DIpil Das

What’s the Story?

The US appears to have turned a corner in the fight against Covid-19, with daily cases decreasing and more than four in 10 US consumers now at least partially inoculated against the virus. As vaccinated consumers become a larger portion of the overall population, understanding how the vaccine rollout has changed their approach to living and spending will be key for retailers in forecasting how the new consumer will behave during the second half of 2021.Why It Matters

Consumers shifted their behaviors at record rates in 2020 in the midst of the pandemic, causing retailers to react and pivot to serve an entirely new type of consumer. A similar shift may be upon us in 2021: As Covid-19 cases go down and vaccinations rise, consumers are likely to again substantially change their shopping patterns. However, unlike at the outset of the pandemic, retailers now have the ability to prepare for these new consumers. Coresight Research’s proprietary data on consumers’ plans for spending following vaccination can provide retailers, service providers, REITs and brands with a roadmap for how they can proactively adapt their businesses to appeal to the post-pandemic consumer.The Next Spending Revolution in the US: In Detail

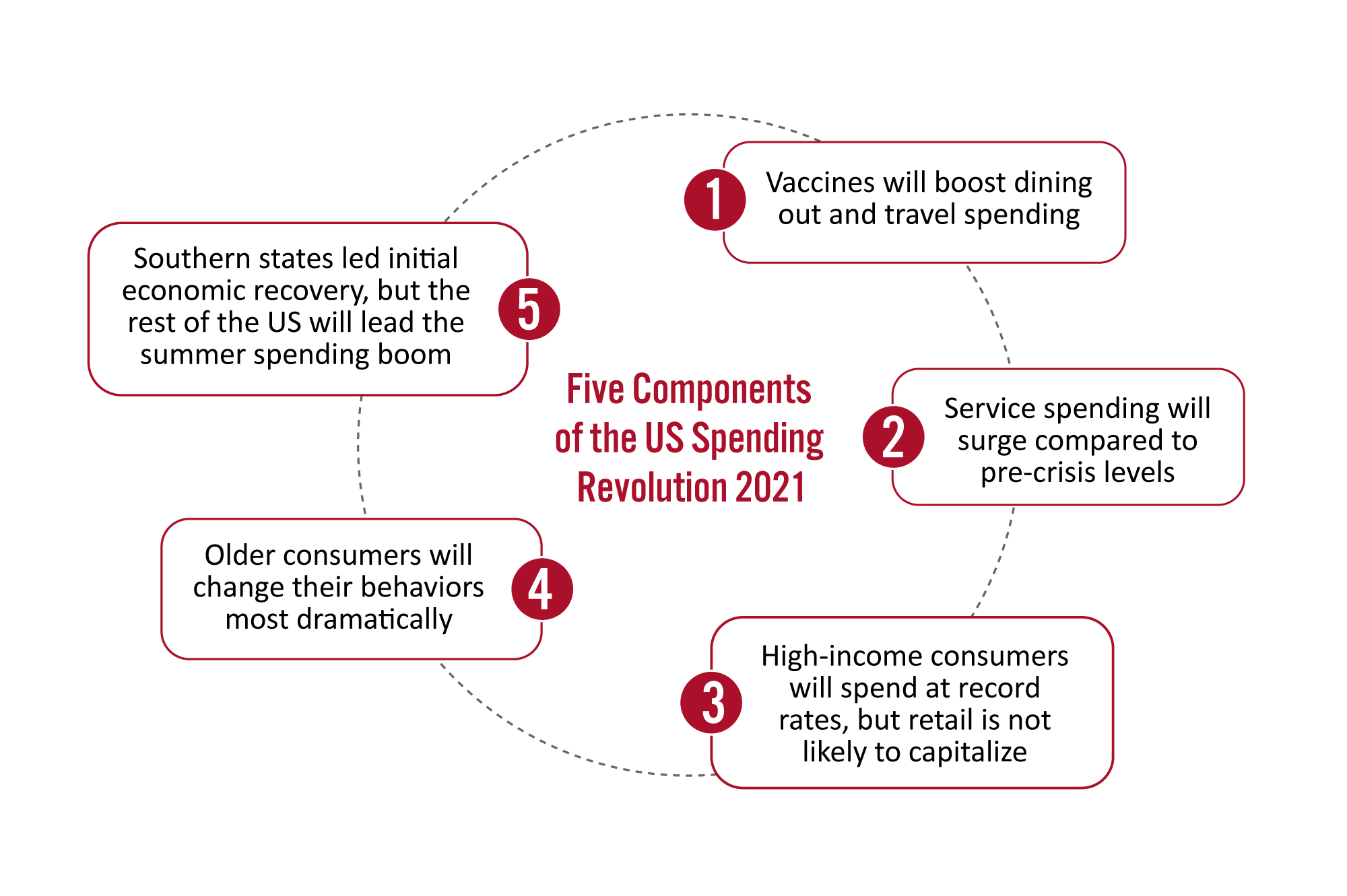

