DIpil Das

What’s the Story?

This report serves as the introduction for Coresight Research’s new series of roundtable discussions and research reports, entitled The New Age of Customer-First Supply Chains, to be published during the course of the second half of 2021. Each roundtable comprises a presentation on the most recent research reports, accompanied by a discussion among supply chain experts. We outline four pillars to building a resilient supply chain, built on a foundation of sustainability and profitability, all of which we will explore further through our new series.Why It Matters

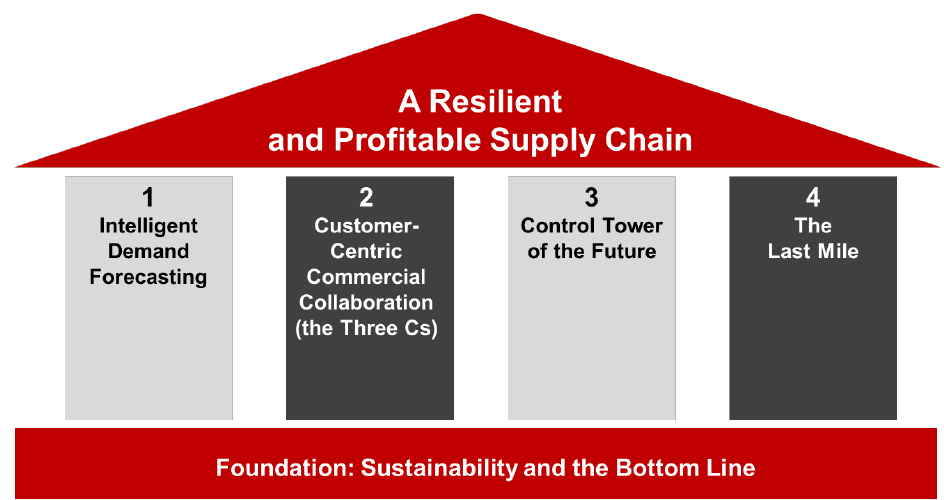

The supply chain represents the backbone of a retailer’s business, across manufacturing, warehousing, the physical store and the ultimate sale to the consumer, and thus is of paramount importance. Supply chains were previously optimized for profitability amid stable demand, but with the global Covid-19 pandemic having given rise to rapidly evolving consumer behaviors and preferences, supply chains need to be more effectively managed for retailers to operate efficiently and keep consumers satisfied. To ensure resilience and profitability in today’s supply chains, retailers need to adopt different strategies and technologies that align with the four pillars of intelligent demand forecasting, customer-centric commercial collaboration, control tower of the future and the last mile—all while enhancing sustainability and protecting the bottom line.Four Pillars of a Resilient and Profitable Supply Chain: A Deep Dive

Through Coresight Research’s The New Age of Customer-First Supply Chains series, we will explore four pillars to building a resilient and profitable supply chain in retail, built on a foundation of sustainability and the bottom line. We summarize these in Figure 1 and outline the importance of artificial intelligence (AI) and machine learning (ML) as enabling technologies, before discussing each pillar in further detail in subsequent sections of this report.Figure 1. Four Pillars of a Resilient and Profitable Supply Chain [caption id="attachment_128965" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Enabling Technologies: AI and ML

AI and ML solutions underpin many of the pillars by automating many manual tasks and offering several benefits that exceed human capabilities:

Source: Coresight Research[/caption]

Enabling Technologies: AI and ML

AI and ML solutions underpin many of the pillars by automating many manual tasks and offering several benefits that exceed human capabilities:

- Faster computational speeds

- Increased accuracy of forecasts

- Real-time updates

- Provides ability to analyze larger quantities of data

- Provides ability to locate hidden patterns in data

- Represents a robust system

- Adapts more quickly to changes

- Provides ability to handle significant complexity

- Descriptive—what happened?

- Predictive—what is expected to happen?

- Prescriptive—what action should we take?

- Read our separate report on how retailers can use prescriptive analytics/AI to improve customer satisfaction.

