DIpil Das

China’s digital landscape has evolved from just a few dominant players to a number of new entrants joining and gaining shares. In this report, we review recent trends in the digital economy, with a focus on Alibaba and Tencent.

Tencent’s Digital Ecosystem Is the Most Popular among Mobile Users, but Emerging Players Are Taking Market Share

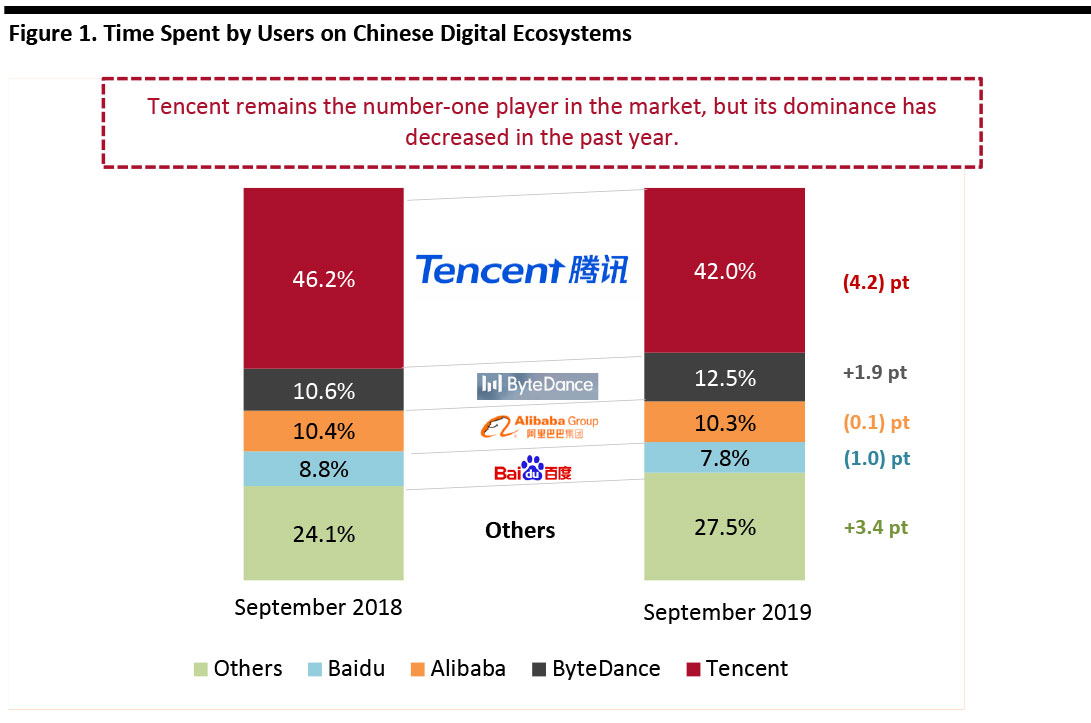

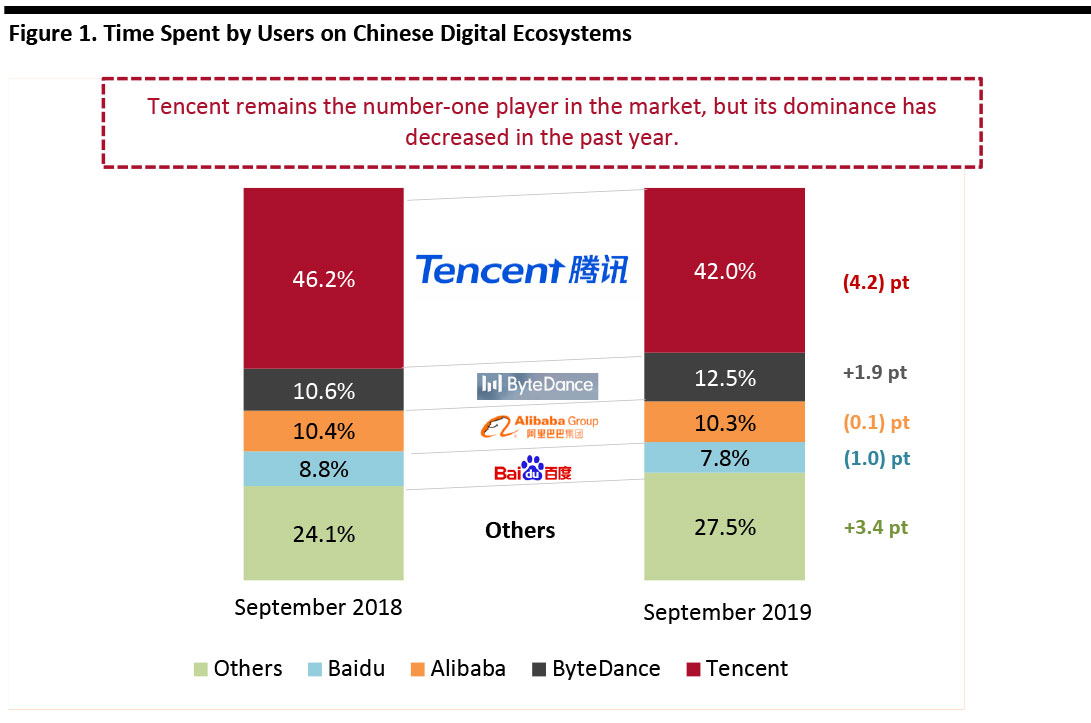

Although Tencent’s digital ecosystem remains the number-one player in the market in terms of the time spent on its platforms by mobile users, its dominance has decreased in the past year, according to a recent report by Chinese app data aggregator QuestMobile. Tencent saw its digital apps account for 42% of the total time spent by mobile users on Chinese digital ecosystems in 2019, down from 46.2% in 2018. The next-most-popular ecosystems are those provided by ByteDance and Alibaba.

[caption id="attachment_101324" align="aligncenter" width="700"] Source: QuestMobile Mobile Report, Q3 2019[/caption]

Tencent’s dominance can be explained to a great extent by its super app WeChat, which contributes to the company’s high user engagement—users spend an average of 21% of their mobile time on WeChat each day (around 44 minutes), according to Chinese financial services firm Sinolink Securities. Users can do a wide range of activities through the app—pay bills, hail taxis, find restaurants, order food, make doctors’ appointments, find nearby parking spots and pay traffic tickets. State-run media and government agencies also have official WeChat accounts through which the general public can directly communicate with them.