Using data from our survey of US adults conducted on April 12, 2021, we explore five key ways in which vaccines will impact consumer spending patterns in the second half of 2021.Figure 1. Five Components of the US Spending Revolution 2021, Driven by Post-Vaccine Changes in Behavior [caption id="attachment_128100" align="aligncenter" width="725"]

Source: Coresight Research [/caption]

1. Vaccines Will Boost Dining Out and Travel Spending

Despite the economic uncertainty of 2020, retail sales surged due to the injection of stimulus checks and a lack of other spending options for consumers who spent record amounts of time in their homes and online. However, while retailers were able to effectively pivot to e-commerce, service industries struggled.

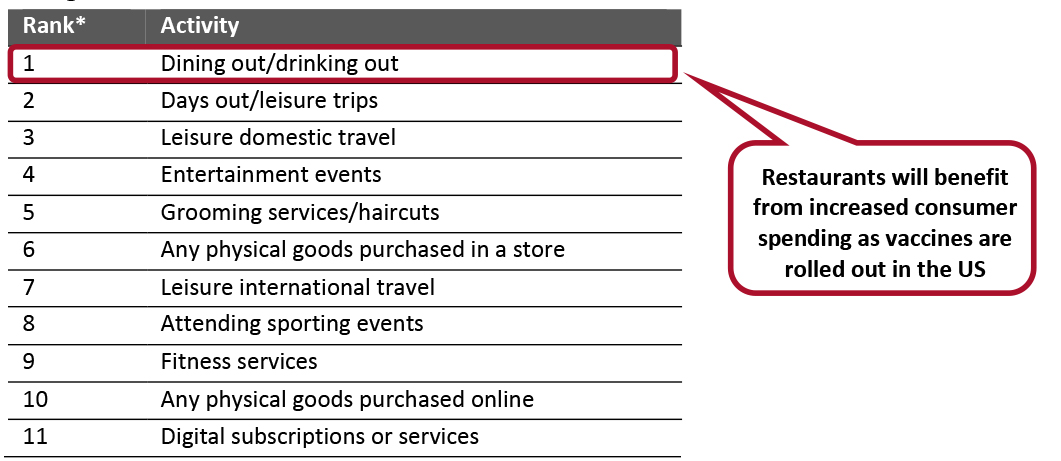

Our survey results indicate that the rest of 2021 will tell a much different story. This year, as the country opens up and virus fears begin to fade, consumers are likely to get out of the house more and resume pre-crisis activities. In particular, we found that large portions of consumers plan to increase their spending on dining and drinking out, days out and travel.

Source: Coresight Research [/caption]

1. Vaccines Will Boost Dining Out and Travel Spending

Despite the economic uncertainty of 2020, retail sales surged due to the injection of stimulus checks and a lack of other spending options for consumers who spent record amounts of time in their homes and online. However, while retailers were able to effectively pivot to e-commerce, service industries struggled.

