DIpil Das

What’s the Story?

In this report, we look at a number of online value marketplaces worldwide and their impacts on traditional, offline players in the budget retail sector. We point to budget marketplaces as an often-overlooked segment of a value retail market that is often seen as predominantly offline and in which brick-and-mortar retailers continue to grow store estates aggressively. Our focus is on the US, the UK and China.Why It Matters

Value retail is a predominantly offline segment in markets such as Europe and the US: Amid mass store closures, discount formats such as off-price retailers and value general merchandisers such as dollar stores have continued to expand their store estates. These types of retailers have tended to eschew e-commerce—at least, until recently. Of the three major standalone US off-price retail companies, two—Burlington and Ross Stores—do not sell online, while rival TJX does. As we discussed recently, discount names such as Big Lots, Dollar General, Dollar Tree and Five Below generally have nascent digital retail operations. In apparel, value retailer Primark still declines to sell online. However, there is a substantial—and growing—online segment in value. E-commerce platforms that have adopted value positionings have seen success over the past few years. We see their growth as presenting challenges to predominantly offline retailers in the value retail sector.The New Value Retailers—Online Marketplaces: In Detail

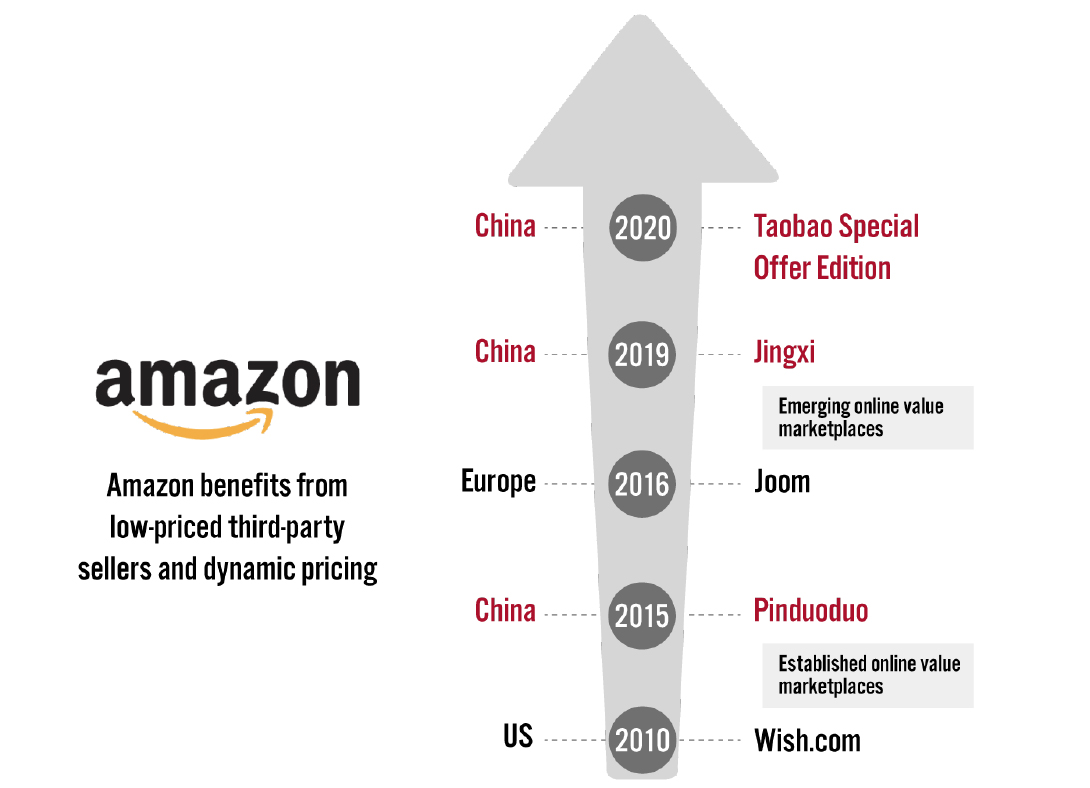

We firstly discuss online value marketplaces Pinduoduo and Wish.com, and then highlight other emerging e-commerce platforms that have adopted the value format. We also include Amazon in this report, as it has many third-party sellers that provide budget offerings—especially in categories such as apparel.Figure 1. Key Online Marketplaces in the Global Value Sector: Timeline by Launch [caption id="attachment_123604" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Established Online Value Marketplaces: Pinduoduo and Wish

