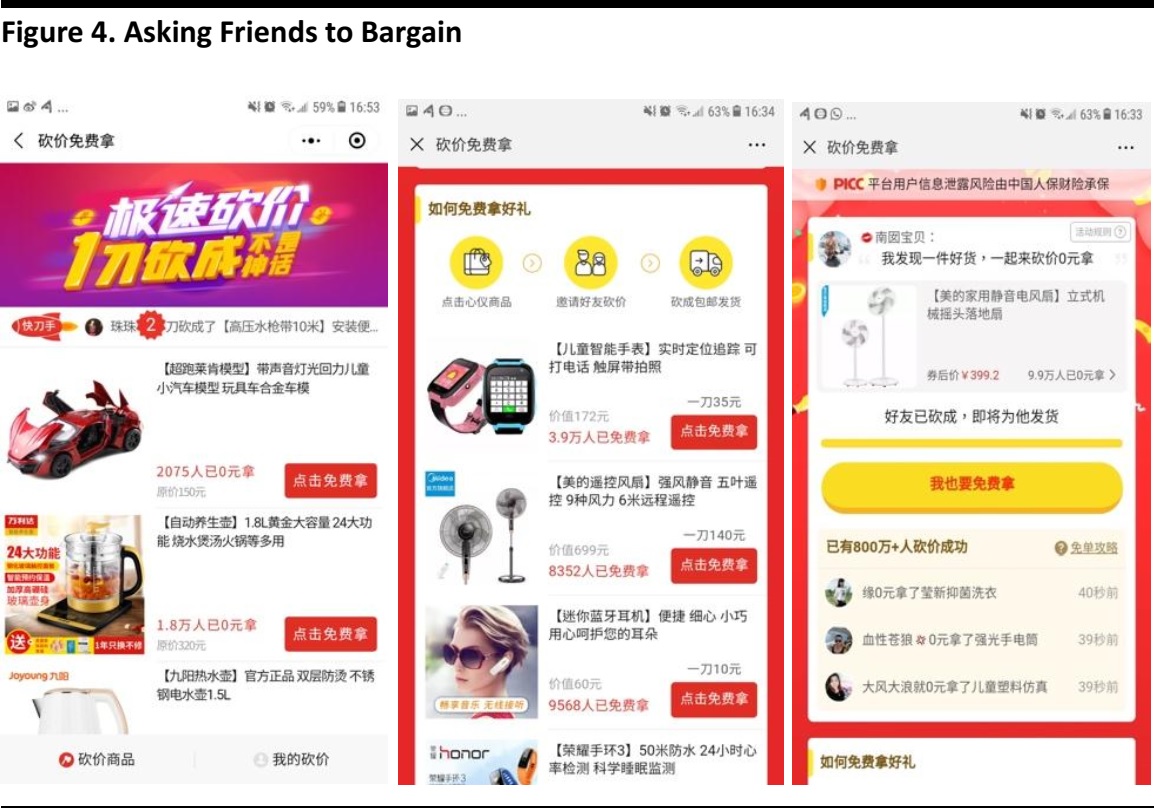

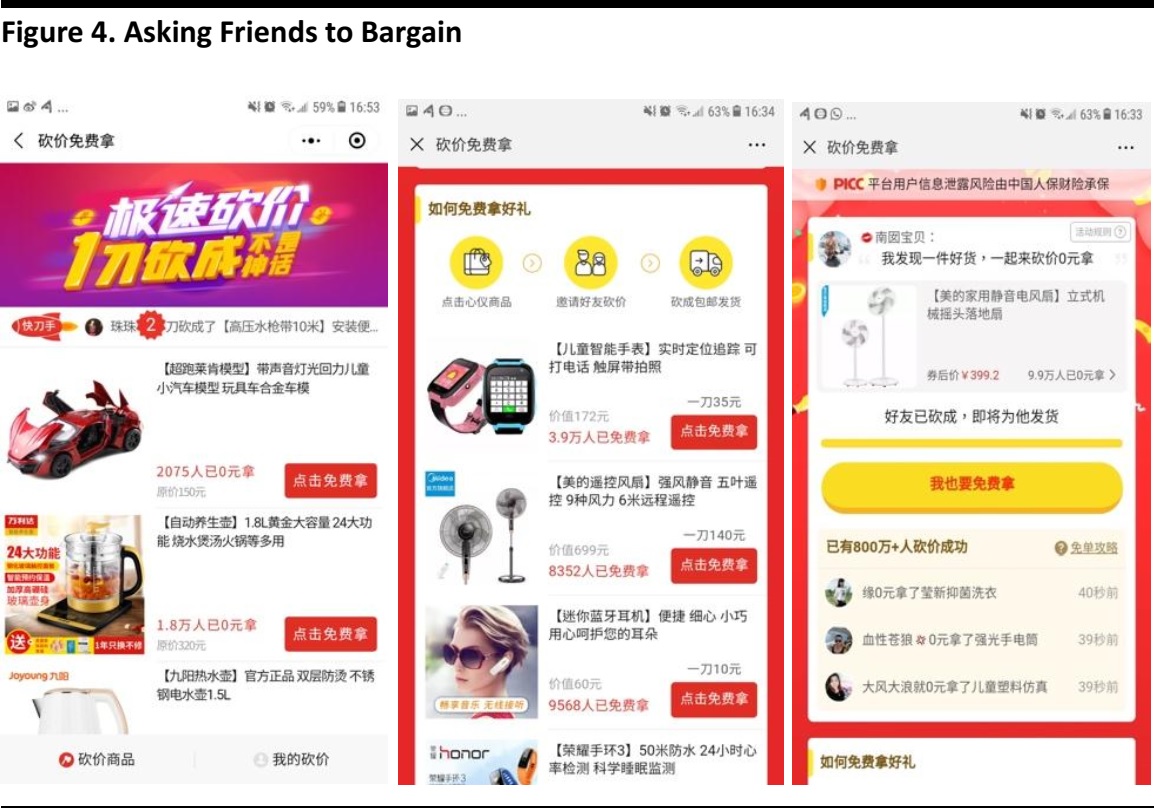

Asking Friends to Join in the Bargain

Pinduoduo offers free products for consumers who invite enough friends to “ask for a bargain” for a given product. After choosing a certain product, the user will need to share the product with friends to “ask for a bargain.” Each time a friend helps to “bargain,” the price decreases, and eventually the user can get the product for free. This feature gamifies online shopping, acts as a marketing activity for brands and also reveals the preferences of certain consumers.

