Nitheesh NH

Introduction

What’s the Story? The preferences of today’s consumers are rapidly changing, driving the need for apparel brands and retailers to find ways to shorten product lead times. One solution is on-demand manufacturing, which also allows businesses to offer customized products built around customers’ needs. In this report, we discuss five key demand factors that are fueling the growth of on-demand manufacturing in the apparel industry. We leverage the findings of a March 2022 Coresight Research survey of US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing strategies within the next three years. This report is sponsored by SoftWear Automation, a US-based advanced robotics startup. The company focuses on disrupting the apparel retail sector through its on-demand manufacturing capabilities. Why It Matters Over the past two years, apparel brands and retailers have faced many shipping challenges and high logistics costs due to the impacts of the Covid-19 pandemic. Supply chain issues will continue through 2022 due to socioeconomic hurdles and political unrest—namely, the Russia-Ukraine war. To combat challenges and reduce overhead costs, many apparel brands and retailers are turning to on-demand manufacturing, either through in-house capabilities or partnerships. On-demand business models also reduce overproduction, as an order is first received and then production begins, leaving no room for textile wastage. In Figure 1, we cover the myriad of challenges faced by apparel brands and retailers and how on-demand manufacturing can solve these bottlenecks.Figure 1. The Shift from Traditional Manufacturing to On-Demand Manufacturing [caption id="attachment_147479" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The On-Demand Manufacturing Revolution in Apparel: Coresight Research x SoftWear Automation