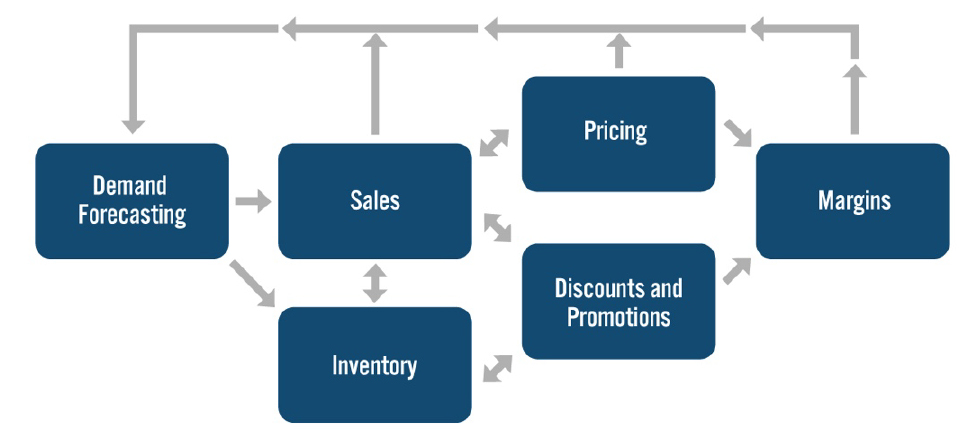

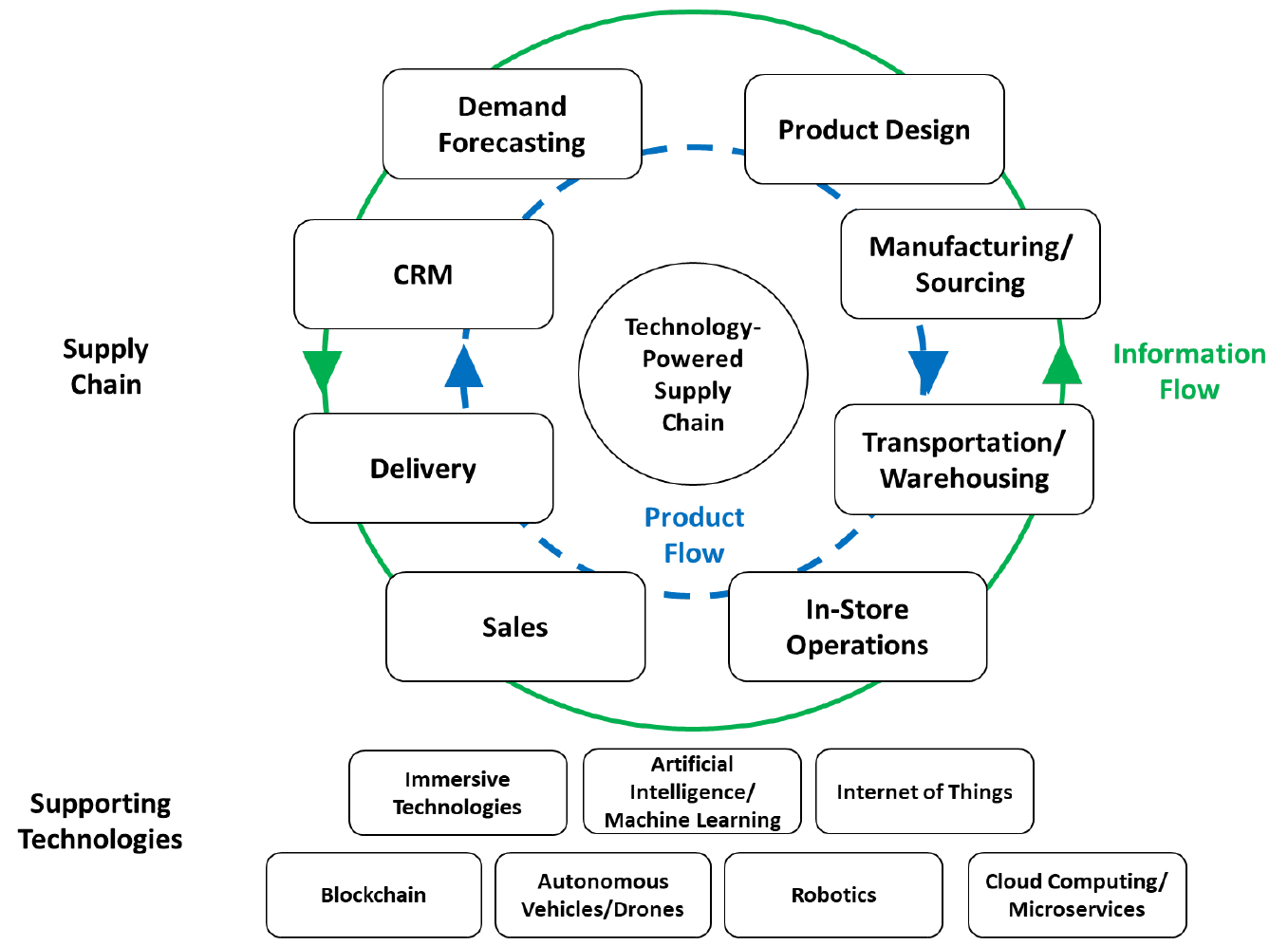

Figure 2. Interconnectedness of Demand Forecasting, Operations and Information Flow [caption id="attachment_128966" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

Types of Data

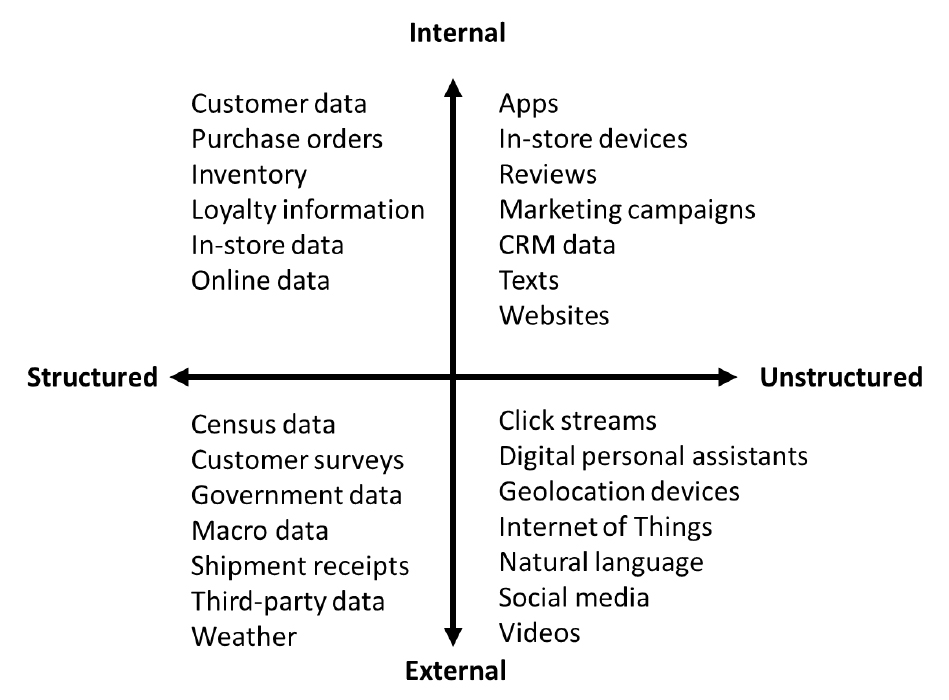

Data available to retailers comes in many forms—internal and external, structured and unstructured—as depicted in the figure below. Incorporating external data is essential for creating accurate demand forecasts. Incorporating weather forecasts and national/local calendars into predictions, for example, enables retailers to align inventory with weather and holidays. Going further, data from product reviews and social media can help retailers sense emerging trends and support the development of new products.

Source: Coresight Research[/caption]

Types of Data

Data available to retailers comes in many forms—internal and external, structured and unstructured—as depicted in the figure below. Incorporating external data is essential for creating accurate demand forecasts. Incorporating weather forecasts and national/local calendars into predictions, for example, enables retailers to align inventory with weather and holidays. Going further, data from product reviews and social media can help retailers sense emerging trends and support the development of new products.

