Introduction: Off-Price Market Leaders on Course to Continue Their Outperformance

Off-price retailers have enjoyed impressive growth in the US market and beyond—and that growth looks set to be sustained in the next few years. Three off-pricers have struck gold by offering compelling mixes of branded and private-label apparel, accessories, and housewares at prices that undercut those typically found in midmarket channels: TJX Companies, the owner of T.J. Maxx, Marshalls, HomeGoods, Homesense and Sierra Trading Post; Ross Stores, which operates the dd’s Discounts and Ross Dress for Less chains; and Burlington Stores.

These off-pricers are growing in an apparel market that is growing slowly: in 2017, total US apparel sales increased by 1.7%, per the US Bureau of Economic Analysis, and we are penciling in growth of around 2% for this year. In this context, the big question is: At which other major retailers’ expense will the off-pricers gain sales?

We deploy three data sets to answer that question:

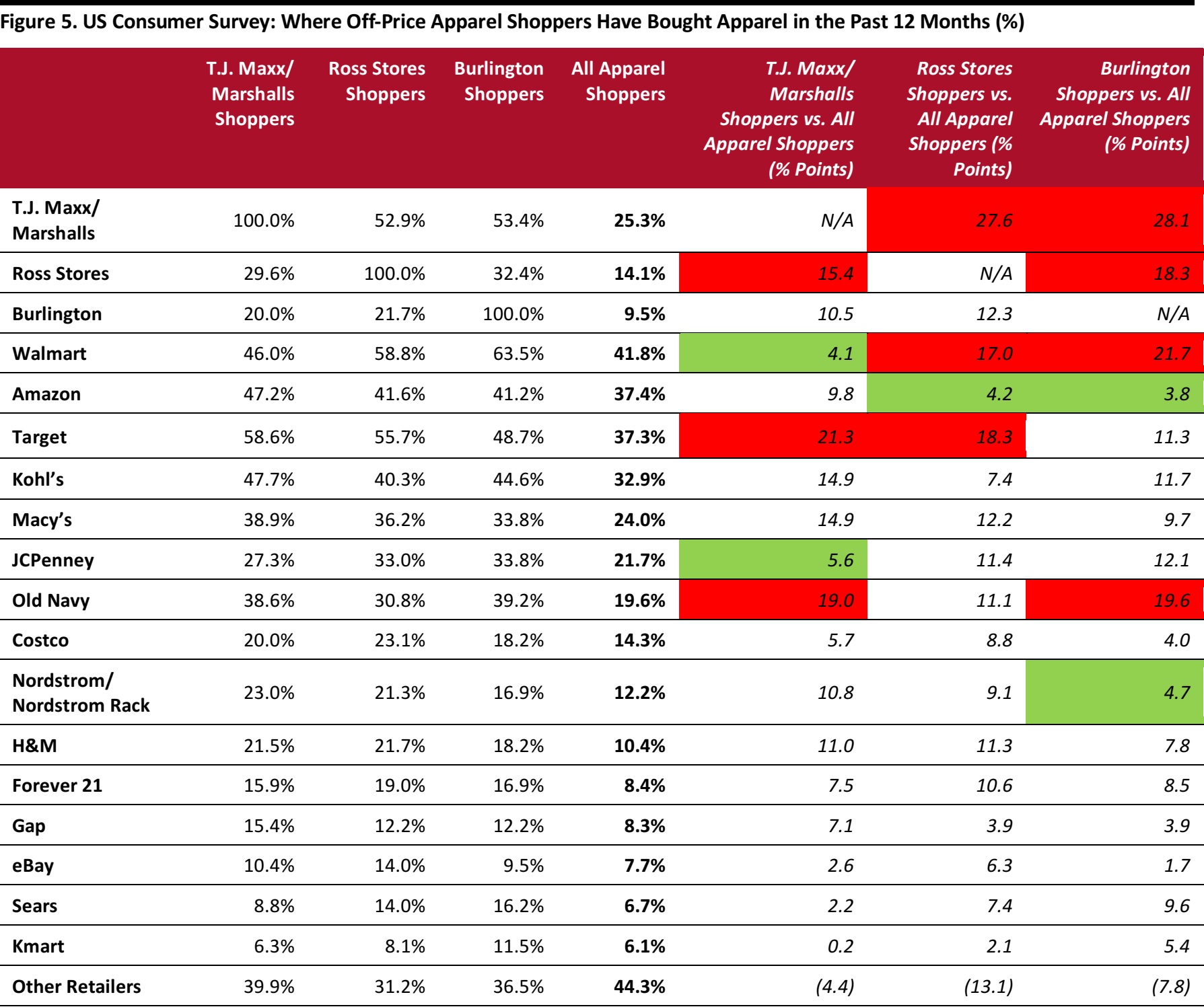

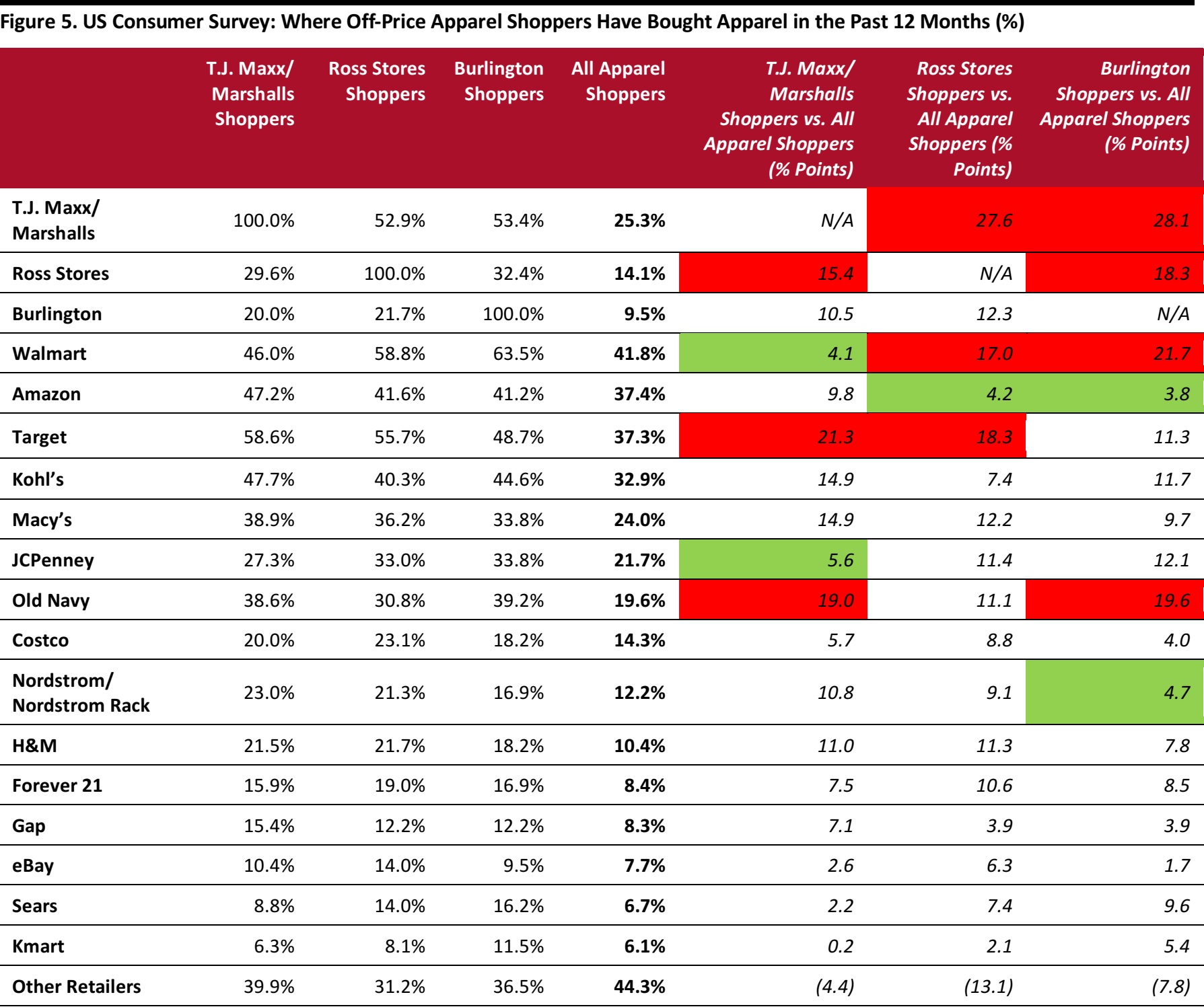

- Cross-shopping data from our proprietary consumer survey. These data show at which other retailers off-price shoppers also shop for apparel, and at what percentages. We compare these with the average apparel shopper’s responses to show which retailers are overexposed to off-price shoppers.