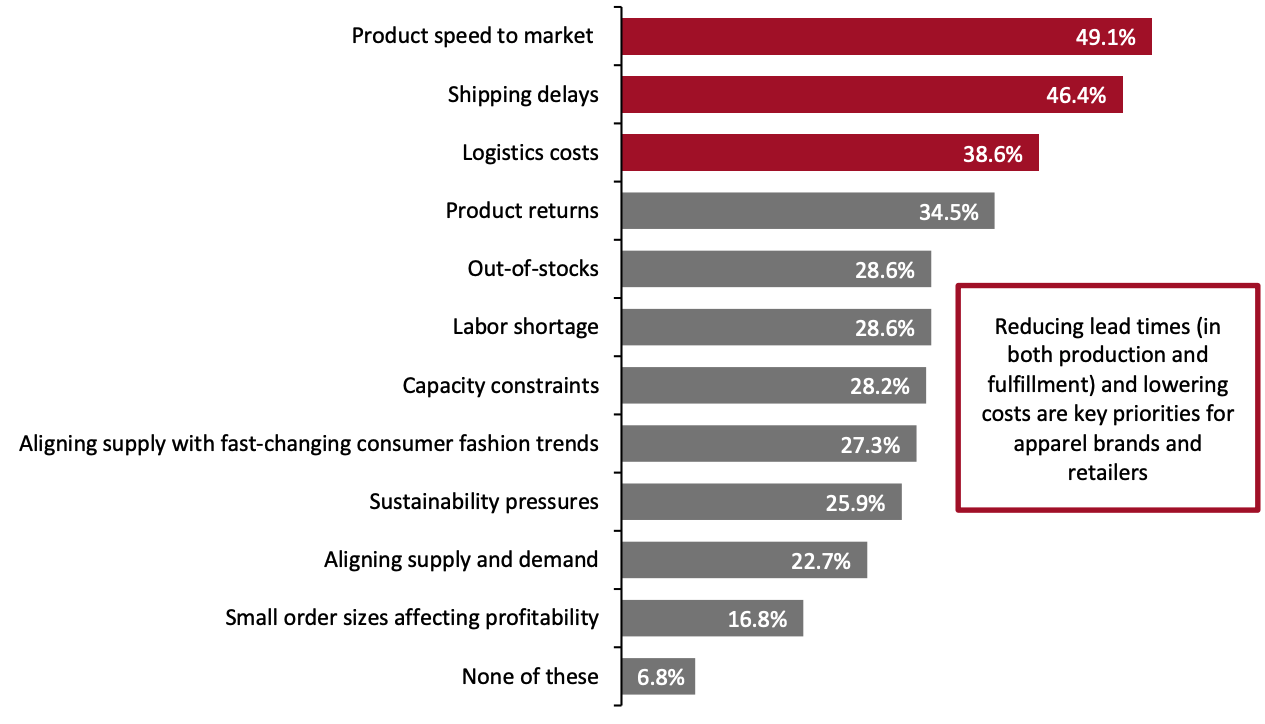

Over the past two years, the apparel industry has faced a variety of challenges, particularly around product speed to market, shipping delays and logistics costs—the top three issues most cited by apparel brands and retailers in our survey (see Figure 2). These challenges have made apparel brands question and change how they produce goods.Figure 2. Challenges Faced by Apparel Brands and Retailers Over the Past Two Years (% of Respondents) [caption id="attachment_147480" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 220 US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing capabilities within the next three years

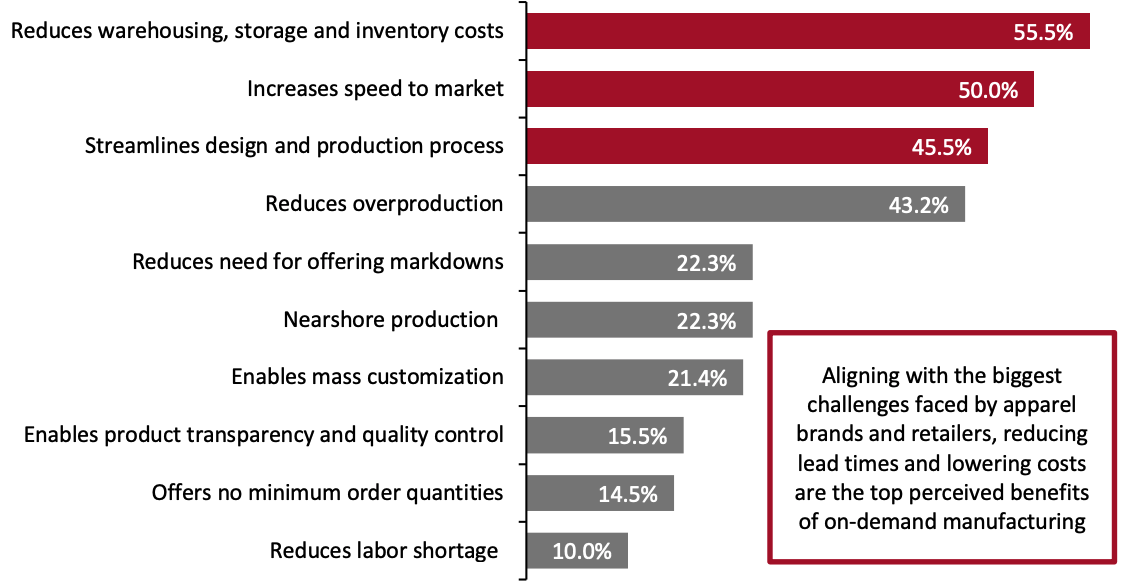

Source: Coresight Research[/caption] On-demand manufacturing offers solutions to many problems brands and retailers face, some of which stem from traditional manufacturing. Our survey found that more than half (55.5%) of brands and retailers surveyed believe that on-demand manufacturing decreases storage and inventory costs, reducing the need for storing raw materials and inventories (see Figure 3). With on-demand manufacturing, brands and retailers no longer need to forecast customer demand and stockpile inventories—products are only manufactured when ordered. This minimizes both warehouse costs and the need to predict order quantities. On-demand manufacturing also lets businesses stay on top of what’s popular in fashion as it produces what customers want quickly and allows brands to try new designs and products with less risk. To this point, increased speed to market and streamlined design ranked as the second- and third-most-cited benefits of on-demand manufacturing in our survey (see Figure 3).

