Nitheesh NH

China Is a Promising Market for Plus-Size Clothing

China has a relatively low rate of obesity, but the sheer size of the country’s population means the absolute number of plus-size female consumers in China is substantial. Some 6.5% of China’s total adult female population (aged 18+) were obese in 2016, according to the World Health Organization. China’s adult female population (aged 15+) stood at 563 million in 2018 according to the CIA World Factbook. These figures imply an adult female population classified as obese of around 36.6 million.

China’s total population is expected to increase by 200 million between 2016 and 2020, according to CEIC Data, a company that compiles and updates global economic and financial information. Assuming a constant female obesity rate of 6.5% and an equal gender split, this would equate to an increase of 6.5 million in the female population classified as obese, taking the total to 43.0 million.

Compared with the US, which has a well-served plus-size market, there is still significant white space in China.

A Potential $10 Billion Market

Data on the Chinese women’s plus-size market are thin on the ground, but we provide our estimates below of the current and potential market value. Our estimates factor in the following: The total market size for women’s clothing in China; the proportion of the female population that is classified as obese; and data from our 2018 report US Plus-Size Apparel: Reviewing the $46 Billion Opportunity, which suggested the plus-size market underindexes relative to the share of the population accounted for by women classified as obese.

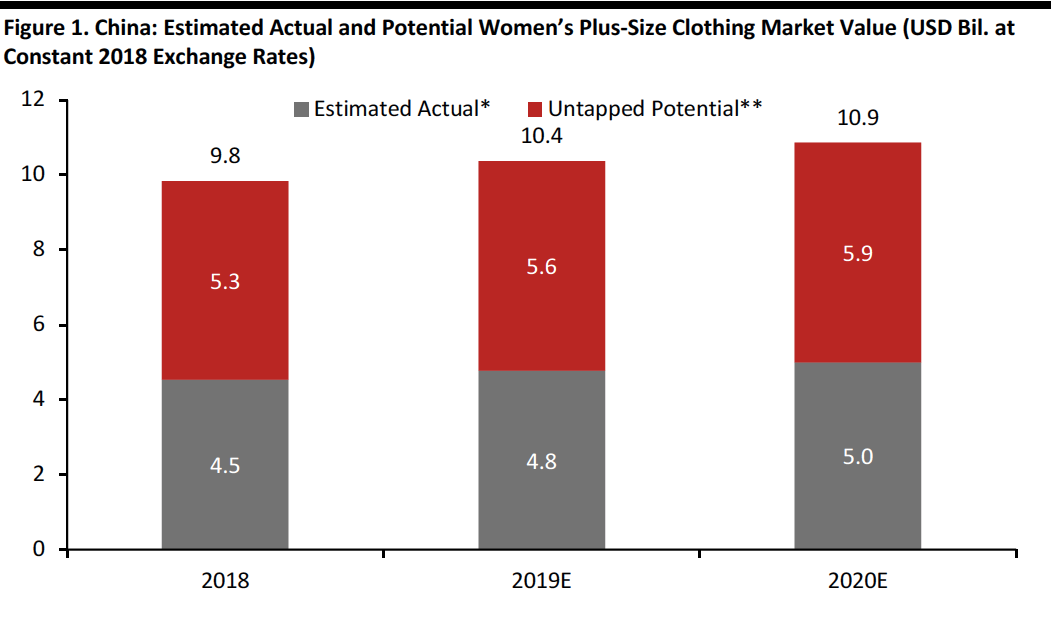

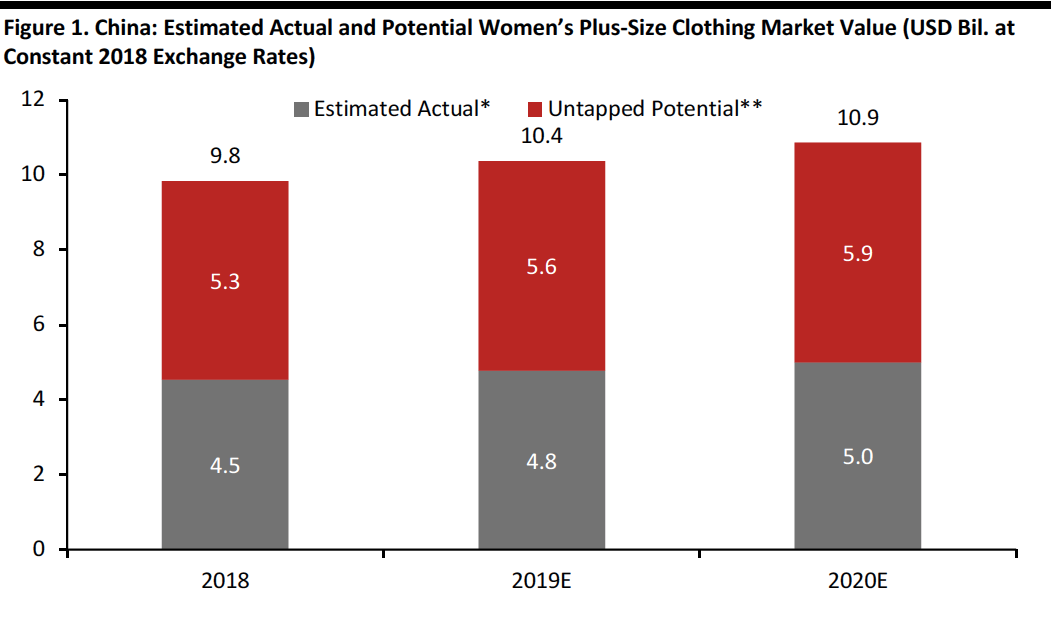

In the chart below, we provide the following estimates:

The total potential market value is based on the plus-size market capturing a share of the women’s clothing market that is equal to the proportion of women that are classified as obese (i.e., 6.5%).

The total potential market value is based on the plus-size market capturing a share of the women’s clothing market that is equal to the proportion of women that are classified as obese (i.e., 6.5%).

*”Estimated Actual” is based on the relative underindexing of the plus-size market versus obesity rates in the US.