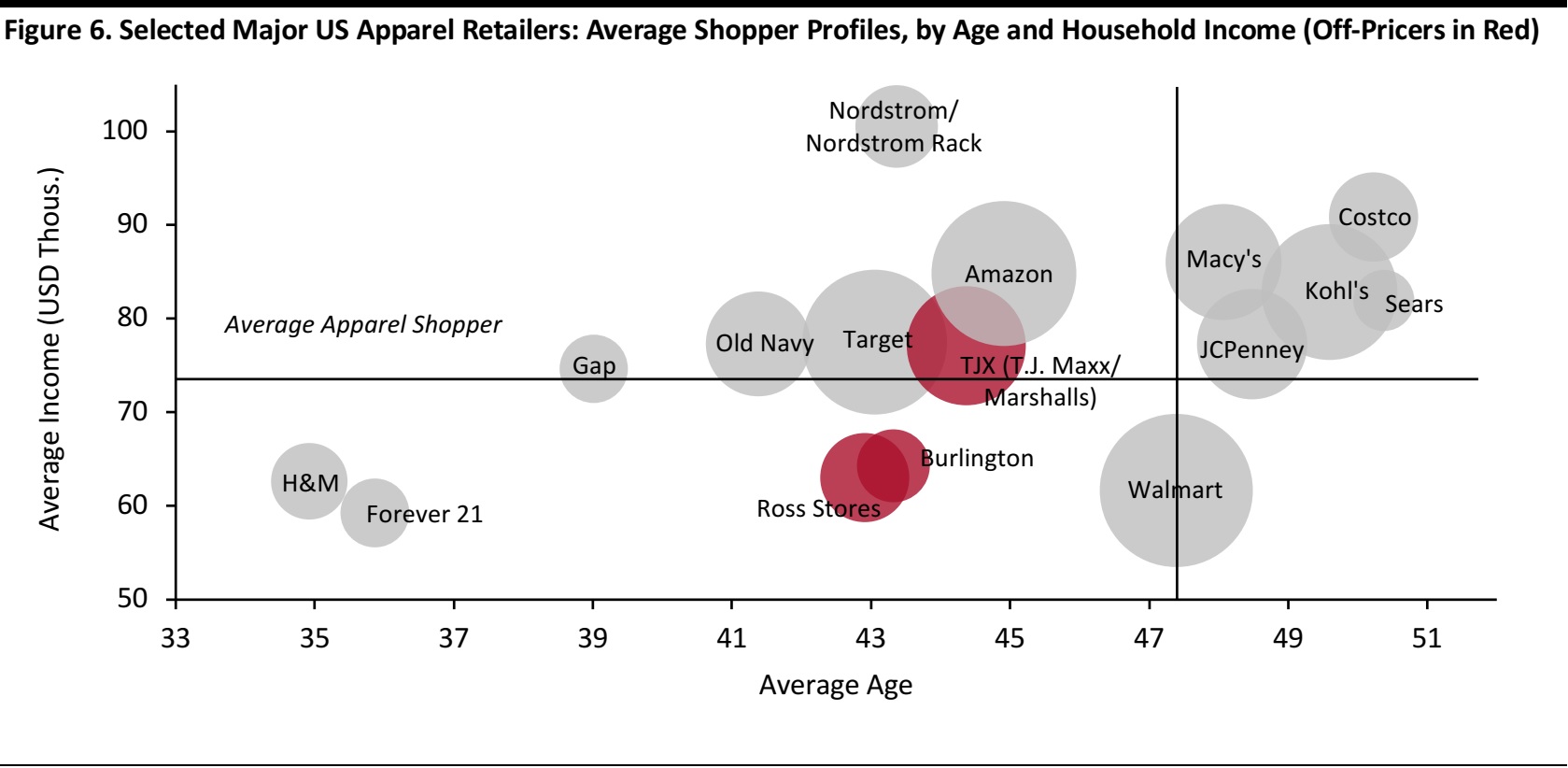

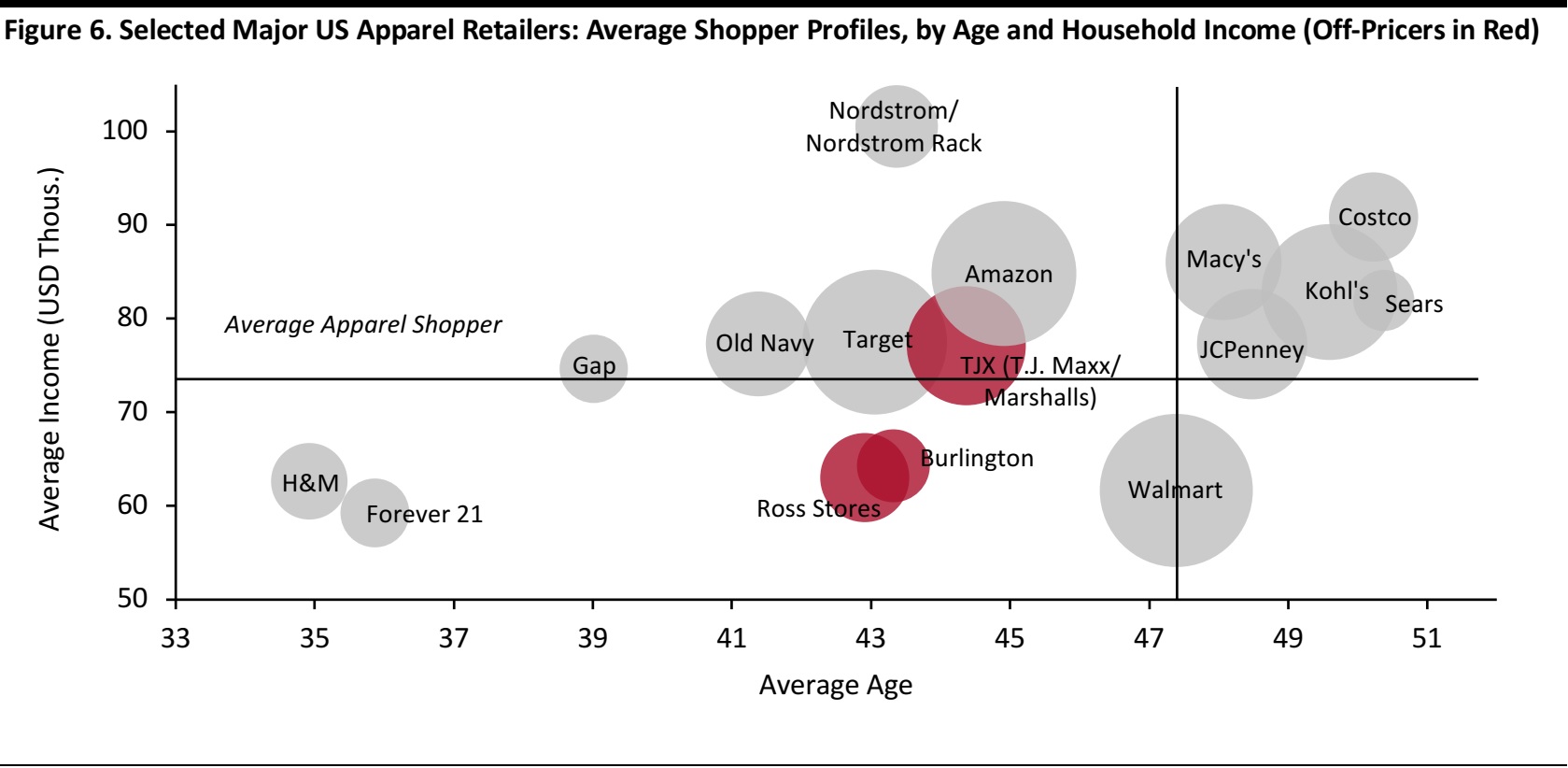

- Our exclusive shopper profiles, based on age and affluence. These profiles provide an indication of demographic overlap and proximity between off-pricers’ shoppers and those of other retailers.

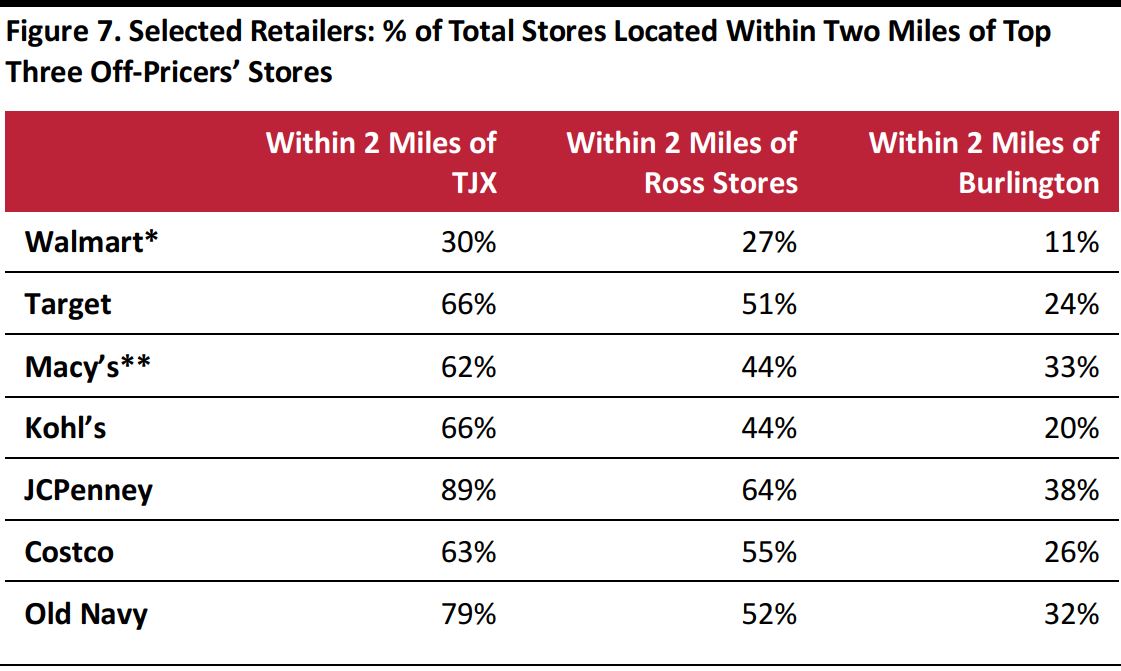

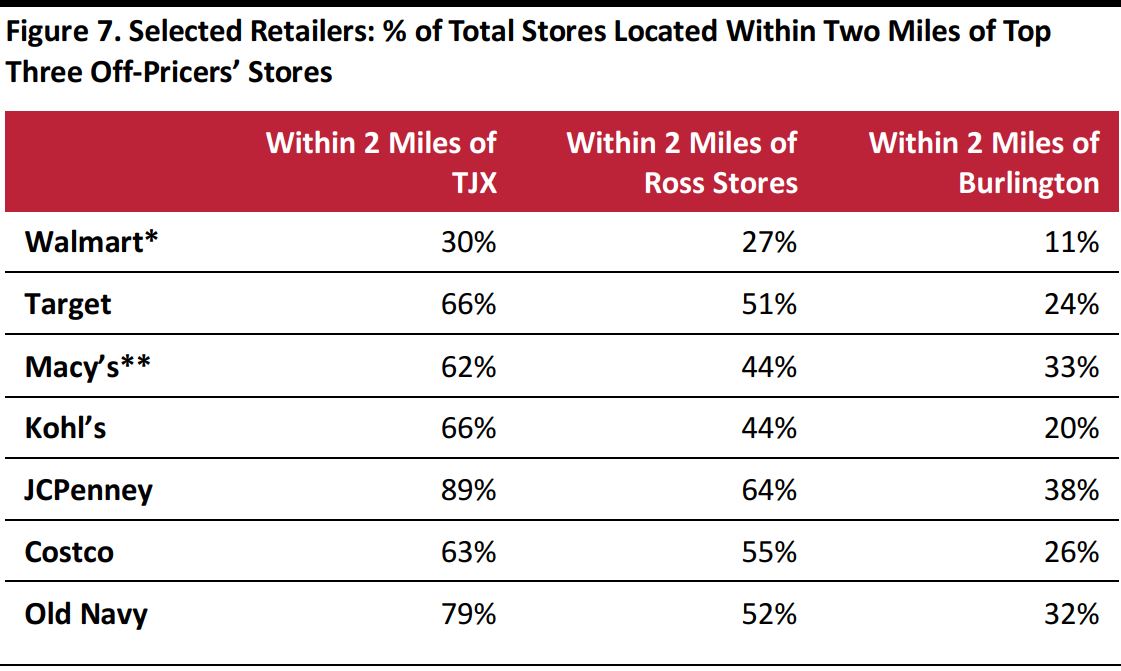

- Geolocation data. These show which major retailers already have stores in close proximity to those of the off-pricers and, so, stand to lose out if the off-pricers continue to see solid same-store sales growth.

This report focuses on TJX, Ross Stores and Burlington, which dominate the off-price sector in the US, although we also discuss fourth-place Nordstrom Rack as well as Saks OFF 5TH and Neiman Marcus Last Call.

We divide our content into two sections. The first reviews the growth prospects for the big three off-pricers, featuring consensus expectations for their revenues and their own guidance regarding store expansion. The second section leverages our data sets to consider which rivals could lose out as a result of this expansion.

Part 1. Reviewing Off-Pricers’ Runway for Growth

Big Three Off-Pricers Set to Grab a Further $13 Billion of Sales in the Next Four Years

In a market characterized by struggling apparel specialty retailers and department stores, off-pricers TJX, Ross Stores and Burlington stand apart for the pace of their growth. Store openings and solid increases in comparable-store sales have driven growth for all three.