Figure 3. Top Three Benefits of On-Demand Manufacturing Over Traditional Manufacturing (% of Respondents) [caption id="attachment_147481" align="aligncenter" width="700"]

Respondents were asked to select the top three benefits

Respondents were asked to select the top three benefitsBase: 220 US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing capabilities within the next three years

Source: Coresight Research[/caption] Recognizing the benefits of on-demand manufacturing, e-commerce giant Amazon adopted the model in 2017, when it was granted a patent for a technology-powered system that automatically cuts, assembles and prints garments, helping Amazon increase its apparel-manufacturing efficiency and order fulfillment speed. Following Amazon’s entry into the space, other apparel brands and retailers have started implementing on-demand strategies, either through partnerships or by developing in-house capabilities. For example, in March 2022, US-based sportswear and lifestyle brand Delta Apparel announced the launch of its on-demand digital print business unit, DTG2Go. The company launched this new “digital-first” business unit in collaboration with Fanatics, a global digital sports platform. In our survey of apparel companies that have already started using on-demand manufacturing strategies or plan to do so within the next three years, 87.3% of respondents currently use the on-demand model. Below, we discuss the key factors fueling the growth of the on-demand manufacturing model. Five Factors Fueling the Growth of On-Demand Manufacturing 1. Focus on Sustainability One of the key issues of traditional manufacturing is that brands and retailers estimate consumer demand for products. Most often than not, these forecasts lead to overproduction. Overproduction is particularly prevalent in the apparel industry, where styles and trends change frequently. The growing number of environmentally conscious customers is forcing retailers to mitigate their negative impact on the environment—more than 90% of respondents in our survey said that environmental sustainability is a vital focus area for their organization. When items are not purchased, many are destroyed or thrown away, as destroying inventory is more convenient and cost-effective for companies than reselling or even donating the unwanted products.

- In 2018, fashion retailer H&M revealed that it had accumulated unsold inventory worth $4.3 billion due to rapidly changing consumer demand. The news came after the retailer was accused by a Danish TV show, Operation X, of burning 12 tons of unsold garments each year since 2013.

- American luxury brand Coach recently faced severe backlash after a video uploaded to social media platform TikTok, which captured the destruction of unsold handbags by the luxury brand, went viral in October 2021. In response, Joon Silverstein, Global Head of Digital and Sustainability at Coach, said, “Finished goods destruction is a very common industry practice, though, of course, that does not make it right. I can’t speak for other brands, but one of Coach’s goals has been zero destruction and that is what we are striving for.”

Respondents could select multiple options

Respondents could select multiple optionsBase: 220 US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing capabilities within the next three years

Source: Coresight Research[/caption] Sustainable, environmentally friendly initiatives undertaken by brands and retailers include the following:

- Amazon’s “Climate Pledge Friendly” certification helps consumers to choose products that are more environmentally friendly. The company identifies products that meet the criteria of 30 independent certification programs.

- Asket, a Swedish menswear brand, only sells a single, permanent collection of men’s apparel. By doing so, the company aims to break the overproduction and overconsumption cycle, according to Co-Founder August Bard Bringéus.

- La Réunion, a US-based upcycling startup, sells apparel made strictly out of deadstock and vintage fabrics collected globally. Upcycling is a creative and effective way of using surplus clothing rather than sending enormous amounts to landfill.