However, as shown in Figure 1, emerging players have recently taken users’ time away from Tencent. ByteDance, which owns the short-video app TikTok and news platform Toutiao, saw its total share of user time increase from 10.6% in September 2018 to 12.5% the following year, according to the QuestMobile data. We believe that ByteDance’s apps have grown at the expense of Tencent’s, contributing to the drop of 4.2 percentage points in user time spent on the latter’s digital ecosystem.

Other emerging players are also attracting users, totalling a 27.5% of users’ time in September 2019. We believe that this is probably attributable to popular short-video platforms such as Kuaishou and some vertical e-commerce platforms—for example, parent-and-baby e-commerce platform Babytree.

Alibaba’s share of total mobile users’ time decreased by 0.1 percentage point year over year as of September 2019, probably due to competition from Pinduoduo. However, Alibaba’s heavy investment in its retail empire seems to enable the company to continue to enjoy strong growth from lower-tier cities in China. In the quarter ended June 30, 2019, Alibaba reported that over 70% of its new annual active consumers were from less-developed cites.

Baidu's digital products may be losing their appeal. The company’s knowledge-sharing site Baidu Baike could not compete with rival Zhihu, which reported 130 million questions and answers on its platform by 220 million registered users as of August 2019. By comparison, Baidu Baike has 16 million entries written by only 6.9 million users as of October 2019. Baidu’s AI initiatives also did not see a strong pickup as user feedback suggested that the products are not frictionless—for example, users complained that AI assistant Xiaoduzaijia did not respond effectively to voice commands, and the company’s AI-powered Chinese input tool does not work smoothly.