Source: Pinduoduo/WeChat/Coresight Research

Source: Pinduoduo/WeChat/Coresight Research

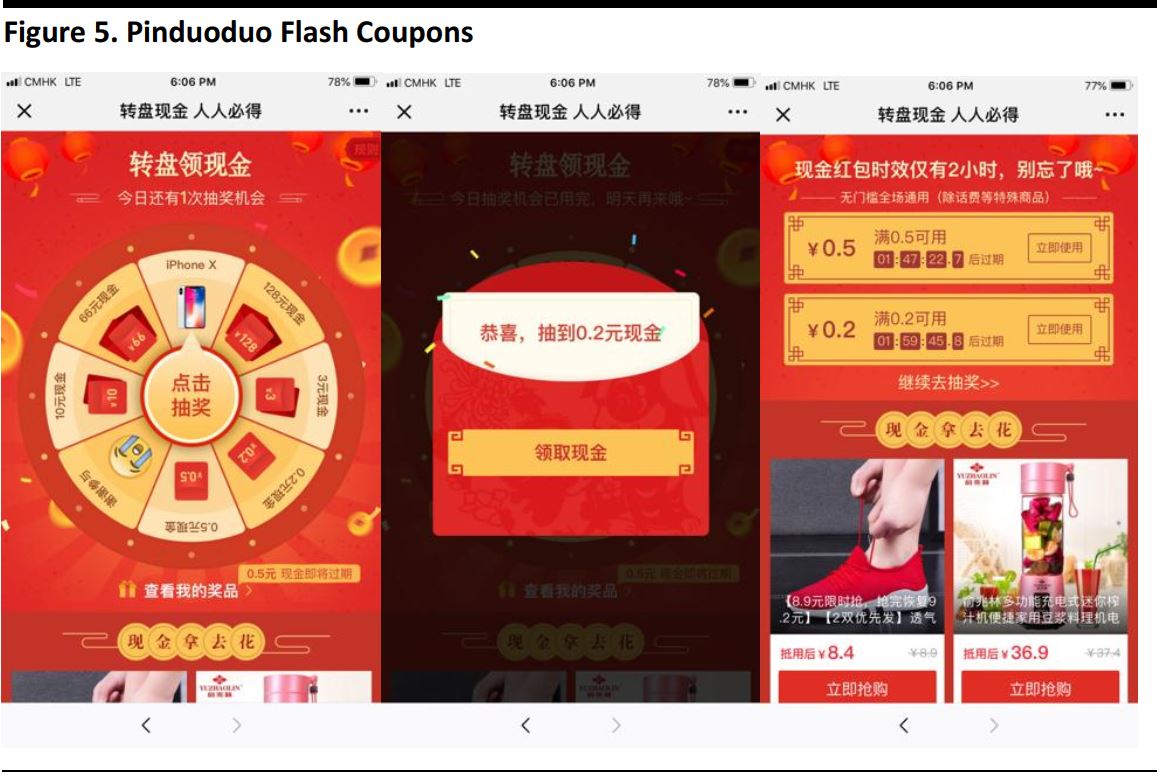

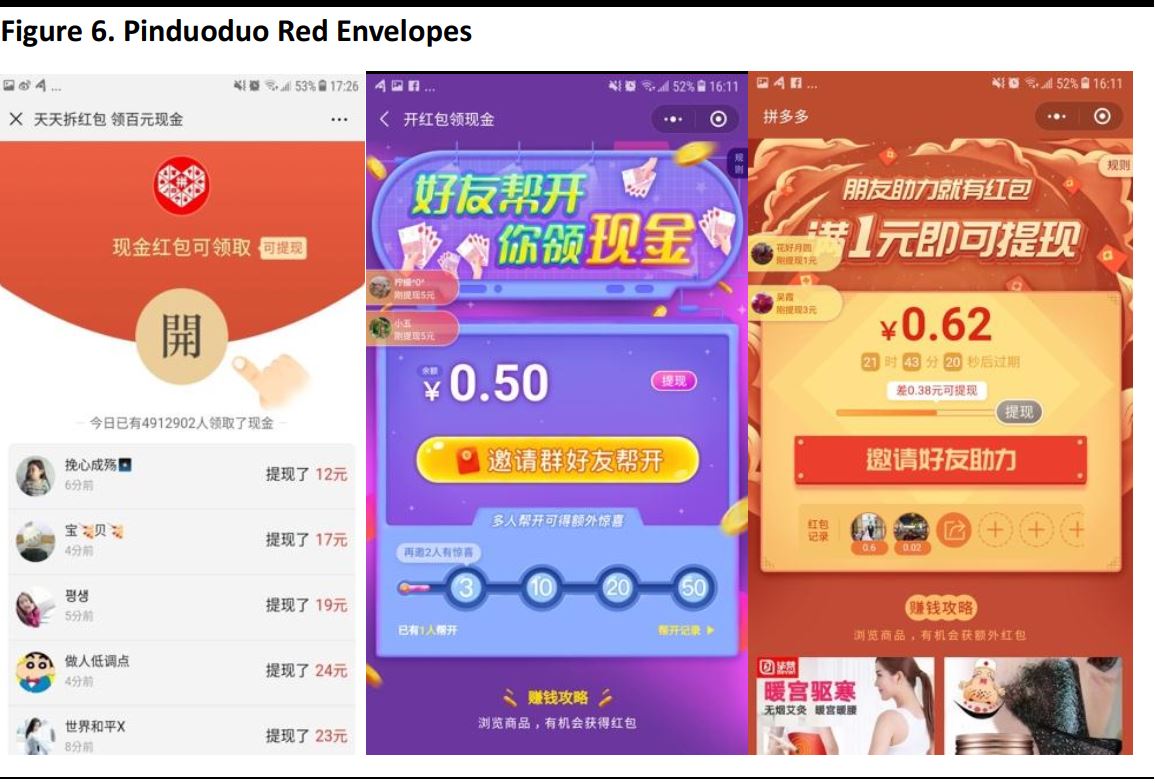

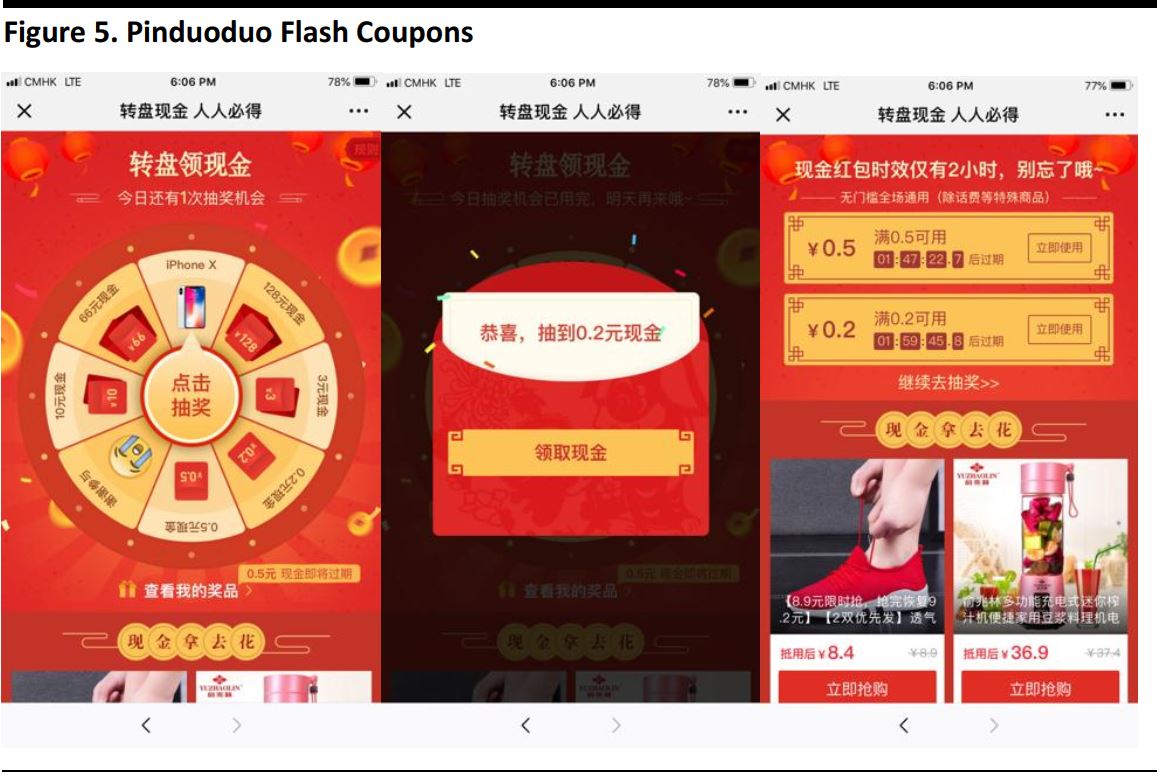

Flash Coupons and Red Envelopes

Pinduoduo offers flash coupons and red envelopes (envelopes filled with money that is traditionally given at Chinese New Year, but now used extensively online to send money to friends and family online) as incentives for consumers to make purchases. Flash coupons are offered for a specific time period, usually only two hours or less.