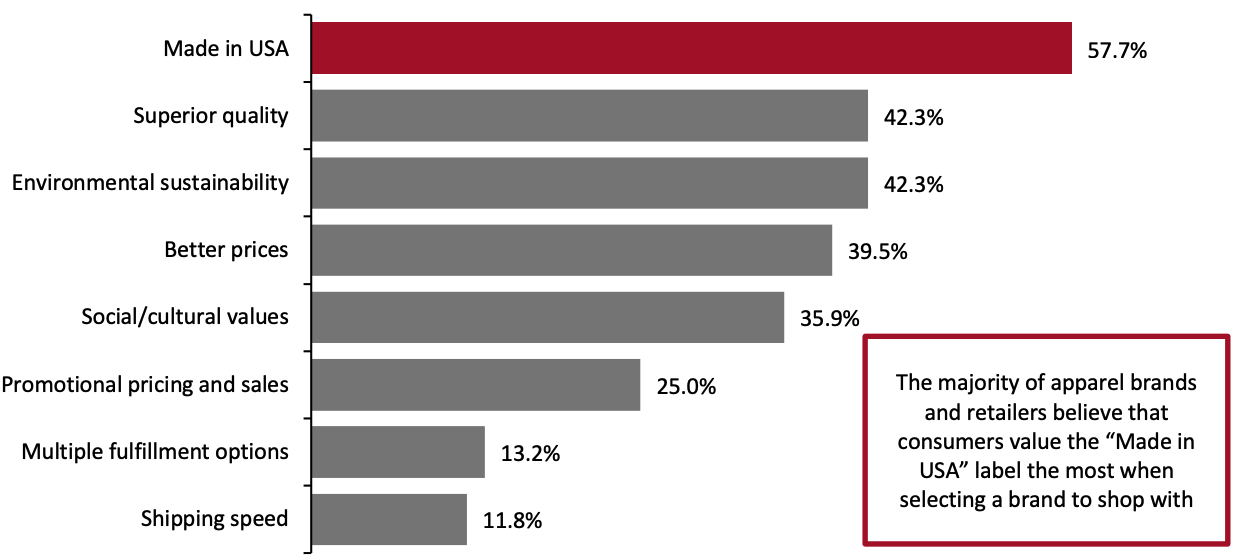

La Réunion’s sustainable product offerings

La Réunion’s sustainable product offeringsSource: Company website[/caption] On-demand manufacturing enables brands and retailers to produce only what consumers order, eliminating unnecessary production and significantly reducing environmentally harmful waste. By manufacturing on-demand, brands and retailers avoid excessive manufacturing, creating a more sustainable process. Additionally, on-demand manufacturing minimizes the need for long-haul logistics: products are made where and when they are needed, saving billions of gallons of fuel and considerably reducing carbon emissions. 2. Demand for “Made in USA” Products With many consumers wanting to know where and how their clothes are made, demand for “Made in USA” products is prompting brands and retailers to bring production back to the US. To label goods as “Made in USA,” companies must follow Federal Trade Commission guidelines, ensuring that “all or virtually all” parts and processing used to create the product are from the US. According to a 2020 survey by nonprofit organization Reshoring Institute, 69.4% of Americans prefer products made in the US. There are many reasons behind the growing demand for “Made in USA” goods, with one being that Americans perceive these products as higher quality due to the stricter regulations that govern manufacturing facilities in the US. In addition, environmentally conscious customers believe that the carbon footprint of foreign-made products is significantly higher than products manufactured in the US. Many US consumers also want to see jobs return to the US. Retailers are recognizing this growing demand: the majority of apparel brands and retailers we surveyed (57.7%) believe that consumers value products marked as “Made in USA” most when selecting a brand to shop with (see Figure 5).

Figure 5. Factors That Brands and Retailers Believe Consumers Value Most When Selecting Brands To Shop with (% of Respondents) [caption id="attachment_147484" align="aligncenter" width="700"]

Respondents were asked to select the top three factors that they believe consumers value the most when selecting brands

Respondents were asked to select the top three factors that they believe consumers value the most when selecting brandsBase: 220 US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing capabilities within the next three years

Source: Coresight Research[/caption] In addition, pandemic lockdowns and the Russia-Ukraine war—which started in February 2022—have worsened supply chain issues. The average weekly rate for a 40-foot container moving from Asia to North America was $15,764 as of April 15, 2022, up almost 167% year over year, according to data from shipping platform Freightos—and there are no signs of the cost returning to pre-pandemic levels of below $1,500 per container.

- Read Coresight Research’s Supply Chain Briefing series for more on challenges in the global retail supply chain.

- US mass merchandiser Walmart announced plans to invest $350 billion in the next 10 years in items grown, made or assembled in the US. The retail chain giant began sourcing more “Made in USA” products in 2013, investing $50 billion in various initiatives and events. The company is set to host more than 2,000 suppliers for its “Made in USA” Open Call pitch event, scheduled for June 2022.

- For a more detailed analysis of onshoring production, please read our report Onshoring: Is Now the Time for the US?

- US-based fashion-technology startup CreateMe provides customization technology for apparel brands. The company partnered with Warner Bros. Consumer Products at the South by Southwest event in March 2022 to display its customization technologies.

- Tokyo-based design consultancy firm Synflux uses AI-based customization software to offer innovative designs via a project called Algorithmic Couture. The software uses 3D scanning to capture body measurements and then analyzes the data using ML algorithms to create optimized garment patterns, reducing fabric waste. Designers can then edit the designs with CAD (computer-aided design) software and produce fashion patterns used to sew the items.