Our survey results indicate that the rest of 2021 will tell a much different story. This year, as the country opens up and virus fears begin to fade, consumers are likely to get out of the house more and resume pre-crisis activities. In particular, we found that large portions of consumers plan to increase their spending on dining and drinking out, days out and travel.

- Dining and drinking out was the category on which most consumers indicated plans to increase spending compared to the 2020 pandemic period. This will provide a welcome boost for the restaurant industry, which as of April 16, 2021, still saw dine-in numbers down 28.6% from pre-pandemic values, according to OpenTable data.

- Days out and domestic leisure travel were the second- and third-most common categories on which consumers plan to spend more versus the 2020 pandemic period. Leisure international travel came in much lower, ranking seventh—the result of continuing global travel restrictions as well as the higher Covid-19 risks and lower vaccination rates in most other countries.

Figure 2. Categories in Which US Consumers Plan To Increase Spending Once Vaccinated, Compared to During the 2020 Pandemic Period [caption id="attachment_128086" align="aligncenter" width="725"]

*Ranked from highest to lowest proportion of respondents that reported they would spend more on the category than during the 2020 pandemic period

*Ranked from highest to lowest proportion of respondents that reported they would spend more on the category than during the 2020 pandemic period Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine

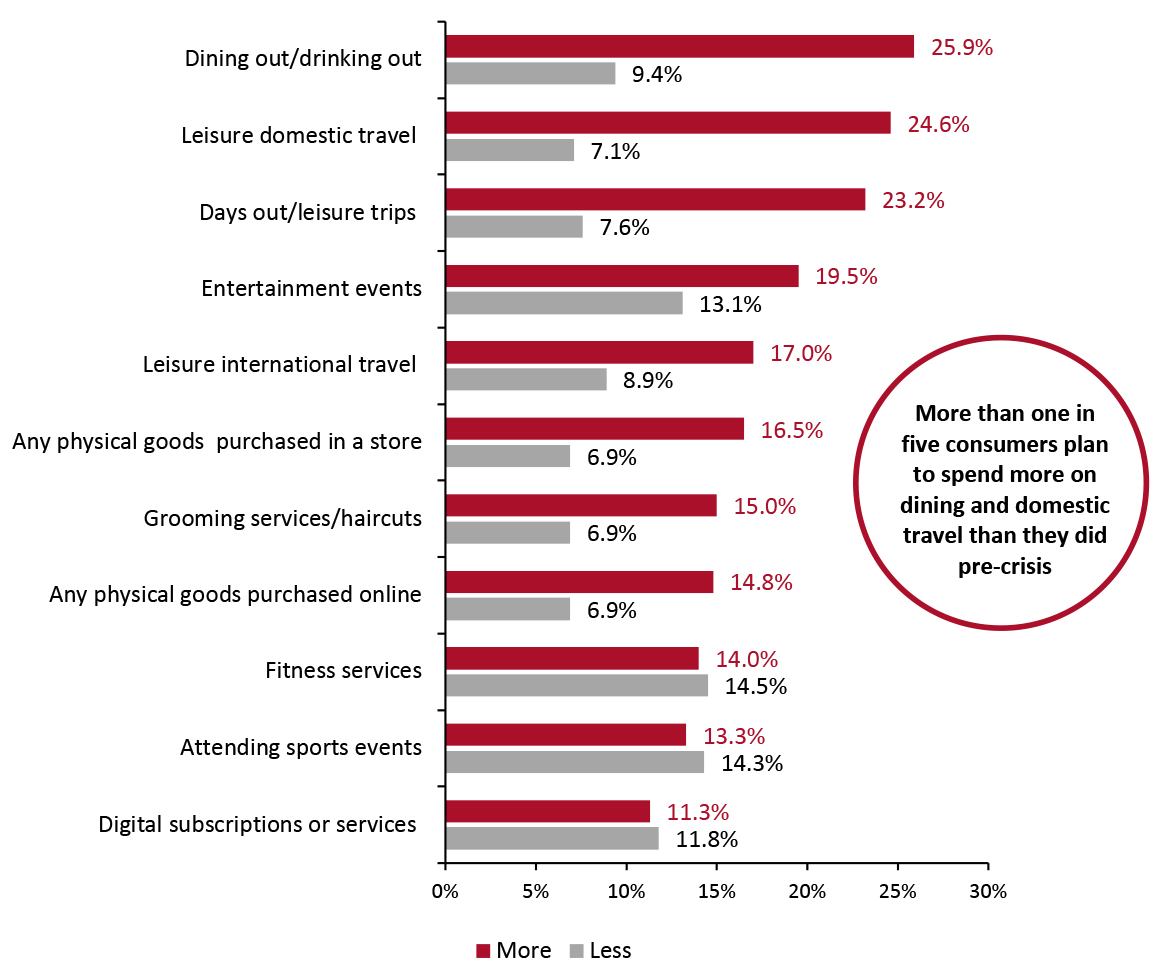

Source: Coresight Research [/caption] 2. Service Spending Will Surge Compared to Pre-Crisis Levels That service spending will rebound this summer is no surprise: Services typically perform better than goods in the aftermath of recessions, and spending on services dropped so dramatically in 2020 that even a mediocre year in the service industry would be a massive improvement over last year. More notable is that service spending looks likely not just to surpass pandemic levels but also to climb past pre-crisis levels, driven by the pent-up spending power consumers accrued while they had fewer opportunities to spend, which Coresight Research estimates now totals about $2.5 trillion. Among consumers who are vaccinated (or plan to get vaccinated), our survey found the following:

- Compared to the proportion who plan to spend less, a higher proportion of consumers plan to spend more than pre-pandemic in all but two of the service spending categories.

- Dining and drinking out again came out on top, with nearly three times as many consumers indicating that they plan to spend more than they did pre-crisis on this category than those who plan to spend less.

- Domestic leisure travel and days out saw similar ratios of about three to one in the proportion of consumers planning to spend more compared to those planning to spend less.

- It largely makes sense that digital subscriptions may be one of the poorest performing categories post pandemic. Consumers ramped up spending on digital services during the pandemic while stuck in their homes with few other sources of entertainment; as consumers go back to work and resume normal social lives, it makes sense that spending here would stagnate or even fall from their 2019 values in the short term as consumers prioritize in-person connection.

- Fitness services, which prior to the pandemic were typically out-of-the-home activities, may see a drop in spending from pre-pandemic levels because consumers now have at-home fitness equipment that they bought amid lockdowns last year.

- It is perhaps surprising that consumers do not plan to spend more on attending sporting events than prior to the pandemic—particularly as travel and dining categories saw better results. However, this might be explained by continuing caution even by vaccinated consumers with regards to mingling in crowds. As case rates continue to decline, we expect to see more consumers get back to these activities than indicated in this survey.

Figure 3. US Consumers Who Have Received or Plan To Receive a Vaccine: Categories in Which They Plan To Spend More or Less Once Vaccinated, Compared to Pre-Pandemic (% of Respondents) [caption id="attachment_128087" align="aligncenter" width="725"]

Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine

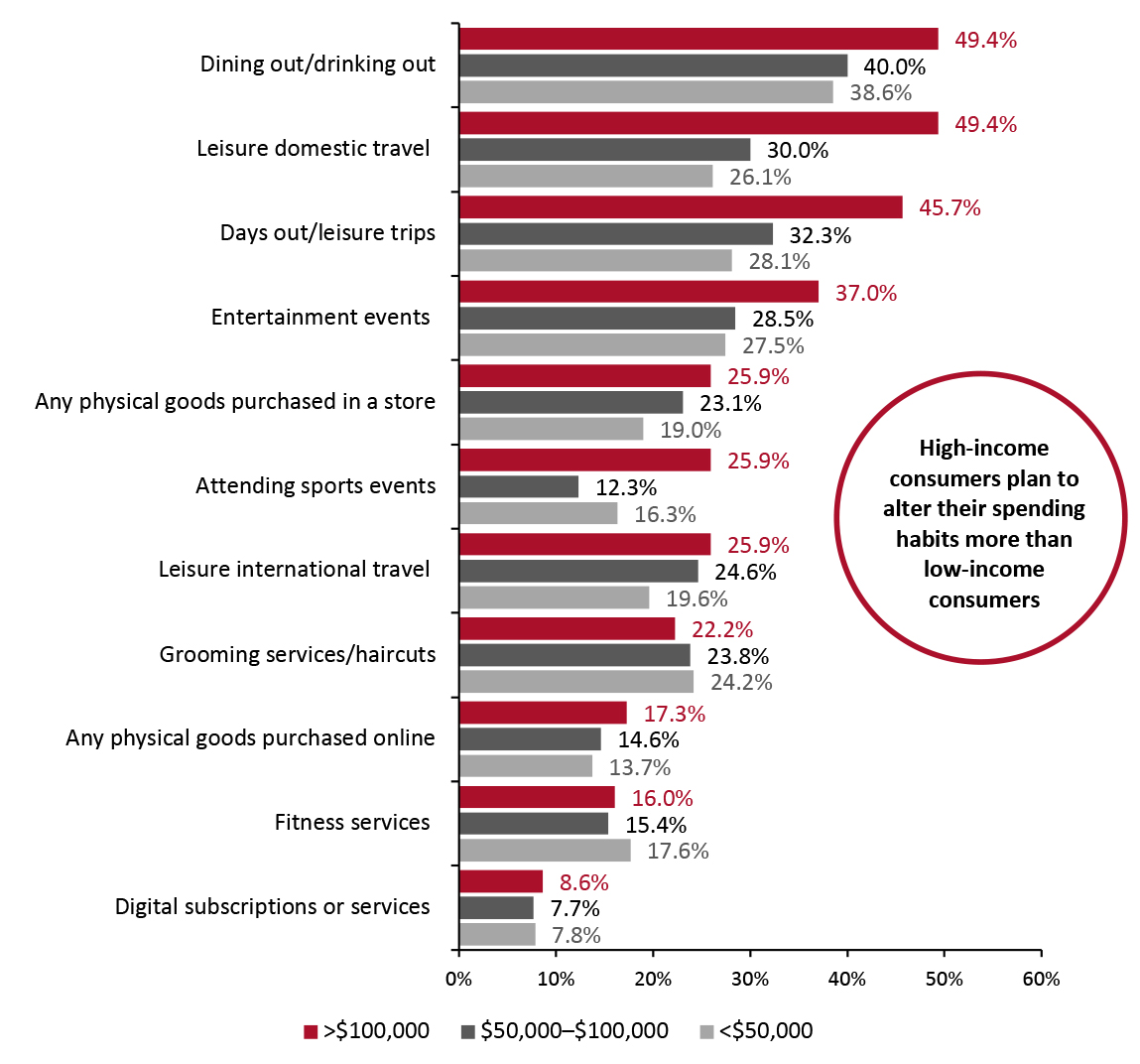

Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine Source: Coresight Research [/caption] 3. High-Income Consumers Will Spend at Record Rates, but Retail Is Not Likely To Capitalize Increases in spending will be concentrated among higher-income consumers—a demographic that saved a disproportionate amount during the pandemic, largely retained their jobs through the crisis and have seen their wealth grow through a strong stock and housing market. The differences between income groups in plans to spend more are most pronounced in service categories. Among consumers who are vaccinated (or plan to get vaccinated), our survey found the following:

- Consumers with incomes over $100,000 are about twice as likely to spend more on leisure domestic travel once vaccinated, compared to consumers with incomes below $50,000. This aligns with data from our weekly US Consumer Tracker, which indicates a recent spike in high-income consumers planning domestic trips, while the proportion of middle- and low-income consumers doing the same has remained steady.