Source: Pinduoduo/WeChat/Coresight Research

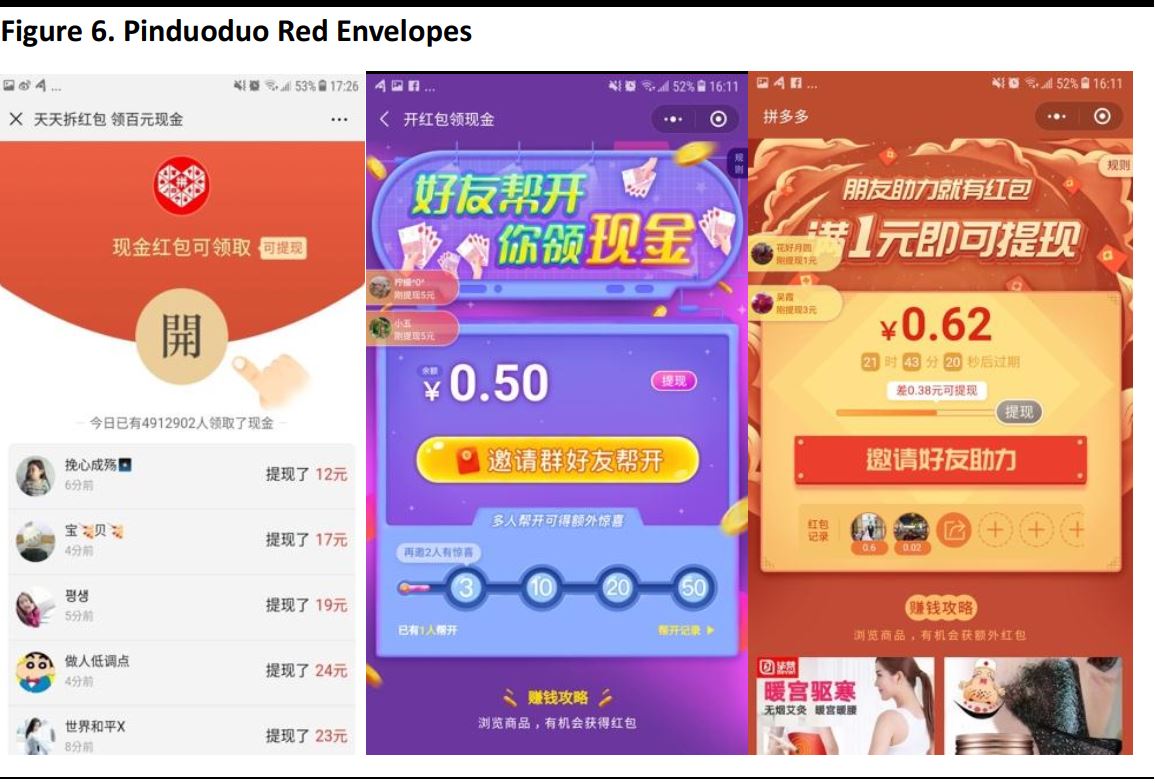

The app also offers red envelopes to consumers, but requires consumers to share with friends to increase the dollar amount they can receive within a given time period (usually 24 hours), and the red envelopes cannot be cashed out before the user reaches a certain threshold. This gamifies the e-commerce process and encourages consumers to keep sharing with their friends to receive more red envelopes or cash discounts.