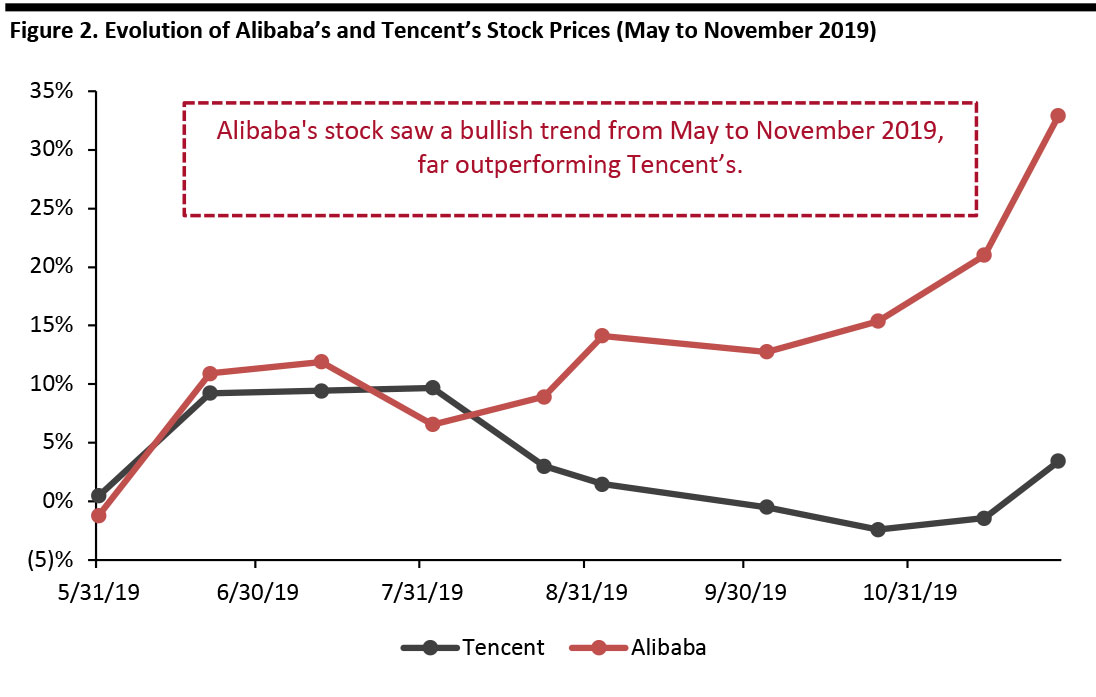

Alibaba’s Stock Outperforms Tencent’s

Alibaba's stock saw an upward trend from May to November 2019, outperforming Tencent’s, which has seen a bearish trend from June to October but started to rise in November. Although the growth rate of Tencent’s share has been lower than Alibaba’s, it has a higher price-to-earnings (PE) ratio—30.79x compared to Alibaba’s 23.54x, as of December 3. A high PE ratio suggests that investors are expecting higher earnings growth in the future compared to companies with a lower PE. This is partly due to the dominance of Tencent’s super app WeChat.

Alibaba’s core e-commerce business remains strong, as does as its cloud business, which is driving growth through a wide investment portfolio (see our coverage here). Alibaba’s core commerce business jumped by 40% in the quarter ended September 30, compared to the previous quarter, with total commerce revenue reaching ¥101.2 billion ($14.4 billion).

Tencent’s hammered stock performance is the result of tighter regulations from the government over gaming and content. New restrictions have been introduced to regulate how minors play video games, including time limits, age-rating limits and spending limits. Tencent’s cloud business did not produce as much revenue as Alibaba’s, although it had a high growth rate of 80% annually to ¥4.7 billion ($670 million) during the third quarter of 2019 ended September 30. Alibaba's cloud revenue, on the other hand, rose 64% annually to ¥9.3 billion ($1.3 billion) in the same quarter.

[caption id="attachment_101325" align="aligncenter" width="700"]

Source: QuestMobile Mobile Report, Q3 2019[/caption]

Tencent’s dominance can be explained to a great extent by its super app WeChat, which contributes to the company’s high user engagement—users spend an average of 21% of their mobile time on WeChat each day (around 44 minutes), according to Chinese financial services firm Sinolink Securities. Users can do a wide range of activities through the app—pay bills, hail taxis, find restaurants, order food, make doctors’ appointments, find nearby parking spots and pay traffic tickets. State-run media and government agencies also have official WeChat accounts through which the general public can directly communicate with them.

However, as shown in Figure 1, emerging players have recently taken users’ time away from Tencent. ByteDance, which owns the short-video app TikTok and news platform Toutiao, saw its total share of user time increase from 10.6% in September 2018 to 12.5% the following year, according to the QuestMobile data. We believe that ByteDance’s apps have grown at the expense of Tencent’s, contributing to the drop of 4.2 percentage points in user time spent on the latter’s digital ecosystem.

Other emerging players are also attracting users, totalling a 27.5% of users’ time in September 2019. We believe that this is probably attributable to popular short-video platforms such as Kuaishou and some vertical e-commerce platforms—for example, parent-and-baby e-commerce platform Babytree.

Alibaba’s share of total mobile users’ time decreased by 0.1 percentage point year over year as of September 2019, probably due to competition from Pinduoduo. However, Alibaba’s heavy investment in its retail empire seems to enable the company to continue to enjoy strong growth from lower-tier cities in China. In the quarter ended June 30, 2019, Alibaba reported that over 70% of its new annual active consumers were from less-developed cites.

Baidu's digital products may be losing their appeal. The company’s knowledge-sharing site Baidu Baike could not compete with rival Zhihu, which reported 130 million questions and answers on its platform by 220 million registered users as of August 2019. By comparison, Baidu Baike has 16 million entries written by only 6.9 million users as of October 2019. Baidu’s AI initiatives also did not see a strong pickup as user feedback suggested that the products are not frictionless—for example, users complained that AI assistant Xiaoduzaijia did not respond effectively to voice commands, and the company’s AI-powered Chinese input tool does not work smoothly.