**“Untapped Potential” is the difference between the total potential market value and “Estimated Actual.”

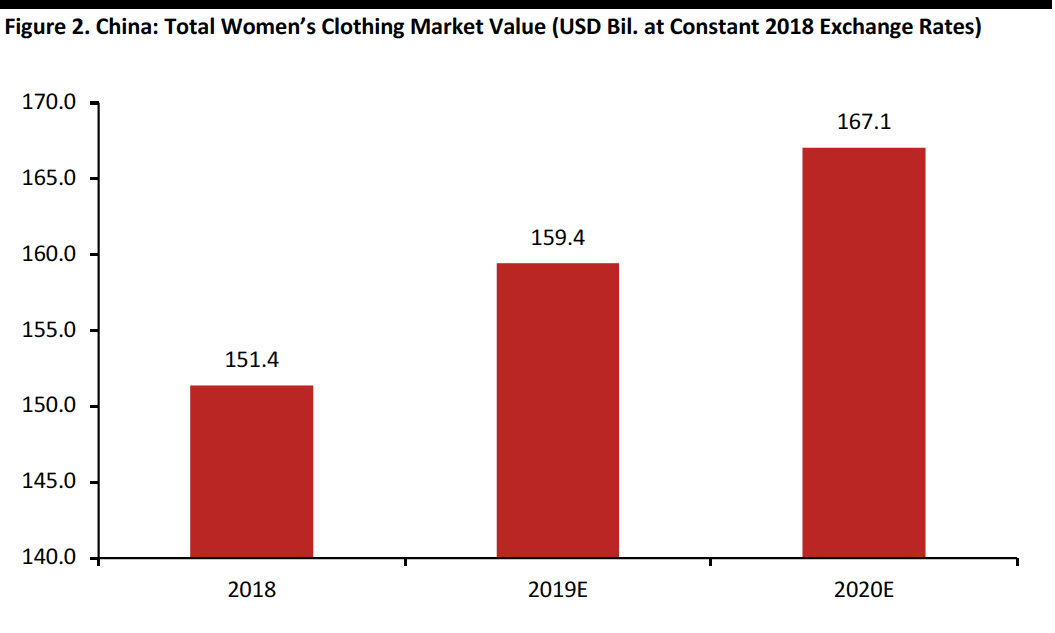

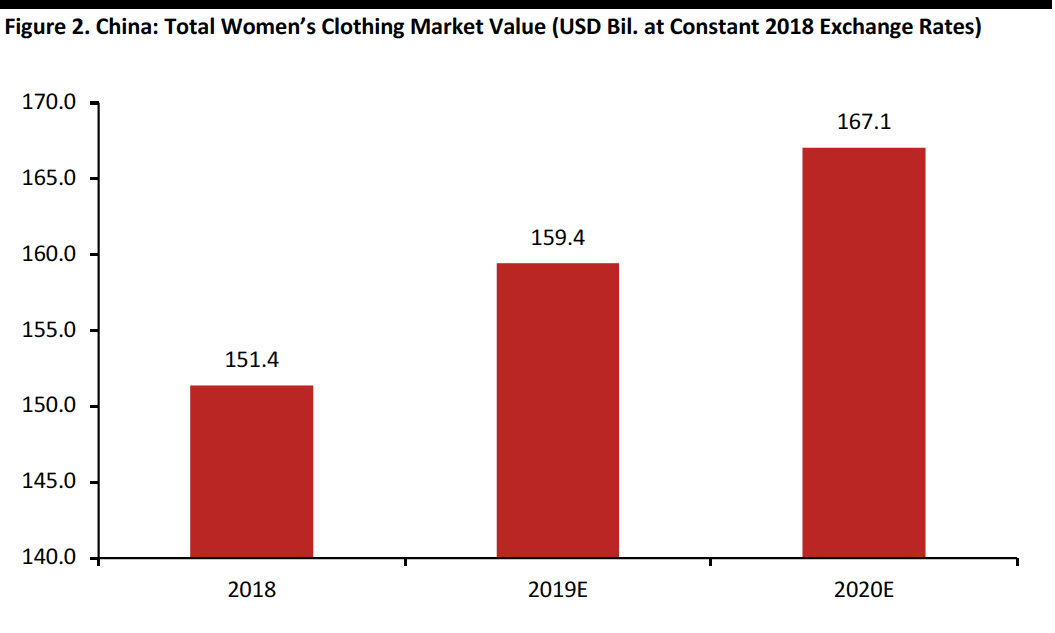

Source: Coresight Research[/caption] The total women’s clothing market in China was worth slightly more than $150 billion in 2018, and is expected to grow 5.3% to almost $160 billion in 2019. In 2020, the market is estimated to reach almost $170 billion, a 4.8% increase year over year. Such growth momentum underscores the potential in plus-size clothing. [caption id="attachment_82129" align="aligncenter" width="640"] Source: Euromonitor International/Coresight Research[/caption]

Market Options are Lacking to Satisfying the Varied Plus-Size Population

China’s plus-size population faces a challenge in the limited availability of options on the market. Ying Dai, founder of Garden Lis, a designer of plus-size clothing for women in China, commented in an interview by tech media platform 36Kr that China’s plus-size market is small, divergent and disorganized, with product categories without clear branding. Available clothing styles in the market are usually conservative, not innovative nor fashionable.

Plus-size consumers that retailers target tend to fall in the 25-50 age group and wear clothing in sizes L-7XL. Xuehua News reported that during the Double 12 shopping holiday in 2018, customers who purchased plus size clothing tended to come from Shandong, Hebei and Jiangsu provinces. In the section below, we discuss the brands and retailers in China that cater to the plus-size women’s clothing market.

China’s Plus-Size Women’s Clothing: Retailers and Brands

Garden Lis

Ying Dai founded Garden Lis to offer premium-price and high-quality plus-size clothing. The brand targets female customers aged 25-35 weighing 130-180 pounds and sells clothes of size L to 6XL. As this customer demographic has fewer choices, they are willing to pay higher prices and are more brand loyal.

Garden Lis has a team of seven designers who all have at least four years’ experience designing plus-size clothing.

Apart from designing plus-size clothing, Garden Liz is also creating an online community on WeChat, where it worked with KOLs to share information on food, fashion and daily activities. Garden Lis currently has presence on Taobao, WeChat and in offline franchise stores.

