Web Developers

We are living in a golden age of consumer data. Retailers and brands now have access to technology that can track a customer's every move, both online and offline. Data-driven insights can be used to understand and influence choices at each stage of the consumer’s shopping journey.

In the highly competitive retail sector, managements are often told that they cannot afford to lose out on the data revolution. And so it seems. Retailers are using data technologies to monitor competitor pricing in real time, and to detect returns fraud and credit-card fraud earlier than before. Data also inform store designs, test products and measure interactions between customers and staff in ways that drive efficiency and allows for better business decision-making.

The increasing ease of collecting consumer data and the advancing technology that uses numeric and geo-location data to build consumer profiles makes consumer insights much more accessible to retailers.

Images, video and text data are also analyzed to inform all facets of a retail operation. However, because of certain legal and ethical boundaries, many retailers may decide not to pursue all of the analytics that are technologically possible.

The increasing ease of collecting consumer data and the advancing technology that uses numeric and geo-location data to build consumer profiles makes consumer insights much more accessible to retailers.

Images, video and text data are also analyzed to inform all facets of a retail operation. However, because of certain legal and ethical boundaries, many retailers may decide not to pursue all of the analytics that are technologically possible.

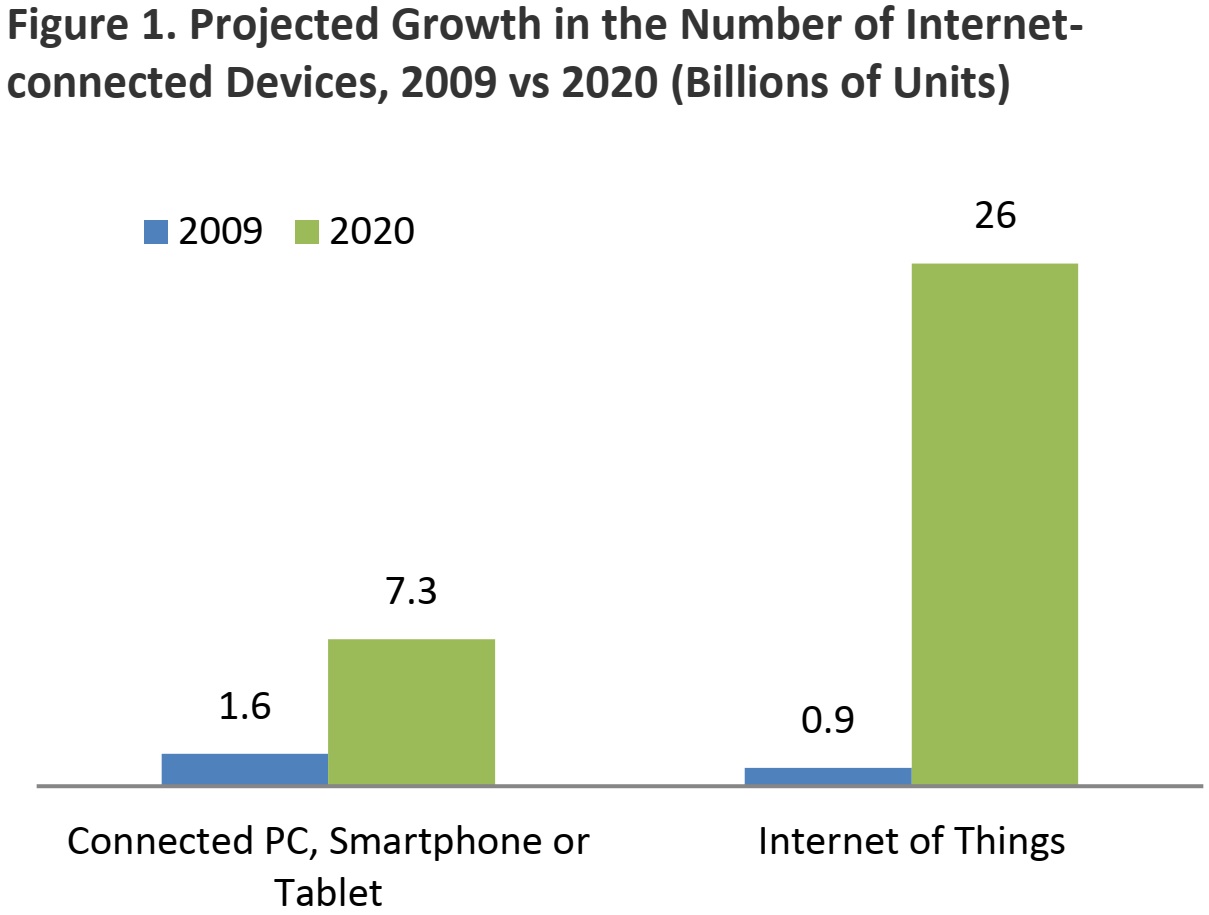

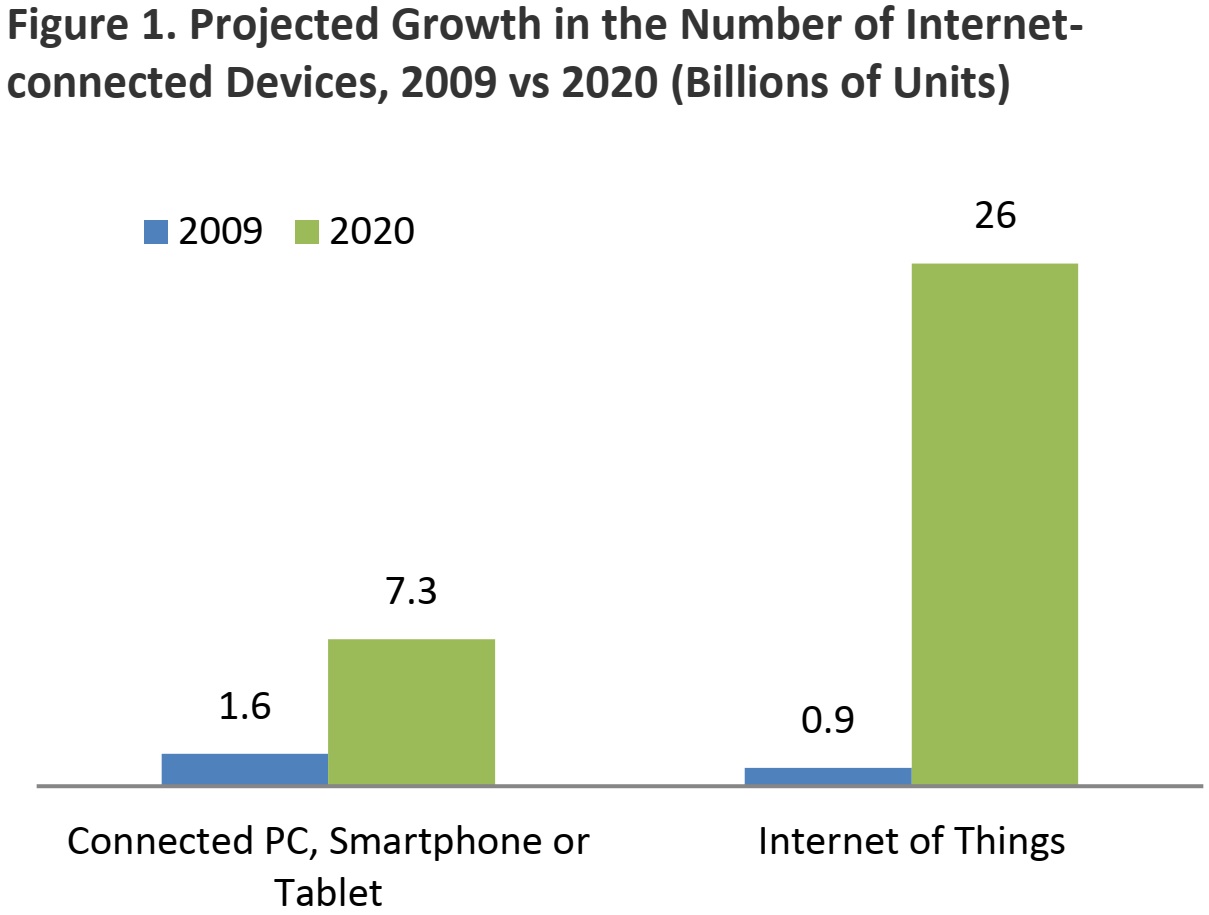

Internet of Things Brings New Challenges

Consumer data-mining will only become more important with the rise of the Internet of Things (IoT). Smartphones are now packed with sensors that collect all kinds of data. The iPhone 6 has 10 sensors and the Samsung Galaxy Note 5 has 11, up from the three sensors in the first-generation iPhone launched in 2007. IoT devices, which are everyday objects equipped with computing capabilities and connected to the Internet, are on the cusp of a meteoric rise over the next few years. According to Gartner, there will be 26 billion IoT devices by 2020, up from 0.9 billion in 2009 (Figure 1). Cisco is even more bullish, projecting 50 billion devices by 2020, versus an estimated 15 billion in 2015. Until recently, the challenge facing the retail sector, with all of its in-store sensors and online sales channels, was how to most efficiently gather data to better understand consumer demand. Now their greatest challenge is how to use the vast amounts of data to personalize, customize and localize the shopping experience—and how to make that a competitive edge.