Alibaba’s Stock Outperforms Tencent’s

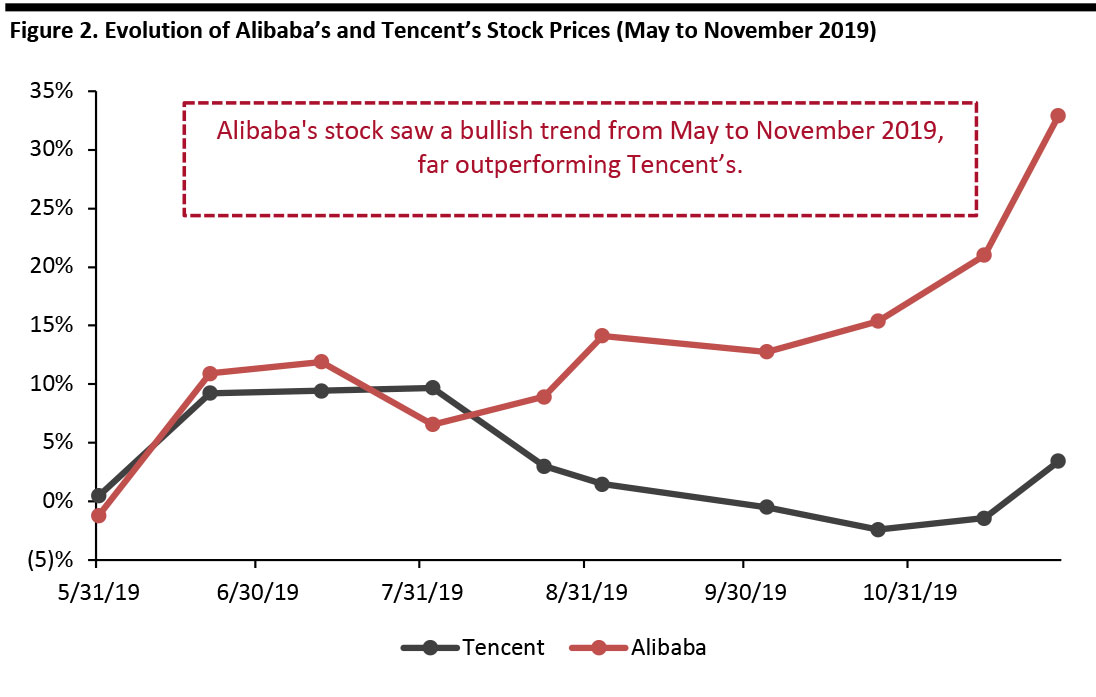

Alibaba's stock saw an upward trend from May to November 2019, outperforming Tencent’s, which has seen a bearish trend from June to October but started to rise in November. Although the growth rate of Tencent’s share has been lower than Alibaba’s, it has a higher price-to-earnings (PE) ratio—30.79x compared to Alibaba’s 23.54x, as of December 3. A high PE ratio suggests that investors are expecting higher earnings growth in the future compared to companies with a lower PE. This is partly due to the dominance of Tencent’s super app WeChat.

Alibaba’s core e-commerce business remains strong, as does as its cloud business, which is driving growth through a wide investment portfolio (see our coverage here). Alibaba’s core commerce business jumped by 40% in the quarter ended September 30, compared to the previous quarter, with total commerce revenue reaching ¥101.2 billion ($14.4 billion).

Tencent’s hammered stock performance is the result of tighter regulations from the government over gaming and content. New restrictions have been introduced to regulate how minors play video games, including time limits, age-rating limits and spending limits. Tencent’s cloud business did not produce as much revenue as Alibaba’s, although it had a high growth rate of 80% annually to ¥4.7 billion ($670 million) during the third quarter of 2019 ended September 30. Alibaba's cloud revenue, on the other hand, rose 64% annually to ¥9.3 billion ($1.3 billion) in the same quarter.

[caption id="attachment_101325" align="aligncenter" width="700"] Source: Google Finance[/caption]