Pinduoduo is the largest Chinese group-buying platform. Founded in September 2015, it rapidly expanded by encouraging shoppers to team up to place orders, with bulk purchases meaning they can access steep discounts. However, its business model is continuously evolving, and consumers now do not need to find friends to join a group-buy deal; each product on Pinduoduo instead has an official price and a discounted price.

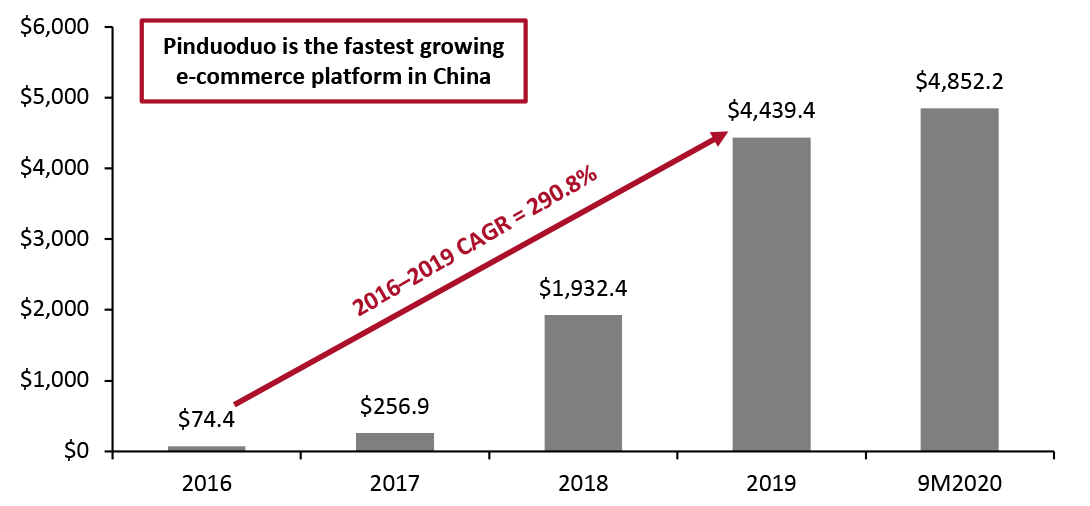

Pinduoduo is growing at a faster rate than all other e-commerce platforms in China—the compound annual growth rate (CAGR) between 2016 and 2019 reached 290.8%. The platform saw a year-over-year revenue increase of 70% in the first nine months of 2020, reaching $4.9 billion—65 times its annual revenue in 2016 (see Figure 2).

Source: Coresight Research[/caption]

Established Online Value Marketplaces: Pinduoduo and Wish

Pinduoduo is the largest Chinese group-buying platform. Founded in September 2015, it rapidly expanded by encouraging shoppers to team up to place orders, with bulk purchases meaning they can access steep discounts. However, its business model is continuously evolving, and consumers now do not need to find friends to join a group-buy deal; each product on Pinduoduo instead has an official price and a discounted price.

Pinduoduo is growing at a faster rate than all other e-commerce platforms in China—the compound annual growth rate (CAGR) between 2016 and 2019 reached 290.8%. The platform saw a year-over-year revenue increase of 70% in the first nine months of 2020, reaching $4.9 billion—65 times its annual revenue in 2016 (see Figure 2).

