albert Chan

What’s the Story?

Africa has the fastest rate of urbanization and one of the youngest populations in the world. As startup culture deepens on the continent, the explosion of technology hubs since early 2010 has shown no signs of slowing. In this report, we discuss the startup ecosystem of Nigeria, home to the largest population and the largest economy of any country in Africa.

We highlight key companies across three areas:

- Retail-technology startups that have now become major players in the country

- Online payment-technology startups

- Accelerators and incubators (organizations that provide facilities, short-term funding and support to startups)

A technology startup comprises a technology business that is less than 10 years old but is at least at the seed stage of funding, for the purpose of this report.

The appendix presents a detailed overview of the startup landscape across Africa as a whole.

Why It Matters

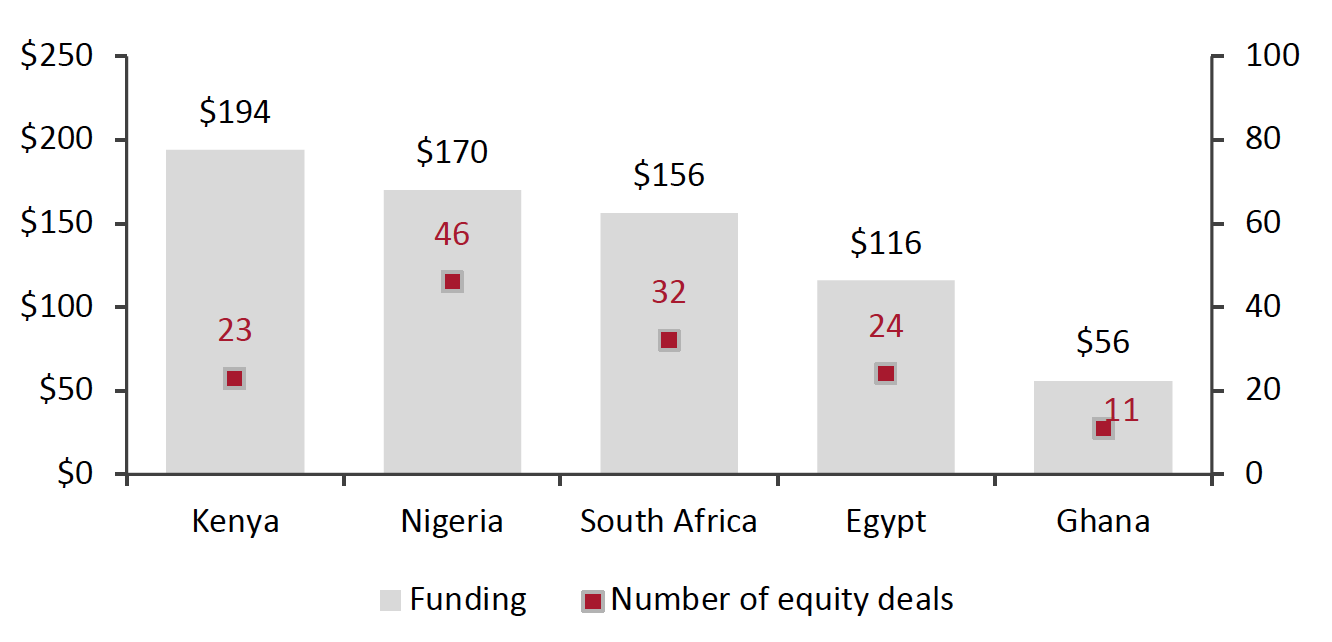

Nigeria’s startup ecosystem is thriving. In 2020, Nigeria had the highest number of startups in Africa, according to venture capital firm Partech Partners. For total startup funding received, Nigeria was second only to Kenya and saw the highest number of equity deals in 2020.

Figure 1. Select African Countries: Startup Funding in 2020 (USD Mil.; Left Axis) and Number of Deals (Right Axis)

[caption id="attachment_130595" align="aligncenter" width="700"] Source: Partech’s 2020 Africa Tech Venture Capital Report[/caption]

Source: Partech’s 2020 Africa Tech Venture Capital Report[/caption]

The Nigerian Startup Ecosystem: A Deep Dive

Nigeria is leading the growth of the technology sector in West Africa and is one of the top three countries driving retail-tech growth across Africa as a whole, according to Partech Partners.