Figure 3. Types of Structured and Unstructured Data, Internal and External [caption id="attachment_128967" align="aligncenter" width="725"]

Source: Institute for Business Planning and Forecasting/Coresight Research[/caption]

Financial Implications

Accurate demand forecasting improves retailers’ revenues, margins, efficiency and working-capital utilization.

Inventory accuracy, which follows demand forecasting, affects revenues by eliminating stock-outs that would hurt customer satisfaction and could lead to walk-outs. Having the correct amount and location of inventory also enables retailers to avoid excessive discounting and to launch effective promotions.

Finally, predicting demand more accurately enables retailers to allocate the optimal amount of space and deploy the minimum amount of working capital for that inventory.

2. Customer-Centric Commercial Collaboration (the Three Cs)

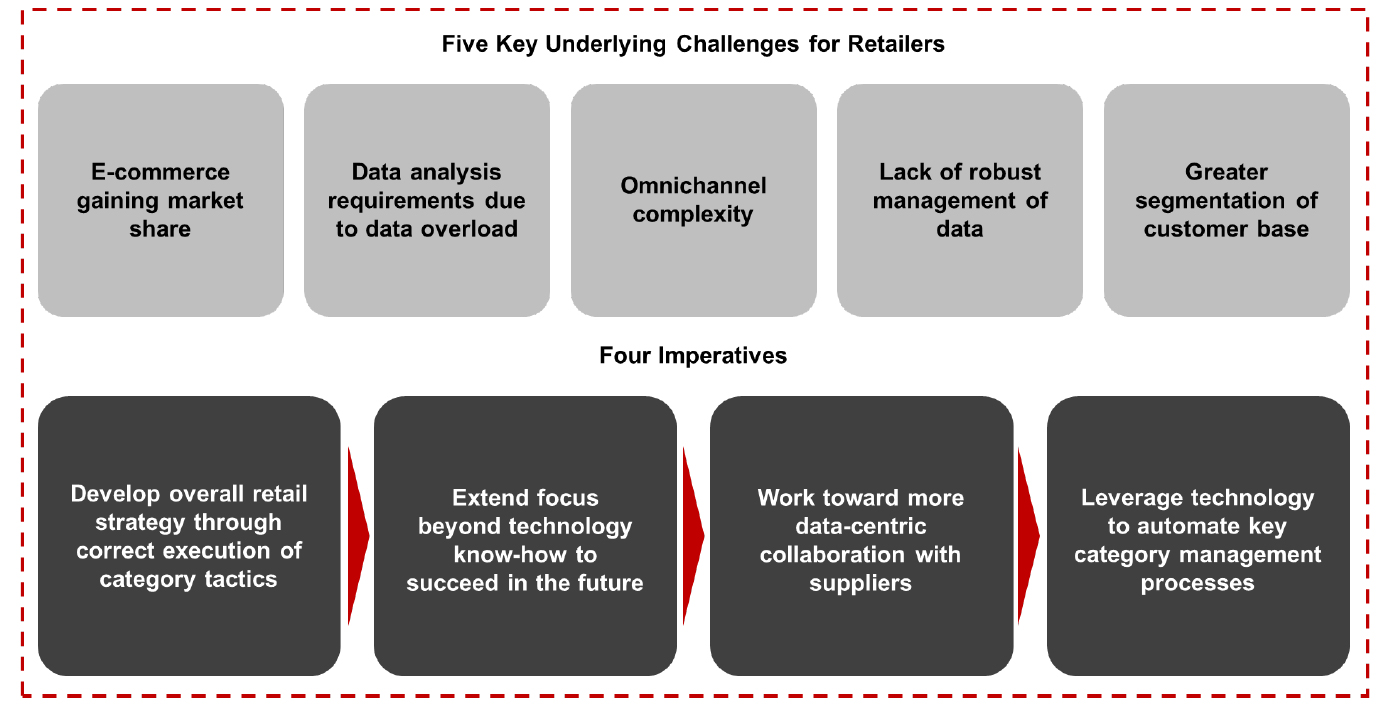

The rapid rate of change in retail has been further accelerated by the Covid-19 pandemic, and the combination of dynamic global supply chains and wide swings in consumer behavior has been driving changes in category management, which can be addressed through cooperation and data sharing with suppliers.