Data-Driven Personalization a Double-Edged Sword

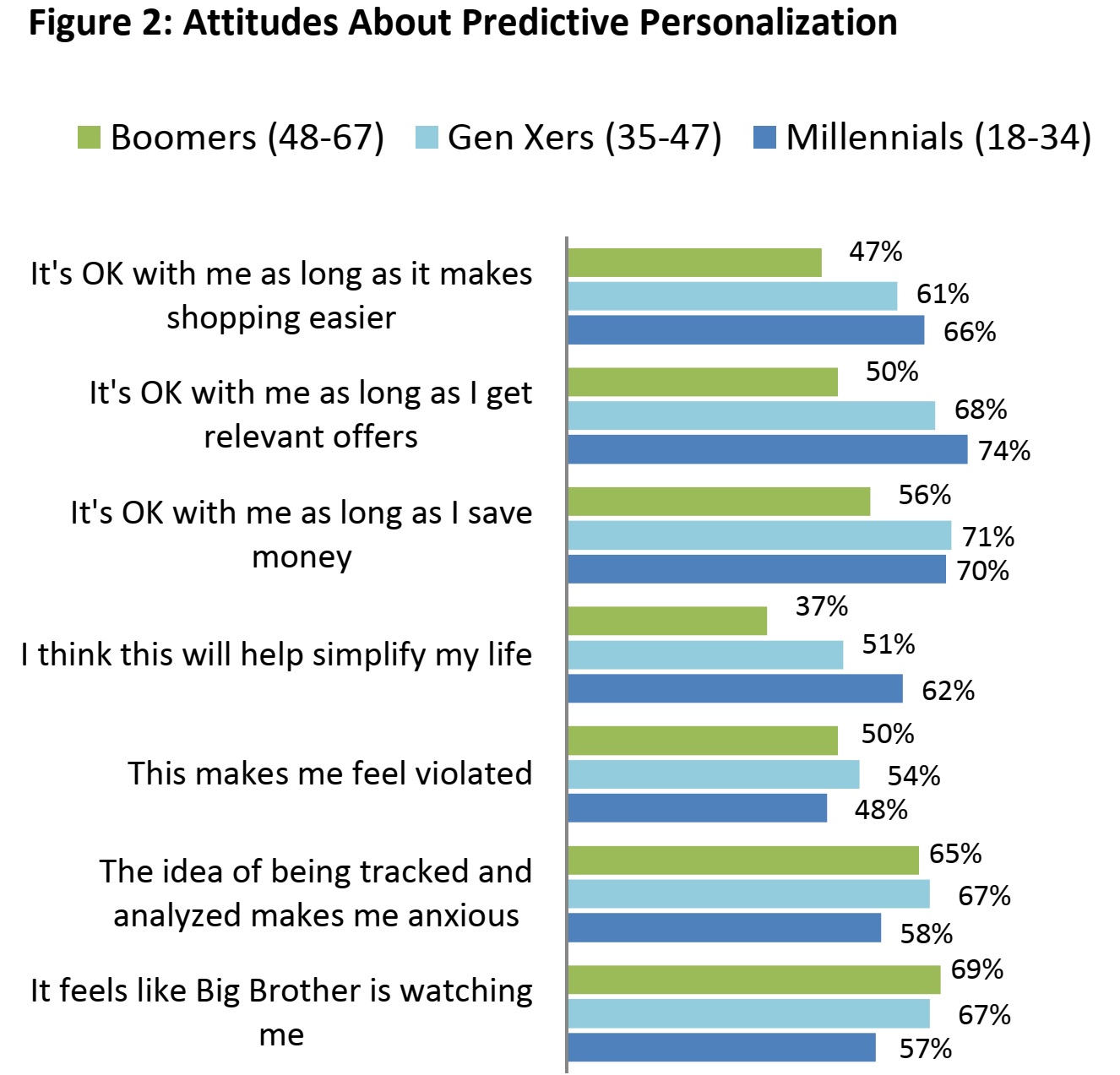

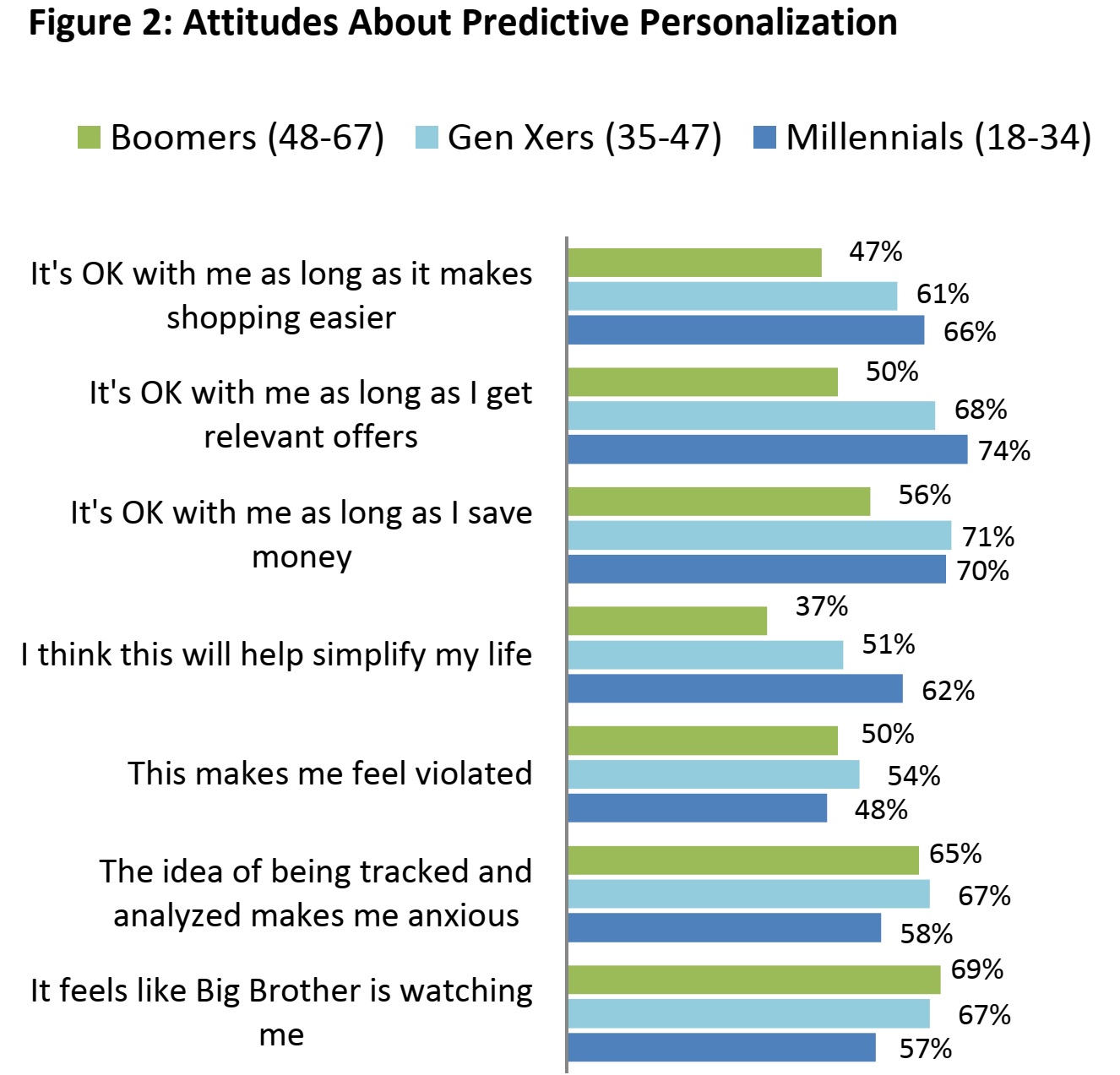

But, despite its enormous usefulness, data-mining can be a double-edged sword. Increasingly, consumers have awakened to how retailers and data brokers are tracking their online lives and offline behaviors—and they don’t like it. The potential consumer backlash is a reputational risk that retailers cannot afford to ignore. In a recent survey conducted by JWTIntelligence, the research arm of marketing agency JWT, nearly two-thirds of respondents said the idea of customized offerings gleaned through data analysis feels like Big Brother is watching and that the idea of being tracked and analyzed makes them anxious. But a majority said they are OK with the idea if they receive a tangible benefit in return, such as saving money, seeing relevant offers or increased convenience. Attitudes towards data-driven personalization or predictive personalization differ significantly across age groups.

Source: JWTIntelligence

UK supermarket giant Tesco also provides a cautionary tale. The chain’s customer loyalty card was considered a major retail innovation when it was introduced two decades ago. Its data analytics arm, Dunnhumby, grew globally and is now valued at around £2 billion. But in a world of frequent data hacks and growing consumer concerns about data privacy and identify theft, sentiment turned against Tesco as customers began to perceive the loyalty program as overly gimmicky and felt that Tesco got more out of the program than they did. Tesco’s analytics haven’t been able to reverse market-share losses over the past several years to discount convenience chains Aldi and Lidl, which offer significantly lower prices than the traditional UK supermarkets.