- Danish shoe manufacturer ECCO’s Quant-U service creates 3D-printed midsoles that are customized to the wearer. Quant-U offers an in-store experience that incorporates real-time analysis, data-driven design and 3D printing to create customized products quickly.

- SoftWear Automation’s fully automated Sewbots come equipped with various features, including custom robotics, grippers and specialized “micromanipulators” that can lead a piece of cloth through a sewing machine with submillimeter accuracy. They also have specialized, high-frame-rate cameras and computer vision software to monitor the automatic sewing process.

SoftWear Automation’s on-demand manufacturing unit used to cut, sew and print garments

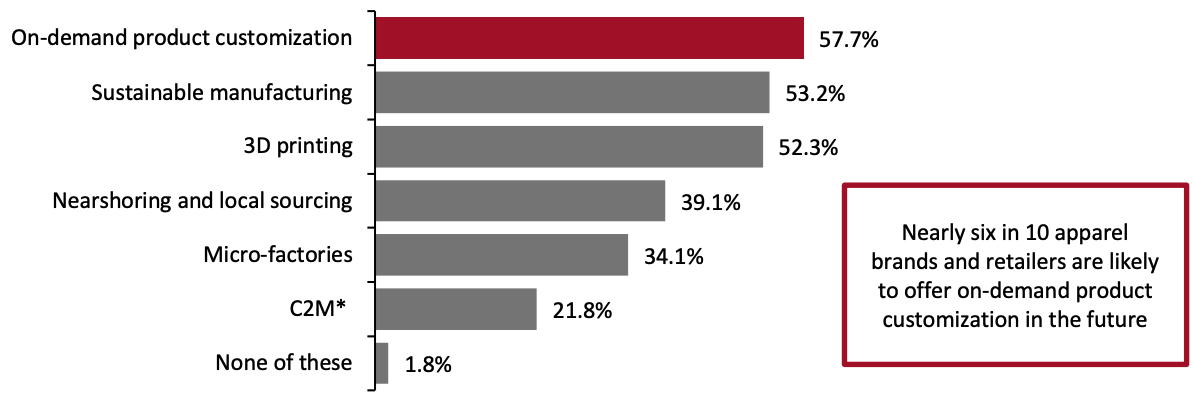

SoftWear Automation’s on-demand manufacturing unit used to cut, sew and print garmentsSource: Company website[/caption] High production costs and the time needed to produce customized products are two major barriers that apparel brands and retailers face in traditional manufacturing. Advanced technologies such as 3D printing and robotics allow businesses to reduce design prototyping, speed up product development and reduce overhead costs. 4. Rise in On-Demand Product Customization With rising interest in on-demand manufacturing and investment in new technologies by apparel manufacturers, new trends such as on-demand product customization are emerging. Apparel brands and retailers are likely to offer real-time customization services, allowing consumers to order bespoke products without needing to wait weeks or months to receive their purchases. Our survey data indicate that on-demand product-customization technology is the manufacturing strategy that the highest proportion of apparel brands and retailers are likely to adopt in 2022 and beyond (see Figure 6).

Figure 6. New Manufacturing Strategies That Businesses Are Likely To Adopt in 2022 and Beyond (% of Respondents) [caption id="attachment_147486" align="aligncenter" width="700"]

*C2M (consumer-to-manufacturer) defined to respondents as a consumer-driven manufacturing business model where consumers directly place an order with the manufacturer

*C2M (consumer-to-manufacturer) defined to respondents as a consumer-driven manufacturing business model where consumers directly place an order with the manufacturerRespondents could select multiple options

Base: 220 US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing capabilities within the next three years

Source: Coresight Research[/caption] Traditional manufacturing techniques have led to overproduction and zero exclusivity for customers. Now, many consumers are unhappy with the one-size-fits-all approach and are willing to pay extra for customized products—providing a sales-boosting opportunity for brands and retailers that offer product customization services.

- Fashion brand Ralph Lauren ventured into the on-demand space in May 2021 when the company introduced “The Custom Polo,” which allows customers to choose the color of the garment and add text. The company believes that the new model will reduce inventories, enable rapid fulfillment and meet consumer desires and tastes, reducing the need for markdowns.