Nigeria has the largest population in Africa—211 million as of July 1, 2021, according to United Nations estimates. Moreover, the country has one of the most advanced startup ecosystems in Africa, offering well-established collaboration and investment networks with 85 active tech hubs—physical organizations providing access to facilities and financial or in-kind support to tech entrepreneurs, according to a 2019 report by the GSMA Ecosystem Accelerator program.

Despite the favorable environment for tech startups, less than 5% of new businesses in the country have been able to access adequate finance to fund their growth as of 2020; new business owners have mainly relied on personal savings and money from friends and relatives to kickstart their businesses, according to the Nigeria Bureau of Statistics (NBS).

However, a small minority of SMEs have been able to raise foreign capital: startups. Technology startups have attracted more foreign investment as they have the greatest potential to scale quickly and globally.

In Figure 2, we provide an overview of notable startups within Nigeria’s ecosystem, before discussing selected major players in detail in the following sections. The companies we present in this report fall under three categories: retail-technology startups, online payment-technology startups and startup accelerators/incubators.

Figure 2. Notable Retail-Technology Startups in Nigeria

[wpdatatable id=1122] Source: Company websites/Coresight Research 1. Retail-Technology StartupsOver 90% of Nigeria’s retail market is taken up by informal retail, according to Euromonitor, comprising market stalls, neighborhood stores and roadside kiosks. On this basis, Nigeria may not seem a promising market for retail innovation and e-commerce. However, its relatively high Internet penetration and high rate of mobile phone ownership—around 60% and 50% of the population, respectively, as of November 2020—according to Statista, combined with the nation’s large, youthful and tech-savvy population, combine to create a huge online audience.

Below, we discuss four key startups that have grown into major players in Nigeria.

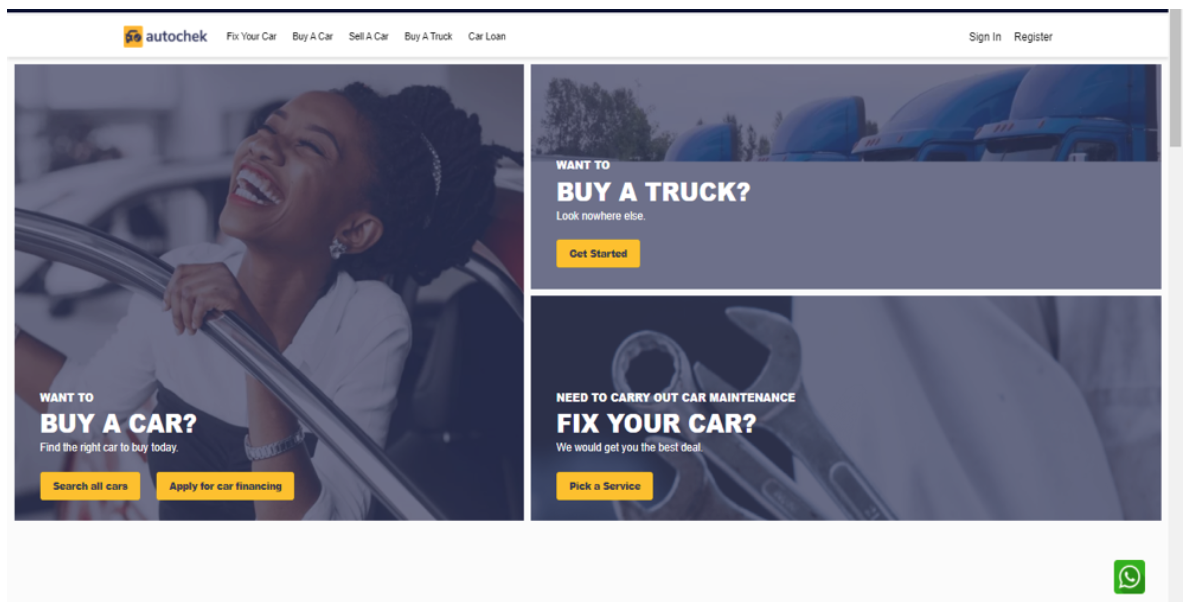

Autochek

Autochek is an online automotive marketplace seeking to capture car and truck sales, and rentals and repair spending that would otherwise take place offline—aiming to lure shoppers away from informal retail, which currently dominates the market.

The startup launched in September 2020, having raised $3.4 million in pre-seed funding. Later the same year, Autochek acquired automotive marketplaces Cheki Nigeria and Cheki Ghana and commenced operation in both countries.

