Nitheesh NH

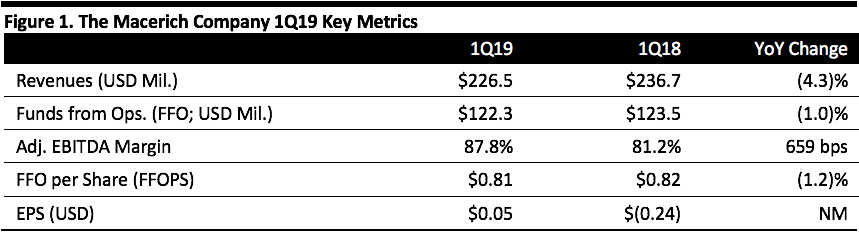

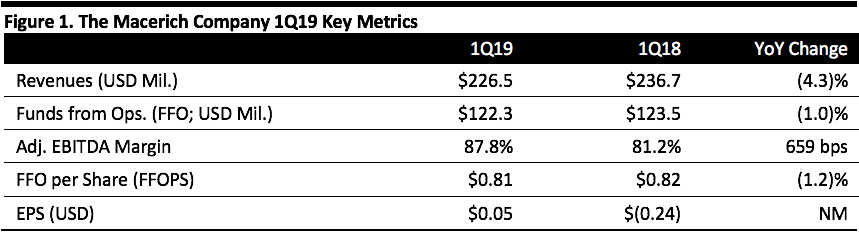

Figure 1. The Macerich Company 1Q19 Key Metrics

[caption id="attachment_86327" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Macerich reported 4Q18 revenues of $226.5 million, down 4.3% year over year and beating the $220.4 million consensus estimate.

FFOPS were $0.81, beating the consensus estimate by a penny.

Details from the Quarter

Management commented that while the year began with a heavy volume of anticipated retailer bankruptcies, the backfill of those vacancies is strong and the sales productivity and attractiveness of those properties continues to improve. In addition, there is extensive demand for the company’s better-situated Sears real estate.

General highlights include:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Macerich reported 4Q18 revenues of $226.5 million, down 4.3% year over year and beating the $220.4 million consensus estimate.

FFOPS were $0.81, beating the consensus estimate by a penny.

Details from the Quarter

Management commented that while the year began with a heavy volume of anticipated retailer bankruptcies, the backfill of those vacancies is strong and the sales productivity and attractiveness of those properties continues to improve. In addition, there is extensive demand for the company’s better-situated Sears real estate.

General highlights include:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Macerich reported 4Q18 revenues of $226.5 million, down 4.3% year over year and beating the $220.4 million consensus estimate.

FFOPS were $0.81, beating the consensus estimate by a penny.

Details from the Quarter

Management commented that while the year began with a heavy volume of anticipated retailer bankruptcies, the backfill of those vacancies is strong and the sales productivity and attractiveness of those properties continues to improve. In addition, there is extensive demand for the company’s better-situated Sears real estate.

General highlights include:

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Macerich reported 4Q18 revenues of $226.5 million, down 4.3% year over year and beating the $220.4 million consensus estimate.

FFOPS were $0.81, beating the consensus estimate by a penny.

Details from the Quarter

Management commented that while the year began with a heavy volume of anticipated retailer bankruptcies, the backfill of those vacancies is strong and the sales productivity and attractiveness of those properties continues to improve. In addition, there is extensive demand for the company’s better-situated Sears real estate.

General highlights include:

- Multi-tenant sales per square foot for the 12 months ended March 31, 2019 were $686, up 8.7%.

- Releasing spreads for the period were 11.0%.

- Mall portfolio occupancy was 94.7% as of March 31, compared to 94.0% a year ago.

- Average rent per square foot was $60.74 as of March 31, compared to $58.44 a year ago.

- Scottsdale Fashion Square: Multi-dimensional development of the property continues. Earlier in the year, Industrious, a coworking concept, opened with strong opening occupancy. Real estate along Scottsdale Road is now fully developed, which has created beneficial leasing activity and consumer traffic. The entire expansion of the 80,000 square-foot luxury wing is now fully leased and expected to be completed in 2019, at a total cost of $140-160 million (Macerich’s share is $70-$80 million).

- Fashion District Philadelphia: The project is a four-level retail hub spanning 800,00 square feet in central Philadelphia, with a total project cost of $400-420 million (of which Macerich’s share is $200-210 million) in a 50/50 joint venture with Pennsylvania REIT. The JV has signed leases or is in active negotiations for more than 87% of the leasable area and is scheduled to open in September 2019. Notable commitments include AMC Theaters, Burlington, Century 21, City Winery, Columbia Sportswear, Forever 21, Guess Factory, H&M, Hollister, Nike, Round One and Ulta.

- Los Angeles Premium Outlets: Site work continues on the property, located in Carson, California, a 50/50 joint venture with Simon Property Group. The property, which management characterized as well-located, fronts Interstate 405 and includes 400,000 square feet in its first phase, followed by an additional 165,000 square feet in the second phase.

- One Westside: Pre-development activity continues on the 584,000 Class A office campus located in West Los Angeles, to be occupied by Google. The property, a joint venture with Hudson Pacific, ceased most of its retail operations in the first quarter, and the redevelopment will commence later in 2019. The company’s remaining costs are 25% of the total, or $100 million.

- Sears locations: The company remains focused on leasing and redevelopment planning for these locations and estimates its share of the redevelopment costs at $250-$300 million.

- The company's joint venture entered into a $220 million, 10-year loan on San Tan Village in Gilbert, Arizona, with a fixed interest rate of 4.30%, whose proceeds will be used to repay the existing $120 million loan. Macerich estimates its share of the incremental proceeds at $84 million.

- Leasing volumes were strong in the quarter. In Q1, Macerich executed 258 leases for a total of 825,000 square feet, 64% and 51% higher year over year, respectively.

- Large format leases remain active. The company signed two leases with Round One: one at Fashion District of Philadelphia and one at Deptford Mall.

- The company executed agreements with several brands in the quarter, including Peloton and Ulta in Washington Square; with Caster at Tyson’s Corner and Washington Square; with UNTUCKit at The Village at Corte Madera; with Indochino at Santa Monica Place; with Morphe at Tysons Corner; and, with Ring at Scottsdale Fashion Square.

- Other notable leases signed in the quarter include a second deal with Industrious and 33,000 square feet of level space at Broadway Plaza; Hollister at Fashion District of Philadelphia; Sandbox, a virtual-reality concept, at Cerritos; a local craft brewery at The Oaks; and Altar'd State at Washington Square.

- EPS of $0.41-0.49 (up from $0.33-0.41 previously).

- FFOPS of $3.65-3.73 (unchanged).