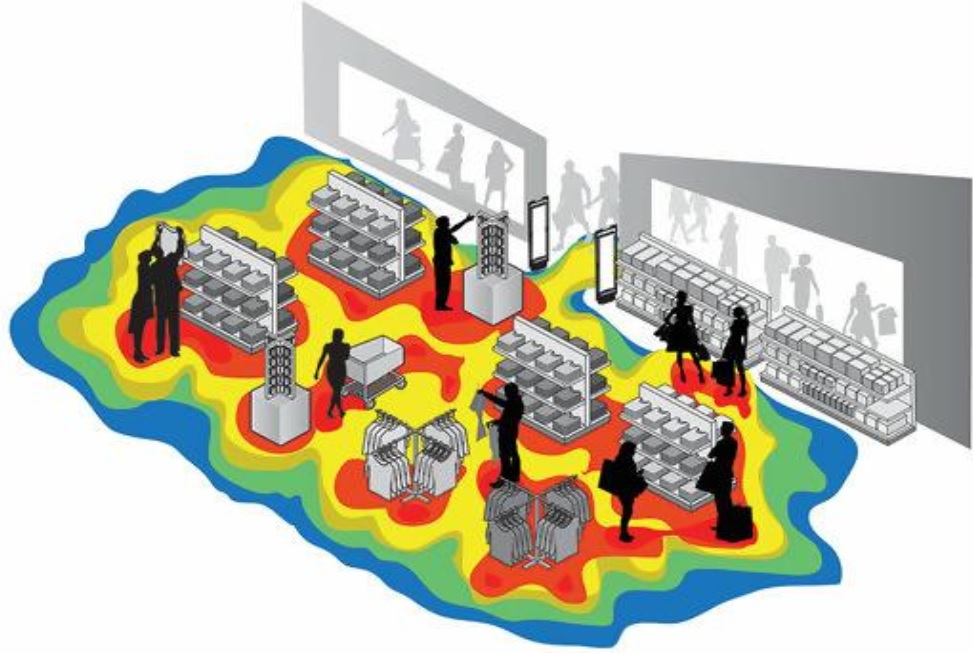

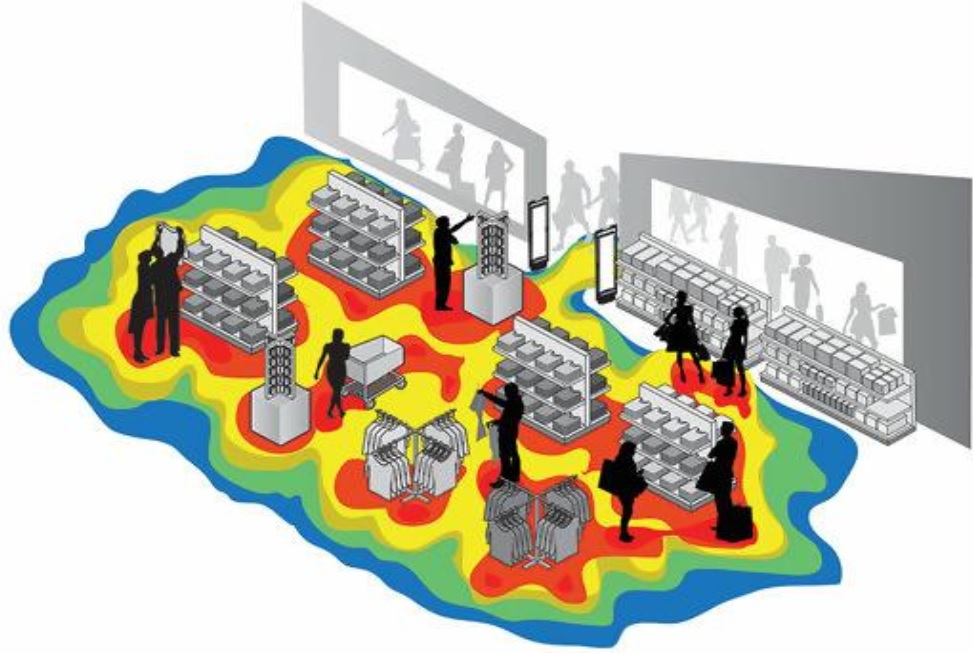

Source: Tyco Retail Solutions

Opportunities: Nuggets of Insights

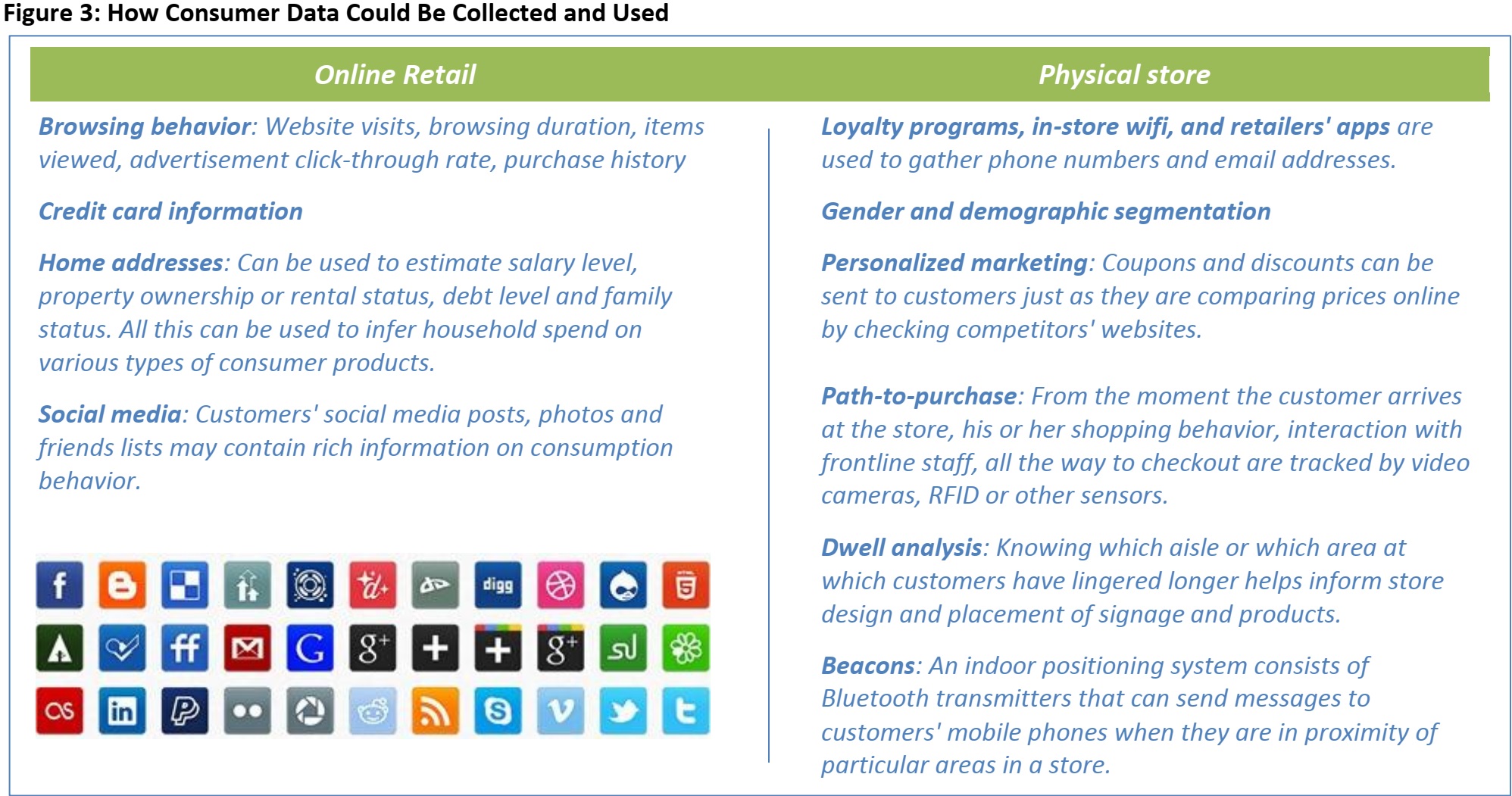

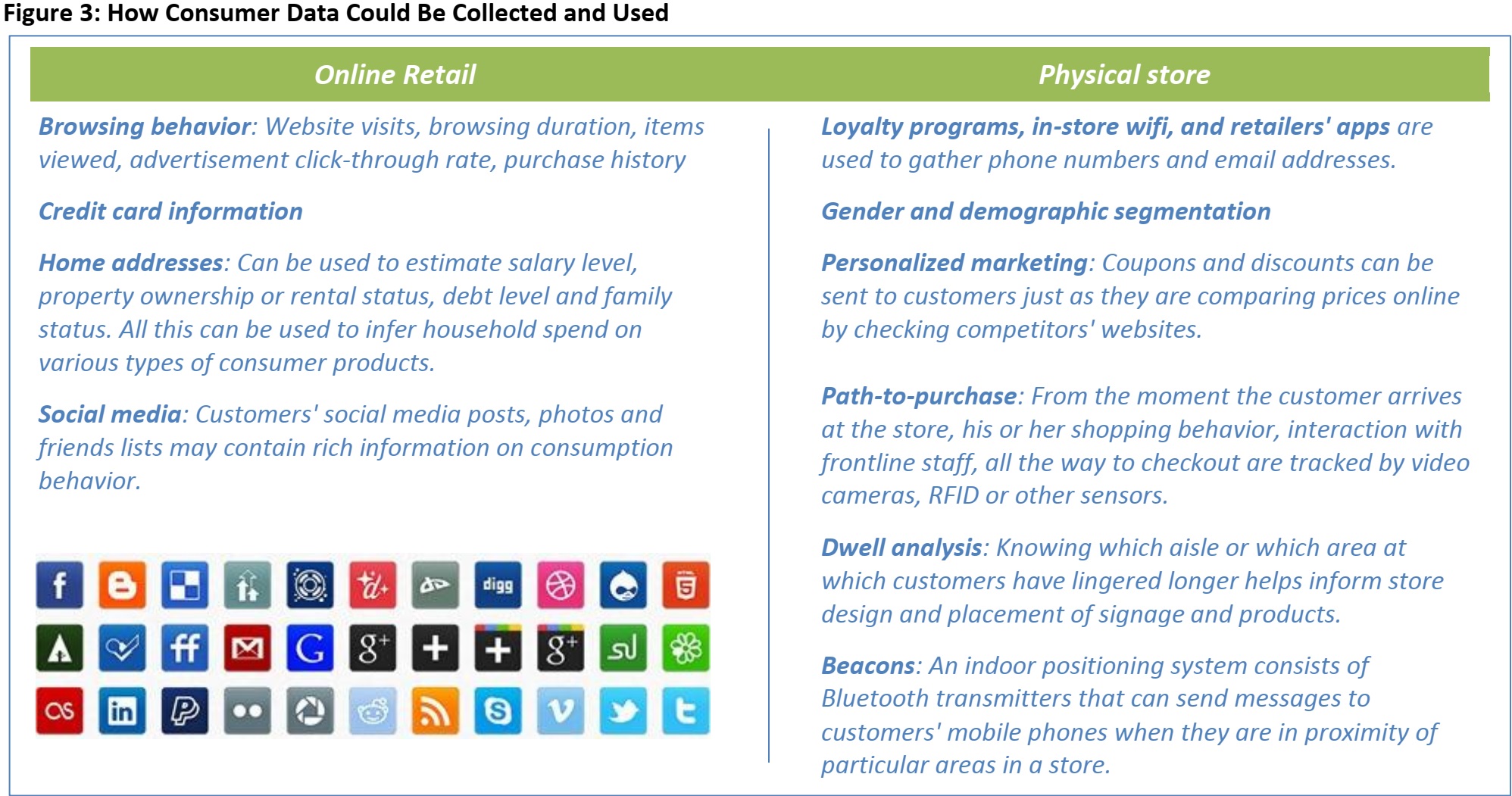

Brick-and-mortar stores were once considered disadvantaged compared to their online counterparts when it came to collecting data for analyzing consumer behaviors. Not anymore. Retailers now have a host of data-collection methods and metrics available to them. Of course, each retailer may choose how aggressively or how extensively they adopt a data-driven approach. Whereas in the past retailers and brands might have relied on “gut feelings” or reports from a marketing research firm to make all kinds of business decisions, they can now use data analytics more directly to better understand customers and develop ways to serve them more effectively. Personalized Shopping Experiences Burberry, for example, is using data analytics to provide its customers with a highly personalized shopping experience. In its flagship store in London, an interactive product video is triggered when a customer picks up an item that is fitted with a radio-frequency-identification (RFID) tag. Shoppers' profiles are developed based on garments customers have tried on. The sophisticated data system pulls in data from social media, cross-referenced with the customers' purchase history. This enables salespeople to greet each customer by name and to know a few details about that customer’s previous purchases. Using Data to Strengthen Customer Loyalty Data generated from customer loyalty cards are now fed through pattern-recognition