As of March 2021, the Autochek app has 20,000 vehicle listings and more than 12,000 dealers and private sellers on the marketplace, as well as a range of corporate partners and customers.

In early 2021, the company announced the launch of its online truck rental marketplace in Nigeria and Ghana, in a bid to move the trucking industry online by providing a structured marketplace.

[caption id="attachment_130337" align="aligncenter" width="700"] Source: Company website[/caption]

Source: Company website[/caption]

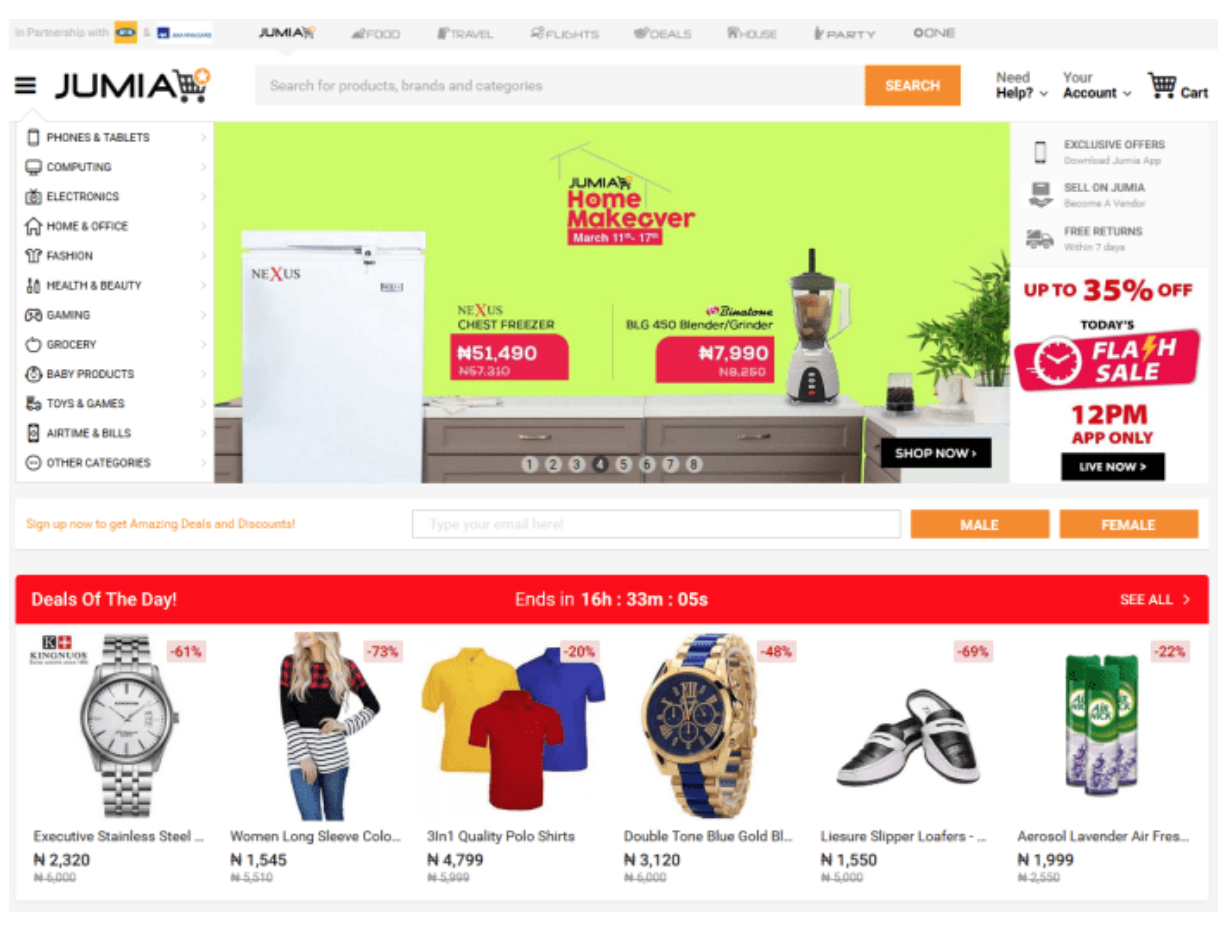

Jumia Group

Founded in 2012 and headquartered in Lagos, Jumia is an e-commerce marketplace that connects local companies directly with consumers. It offers a wide assortment, ranging from food to travel tickets and real estate, sold through its secure payment platform. Jumia’s online platform is available in 11 African countries, offering its 6.9 million active users over 40 million products from over 110,000 active sellers.