A Closer Look at Investments by Alibaba and Tencent

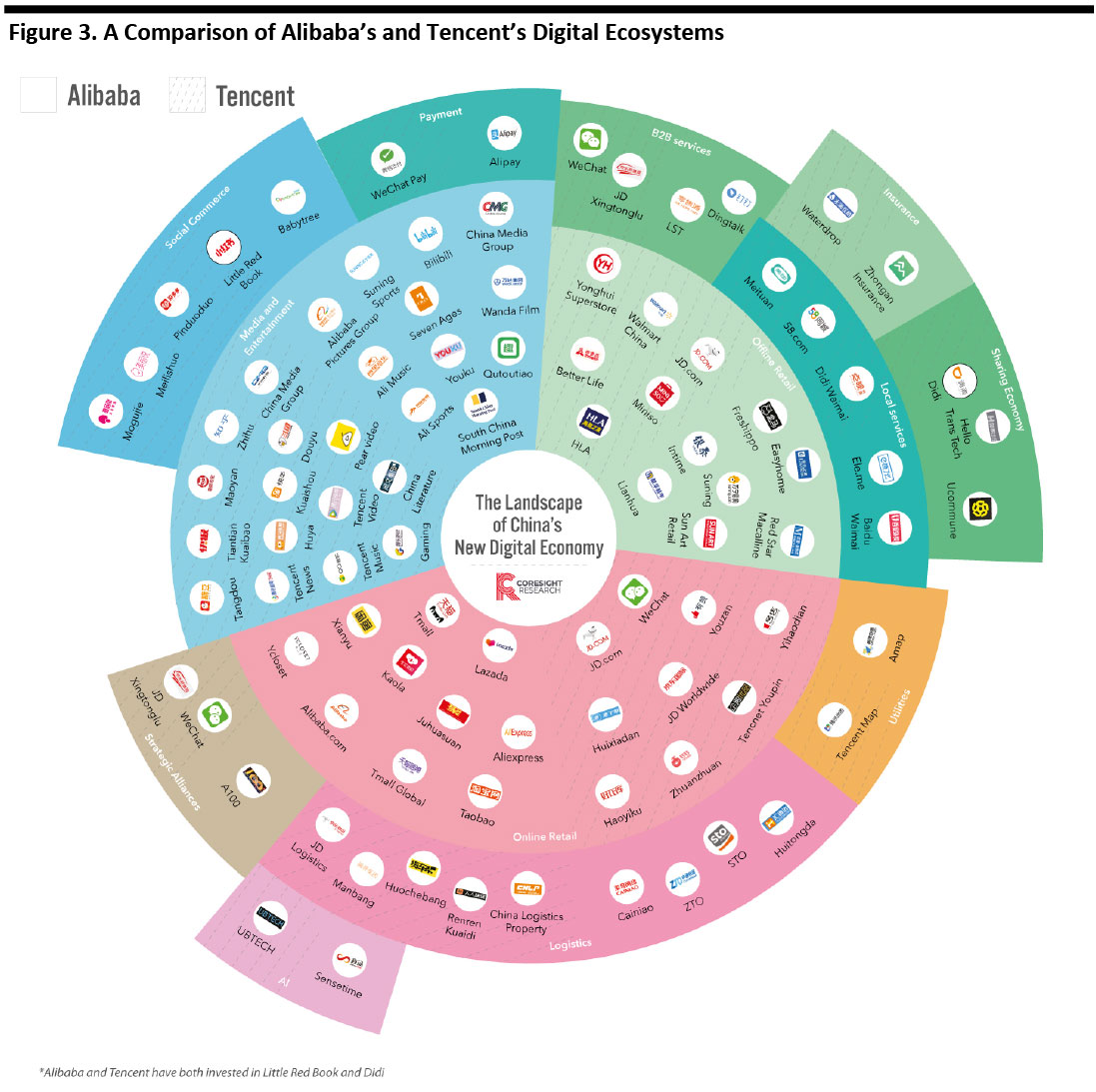

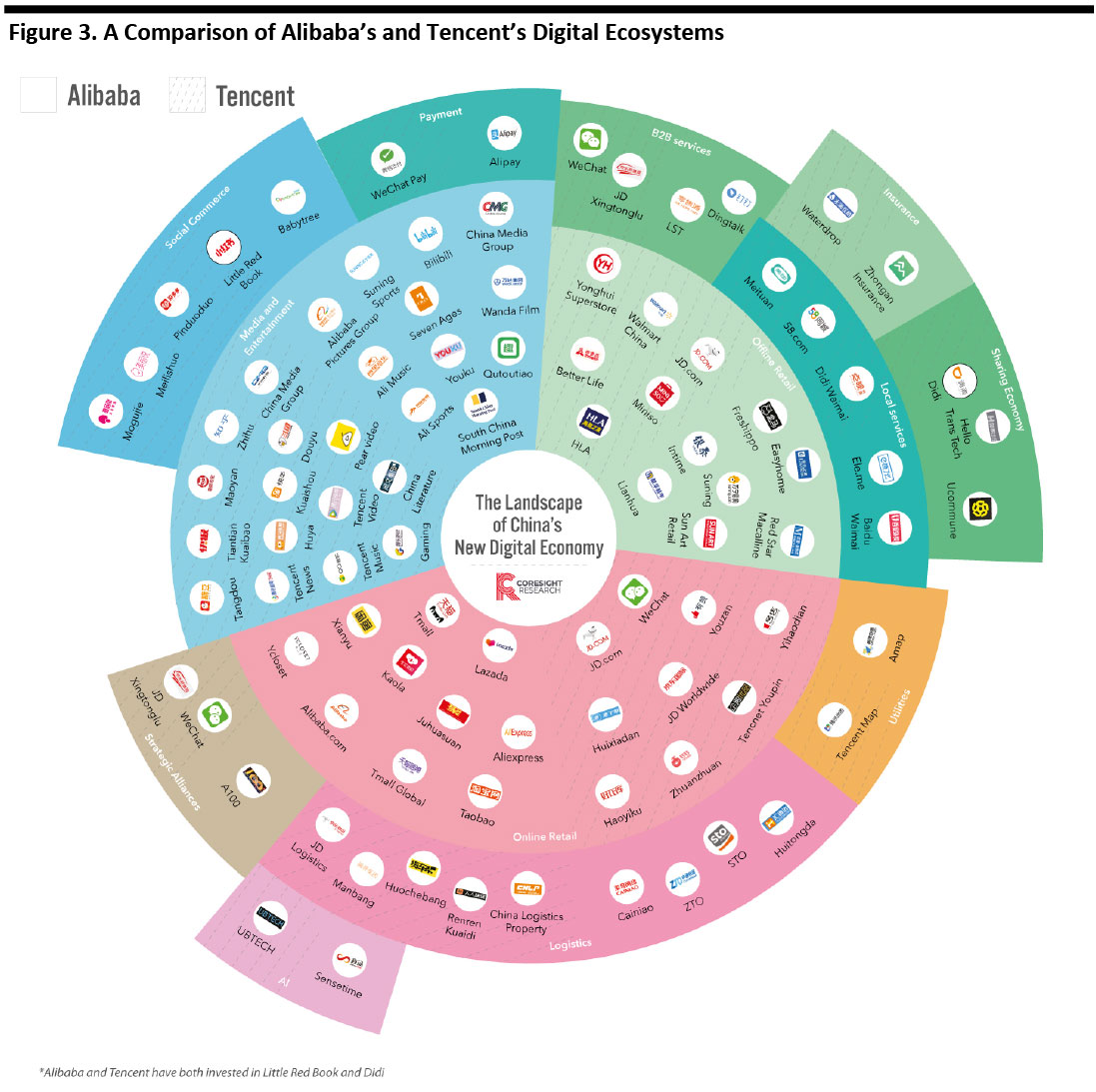

Both Alibaba and Tencent have made investments to complement their digital ecosystems and achieve further growth, with Tencent’s investment stronger in social media content and Alibaba being more focused on retail and artificial intelligence (AI) technologies.

Tencent has invested in short-video apps Huya and Kuaishou. The company also owns leading online literature platform China Literature and the dominating music streaming service company Tencent Music. By comparison, Alibaba has invested in home-furnishing retailer Easyhome and social-commerce platform Xiaohongshu (known as Little Red Book outside China). Alibaba also invested in AI companies, such as SenseTime.

Alibaba and Tencent are shoulder to shoulder on investment in local services and finance. For local services, both invest in ridesharing platform Didi Chuxing, Alibaba acquired delivery platform Ele.me and Tencent invested in local-services platform 58.com. In the finance sector, Alibaba invested in online-only insurance company Zhongan Insurance.

[caption id="attachment_101348" align="aligncenter" width="700"]

Source: Google Finance[/caption]

A Closer Look at Investments by Alibaba and Tencent

Both Alibaba and Tencent have made investments to complement their digital ecosystems and achieve further growth, with Tencent’s investment stronger in social media content and Alibaba being more focused on retail and artificial intelligence (AI) technologies.

Tencent has invested in short-video apps Huya and Kuaishou. The company also owns leading online literature platform China Literature and the dominating music streaming service company Tencent Music. By comparison, Alibaba has invested in home-furnishing retailer Easyhome and social-commerce platform Xiaohongshu (known as Little Red Book outside China). Alibaba also invested in AI companies, such as SenseTime.

Alibaba and Tencent are shoulder to shoulder on investment in local services and finance. For local services, both invest in ridesharing platform Didi Chuxing, Alibaba acquired delivery platform Ele.me and Tencent invested in local-services platform 58.com. In the finance sector, Alibaba invested in online-only insurance company Zhongan Insurance.

[caption id="attachment_101348" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Key Insights

