Nitheesh NH

Introduction

On July 12–13, 2022, more than 1,700 people from the fashion, retail, retail tech and consumer innovation communities converged in New York for The Lead Innovation Summit to learn, connect and discuss what the retail world of tomorrow will look like. The Lead “bridges fashion and retail” through events and publications. The Innovation Summit featured more than 100 speakers across 40+ sessions. During the event, Coresight Research moderated a panel on livestreaming and interviewed beauty company Coty about its approach to e-commerce. We present our key insights from these sessions and more across the Innovation Summit.The Lead Innovation Summit: Coresight Research Insights

Thinking Outside the DTC Box Marie Driscoll, Senior Analyst and Managing Director, Luxury and Retail, at Coresight Research, interviewed Christina Rapsomanikis, VP of E-Commerce and Digital, North America, at Coty, to discuss the beauty giant’s approach to e-commerce. Coty has a portfolio of 40 brands, including CoverGirl, Gucci Beauty, Lancaster and the recently launched SKKN BY KIM. Five of its brands currently have DTC (direct-to-consumer) e-commerce options on their websites. With its consumer-centric approach, Coty uses social media and its branded websites, such as CoverGirl.com, to engage with consumers and drive brand awareness and education, sending shoppers to retail partners’ websites for ordering. [caption id="attachment_151700" align="aligncenter" width="550"] Marie Driscoll from Coresight Research (left) interviewing Christina Rapsomanikis from Coty (right)

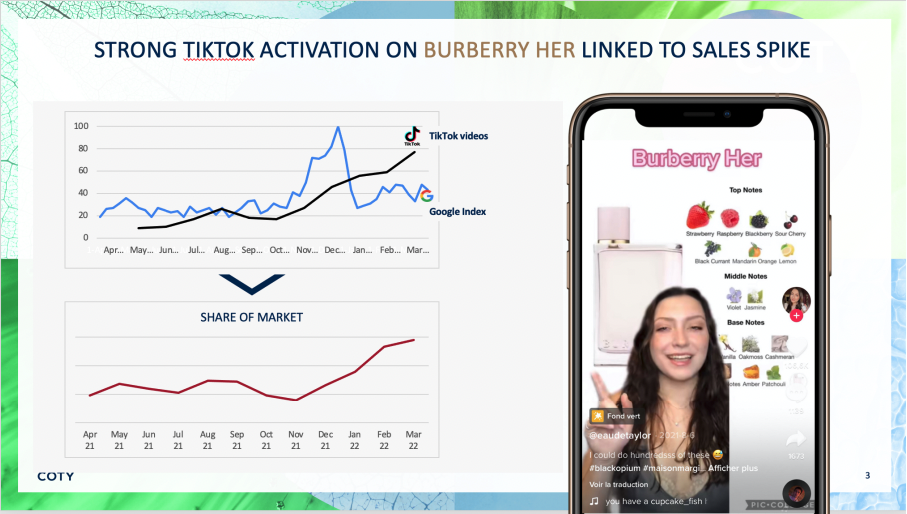

Marie Driscoll from Coresight Research (left) interviewing Christina Rapsomanikis from Coty (right)Source: Coty[/caption] Rapsomanikis explained that one of Coty’s brand extensions, Burberry Her, saw market share gains following activation on short-video platform TikTok (see image below). She also discussed social commerce beauty app Flip, where users can purchase beauty products as well as post video reviews to earn money based on community engagement. Coty has partnered with the app via its brands CoverGirl, Sally Hansen and philosophy, exploring a new, customer-centric channel. [caption id="attachment_151702" align="aligncenter" width="700"]

