Nitheesh NH

Sector: E-commerce

Country of operation: US

Key product categories: Luxury apparel, footwear and accessories

Annual Metrics

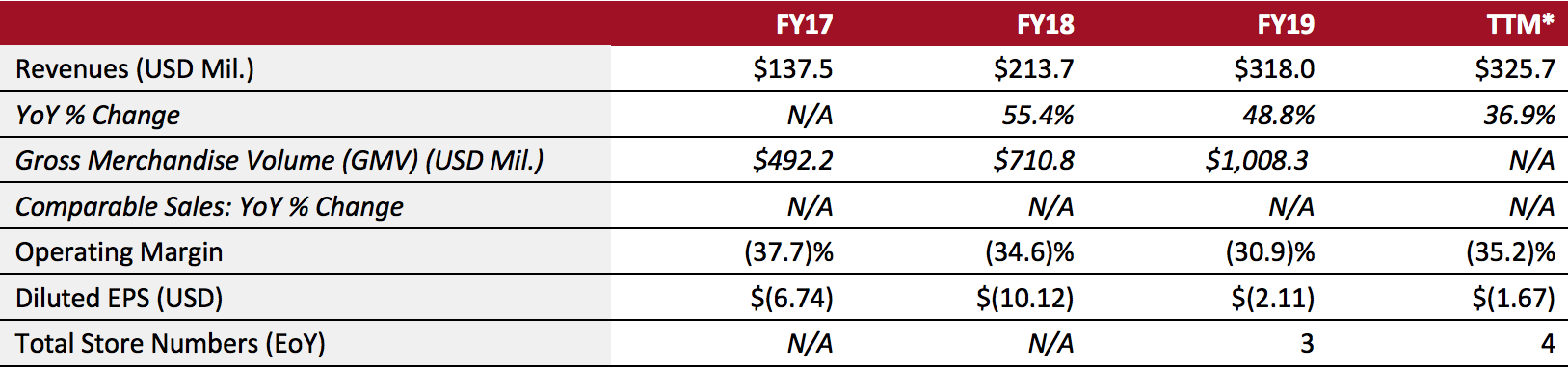

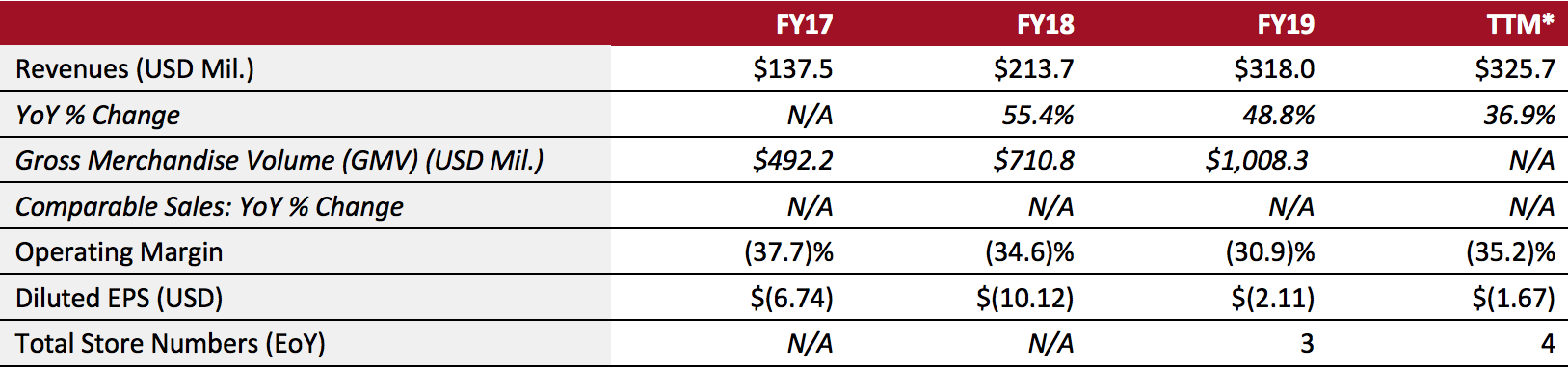

[caption id="attachment_114079" align="aligncenter" width="700"] Fiscal year ends on December 31

