Nitheesh NH

What’s the Story?

Supply chains, the backbone of a retailer’s business, were previously optimized for profitability amid stable demand, but environmental sustainability has become a key priority for businesses today due to the demands of multiple stakeholders. It is widely assumed that sustainability adds cost, but we see a sustainable business model as having a high return on investment over the long term, offering both fiscal and environmental benefits. We explore environmental sustainability in the supply chain through the lens of Coresight Research’s proprietary EnCORE framework, with a focus on the potential to enhance the bottom line. This report is the final installment in Coresight Research’s series of roundtable discussions and research reports, entitled The New Age of Customer-First Supply Chains, which presents key insights into the strategic areas in which brands and retailers can take action to build a resilient and profitable supply chain.Why It Matters

The Covid-19 pandemic has consumers and businesses alike riveted around the global supply chain. US President Joe Biden has chastised the US media for not better explaining the supply chain. It’s complicated—and, increasingly, we see it as a source of competitive advantage, as much as intellectual property, brand equity and customer loyalty. Here are three reasons why making environmental sustainability integral to a retailer’s business model, strategy and supply chain is one of the most pressing issues in retail right now:- The risks to businesses, society and the world come together in climate change. Companies including Kering and Walmart are looking across their global footprint to minimize their environmental impact and reduce greenhouse gas emissions.

- Consumers, employees and investors are prioritizing environmental sustainability and social issues when choosing what they buy, where they work and what companies they invest in: 64% of US consumers are willing to pay more for a sustainable product according to the “Business of Sustainability Index” publish in March 2021 by environmental technology company GreenPrint.

- Investors are actively pricing in risk from emissions profiles, impacting valuation and market capitalization. Reputational risk, which is difficult to quantify until it happens, can be significant and ultimately result in lost consumers, sales and profits.

Can Profits and Sustainability Align in the Supply Chain? Coresight Research Analysis

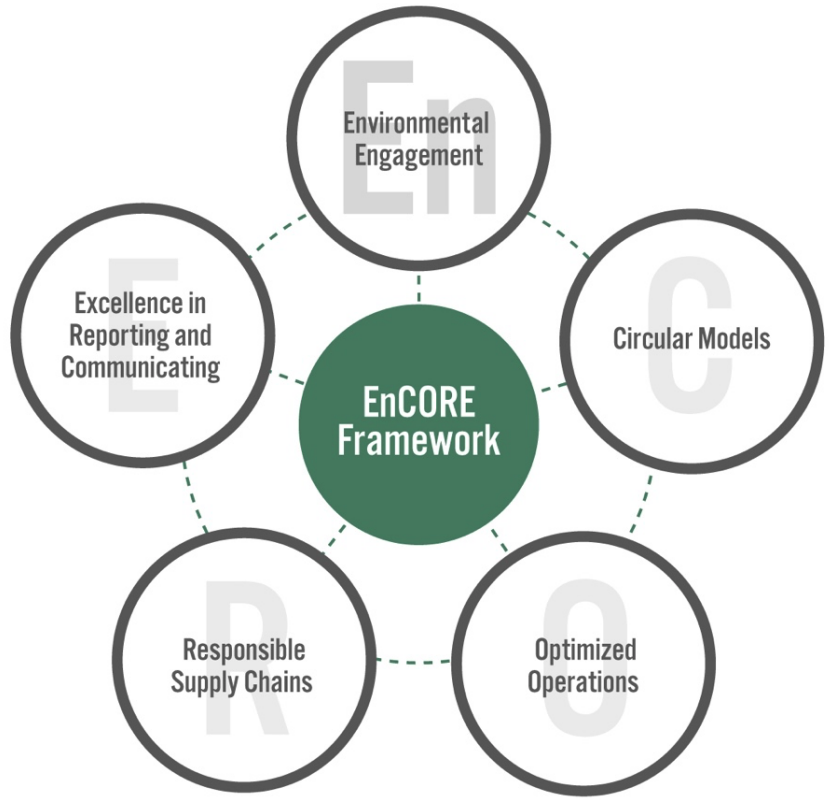

Increasingly, governments, employees and customers are demanding to see businesses make efforts to improve sustainability. Brands and retailers need to get in front of these demands by setting targets and communicating their progress. Sustainable strategies should produce superior profitability as they harness efficiencies and wring out excesses in supply chains, but sustainable supply chains require long-term vision and collaboration across multiple stakeholders. Similar to the economic truism, “the effect of the elasticity of demand is instantaneous, while the elasticity of supply operates with a time-lag,” addressing the environmental sustainability of a company’s supply chain is a lengthy commitment—and it will likely uncover inefficient and unsustainable business practices and business partners. Creating the needed changes requires buy-in across a firm and its business partners, which takes time, as does the implementation of new business practices. Coresight Research created the EnCORE framework to provide a model through which retailers can begin to internalize a sustainability strategy. The framework comprises five elements, as shown in Figure 1. In the following sections of this report, we discuss each element as they align with profitability in the supply chain.- For more on EnCORE, see our separate report, The Time for Sustainability in Retail is Now.