Sellers on Jumia have access to its fulfillment and delivery service under Jumia Logistics across all the countries in which it operates. The startup also operates “JForce,” a network of sales consultants that place orders on the platform on behalf of consumers in a commission-based program. The aim is to overcome the challenges of low trust in e-commerce and limited Internet access in some consumer groups. In Nigeria, where these challenges are less severe than in other African markets, its network of sales consultants who engage consumers with the platform still gives Jumia an advantage over its competitors.

Jumia was listed on the New York Stock Exchange in 2019 and rose to a valuation of $1.9 billion on its first day.

[caption id="attachment_130338" align="aligncenter" width="700"] Source: Company website[/caption]

Source: Company website[/caption]

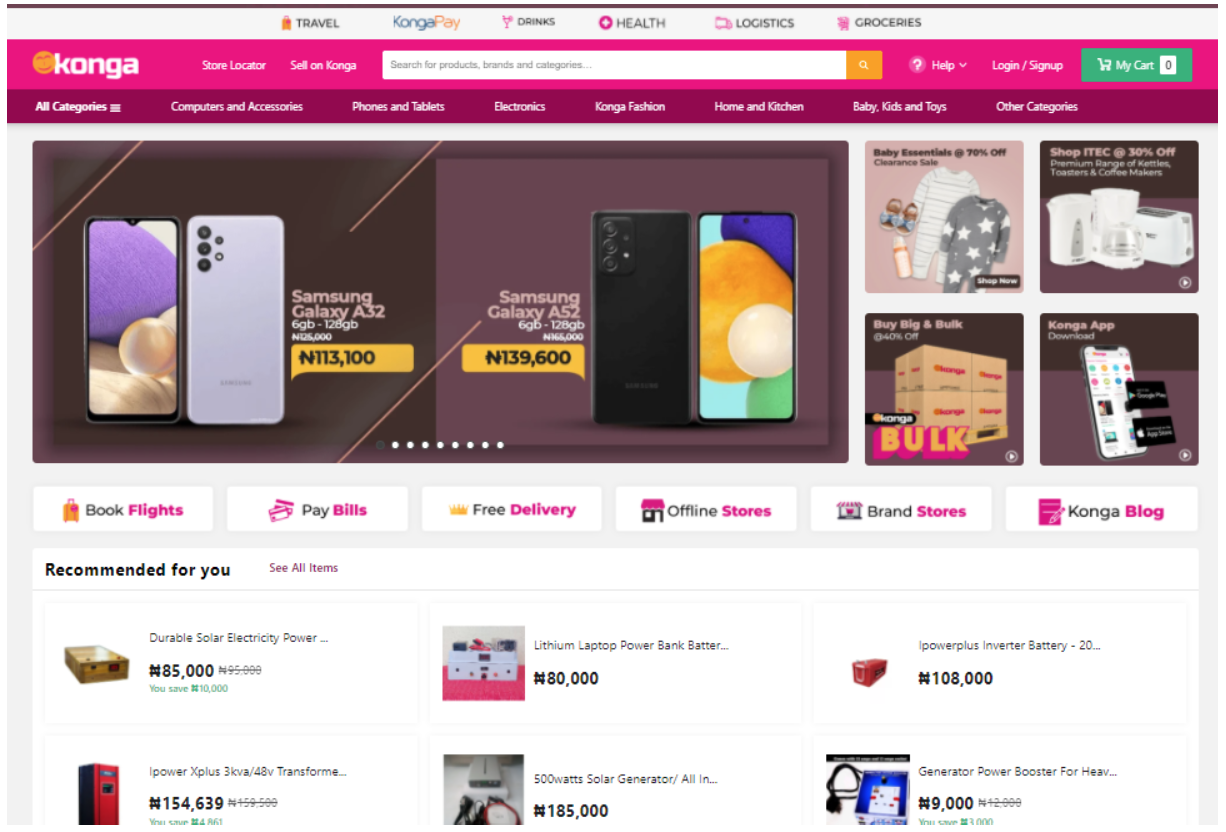

Konga

Founded in July 2012, Konga is a Nigerian digital marketplace that also offers third-party vendors access to delivery services. Originally founded as a Lagos-only online retailer of baby, beauty and personal care products, it broadened its scope later in 2012 to operate across categories and across Nigeria. In its seed-round funding in 2021, Konga raised $3.5 million from Swedish investment company Investment AB Kinnevik.