[caption id="attachment_82130" align="aligncenter" width="640"]

Source: Euromonitor International/Coresight Research[/caption]

Market Options are Lacking to Satisfying the Varied Plus-Size Population

China’s plus-size population faces a challenge in the limited availability of options on the market. Ying Dai, founder of Garden Lis, a designer of plus-size clothing for women in China, commented in an interview by tech media platform 36Kr that China’s plus-size market is small, divergent and disorganized, with product categories without clear branding. Available clothing styles in the market are usually conservative, not innovative nor fashionable.

Plus-size consumers that retailers target tend to fall in the 25-50 age group and wear clothing in sizes L-7XL. Xuehua News reported that during the Double 12 shopping holiday in 2018, customers who purchased plus size clothing tended to come from Shandong, Hebei and Jiangsu provinces. In the section below, we discuss the brands and retailers in China that cater to the plus-size women’s clothing market.

China’s Plus-Size Women’s Clothing: Retailers and Brands

Garden Lis

Ying Dai founded Garden Lis to offer premium-price and high-quality plus-size clothing. The brand targets female customers aged 25-35 weighing 130-180 pounds and sells clothes of size L to 6XL. As this customer demographic has fewer choices, they are willing to pay higher prices and are more brand loyal.

Garden Lis has a team of seven designers who all have at least four years’ experience designing plus-size clothing.

Apart from designing plus-size clothing, Garden Liz is also creating an online community on WeChat, where it worked with KOLs to share information on food, fashion and daily activities. Garden Lis currently has presence on Taobao, WeChat and in offline franchise stores.

[caption id="attachment_82130" align="aligncenter" width="640"] One of Garden Lis’s offline franchise stores

One of Garden Lis’s offline franchise stores

Source: Lieyunwang.com[/caption] MsShe MsShe is a plus-size clothing retailer and the had the best-selling plus-size clothing retailer on Tmall from 2011 to 2018. The brand targets female customers aged 30-40 and sells clothes size XL to 6XL. Starting from product development, MsShe creates designs catering to different body configurations. MsShe employs 10 plus-size women to try on all clothing designed by the store, and then write about their product trial experience, share it with potential customers, and offer suggestions on how to match with other clothing. [caption id="attachment_82131" align="aligncenter" width="640"] MsShe’s Tmall store

MsShe’s Tmall store

Source: MsShe’s Weibo page[/caption] Muzi Lixiang Muzi Lixiang is a plus-size clothing retailer founded in 2016, targeting oversize females aged between 30 and 40 weighing 150 and 200 pounds. The company sells clothes size 2XL to 5XL. Xiang Li, founder of the retailer, became the store’s plus-size model and influencer. To ensure the company remains close to its customer base, all staff have to weigh at least 150 pounds. Muzi Lixiang had over 860,000 followers and generates about ¥100 million in revenue on its Tmall store in 2018. On the shopping holiday 12.12, the brand sold about 6,000 XXXL-sized cotton clothes. [caption id="attachment_82132" align="aligncenter" width="640"] Muzi Lixiang’s Logo and the retailer’s founder, Xiang Li

Muzi Lixiang’s Logo and the retailer’s founder, Xiang Li

Source: Muzi Lixiang’s Tmall flagship store[/caption] Smeilovly Smeilovly targets plus-size females aged 25-50. Founded in 2012 and selling women’s clothes size L-7XL, Smeilovly is now a leading plus-size brand thanks to its unique clothing designs, innovative styles, consistent quality, attentive customer service and fast delivery. The company says it believes obese women can also be beautiful and fashionable, and each woman is born to be charismatic. Its vision is to be the most-liked fashionable plus-size clothing retailer. [caption id="attachment_82133" align="aligncenter" width="640"] Smeilovly’s Brand Logo

Smeilovly’s Brand Logo

Source: Smeilovly’s Tmall flagship store[/caption] Strategies for Plus-Size Brands and Retailers in China Plus-size retailers in China are starting to offer various plus-size clothing styles to fit women with a variety of body shapes, work on customer service and live stream. Some 90% of plus-size retailers on Taobao live stream, according to Dama Wenchuang, an incubator platform of Taobao plus-size live-streamers based in Hangzhou. Influencers, social media, and online sales platforms offer multiple channels to reach China’s plus-size community. [caption id="attachment_82134" align="aligncenter" width="479"] A plus-size model live streaming on social media platform

A plus-size model live streaming on social media platform

Source: 3yyule[/caption] Key Insights Despite the relatively low proportion of obesity in China compared to global norms, the sheer size of China’s population means the absolute number is still high. We estimate the women’s plus-size market in China would be worth over $10 billion if the plus-size segment achieved a share of China’s apparel market equal to the obesity rate among the female population. Plus-size clothing retailers in China have demonstrated they can fill unmet customer needs, leveraging influencers and social media to build their brands and drive shopper loyalty.