The first quarter of fiscal 2018 is the latest quarter for which the three companies had reported results at the time of writing. That quarter ended on May 5 for all three companies, and they reported the following details:

- TJX grew total sales by 11.6% and comparable sales by 3% year over year. Comp growth at the Marmaxx segment—which consists of T.J. Maxx and Marshalls in the US—was 4%. Comp growth at US HomeGoods stores was 2%.

- Ross Stores grew total sales by 8.5% and comparable sales by 3%. Top- and bottom-line expansion was ahead of management’s plans, and the company forecast comp growth of 1%–2% in the second quarter, which ends August 4.

- Burlington grew total sales by 12.8%, with comparable sales up 4.8%. Adjusted EPS was ahead of guidance, and the company raised its outlook for the full year. Management expects total sales growth of 9.7%–10.5% for the fiscal year, and comp growth of 2.6%–3.4%.

TJX, Ross Stores and Burlington are not, however, representative of all off-price players. Others are posting less-impressive results. In the quarter ended May 5, Nordstrom Rack posted comp growth of only 0.4%. For the same period, Hudson’s Bay Company reported a 3.5% decline in comparable sales at its off-price Saks OFF 5TH banner. Neiman Marcus does not break out performance for its Last Call off-price banner, but the company has been closing Last Call stores, which implies pockets of underperformance.

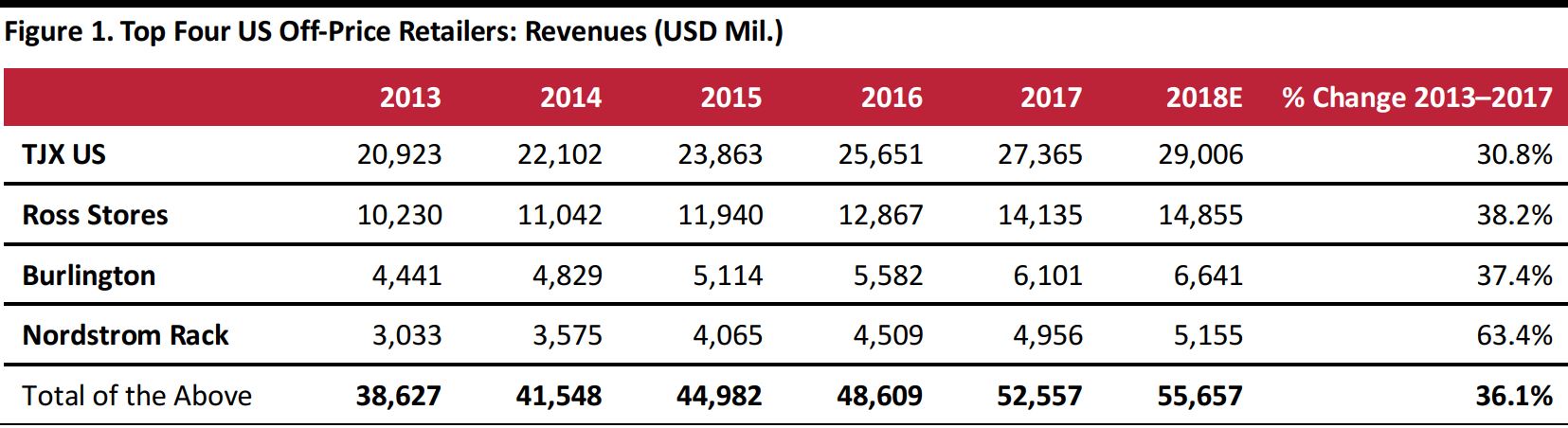

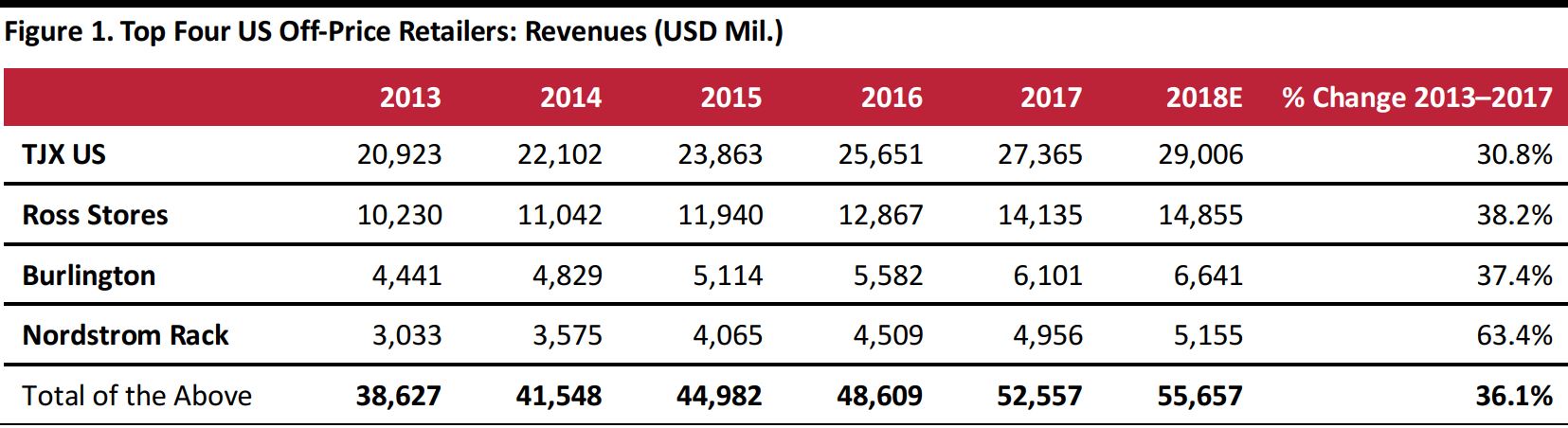

In aggregate, the four biggest players—and the only major retailers for which we have confirmed off-price data—grew their total revenues to $52.56 billion in calendar year 2017. Consensus estimates call for these four retailers to capture an extra $3.1 billion in aggregate revenues this calendar year, which would take their combined total to $55.66 billion.

2018E are consensus estimates; TJX US and Nordstrom Rack 2018E figures are based on estimated group-level revenue growth. Years refer to closest calendar year to fiscal year; all of the retailers listed have fiscal years that end in January or February.