China’s digital economy has gone through a period of change recently, with Alibaba and Tencent positioning themselves as the main players, while Baidu’s role in the Chinese digital world shrunk. Alibaba continues to dominate in ecommerce sector and is seeing its cloud business thrive. Tencent’s super app WeChat is the major contributor to the company’s huge influence in the Chinese landscape—it remains the go-to app for nearly 1.1 billion monthly active users as of June 2019, according to Statista.

However, Alibaba and Tencent are increasingly facing competition from emerging players such as ByteDance, whose digital content apps TikTok and Toutiao have been popular among Chinese users. ByteDance recorded over 1.5 billion monthly active users across its platforms in July 2019. To solidify their market positions, Alibaba and Tencent have therefore diversified investments in a wide range of businesses, with Tencent showing strength in content and Alibaba in retail.

Source: Company reports/Coresight Research[/caption]

Key Insights

China’s digital economy has gone through a period of change recently, with Alibaba and Tencent positioning themselves as the main players, while Baidu’s role in the Chinese digital world shrunk. Alibaba continues to dominate in ecommerce sector and is seeing its cloud business thrive. Tencent’s super app WeChat is the major contributor to the company’s huge influence in the Chinese landscape—it remains the go-to app for nearly 1.1 billion monthly active users as of June 2019, according to Statista.

However, Alibaba and Tencent are increasingly facing competition from emerging players such as ByteDance, whose digital content apps TikTok and Toutiao have been popular among Chinese users. ByteDance recorded over 1.5 billion monthly active users across its platforms in July 2019. To solidify their market positions, Alibaba and Tencent have therefore diversified investments in a wide range of businesses, with Tencent showing strength in content and Alibaba in retail.

Source: QuestMobile Mobile Report, Q3 2019[/caption]

Tencent’s dominance can be explained to a great extent by its super app WeChat, which contributes to the company’s high user engagement—users spend an average of 21% of their mobile time on WeChat each day (around 44 minutes), according to Chinese financial services firm Sinolink Securities. Users can do a wide range of activities through the app—pay bills, hail taxis, find restaurants, order food, make doctors’ appointments, find nearby parking spots and pay traffic tickets. State-run media and government agencies also have official WeChat accounts through which the general public can directly communicate with them.