- The estimated actual women’s plus-size market size, which our calculations suggest will be around $4.8 billion in 2019. This estimate assumes the plus-size market in China underindexes relative to obesity levels at a rate similar to the US (where the plus-size market is meaningfully lower as a share of total clothing sales than the obesity rate).

- The estimated potential women’s plus-size market size, which is based on the plus-size market capturing a share of the women’s clothing market that is equal to the level of obesity among China’s women (i.e., a 6.5% share). If the plus-size market corresponded exactly to this level of obesity, it would be worth over $10 billion this year.

- The untapped potential in the women’s plus-size market, which is the difference between our estimates for actual and potential market sizes.

The total potential market value is based on the plus-size market capturing a share of the women’s clothing market that is equal to the proportion of women that are classified as obese (i.e., 6.5%).

The total potential market value is based on the plus-size market capturing a share of the women’s clothing market that is equal to the proportion of women that are classified as obese (i.e., 6.5%). *”Estimated Actual” is based on the relative underindexing of the plus-size market versus obesity rates in the US.

**“Untapped Potential” is the difference between the total potential market value and “Estimated Actual.”

Source: Coresight Research[/caption] The total women’s clothing market in China was worth slightly more than $150 billion in 2018, and is expected to grow 5.3% to almost $160 billion in 2019. In 2020, the market is estimated to reach almost $170 billion, a 4.8% increase year over year. Such growth momentum underscores the potential in plus-size clothing. [caption id="attachment_82129" align="aligncenter" width="640"]

Source: Euromonitor International/Coresight Research[/caption]

Market Options are Lacking to Satisfying the Varied Plus-Size Population

China’s plus-size population faces a challenge in the limited availability of options on the market. Ying Dai, founder of Garden Lis, a designer of plus-size clothing for women in China, commented in an interview by tech media platform 36Kr that China’s plus-size market is small, divergent and disorganized, with product categories without clear branding. Available clothing styles in the market are usually conservative, not innovative nor fashionable.

Plus-size consumers that retailers target tend to fall in the 25-50 age group and wear clothing in sizes L-7XL. Xuehua News reported that during the Double 12 shopping holiday in 2018, customers who purchased plus size clothing tended to come from Shandong, Hebei and Jiangsu provinces. In the section below, we discuss the brands and retailers in China that cater to the plus-size women’s clothing market.

China’s Plus-Size Women’s Clothing: Retailers and Brands

Garden Lis

Ying Dai founded Garden Lis to offer premium-price and high-quality plus-size clothing. The brand targets female customers aged 25-35 weighing 130-180 pounds and sells clothes of size L to 6XL. As this customer demographic has fewer choices, they are willing to pay higher prices and are more brand loyal.

Garden Lis has a team of seven designers who all have at least four years’ experience designing plus-size clothing.

Apart from designing plus-size clothing, Garden Liz is also creating an online community on WeChat, where it worked with KOLs to share information on food, fashion and daily activities. Garden Lis currently has presence on Taobao, WeChat and in offline franchise stores.

[caption id="attachment_82130" align="aligncenter" width="640"]

Source: Euromonitor International/Coresight Research[/caption]

Market Options are Lacking to Satisfying the Varied Plus-Size Population

China’s plus-size population faces a challenge in the limited availability of options on the market. Ying Dai, founder of Garden Lis, a designer of plus-size clothing for women in China, commented in an interview by tech media platform 36Kr that China’s plus-size market is small, divergent and disorganized, with product categories without clear branding. Available clothing styles in the market are usually conservative, not innovative nor fashionable.