Figure 1. The EnCORE Framework for Sustainability in Retail [caption id="attachment_138497" align="aligncenter" width="580"]

Source: Coresight Research[/caption]

Environmental Awareness

Internal and external audits enable companies to get a clear picture of their environmental footprint. Audits should point out low-hanging fruit for where supply chain parties can focus their efforts to have maximum effect on sustainability for minimal cost.

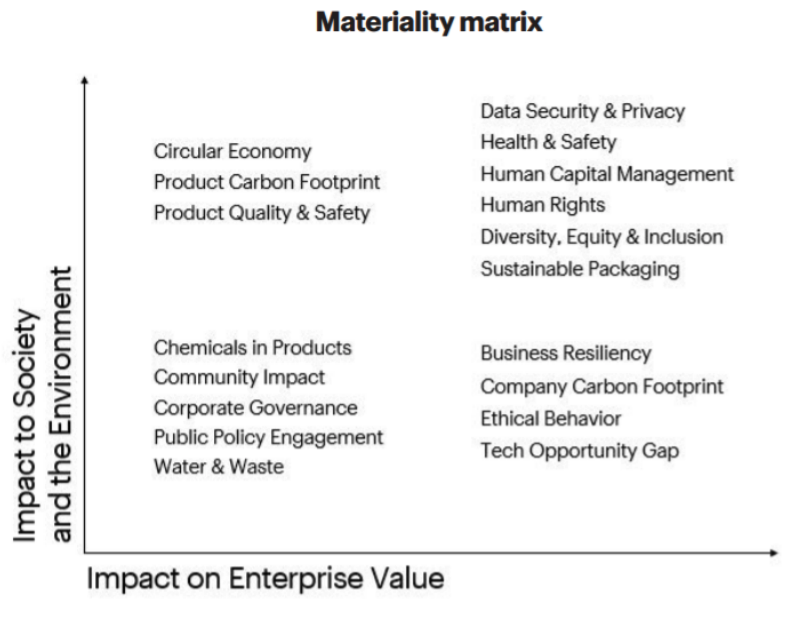

Consumer electronics retailer Best Buy ranked number one on Barron’s 100 Most Sustainable Companies 2021—and has been among the top five for four consecutive years. Best Buy conducted a materiality assessment (which includes stakeholder surveys and interviews) in 2021 to determine which issues are important to stakeholders based on a five-year outlook, and ranked them in a matrix (as shown in the image below).

[caption id="attachment_138498" align="aligncenter" width="520"]

Source: Coresight Research[/caption]

Environmental Awareness

Internal and external audits enable companies to get a clear picture of their environmental footprint. Audits should point out low-hanging fruit for where supply chain parties can focus their efforts to have maximum effect on sustainability for minimal cost.

Consumer electronics retailer Best Buy ranked number one on Barron’s 100 Most Sustainable Companies 2021—and has been among the top five for four consecutive years. Best Buy conducted a materiality assessment (which includes stakeholder surveys and interviews) in 2021 to determine which issues are important to stakeholders based on a five-year outlook, and ranked them in a matrix (as shown in the image below).

[caption id="attachment_138498" align="aligncenter" width="520"] Best Buy’s ESG (Environmental, Social and Governance) Materiality Matrix 2021