In early 2013, Konga raised $10 million in Series A funding, from two investors: Investment AB Kinnevik and South African technology investor Naspers. In the same year, the company achieved a $25 million Series B round from the same investors, the largest single round raised by a single African startup at the time.

In 2018, Konga was acquired by Zinox Technologies, a Nigerian information technology manufacturer, and merged with its subsidiary Yudala—a combined brick-and-mortar retailer and e-commerce platform that operated mainly in northern Nigeria—to become the largest e-commerce player in Africa at the time. The key legacy of this merger, Konga’s network of physical stores, is what differentiates it from its competitors.

[caption id="attachment_130339" align="aligncenter" width="700"] Source: Company website[/caption]

Source: Company website[/caption]

TradeDepot

TradeDepot was founded in 2016 and is headquartered in Lagos. It operates an end-to-end distribution platform that aims to connect the world’s top consumer goods companies directly to African retailers. It handles inventory, shipping, returns and customer service for its registered suppliers. With a network of over 40,000 micro-retailers across Nigeria, the startup plans to build the largest retail distribution network in Africa.

In 2020, the company raised $10 million in pre-Series B equity funding to expand into more Nigerian cities, including Abuja and Port-Harcourt, and launch a suite of financial products and credit facilities for retailers. It has raised a total of $13 million in funding to date.

[caption id="attachment_130340" align="aligncenter" width="700"] Source: Company website[/caption]

2. Online Payment Startups

Source: Company website[/caption]

2. Online Payment Startups

Flutterwave and Paystack provide support to businesses by facilitating payments and international transactions. They are notable for the volume of investment they have received and their successes both in Nigeria and across Africa.

Flutterwave

Founded in 2016, Flutterwave develops payment technology and infrastructure, enabling banks and merchants to replace multiple payment integrations with one simple API. It facilitates all forms of payment across Africa.

The company raised $10 million in Series A funding in August 2017 and in an extension round in 2018. In January 2021, it raised a $35 million Series B funding round from a consortium of strategic investors, including global venture capital firms Greycroft and eVentures, and announced a partnership with WorldPay FIS.

Flutterwave currently has an active presence in 10 African countries, including Ghana, Kenya, Nigeria and South Africa. The company stated that it would use the funding to expand across Francophone and North Africa, with new target markets including Egypt, Ivory Coast, Malawi, Morocco, Senegal and Zambia.

[caption id="attachment_130341" align="aligncenter" width="700"] Source: Company website[/caption]

Source: Company website[/caption]

Paystack

Launched in January 2016, Paystack is a payments company that now processes over 50% of all online transactions in Nigeria, for over 60,000 organizations, including FedEx, MTN and UPS.

In October 2020, the company was acquired by Irish–American technology company Stripe, which had previously led Paystack’s $8 million funding round in 2018. Stripe’s payments software is used by customers including Amazon, Google, Shopify and Zoom, and its acquisition of Paystack is the latest move in its international expansion. Paystack will be Stripe’s catalyst for developing e-commerce in Africa—the Lagos-based Paystack has plans to expand across the continent, starting with a pilot in South Africa toward the end of 2021.

[caption id="attachment_130342" align="aligncenter" width="700"] Source: Company website[/caption]

3. Startup Accelerators and Incubators

Source: Company website[/caption]

3. Startup Accelerators and Incubators

Below, we present three key accelerators that have incubated and provided funding or access to facilities for Nigerian startups.

Co-creation Hub (CcHUB)

CcHUB is a pre-incubation space that provides startup teams with mentoring and pre-seed funding, as well as support for project planning, usability testing and customer trials. CcHUB brings together technologists, social entrepreneurs, governments, tech companies and impact investors in and around Lagos.

Operating since 2011, the incubator largely focuses on the intersection between technology and social impact. CcHUB has supported over 50 technology startups in Nigeria, including BudgIT, a civic organization that uses technology to simplify public Nigerian government data; Efiko, a social quiz platform related to the country’s national curriculum to support secondary school students; and Truppr, a social tool that enables sports lovers to organize and find fitness events and team mates.

In 2015, CcHUB announced the launch of its $5 million social innovation fund, Growth Capital, backed by companies including the Omidyar Network. The incubation program at CcHUB also delivers a range of initiatives including CodeCamp, the Social Change Summit and the Summer of Code.