- Although less stark, the same disparities emerge in most other service categories—notably dining out, days out, and entertainment and sports events. Each of these categories saw at least a seven-percentage-point gap between the proportions of high-income consumers planning to increase spending and other income groups.

Figure 4. US Consumers Who Have Received or Plan To Receive a Vaccine: Categories in Which They Plan To Increase Spending Once Vaccinated, Compared to During the Pandemic, by Income Level (% of Respondents) [caption id="attachment_128088" align="aligncenter" width="725"]

Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine

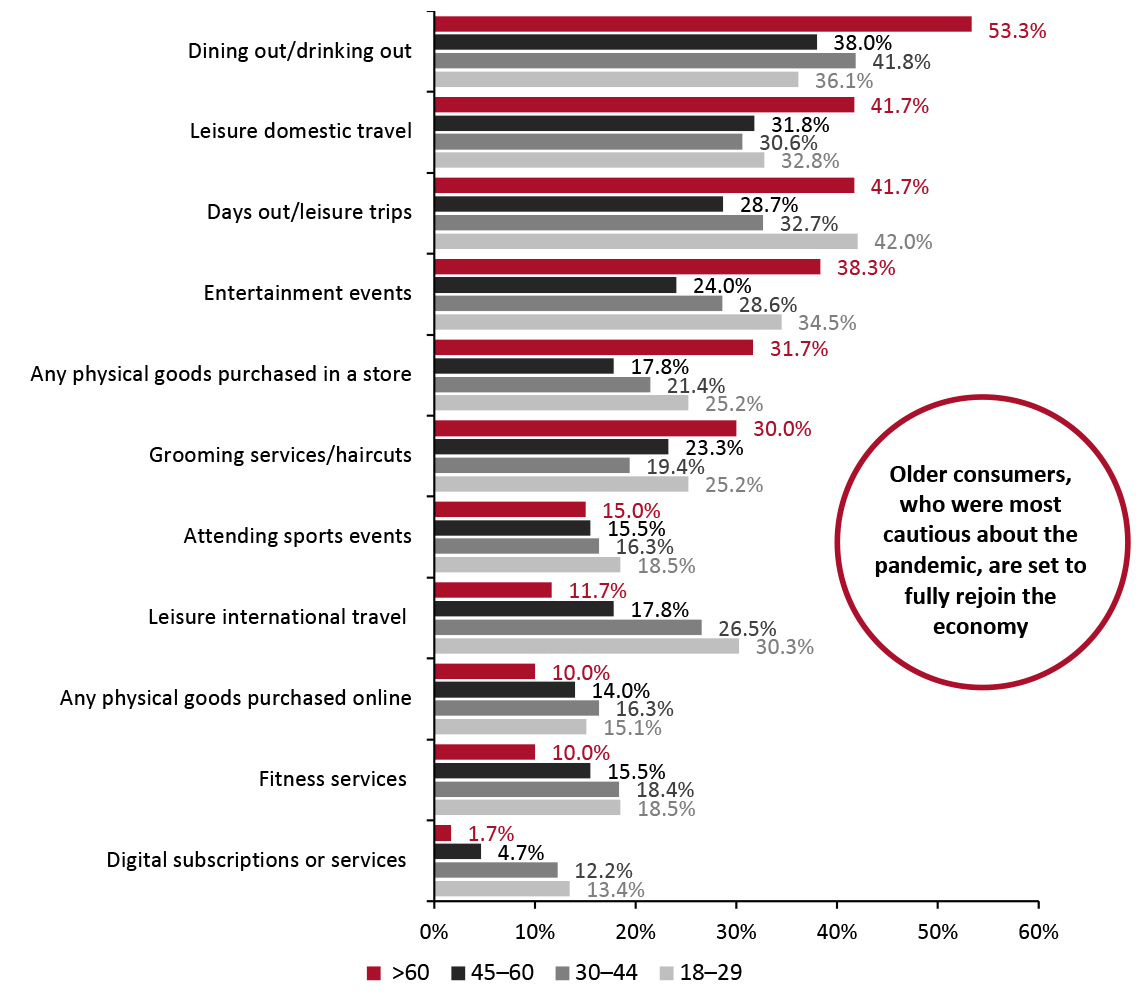

Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine Source: Coresight Research [/caption] 4. Older Consumers Will Change Their Behaviors Most Dramatically Older consumers were among the most cautious about dining out and other higher-risk activities during the pandemic. At the same time, the pandemic encouraged these consumers to fully embrace digital commerce. While we do not expect these consumers to fully revert to their pre-pandemic habits, our survey data suggest that they will shift back toward service spending and spending in brick-and-mortar stores. Among consumers who are vaccinated (or plan to get vaccinated), our survey found the following:

- Dining out was a popular category among all consumers but was headlined by the older demographic, nearly half of whom plan to increase spending on dining out once vaccinated. That proportion is more than 14 percentage points higher than the other age groups, each of which saw about one in three consumers planning to spend more in this category than they did during the pandemic.

- A similar but less drastic trend is apparent in older consumers’ propensity to purchase goods in-store. Some 31.7% of consumers over the age of 60 reported plans to spend more in this category once vaccinated than they did during the pandemic period in 2020—nearly double the proportion of consumers aged 45–60 reporting the same and substantially higher than the two youngest age groups.

Figure 5. US Consumers Who Have Received or Plan To Receive a Vaccine: Categories in Which They Plan To Increase Spending Once Vaccinated, Compared to During the 2020 Pandemic Period, by Age Group (% of Respondents) [caption id="attachment_128089" align="aligncenter" width="725"]

Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine

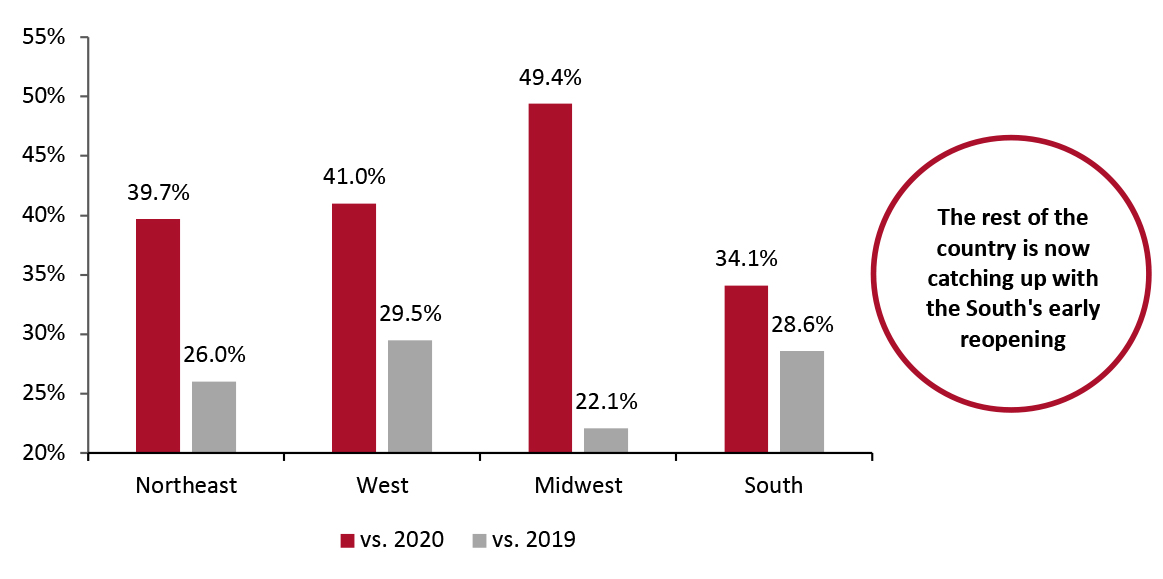

Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine Source: Coresight Research [/caption] 5. Southern States Led Initial Economic Recovery, but the Rest of the US Will Lead the Summer Spending Boom Southern states, which, in general, reopened businesses earlier and at higher capacities than elsewhere in the US, have seen a speedier economic recovery. Restaurant spending has been a key component of this geographic divide, as we noted in a recent US Consumer Tracker report; restaurant spending in southern states has recovered strongly, ahead of the rest of the country. However, our April 2021 survey results indicate that this geographic discrepancy will fade, and spending may in fact be stronger in the regions of the country that implemented stricter pandemic-related restrictions last year. As shown in Figure 6, respondents from southern states are less likely than their counterparts in the Northeast, West and Midwest to increase their spending on dining out once they have been vaccinated—with a gap of at least five percentage points emerging.

Figure 6. US Consumers Who Have Received or Plan To Receive a Vaccine: Plans To Increase Spending on Dining Out Once Vaccinated Compared to 2020 and 2019 Spending Levels, by Region (% of Respondents) [caption id="attachment_128090" align="aligncenter" width="725"]

Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine

Base: 399 US Internet users aged 18+ who have received, or plan to receive, a Covid-19 vaccine Source: Coresight Research [/caption]

What We Think

This marks the second straight year of spring ushering in historic changes in the retail landscape. Vaccines are now available to all adults nationwide in the US, and consumers are largely taking advantage: Our surveys indicate that more than 80% of consumers have either received or plan to receive a Covid-19 vaccine. Nearly everyone who receives a vaccine is likely to change their behavior at least marginally—across age and income groups, consumers look more likely to get out to restaurants and travel more once they have been vaccinated—but certain groups appear more likely to drive shifts in spending than others. Older consumers, those at the highest risk of experiencing serious complications from contracting Covid-19, look the most likely to move closer to previous spending patterns, while wealthy consumers