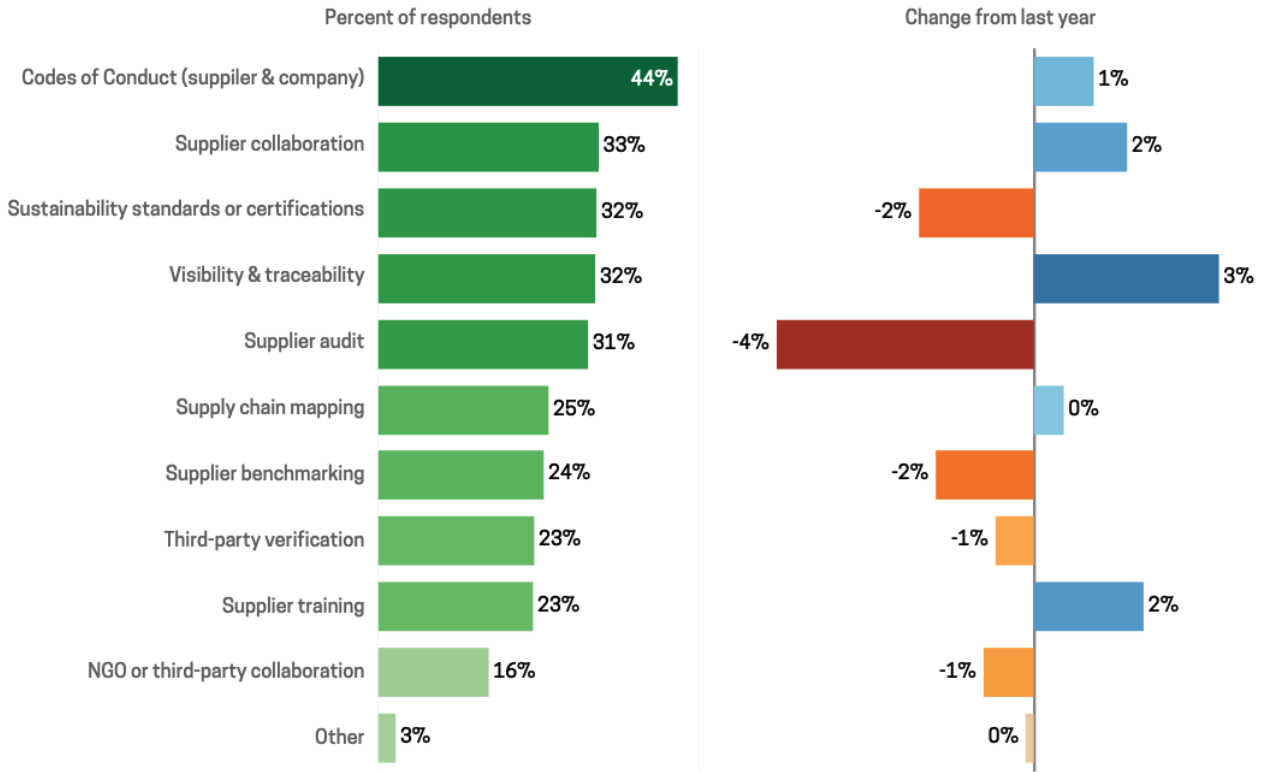

Best Buy’s ESG (Environmental, Social and Governance) Materiality Matrix 2021Source: Company reports[/caption] Best Buy is a good example of how a retailer can partner with various parties to move the issue of environmental sustainability forward. Through its Responsible Sourcing program, Best Buy intends to mitigate risk, enhance partnering with its suppliers and create value for all stakeholders. As a member of the Responsible Business Alliance (RBA), the company partners with many of the brands it sells, including Apple, Intel, Microsoft and Samsung—which collectively embrace a common Supplier Code of Conduct and audit methodology that creates business value by improving working conditions and environmental practices in the supply chain. According to the MIT (Massachusetts Institute of Technology) Center of Transportation & Logistics and the Council of Supply Chain Management Professionals in the “State of Supply Chain Sustainability 2021” report, only 31% of supply chain executives reported that they employed supplier audits in 2020 and 33% practiced supplier collaboration, suggesting huge scope for improvement in this area. The report states that the 4% drop in the use of supplier audits compared to 2019 was due to difficulties in visiting suppliers’ sites during Covid-19 restrictions. According to MIT’s survey, 58% of respondents employed one or more of the practices listed in the lefthand chart of Figure 2.