Polo customization options available on Ralph Lauren’s website

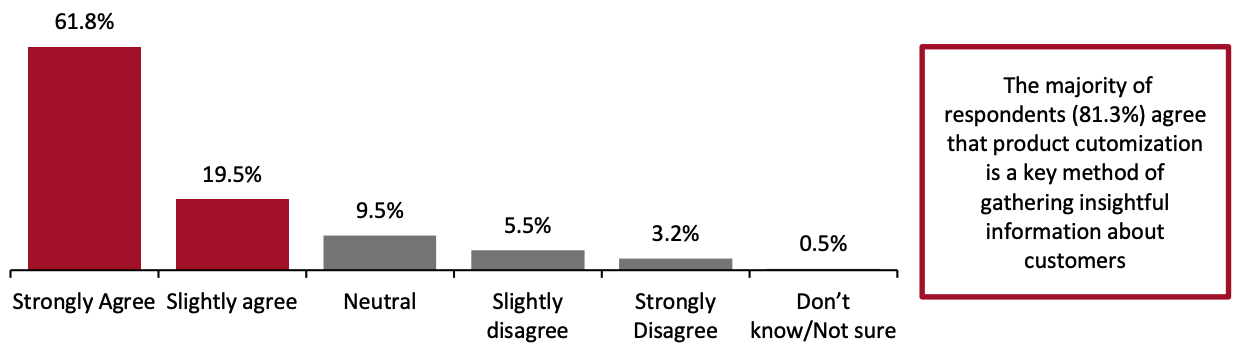

Polo customization options available on Ralph Lauren’s websiteSource: Company website[/caption] Product customization options also enhance the customer experience, increasing loyalty and engagement. Our survey found that 78.2% of respondents feel that offering product customization drives customer retention. Meanwhile, 81.4% of apparel brands and retailers agree that product customization is a key method of gathering customer data (see Figure 7). During the shopping journey and post purchase, brands and retailers can ask customers multiple questions, the answers to which can be used to determine customer profiles and inform curate customized experiences for shoppers.

Figure 7. The Extent To Which Apparel Brands and Retailers Agree That Product Customization Is a Key Method of Gathering Customer Data (% of Respondents) [caption id="attachment_147488" align="aligncenter" width="700"]

Base: 220 US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing capabilities within the next three years

Base: 220 US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing capabilities within the next three yearsSource: Coresight Research[/caption] On-demand manufacturing allows brands and retailers to offer real-time customization services to customers in a cost-efficient manner. As products are created when they are needed, there is no need to hold any inventory—minimizing associated costs, especially compared to traditional businesses offering customization services. Product returns costs are also comparatively lower, as there is little disappointment from customers regarding apparel fit and style. As everything starts from scratch, the time it takes to create products is one of the major issues with on-demand customization. However, advanced technologies such as automation, 3D printing and robotic sewing machines can reduce the overall time required to deliver custom-made products. 5. Popularity of Print-on-Demand Apparel “Print on demand” (PoD) refers to a business model where items are printed only when orders are made, with no minimum order value. The popularity of PoD companies grew significantly during the pandemic and has continued to do so.

- Printful, a US-based PoD company, announced an 80% year-over-year increase in order count over the last three quarters of 2020. Between Black Friday and Cyber Monday in 2020, the online PoD company fulfilled 25 million orders, a 70% increase in orders compared to pre-pandemic.

- Printify, a Latvia-based PoD company, was able to secure funding of $45 million in its Series A funding round led by Index Ventures, a San Francisco and London-based investment venture capital firm, on the back of rising demand for PoD services. The company claims to have shipped more than 3 million units of PoD products (including T-shirts) in one month in 2021. Owing to demand, Printify also doubled its headcount in 2021 compared to 2020.

- Global PoD company Gelato.com introduced PoD T-shirts, hoodies and sweatshirts as part of its offerings in 2021, after more than 50% of its e-commerce sellers showed interest in selling PoD apparel, according to the company. The platform allows customers to design and produce printed clothing on demand and targets delivery to most customers within 72 hours.