Source: Pinduoduo/WeChat/Coresight Research

Source: Pinduoduo/WeChat/Coresight Research

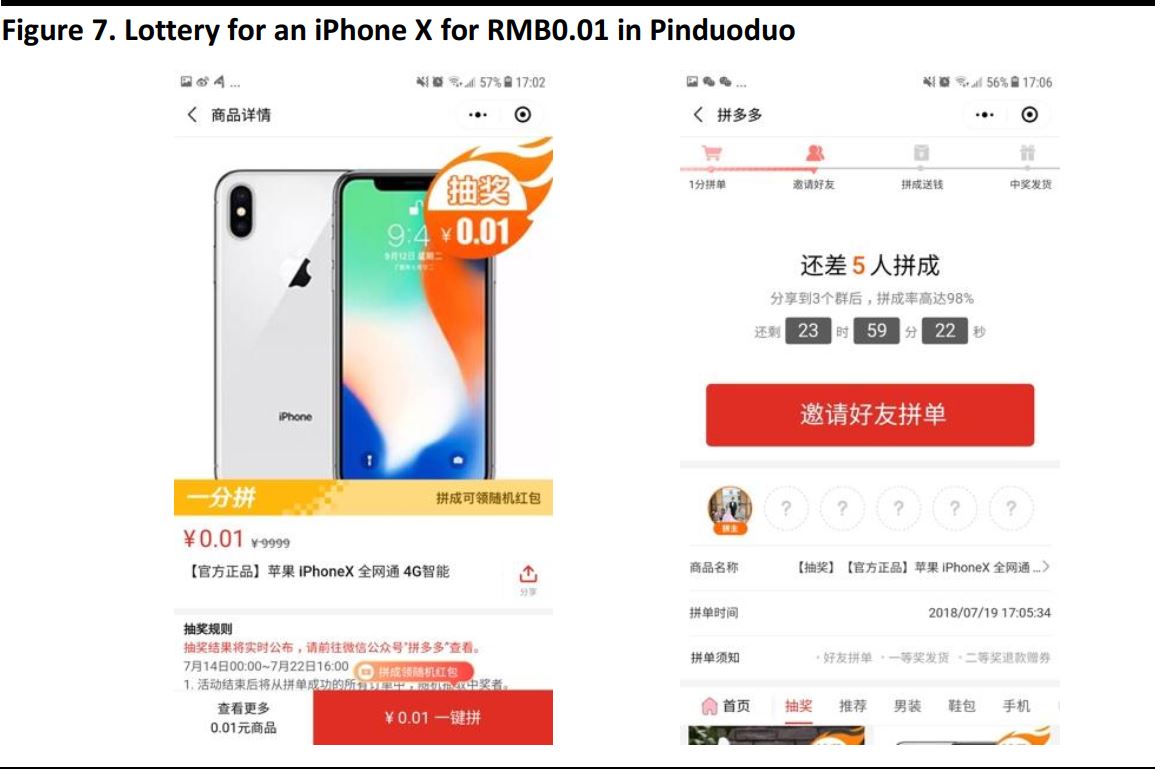

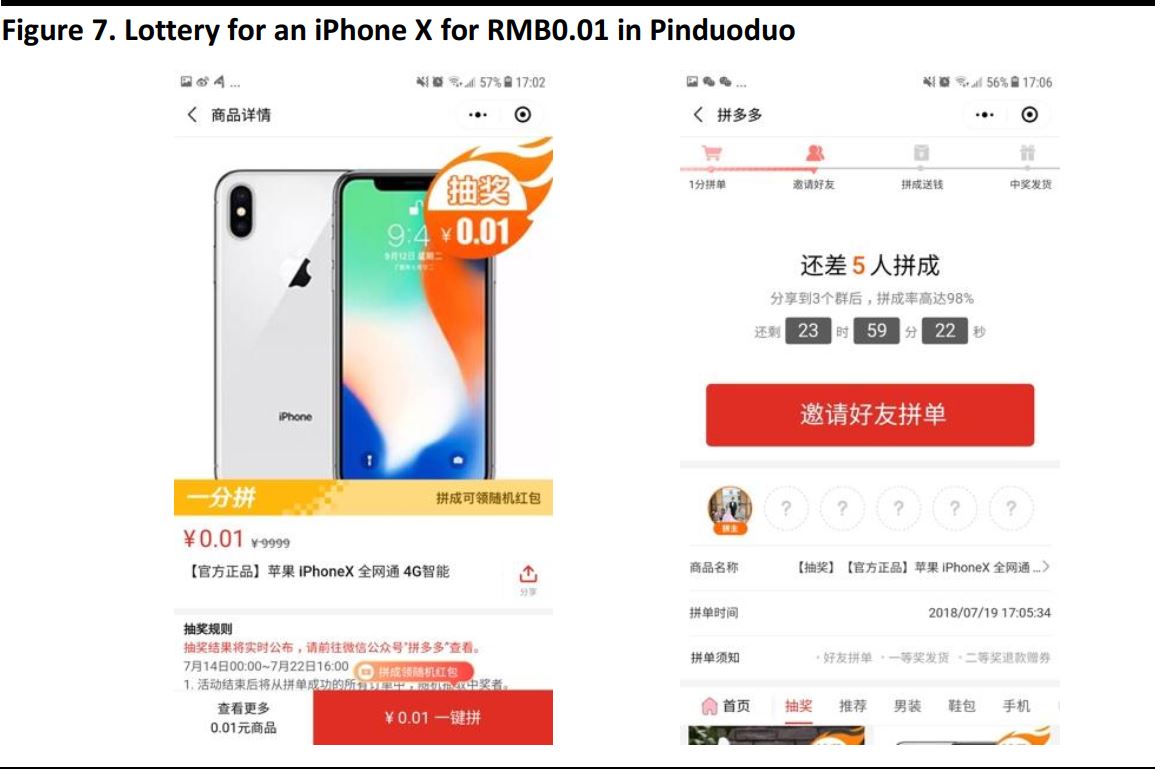

Lottery

Lottery is another social e-commerce feature of Pinduoduo. Users need to pay a small entry fee of RMB0.01 to enter a lottery. To activate the lottery, the user needs to invite enough friends to join within a specific time period. For a lottery for an iPhone X, for example, a user will need to invite five friends to join to get a chance to win the product. Although the chances of winning may be slim, it encourages consumers to share the activity, and hence the app as well, with each other.