Source: S&P Capital IQ/company reports/Coresight Research

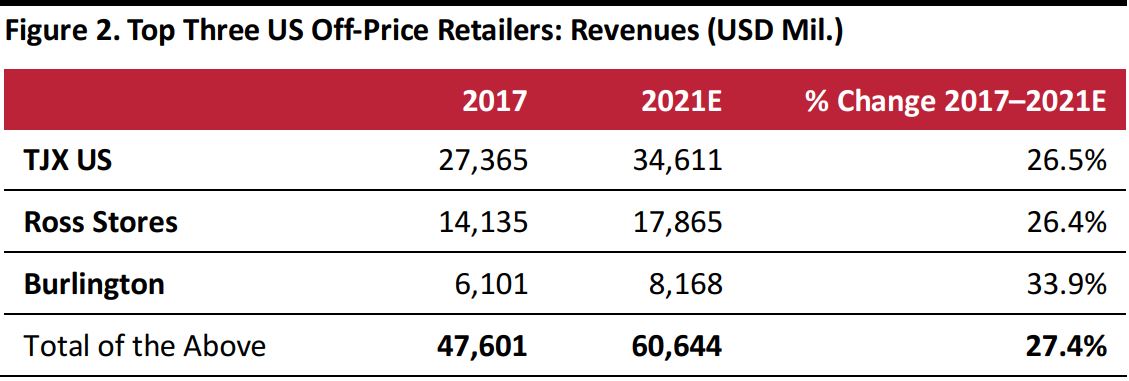

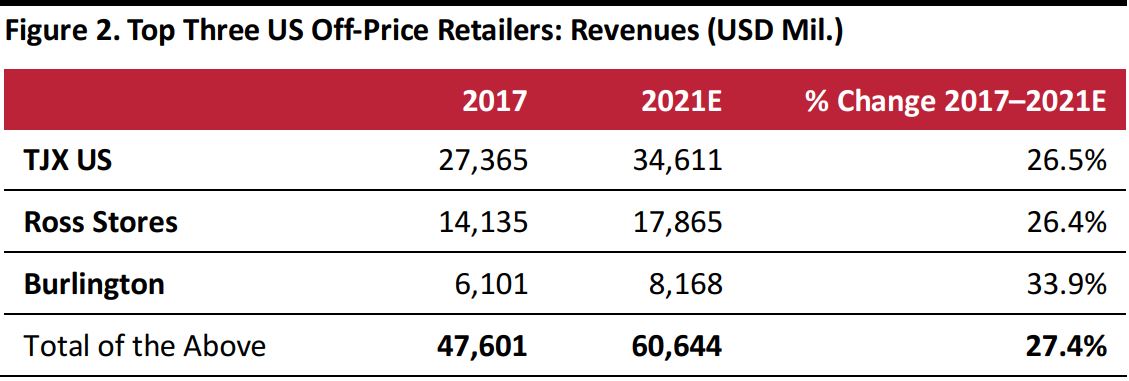

Analyst consensus is for the three biggest US off-price players to sustain growth in the coming years. By calendar year 2021, these retailers will each have grown their sales by at least one-quarter from 2017, according to consensus estimates. In total, that will equate to an additional $13 billion flowing to these three off-pricers within four years.

TJX US 2021E figure is based on estimated group-level revenue growth. Years refer to closest calendar year to fiscal year; all of the retailers listed have fiscal years that end in January or February.

Source: S&P Capital IQ/company reports/Coresight Research

Off-Pricers Are Gaining Share in a Fragmented Apparel Market and Seeing Opportunities in Home Goods, Too

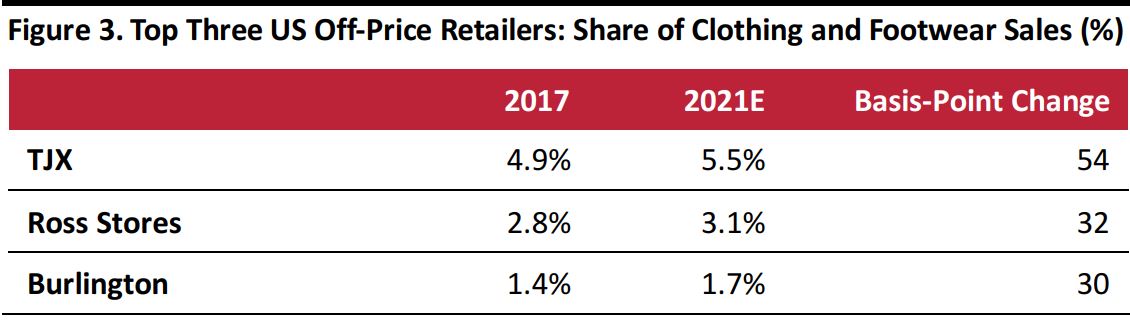

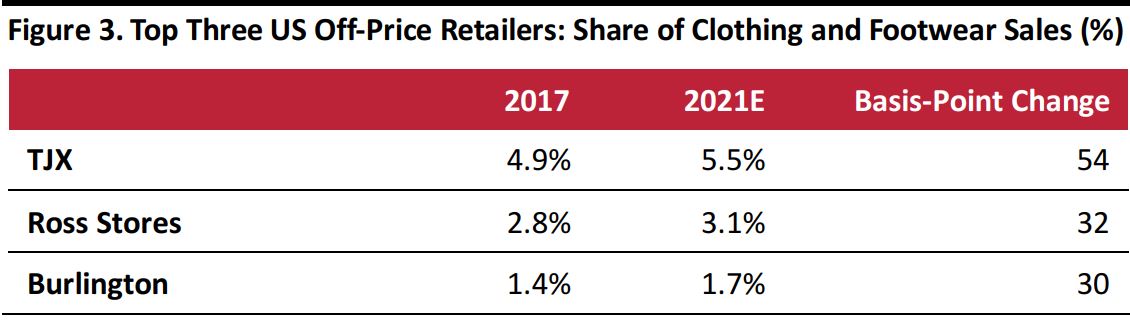

The US clothing and footwear market is highly fragmented, with even the biggest players capturing relatively small shares of spending. TJX is the country’s

third-biggest apparel retailer, yet we calculate that its share of the category is only around 5%. Current consensus estimates imply that this share will climb to around 5.5% in 2021.

Source: S&P Capital IQ/company reports/US Bureau of Economic Analysis/Coresight Research

These retailers face a number of opportunities, and some potential challenges, too. One factor mitigating their potential apparel market-share gains relative to their forecast total revenue growth is the expansion of nonapparel category sales as a share of their revenues. TJX, for example, is pushing further into home categories with its new Homesense banner as well as through its long-standing HomeGoods chain.

In fact, home goods’ proportion of total revenues has increased at all three of the top off-pricers in recent years, and we see further opportunities for them to capture share in categories such as household textiles, furniture and home accessories. As we discuss in more detail later, the millennial cohort will be establishing households and starting families in greater numbers in the coming years, and many millennials are likely to look to low-price retailers for home goods and softline products.

Of the three major off-pricers, Burlington faces a unique opportunity to grow sales in non-outerwear categories. Coats fell from 7% of the retailer’s sales in 2015 to 5% in 2017, and the company has room to dilute this category further by growing non-outerwear apparel sales more quickly.

E-commerce is also an opportunity for the top three players, given that off-price retail has a less comprehensive online offering than almost any other subsegment of the apparel market. TJX launched e-commerce operations at T.J. Maxx only in 2013, and its Marshalls, HomeGoods and Homesense banners do not yet sell online. Burlington has long sold online, but Ross Stores still does not. Any further e-commerce launches would bring the risk of cannibalization of store-based sales, but also open up the off-price offering to those shoppers who cannot—or will not—visit a store.

At the same time, the online channel brings heightened competition, particularly in the form of Amazon. We have long pointed to Amazon as a

de facto off-pricer in apparel, in that it focuses on third-party brands, has patchy offerings (often including subprime or previous-season stock), and almost always prices apparel items below standard retail price. The results of our

consumer survey earlier this year support this perception: fully 48% of all Amazon apparel shoppers we surveyed said that they expect to always pay less than full price on Amazon and only 12% of respondents said that they shopped on the site because its fashion ranges are up to date.

As Amazon expands further into apparel with price-competitive offerings, it threatens to capture shopper dollars at the expense of off-price stores. However, Amazon looks to be shifting its focus away from cut-price, third-party-branded offerings with the launch of

many more private labels and stronger relationships with brands, which may somewhat mitigate its ability to grab share from the big three off-pricers.

TJX, Ross Stores and Burlington also face heightened competition from newer off-price players. Macy’s launched its off-price Backstage concept in 2015 and plans to

open 100 such stores within Macy’s stores in 2018. One possible counterbalance to the competitive pressures new players present would be ongoing softness at rival off-price formats Saks OFF 5TH and Neiman Marcus Last Call.