Figure 2. Pinduoduo’s Annual Revenue (USD Mil. at Constant Rate) [caption id="attachment_123605" align="aligncenter" width="725"]

Pinduoduo’s fiscal year ends on December 31; 9M2020 refers to nine months ended September 30, 2020

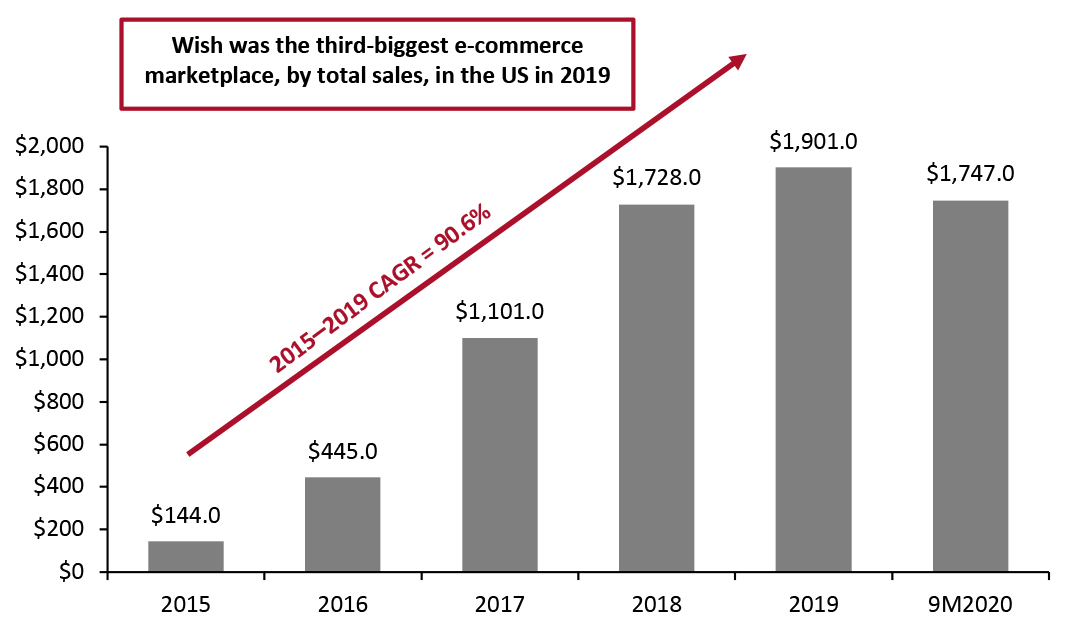

Pinduoduo’s fiscal year ends on December 31; 9M2020 refers to nine months ended September 30, 2020 Source: Company reports [/caption] Positioning itself as offering best value to consumers, Pinduoduo aims to reduce the cost of products from the production stage, to ensure that it can continue to provide attractive prices while maintaining product quality. In November 2020, the company announced that it will continue to invest in the C2M (consumer-to-manufacturer) model, which will direct more resources to support brand development for manufacturers, incubate new sub-brands under well-known brands, support new emerging brands and rejuvenate heritage brands to provide low-price products to consumers. Wish, a US-based e-commerce platform, grew by focusing solely on price. Wish was the most downloaded shopping app worldwide in 2018, and as of 2019, it became the third largest e-commerce marketplace in the US by sales. Its early adoption of the direct-to-consumer model in the US gave Wish the ability to offer products at a significantly lower cost than other online retailers such as Amazon. Over 90% of merchants on Wish were based in China in 2020, according to research firm Marketplace, and Chinese merchants usually sell products at lower prices than those in the US. Wish experienced year-over-year revenue growth of 32% in the first nine months in 2020, amounting to over $1.7 billion.

