Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

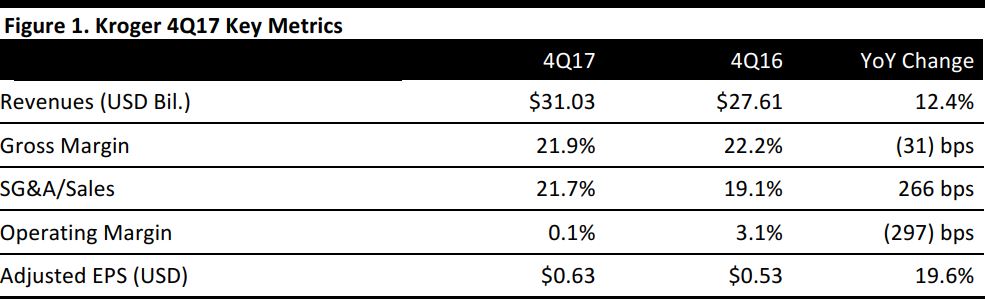

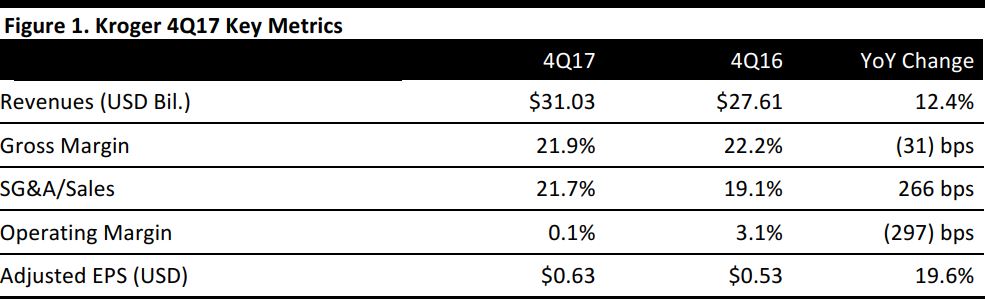

4Q17 Results

Kroger reported 4Q17 adjusted EPS of $0.63, up 19.6% year over year and in line with the consensus estimate. GAAP EPS was $0.96, compared with $0.53 in the year-ago quarter. Adjustments were for pension plan agreements, specialty pharmacy goodwill impairment, company-sponsored pension plan termination, depreciation related to held-for-sale assets, and the Tax Cuts and Jobs Act. The 53rd week in the year contributed $0.09 to quarterly and annual EPS.

Comps (excluding fuel) were up 1.5%, in line with the consensus estimate. Comps were 2.7% including fuel centers.

The company commented that SG&A expense—excluding fuel, the 53rd week and 4Q17 adjustment items—increased by 22 basis points.

Details from the Year

- The company launched its Restock Kroger program.

- Digital sales grew by more than 90%.

- Kroger gained share for the 13th consecutive year, according to management.

- The company created 10,000 new jobs.

Details from the Quarter

During the quarter, Kroger:

- Recorded $16.7 billion in annual natural and organic sales, including $2 billion in Simple Truth sales.

- Opened the Kroger Culinary Innovation Center in downtown Cincinnati, Ohio.

- Opened its 1,000th ClickList store.

- Announced a definitive agreement for the sale of its convenience store business unit to EG Group for $2.15 billion.

- Announced plans to expand Scan, Bag, Go service to 400 stores.

- Established a digital wallet partnership with Chase Pay.

- Made plans to take a balanced approach regarding proceeds from the Tax Cuts and Jobs Act: shareholders will benefit from approximately one-third of the tax savings flowing through net earnings per diluted share. For customers, Kroger plans to make strategic investments to continue redefining the grocery customer experience through a combination of improved services, lower prices and added convenience.For associates, Kroger is developing plans to invest in long-term benefits, including education, wages and retirement.

- Introduced a seamless digital shopping experience that fully integrates ClickList with other digital services, including coupons, recipes, rewards and more. The company said that, after a couple of months, customer response has been very positive. Customers are making purchases on the site at a higher frequency than before and spending more per online order. Households that participate in the company’s seamless offerings, and those that engage with both its digital platforms and physical stores, spend more per week than households that do not. Households that transact with Kroger online spend even more.

- Pickup and/or delivery service is available to more than two-thirds of Kroger’s customers—more than 40 million shoppers. The company’s goal is for every customer to have access to these services. In FY18, Kroger plans to expand its digital coverage area and enhance its digital shopping experience to provide customers with relevant products, recipes, digital coupons, weekly ads, smart shopping lists and more. Kroger offers customers 1,091 pickup locations and more than 872 delivery locations across the country, and those figures continue to grow.

FY17 Results

Full-year revenues were $122.66 billion, up 6.4%.

Comps increased by 1.9% including fuel centers and by 0.7% excluding fuel centers.

Adjusted EPS was $2.04, compared with $2.12 the prior year. GAAP EPS was $2.11, versus $2.07 the prior year.

Outlook

For FY18, management expects:

- Comps of 1.5%–2.0%, the midpoint of which is above the 1.6% consensus estimate.

- EPS of $1.95–$2.15, below the $2.16 consensus estimate.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research