Retailers are adopting a holistic view of improving merchandising tactics within category management to handle a surge in e-commerce, an ever more competitive environment and a higher penetration of private-label products. As well as adapting their organizations to meet current challenges, category managers need to take advantage of tools such as AI/ML to thrive in the current environment.

The consumer shift to e-commerce has created omnichannel complexity and a surge in data. Retailers that can turn real-time data into actionable insights will be better placed to improve the customer experience and therefore improve revenues and margins. Retail category managers must master current trends and anticipate future trends that have consequences for the category and for the store as a whole.

Source: Institute for Business Planning and Forecasting/Coresight Research[/caption]

Financial Implications

Accurate demand forecasting improves retailers’ revenues, margins, efficiency and working-capital utilization.

Inventory accuracy, which follows demand forecasting, affects revenues by eliminating stock-outs that would hurt customer satisfaction and could lead to walk-outs. Having the correct amount and location of inventory also enables retailers to avoid excessive discounting and to launch effective promotions.

Finally, predicting demand more accurately enables retailers to allocate the optimal amount of space and deploy the minimum amount of working capital for that inventory.

2. Customer-Centric Commercial Collaboration (the Three Cs)

The rapid rate of change in retail has been further accelerated by the Covid-19 pandemic, and the combination of dynamic global supply chains and wide swings in consumer behavior has been driving changes in category management, which can be addressed through cooperation and data sharing with suppliers.

Retailers are adopting a holistic view of improving merchandising tactics within category management to handle a surge in e-commerce, an ever more competitive environment and a higher penetration of private-label products. As well as adapting their organizations to meet current challenges, category managers need to take advantage of tools such as AI/ML to thrive in the current environment.

The consumer shift to e-commerce has created omnichannel complexity and a surge in data. Retailers that can turn real-time data into actionable insights will be better placed to improve the customer experience and therefore improve revenues and margins. Retail category managers must master current trends and anticipate future trends that have consequences for the category and for the store as a whole.

- Read more about how retail category management has changed, with insights from a recent Coresight Research survey of global retailers and suppliers, in our separate report.

Figure 4. Retail Category Management: Key Challenges and Imperatives [caption id="attachment_128968" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

We believe there are several key opportunities for retailers to enhance category management effectiveness and overcome the five underlying challenges:

Source: Coresight Research[/caption]

We believe there are several key opportunities for retailers to enhance category management effectiveness and overcome the five underlying challenges:

- Effectively leverage advanced technology. Technologies such as AI and ML can help retailers to better interpret data.

- Insist on actionable insights. Insights obtained from large data sets must be actionable for retailers to improve execution. More accurate insights can help retailers offer more personalized experiences to shoppers (through targeted promotions), improve planning efficiency and identify market shifts.

- Transparent collaboration with suppliers can alleviate the burdens of managing data. Taking a joint approach to data interpretation and analysis enables retailers and suppliers to increase their ability to assess consumer and market trends. In the grocery sector in particular, trends can change rapidly, hurting margins and sustainability, but collaboration can ease the pressure on managing supply chains.

Figure 5. Product and Information Flow in Modern, Technology-Powered Supply Chain [caption id="attachment_128969" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

AI/ML software is a powerful tool that retailers can use to make operations more efficient, in addition to personalizing engagement with customers, communicating with them in their channel of choice, reducing friction and creating better experiences.

On the operations side, AI/ML software excels at analysis and making predictions, which provide benefits related to supply chain efficiency—namely, better space utilization; lower fuel, water and electricity consumption; reduced carbon emissions; less waste and spoilage; and higher inventory turnover. This efficiency leads to direct financial benefits, including the following:

Source: Coresight Research[/caption]

AI/ML software is a powerful tool that retailers can use to make operations more efficient, in addition to personalizing engagement with customers, communicating with them in their channel of choice, reducing friction and creating better experiences.

