The Coffee Shop Industry in China

In 2017, coffee shop sales in China reached some ¥30 billion (US$4.4 billion),according to consultancy firm Qianzhan – and it expects the market to reach ¥1 trillion (US$145.9 billion) by 2025, representing an annual growth rate of 15-20%. Starbucks is the clear leader with a 58.6% market share according to Euromonitor International data cited by the

South China Morning Post. Luckin Coffee, which was founded in October 2017 and started building its physical coffee shop network only in 2018, is looking to take on Starbucks.

The Rapid Rise of Luckin Coffee

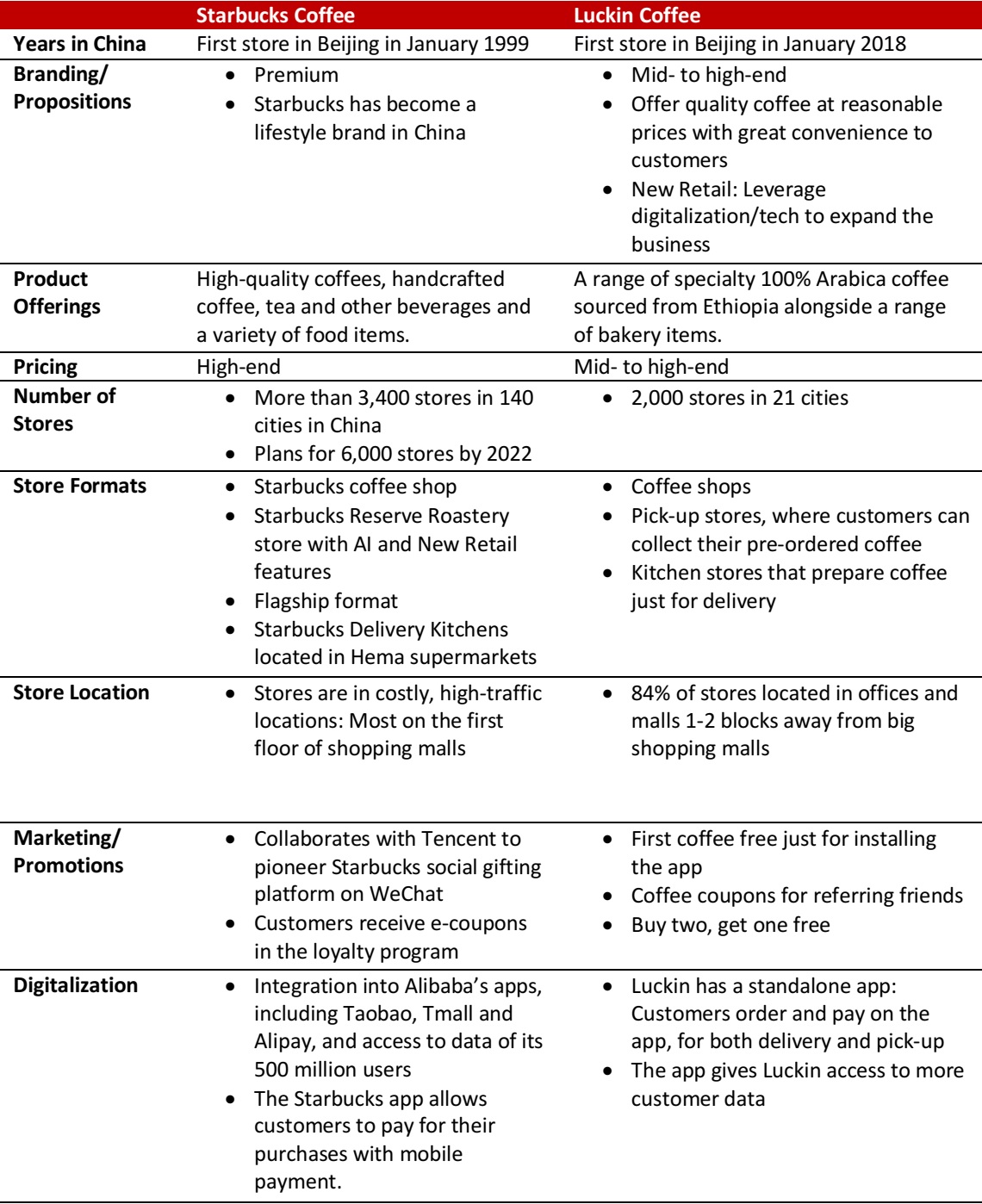

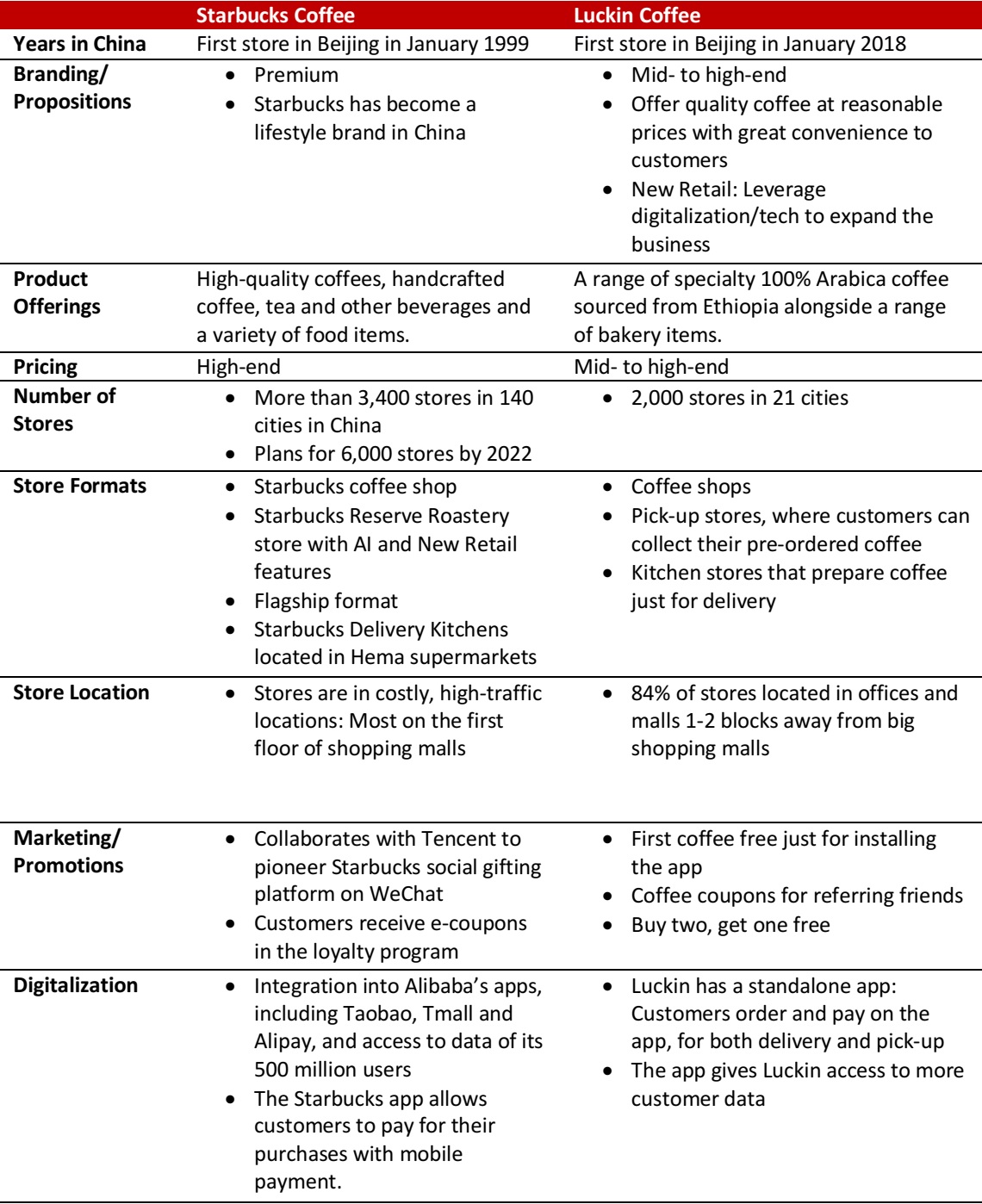

Luckin Coffee expanded quickly, going from zero to 2,000 stores in China in 2018.Pundits were surprised when Starbucks outlined plans to open a new store in China every 15 hours but Luckin Coffee is opening a new store every