Slide from presentation explaining Burberry Her’s success on TikTok

Slide from presentation explaining Burberry Her’s success on TikTokSource: Coty[/caption] As a house of beauty brands, Rapsomanikis said, “We are basically an advertising company. We know marketing and can provide content and execute in multiple channels. We are reducing channel friction with our retail partners by being selective about which of our brands have a brand.com e-commerce site—but the customer decides.” The Merits of DTC In a keynote panel, “The Direct 60: Incumbent Brands Building D2C Muscle,” Alex Baillargeoun, SVP of Digital at Authentic Brands Group, explained the metrics of building a DTC ecosystem: “DTC helped traditional wholesale brands from being commodity products and to build community by engaging with the consumer. DTC helps create loyalty and longevity.” Likewise, Justine Mohr, Chief Revenue Officer at 3.1 Philip Lim, explained that “DTC is a direct line to the customer, with direct feedback on the product and the needs of the modern luxury shopper, you don’t get that from the wholesale relationship.” Still, while DTC typically has higher merchandise margins, spending on digital marketing can destroy the DTC all-in margin. “DTC can’t win on Instagram or TikTok,” stated Heath Golden, Chief Commercial and Strategy Officer at Marquee Brands. How to Livestream Many brands looking for alternative digital customer acquisition strategies are considering livestream shopping, a blend of rapidly developing technology (streaming), live interactions, physical demonstrations and entertainment. Marie Driscoll of Coresight Research moderated a panel discussing the benefits of livestreaming, which Coresight Research views as one the fastest-growing retail channels. During the panel, Gabby Hirata, President at DVF; Andrea Moore, SVP of Digital, E-Commerce and Consumer Insights at Nest New York; and Jill Scalamandre, CEO of Beekman 1802, discussed their livestreaming strategies with Driscoll. Hirata urged retailers to make it profitable by starting small, using employees for engagement and focusing on returns. “Consistency is key, show up regularly and your audience will build” Hirata told Driscoll. She also added that DVF is lucky to have a dynamic founder, Diane Von Furstenberg, to inspire new channel exploration. While Nest New York uses special guests for product launches and online conversations, it uses its founder, Laura Slatkin, for onsite livestreaming events. According to Moore, this strategy is creating a community at Nest Fragrances that attracts new shoppers to the brand and drives engagement and return visits. Moore also explained that “at Nest we have special limited editions and gifts during the event that drive excitement and sales.” At Beekman 1802, a brand born on the Home Shopping Network (HSN), and when the pandemic occurred, the founders, Josh Kilmer-Purcell and Dr. Brent Ridge, were sent a “livestreaming playbook” so they could continue to sell from home. Livestreaming eventually became so essential that the brand added livestreaming capabilities to beekman1802.com. The company now also offers one-on-one streaming for shoppers who want skincare consultations. Scalamandre touched upon the work required to make livestreaming profitable, saying, “it takes the whole organization pulling together, many hours, emails to customers, social postings for the event.” However, Scalamandre told Driscoll that even having 80 people show up makes the work worth it, as the conversion rate is three to four times better than traditional e-commerce due to an increased halo effect and “valuable” word of mouth. Livestream shopping is quickly becoming an essential marketing tool that companies should use to directly engage with customers worldwide, in real time. Coresight Research estimates that the US livestreaming e-commerce sector will grow to $23 billion by the end of 2023. Following in the above companies’ footsteps, retailers and brands should learn to adopt livestreaming into their business model, whether it be on their own websites or via dedicated social media apps or dedicated livestreaming sites.

- For more on Coresight Research’s recommendation for brands and retailers looking to enter the livestreaming space, read our report, Playbook: Livestreaming E-Commerce.

Pavan Bahl and Frank Weil during the “Need to Know Tech” panel

Pavan Bahl and Frank Weil during the “Need to Know Tech” panelSource: Coresight Research[/caption] NFTs have become incredibly popular following the pandemic-fueled interest in the blockchain, metaverse and cryptocurrencies. As such, Coresight Research views them as a crucial technology for those wishing to enter the metaverse and build a presence there. Specifically, retailers with strong branding have an excellent opportunity to leverage NFTs, as they can connect NFTs to their brand story, while providing increased product interaction and customer engagement.

- For more information on the various approaches to capitalizing on the metaverse and metaverse-related technologies, including releasing products through NFTs, see Coresight Research’s report, Playbook: Strategies for Retailers To Monetize the Metaverse.

- Read more of Coresight Research’s coverage of the supply chain.

Slide explaining the benefits of brands sharing a supply chain network

Slide explaining the benefits of brands sharing a supply chain networkSource: AEO[/caption] Adaptive Retail—An Underserved Market Adaptive apparel, clothing made for individuals with disabilities, is an underserved market of one billion people worldwide, creating an excellent opportunity for brands to connect with a large consumer base and growing community. Mindy Scheier founded Runway of Dreams, a foundation that helps people with disabilities access the apparel they need, in response to her son, Oliver, desiring to be like every other eight-year-old and wear jeans to school, even though he has multiple sclerosis. Now, Runway of Dreams has partnered with the likes of JCPenney, Kohl’s, Target, Tommy Hilfiger and more to develop, manufacture and support adaptive apparel initiatives, including creating jeans with Velcro closings. Scheier said, “it changed [her] life when Oliver could dress himself…clothing is incredibly powerful.” This September, Runway of Dreams will participate in New York Fashion Week. During the event, 70 models with various disabilities will model adaptive clothing that looks fashionable and is designed to be taken on and off easily. Scheier urged the audience to attend the fashion show and support the inclusive market, where there are still “powerful market dynamics and it is a game changer for the wearer.” Coresight Research sees adaptive products—and increased inclusivity overall—as much more than a trend; rather, it is the beginning of a long-term change within the retail world. Companies should leverage their strengths to expand their offerings to more consumers and, in turn, become more inclusive. There are many opportunities to do so across various categories, including adaptive retail.

- For more on how retailers and brands can become more inclusive, read Coresight Research’s inclusivity coverage.