DIpil Das

“Re-commerce” is the process of buying and selling previously owned secondhand goods, sometimes pristine and new, or more often, gently used. In recent years, numerous startups have emerged to facilitate the consignment process.

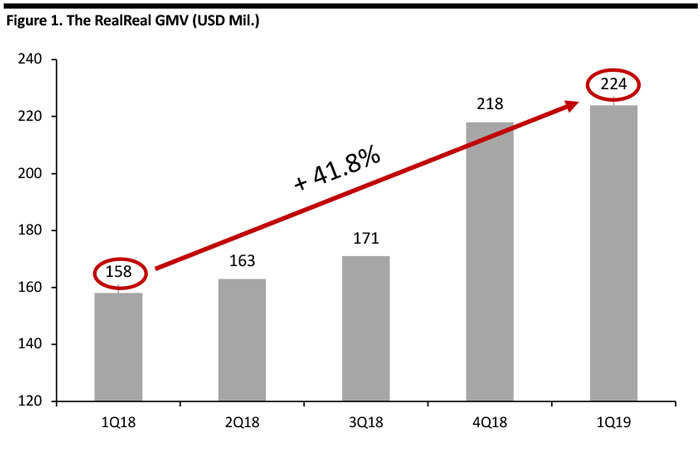

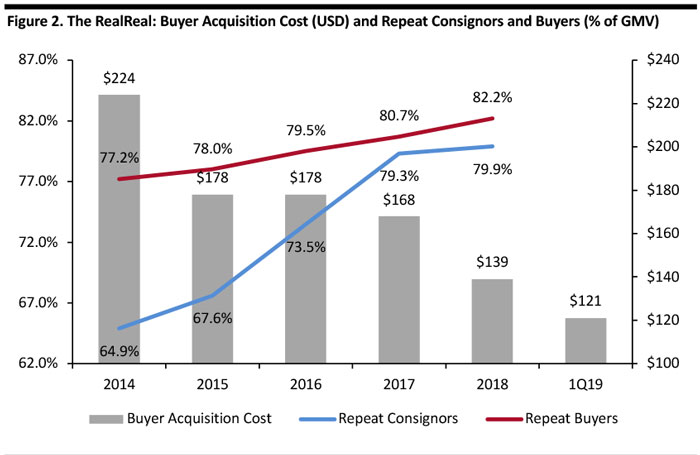

The RealReal is an online marketplace for consigned luxury goods in various categories. The company filed for an IPO in May 2019 and went public on the NASDAQ under the symbol REAL on June 28, 2019. The firm raised $300 million at $20 per share. The stock rose 44.5% to $28.9 per share in its first day of trading, pushing the company’s market capitalization above $2 billion. The company reported 1Q19 GMV of $224 million, up 41.8% year over year. In 2018, GMV increased 44% to $711 million. Since inception, the company has sold a total of 9.4 million items and topped $1 billion in cumulative gross merchandise volume (GMV) on the platform since 2017. The RealReal also reported that approximately 80% of the consignments on the marketplace were sold within 90 days and the sell-through ratio was 96% in 2018. [caption id="attachment_92082" align="aligncenter" width="700"] Source: The RealReal/Coresight Research[/caption]

Unlike other resale marketplaces, The RealReal authenticates consignments before accepting them. After authentication, the company handles the selling process, including photograph, price, fulfillment and returns logistics. For sellers, The RealReal offers sellers the option of the following consignment methods:

Source: The RealReal/Coresight Research[/caption]

Unlike other resale marketplaces, The RealReal authenticates consignments before accepting them. After authentication, the company handles the selling process, including photograph, price, fulfillment and returns logistics. For sellers, The RealReal offers sellers the option of the following consignment methods:

- White Glove in-home consultation and pickup.

- Drop off at one of eleven consignment locations.

- Complimentary shipping directly to fulfillment facilities.

Source: The RealReal[/caption]

The RealReal launched its first retail stores in SoHo, New York, in 2017, and in Los Angeles in 2018. The company opened another retail store in New York in 2019 and intends to open more in the future. The company has 11 luxury consignment offices, including the retail locations. Its IPO filing shows the SoHo store generated $2,450 in GMV per square foot in 2018, close to Tiffany’s $2,800 sales per gross square foot in company-operated stores in 2018.

June 2019 turned out to be a big month for re-commerce companies: Vestiaire Collective, a France-based social re-commerce platform that authenticates merchandise before listing, raised $45 million in June 2019. In addition, StockX, the world’s first stock market for sneakers, raised $110 million for a $1 billion valuation in June 2019. This Detroit-based company serves as a live auction marketplace where buyers can bid for a specific product which are authenticated before finalizing the transaction.

Coresight Research will publish a more in-depth report on re-commerce in the coming weeks – stay tuned.

Source: The RealReal[/caption]

The RealReal launched its first retail stores in SoHo, New York, in 2017, and in Los Angeles in 2018. The company opened another retail store in New York in 2019 and intends to open more in the future. The company has 11 luxury consignment offices, including the retail locations. Its IPO filing shows the SoHo store generated $2,450 in GMV per square foot in 2018, close to Tiffany’s $2,800 sales per gross square foot in company-operated stores in 2018.

June 2019 turned out to be a big month for re-commerce companies: Vestiaire Collective, a France-based social re-commerce platform that authenticates merchandise before listing, raised $45 million in June 2019. In addition, StockX, the world’s first stock market for sneakers, raised $110 million for a $1 billion valuation in June 2019. This Detroit-based company serves as a live auction marketplace where buyers can bid for a specific product which are authenticated before finalizing the transaction.

Coresight Research will publish a more in-depth report on re-commerce in the coming weeks – stay tuned.