Ventures Platform

Founded in 2016, Ventures Platform is an Abuja-based seed-stage investment fund and accelerator. It invests in startups that are past the minimum viable product (MVP) stage and aims to help companies grow rapidly, offering support in implementing frameworks for B2C marketing, business development and partnerships.

The company offers pre-seed investments of up to $40,000 and Series A+ investments in of up to $1 million.

Wennovation Hub

Founded in 2010, Wennovation Hub was one the earliest, if not the first, technology startup accelerators in Nigeria. The accelerator is managed by Wole Odetayo and operates in Lagos and Ibadan.

Wennovation Hub emphasizes the importance of job creation in its programs, and aims to inspire and empower young African entrepreneurs in sectors with high social impact including agriculture, education, healthcare and technology.

What We Think

The Nigerian market is steadily growing and will continue to do so, spurred by growing e-commerce penetration and the country’s youthful population. E-commerce presents an opportunity for retail to “leapfrog” from the informal systems that still dominate straight to a tech-driven, online-first ecosystem. The tech hubs and startup accelerators active in Nigeria, particularly in Lagos, have demonstrated their ability to nurture successful businesses and show no signs of stopping now.

Implications for Brands/Retailers

- Nigeria’s startup ecosystem includes many technology companies that have the potential to scale rapidly. Brands and retailers should consider opportunities related to startups when looking to expand their reach in Nigeria and Africa.

Implications for Technology Vendors

- Nigeria’s population is young, technology-savvy and seeking more convenient means to buy and sell, presenting a tremendous opportunity for technology vendors that can offer platforms as alternatives to the informal retail systems in place.

- The challenges of transporting and delivering goods in the context of Nigeria’s size and infrastructure status present opportunities for technology vendors that can offer logistical solutions—such as real-time supply chain management or delivery drones.

Appendix: Overview of the African Startup Landscape

Africa has the fastest rate of urbanization and one of the youngest populations in the world. According to Compliant AI, more than 40% of its population are currently living in urban centers and by 2030, Africa’s 18 largest cities will have a combined spending power of $1.3 trillion.

Regarded as an emergent market, Africa comprises 55 independents states, which are characterized by diverse economies and consumption patterns. The continent hosts a variety of different customs, income groups, languages, races and religions. Furthermore, different countries are at different development stages.

As startup culture deepens on the continent, the explosion of technology hubs across Africa since early 2010 has shown no signs of slowing down: A 2019 report by the GSMA Ecosystem Accelerator program and research company Briter Bridges identified 618 active technology hubs across the continent.

African startups are becoming increasingly appealing to an international audience. Several global brands such as Founders Factory, Startupbootcamp and Y Combinator have established a presence on the continent, funding a growing number of startups: Y Combinator, for instance, has funded over 40 startups in Africa.

Top Ecosystems in Africa

The following cities are the top 10 cities with the best startup ecosystems across Africa, according to a 2020 report by StartupBlink, which analyzes startup ecosystems in in 100 countries worldwide:

- Nairobi, Kenya

- Lagos, Nigeria

- Cape Town, South Africa

- Johannesburg, South Africa

- Cairo, Egypt

- Kigali, Rwanda

- Tunis, Tunisia

- Kampala, Uganda

- Accra, Ghana

- Casablanca, Morocco

Retail in Africa

The retail segment of Africa is largely driven by informal retail. According to the United Nations Economic Commission for Africa (UNECA), approximately 90% of transactions in the African retail market are conducted through informal channels—though informal retail is, by its nature, difficult to measure. For example, informal retail transactions account for 96% of retail transactions in Ghana and 98% in Cameroon. Even in Kenya, which is more urbanized, the vast consumer base in rural areas still shops at informal outlets, accounting for approximately 70% of transactions. Similarly, Zimbabwe has a fragmented retail market and is seeing a recent upsurge in small “tuck shops.” South Africa, by contrast, leads the way in formal retail, with only 40% of South Africans—still a significant minority—shopping through informal retail.

The large portion of informal retail signals significant opportunity for formal retailers capture market share. However, there are numerous hurdles for big companies in establishing in-country operations across Africa, including the diverse consumer mix, limited established distribution networks, constraints in infrastructure, and political and economic uncertainties. However, e-commerce players—such as Jumia and Konga in Nigeria—have demonstrated how new technology can enable retailers to bypass establishing a formal store network and succeed as online-only or online-first businesses.