However, as shown in Figure 1, emerging players have recently taken users’ time away from Tencent. ByteDance, which owns the short-video app TikTok and news platform Toutiao, saw its total share of user time increase from 10.6% in September 2018 to 12.5% the following year, according to the QuestMobile data. We believe that ByteDance’s apps have grown at the expense of Tencent’s, contributing to the drop of 4.2 percentage points in user time spent on the latter’s digital ecosystem.

Other emerging players are also attracting users, totalling a 27.5% of users’ time in September 2019. We believe that this is probably attributable to popular short-video platforms such as Kuaishou and some vertical e-commerce platforms—for example, parent-and-baby e-commerce platform Babytree.

Alibaba’s share of total mobile users’ time decreased by 0.1 percentage point year over year as of September 2019, probably due to competition from Pinduoduo. However, Alibaba’s heavy investment in its retail empire seems to enable the company to continue to enjoy strong growth from lower-tier cities in China. In the quarter ended June 30, 2019, Alibaba reported that over 70% of its new annual active consumers were from less-developed cites.

Baidu's digital products may be losing their appeal. The company’s knowledge-sharing site Baidu Baike could not compete with rival Zhihu, which reported 130 million questions and answers on its platform by 220 million registered users as of August 2019. By comparison, Baidu Baike has 16 million entries written by only 6.9 million users as of October 2019. Baidu’s AI initiatives also did not see a strong pickup as user feedback suggested that the products are not frictionless—for example, users complained that AI assistant Xiaoduzaijia did not respond effectively to voice commands, and the company’s AI-powered Chinese input tool does not work smoothly.

Alibaba’s Stock Outperforms Tencent’s

Alibaba's stock saw an upward trend from May to November 2019, outperforming Tencent’s, which has seen a bearish trend from June to October but started to rise in November. Although the growth rate of Tencent’s share has been lower than Alibaba’s, it has a higher price-to-earnings (PE) ratio—30.79x compared to Alibaba’s 23.54x, as of December 3. A high PE ratio suggests that investors are expecting higher earnings growth in the future compared to companies with a lower PE. This is partly due to the dominance of Tencent’s super app WeChat.

Alibaba’s core e-commerce business remains strong, as does as its cloud business, which is driving growth through a wide investment portfolio (see our coverage here). Alibaba’s core commerce business jumped by 40% in the quarter ended September 30, compared to the previous quarter, with total commerce revenue reaching ¥101.2 billion ($14.4 billion).

Tencent’s hammered stock performance is the result of tighter regulations from the government over gaming and content. New restrictions have been introduced to regulate how minors play video games, including time limits, age-rating limits and spending limits. Tencent’s cloud business did not produce as much revenue as Alibaba’s, although it had a high growth rate of 80% annually to ¥4.7 billion ($670 million) during the third quarter of 2019 ended September 30. Alibaba's cloud revenue, on the other hand, rose 64% annually to ¥9.3 billion ($1.3 billion) in the same quarter.

[caption id="attachment_101325" align="aligncenter" width="700"]

Source: QuestMobile Mobile Report, Q3 2019[/caption]

Tencent’s dominance can be explained to a great extent by its super app WeChat, which contributes to the company’s high user engagement—users spend an average of 21% of their mobile time on WeChat each day (around 44 minutes), according to Chinese financial services firm Sinolink Securities. Users can do a wide range of activities through the app—pay bills, hail taxis, find restaurants, order food, make doctors’ appointments, find nearby parking spots and pay traffic tickets. State-run media and government agencies also have official WeChat accounts through which the general public can directly communicate with them.

However, as shown in Figure 1, emerging players have recently taken users’ time away from Tencent. ByteDance, which owns the short-video app TikTok and news platform Toutiao, saw its total share of user time increase from 10.6% in September 2018 to 12.5% the following year, according to the QuestMobile data. We believe that ByteDance’s apps have grown at the expense of Tencent’s, contributing to the drop of 4.2 percentage points in user time spent on the latter’s digital ecosystem.

Other emerging players are also attracting users, totalling a 27.5% of users’ time in September 2019. We believe that this is probably attributable to popular short-video platforms such as Kuaishou and some vertical e-commerce platforms—for example, parent-and-baby e-commerce platform Babytree.

Alibaba’s share of total mobile users’ time decreased by 0.1 percentage point year over year as of September 2019, probably due to competition from Pinduoduo. However, Alibaba’s heavy investment in its retail empire seems to enable the company to continue to enjoy strong growth from lower-tier cities in China. In the quarter ended June 30, 2019, Alibaba reported that over 70% of its new annual active consumers were from less-developed cites.

Baidu's digital products may be losing their appeal. The company’s knowledge-sharing site Baidu Baike could not compete with rival Zhihu, which reported 130 million questions and answers on its platform by 220 million registered users as of August 2019. By comparison, Baidu Baike has 16 million entries written by only 6.9 million users as of October 2019. Baidu’s AI initiatives also did not see a strong pickup as user feedback suggested that the products are not frictionless—for example, users complained that AI assistant Xiaoduzaijia did not respond effectively to voice commands, and the company’s AI-powered Chinese input tool does not work smoothly.