Source: Pinduoduo/WeChat/Coresight Research

Source: Pinduoduo/WeChat/Coresight Research

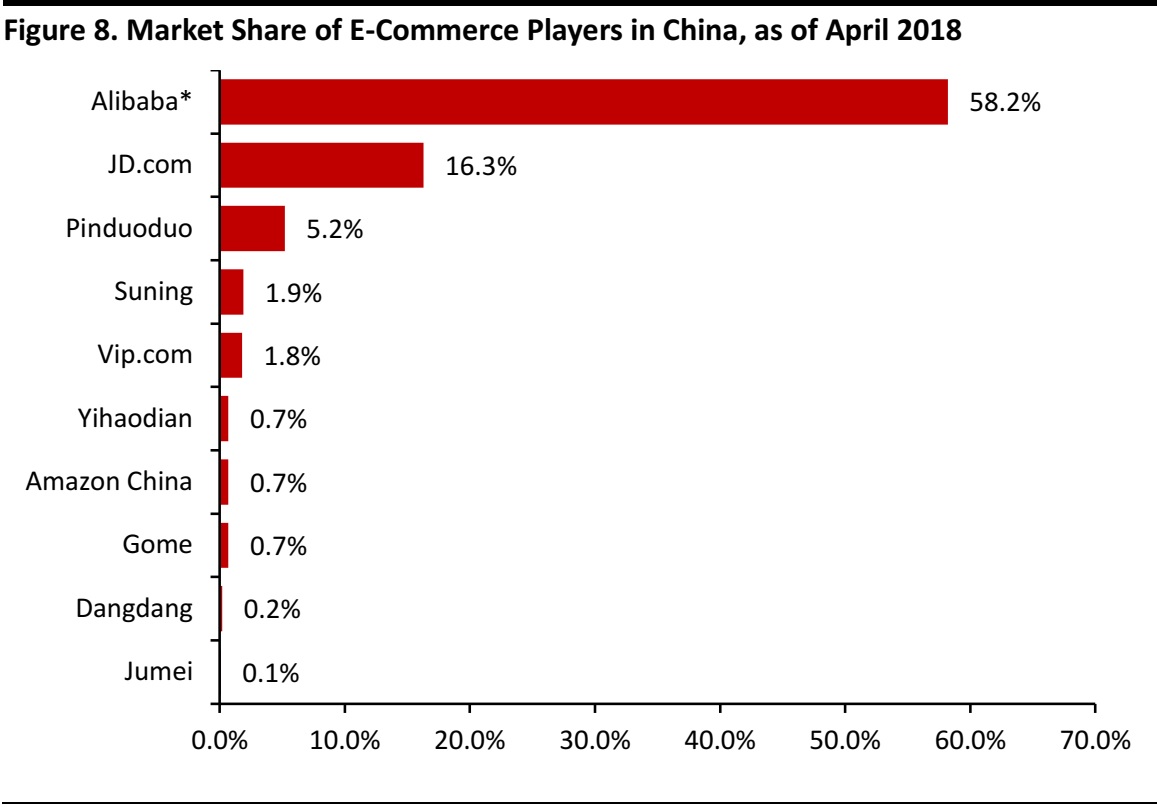

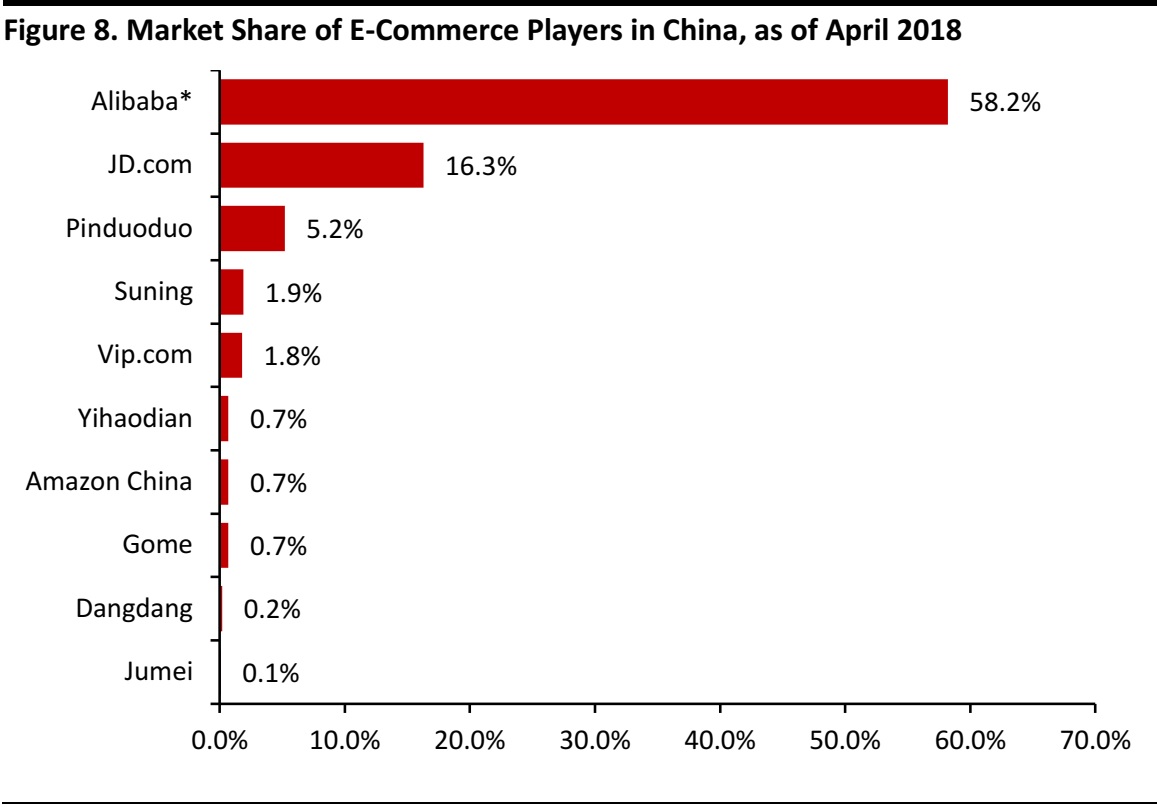

Pinduoduo Gains Considerable Market Share Despite Dominance of Alibaba and JD.com

Despite the dominance of Alibaba and JD.com, Pinduoduo has grown quickly to take 5.2% market share of the e-commerce market in China (latest as of April 2018), according to eMarketer.

Note: Includes products or services purchased online via any device, excludes travel and event tickets; excludes Hong Kong.

*Includes GMV for Tmall, Taobao marketplace and AliExpress Global on a calendar year basis.

Source: eMarketer, April 2018

Note: Includes products or services purchased online via any device, excludes travel and event tickets; excludes Hong Kong.

*Includes GMV for Tmall, Taobao marketplace and AliExpress Global on a calendar year basis.

Source: eMarketer, April 2018

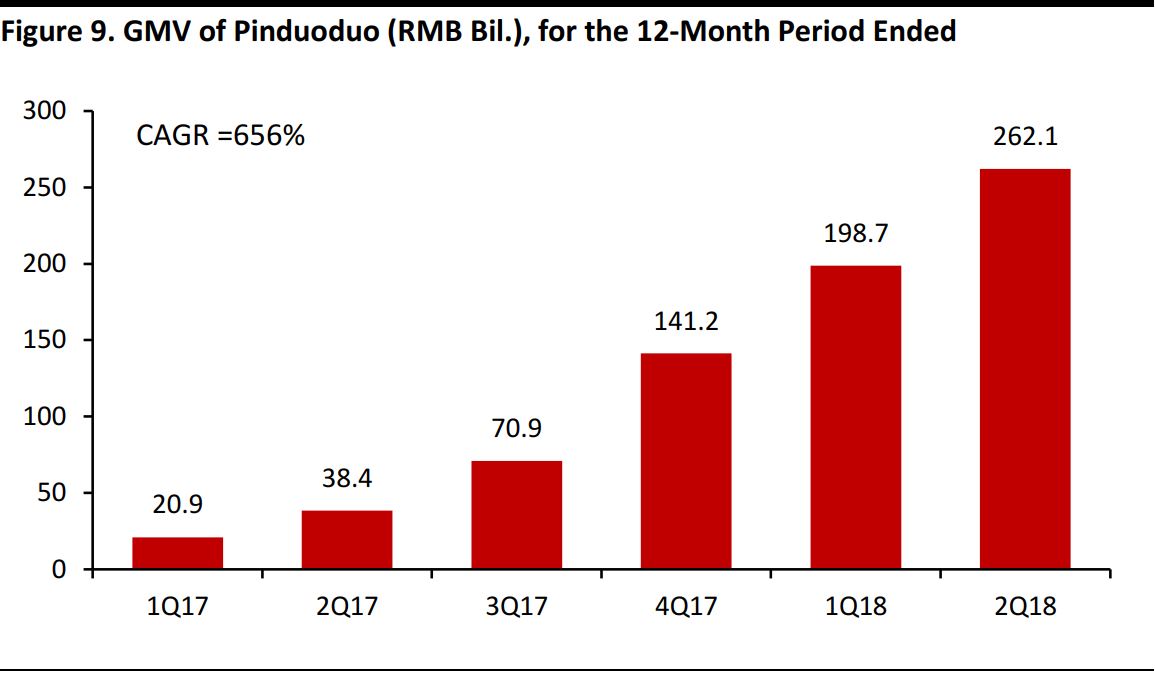

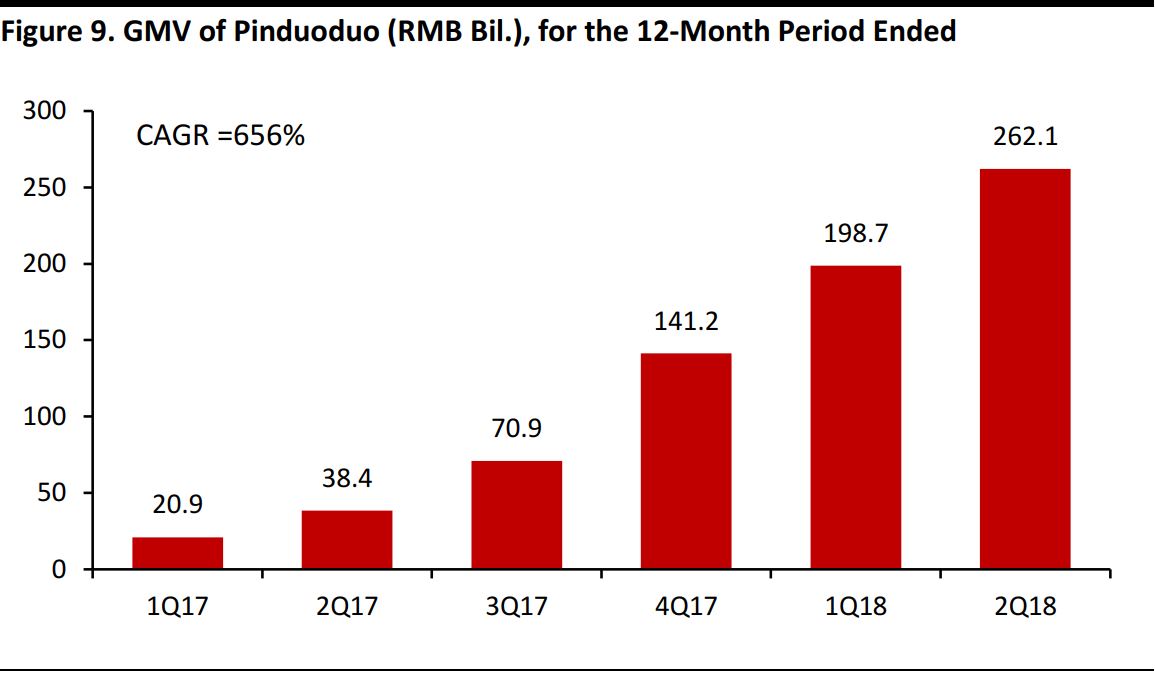

Pinduoduo’s gross merchandise value (GMV) grew more than tenfold in just over one year, from RMB20.9 billion in March 2017, to RMB262.1 billion, as of June 2018. In only 2.5 years, the GMV of the e-commerce app exceeded RMB100 billion, reaching RMB141.2 billion (US$20.6 billion) in 2017. By comparison, it took JD.com 10 years, VIPshop eight years and Taobao five years to achieve this same hallmark, according to data from research firm QuestMobile and popular Chinese website 36kr.