algorithms to uncover new and unexpected insights. For example, UK supermarket Sainsbury's discovered that the cereal brand Grape-Nuts was worth stocking—despite weak sales— because shoppers who bought it were extremely loyal to Sainsbury's and were often big spenders. The chain was also encouraged to buy the 50% of Sainsbury's Bank it didn't already own after seeing data showing that customers who were loyal to the bank also tended to spend more in Sainsbury’s stores and were particularly loyal to the brand overall. Leveraging Instagram for Online Retail Photos shared on social media can be rich in information for retailers and brands. Michael Kors has amassed 3.1 million Instagram followers, beating Burberry (2.25 million), Prada (2 million) and other competitors. Instagram followers and their photos are of enormous value for boosting sales conversion and market research. Instagram doesn’t make it easy to sell items on its site. To work around that obstacle, Michael Kors asks its Instagram fans to register for its program (known as #InstaKors) with an email address. When fans “like” a photo, the company sends a direct link to that email, to encourage the fan to purchase the item. Retailers and brands can also extract valuable market research about their customers from these photo-swapping sites by analyzing the context in which their products or competitors' products are used and working that information into their marketing strategies. In-the-Mood-for-Shopping Detection The technology already exists for cameras to detect customers' facial expressions, matched with whatever items they are looking at in the store—though