Alibaba’s Stock Outperforms Tencent’s

Alibaba's stock saw an upward trend from May to November 2019, outperforming Tencent’s, which has seen a bearish trend from June to October but started to rise in November. Although the growth rate of Tencent’s share has been lower than Alibaba’s, it has a higher price-to-earnings (PE) ratio—30.79x compared to Alibaba’s 23.54x, as of December 3. A high PE ratio suggests that investors are expecting higher earnings growth in the future compared to companies with a lower PE. This is partly due to the dominance of Tencent’s super app WeChat.

Alibaba’s core e-commerce business remains strong, as does as its cloud business, which is driving growth through a wide investment portfolio (see our coverage here). Alibaba’s core commerce business jumped by 40% in the quarter ended September 30, compared to the previous quarter, with total commerce revenue reaching ¥101.2 billion ($14.4 billion).

Tencent’s hammered stock performance is the result of tighter regulations from the government over gaming and content. New restrictions have been introduced to regulate how minors play video games, including time limits, age-rating limits and spending limits. Tencent’s cloud business did not produce as much revenue as Alibaba’s, although it had a high growth rate of 80% annually to ¥4.7 billion ($670 million) during the third quarter of 2019 ended September 30. Alibaba's cloud revenue, on the other hand, rose 64% annually to ¥9.3 billion ($1.3 billion) in the same quarter.

[caption id="attachment_101325" align="aligncenter" width="700"] Source: Google Finance[/caption]

A Closer Look at Investments by Alibaba and Tencent

Both Alibaba and Tencent have made investments to complement their digital ecosystems and achieve further growth, with Tencent’s investment stronger in social media content and Alibaba being more focused on retail and artificial intelligence (AI) technologies.

Tencent has invested in short-video apps Huya and Kuaishou. The company also owns leading online literature platform China Literature and the dominating music streaming service company Tencent Music. By comparison, Alibaba has invested in home-furnishing retailer Easyhome and social-commerce platform Xiaohongshu (known as Little Red Book outside China). Alibaba also invested in AI companies, such as SenseTime.

Alibaba and Tencent are shoulder to shoulder on investment in local services and finance. For local services, both invest in ridesharing platform Didi Chuxing, Alibaba acquired delivery platform Ele.me and Tencent invested in local-services platform 58.com. In the finance sector, Alibaba invested in online-only insurance company Zhongan Insurance.

[caption id="attachment_101348" align="aligncenter" width="700"]

Source: Google Finance[/caption]

A Closer Look at Investments by Alibaba and Tencent

Both Alibaba and Tencent have made investments to complement their digital ecosystems and achieve further growth, with Tencent’s investment stronger in social media content and Alibaba being more focused on retail and artificial intelligence (AI) technologies.

Tencent has invested in short-video apps Huya and Kuaishou. The company also owns leading online literature platform China Literature and the dominating music streaming service company Tencent Music. By comparison, Alibaba has invested in home-furnishing retailer Easyhome and social-commerce platform Xiaohongshu (known as Little Red Book outside China). Alibaba also invested in AI companies, such as SenseTime.

Alibaba and Tencent are shoulder to shoulder on investment in local services and finance. For local services, both invest in ridesharing platform Didi Chuxing, Alibaba acquired delivery platform Ele.me and Tencent invested in local-services platform 58.com. In the finance sector, Alibaba invested in online-only insurance company Zhongan Insurance.

[caption id="attachment_101348" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Key Insights

China’s digital economy has gone through a period of change recently, with Alibaba and Tencent positioning themselves as the main players, while Baidu’s role in the Chinese digital world shrunk. Alibaba continues to dominate in ecommerce sector and is seeing its cloud business thrive. Tencent’s super app WeChat is the major contributor to the company’s huge influence in the Chinese landscape—it remains the go-to app for nearly 1.1 billion monthly active users as of June 2019, according to Statista.

However, Alibaba and Tencent are increasingly facing competition from emerging players such as ByteDance, whose digital content apps TikTok and Toutiao have been popular among Chinese users. ByteDance recorded over 1.5 billion monthly active users across its platforms in July 2019. To solidify their market positions, Alibaba and Tencent have therefore diversified investments in a wide range of businesses, with Tencent showing strength in content and Alibaba in retail.

Source: Company reports/Coresight Research[/caption]

Key Insights

China’s digital economy has gone through a period of change recently, with Alibaba and Tencent positioning themselves as the main players, while Baidu’s role in the Chinese digital world shrunk. Alibaba continues to dominate in ecommerce sector and is seeing its cloud business thrive. Tencent’s super app WeChat is the major contributor to the company’s huge influence in the Chinese landscape—it remains the go-to app for nearly 1.1 billion monthly active users as of June 2019, according to Statista.

However, Alibaba and Tencent are increasingly facing competition from emerging players such as ByteDance, whose digital content apps TikTok and Toutiao have been popular among Chinese users. ByteDance recorded over 1.5 billion monthly active users across its platforms in July 2019. To solidify their market positions, Alibaba and Tencent have therefore diversified investments in a wide range of businesses, with Tencent showing strength in content and Alibaba in retail.