Fiscal year ends on December 31

*Trailing 12 months ended March 31, 2020.[/caption] Summary The RealReal operates as an online marketplace for consigned luxury goods. It sells pre-owned products, including fashion, jewelry and watches for men, women and kids—as well as home and art products. The company holds inventory, and has a merchandising team, authentication specialists and gemologists to evaluate and authenticate items before selling to customers. The company was founded in 2011 and is headquartered in San Francisco, California. It went public in June 2019. Company Analysis Coresight Research insight: Resale has taken off in recent years—experiencing bigger growth than mainstream, subscription or rental. According to Coresight Research’s online survey of 1,934 US consumers published in February 2020, 29.8% of respondents reported making a purchase on resale platforms in the past 12 months, compared to subscription (17.0%) and rental (10.9%). The RealReal is a main player in the luxury resale industry. The company’s strategy centers around attracting new buyers and consigners, as well as investing in automation to improve operational efficiency, including copywriting and pricing. However, in November 2019 the company was subject to complaints regarding counterfeit goods and damaged products. Chanel also sued the company for selling fake Chanel products in November 2018. Relying on consumer’s directly to meet its inventory needs poses a high risk for the company and ensuring sufficient supplies to meet consumers’ diverse needs still poses a significant challenge as consumers increasingly utilize other resale platforms and stores to sell goods.

Strategy:

1. Generate sufficient supplies

Management Team

Julie Wainwright—Founder, President, CEO and Chairperson

Matthew Gustke—CFO

Rati Sahi—COO and Head of Merchandising

Fredrik Björk—CTO

Todd A. Suko—Chief Legal Officer

Fiscal year ends on December 31

Fiscal year ends on December 31*Trailing 12 months ended March 31, 2020.[/caption] Summary The RealReal operates as an online marketplace for consigned luxury goods. It sells pre-owned products, including fashion, jewelry and watches for men, women and kids—as well as home and art products. The company holds inventory, and has a merchandising team, authentication specialists and gemologists to evaluate and authenticate items before selling to customers. The company was founded in 2011 and is headquartered in San Francisco, California. It went public in June 2019. Company Analysis Coresight Research insight: Resale has taken off in recent years—experiencing bigger growth than mainstream, subscription or rental. According to Coresight Research’s online survey of 1,934 US consumers published in February 2020, 29.8% of respondents reported making a purchase on resale platforms in the past 12 months, compared to subscription (17.0%) and rental (10.9%). The RealReal is a main player in the luxury resale industry. The company’s strategy centers around attracting new buyers and consigners, as well as investing in automation to improve operational efficiency, including copywriting and pricing. However, in November 2019 the company was subject to complaints regarding counterfeit goods and damaged products. Chanel also sued the company for selling fake Chanel products in November 2018. Relying on consumer’s directly to meet its inventory needs poses a high risk for the company and ensuring sufficient supplies to meet consumers’ diverse needs still poses a significant challenge as consumers increasingly utilize other resale platforms and stores to sell goods.

| Tailwinds | Headwinds |

|

|

a. Continuous efforts to acquire and retain consignors.

2. Increase penetration in existing categoriesa. Build on the strong performance in the women’s category.

b. Improve penetration in categories such as men’s jewelry and watches, and home and art products.

3. Continue to invest in innovation and infrastructurea. Continue to optimize merchandising operations and automation capabilities regarding pricing, authentication, photo-editing and copy writing.

b. Invest in fulfillment facilities and logistics infrastructure to optimize SKU processing.

4. Add growtha. Strategically expand offline.

b. Grow the company’s international presence.

The RealReal aims to drive innovation across its supply chain from acquiring and retaining consignors, to upgrading its infrastructure for warehousing and logistics. The company is also looking to expand into offline stores, offering consigners and consumers a seamless in-store experience. Company Developments| Date | Development |

| May 22, 2020 | The RealReal hires Todd Suko as Chief Legal Officer and Secretary. |

| May 8, 2020 | The RealReal’s total revenue rose 11% year-over-year in the first quarter of 2020, with gross merchandise value (GMV) up 15%. Repeated buyers accounted for 84.4% of GMV, up 2% year-over-year. |

| May 7, 2020 | The RealReal uses virtual video calls to conduct its consignment jobs. |

| April 15, 2020 | The Real Real’s GMV plummets around 40% to 45% year-over-year from March 17 to mid-April. |

| April 14, 2020 | The RealReal lays off 10% and furloughs 15% of its employees, respectively. As of December 31, 2020, the company had 2,353 full-time employees. |

| March 17, 2020 | The RealReal withdraws its 2020 business outlook and closes its e-commerce center in Brisbane, California due to Covid-19. |

| March 6, 2020 | The RealReal opens a new flagship store in San Francisco. |

Source: Company reports/S&P Capital IQ