Growing Store Numbers Set to Support Top-Line Expansion

Off-pricers are bucking the trend of store closures and continuing to grow their brick-and-mortar footprints. The three biggest players have confirmed plans to grow their store estates solidly:

- At the end of its latest reported quarter (May 5, 2018), TJX operated 2,983 stores in the US, 171 more than it did one year earlier, equivalent to a 6% uplift year over year. In 2017, TJX’s management repeatedly noted the potential for 5,600 stores worldwide: the company ended its fiscal year with 4,070 stores.

- Ross Stores operated 1,651 stores at its May 5 quarter-end; slightly more than 200 of those were under the dd’s Discounts banner. The company’s total store count grew by 90, or 6%, year over year as of May 5. Ross Stores plans to open around 100 stores in 2018, up from its long-term average of 90 stores per year. In March 2018, management stated that it believed the company had potential for about 2,000 stores under the Ross Dress for Less banner and 500 under the dd’s Discounts banner.

- Burlington grew its store numbers by 51, or nearly 9%, in the year ended May 5, when it operated 647 stores. Burlington plans to open 35–40 net new stores in its current fiscal year, which ends February 2, 2019.

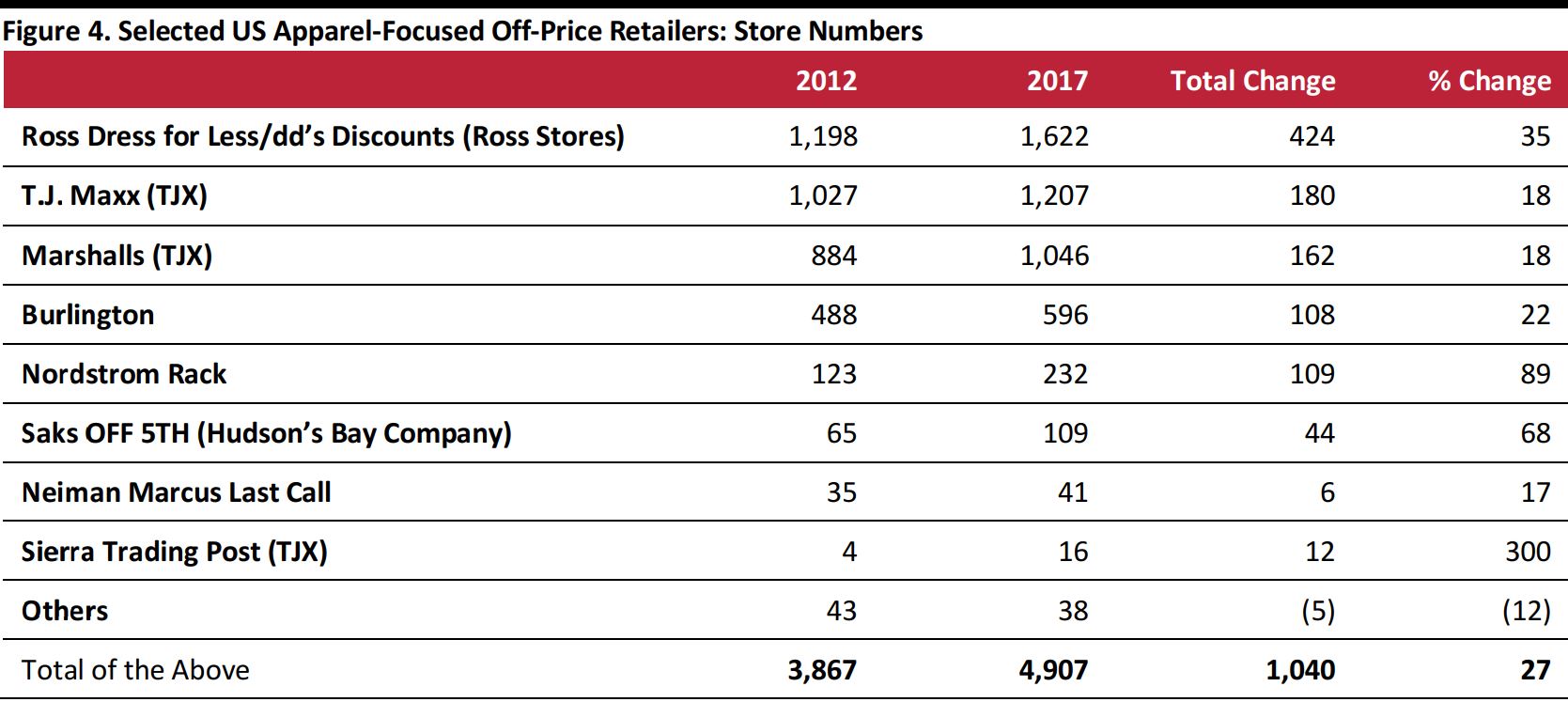

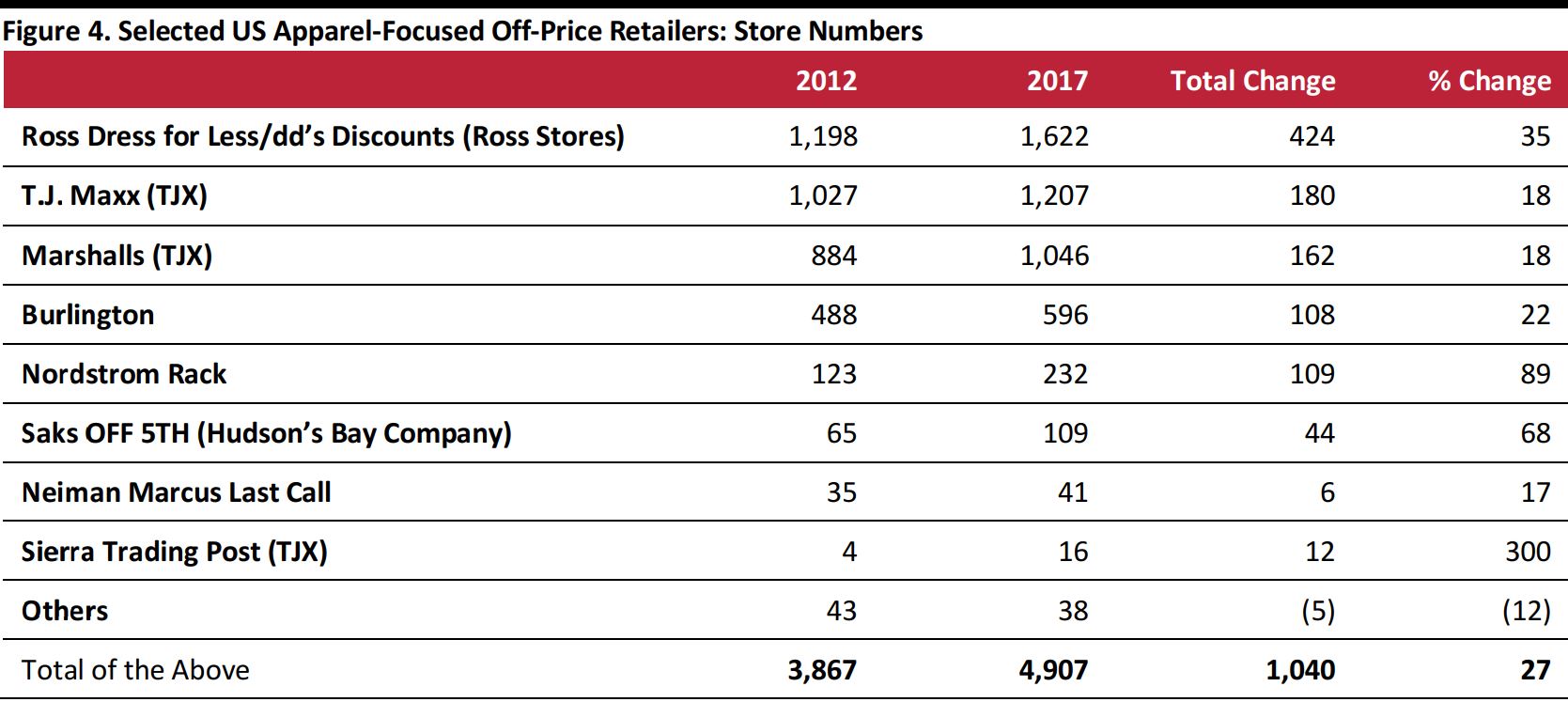

In total, apparel-focused off-price retailers grew store numbers by more than 25% in the five years ended 2017.