Figure 3. Wish’s Annual Revenue (USD Mil.) [caption id="attachment_123606" align="aligncenter" width="725"]

Wish’s fiscal year ends on December 31; 9M2020 refers to nine months ended September 30, 2020

Wish’s fiscal year ends on December 31; 9M2020 refers to nine months ended September 30, 2020 Source: Company reports [/caption] Amazon: Low-Priced Third-Party Sellers and Dynamic Pricing Amazon is clearly a giant in general merchandise; it is also one that has sharpened its longstanding price-competitive positioning by encouraging more third-party sellers, including overseas sellers, onto its platform. Over many years, Amazon’s first-party sales have established a reputation as being highly price competitive and, in many cases, below recommended retail price. That competitiveness is sharpened by the use of dynamic pricing to frequently adjust the prices of its own first-party products according to conditions in the market, including pricing by rivals. In apparel, a 2020 Coresight Research survey confirmed that very many shoppers expect to pay less on Amazon, and we argue that consumers perceive Amazon.com to be a borderline off-pricer: Among purchasers of clothing or footwear on Amazon, some 42.9% always expect to pay less than full price on Amazon, making this one of the top attitude statements that we asked Amazon apparel shoppers about. Added to this has been Amazon’s expansion of its third-party marketplace, which has grown its product offering with an apparently strong emphasis on products at the lower end of the price spectrum. Coresight Research data have shown the extent to which cheap imported product (largely shipped from China) now dominates Amazon’s clothing offering in multiple markets. In the UK, our data show that unknown, imported brands are the most-listed brands on Amazon Fashion, with several listing tens of thousands of clothing products on the site and accounting for a large share of total listings. In our 2020 analysis of listings on Amazon Fashion in the US, we noted that cheap Chinese product had proliferated—the rankings of the most-listed apparel products were swamped by ultra-low-price, generic clothing items dispatched from China. During Amazon’s fiscal 2019, third-party/independent sellers accounted for a higher proportion of dollar sales in softlines than in other major categories, at 72%, according to information filed by the company in September 2020 with the US House of Representatives (see Figure 4).

Figure 4. Amazon: Third-Party vs. First-Party Sales Breakdown in Selected Major Categories (Fiscal 2019 Ended December 31) [wpdatatable id=766 table_view=regular]

Source: US House of Representatives Hearing of the Subcommittee on Antitrust, Commercial and Administrative Law, Committee on the Judiciary On Prime Day 2020 (October 13–14), sales by third-party sellers were up nearly 60% year over year, according to Amazon—representing stronger growth than it saw for first-party sales. Emerging Online Value Marketplaces Competition is growing in the value e-commerce space. We discuss some of the notable new players below. Similar to Wish, Joom is an online marketplace that sells mostly Chinese-made and low-price products, but to European markets. Founded in 2016, Joom positions itself as a value-focused shopping app with a built-in social network, offering personalized deals and recommendations to consumers. The company’s “Influencers Exchange” program enables sellers and brands to send products for selected influencers to test and review on the platform. Joom also provides free delivery throughout Europe. Within just two years of its launch, Joom had attracted over 100 million users. It achieved global net sales of $186.2 million in 2019. In China, e-commerce giants Alibaba and JD.com both launched their own discount marketplaces in response to Pinduoduo’s growth:

- JD.com launched its group-buying e-commerce platform Jingxi on September 19, 2019. The platform features deals priced at ¥1.00 ($0.15) for new users, and offers low-price goods sourced directly from manufacturers to cater to price-sensitive customers in smaller and lower-tier cities and rural areas. One year after the launch of the platform, JD.com announced that Jingxi has “helped more than 1,000 merchants achieve sales of more than ¥10 million” ($1.5 million). The number of orders also grew 84.2% in the second quarter of 2020 compared to the first quarter.

- Alibaba launched Taobao Special Offer Edition in March 2020. The platform provides low-price products to consumers by digitalizing manufacturing businesses in rural China. As of August 2020, the number of monthly active users of Taobao Special Offer Edition reached 55 million, and more than 1.2 million merchants sell through the platform.

Figure 5. The Coresight Research Hourglass Model of Retail [caption id="attachment_123607" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]