On the operations side, AI/ML software excels at analysis and making predictions, which provide benefits related to supply chain efficiency—namely, better space utilization; lower fuel, water and electricity consumption; reduced carbon emissions; less waste and spoilage; and higher inventory turnover. This efficiency leads to direct financial benefits, including the following:

- Higher sales due to inventory availability

- Lower working capital

- Reduced warehouse space

- Better margins due to full pricing of products

- Higher revenue and margins from customer satisfaction (due to inventory availability and shorter delivery times) and positive customer reviews

- End-to-end visibility

- Information sharing

- Warning and alert management

- Automated decision-making and control

- Improvement over time

Whole Foods Market dark store in Brooklyn, New York

Whole Foods Market dark store in Brooklyn, New York Source: Amazon [/caption] Dark stores offer several benefits for retailers:

- More efficient layout for picking

- Reduced labor cost from a more-targeted facility

- Shorter fulfillment times

- More efficient restocking than in a physical store

- Better inventory visibility

- Greater customer satisfaction from all of the above

- Faster delivery

- Localized assortment

- Greater product breadth than in a physical store—an “endless aisle”

- Pickers not impeding consumers in physical stores

Micro-fulfillment center

Micro-fulfillment center Source: Fabric [/caption] For more information, please see our report on fulfillment for US grocery e-commerce. The Bottom Line Whereas e-commerce has historically been considered as offering lower margins of even unprofitable for retailers, the introduction of automated technologies offers the promise of more-profitable operations in certain applications. For example, micro-fulfillment technology vendor Fabric claims that its customers benefit from:

- A 70% saving in labor and rent

- One-hour delivery

- 99.9% order accuracy

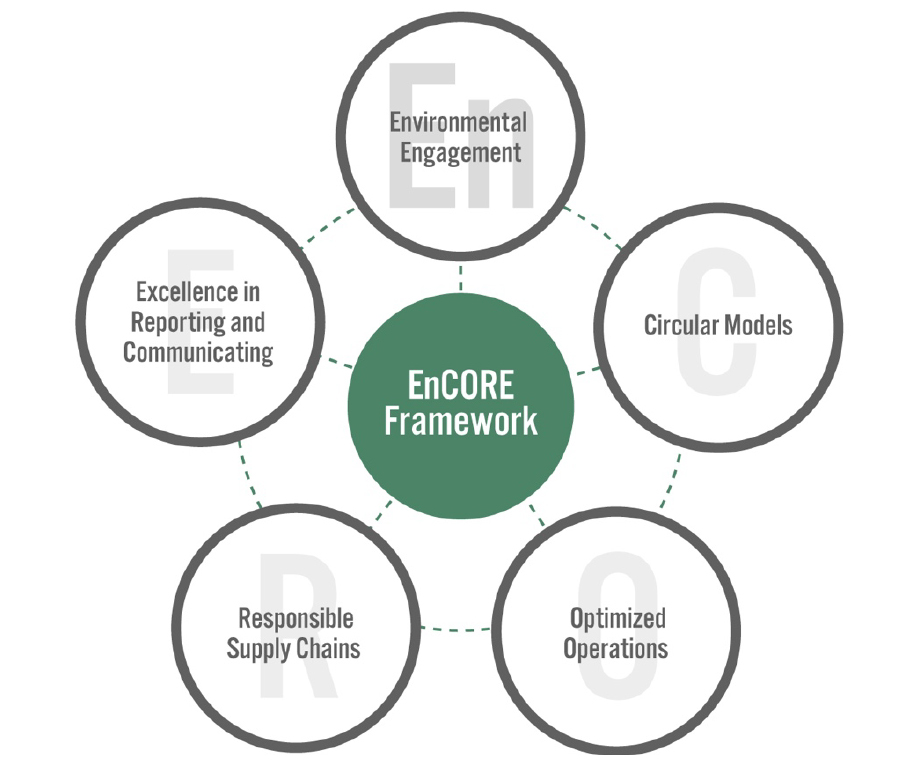

Figure 6. The EnCORE Framework [caption id="attachment_128972" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

There are several measures that brands and retailers can take under each EnCORE component to manage and improve their sustainability while protecting revenues. We outline selected examples below that are particularly prevalent to building a sustainable and profitable supply chain.