it is not extensively adopted, possibly for fear of consumer backlash. Synqera, a start-up in St Petersburg, Russia, sells software for checkout devices or computers that tailors marketing messages to the customer's age, gender and mood, as detected by facial-recognition technology. "If you are an angry man of 30, and it is Friday evening, it may offer you a bottle of whiskey," Ekaterina Savchenko, the company’s head of marketing told the New York Times. Other facial-recognition systems consist of a face-detection and database-lookup engine. NEC IT Solutions, one of the leading providers of facial-recognition products for the retail sector, originally developed the technology for identifying terrorists. The latest NEC software is used for recognizing VIPs or celebrities in real time as they walk into the store. Meanwhile in the UK, Yum Brands-owned Pizza Hut launched a "subconscious menu," which uses eye detection technology. When customers look at a menu showing the pictures of 20 pizza toppings on a tablet screen, a camera detects within 2.5 seconds which topping is being viewed the most, and recommends it. This might sound like a marketing gimmick, but it shows how the technology has matured and how easily it can be used in all kinds of in-store environments. The table below summarizes various ways consumer data can be collected online and offline, and what kind of insights retailers might be able to draw from such data. The increasing ease of collecting consumer data and the advancing technology that uses numeric and geo-location data to build consumer profiles makes consumer insights much more accessible to retailers.