Source: Pinduoduo/Coresight Research

Source: Pinduoduo/Coresight Research

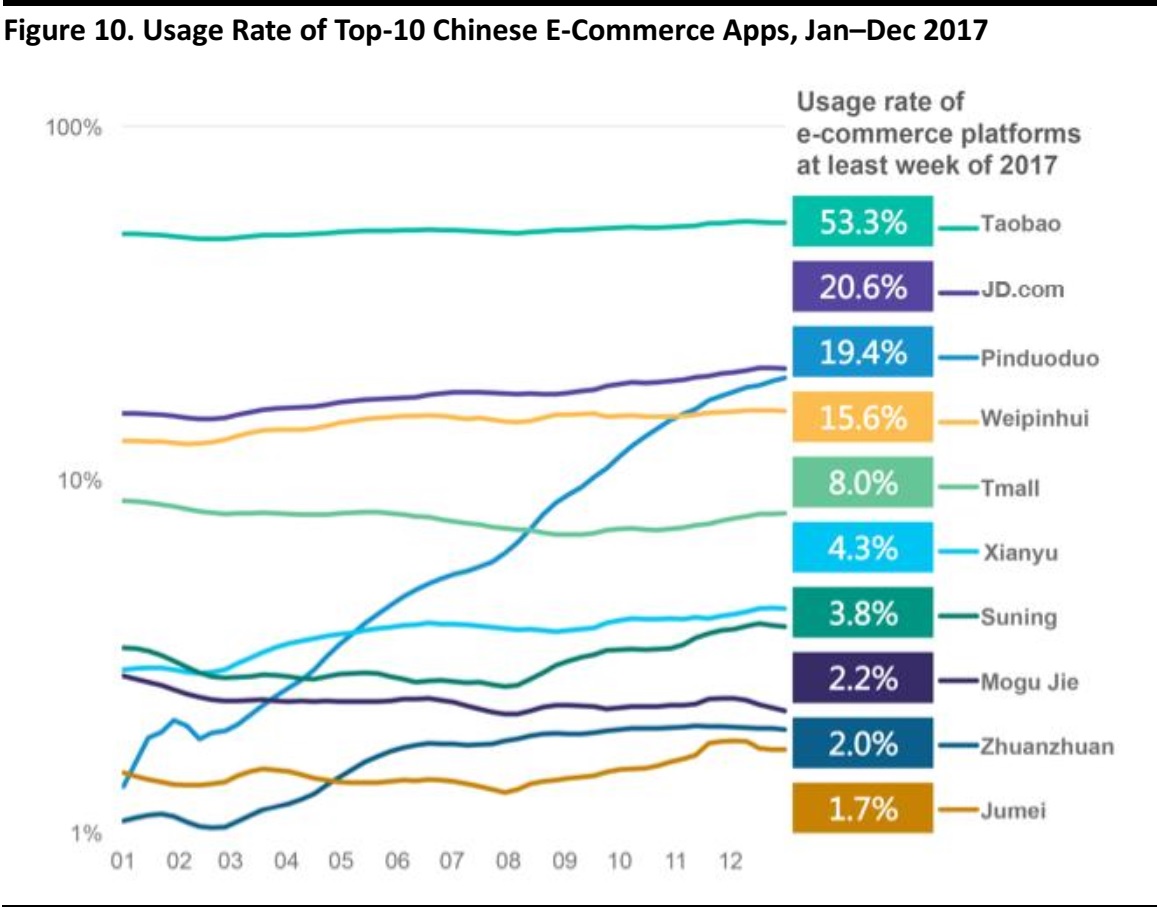

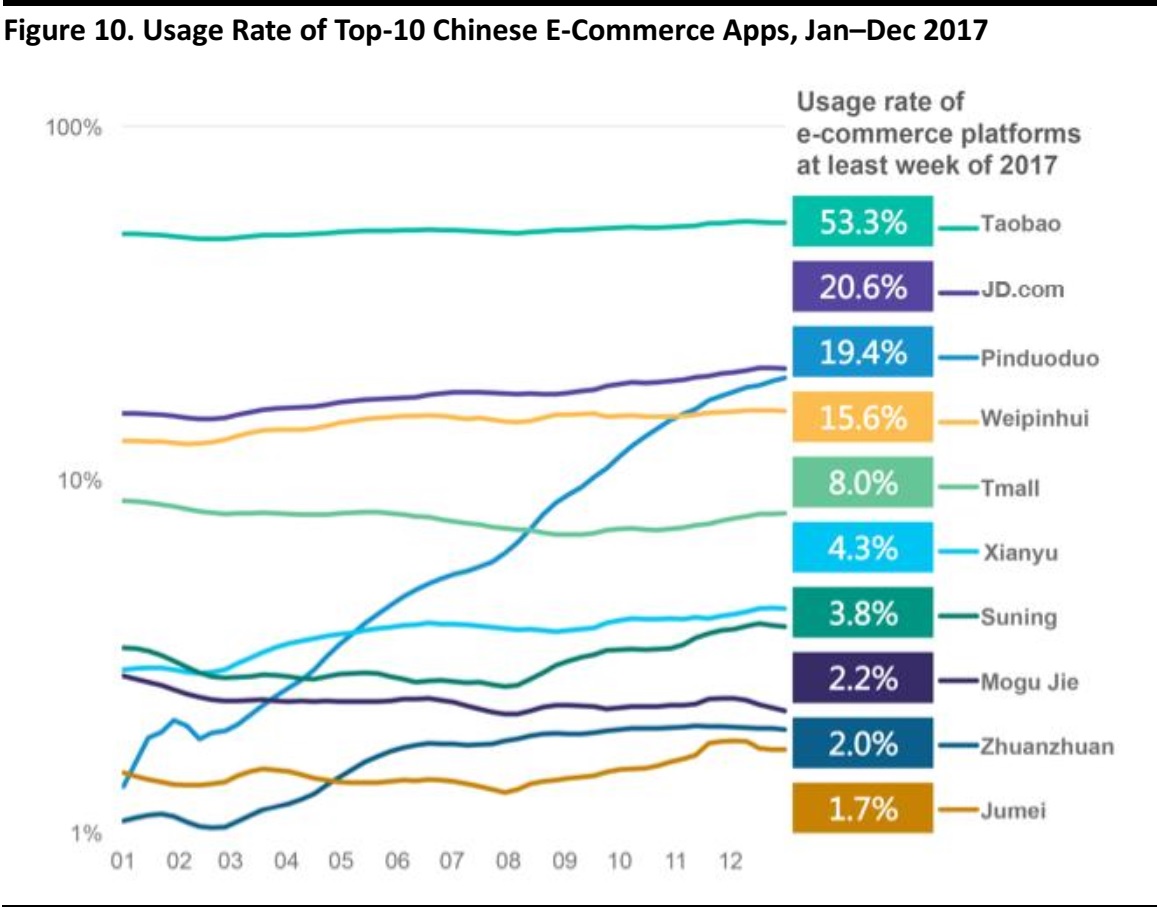

According to data from data analytics firm Jiguang, the usage rate of Pinduoduo at 19.4% is nearing that of JD.com at 20.6% and behind Taobao at 53.3%.