Plus-size consumers that retailers target tend to fall in the 25-50 age group and wear clothing in sizes L-7XL. Xuehua News reported that during the Double 12 shopping holiday in 2018, customers who purchased plus size clothing tended to come from Shandong, Hebei and Jiangsu provinces. In the section below, we discuss the brands and retailers in China that cater to the plus-size women’s clothing market.

China’s Plus-Size Women’s Clothing: Retailers and Brands

Garden Lis

Ying Dai founded Garden Lis to offer premium-price and high-quality plus-size clothing. The brand targets female customers aged 25-35 weighing 130-180 pounds and sells clothes of size L to 6XL. As this customer demographic has fewer choices, they are willing to pay higher prices and are more brand loyal.

Garden Lis has a team of seven designers who all have at least four years’ experience designing plus-size clothing.

Apart from designing plus-size clothing, Garden Liz is also creating an online community on WeChat, where it worked with KOLs to share information on food, fashion and daily activities. Garden Lis currently has presence on Taobao, WeChat and in offline franchise stores.

[caption id="attachment_82130" align="aligncenter" width="640"] One of Garden Lis’s offline franchise stores

One of Garden Lis’s offline franchise stores Source: Lieyunwang.com[/caption] MsShe MsShe is a plus-size clothing retailer and the had the best-selling plus-size clothing retailer on Tmall from 2011 to 2018. The brand targets female customers aged 30-40 and sells clothes size XL to 6XL. Starting from product development, MsShe creates designs catering to different body configurations. MsShe employs 10 plus-size women to try on all clothing designed by the store, and then write about their product trial experience, share it with potential customers, and offer suggestions on how to match with other clothing. [caption id="attachment_82131" align="aligncenter" width="640"]

MsShe’s Tmall store

MsShe’s Tmall store Source: MsShe’s Weibo page[/caption] Muzi Lixiang Muzi Lixiang is a plus-size clothing retailer founded in 2016, targeting oversize females aged between 30 and 40 weighing 150 and 200 pounds. The company sells clothes size 2XL to 5XL. Xiang Li, founder of the retailer, became the store’s plus-size model and influencer. To ensure the company remains close to its customer base, all staff have to weigh at least 150 pounds. Muzi Lixiang had over 860,000 followers and generates about ¥100 million in revenue on its Tmall store in 2018. On the shopping holiday 12.12, the brand sold about 6,000 XXXL-sized cotton clothes. [caption id="attachment_82132" align="aligncenter" width="640"]

Muzi Lixiang’s Logo and the retailer’s founder, Xiang Li

Muzi Lixiang’s Logo and the retailer’s founder, Xiang Li Source: Muzi Lixiang’s Tmall flagship store[/caption] Smeilovly Smeilovly targets plus-size females aged 25-50. Founded in 2012 and selling women’s clothes size L-7XL, Smeilovly is now a leading plus-size brand thanks to its unique clothing designs, innovative styles, consistent quality, attentive customer service and fast delivery. The company says it believes obese women can also be beautiful and fashionable, and each woman is born to be charismatic. Its vision is to be the most-liked fashionable plus-size clothing retailer. [caption id="attachment_82133" align="aligncenter" width="640"]

Smeilovly’s Brand Logo

Smeilovly’s Brand Logo Source: Smeilovly’s Tmall flagship store[/caption] Strategies for Plus-Size Brands and Retailers in China Plus-size retailers in China are starting to offer various plus-size clothing styles to fit women with a variety of body shapes, work on customer service and live stream. Some 90% of plus-size retailers on Taobao live stream, according to Dama Wenchuang, an incubator platform of Taobao plus-size live-streamers based in Hangzhou. Influencers, social media, and online sales platforms offer multiple channels to reach China’s plus-size community. [caption id="attachment_82134" align="aligncenter" width="479"]

A plus-size model live streaming on social media platform

A plus-size model live streaming on social media platform Source: 3yyule[/caption] Key Insights Despite the relatively low proportion of obesity in China compared to global norms, the sheer size of China’s population means the absolute number is still high. We estimate the women’s plus-size market in China would be worth over $10 billion if the plus-size segment achieved a share of China’s apparel market equal to the obesity rate among the female population. Plus-size clothing retailers in China have demonstrated they can fill unmet customer needs, leveraging influencers and social media to build their brands and drive shopper loyalty.