The absolute data shown are from Euromonitor International; due to definitions and calendarization, store numbers cited elsewhere in this report may differ.

Source: Euromonitor International/Coresight Research

Shifts in Demographics and Consumer Spending Power Set to Underpin Off-Price Demand

We see a number of factors supporting demand for off-price retailing in the coming years. In particular, millennials’ limited spending power and prioritization of spending on leisure experiences are likely to support an ongoing shift from midmarket formats to value retailers, including off-pricers, as well as to mass merchandisers and warehouse clubs.

Younger consumers tend to be more financially squeezed than older generations are, as many have been impacted by higher student debt and a degradation of employment conditions. Millennials are now setting up households and establishing families and, so, becoming a core consumer group for retailers. In the coming years, these shoppers will buy more furniture and furnishings, baby goods, and childrenswear, and we think that many of them will look to low-price retailers when shopping for such items. This is likely to fuel sustained growth in discount formats and underpin off-pricers’ expansion into home goods. See our

Millennials and Furniture in the US and the UK report for further discussion of this trend.

In a similar vein, the well-documented stagnation of US middle-class incomes is likely to prompt some trading down among consumers who traditionally would not have been core discount shoppers. According to the Pew Research Center, the US wealth (net assets) gap between upper-income and middle-income families is now the widest it has been since 1983, at 6.6 times, reflecting no wealth growth for middle- and lower-income families. This shift has underpinned growth in discount formats.

Another factor at play is the prioritization of leisure spending. Consumers, particularly those in younger age groups, increasingly prefer to spend their discretionary income on leisure services such as trips and dining out, rather than on retail purchases. This is one reason apparel spending has grown only weakly in recent years. The off-price channel allows shoppers to “fund” that increased leisure spending by making sacrifices in their retail spending.

Even putting aside the shift of spending to leisure and looking at retail spending only, apparel appears to be less of a priority than it used to be for many consumers. This is partly due to competition from newer retail categories such as consumer technology. An unwillingness to spend big on fashion has supported the flow of shoppers to off-price retail.

Part 2. Who Stands to Lose Share to the Off-Pricers?

Cross-Shopping Data Suggest that Target and Walmart Could be at Risk from Off-Pricers’ Expansion

Off-pricers can build sales by encouraging their existing shoppers to spend more on each visit or by converting occasional shoppers into more frequent shoppers. Data on cross-shopping—which here refers to the tendency of off-price shoppers to shop other retailers in addition to off-pricers—can therefore suggest which rivals stand to lose out to the off-price retailers.

Our exclusive consumer survey data show at which other retailers off-price apparel shoppers

also shop for apparel. In the table below, we show:

- Where those who have bought apparel from selected off-price retailers in the last 12 months have also bought apparel in the last 12 months.

- Where shoppers in total have bought apparel in the last 12 months.

- The percentage-point difference between the rates at which off-price apparel shoppers and the average apparel shopper shop at specific retailers.

High cross-shopping propensity implies that other retailers will risk shopper attrition should the off-pricers continue to grow rapidly. In the table below, we highlight in red where cross-shopping rates are 15 percentage points or more above the average and we highlight in green where cross-shopping rates are relatively low.

Our first observation is that off-price shoppers overindex at almost all apparel stores. This suggests that off-price shoppers are more enthusiastic apparel shoppers than the average consumer is, which makes sense, given off-pricers’ brand-heavy offerings. It also implies that off-price shoppers are repertoire shoppers, meaning they are willing to shop around at various retailers to get the products they want at the best prices. Our other observations include:

- J. Maxx/Marshalls shoppers and Ross Stores shoppers show high propensity to also shop for apparel from Target. In addition, T.J. Maxx/Marshalls shoppers show high propensity to also shop for apparel at Old Navy, despite the fact that TJX has a multibrand offering and Old Navy a monobrand offering.

- Ross Stores shoppers and Burlington shoppers show high rates of cross-shopping for apparel at Walmart, while TJX shoppers show a much lower rate.

- Ross Stores shoppers and Burlington shoppers also show higher rates of cross-shopping at JCPenney than TJX shoppers. TJX shoppers show much higher cross-shopping rates at Macy’s than at JCPenney.

- TJX shoppers are much more likely to cross-shop for apparel at Amazon than are shoppers at Ross Stores and Burlington.

- Finally, comparing the off-pricers themselves, Ross Stores shoppers and Burlington shoppers show high propensity to also buy apparel from J. Maxx/Marshalls. Meanwhile, T.J. Maxx/Marshalls shoppers overindex at Ross Stores more than they do at Burlington.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, surveyed in January 2018.

Source: Coresight Research

Profiling Off-Price Shoppers: Ross Stores and Burlington Attract a Less Affluent Shopper than T.J. Maxx Does

Many of our cross-shopping findings are in line with our demographic profiles of shoppers, and they underline that TJX competes head-on with Target and Old Navy, while Ross Stores and Burlington compete head-to-head with Walmart. As the chart below shows:

- All three of the top off-pricers attract shoppers who are younger, on average, than those who shop at department stores.

- Our research found that TJX apparel shoppers’ typical incomes are very close to the average apparel shopper’s income, which suggests that TJX could gain share at the expense of a number of midmarket rivals.

- By contrast, shoppers at Ross Stores and Burlington typically have incomes that are lower than the average apparel shopper’s. These shoppers’ incomes are similar to the average Walmart apparel shopper’s, which helps explain the high cross-shopping rates noted above. The lower incomes of Ross Stores’ and Burlington’s shopper bases could place some limits on the two retailers’ ability to win shoppers from midmarket rivals such as traditional department stores.

- TJX’s proximity to Target and Old Navy in terms of shopper age and affluence dovetails with the high cross-shopping rates recorded between TJX and each of these two retailers.

- Among the department stores, JCPenney shoppers have the closest average income to those of off-price shoppers.

Bubble size represents shopper numbers. Note that average age excludes shoppers under age 18, who were not surveyed.

Base: 1,564 US Internet users ages 18+ who have bought clothing or footwear in the past 12 months, surveyed in January 2018.

Source: Coresight Research

Store Proximity Data Confirm TJX Overlap with Target and Old Navy

Our third data set looks at the physical proximity of off-pricers’ stores and those of their competitors. We note that this is a less direct indicator of which retailers may lose out to the off-pricers because consumers factor in much more than proximity when choosing where to shop and because these data do not, by their nature, show the threat posed by off-pricers opening stores in the future. Nevertheless, we think that the data are meaningful, for two reasons:

- Off-price retail remains disproportionately store-based: as we noted earlier, the major off-pricers’ e-commerce offerings are incomplete, with only T.J. Maxx and Burlington selling online. So, store proximity data are more relevant in the apparel segment than in most other segments.

- The top three off-price retailers continue to post solid same-store sales growth, suggesting that their existing store estates threaten to chip away at rivals’ sales and that off-price growth is not all about new stores.