Images, video and text data are also analyzed to inform all facets of a retail operation. However, because of certain legal and ethical boundaries, many retailers may decide not to pursue all of the analytics that are technologically possible.

The increasing ease of collecting consumer data and the advancing technology that uses numeric and geo-location data to build consumer profiles makes consumer insights much more accessible to retailers.

Images, video and text data are also analyzed to inform all facets of a retail operation. However, because of certain legal and ethical boundaries, many retailers may decide not to pursue all of the analytics that are technologically possible.

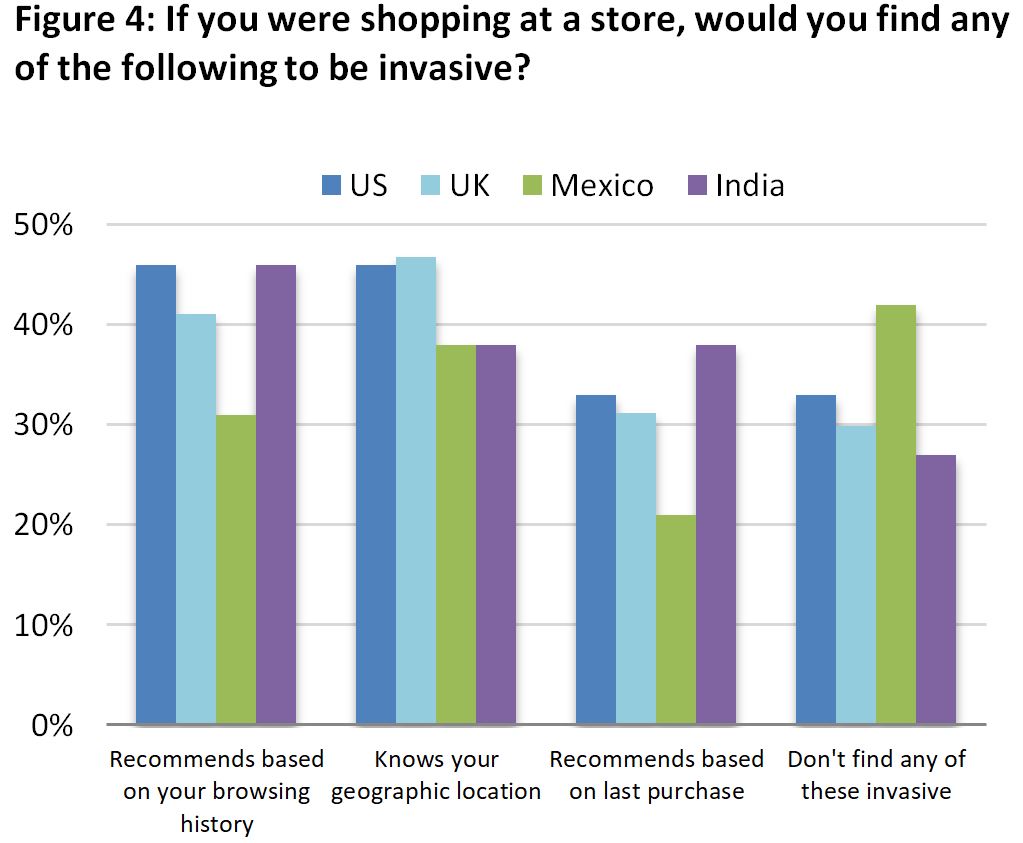

The Downsides: The Creepiness Factor

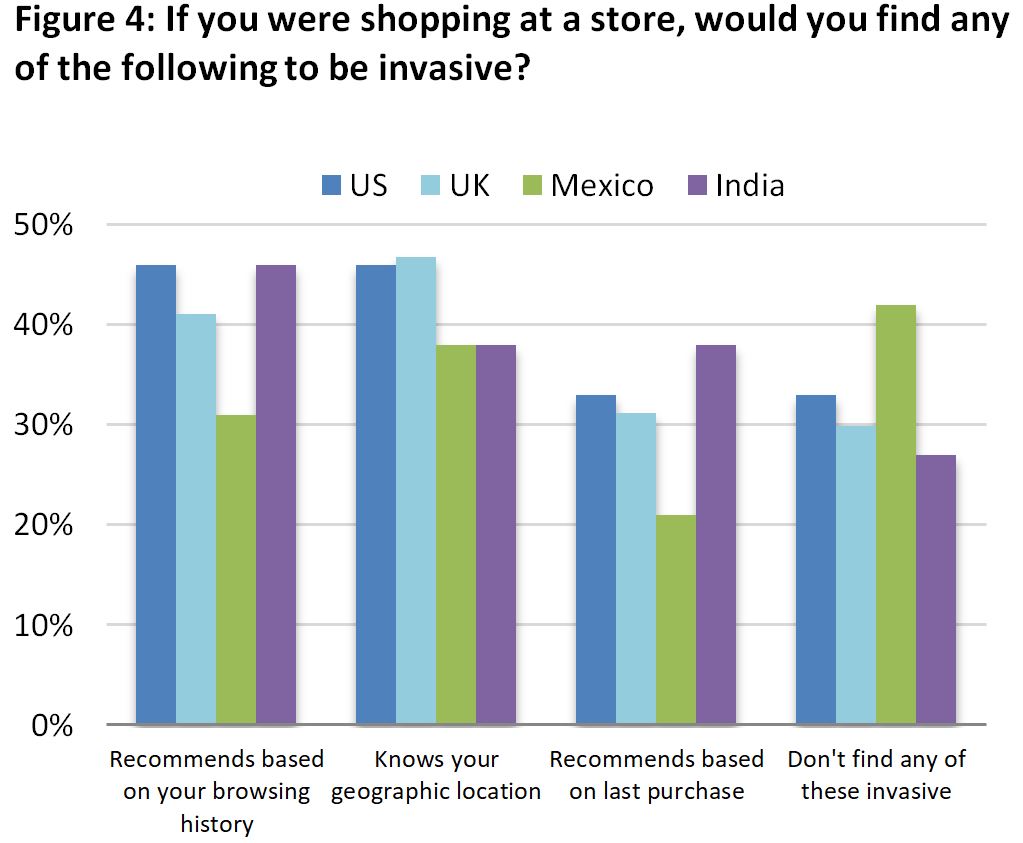

When retailers are perceived to be overstepping privacy boundaries, it can unleash public relations firestorms, even though they are simply on a quest to learn more about their customers. This is a major dilemma facing the retail industry when it comes to big data. On one hand, competitive pressures are forcing retailers to invest heavily in data analytics and, of course, they want to extract maximum value from the data. On the other hand, retailers have to move cautiously in using those insights to make sure that what they do is acceptable to customers. Sara Watson, a fellow at the Berkman Center for Internet and Society at Harvard and a technology critic, warns retailers to carefully gauge their data-driven customer-engagement strategies for the “creepiness factor.” For instance, with loyalty programs, consumers are increasingly realizing that they are giving up their personal data in exchange for discounts. For these programs to be successful, retailers need to build trust and provide a recognizable value to customers, thus completing their end of the bargain. Transparency and keeping an open dialogue with customers are critical in this regard, she says. The latest IT Risk/Reward Barometer from the Information Systems Audit & Control Association (ISACA) shows that consumers around the world have grown increasingly wary of data-driven personalization. For example, 46% of the US respondents find promotional text messages sent to them as they walk past a store invasive, and 40% have similar feelings towards online recommendations based on browsing history (Figures 4 and 5).

Source: IT Risk/Reward Barometer 2013, Information Systems Audit & Control Association

Data Leakage – Controlling Third Parties Data leakage is another concern contributing to the creepiness factor. With the frequency of IT security breaches (Figure 4), retailers may need to double up their protection of the troves of consumer data they possess. Making sure third-party data transactions are secure will also prove challenging. In June, Reuters was attacked through Taboola, a third-party advertising platform that is part of the Reuters website. Hackers from a propaganda group (known as the Syrian Electronic Army) redirected visitors intending to read some Reuters articles to a defacement page that berated news organizations for "fake reports and false articles about Syria." The attackers did not breach Reuters network, but modified a content widget provided by Taboola, which