Source: Jiguang/WalktheChat/Coresight Research

Source: Jiguang/WalktheChat/Coresight Research

How Has Pinduoduo Managed to Grow Despite the Dominance of Alibaba and JD.com?

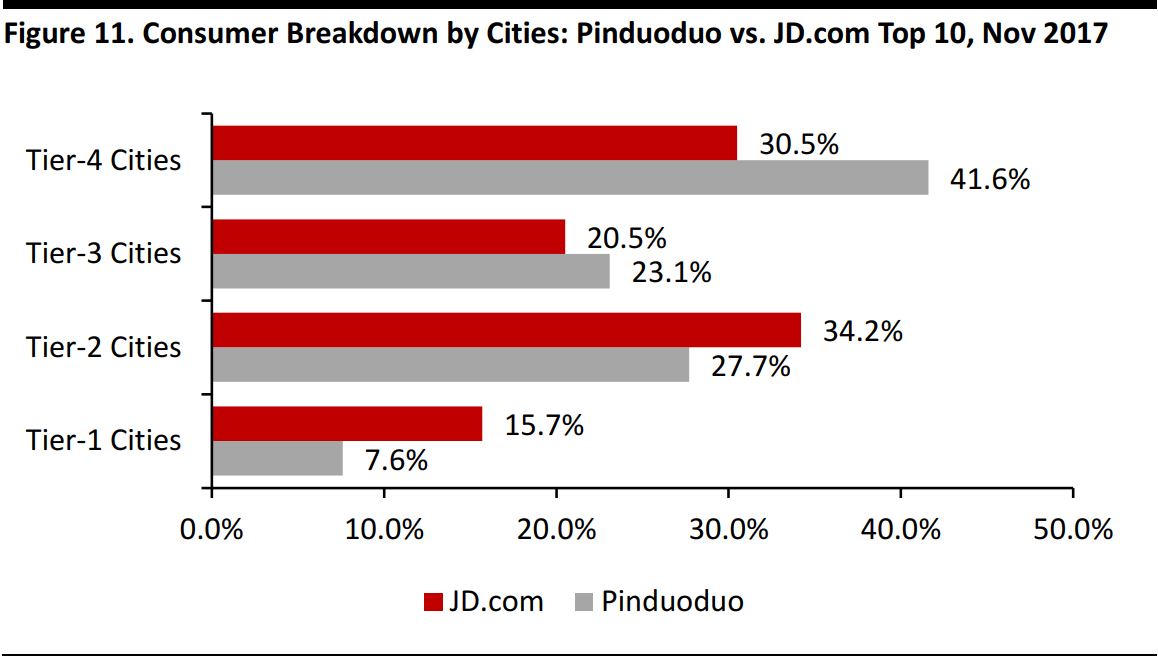

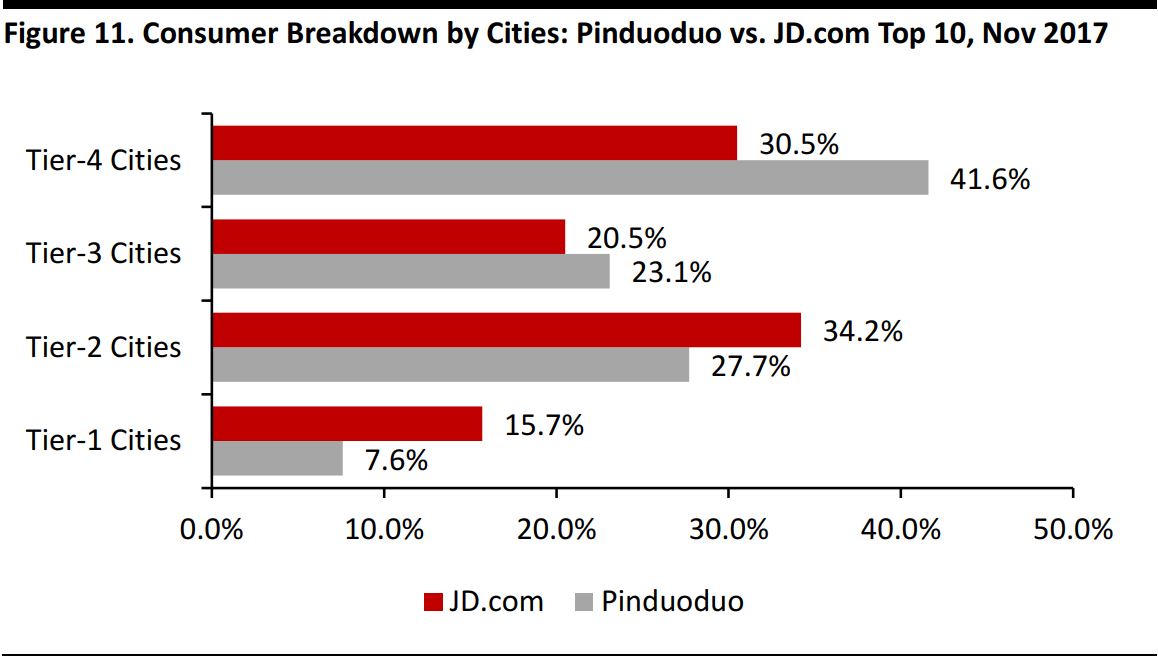

Pinduoduo is particularly popular among consumers in China’s lower-tier cities who are price-sensitive and looking for a bargain. Given the dominance of Alibaba and JD.com in tier-one cities, Pinduoduo’s strategy to target price-sensitive consumers from lower-tier cities is one of the keys to the remarkable growth it has achieved in just three years. According to Jiguang, a big data service provider in China, 64.7% of Pinduoduo’s consumers are from tier-3 and tier-4 cities, compared to 51.0% for JD.com.

Source: Jiguang

Source: Jiguang

Another reason for its succes is that Pinduoduo takes advantage of the social aspect of shopping, leveraging the user base of WeChat, and gamifies the online shopping process. Inviting friends to buy together to bargain facilitates social bonding among consumers via e-platforms. The social e-commerce model brings in new app users as well as reinforces app usage of existing users who want a bargain and enjoy the shopping process. Leveraging WeChat’s over 1 billion MAUs, Pinduoduo app users can easily invite friends in WeChat to purchase products together for a better price or ask friends to bargain for them.