Optimize operations

Source: Coresight Research[/caption]

There are several measures that brands and retailers can take under each EnCORE component to manage and improve their sustainability while protecting revenues. We outline selected examples below that are particularly prevalent to building a sustainable and profitable supply chain.

Optimize operations

- In addition to monitoring carbon emissions throughout the supply chain, retailers can take measures to reduce their carbon footprint. This includes carbon emissions in shipping from the factory and to the consumer. Fully electric vehicles do not consume hydrocarbons or emit carbon dioxide (though it is generated in electricity generation). Some companies levy a carbon tax on their employees’ group budgets to consider the urgency and carbon impact of corporate travel, and other companies purchase carbon offsets to bring themselves into carbon neutrality or negativity.

- Energy efficiency offers many opportunities for cost and carbon savings. New lighting technologies such as light-emitting diode (LED) bulbs last longer than traditional incandescent bulbs and use a fraction of the electricity. Motion sensors and timers in rooms turn off the lights when rooms are unoccupied, preventing them from consuming electricity on nights and weekends. The provision of heating can be controlled using similar devices.

- Cloud computing is another method for reducing electricity consumption. Rather than purchasing a rack of servers that sit idle except on unusual events such as Good Friday, consuming electricity the entire time, cloud service providers aggregate demand from diverse industries, which realizes an enormous reduction in energy consumption as compared to each segment operating its own hardware.

- Accurate demand forecasting reduces the potential impact of waste and spoilage. Reducing waste in manufacturing is positive for margins, and dynamic pricing of perishable grocery items as they approach their expiration dates drives incremental revenues for the retailer, offers lower-priced items to resilient consumers, and reduces the amount of food that must be discarded and sent to a landfill.

- Vendors are resigning containers and packaging to take on other functions. There is a trend in grocery of consumers bringing their own bags to purchase certain bulk items (“bring your own container”), and the beauty industry is beginning to embrace reusable containers. Brands are also beginning to reconsider the materials used in packaging, for example using sustainable materials in both containers and external packaging in an effort to eliminate single-use plastics. The amount of packaging material can be minimized, and for packaging that cannot be reused, then using recyclable materials such as metals, glass and paper reduces burdens on landfills.

- Retailers can build consumer and investor loyalty and trust through supply chain transparency, sharing goals, achievements and setbacks. They should communicate their sustainability commitments to stakeholder and can also advocate for sustainability and demonstrate evidence of benefits to revenues or margins to encourage other retailers and brands to follow suit.

What We Think

We believe that supply chains should be a key focus for retailers to achieve sustainability goals while preserving or even enhancing profitability. Many supply chain improvements can achieve multiple goals—for example, more accurate demand forecasting can also improve allocation efficiency as well as reduce waste and carbon emissions. Since it is difficult to optimize what one cannot see, supply chain visibility is essential to the management process. Recent fulfillment technologies such as dark stores and micro-fulfillment centers improve accuracy and reduce real-estate cost while improving customer satisfaction, which leads to repeat purchases. Implications for Brands/Retailers- Brands and retailers can see multiple benefits from more accurate demand forecasting.

- Enhancing sustainability raises the brand’s value to like-minded consumers.

- While supply chain visibility is more meaningful for private-label brands, it has a major role to play for multiband retailers.

- More efficient fulfillment is key to keeping pace with large e-commerce retailers.

- Real estate firms can use technology to make their properties more energy efficient, which is a benefit in itself and will attract sustainability-minded tenants.

- Better supply chain management will likely require less warehousing space.

- The trend of dark stores and micro-fulfillment centers represents increased demand for small warehouse space.

- There are multiple opportunities for technology vendors in demand forecasting, supply chain visibility and assortment optimization serving all types of retailers.

- AI/ML technology continues to evolve a rapid pace, offering opportunities for developers of tools, enterprise software and applications.

- Integrating sustainability measurement and optimization represents an emerging opportunity for software vendors.

- There are also opportunities in hardware to reduce the environmental impact of stores, manufacturing and transportation.