albert Chan

The Macerich Company

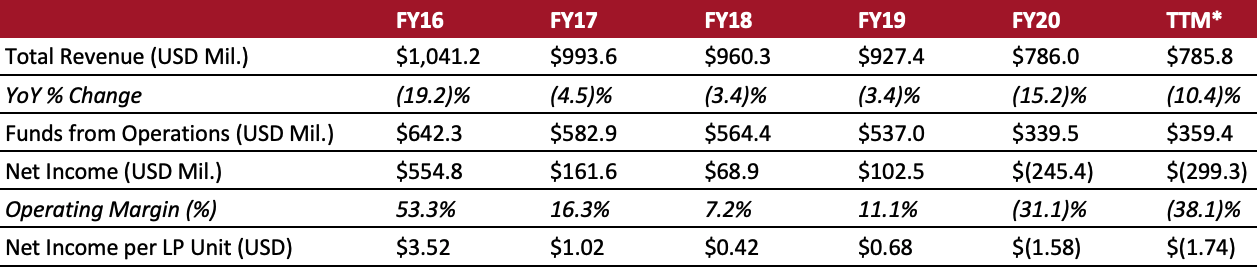

Sector: Real estate investment trusts (REITs) Country of operation: The US Key categories: Community/power centers and regional malls Annual Metrics [caption id="attachment_136359" align="aligncenter" width="700"] The fiscal year ends on December 31

The fiscal year ends on December 31*Trailing 12 months ended June 30, 2021[/caption] Summary Founded in 1964 and headquartered in Santa Monica, California, The Macerich Company is the third-largest owner and operator of retail shopping centers in the US. The company is a fully integrated, self-managed and self-administered real estate investment trust (REIT). It works in the acquisition, development, leasing, management, ownership, and redevelopment of regional malls and community/power shopping centers across the US. As of its second quarter of 2021 (ended June 30, 2021), the company has approximately 50 million square feet of gross leasable area (GLA), consisting of 51 regional malls and five community/power centers. The company has a significant presence in major urban centers across Arizona, Chicago, New York, Washington and on the West Coast. The Macerich Company was ranked top of the Global Real Estate Sustainability Benchmark (GRESB) in the North American Retail Sector for six consecutive years, from 2015 through 2020. As of December 31, 2020, the company has 670 employees, 659 working full time and 11 part time. Company Analysis Coresight Research insight: As Covid-19 restrictions have eased, many markets have achieved a full economic re-opening, including The Macerich Company’s key markets, California and New York—which were also its markets with the heaviest capacity restrictions. Consequently, the company has reported that rent collections have consistently been improving over the year and now are in line with pre-Covid levels, as of its second quarter of 2021 (ended June 30, 2021) The Macerich Company has also reported that traffic levels continued to remain around 90% during its second quarter, in comparison to pre-pandemic 2019. In particular, the company’s properties in the Phoenix area are close to pre-crisis levels. Its revenues grew by 20.7% year over year and its fund from operations (FFO) was $127.6 million (not including the financial impact of the sale of a stake of its properties Chandler Beauty Center and Freehold Raceway Mall to REIT Heitman)—up from $60.5 million last year. The company also continued to strengthen its balance sheet by deleveraging about $1.3 billion during the quarter. As the leasing environment improves, reinforced by strong leasing demand along with a gradual rise in both occupancy rates and tenant sales, we expect the company to witness a rise in its revenues in its third quarter.

| Tailwinds | Headwinds |

|

|

- Focus on well-located, quality regional shopping centers across the US.

- Acquire retail properties which complement the overall portfolio, such as outlet centers.

- Establish in-house specialized departments across various disciplines, including accounting, acquisition, development, finance, IT, leasing, legal, marketing, property management and redevelopment expertise.

- Establish decentralized property management led by on-site professionals responsible for the cost functions, leasing, maintenance, marketing and operation of their respective centers.

- Hire regionally located leasing managers to better understand the needs of their respective markets, communities and tenants.

- Redevelop properties to optimize space through mixed-use densification, demolish underperforming department store boxes and develop available land at shopping centers.

- Establish a separate department of redevelopment professionals to identify opportunities, obtain necessary government approvals and oversee design and construction.

- Pursue ground-up new development projects on a selective basis.

- Focus on fewer and higher-quality properties.

- Incorporate the value of stores as brand builders, media and efficient distribution platforms into its new leasing metrics.

- Set the stage for new growth after the pandemic, aligning with its town center strategy.

- Densify and diversify essential properties to provide wider use for a larger number of people.

- Engage in pre-development work for mixed-use expansions in prime locations and fast-growing centers.

- Pursue mixed-use expansion and use joint ventures and ground leases as tools to redevelop and densify its assets.

| Date | Development |

| May 20, 2021 | The Macerich Company and Scheels announce that Arizona’s first Scheels store in Chandler Fashion Center, Phoenix, will open in fall 2023. |

| May 10, 2021 | The Macerich Company announces that two Primark stores will be added to its retail lineup, one opening in Tysons Corner Center and one in Green Acres Mall. |

| April 14, 2021 | The Macerich company closes on the renewal of its corporate credit facility worth $700 million. |

| April 1, 2021 | The Macerich Company sells 95% of a non-core property in Phoenix, Paradise Valley Mall, for $95 million to a newly formed joint venture with an affiliate of RED Development. |

| December 22, 2020 | The Macerich Company is ranked first in GRESB’s Performance Score in the North America retail sector and is included in the CDP Climate Change A-List for 2020. |

| December 4, 2020 | The Macerich Company receives Bureau Veritas SafeGuard Certification for its 11 properties. |

| September 14, 2020 | The Macerich Company and PREIT’s joint venture, Fashion District Philadelphia, adds Ardene, DSW, Francesca’s, Industrious, Kate Spade Outlet and Starbucks stores on completing its first successful year of operations. |

| December 9, 2019 | The Macerich Company adds a Versace store to its elevated luxury wing at Scottsdale Fashion Square, Arizona. |

| October 1, 2019 | The Macerich Company leases former Sears space at Wilton Mall, New York, to Saratoga Hospital. |

| August 8, 2019 | The Macerich Company appoints Will Voegele to the new position of Executive Vice President, Chief Development. |

| September 17, 2019 | The Macerich Company and PREIT launch a joint venture, Fashion District Philadelphia. |

| Nov 16, 2018 | The Macerich Company launches BrandBox, a new retail concept designed for digitally native brands to open, operate and scale physical retail. |

| September 11, 2018 | The Macerich Company and Simon Property Group enter a 50:50 joint venture to develop Los Angeles Premium Outlets. |

- Thomas E. O’Hern—CEO and Director

- Edward C. Coppola—President and Director

- Douglas J. Healey—Senior EVP, Head of Leasing

- Scott W. Kingsmore—Senior EVP, CFO and Treasurer

- Ann C. Menard—Senior EVP, Chief Legal Officer, and Secretary

- William P. Voegele—EVP and Chief Development Officer

- Kenneth L. Volk—EVP, Business Development

- Jean Wood—VP of Investor Relations

Source: Company reports/S&P Capital IQ