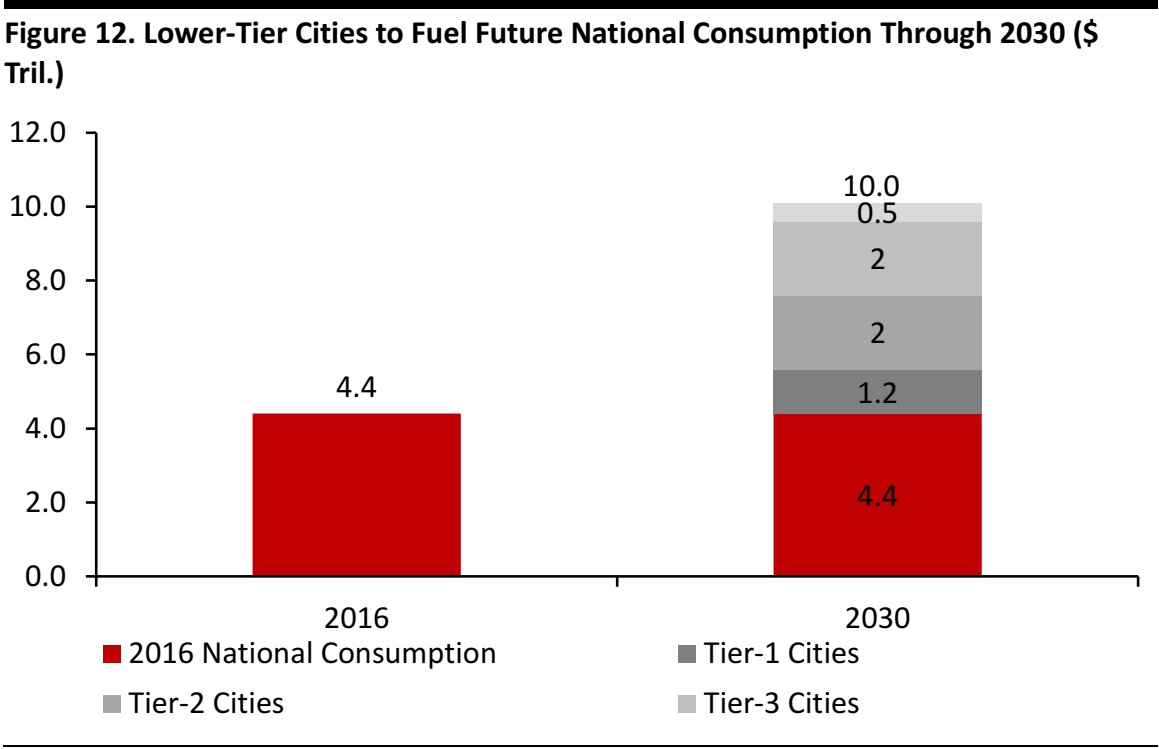

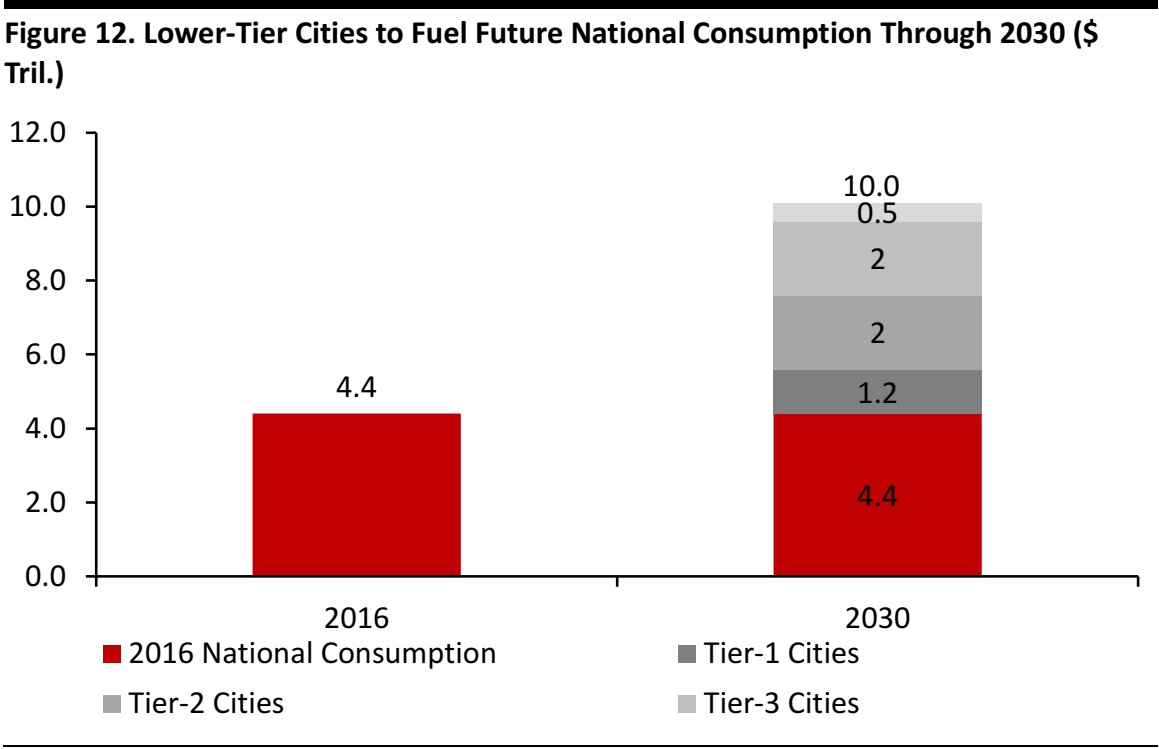

Lucrative Future Growth in Lower-Tier Cities

Pinduoduo is popular among consumers in lower-tier cities, and we expect continued spending in lower-tier cities to be a key driver of Pinduoduo’s growth. Our

Chinese tourist survey in 2017 found that spending by Chinese tourists from lower-tier cities was 10% higher than those from tier-one cities, indicating the consumption upgrade trend in lower-tier cities, despite that consumers there are more price-sensitive.

In addition, the population of lower-tier cities is expected to increase, particularly from the influx of talented workers from the growing middle class, as the governments of lower-tier cities unveil policies to attract young professionals who cannot afford to live in the tier-one cities.

Lower-tier cities are poised to become a significant growth driver of Chinese consumption through 2030, indicating a growing consumer market for Pinduoduo.

Source: NBS/Coresight Research

Source: NBS/Coresight Research

Key Takeaways

Despite the dominance of e-commerce giants Alibaba and JD.com, social e-commerce app Pinduoduo has seen remarkable growth in just three years to take a 5.2% share of the e-commerce market, as of April 2018. Pinduoduo’s rapid growth can be attributed to its social approach to e-commerce, as it encourages users to invite friends to take part in the shopping process and share with them to get better bargains.

Its success is also due to its strategy of targeting lower-tier cities in China, where consumers are price-sensitive and want a bargain. We view the growth in expected spending through to 2030 in lower-tier cities, where Pinduoduo is popular, as a major growth driver for the company.

Source: Pinduoduo/WeChat/Coresight Research

Source: Pinduoduo/WeChat/Coresight Research

Source: Pinduoduo/WeChat/Coresight Research

Source: Pinduoduo/WeChat/Coresight Research Source: Pinduoduo/WeChat/Coresight Research

Source: Pinduoduo/WeChat/Coresight Research Note: Includes products or services purchased online via any device, excludes travel and event tickets; excludes Hong Kong.

*Includes GMV for Tmall, Taobao marketplace and AliExpress Global on a calendar year basis.

Source: eMarketer, April 2018

Note: Includes products or services purchased online via any device, excludes travel and event tickets; excludes Hong Kong.

*Includes GMV for Tmall, Taobao marketplace and AliExpress Global on a calendar year basis.

Source: eMarketer, April 2018 Source: Pinduoduo/Coresight Research

Source: Pinduoduo/Coresight Research Source: Jiguang/WalktheChat/Coresight Research

Source: Jiguang/WalktheChat/Coresight Research Source: Jiguang

Source: Jiguang Source: NBS/Coresight Research

Source: NBS/Coresight Research