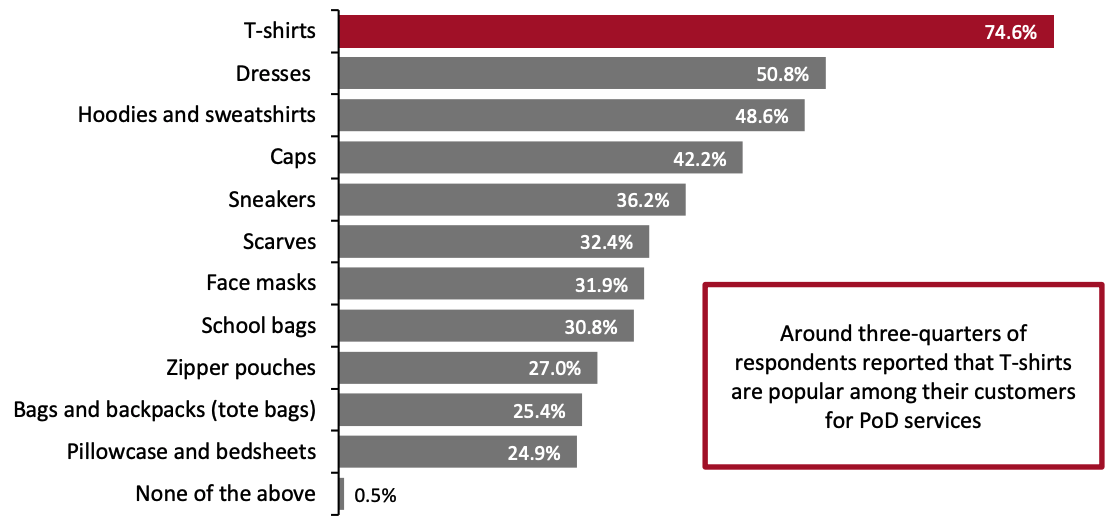

- According to our survey, 84.1% of the apparel brands and retailers that currently use or plan to implement on-demand manufacturing services within the next three years also offer PoD services to customers. The most popular category for PoD is T-shirts, as cited by 74.6% of that subset of respondents (see Figure 8).

Figure 8. Most Popular Product Categories Among Customers with Respect to PoD (% of Respondents) [caption id="attachment_147489" align="aligncenter" width="700"]

Respondents could select multiple options

Respondents could select multiple optionsBase: 138 US-based apparel brands and retailers that currently use or plan to implement on-demand manufacturing capabilities within the next three years and offer PoD services

Source: Coresight Research[/caption] PoD business requires little to no overhead or upfront investment, making it quite attractive to new entrepreneurs and e-commerce companies eager to enter the apparel industry without spending considerable capital. While some might argue that PoD is not scalable and requires too much time to ready products, emerging technologies are changing those perceptions. For instance, SoftWear Automation, which produces on-demand “Made in USA”-label T-shirts, ensures that all PoD orders are fulfilled within 24 hours of order placement. The rising demand for custom and PoD apparel—especially T-shirts—will help grow the on-demand manufacturing industry.

What We Think

The apparel manufacturing industry is changing, and on-demand manufacturing has become more popular than ever, as it allows for the creation of small series of products at less expensive rates. It is also in line with the demand for shorter lead times, as customers do not want to wait for days or even months for their products to be manufactured and delivered. With an on-demand manufacturing model, manufacturers can process customers’ orders quickly. We believe that leading apparel brands and retailers will adopt on-demand as their new manufacturing strategy in 2022 and beyond. Implication for Apparel Brands and retailers:- Apparel brands and retailers must leverage existing technology platforms to make on-demand manufacturing quick and hassle-free.

- Brands and retailers should use on-demand product customization services to access insightful first-party customer data.

- Apparel companies can offer on-demand options to improve their financial performance, as it allows them to reduce inventory costs.

Survey Methodology

The report is based on the analysis of data from an online survey of 220 US-based executives conducted by Coresight Research in March 2022. We selected respondents based on the following criteria:- Based in the US

- Holding senior positions (C-suite, presidents, directors, department heads)

- From brands and retailers operating in the apparel segment

- From brands and retailers operating either both online and in-store, or only online sales channels

- From brands and retailers that either currently implement an on-demand manufacturing strategy or plan to do so in the next three years