allows media sites to monetize page views. The hackers had fooled one Taboola employee to give up his/her password, which was then used to alter the content widget. The Death of Anonymity – The Case of New York Cabs Consumers have found it hard to accept that anonymity does not exist anymore. Even when datasets are anonymized, others can de-anonymize it by taking relatively simple steps. In March, a large anonymized dataset showing 174 million cab rides in New York City in 2013 was released under the New York State's Freedom of Information Law. By September, programmers were able to show how much celebrities tipped by matching photos of celebrities taking taxis in New York. In one case, a diligent intern at a data analytics firm was able to search the database for early-morning pickups outside Larry Flynt's Hustler Club in New York City, and was able to discern where some of the club’s best customers lived. A bit more digging would have enabled him to discover their names. As retailers collect richer and more detailed data about their customers, it will become more difficult to protect consumer anonymity. Even data segments that in themselves may seem innocuous could reveal much more private information when merged and analyzed together with other datasets or information sources. Regulatory Changes Ahead For retailers that operate globally, it is also important to note that attitudes about data protection are different in Europe. This is reflected in the EU's privacy directive, which is expected to be passed in the next few months country, will mandate the reporting of all data security breaches and allow individuals the right to be "forgotten" online. For example, when switching to a and will take effect in 2016. The new EU law, which lay down requirements that must be enforced in every EU new mobile phone company, a consumer can ask his old phone company to delete all previous call data. It is a moot point whether US regulations will be heading in the same direction. Regulators in the US recently cracked down on a pair of data brokers for violating consumer protection laws. The Federal Trade Commission (FTC) announced legal settlements in September with two data brokers for violations of the Fair Credit Reporting Act. The web site Instant Checkmate and InfoTrack Information Services both agreed to pay civil fines and permanent injunctions against continuing their alleged illegal practices. FTC Chairwoman Edith Ramirez has said that the agency is examining how existing privacy and other laws apply to big data practices and whether gaps exist in the current privacy law framework. The Washington-based Electronic Frontier Foundation posted a blog detailing wireless giant Verizon’s use of "perma-cookies" to track customers’ web visits from mobile phones. That consumer data "allows third-party advertisers and web sites to assemble a deep, permanent profile of visitors’ web browsing habits without their consent," the privacy group claimed. In February, the House of Representatives sent the Personal Data Protection and Breach Accountability Act of 2014 to the Senate, but it is unclear how far it will go. Regulations aside, the main deterrent against misusing data will be potential for customer resistance and the loss of trust.CONCLUSION: