albert Chan

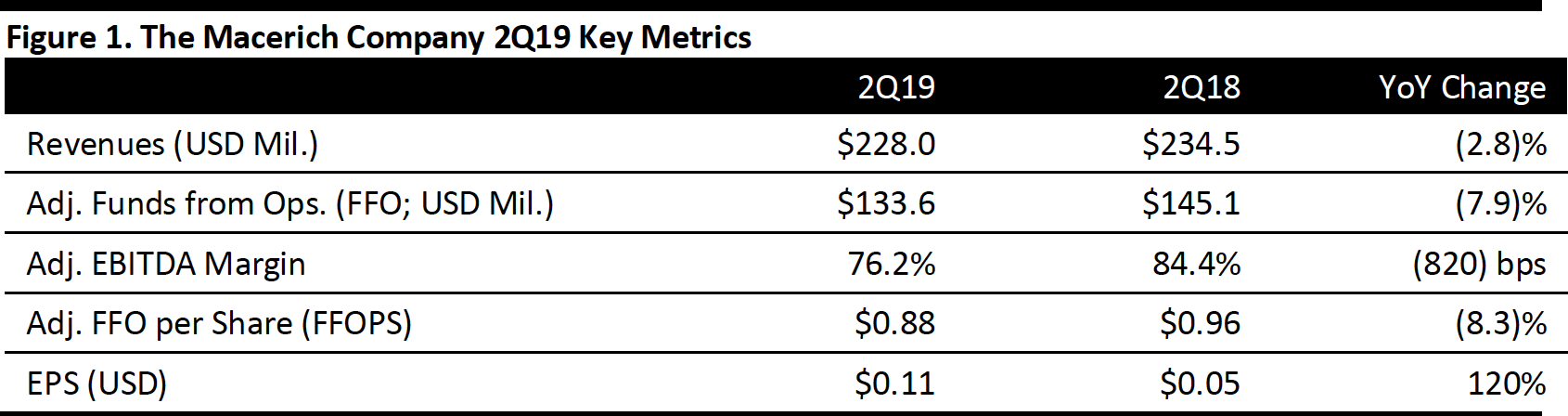

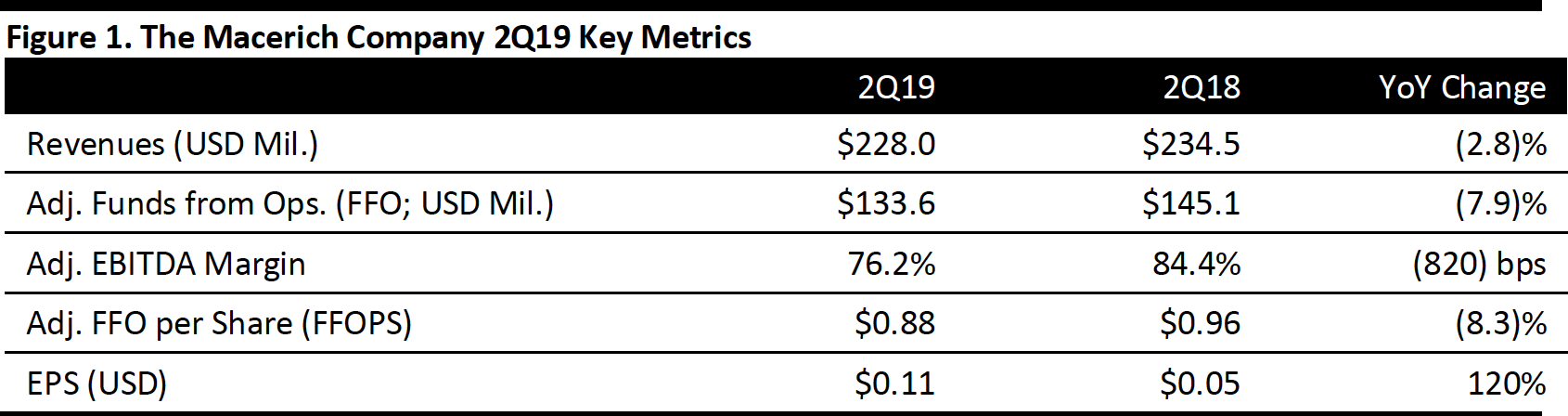

[caption id="attachment_94104" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

Macerich reported 2Q19 revenues of $228.0 million, down 2.8% year over year and missing the $229.4 million consensus estimate.

Adjusted FFOPS were $0.88, beating the consensus estimate of $0.86.

Details from the Quarter

Management commented that the leasing environment remains strong with total leasing volume up 29% year to date compared to 2018. In addition, the company recaptured former Sears boxes at some of their best centers and were able to redevelop those with more productive use.

General highlights include:

- Mall tenant sales per square foot for the 12 months ended June 30, 2019 were $776, up 12.1%.

- Re-leasing spreads for the period were up 9.4%.

- Mall portfolio occupancy was 94.1% as of June 30, compared to 94.3% a year ago.

- Average rent per square foot grew 4.0% to $61.17 as of June 30, compared to $58.84 a year ago.

Development/redevelopment highlights:

- Scottsdale Fashion Square. Multi-dimensional development of the property continues. The entire expansion of the 80,000 square-foot luxury wing is now fully leased and expected to be completed in 2019 at a total cost of $140-160 million (Macerich’s share is $70-$80 million). Notable new restaurants to open include Farmhouse, Nobu, Oceans 44, Toca Madera, Tocaya Organica and Zinque. In addition, both Equinox and Caesars Republic are expected to open during the first half of 2021. The capital investment increased consumer traffic by almost 7% through June 2019.

- Fashion District Philadelphia. The project is a four-level retail hub spanning 800,00 square feet in Center City Philadelphia, with a total project cost of $400-420 million (of which Macerich’s share is $200-210 million) in a 50/50 joint venture with Pennsylvania REIT. The JV has signed leases or is in active negotiations for 90% of the leasable area and is scheduled to open in September 2019. Tenant construction is proceeding in preparation for store openings. Notable commitments include AMC Theaters, American Eagle/Aerie, Burlington, Century 21, City Winery, Columbia Sportswear, Forever 21, Guess Factory, H&M, Hollister, Nike, Round One, Skechers and Ulta.

- Los Angeles Premium Outlets. Site work continues on the property located in Carson, a 50/50 joint venture with Simon Property Group. The property, which management characterized as well-located, fronts Interstate 405 and includes 400,000 square feet in its first phase. It is scheduled to open in fall 2021 with an additional 165,000 square feet in its second phase.

- One Westside. Construction started on the 584,000 Class A office campus located in West Los Angeles to be occupied by Google. The company’s remaining costs are $100 million, 25% of the total.

- Sears locations. The company recaptured ten Sears locations through formal lease rejections and lease terminations. Seven of them are owned by the company's 50/50 joint venture with Seritage Growth Properties.

- Los Cerritos Center, Washington Square, Vintage Faire Mall, Chandler Fashion Center, Arrowhead Towne Center, Deptford Mall and South Plains Mall are owned by the company's 50/50 joint venture with Seritage Growth Properties and the remaining three, Wilton Mall, La Cumbre Mall and Towne Mall, are wholly-owned by the company. The redevelopment costs were estimated at $250-$300 million.

Financing highlights:

- The company's joint venture closed a $220 million, 10-year loan on San Tan Village in Gilbert, Arizona, with a fixed interest rate of 4.30%. The proceeds will be used to repay the existing $120 million loan. Macerich estimates its share of the incremental proceeds at $85 million.

- The company's joint venture closed a $256 million, five-year loan on Chandler Fashion Center in Chandler, Arizona, with a fixed interest rate of 4.10%. The proceeds will be used to repay the existing $200 million loan. Macerich estimates its share of the incremental proceeds at $28 million.

- The company's joint venture is engaged in financing $190 million for Tysons Tower (an office building) and $95 million on Tysons Vita (multi-family). Both transactions are expected to close near the end of the next quarter.

Outlook

The company provided the following updated guidance for 2019:

- EPS of $0.42-0.50 (up from $0.41-$0.49 previously).

- FFOPS of $3.50-3.58 (down from $3.65-3.73 previously).