outside of the South look set to unleash the most pent-up spending firepower relative to their constrained purchasing habits during the pandemic. These demographic splits in spending habits are likely to shape retail and service spending growth over the summer, but we expect them to fade in the fall as a nearly fully vaccinated US becomes the new normal and consumers settle into re-established habits. Implications for Brands/Retailers- In general, with older consumers being a notable exception, not many consumers plan to spend more on goods purchased in physical stores than they did during the pandemic. This is likely an undercount of the proportion of consumers who will actually increase store spending—consumers may not plan to spend more in stores, but we expect mall and store traffic to increase substantially over the summer, driving sales growth not just from consumers planning to spend more, but from those who make impulse purchases. Increasingly, when consumers know what they want, they turn to online channels for a larger selection and seamless purchase experience. Physical retailers will now have to focus on capturing the dollars of the consumer that is less certain on exactly what they want to purchase. Physical retailers must make their stores attractive destinations for consumers to go to be social, browse or engage with retailers in more creative formats.

- In-store support for older consumers will be far more relevant in 2021, as these consumers flock back to stores at the highest rate and generally have more money to spend than their younger counterparts. While most in-store retail innovation has focused on the digital, retailers cannot disregard the retained importance of personal support from store associates.

- Mall owners must make their shopping centers destinations for consumers who may not intend to increase their spending on retail sales but are looking for places to get back out and about and can drive sales through incidental and impulse purchases.

- Restaurant tenants can help malls attract consumers who are likely to begin switching their spending from goods to services. If possible, higher-price-point restaurants could be a valuable addition to malls: Wealthy consumers are the most likely to increase restaurant spending and can disproportionately drive retail sales. However, in many cases, it may be a challenge to convince consumers to pay hefty prices for restaurant food inside a mall.