four hours.Starbucks entered China in 1999 and currently has over 3,400 stores in 140 cities; it plans to have 6,000 stores by 2022.

Embracing New Retail is The Key of Luckin’s Success

In addition to its rapid expansion via physical stores, Luckin Coffee is leveraging “New Retail” and digitalization to support its breakneck expansion effort.

Luckin Coffee outlets do not accept cash: Customers can pay only with the Luckin app.

Customers can order via the Luckin Coffee mobile app and have coffee delivered in 30 minutes. And delivery is proving to be an integral part of the business: 40% of stores serve primarily as delivery kitchens to fulfil online orders. The company currently works with SF express to deliver its products, and is planning another deal with MeituanDianping to deliver coffee and other food products through Meituan’s delivery network in China.Consumers will also be able to order Luckin Coffee products on Meituan’s delivery app MeituanWaimai

.

Luckin Coffee is also leveraging digitalization to promote its brand. The coffee company offers extreme discounts to customers such as “buy two get one free” or even “buy five get five free” vouchers for customers who invite friends to buy coffee via the app.

Starbucks has carved out a position for itself at the premium, higher-priced end of the market, while LuckinCoffee caters to mid-tohigh-end customers. Luckin Coffee has avoided fighting head-to-head for the high-end and premium segment with Starbucks, as Starbucks has already built a strong brand name in coffee over its 20 years in the country. Instead, Luckin Coffee is combining digitalization and greater convenience at a lower price point to woo customers: A tall-sized latte costs ¥31 (US$4.5) in Starbucks but just ¥24 (US$3.5) at Luckin.

Starbucks Ups Its Game

In response to Luckin’s challenge, Starbucks is upping its game in China. In 2018, the company partnered with Ele.me to provide a delivery service, and says it plans to expand this service to more than 2,000 stores in 30 cities. To support an anticipated boom in delivery orders, Starbucks has expanded its kitchen stores by locating Starbucks delivery kitchens in Hema supermarkets, initially in two Hema stores (in Shanghai and Hangzhou) in late 2018.

Substantial Investment and Marketing Expenses to Fuel Growth

Luckin Coffee’s rapid expansion is clearly a challenge to Starbucks, but Luckin is burning through cash to fuel its rapid expansion: The company reportedly lost¥857 million (US$124 million) from January to September 2018, according to a Sina Technology report.The company entered the market with an initial investment of over ¥1 billion (US$145.9 million). The bulk of that startup money was spent on celebrity endorsement, plastering cities with billboards, waging heavy initial subsidies and discounts to court new customers, and of course setting up shops across the country. So far, despite ongoing losses, the company is acquiring a solid customer base: The company says that it sold over 85 million cups of coffee in 2018 and it has a customer base of more than 12 million.

How long can Luckin continue to burn cash as it seeks to grab a piece of the lucrative coffee pie in China? So far, it seems able to continue raising VC funding: It raised $200 million in a Series A issue in July 2018, and $200 million in a Series B round in December 2018. The company says it is now valued at $2 billion.

Is China Big Enough for Both?

It is too soon to say whether Luckin Coffee will be successful in its bid to challenge Starbucks. Luckin’s expansion has been astonishing, its price points are more appealing and its delivery service has filled an unmet need. Starbucks is responding with a delivery service of its own, and continues to rely on its more upmarket position to justify higher prices. That said, the average Chinese consumer drank just five cups of coffee last year while the average American drank about 400.If China’s coffee market continues to expand, there may be room for two big coffee purveyors.