The table below represents the proportion of selected retailers’ total store estates that have an off-price store located within two miles.

- The data set, like the other two discussed above, suggests that Target faces a greater relative threat from TJX than Walmart does. The proportion of Target stores located near a TJX store is 66%, more than double the comparable figure for Walmart.

- Similarly, the data further underscore the potential for Old Navy to lose out to TJX.

- JCPenney sees a very high rate of proximity to TJX stores. Moreover, its estate has a higher exposure to each of the three major off-pricers than do its department store peers Macy’s and Kohl’s.

- As shown earlier, cross-shopping rates between Ross Stores and Walmart and Burlington and Walmart are significant. However, a relatively low percentage of Walmart stores are located within two miles of a Ross Stores location or a Burlington store. Target has a greater share of its estate located close to a Ross Stores location or a Burlington store than Walmart does.

*Includes Walmart discount stores, Walmart Neighborhood Markets and Walmart Supercenters only; excludes Sam’s Club and Walmart pickup points

**Includes Bloomingdale’s and Macy’s

Source: Thinknum/Coresight Research

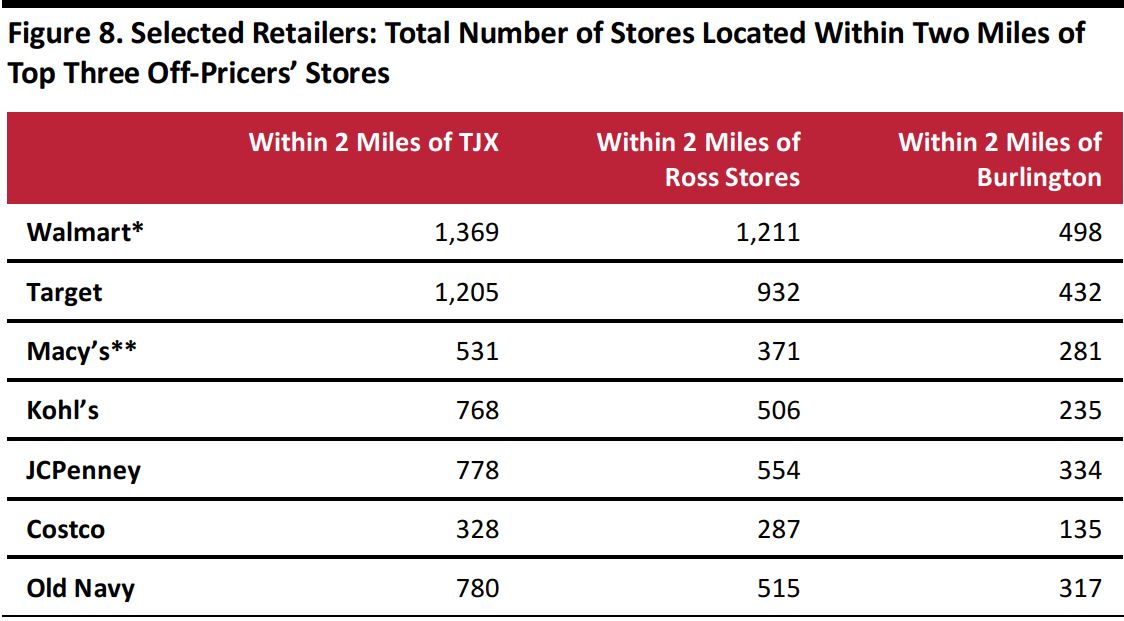

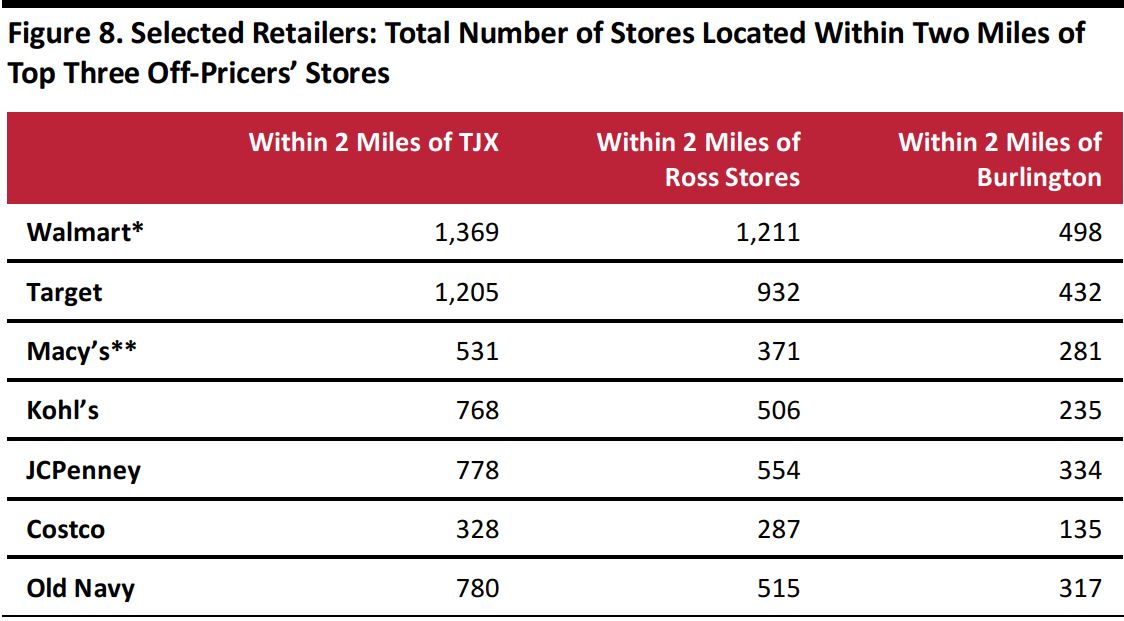

The next table represents the same findings in absolute terms: it shows the number of selected rivals’ stores that are located within two miles of one of the off-pricers’ respective locations.

- These data help explain the high cross-shopping rates between Ross Stores and Walmart and Burlington and Walmart. In absolute terms, Walmart is the retailer with the most exposure to these rivals.

*Includes Walmart discount stores, Walmart Neighborhood Markets and Walmart Supercenters only; excludes Sam’s Club and Walmart pickup points **Includes Bloomingdale’s and Macy’s Source: Thinknum/Coresight Research

Key Takeaways

Various retailers will face heightened competition from off-pricers TJX, Ross Stores and Burlington in the coming years.

- Our cross-shopping data and consumer profiles show that TJX shoppers differ significantly from those who shop at Ross Stores or Burlington. TJX shoppers tend to cross-shop at different stores than those who buy from Ross Stores or Burlington, and they tend to be more affluent.

- Target and Old Navy are likely to face strong competition from TJX. Our data show high rates of cross-shopping between TJX banners and Target and between TJX banners and Old Navy. The demographic profiles of these three retailers’ shoppers are very similar, and a high proportion of Target’s and Old Navy’s store estates have a TJX store nearby. The crossover with Old Navy is seen despite the fundamental difference between Old Navy’s monobrand offering and TJX’s multibrand offering.

- Walmart could face challenges from Ross Stores and Burlington. Ross Stores shoppers and Burlington shoppers show high rates of apparel cross-shopping at Walmart, and all three retailers register shoppers with below-average income levels. In relative terms, Walmart’s store estate faces limited exposure to both Ross Stores locations and Burlington locations. But in absolute terms, a large number of Walmart stores face local competition from these retailers.

- Among the department stores, our consumer profiles and store proximity data suggest that JCPenney could face the greatest competition from the major off-pricers.