Figure 2. Practices Employed To Manage Supply Chain Sustainability (SCS) in 2020 (Left; % of Respondents) and Change from 2019 (Right; YoY %) [caption id="attachment_138499" align="aligncenter" width="700"]

Base: 616 (2019) and 1,561 (2020) supply chain executives

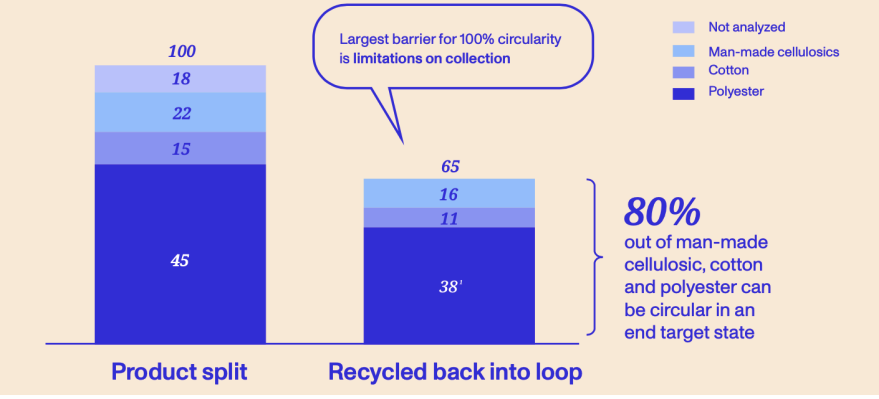

Base: 616 (2019) and 1,561 (2020) supply chain executivesSource: Council of Supply Chain Management Professionals/MIT Center of Transportation & Logistics[/caption] Circular Models Truly circular models are not retrofitted onto existing business models but rather are business models created at inception with circularity at their core—in other words, serious consideration of a product’s end of life has been incorporated at their creation. The majority of circularity today is retrofitted and, therefore, is often inefficient and costly. Unifying logistics that spans upstream visibility into raw material availability, visibility, sourcing and timing can eliminate excess inventory and the related logistical expediting and promotional pricing necessary to move goods, and so improve unit profitability. We are in the early innings of digitalizing the supply chain and benefitting from instantaneous information, insights and collaboration—all of which will result in improved sustainability and profitability for the retail ecosystem. Many retailers recognize that environmental (and social) issues in supply chains are often upstream and challenging to reach with traditional retailer oversight monitoring tools. A lack of reliable data on source/origin of certain commodities and product ingredients and the way they are produced—as well as the blending and commoditization of product inputs and ingredients—complicates matters. The use of technology can help to improve transparency and traceability (e.g., blockchain, vessel monitoring), but adoption takes time and further innovation is necessary to meet these challenges. Artificial intelligence firm Blue Yonder’s Luminate Control Tower enables upstream visibility into suppliers and other trading partners, supporting new fulfillment strategies and collaboration. Luminate also supports downstream sharing, creating a hyper-connected network that can proactively sense and respond to potential supply chain disruptions due to weather, port congestions, labor shortages or natural disasters and pandemics, according to the company. The fashion and luxury industries are just beginning to transform business models into a circular economy, as highlighted by Marie-Claire Daveu, Chief Sustainability Officer at Kering, in a conversation with Coresight Research. She said that business models today are “designing out pollution, keeping products in use longer and regenerating material.” Via the Fashion Pact, Kering and 200 fashion brands are collaborating to take collective action to make fashion a more sustainable industry, with commitments to science-based sustainability targets. Much of circularity has focused on post-consumer use, or resale opportunities, which extends the life of a product. However, recycling post-industrial waste is a huge opportunity, with textile recycling supporting most of the 80% recycling potential in fashion by 2035, according to the “Scaling Circularity” report published by the Global Fashion Agenda (a nonprofit for industry collaboration on sustainability in fashion) and McKinsey & Company (see image below). [caption id="attachment_138500" align="aligncenter" width="520"]

Scope for recycling in the fashion industry

Scope for recycling in the fashion industrySource: Global Fashion Agenda[/caption] Optimized Operations Like most aspects of environmentally sustainable business practices, carbon reduction strategies take time to put into action. It is an uphill battle to offset greenhouse gas emissions, and many businesses turn to carbon-offset programs. A more holistic and integrated approach to reducing carbon emissions specifically in the last mile is to transition to electric vehicle fleets (from vehicles powered by petrol or diesel), which we have seen from retailers such as Amazon and Walmart. Amazon delivered more than 20 million packages to customers in electric vehicles across North America and Europe in 2020, and the company is redesigning its delivery stations to service electric vehicles. As part of its Climate Pledge, Amazon has committed to purchase 100,000 custom electric delivery vehicles by 2030 from Rivian Automotives (in which Amazon has 20% equity ownership). The company is testing the new vans on delivery routes and plans to have 10,000 vehicles on the road as early as 2022. Walmart estimates that 36% of its global electricity needs were supplied by renewable sources in 2020, and the company has a goal of using 100% renewable energy by 2035. One area of focus is the refrigeration and air-cooling equipment across its distribution centers, delivery vehicles, stores and clubs, which can account for 30%–40% of Walmart’s energy consumption in its buildings. Since most of the refrigerant gases used in these systems are hydrofluorocarbons or greenhouse gases, improving these systems is a high priority. Realizing efficiencies through its supply chain while being mindful of costs is key to Walmart’s business model and its everyday low pricing strategy. For example, between 2005 and 2015, Walmart doubled the efficiency of its trucking fleet and saved $1 billion compared to the 2005 baseline. With its Project Gigaton, announced in 2017, Walmart provides a sustainability platform with an emissions reduction toolkit to its broad network of suppliers, with the goal of eliminating one gigaton of emissions in manufacturing, materials and use of products by 2030. Green buildings are another path to reducing carbon emissions. In mid-November 2021, Tapestry, the global luxury house that includes the Coach, Kate Spade and Stuart Weitzman brands, broke ground on a new distribution center in Las Vegas, Nevada, that is being designed for LEED (Leadership in Energy and Environmental Design) Gold building certification. The new fulfillment center will be partially powered by a solar array on its roof, use innovative landscaping to minimize water usage, have energy efficient lighting throughout the facility, and feature electric vehicle charging stations. Responsible Supply Chains The rapid growth of online shopping has been accompanied by an escalating packaging problem as more parcels are shipped each year. In the US in 2020, 20 billion parcels were shipped, up from 15 billion in 2019, according to Statista. Globally, 100 billion parcels were shipped last year, and this number is set to double by 2026. The only solution for packaging waste is to use reusable/recycled/recyclable materials. However, reusable packaging is more costly and energy intensive to produce, so the benefit of reusable packaging is dependent on the number of times it is reused. According to Fashion for Good, a platform for sustainable fashion innovation, reusable packaging must fulfill more than four cycles before it presents a reduction in carbon dioxide-equivalent emissions. Unless the returns rate is 75% or higher, businesses are likely creating more environmental harm, not less, by switching to reusables—and getting consumers to return/recycle packaging is a hurdle most consumer-facing businesses do not want to tackle. Mike Newman, CEO at retail-technology startup Returnity, told Coresight Research that “the key consideration is the number of times the packaging can be reused—which is not a function so much of the durability of the packaging, rather the viability of the business model—the cost to return the packaging and the frequency of getting it back in circulation.” Returnity focuses its efforts on what it calls the “circular-adjacent” economy—customers who have an element of circularity inherent in their business model, such as using internal shipments from distribution centers to retail stores and back again, or in the DTC (direct-to-consumer) rental market. These use cases allow for greater assurance that packaging will be returned and available for reuse. Returnity counts Electrolux, Estée Lauder, Happy Returns, Rent the Runway, Walmart and more among its customers. Excellence in Reporting and Communicating Retailers and brands should communicate regularly with stakeholders regarding their sustainability strategies, capital investments that are expected to result in improved sustainability metrics such as reduced waste, water and energy efficiencies, and efforts to reduce climate change. Additionally, communicating collaborative efforts spanning multiple industry participants (in a pre-competitive environment) as well as along one’s supply chain can spur further collaboration and quicken the pace of sustainability improvements. In its “2020 Sustainability Report” published in September 2021, Levi’s stated that the biggest contributor to its carbon footprint is its supply chain, which represented 60.4% of its footprint last year. “To make progress on these impacts and achieve our climate goals, we must collaborate with our suppliers. That means working with them to set clear and ambitious targets, while also supporting their efforts to become more water and energy efficient and increasing their use of renewable electricity,” the report states. VF Corporation makes a similar comment in its “Made For Change” ESG report: “Most of the environmental impacts of our business, approximately 65%, occur in our supply chain. That’s why we collaborate with industry associations, supply chain partners and key stakeholders to measure our impact, share best practices and implement programs to drive meaningful change.” As firms pursue sustainability and communicate their progress, they are likely to experience lower capital costs, reduced employee turnover, low inventory-to-sales and COGS (cost of goods sold) ratios and a sustainability premium. Larry Fink, CEO at investment management firm BlackRock and a longtime advocate of sustainability, wrote in his 2021 letter to company shareholders, “During 2020, 81% of a globally representative selection of sustainable indexes outperformed their parent benchmarks—and within industries (from automobiles to banks to oil and gas companies), we are seeing another divergence: Companies with better ESG profiles are performing better than their peers, enjoying a ‘sustainability premium.’”